Europe Recreational Vehicles Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD9946

December 2024

87

About the Report

Europe Recreational Vehicles Market Overview

- The Europe Recreational Vehicles (RV) market, valued at USD 30 billion, is driven by an increasing trend of outdoor recreational activities, particularly in countries like Germany and France. The market has witnessed consistent growth over the past five years due to the rising popularity of motorhomes and caravans, as well as growing consumer preferences for travel independence and outdoor experiences. Consumer interest in recreational vehicles has further been fueled by technological advancements in RV manufacturing, such as improved fuel efficiency and smarter connectivity systems.

- Germany and France are the dominant countries in the European RV market. Germany leads due to its strong manufacturing base, with major RV producers headquartered in the country. The French market, while robust, benefits from a strong culture of leisure travel and camping. These countries also have well-established networks of RV parks and campsites, which contribute to their dominance in the market.

- The European Union's emissions standards are having a significant impact on the RV market. Under the Euro 6d emissions regulations, recreational vehicles must meet strict limits on nitrogen oxide (NOx) emissions, with allowable levels set at 80 mg/km. In 2023, the European Environment Agency (EEA) reported that over 30% of RVs on European roads were non-compliant with these standards, leading to penalties and restrictions on vehicle use in low-emission zones. The push for cleaner vehicle technologies, including electric and hybrid RVs, is driven by the EU's commitment to achieving carbon neutrality by 2050.

