Europe Systems Integrator Market Outlook to 2030

Region:Europe

Author(s):Sanjna

Product Code:KROD7747

December 2024

85

About the Report

Europe Systems Integrator Market Overview

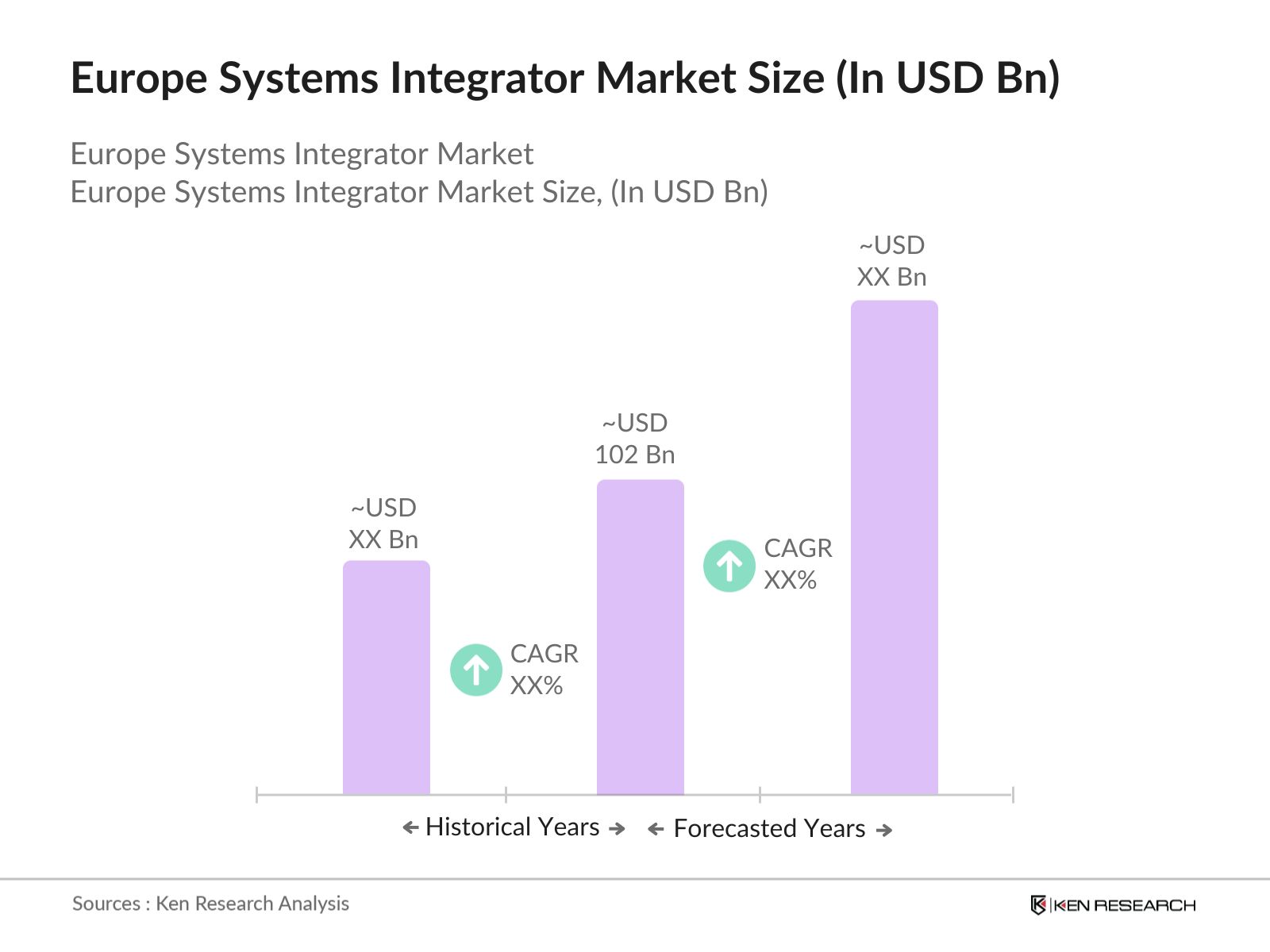

- The Europe Systems Integrator market is valued at USD 102 billion, based on a five-year historical analysis. The market is primarily driven by the accelerated adoption of digital transformation initiatives, government-led modernization projects, and the increasing complexity of IT environments across various industries, including finance, healthcare, and manufacturing.

