Europe Smart Water Meter Market Outlook to 2030

Region:Europe

Author(s):Sanjeev

Product Code:KROD4264

November 2024

89

About the Report

Europe Smart Water Meter Market Overview

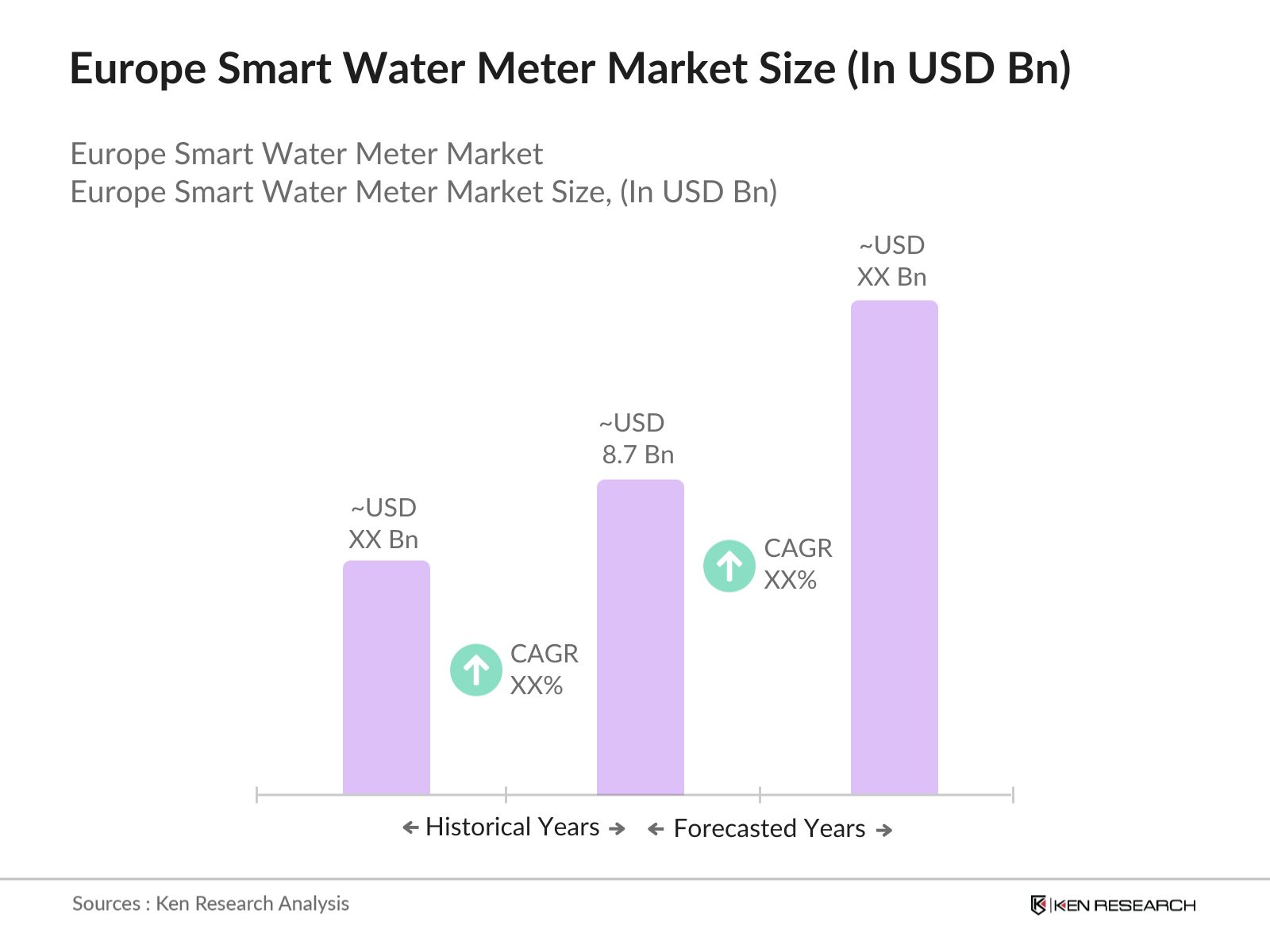

- The Europe Smart Water Meter market, valued at USD 8.7 billion, is primarily driven by the growing adoption of smart city initiatives and government regulations focused on water conservation. The need for more efficient water management systems and the implementation of advanced metering infrastructure (AMI) have fueled market growth. Factors like increasing population, rapid urbanization, and the need for sustainable water use have further contributed to the expansion of the smart water meter market across Europe, with large-scale deployment in both residential and commercial sectors.

