Europe Rubber Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD2211

October 2024

85

About the Report

Europe Rubber Market Overview

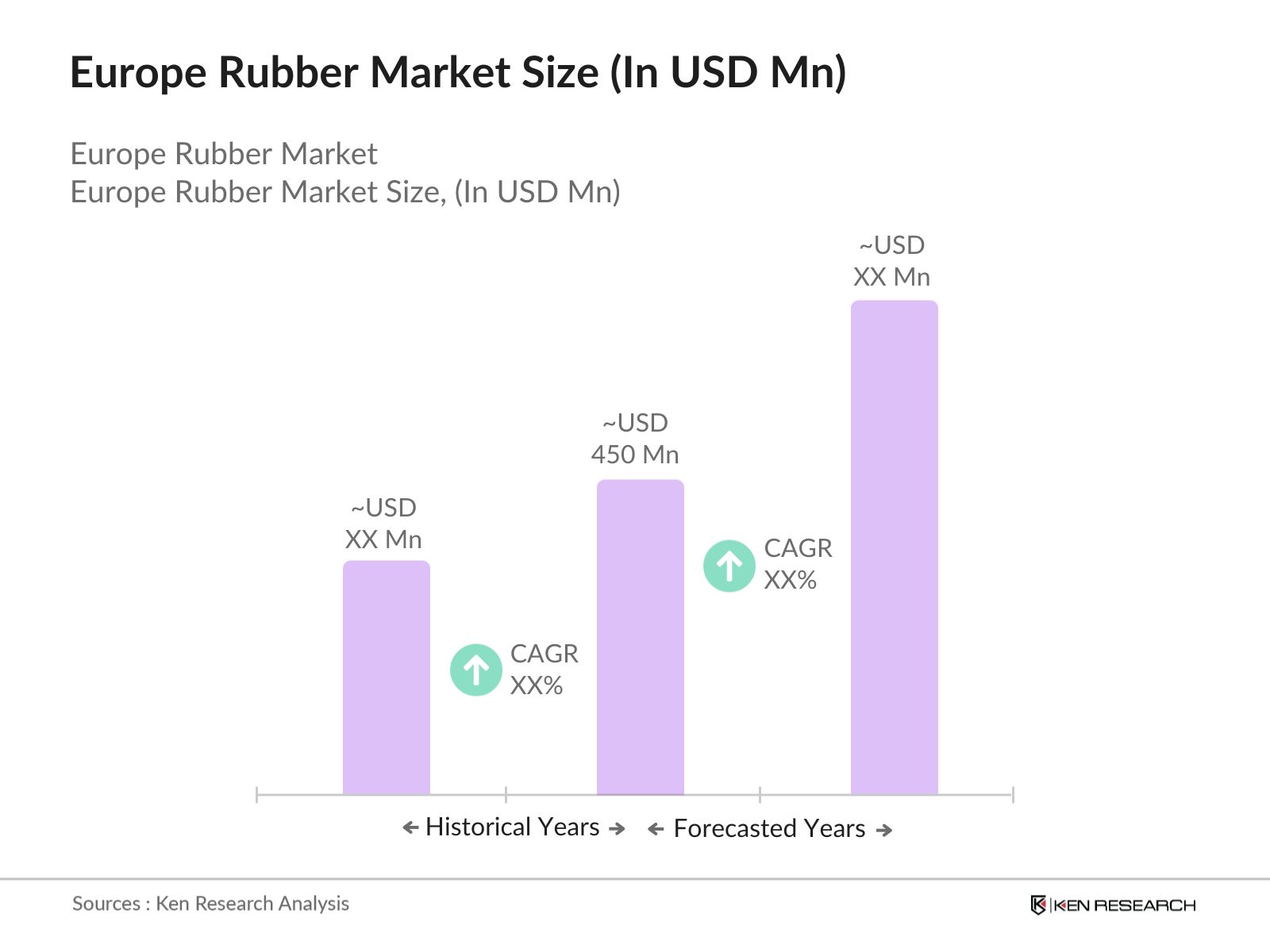

- In 2023, the Europe Rubber Market is valued at USD 450 million, driven by the increasing demand for automotive tires, industrial applications, and the growth of the construction sector. The market is highly influenced by the region's strong automotive manufacturing presence, particularly in Germany and Italy. Rising environmental concerns are also pushing companies toward adopting sustainable rubber production methods, further fueling market growth. Key government regulations regarding rubber recycling and import restrictions have also played a role in driving the markets expansion.