- Germany, France, and the United Kingdom dominate the market due to their advanced IT infrastructure and high demand for integrated solutions in sectors like manufacturing, financial services, and public administration. Germany, with its robust industrial sector, requires complex integration solutions to support Industry 4.0 initiatives, while the UK and France benefit from government-backed digitalization efforts, particularly in smart city development and national cybersecurity projects.

- National digitalization initiatives are fostering growth in Europes systems integration market. Germany, France, and the Netherlands have outlined digital transformation roadmaps, allocating over USD 16.8 billion collectively for public digital infrastructure projects through 2025. Systems integrators are essential for deploying integrated IT infrastructures that align with these national goals, particularly in areas like cloud migration and cybersecurity.

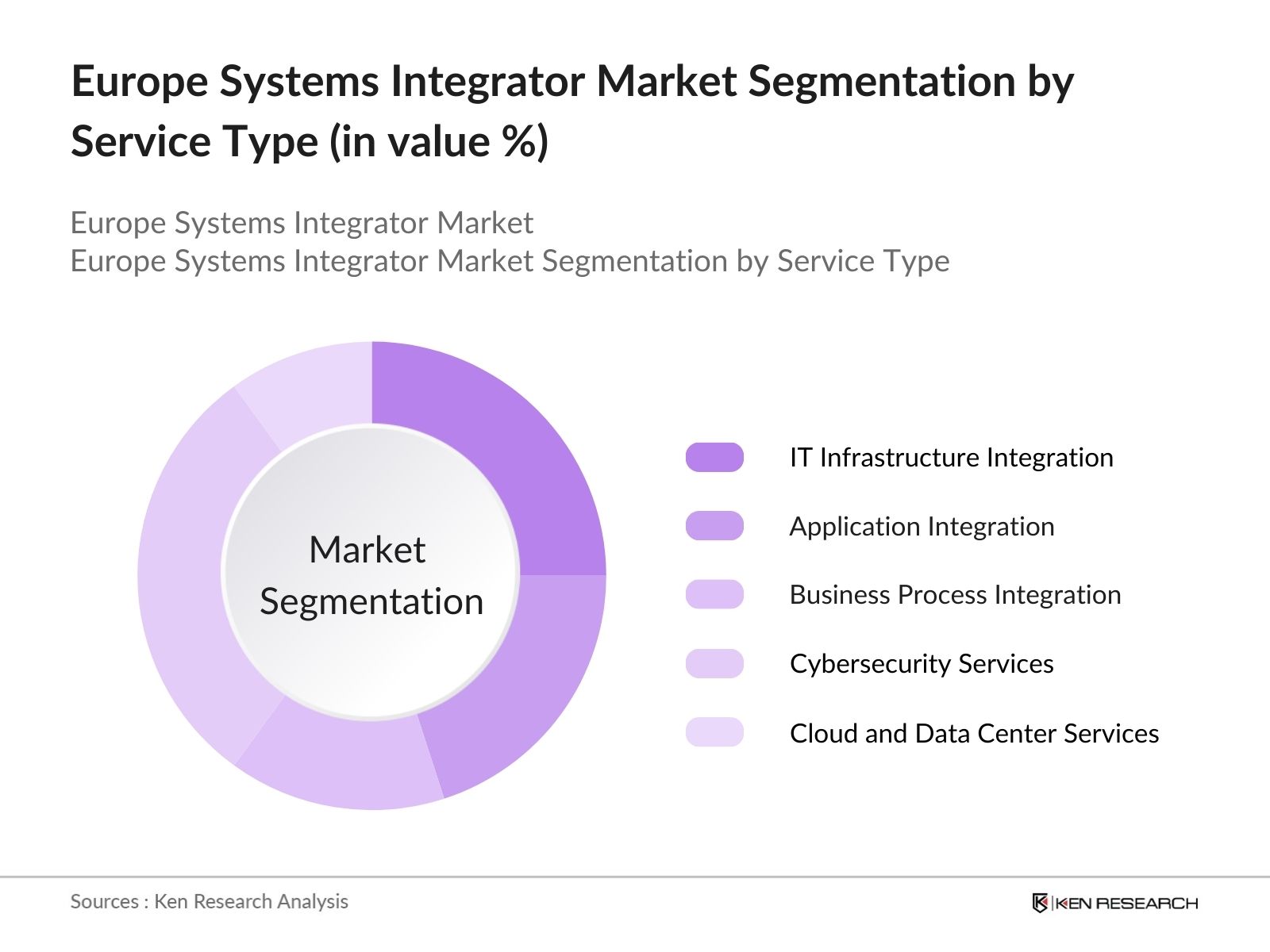

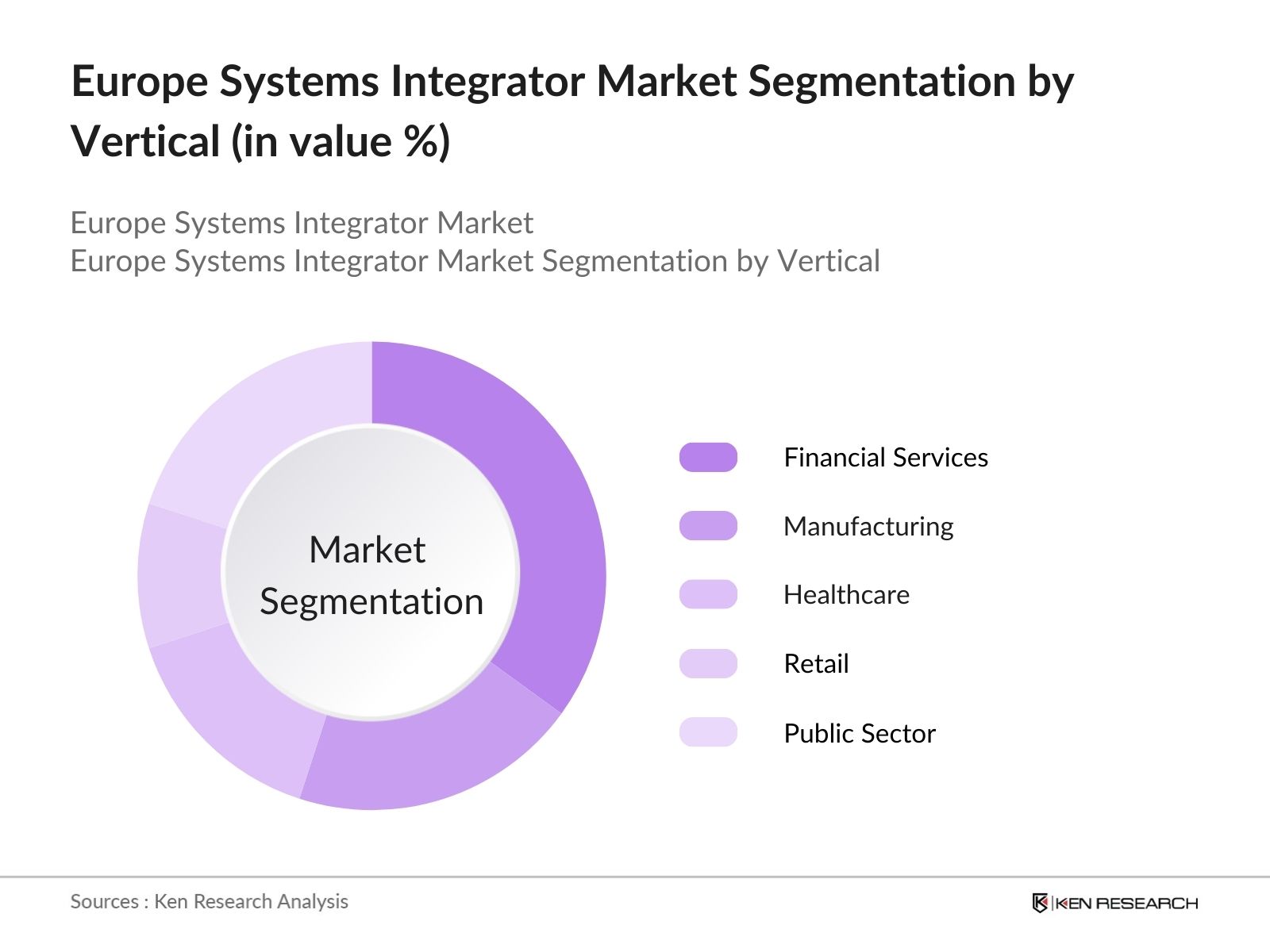

Europe Systems Integrator Market Segmentation

- By Service Type: The Europe Systems Integrator market is segmented by service type into IT infrastructure integration, application integration, business process integration, cybersecurity services, and cloud and data center services. Among these, cybersecurity services currently dominate the market share due to increasing threats to data privacy and the growing importance of GDPR compliance.

- By Vertical: The market is segmented by vertical into financial services, manufacturing, healthcare, retail, and the public sector. Financial services dominate the market due to the sector's need for highly secure and compliant IT solutions. As one of the most regulated industries, financial institutions are investing heavily in systems integrators to help them meet stringent regulatory requirements while ensuring smooth operational efficiency across distributed digital infrastructures.