- Several European countries, including Germany, the UK, and France, are dominant players in the smart water meter market. These nations are spearheading the market due to their proactive government policies promoting water conservation and extensive investment in infrastructure upgrades. Germany leads with its robust smart water grid initiatives, while the UK and France benefit from strong governmental regulations around water usage efficiency and environmental sustainability.

- The EU Water Framework Directive, established in 2000 and updated in 2023, sets stringent guidelines for sustainable water use across Europe. The Directive mandates that member states achieve good water status by 2027, and smart water meters are essential in tracking consumption and minimizing waste. The European Commission reported that 10 billion has been allocated to water management reforms in 2023-2024, with smart metering technology playing a critical role in compliance. France and the Netherlands have led the charge, implementing smart meters in over 80% of households by 2024.

Europe Smart Water Meter Market Segmentation

The Europe Smart Water Meter market can be segmented by product type and by application.

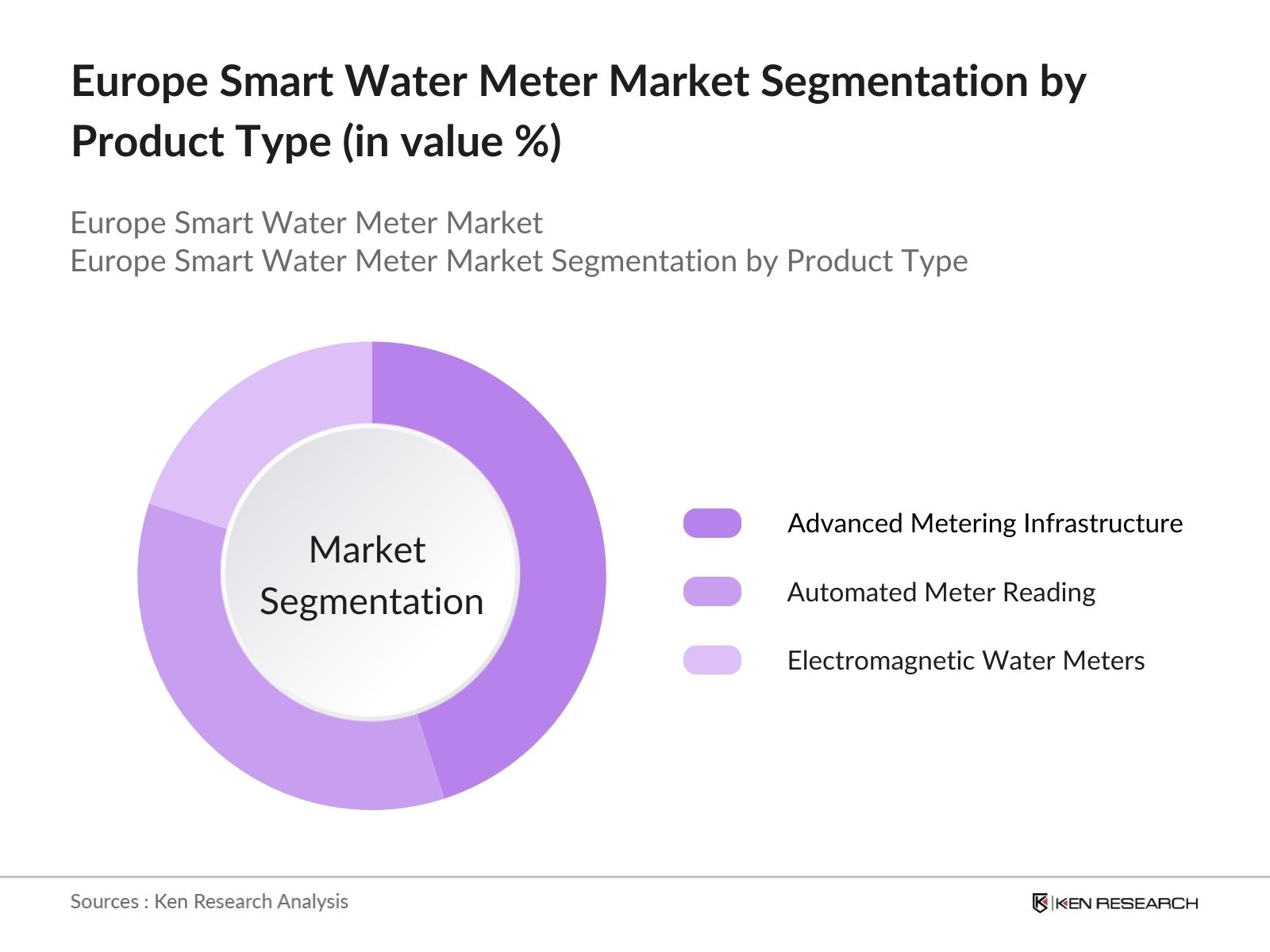

- By Product Type: The Europe Smart Water Meter market is segmented by product type into Advanced Metering Infrastructure (AMI), Automated Meter Reading (AMR), and Electromagnetic Water Meters. Advanced Metering Infrastructure (AMI) has a dominant market share in this segment, mainly due to its ability to provide real-time data, two-way communication between the utility and the meter, and enhanced consumer control over water usage. AMI is favored by utility providers due to its superior capabilities in data analysis, leak detection, and water management, which have significantly reduced operational costs.