- Key players dominating the Europe Rubber Market include Continental AG (Germany), Michelin (France), Bridgestone Europe (Italy), Lanxess AG (Germany), and Pirelli (Italy). These companies have long-standing market shares due to their strong distribution networks and innovation in rubber technology. Their ability to supply high-quality rubber for automotive, industrial, and consumer goods segments ensures their continued leadership in the market. Continuous research into synthetic rubber and sustainable materials also keeps these players at the forefront of the industry.

- In 2023, Continental AG announced a significant partnership with a leading European recycling firm to develop sustainable methods for tire recycling. This development comes in response to the European Union's directive to reduce rubber waste and increase recycling rates by 25% by 2025. Continental aims to use advanced chemical processes to break down old rubber tires into reusable materials, reducing raw rubber consumption by 15% in its production lines by 2024. This partnership will significantly impact the supply chain of raw materials in Europe.

- Germany's cities, particularly Stuttgart and Munich, dominate the European Rubber Market due to their robust automotive industries. Stuttgart, home to major car manufacturers like Mercedes-Benz and Porsche, demands high volumes of rubber for tires and automotive components, ensuring its dominance. Munich, with its focus on industrial rubber for machinery and equipment, also holds a substantial market share. The well-established logistics and supply chains in these cities support their market leadership. Frances Clermont-Ferrand, where Michelin is headquartered, also significantly contributes to the market.

