Europe Tea Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD3245

December 2024

85

About the Report

Europe Tea Market Overview

- The Europe tea market is currently valued at USD 13.4 billion, based on a five-year historical analysis. This market is driven by the increasing demand for organic and herbal teas, which have gained traction among health-conscious consumers. The rise of specialty teas such as matcha and rooibos, alongside functional teas offering health benefits like digestion and relaxation, has contributed to this substantial market valuation. Furthermore, the growing awareness of sustainability and ethical sourcing practices has fueled the shift towards organic teas.

- Countries such as the United Kingdom, Germany, and France dominate the European tea market due to their long-standing tea culture and consumption habits. The UK, in particular, holds a strong position because of its historical connection to tea, high per capita consumption, and established retail infrastructure. Germanys dominance stems from its role as a leading importer of tea, especially green and herbal varieties, while France's specialty tea culture and premiumization trends have also contributed to its significant market presence.

- The European Green Deal, implemented in 2020, continues to play a significant role in promoting sustainable agriculture, including tea farming. In 2024, the European Union has allocated over 20 billion to organic farming subsidies, with specific support for organic tea cultivation in countries like France, Italy, and Spain. These initiatives include grants for farmers transitioning from conventional to organic farming practices, as well as financial aid for certification processes. This policy directly impacts the tea market, as governments aim to reduce pesticide use and promote biodiversity through organic agricultural methods.