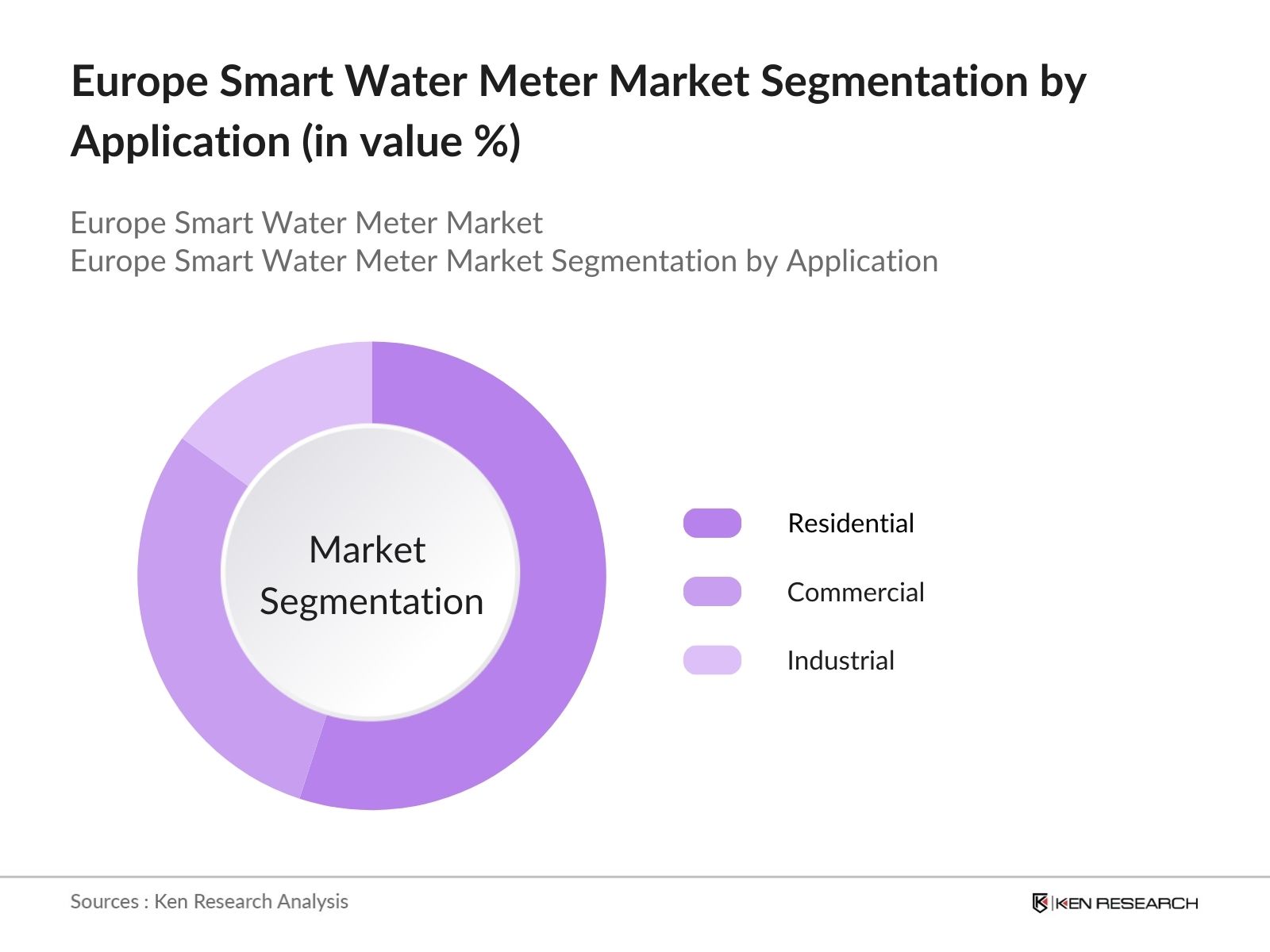

- By Application: By application, the smart water meter market is segmented into Residential, Commercial, and Industrial sectors. The residential sector holds the dominant market share due to the rapid adoption of smart water meters in households across Europe, driven by growing concerns about water scarcity and the push for water conservation. The deployment of smart meters in residential areas has also been promoted by government initiatives to encourage consumers to monitor and manage their water usage more efficiently.

