Europe Reusable Water Bottle Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD4846

December 2024

92

About the Report

Europe Reusable Water Bottle Market Overview

- The Europe Reusable Water Bottle market is valued at USD 2 billion, driven primarily by an increasing consumer demand for sustainable products. The market benefits from the rising environmental consciousness among consumers, which promotes a shift away from single-use plastics. This growing trend, alongside favorable government policies aimed at reducing plastic waste, is expected to drive further growth, positioning reusable bottles as essential household and personal items.

- Leading markets in Europe include Germany, the UK, and France, attributed to strong environmental awareness and substantial governmental backing for sustainability efforts. These countries have higher adoption rates of eco-friendly products due to stringent regulations on plastic use and a strong inclination among consumers towards environmentally conscious purchases.

- The European Unions 2024 Plastic Strategy aims to eliminate single-use plastics, including water bottles, by supporting the adoption of reusable alternatives. Under this directive, the EU has allocated 100 million towards promoting the use of sustainable packaging solutions across member states. This policy is expected to drive further growth in the reusable water bottle market as consumers transition to eco-friendly options.

Europe Reusable Water Bottle Market Segmentation

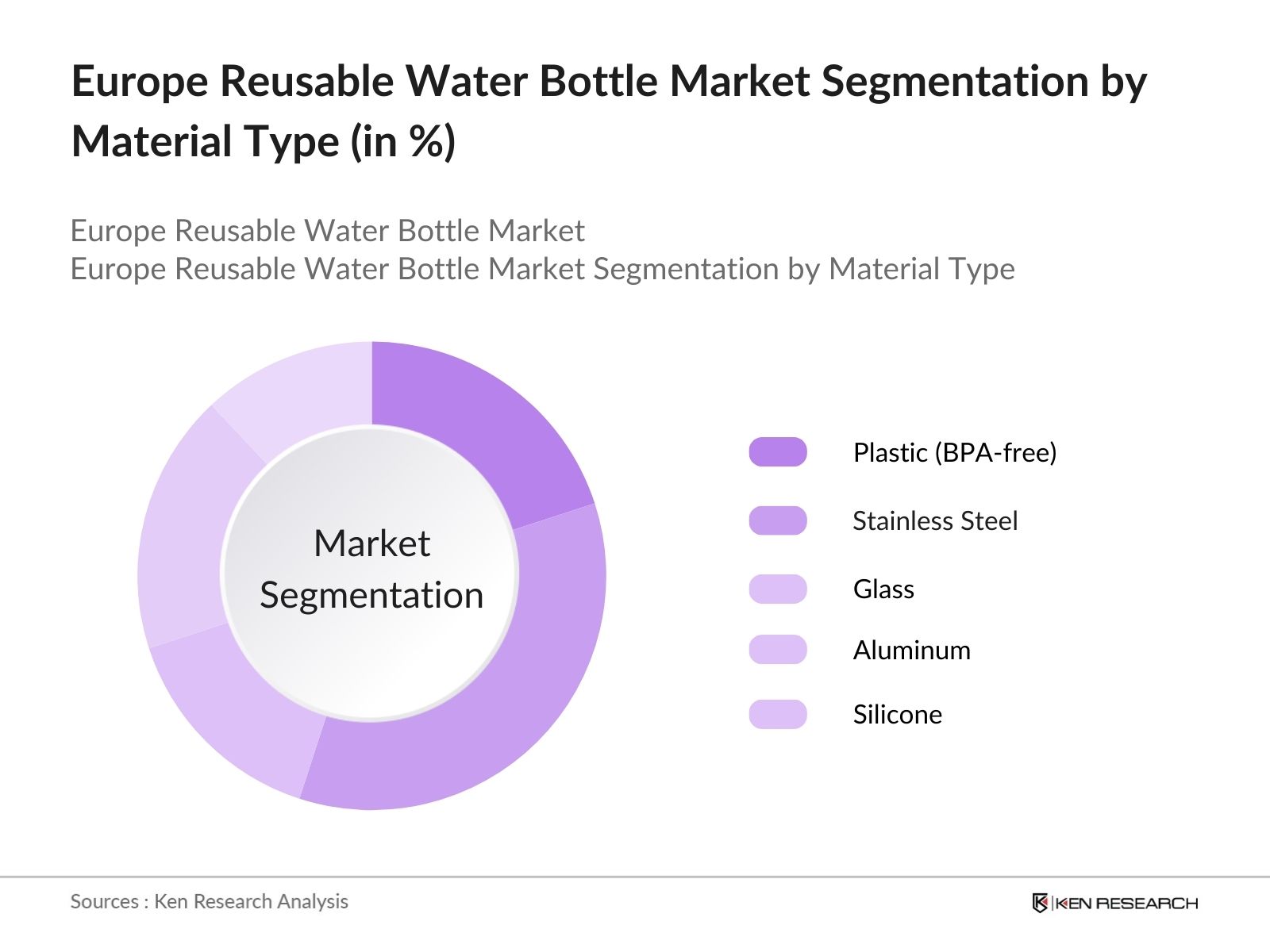

By Material Type: The market is segmented by material type into plastic (BPA-free), stainless steel, glass, aluminum, and silicone. Among these, stainless steel bottles dominate due to their durability, insulation properties, and ease of maintenance. Consumers in Europe prefer stainless steel as it offers longevity and reduces the frequency of purchases, aligning with their eco-friendly values.