Europe Tea Market Segmentation

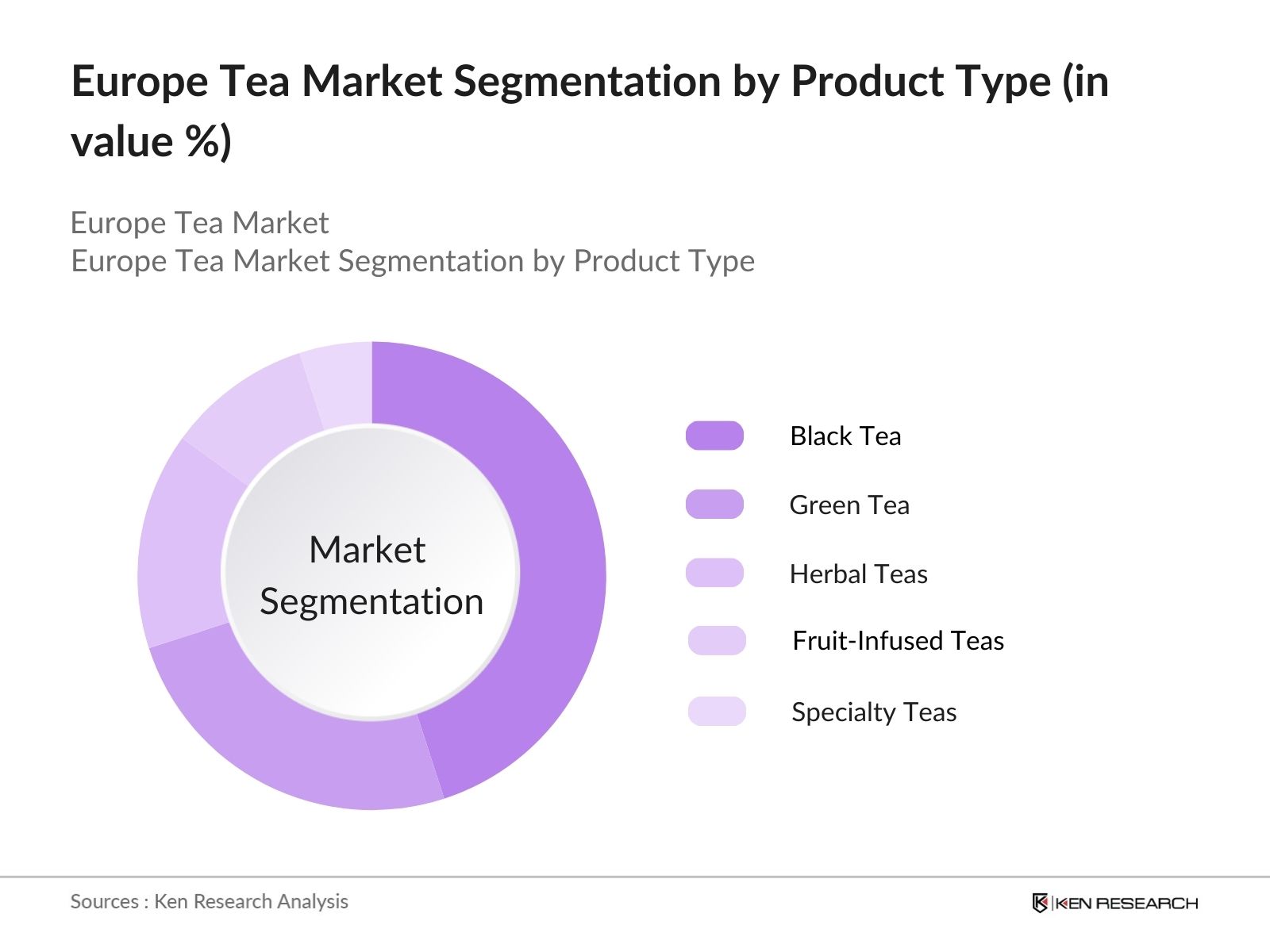

By Product Type: The Europe tea market is segmented by product type into black tea, green tea, herbal teas, fruit-infused teas, and other specialty teas. Black tea dominates the market due to its deeply rooted cultural significance, particularly in countries like the United Kingdom, where traditional black tea blends such as English Breakfast and Earl Grey remain highly popular. Furthermore, the robust flavor profile of black tea has maintained its demand in both households and foodservice sectors.

By Distribution Channel: The market is segmented by distribution channels into supermarkets/hypermarkets, specialty tea stores, online retail, cafes, and direct sales. Supermarkets and hypermarkets lead in market share due to the wide availability of mainstream tea brands and consumer preference for convenient, one-stop shopping experiences. The vast selection of tea products in these outlets, often accompanied by promotional offers, makes them the preferred distribution channel for many consumers across Europe.

Europe Tea Market Competitive Landscape

The Europe tea market is dominated by a few key players, both local and global. The competitive landscape is defined by strong brand recognition, extensive distribution networks, and a focus on sustainability and ethical sourcing practices. Leading companies have also increasingly shifted their focus to premium and specialty teas, particularly as consumer preferences have evolved towards high-quality and ethically sourced products. Additionally, innovations in tea blends and packaging, including eco-friendly options, have given some players a competitive edge.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD) |

Sustainability Focus |

Product Portfolio |

Market Presence |

|

Unilever |

1929 |

London, UK |

- | - | - | - | - |

|

Tata Consumer Products |

1964 |

Mumbai, India |

- | - | - | - | - |

|

Twinings |

1706 |

Andover, UK |

- | - | - | - | - |

|

Harney & Sons |

1983 |

Millerton, US |

- | - | - | - | - |

|

Teekanne GmbH |

1882 |

Dsseldorf, Germany |

- | - | - | - | - |

Europe Tea Market Analysis

Growth Drivers

- Growth in Organic Tea Cultivation: Europe has seen a significant increase in organic tea cultivation, driven by rising consumer demand for organic products. In 2024, organic tea farms across Europe, especially in regions like Italy and France, have expanded by over 100,000 hectares, supported by government subsidies for organic farming. Countries such as Germany and the Netherlands are major markets for organic tea, accounting for a substantial portion of tea imports from organic-certified plantations in regions like India and Sri Lanka. The shift toward organic cultivation aligns with the European Green Deal's focus on sustainable agriculture.

- Increasing Demand for Herbal and Functional Teas: Consumers in Europe are increasingly gravitating towards herbal and functional teas for their perceived health benefits. Chamomile, ginger, and mint teas have seen a rise in demand, with Germany importing more than 40,000 tons of herbal tea in 2024. This shift is largely attributed to the growing focus on wellness and immunity, particularly post-pandemic, where herbal teas are consumed for their functional benefits, such as aiding digestion and boosting immunity. Governments are promoting herbal tea cultivation as part of wellness programs, particularly in countries like Austria.

- Rise in Health-Conscious Consumers: The rise in health-conscious consumers is a key driver of tea consumption in Europe. In 2024, approximately 120 million Europeans identify themselves as health-conscious, preferring tea over sugary beverages. This trend has bolstered sales of green and matcha teas, both considered rich in antioxidants. Countries such as Sweden and the UK are leading the market, where green tea consumption has grown substantially, encouraged by health initiatives that promote tea as part of a balanced diet. Public health campaigns have played a pivotal role in shifting preferences towards healthier options.