Europe Systems Integrator Market Competitive Landscape

The Europe Systems Integrator market is characterized by the presence of global technology leaders as well as regional players specializing in specific verticals. The market's competitive landscape is marked by frequent mergers and acquisitions, strategic partnerships, and heavy investment in research and development, particularly in areas such as cloud integration and cybersecurity. The consolidation of the market around a few key players allows for streamlined service offerings, while smaller niche firms focus on custom solutions for specialized sectors like healthcare and manufacturing.

|

Company |

Establishment Year |

Headquarters |

Key Service Offerings |

Geographic Presence |

Revenue (2023) |

Strategic Focus |

Industry Specialization |

Recent Acquisitions |

Partnerships |

|

Accenture |

1989 |

Dublin, Ireland |

- |

- |

- |

- |

- |

- |

- |

|

Atos SE |

1997 |

Bezons, France |

- |

- |

- |

- |

- |

- |

- |

|

Capgemini |

1967 |

Paris, France |

- |

- |

- |

- |

- |

- |

- |

|

DXC Technology |

2017 |

Virginia, USA |

- |

- |

- |

- |

- |

- |

- |

|

IBM Corporation |

1911 |

New York, USA |

- |

- |

- |

- |

- |

- |

- |

Europe Systems Integrator Market Analysis

Growth Drivers

- Cloud Integration Demand: Cloud integration in Europe is increasingly vital due to the region's shift towards digital transformation. By 2024, government bodies across the EU are investing heavily in cloud-based IT infrastructure to reduce dependency on legacy systems, streamline operations, and enhance cybersecurity. For example, the European Commission has committed over USD 1.3 billion for cloud and edge computing projects under its Digital Europe Programme. This funding directly supports systems integrators in integrating multi-cloud environments into public and private sectors.