Europe Smart Water Meter Market Competitive Landscape

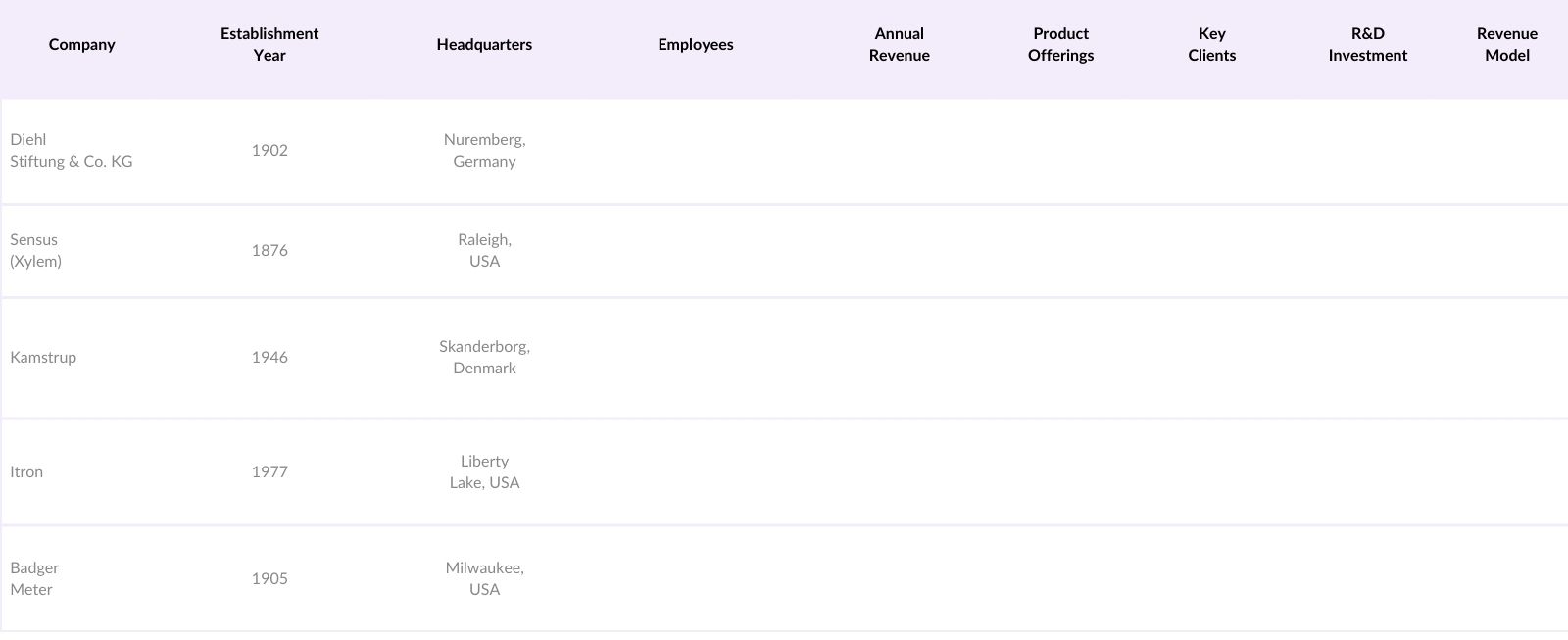

The Europe Smart Water Meter market is dominated by several key players, both regional and global. These companies play a pivotal role in market consolidation, providing advanced metering solutions and working closely with local utilities to enhance water management systems. Major companies include Diehl Stiftung & Co. KG, Sensus (Xylem), Kamstrup, and Itron. Their strong market presence is driven by continuous product innovation, strategic partnerships with utilities, and a focus on R&D for advanced metering technologies.

Europe Smart Water Meter Market Analysis

Growth Drivers

- Water Conservation Initiatives: Water conservation has become a top priority in Europe, as many countries experience increased pressure on their water resources due to climate change and urbanization. In 2024, the European Environment Agency (EEA) reported that water scarcity affects over 130 million people across Europe, with southern regions being the most impacted. Smart water meters play a crucial role in reducing water wastage by providing real-time consumption data. Governments across Europe, particularly in Spain and Italy, have allocated over 5 billion in 2023 towards water conservation projects that prioritize smart metering technology. This trend is driven by the EUs Water Framework Directive, which promotes efficient water usage.

- Smart City Projects (Infrastructure Integration): The European Commission's Smart City initiative has led to significant investments in integrating smart water meters with broader urban infrastructure projects. Over 300 smart city projects in Europe, covering cities like Copenhagen and Barcelona, have incorporated water management solutions, including smart metering systems. In 2024, the European Investment Bank committed 2.5 billion to smart city projects, with a focus on sustainable water management infrastructure. These meters enable real-time monitoring of water usage, helping cities reduce leaks, enhance resource efficiency, and ensure the sustainable delivery of water to urban populations.