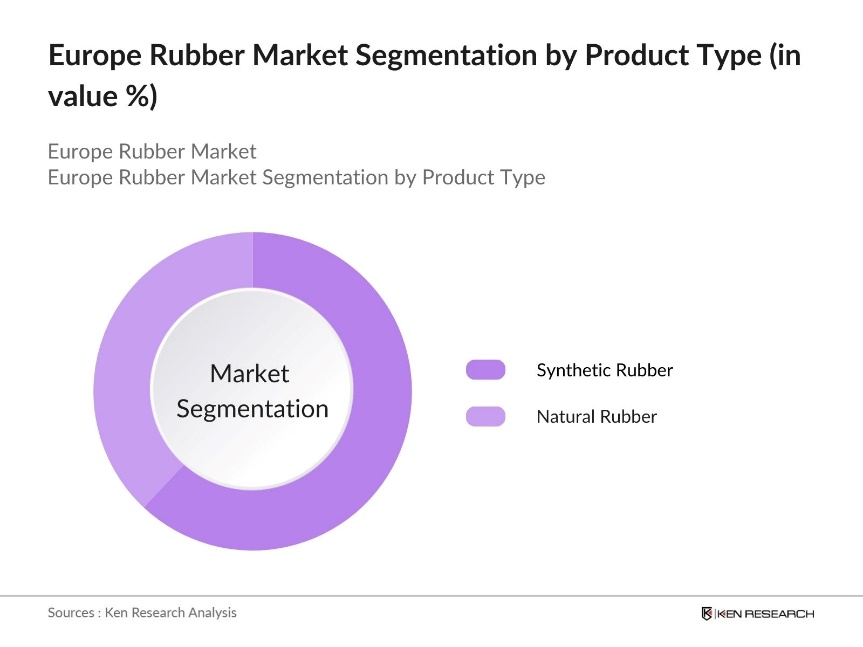

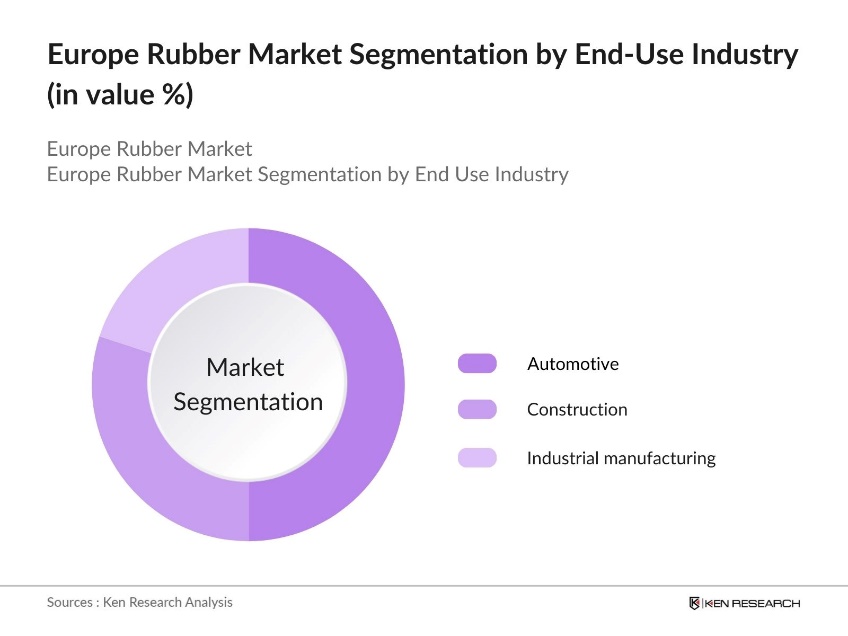

Europe Rubber Market Segmentation

By Product Type: The Europe Rubber Market is segmented by product type into natural rubber and synthetic rubber. In 2023, synthetic rubber dominated the market share due to its widespread use in automotive applications, particularly in tire manufacturing. Synthetic rubber is preferred due to its superior resistance to wear and environmental degradation. Leading tire manufacturers like Continental and Michelin extensively utilize synthetic rubber, contributing to its dominance.

By End-Use Industry: The market is segmented by end-use industries into automotive, construction, and industrial manufacturing. In 2023, the automotive industry held the largest market share due to the increasing production of vehicles, especially in Germany and Italy. The rising demand for high-performance tires in the electric vehicle segment further bolstered this industrys market share.

By Region: The Europe Rubber Market is segmented by region into Germany, France, United Kingdom, Sweden, Italy, and Rest of Europe. In 2023, Germany led the Europe rubber market, driven by its dominance in automotive production and substantial demand for synthetic rubber. The country's strong manufacturing capabilities in the automotive sector made it the largest contributor to the regional market share.

Europe Rubber Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Continental AG |

1871 |

Hanover, Germany |

|

Michelin |

1889 |

Clermont-Ferrand, France |

|

Bridgestone Europe |

1931 |

Rome, Italy |

|

Lanxess AG |

2004 |

Cologne, Germany |

|

Pirelli |

1872 |

Milan, Italy |

- Continental AG (2023): Continental AG introduced its new tire range specifically designed for electric vehicles, addressing the growing demand in the EV sector. The new tires feature low rolling resistance, enhancing EV efficiency and reducing battery consumption. The company plans to invest $500 million by 2024 to expand its tire production facilities across Europe, particularly in Germany and Poland, to cater to the rising demand for high-performance tires.

- Michelin (2023): In 2023, Michelin launched a new sustainability initiative aimed at increasing the use of recycled rubber in its tire production by 40% by 2030. The company has partnered with several European recycling firms to enhance its rubber recycling capabilities. This initiative aligns with the EU's Circular Economy Action Plan, and Michelin has committed $300 million towards this effort, further strengthening its market position as a leader in sustainable practices.

Europe Rubber Market Analysis

Growth Drivers

- Rising Demand from the Automotive Industry: The demand for rubber in the European automotive sector continues to be a significant driver of market growth. With over 10.5 million cars produced in Europe in 2023, according to the European Automobile Manufacturers Association (ACEA), the need for high-performance rubber for tires, gaskets, and seals has surged. The increasing adoption of electric vehicles (EVs) has also contributed to this growth, with EVs requiring specialized tires that have higher durability and low rolling resistance, pushing the demand for synthetic rubber higher.

- Sustainability Initiatives in Rubber Production: Germanys tire recycling industry has seen substantial progress, with over 68% of used tires being recycled, as per the German Rubber Manufacturers Association (WDK). In 2019 alone, around 251 kilotons of tires were processed into granulates and rubber crumbs. This high recycling rate is a significant driver for the rubber market as recycled rubber is increasingly being used for manufacturing high-quality products, promoting sustainability, and reducing reliance on raw rubber imports.

- Increased Infrastructure Development Projects: The European rubber market is also driven by large-scale infrastructure projects, particularly in Germany, France, and Italy, where investments in road and building construction have grown steadily. The European Investment Bank (EIB) allocated funds for infrastructure projects across Europe in 2024, which has created significant demand for rubber-based construction materials such as sealing products, roofing, and insulation. The growth in these sectors is pushing the need for durable and versatile rubber materials.