- Rise in IoT and AI Adoption: The adoption of IoT and AI is surging in Europe, driving demand for systems integration services. The European IoT market is projected to reach 14 billion connected devices by 2025, necessitating seamless system integration. Meanwhile, EU funding for AI projects under the Horizon Europe program amounts to USD 2 billion, facilitating AI deployment across industries like manufacturing, healthcare, and transportation. These numbers highlight the significant role systems integrators will play in consolidating IoT and AI solutions into existing IT infrastructures.

- Government Digitalization Initiatives: Government-led digitalization projects are central to systems integration demand in Europe. The European Unions Digital Decade targets, which allocate 10 billion for 5G and broadband infrastructure, encourage rapid digital transformation across member states. National governments, such as Germany and France, are also prioritizing cloud adoption and e-governance platforms. Germany's Federal Ministry of the Interior (BMI) has allocated 3 billion to develop a cloud-based public administration system by 2025, which boosts the demand for system integrators to ensure seamless transitions.

Challenges

- High Cost of System Upgrades: The rising cost of upgrading legacy IT systems remains a significant challenge for European businesses. In 2023, IT infrastructure upgrade costs were reported to exceed USD 432 million annually for large corporations across Europe. This financial burden impacts the ability of enterprises, particularly SMEs, to invest in advanced systems integration services, hindering large-scale digital transformation projects.