- Government Policies for Water Management: Governments across Europe are implementing stringent policies aimed at improving water management through smart metering. In 2023, the European Union adopted legislation under the European Green Deal aimed at reducing water waste by 15%, and smart water meters are at the forefront of this effort. Germany, for instance, allocated 700 million in 2024 for the nationwide installation of smart water meters as part of its climate change adaptation policy. These government initiatives provide a conducive environment for market growth, as they mandate the integration of advanced metering infrastructure to meet water conservation targets.

Market Challenges

High Capital Expenditure: One of the significant challenges in the adoption of smart water meters is the high capital expenditure involved in their deployment. In 2023, a study by the European Investment Bank highlighted that the installation of smart water meters costs approximately 150 per household in countries like the Netherlands and Germany. Utilities face high upfront costs, which can deter smaller water companies from adopting the technology on a large scale. These costs are often passed on to consumers, making it a financial burden for many municipalities. Additionally, the need for infrastructure upgrades adds to the overall expense.

Data Security Concerns: With the rise of IoT-enabled smart meters, data security has become a pressing concern. In 2024, a report from the European Union Agency for Cybersecurity (ENISA) noted that water utilities are increasingly targeted by cyberattacks aimed at disrupting water supply services and accessing sensitive consumer data. Approximately 25% of water utilities in Europe reported cyber incidents in 2023, with data breaches affecting 1.5 million households. This challenge necessitates enhanced security measures for data encryption and secure communication protocols to protect consumer information and maintain system integrity.