Challenges

- Supply Chain Disruptions and Raw Material Shortages: The European rubber industry has been facing challenges related to the supply of natural rubber, primarily imported from Southeast Asian countries. Due to geopolitical tensions and disruptions caused by the COVID-19 pandemic, rubber imports into Europe fell between 2022 and 2023, according to data from Eurostat. This shortage of raw materials has led to an increase in production costs for rubber manufacturers, affecting profitability and overall market growth.

- Environmental Regulations and Compliance Costs: The tightening of environmental regulations under the EUs Green Deal, which sets strict recycling and emission targets for industries, is a significant challenge for rubber manufacturers. Compliance with the EU's mandate to recycle rubber waste by 2025 has increased operational costs for companies in the sector. Furthermore, many small and medium-sized enterprises (SMEs) in the rubber industry struggle to afford the necessary technology and processes required for compliance, creating barriers to market entry.

Government Initiatives

- Green Public Procurement (GPP) Directive: In 2023, the EU introduced the Green Public Procurement (GPP) directive, which obligates public authorities to prioritize the use of eco-friendly materials in government-funded construction projects. The directive aims to boost the demand for sustainable rubber products, particularly in infrastructure development projects. The GPP is expected to generate an additional demand for rubber worth 1.2 billion in the construction sector across Europe by 2025, as noted by the European Commission.

- EU Taxonomy for Sustainable Activities: In 2024, the EU expanded its Taxonomy for Sustainable Activities to include the rubber manufacturing sector. This initiative aims to provide clear guidelines on what constitutes sustainable rubber production, encouraging private investments in eco-friendly projects. The taxonomy also facilitates easier access to financing for companies committed to sustainable practices, ensuring more investments in recycling technology and sustainable rubber production processes. This regulatory push is expected to attract an additional 500 million in green investments by 2025.

Europe Rubber Market Future Outlook

The Europe Rubber Market is projected to grow exponentially in coming years. This growth will be driven by the rising demand from the automotive industry, sustainability initiatives in rubber production and increased infrastructure development projects.

Future Trends

- Rising Electric Vehicle Adoption: The Europe Rubber Market is expected to see significant growth over the next five years, driven primarily by the rapid adoption of electric vehicles (EVs). With EV registrations, the demand for high-performance, EV-specific rubber will grow. Manufacturers like Continental and Michelin are likely to invest further in research and development of sustainable and high-performance rubber materials to cater to this expanding market.

- Sustainability to Become a Major Focus: By 2028, sustainability will become a central theme in the Europe Rubber Market. As more countries across Europe implement stringent environmental regulations, including the expansion of the CEAP, manufacturers will be forced to invest heavily in recycling technologies and bio-based rubber alternatives. By 2028, it is estimated that recycled rubber could account for over 35% of total rubber production in Europe, significantly reducing the demand for raw natural rubber imports.

Scope of the Report

|

By Product Type |

Natural Rubber Synthetic Rubber |

|

By End-Use Industry |

Automotive Construction Industrial Manufacturing |

|

By Region |

Germany France United Kingdom Sweden Italy Rest of Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Rubber Product Manufacturers

Industrial Machinery Producers

Construction Firms

Tire Manufacturers

Logistics and Supply Chain Companies

Recycled Rubber Companies

Electric Vehicle Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Union, Ministry of Industry and Trade - Germany)

Companies

Players mentioned in report:

Continental AG

Michelin

Bridgestone Europe

Lanxess AG

Pirelli

Goodyear

Trelleborg AB

Semperit AG

Hutchinson SA

Toyo Tire Europe

Table of Contents

1. Europe Rubber Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate Analysis

1.4. Market Dynamics Overview

1.5. Key Market Segmentation Overview

1.6. Supply Chain Overview (Production, Imports, Exports)

2. Europe Rubber Market Size (in USD)

2.1. Historical Market Size (in value, YoY growth rate)

2.2. Market Size in 2023 (in value)

2.3. Major Market Milestones

2.4. Key Market Developments in 2023

2.5. Forecasted Market Size

3. Europe Rubber Market Analysis

3.1. Growth Drivers

3.1.1. Automotive Industry Expansion

3.1.2. Infrastructure Development Projects

3.1.3. Sustainability Initiatives (Regulations & Recycling)

3.2. Challenges

3.2.1. Raw Material Shortages

3.2.2. Environmental Compliance Costs

3.2.3. Price Competition from Asian Markets

3.3. Opportunities

3.3.1. Innovation in Synthetic Rubber Production

3.3.2. Rising Electric Vehicle (EV) Demand

3.3.3. Investment in Green Technologies

3.4. Trends

3.4.1. Adoption of Recycled Rubber

3.4.2. Bio-Based Rubber Alternatives

3.4.3. EV-Specific Tire Development

3.5. Government Regulation

3.5.1. Circular Economy Action Plan (CEAP)

3.5.2. EU Green Deal Compliance

3.5.3. National Recycling and Waste Reduction Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Value Chain Analysis

4. Europe Rubber Market Segmentation

4.1. By Product Type (in value %)

4.1.1. Synthetic Rubber

4.1.2. Natural Rubber

4.2. By End-Use Industry (in value %)

4.2.1. Automotive

4.2.2. Industrial Manufacturing

4.2.3. Construction

4.3. By Region (in value %)

4.3.1. Germany

4.3.2. France

4.3.3. Italy

4.3.4. United Kingdom

4.3.5. Rest of Europe

5. Competitive Landscape

5.1. Market Share Analysis

5.2. Key Players (in-depth company profiles)

5.2.1. Continental AG

5.2.2. Michelin

5.2.3. Bridgestone Europe

5.2.4. Lanxess AG

5.2.5. Pirelli

5.2.6. Trelleborg AB

5.2.7. Goodyear

5.2.8. Semperit AG

5.2.9. Toyo Tire Europe

5.2.10. Hutchinson SA

5.2.11. Apollo Tyres

5.2.12. Nexen Tire

5.2.13. Cooper Tire & Rubber Company

5.2.14. Sumitomo Rubber Industries

5.2.15. Kumho Tire

5.3. Company-Specific Recent Developments

5.4. Mergers, Acquisitions, and Joint Ventures

5.5. Strategic Initiatives

5.6. Innovation and R&D Initiatives

5.7. Cross-Comparison (headquarters, revenue, establishment year)

6. Financial Analysis and Investment Landscape

6.1. Revenue Analysis

6.2. Investment Trends

6.3. Venture Capital and Private Equity Investments

6.4. Government Grants and Subsidies

6.5. Financial Performance of Major Players

6.6. ROI and Profitability Analysis

7. Regulatory Framework

7.1. Environmental Standards and Certifications

7.2. Compliance and Legal Requirements

7.3. EU-Specific Regulatory Policies

7.4. Impact of Global Trade Regulations

7.5. Government Policies Supporting Sustainability

8. Future Market Outlook

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

8.3. Forecasted Market Segmentation (in Value %)

8.3.1. By Product Type

8.3.2. By End-Use Industry

8.3.3. By Application

8.3.4. By Rubber Type

8.3.5. By Region

8.4. Expected Technological Advancements

8.5. Sustainability and Recycling Initiatives

9. Analysts Recommendations and Strategic Insights

9.1. TAM/SAM/SOM Analysis

9.2. Market Penetration Strategies

9.3. M&A Opportunities

9.4. New Product Launch Strategies

9.5. White Space and Innovation Opportunities

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe Rubber market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Europe rubber market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple rubber production companies to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe rubber market.

Frequently Asked Questions

01. How big is the Europe Rubber Market?

The Europe Rubber Market was valued at approximately USD 450 million in 2023. The market is driven by the strong demand from the automotive, construction, and industrial sectors, along with sustainability initiatives and government regulations.

02. What are the challenges in the Europe Rubber Market?

Challenges in the Europe Rubber Market include raw material shortages due to supply chain disruptions, high compliance costs related to environmental regulations, and increasing competition from low-cost manufacturers in Asia, especially China and India.

03. Who are the major players in the Europe Rubber Market?

Key players in the Europe Rubber Market include Continental AG, Michelin, Bridgestone Europe, Lanxess AG, and Pirelli. These companies lead due to their innovation, strong distribution networks, and focus on sustainable rubber production.

04. What are the growth drivers of the Europe Rubber Market?

The growth of the Europe Rubber Market is driven by rising demand for electric vehicle-specific tires, sustainability initiatives in rubber recycling, and significant investments in infrastructure projects across Europe, particularly in Germany, France, and Italy.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.