- Complex Regulatory Compliance: Systems integrators face stringent regulatory compliance challenges in Europe, particularly with data privacy regulations like GDPR. In 2022, GDPR non-compliance fines in the EU amounted to over USD 898 million. Systems integrators must navigate a complex regulatory landscape when integrating new technologies and IT systems, adding significant overhead costs and delaying implementation timelines.

Europe Systems Integrator Market Future Outlook

Europe Systems Integrator market is expected to experience significant growth driven by the continued expansion of digital transformation initiatives across industries. Increasing reliance on cloud computing, the roll-out of 5G networks, and the adoption of advanced cybersecurity measures will be key drivers of this growth. Moreover, advancements in AI, IoT, and robotic process automation (RPA) are expected to further fuel the demand for integration services as companies look to leverage these technologies for operational efficiency and competitive advantage.

Market Opportunities

- Integration of 5G in Industries: The rollout of 5G technology across Europe presents significant opportunities for systems integrators. As of 2024, the EUs 5G Action Plan has led to the deployment of 5G infrastructure in over 50% of urban areas. This rapid expansion opens new avenues for systems integration in sectors like manufacturing, healthcare, and transportation, where 5G enables real-time data processing and smart automation solutions.

- Expansion into Non-Urban Markets: Systems integrators can also capitalize on expanding digital infrastructure in non-urban areas. he CEF Digital component, which focuses on digital infrastructure, has a budget of USD 2.24 billion for the 2021-2027 period, aimed at funding connectivity projects across the EU, including high-speed broadband initiative This initiative promotes IT infrastructure development in underserved regions, offering systems integrators the opportunity to support digitalization efforts in agriculture, logistics, and rural healthcare.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Service Type |

IT Infrastructure Integration |

|

Application Integration |

|

|

Business Process Integration |

|

|

Cybersecurity Services |

|

|

Cloud and Data Center Services |

|

|

By Vertical |

Financial Services |

|

Manufacturing |

|

|

Healthcare |

|

|

Retail |

|

|

Public Sector |

|

|

By Technology |

IoT |

|

AI and Machine Learning |

|

|

Cloud Computing |

|

|

Blockchain |

|

|

Robotic Process Automation (RPA) |

|

|

By Deployment Model |

On-Premise |

|

Cloud |

|

|

Hybrid |

|

|

By Country |

Germany |

|

France |

|

|

United Kingdom |

|

|

Italy |

|

|

Spain |

Products

Key Target Audience

Financial Institutions

Manufacturing Companies

Healthcare Providers

Retail Chains

Public Sector Departments (Ministries of IT and Communications)

Technology Companies and Startups

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (European Union Agencies, National Data Protection Authorities)

Companies

Players Mentioned in the Report

Accenture

Atos SE

Capgemini

DXC Technology

IBM Corporation

Tata Consultancy Services (TCS)

Cognizant Technology Solutions

Infosys Limited

Wipro Limited

NTT Data Corporation

Table of Contents

1. Europe Systems Integrator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Systems Integrator Market Size (in USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Systems Integrator Market Analysis