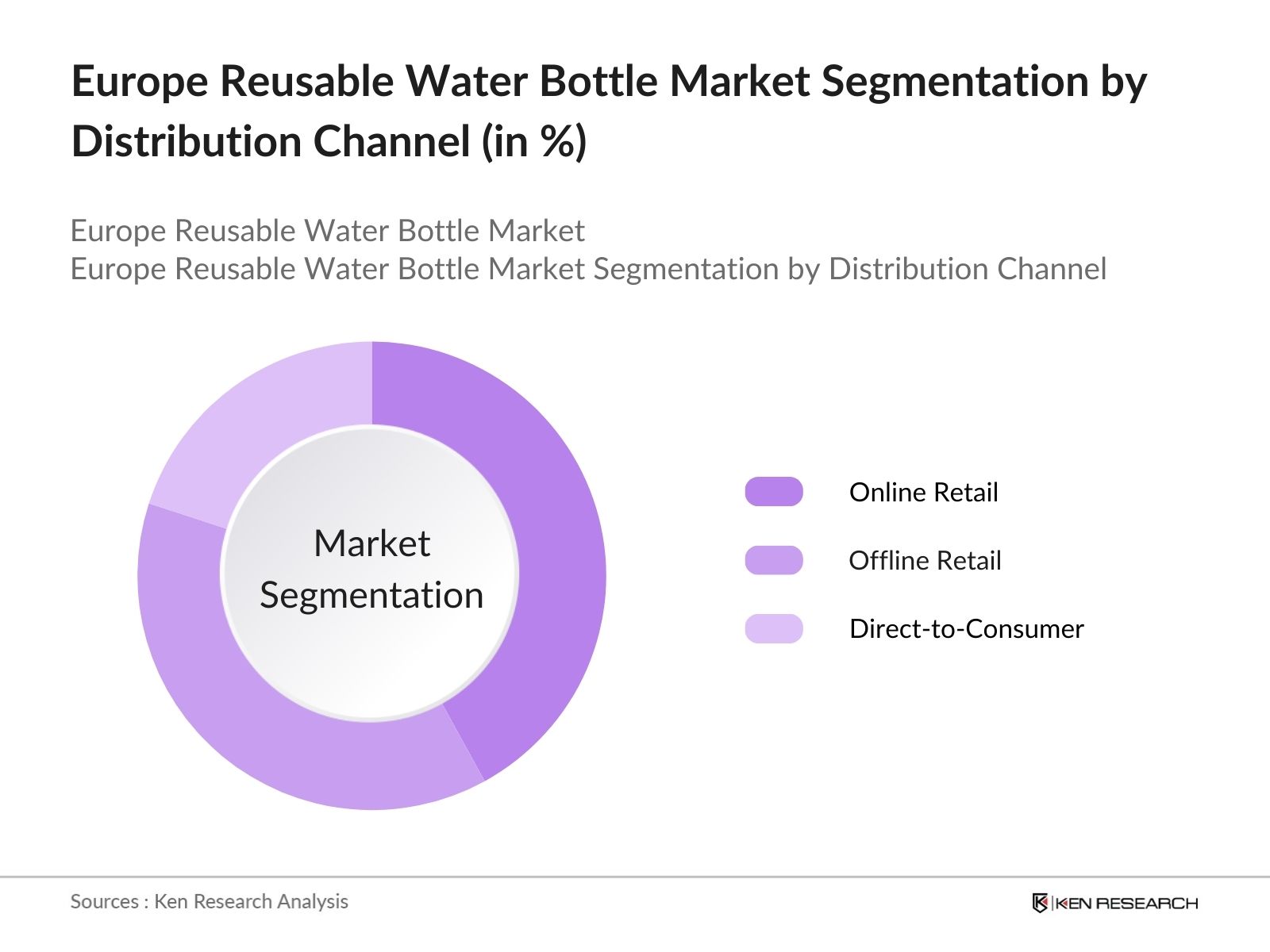

By Distribution Channel: The market is also segmented by distribution channels, including online retail, offline retail (supermarkets and specialty stores), and direct-to-consumer. The online retail channel leads due to the convenience it offers, especially with increasing e-commerce adoption across Europe. Leading platforms provide a variety of options and customization, attracting eco-conscious consumers who seek both quality and uniqueness in products.

Europe Reusable Water Bottle Market Competitive Landscape

The market is dominated by established brands and a few prominent new players. Companies like S'well, Hydro Flask, and Klean Kanteen leverage product quality, brand loyalty, and sustainability initiatives to maintain their market positions.

Europe Reusable Water Bottle Market Analysis

Market Growth Drivers

- Increasing Health Awareness and Hydration Needs: The rise in awareness regarding health and hydration among European consumers has driven the demand for reusable water bottles. In 2024, around 390 million consumers in Europe are prioritizing hydration as a core part of their health routine, contributing to a substantial uptick in the adoption of sustainable water bottles. With a growing emphasis on wellness, individuals are increasingly choosing reusable bottles over single-use plastics to reduce health risks associated with plastic contaminants.

- Expansion of Eco-friendly Packaging Initiatives by Corporates: The emphasis on sustainable practices has led to over 5,000 corporates across Europe pledging to reduce plastic waste, with many introducing eco-friendly alternatives, including reusable bottles for employees and consumers alike. In 2024, multinational corporations like Unilever and L'Oral have incorporated sustainability goals in line with the European Commissions Green Deal, driving over 300,000 new reusable bottle units into the market, indicating a notable shift towards sustainable consumption.

- Increase in Outdoor Recreational Activities: Europes outdoor recreational market has seen growth, with over 120 million people participating in activities like hiking, cycling, and camping in 2024. These activities have increased the demand for reusable, durable water bottles that cater to the needs of outdoor enthusiasts. The Outdoor Industry Association in Europe reported that 76% of outdoor participants prefer reusable bottles for their durability and convenience, leading to a steady rise in reusable water bottle purchases tied to outdoor recreation trends.

Market Challenges

- High Costs of Raw Materials and Manufacturing: The cost of high-grade stainless steel and BPA-free materials, widely used in reusable water bottles, has surged due to supply chain disruptions and increased demand. In 2024, Europe saw a 22% rise in raw material prices for these materials, with the average manufacturing cost per bottle increasing by 1.2.