Europe Recreational Vehicles Market Segmentation

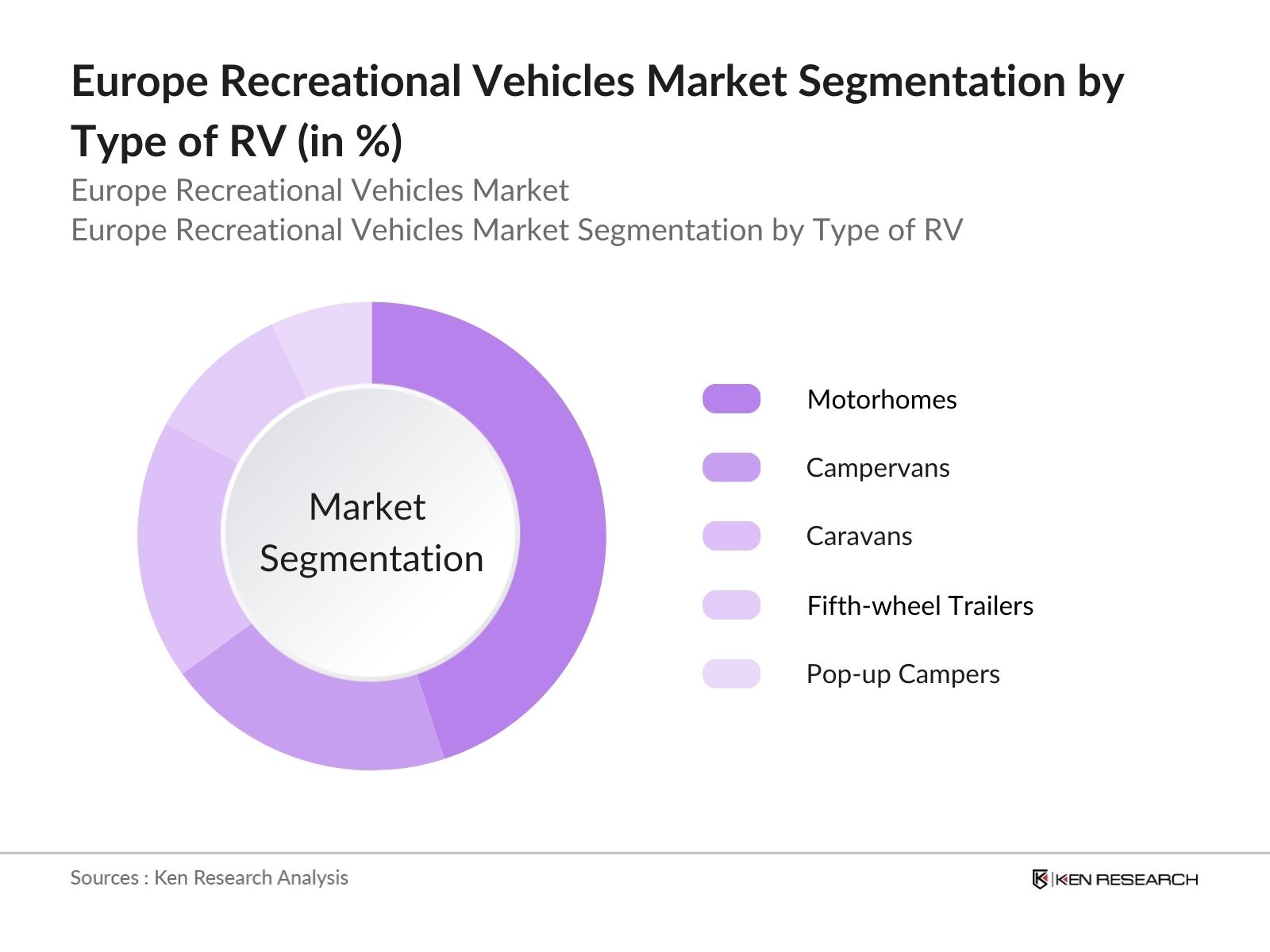

By Type of RV: The market is segmented by type into motorhomes, campervans, caravans, fifth-wheel trailers, and pop-up campers. Among these, motorhomes dominate the market due to their self-sufficiency and versatility, providing an all-in-one solution for travelers. The growing demand for motorhomes is driven by consumers seeking greater comfort and convenience during extended trips. Additionally, motorhomes offer enhanced mobility compared to traditional caravans, which require towing vehicles.