Europe Smart Water Meter Market Future Outlook

The Europe Smart Water Meter market is expected to witness significant growth in the next five years, driven by continuous advancements in IoT technology, rising awareness of water conservation, and government policies promoting smart city initiatives. The shift towards sustainable and efficient water management practices will further accelerate market demand. Innovations in AMI technology and the integration of AI-driven data analytics are likely to enhance the precision and utility of smart water metering systems, fostering market expansion.

Market Opportunities

- Integration with Smart Grid Solutions: Smart water meters are increasingly being integrated with smart grid solutions to create more efficient utility systems. In 2024, Germany launched a pilot project integrating 500,000 smart water meters with the national smart grid, allowing for real-time data sharing between water and electricity utilities. This integration enables better demand response, resource allocation, and efficiency improvements. The European Union has also earmarked 1.5 billion under the NextGenerationEU initiative to promote smart grid integration across member states, particularly in water-stressed regions.

- Expansion in Emerging European Economies: Emerging economies in Eastern Europe, such as Poland and Hungary, are witnessing rapid growth in smart water meter adoption. In 2024, Poland announced a 300 million investment into smart water management technologies, including the deployment of 1 million smart water meters by the end of the year. These countries are benefiting from European Union funding aimed at modernizing water infrastructure, with a specific focus on enhancing resource efficiency and reducing water wastage. This presents significant opportunities for market players to expand into these growing markets.

Scope of the Report

|

Advanced Metering Infrastructure (AMI) Automated Meter Reading (AMR) Electromagnetic Water Meters Ultrasonic Water Meters Mechanical Water Meters |

|

|

By Component |

Meters Communication Modules IT Solutions (Data Management Systems) |

|

By Application |

Residential Commercial Industrial |

|

By Connectivity Tech |

Wired Wireless (RF, LoRa, NB-IoT) |

|

By Region |

North East West South |

Products

Key Target Audience

Water Utility Companies

Municipalities and Government Bodies (European Union Water Initiative, OFWAT, Bundesministerium fr Umwelt)

Technology and IoT Solution Providers

Infrastructure Development Agencies

Venture Capital and Private Equity Firms

Environmental Regulatory Agencies (European Environment Agency)

Investment Firms

Water Conservation Organizations

Companies

Major Players Mention in the Report:

Diehl Stiftung & Co. KG

Sensus (Xylem)

Kamstrup

Itron

Badger Meter

Arad Group

Neptune Technology Group

Aclara Technologies

Zenner International

Elster Group (Honeywell)

Metron-Farnier

Aquiba Pty Ltd

Datamatic Inc.

Apator Group

Master Meter

Table of Contents

1. Europe Smart Water Meter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Smart Water Meter Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Smart Water Meter Market Analysis

3.1. Growth Drivers

3.1.1. Water Conservation Initiatives

3.1.2. Smart City Projects (Infrastructure Integration)

3.1.3. Government Policies for Water Management

3.1.4. Adoption of IoT in Water Management Systems

3.2. Market Challenges

3.2.1. High Capital Expenditure

3.2.2. Data Security Concerns

3.2.3. Limited Connectivity in Rural Areas

3.3. Opportunities

3.3.1. Integration with Smart Grid Solutions

3.3.2. Expansion in Emerging European Economies

3.3.3. Technological Advancements in Metering Technologies

3.4. Trends

3.4.1. AI-based Data Analytics (For Usage Prediction)

3.4.2. Prepaid Water Metering Systems

3.4.3. Cloud-based Data Management Platforms

3.5. Government Regulation

3.5.1. Water Framework Directive (EU)

3.5.2. Sustainable Water Use Legislation

3.5.3. Public-Private Partnership Incentives

3.5.4. Subsidies for Smart Meter Adoption

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Utilities

3.7.2. Technology Providers

3.7.3. Government Bodies

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Europe Smart Water Meter Market Segmentation