- Lack of Infrastructure for Cleaning and Maintenance: Europe lacks adequate public infrastructure for cleaning reusable bottles, which discourages daily use among consumers. A survey of 10,000 reusable bottle users in urban areas revealed that over 35% find it inconvenient to maintain hygiene, leading to a preference for single-use bottles in situations where frequent cleaning isnt feasible.

Europe Reusable Water Bottle Market Future Outlook

Over the next five years, the Europe Reusable Water Bottle industry is projected to experience considerable growth. This expansion will likely be driven by stringent environmental regulations, an increased focus on sustainable living among consumers, and advancements in materials used for manufacturing, such as biodegradable and smart technology-enhanced bottles.

Future Market Opportunities

- Growth in Premiumization and Customization of Bottles: Over the next five years, the reusable water bottle market in Europe will likely see a shift towards premium and customized bottles, catering to consumers seeking personalized products. By 2029, it is estimated that over 10 million units annually will feature customization options, driven by consumer demand for unique and stylish products, particularly among younger demographics.

- Increased Integration of Smart Technology: Smart technology in reusable bottles, like hydration tracking and temperature control, is expected to grow, with European manufacturers investing 50 million in research and development by 2026. These advancements will attract health-conscious consumers who are willing to invest in bottles that support their wellness goals, with an estimated 15% of reusable bottles featuring smart technology by 2029.

Scope of the Report

|

Material Type |

Plastic (BPA-Free) Stainless Steel Glass Aluminum Silicone |

|

Distribution Channel |

Online Retail Offline Retail (Supermarkets, Specialty Stores) Direct-to-Consumer |

|

End User |

Individual Consumers Corporate and Institutional Sports and Fitness |

|

Capacity |

Below 500ml 500ml 1L Above 1L |

|

Region |

Western Europe Eastern Europe Northern Europe Southern Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Reusable Water Bottle Manufacturers

Raw Material Suppliers

Retail and Distribution Channels

Government and Regulatory Bodies (e.g., European Commission, Environmental Protection Agencies)

Consumer Advocacy Groups

Investor and Venture Capitalist Firms

Health and Fitness Industry Players

Sports Organizations and Events Coordinators

Companies

Players Mentioned in the Report:

S'well

Hydro Flask

Klean Kanteen

SIGG Switzerland

Tupperware Brands

CamelBak

Thermos LLC

Brita

Contigo

LARQ

Table of Contents

1. Europe Reusable Water Bottle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate and CAGR Analysis

1.4 Market Segmentation Overview

2. Europe Reusable Water Bottle Market Size (USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Market Dynamics and Key Milestones