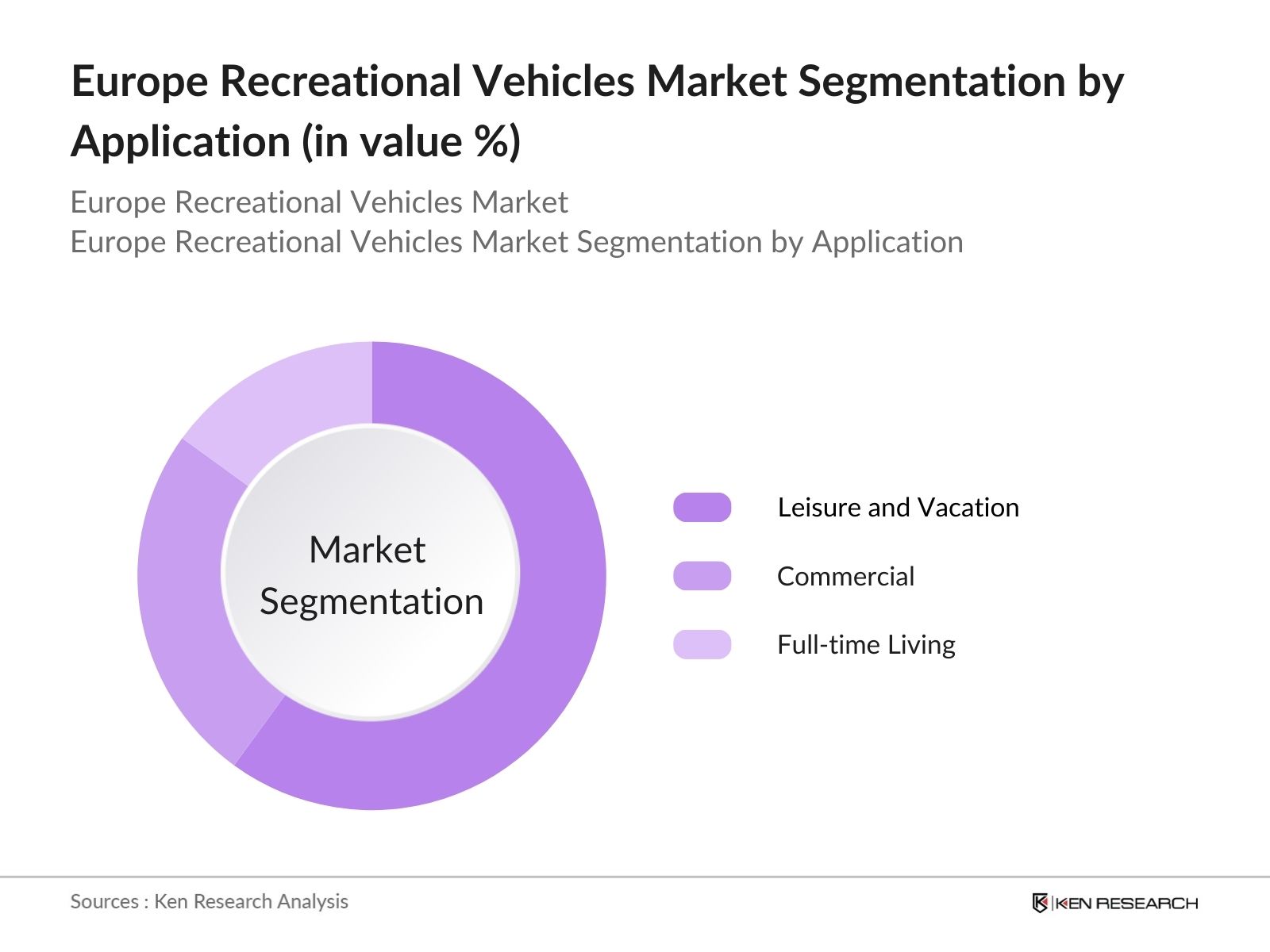

By Application: The market is also segmented by application into leisure and vacation, commercial, and full-time living. The leisure and vacation segment holds a dominant market share as RVs are primarily used by families and individuals for holidays. The rise in domestic tourism and the preference for customizable travel experiences are key factors contributing to the dominance of this segment. Many consumers are drawn to the flexibility of RV travel, which allows for spontaneous route planning and the convenience of bringing personal belongings.

Europe Recreational Vehicles Market Competitive Landscape

The Europe Recreational Vehicles market is dominated by a few key players who have established themselves through a combination of innovation, brand loyalty, and extensive distribution networks. These companies control a significant portion of the market due to their broad product ranges, high manufacturing capacities, and technological advancements in RV design. The markets competitive landscape is characterized by the presence of both well-established global companies and regional manufacturers.

|

Company Name |

Year of Establishment |

Headquarters |

Revenue |

No. of Employees |

Product Range |

Global Reach |

Electric RV Offerings |

Sustainability Initiatives |

Strategic Partnerships |

|

Thor Industries |

1980 |

USA |

|||||||

|

Winnebago Industries |

1958 |

USA |

|||||||

|

Hymer AG |

1923 |

Germany |

|||||||

|

Swift Group |

1964 |

UK |

|||||||

|

Knaus Tabbert AG |

1960 |

Germany |

Europe Recreational Vehicles Industry Analysis

Growth Drivers

- Increasing Popularity of RV Travel: The rising trend of recreational vehicle (RV) travel is being fueled by the growing interest in road trips and nature exploration in Europe. In 2024, the European recreational travel sector saw an increase in domestic tourism, driven by the desire for personal transportation due to health safety concerns. According to Eurostat, the number of domestic overnight trips increased by 25% between 2022 and 2023, supporting the growing demand for RVs as flexible, self-contained travel solutions. Furthermore, increased highway infrastructure investments, particularly in Germany and France, are making RV travel more accessible and convenient.

- Growth of Domestic Tourism: Domestic tourism in Europe continues to expand, contributing significantly to the RV market. In 2024, over 90% of European travelers preferred local destinations, a 22% increase from 2022, as reported by the European Travel Commission (ETC). Countries like Italy and Spain have seen a surge in RV rentals, making it a popular mode of transport for exploring rural and natural landscapes. This trend aligns with the European Commission's focus on promoting local tourism to bolster regional economies. This rise in domestic tourism directly supports the RV market's growth by driving up the demand for vehicle rentals and purchases.

- Enhanced Vehicle Comfort and Technology: Technological advancements in recreational vehicles, such as improved powertrain systems, smart interiors, and enhanced insulation, are driving the market forward. In 2023, RV manufacturers introduced over 15,000 new models equipped with energy-efficient systems, solar-powered solutions, and smart IoT integration for convenience. This has led to a surge in demand for RVs that offer home-like comforts, particularly among retirees and digital nomads, which have grown by 30% since 2022, according to the European Parliament's analysis on technology adoption in vehicles. The increasing innovation in RV design ensures user comfort, aligning with the growing demand for leisure travel solutions.

Market Challenges

- High Initial Purchase Cost: Recreational vehicles come with a substantial initial purchase price, posing a challenge for many potential buyers. In 2024, the average price of a new RV in Europe ranged from EUR 55,000 to EUR 90,000, as recorded by the European Automobile Manufacturers' Association (ACEA). This price point, coupled with the rising costs of raw materials such as steel and aluminum, has increased the overall expense of owning an RV. Additionally, higher financing costs due to the European Central Bank's interest rate hikes in 2023 have further discouraged middle-income consumers from purchasing RVs, making affordability a key market challenge.