3.1. Growth Drivers (Digital Transformation, Cybersecurity Needs, IT Infrastructure Investments)

3.1.1. Cloud Integration Demand

3.1.2. Rise in IoT and AI Adoption

3.1.3. Government Digitalization Initiatives

3.1.4. Increased Demand for Cybersecurity Solutions

3.2. Market Challenges (Cost Pressures, Data Privacy Regulations, Skill Gaps)

3.2.1. High Cost of System Upgrades

3.2.2. Complex Regulatory Compliance

3.2.3. Shortage of Skilled IT Professionals

3.3. Opportunities (5G Rollout, Smart Cities, Public-Private Partnerships)

3.3.1. Integration of 5G in Industries

3.3.2. Expansion into Non-Urban Markets

3.3.3. Cross-Border Collaborations

3.4. Trends (AI-Powered Integrations, Sustainable IT Solutions, Hybrid Cloud Strategies)

3.4.1. Growing Preference for Hybrid IT Models

3.4.2. Rise in Edge Computing Services

3.4.3. Adoption of Green IT Solutions

3.5. Government Regulation (GDPR, Data Localization, Public Digital Infrastructures)

3.5.1. GDPR Compliance Requirements

3.5.2. Data Localization Policies in the EU

3.5.3. National Digitalization Roadmaps

3.5.4. Regulatory Initiatives Supporting IT Investments

3.6. SWOT Analysis

3.7. Stake Ecosystem (System Integrators, Tech Providers, Government Agencies)

3.8. Porters Five Forces (Bargaining Power of Buyers, Suppliers, Threat of Substitutes)

3.9. Competition Ecosystem

4. Europe Systems Integrator Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. IT Infrastructure Integration

4.1.2. Application Integration

4.1.3. Business Process Integration

4.1.4. Cybersecurity Services

4.1.5. Cloud and Data Center Services

4.2. By Vertical (In Value %)

4.2.1. Financial Services

4.2.2. Manufacturing

4.2.3. Healthcare

4.2.4. Retail

4.2.5. Public Sector

4.3. By Technology (In Value %)

4.3.1. IoT

4.3.2. AI and Machine Learning

4.3.3. Cloud Computing

4.3.4. Blockchain

4.3.5. Robotic Process Automation (RPA)

4.4. By Deployment Model (In Value %)

4.4.1. On-Premise

4.4.2. Cloud

4.4.3. Hybrid

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

5. Europe Systems Integrator Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Accenture

5.1.2. Atos SE

5.1.3. Capgemini

5.1.4. DXC Technology

5.1.5. IBM Corporation

5.1.6. Tata Consultancy Services (TCS)

5.1.7. Cognizant Technology Solutions

5.1.8. Infosys Limited

5.1.9. Wipro Limited

5.1.10. NTT Data Corporation

5.2 Cross Comparison Parameters (Revenue, Headquarters, Key Services, Market Share, Strategic Partnerships, Technology Specializations, Industry Focus, Geographic Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Systems Integrator Market Regulatory Framework

6.1. GDPR Compliance

6.2. Certification Processes (ISO 27001, SOC 2)

6.3. Compliance Requirements (Industry-Specific Regulations, Cybersecurity Standards)

7. Europe Systems Integrator Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Systems Integrator Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Vertical (In Value %)

8.3. By Technology (In Value %)

8.4. By Deployment Model (In Value %)

8.5. By Country (In Value %)

9. Europe Systems Integrator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that captures all major stakeholders within the Europe Systems Integrator Market. This is achieved through comprehensive desk research, utilizing proprietary databases and industry reports to gather information. The objective is to pinpoint critical variables such as service demand, regulatory influences, and industry dynamics that drive market behavior.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data specific to the Europe Systems Integrator Market. Key factors like market penetration, service adoption rates, and sector-wise revenue generation are assessed. This analysis helps form a base for accurate predictions about the future growth trajectory of the market.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed concerning future trends and market opportunities, which are then validated through consultations with industry experts. These experts provide insights into operational trends and challenges, offering on-ground perspectives that complement the quantitative data analysis.

Step 4: Research Synthesis and Final Output

The final phase entails synthesizing the research findings into actionable insights. Direct interviews with key players in the market provide critical qualitative data, ensuring that the final output is well-rounded and incorporates both top-down and bottom-up approaches for a comprehensive market evaluation.

Frequently Asked Questions

1. How big is the Europe Systems Integrator Market?

The Europe Systems Integrator market is valued at USD 102 billion, driven by growing digital transformation projects and increasing demand for integrated IT and cybersecurity solutions across various industries.

2. What are the challenges in the Europe Systems Integrator Market?

Key challenges in Europe Systems Integrator market include navigating the complex regulatory environment, managing cost pressures associated with large-scale integration projects, and addressing the ongoing shortage of skilled IT professionals across Europe.

3. Who are the major players in the Europe Systems Integrator Market?

Major players in Europe Systems Integrator market include Accenture, Atos SE, Capgemini, DXC Technology, and IBM Corporation. These companies dominate due to their global presence, extensive service offerings, and expertise in key technologies such as AI, cloud computing, and cybersecurity.

4. What are the growth drivers of the Europe Systems Integrator Market?

Growth drivers in Europe Systems Integrator market include the increasing demand for cloud integration services, the adoption of Industry 4.0 in manufacturing, advancements in cybersecurity solutions, and the expansion of IoT applications in various sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.