3. Europe Reusable Water Bottle Market Analysis

3.1 Growth Drivers

3.1.1 Environmental Awareness (Reduction in Single-Use Plastic)

3.1.2 Rising Health and Wellness Trends

3.1.3 Increasing Government Regulations on Plastic Usage

3.1.4 Shift in Consumer Preferences Toward Sustainable Products

3.2 Market Challenges

3.2.1 High Manufacturing Costs

3.2.2 Competitive Pricing from Disposable Bottles

3.2.3 Limited Consumer Awareness in Emerging Markets

3.3 Opportunities

3.3.1 Expansion in Online Retail

3.3.2 Innovations in Materials (Stainless Steel, BPA-Free Plastics, etc.)

3.3.3 Partnerships with Health and Wellness Brands

3.4 Trends

3.4.1 Growing Demand for Customizable Designs

3.4.2 Integration of Technology (Smart Bottles)

3.4.3 Growth of Eco-friendly and Biodegradable Bottles

3.5 Government Regulation

3.5.1 EU Single-Use Plastics Directive

3.5.2 National Plastic Waste Reduction Policies

3.5.3 Compliance and Labeling Standards

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Stakeholder Ecosystem

4. Europe Reusable Water Bottle Market Segmentation

4.1 By Material Type (Market Share %)

4.1.1 Plastic (BPA-Free)

4.1.2 Stainless Steel

4.1.3 Glass

4.1.4 Aluminum

4.1.5 Silicone

4.2 By Distribution Channel (Market Share %)

4.2.1 Online Retail

4.2.2 Offline Retail (Supermarkets, Specialty Stores)

4.2.3 Direct-to-Consumer

4.3 By End User (Market Share %)

4.3.1 Individual Consumers

4.3.2 Corporate and Institutional

4.3.3 Sports and Fitness

4.4 By Capacity (Market Share %)

4.4.1 Below 500ml

4.4.2 500ml 1L

4.4.3 Above 1L

4.5 By Region (Market Share %)

4.5.1 Western Europe

4.5.2 Eastern Europe

4.5.3 Northern Europe

4.5.4 Southern Europe

5. Europe Reusable Water Bottle Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Swell

5.1.2 Klean Kanteen

5.1.3 Hydro Flask

5.1.4 Tupperware Brands

5.1.5 CamelBak

5.1.6 SIGG Switzerland

5.1.7 Nalgene Outdoor

5.1.8 Contigo

5.1.9 Brita

5.1.10 Thermos LLC

5.1.11 LARQ

5.1.12 Vapur

5.1.13 Aquasana

5.1.14 Kor Water

5.1.15 Fressko

5.2 Cross Comparison Parameters (Employee Count, Headquarters, Founding Year, Revenue, Market Presence, Product Portfolio, Environmental Certifications, Recent Innovations)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Market Expansion)

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Joint Ventures and Collaborations

5.8 Marketing and Advertising Expenditure Analysis

6. Europe Reusable Water Bottle Market Regulatory Framework

6.1 Environmental Standards and Compliance

6.2 Industry Certifications and Eco-Labels

6.3 Import and Export Regulations

7. Europe Reusable Water Bottle Future Market Size (USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Growth

8. Europe Reusable Water Bottle Future Market Segmentation

8.1 By Material Type (Projected Market Share %)

8.2 By Distribution Channel (Projected Market Share %)

8.3 By End User (Projected Market Share %)

8.4 By Capacity (Projected Market Share %)

8.5 By Region (Projected Market Share %)

9. Europe Reusable Water Bottle Market Analysts Recommendations

9.1 Market Penetration Strategy

9.2 Product Differentiation Strategy

9.3 Consumer Engagement Tactics

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involved constructing a comprehensive market map of all stakeholders in the Europe Reusable Water Bottle market. Through desk research and secondary sources, we identified key drivers, inhibitors, and emerging trends shaping the industry.

Step 2: Market Analysis and Construction

This stage involved gathering historical data on product adoption, demand trends, and revenue streams. We conducted an in-depth analysis of product portfolios across different distribution channels to establish accurate market segment valuations.

Step 3: Hypothesis Validation and Expert Consultation

We validated market assumptions through structured interviews with industry experts, including product managers and senior executives. Their insights provided clarity on the market dynamics and company strategies influencing growth.

Step 4: Research Synthesis and Final Output

Data synthesis entailed cross-verification with direct insights from manufacturers and sales data to ensure a comprehensive and accurate market analysis.

Frequently Asked Questions

01. How big is the Europe Reusable Water Bottle market?

The Europe Reusable Water Bottle market is valued at USD 2 billion, driven by increased consumer awareness of environmental issues and government regulations on plastic waste reduction.

02. What are the challenges in the Europe Reusable Water Bottle market?

Challenges in the Europe Reusable Water Bottle market include high competition, price sensitivity among consumers, and manufacturing costs associated with sustainable materials.

03. Who are the major players in the Europe Reusable Water Bottle market?

Key players in the Europe Reusable Water Bottle market include S'well, Hydro Flask, Klean Kanteen, SIGG Switzerland, and Tupperware Brands. These companies leverage their established reputations and strong sustainability commitments.

04. What drives growth in the Europe Reusable Water Bottle market?

Growth in the Europe Reusable Water Bottle market is propelled by consumer demand for sustainable products, stringent environmental regulations, and a shift towards eco-conscious lifestyles.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.