- Limited Parking Spaces in Urban Areas: Urban congestion and limited parking availability for RVs in European cities present a significant challenge to market growth. In 2024, cities like Paris, Berlin, and London have restricted RV parking, offering less than 1,500 designated parking spots for such vehicles, according to local municipal data. Moreover, restrictions on large vehicles entering urban areas due to environmental regulations have further limited access. The growing need for urban infrastructure to accommodate RVs, particularly in city centers and popular tourist destinations, has become a pressing issue that constrains market expansion.

Europe Recreational Vehicles Market Future Outlook

The Europe Recreational Vehicles market is expected to experience significant growth in the coming years, driven by evolving consumer preferences for more personalized and independent travel experiences. Increasing awareness of sustainable tourism, alongside advancements in RV technology, such as electric and hybrid models, will likely contribute to market expansion. Furthermore, the rise in work-from-anywhere lifestyles is set to boost the full-time living segment, where RVs offer a flexible solution for digital nomads. The expected growth of campsites and RV parks, as well as the government's push for greener transportation, will further support the markets expansion.

Future Market Opportunities

- Expansion of RV Rental Market: The RV rental market in Europe has grown rapidly, providing a more affordable alternative to ownership. In 2024, rental services accounted for over 40% of the market demand, with rental bookings increasing by 18% compared to 2022, according to Eurostat data. The shift toward renting is particularly strong among younger travelers and those seeking temporary leisure options, without the long-term financial commitment of ownership. Countries like Germany and France have reported the highest growth in RV rentals, driven by an expanding network of peer-to-peer rental platforms. The rise of "RV sharing" has also contributed to the markets expansion.

- Electrification of RVs: The electrification of RVs presents a major opportunity for manufacturers and consumers alike. In 2023, there were over 12,000 electric RVs registered across Europe, an increase of 50% from 2022, according to the European Alternative Fuels Observatory (EAFO). The growing demand for eco-friendly travel options is pushing manufacturers to develop battery-electric and hybrid RV models. European governments are also incentivizing the shift to electric RVs, with countries like Norway and Sweden offering tax rebates and reduced road tolls for electric recreational vehicles. This shift toward electrification aligns with the EUs sustainability goals and offers growth potential in the RV market.

Scope of the Report

|

By Type of RV |

Motorhomes Campervans Caravans Fifth-wheel Trailers Pop-up Campers |

|

By Fuel Type |

Gasoline Diesel Electric Hybrid |

|

By Application |

Leisure and Vacation Commercial Full-time Living |

|

By End-User |

Individuals and Families Corporate Buyers Rental and Leasing Companies |

|

By Region |

Western Europe Eastern Europe Northern Europe Southern Europe |

Products

Key Target Audience

RV Manufacturers

RV Dealers and Distributors

Campground and RV Park Operators

Tourism Boards and Local Government Bodies

Government and Regulatory Bodies (European Commission, National Road Safety Authorities)

Travel and Leisure Agencies

Investors and Venture Capitalist Firms

Component and Material Suppliers

Companies

Major Players

Thor Industries

Winnebago Industries

Hymer AG

Swift Group

Knaus Tabbert AG

Hobby Wohnwagenwerk

Adria Mobil

Brstner GmbH

Pilote Group

Rapido Group

Trigano

Auto-Sleepers

Airstream

Carthago

Dethleffs GmbH

Table of Contents

1. Europe Recreational Vehicles Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Recreational Vehicles Market Size (In EUR Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Recreational Vehicles Market Analysis

3.1. Growth Drivers

- Increasing Popularity of RV Travel

- Growth of Domestic Tourism

- Enhanced Vehicle Comfort and Technology

- Rise in Outdoor Leisure Activities

3.2. Market Challenges

- High Initial Purchase Cost

- Limited Parking Spaces in Urban Areas

- Regulatory Constraints (Vehicle Emissions, Road Taxation)

- Seasonal Nature of RV Use

3.3. Opportunities

- Expansion of RV Rental Market

- Electrification of RVs

- Digital Nomad and Remote Work Trends

- Growth in Adventure Tourism

3.4. Trends

- Adoption of Electric and Hybrid RVs

- Smart Connectivity Solutions (IoT-enabled RVs)

- Customizable and Modular Interiors

- Lightweight Construction for Fuel Efficiency

3.5. Government Regulations

3.5.1. European Emissions Standards

3.5.2. Vehicle Safety and Certification

3.5.3. Taxation on Recreational Vehicles

3.5.4. Incentives for Sustainable and Electric RVs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Rental Agencies, Campsites, etc.)