4.1. By Product Type (In Value %) 4.1.1. Advanced Metering Infrastructure (AMI)

4.1.2. Automated Meter Reading (AMR)

4.1.3. Electromagnetic Water Meters

4.1.4. Ultrasonic Water Meters

4.1.5. Mechanical Water Meters

4.2. By Component (In Value %) 4.2.1. Meters

4.2.2. Communication Modules

4.2.3. IT Solutions (Data Management Systems)

4.3. By Application (In Value %) 4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.4. By Connectivity Technology (In Value %) 4.4.1. Wired

4.4.2. Wireless (RF, LoRa, NB-IoT)

4.5. By Region (In Value %) 4.5.1. West

4.5.2. South

4.5.3. East

4.5.4. North

5. Europe Smart Water Meter Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Diehl Stiftung & Co. KG

5.1.2. Sensus (Xylem)

5.1.3. Kamstrup

5.1.4. Itron

5.1.5. Badger Meter

5.1.6. Arad Group

5.1.7. Neptune Technology Group

5.1.8. Aclara Technologies

5.1.9. Zenner International

5.1.10. Elster Group (Honeywell)

5.1.11. Metron-Farnier

5.1.12. Aquiba Pty Ltd

5.1.13. Datamatic Inc.

5.1.14. Apator Group

5.1.15. Master Meter

5.2. Cross Comparison Parameters

(Revenue, Number of Employees, Headquarters, Geographical Presence, Smart Water Meter Deployments, Key Clients, R&D Investments, Product Innovations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.4.1. Product Development & Innovation

5.4.2. Partnerships & Collaborations

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Smart Water Meter Market Regulatory Framework

6.1. Regulatory Standards for Water Metering

6.2. Data Privacy and Security Regulations

6.3. Compliance Requirements

6.4. Certification Processes

7. Europe Smart Water Meter Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Smart Water Meter Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Component (In Value %)

8.3. By Application (In Value %)

8.4. By Connectivity Technology (In Value %)

8.5. By Region (In Value %)

9. Europe Smart Water Meter Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all major stakeholders within the Europe Smart Water Meter Market. Extensive desk research is carried out using secondary and proprietary databases to gather comprehensive industry-level data. The objective is to define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the Europe Smart Water Meter Market is compiled and analyzed. This includes evaluating market penetration, the ratio of smart meter deployments, and the resultant revenue generation across residential, commercial, and industrial sectors.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through computer-assisted interviews (CATIs) with industry experts from water utility companies, technology providers, and regulatory bodies. This process provides operational insights from key industry players, supporting market data analysis.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple smart water meter manufacturers and utility companies. Detailed insights into product segments, consumer preferences, and sales performance are gathered to complement the bottom-up approach, ensuring a comprehensive and validated analysis of the market.

Frequently Asked Questions

01. How big is the Europe Smart Water Meter Market?

The Europe Smart Water Meter market is valued at USD 8.7 billion, driven by water conservation initiatives, government policies, and the increasing need for smart infrastructure to improve water management across the region.

02. What are the major challenges in the Europe Smart Water Meter Market?

The Europe Smart Water Meter market key challenges include high capital costs for infrastructure development, data security concerns related to the deployment of smart technologies, and limited connectivity in rural areas, which impacts widespread adoption.

03. Who are the major players in the Europe Smart Water Meter Market?

Europe Smart Water Meter market Key players include Diehl Stiftung & Co. KG, Sensus (Xylem), Kamstrup, Itron, and Badger Meter. These companies dominate the market due to their advanced metering solutions, partnerships with utilities, and strong R&D investments.

04. What are the growth drivers of the Europe Smart Water Meter Market?

Europe Smart Water Meter market Growth drivers include increasing government regulations promoting water conservation, the adoption of smart city projects, and advancements in IoT technology, which enhance the efficiency of water management systems.

05. Which sectors are adopting Smart Water Meters the fastest?

The residential sector is the fastest adopter of smart water meters, driven by rising consumer awareness of water conservation and government incentives aimed at reducing water waste in households across Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.