3.8. Porters Five Forces Analysis (Bargaining Power of Suppliers, Threat of Substitutes, etc.)

3.9. Competition Ecosystem

4. Europe Recreational Vehicles Market Segmentation

4.1. By Type of RV (In Value %)

- Motorhomes

- Campervans

- Caravans/Travel Trailers

- Fifth-wheel Trailers

- Pop-up Campers

4.2. By Fuel Type (In Value %)

- Gasoline

- Diesel

- Electric

- Hybrid

4.3. By Application (In Value %)

- Leisure and Vacation

- Commercial (Rental, Events)

- Full-time Living

4.4. By End-User (In Value %)

- Individuals and Families

- Corporate Buyers

- Rental and Leasing Companies

4.5. By Region (In Value %)

- Western Europe

- Eastern Europe

- Northern Europe

- Southern Europe

5. Europe Recreational Vehicles Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Thor Industries

5.1.2. Winnebago Industries

5.1.3. Hymer AG

5.1.4. Swift Group

5.1.5. Knaus Tabbert AG

5.1.6. Hobby Wohnwagenwerk

5.1.7. Adria Mobil

5.1.8. Pilote Group

5.1.9. Brstner GmbH

5.1.10. Dethleffs GmbH

5.1.11. Rapido Group

5.1.12. Trigano

5.1.13. Auto-Sleepers

5.1.14. Airstream

5.1.15. Carthago

5.2 Cross Comparison Parameters (No. of Employees, Revenue, Product Portfolio, Geographic Presence, Market Share, Innovation Initiatives, Electric Vehicle Capabilities, Sustainability Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Recreational Vehicles Market Regulatory Framework

6.1. Environmental Standards and Regulations

6.2. Compliance Requirements for Vehicle Manufacturers

6.3. Certification Processes

7. Europe Recreational Vehicles Future Market Size (In EUR Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Recreational Vehicles Future Market Segmentation

8.1. By Type of RV (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Europe Recreational Vehicles Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

We began by constructing an ecosystem map encompassing all major stakeholders in the Europe Recreational Vehicles market. This step involved extensive desk research to identify key variables that influence market trends, such as consumer preferences, tourism rates, and vehicle technology advancements.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data for the market. This phase involved assessing market penetration across different regions and evaluating the demand for various types of RVs. Additionally, key metrics like vehicle registration data and tourism rates were analyzed to develop accurate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, we conducted interviews with RV manufacturers, dealers, and tourism industry experts. These consultations provided insights into industry challenges, growth opportunities, and competitive strategies, helping us refine our hypotheses and validate the collected data.

Step 4: Research Synthesis and Final Output

The final stage involved consolidating the data and expert insights into a coherent report, ensuring that all information was cross-referenced with authoritative sources such as the European Automobile Manufacturers Association and the European Commission.

Frequently Asked Questions

01. How big is the Europe Recreational Vehicles Market?

The Europe Recreational Vehicles market is valued at USD 30 billion, driven by a growing preference for leisure travel and outdoor activities. The market has seen significant growth over the past five years, supported by consumer demand for motorhomes and caravans.

02. What are the challenges in the Europe Recreational Vehicles Market?

Key challenges in the Europe Recreational Vehicles market include the high initial cost of purchasing an RV, regulatory restrictions related to vehicle emissions, and the seasonal nature of RV usage, which impacts consistent demand throughout the year.

03. Who are the major players in the Europe Recreational Vehicles Market?

Major players in the Europe Recreational Vehicles market include Thor Industries, Winnebago Industries, Hymer AG, Swift Group, and Knaus Tabbert AG. These companies dominate the market due to their extensive product offerings, advanced manufacturing capabilities, and strategic partnerships.

04. What are the growth drivers of the Europe Recreational Vehicles Market?

Growth in the Europe Recreational Vehicles market is driven by an increasing interest in personalized travel, advancements in vehicle technology such as electric RVs, and rising domestic tourism. Additionally, government incentives for sustainable travel are supporting market growth.

05. What opportunities exist in the Europe Recreational Vehicles Market?

Opportunities in the Europe Recreational Vehicles market include the expansion of the RV rental market, the development of electric and hybrid RVs, and the increasing adoption of smart technologies like IoT-enabled vehicles, which cater to modern travel needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.