Market Challenges

- Fluctuations in Tea Leaf Prices: The European tea market is vulnerable to fluctuations in global tea leaf prices, particularly due to reliance on imports from Asian countries. In 2024, tea leaf prices have fluctuated significantly due to climate changes affecting major producing countries like Sri Lanka, Kenya, and India. The average price for imported black tea in Europe has increased by 300 per ton, affecting profitability for European tea retailers. These fluctuations are exacerbated by supply chain disruptions, making price management a significant challenge for the industry.

- Supply Chain Disruptions: Global supply chain issues have persisted into 2024, affecting the availability and cost of tea imports to Europe. Shipping delays, higher transportation costs, and geopolitical tensions in key exporting regions such as East Africa and Southeast Asia have led to a shortage of certain tea varieties in European markets. The tea industry faces extended lead times and increased logistics costs, with import costs rising by 15% compared to the previous year, particularly for tea shipments from Sri Lanka, a major supplier to Europe.

Europe Tea Market Future Outlook

Over the next five years, the Europe tea market is expected to continue growing, driven by consumer shifts toward healthier lifestyle choices and sustainable products. As more consumers prioritize wellness and ethical consumption, demand for herbal, organic, and specialty teas is likely to increase. Additionally, the rise of direct-to-consumer models, online retail expansion, and subscription-based services are set to shape the future landscape of the tea market. Innovations in flavor combinations, eco-friendly packaging, and enhanced sourcing transparency are also expected to be key growth drivers.

Market Opportunities

- Growth in Tea-Infused Beverages (Kombucha, Ready-to-Drink Teas): Tea-infused beverages, such as kombucha and ready-to-drink teas, present significant opportunities for growth in Europe. In 2024, the European kombucha market alone is valued at over 900 million, driven by health-conscious consumers and the rising popularity of fermented drinks. Ready-to-drink teas are also gaining momentum, particularly among younger consumers who value convenience and wellness. This segment is expected to grow further as more companies invest in developing innovative, functional beverages that cater to the modern European lifestyle.

- Rising Demand for Sustainable and Ethical Sourcing: European consumers are increasingly seeking sustainably sourced and ethically produced teas. In 2024, over 70% of tea sold in Germany carries certifications such as Fair Trade or Rainforest Alliance, reflecting the growing consumer demand for transparency and ethical business practices. This shift opens opportunities for tea producers who can demonstrate responsible sourcing practices and contribute to environmental sustainability. Additionally, government-backed incentives for sustainable agricultural practices in Europe support the growth of this trend.

Scope of the Report

|

By Product Type |

Green Tea Black Tea Herbal/Floral Teas Fruit-Infused Teas Other Specialty Teas |

|

By Format |

Loose Leaf Tea Tea Bags Ready-to-Drink (RTD) Teas Tea Capsules Instant Tea |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Tea Stores Online Retail Cafes and Tea Houses Direct Sales |

|

By End User |

Retail Consumers Foodservice & Hospitality Corporate Offices Institutions Specialty Stores |

|

By Region |

West East North South Central |

Products

Key Target Audience

Tea Manufacturers

Specialty Tea Retailers

Food and Beverage Distributors

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (EU Organic Certification, Fair Trade Europe)

Health and Wellness Industry

Hospitality and Foodservice Operators

Online Retailers and E-commerce Platforms

Companies

Players Mentioned in the Report:

Unilever

Tata Consumer Products

Twinings

Harney & Sons

Teekanne GmbH

Dilmah Ceylon Tea Company

R. Twining & Co. Ltd

Celestial Seasonings

Bigelow Tea

Yogi Tea

Table of Contents

1. Europe Tea Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Structure and Value Chain Analysis

1.4. Market Segmentation Overview

2. Europe Tea Market Size (In USD Bn)

2.1. Historical Market Size (In USD Bn)

2.2. Year-On-Year Growth Analysis (In USD Bn)

2.3. Key Market Developments and Milestones (Market Specific Metrics - Growth in Specialty Tea Categories, Consumption by Demographics, etc.)

3. Europe Tea Market Analysis

3.1. Growth Drivers

3.1.1. Growth in Organic Tea Cultivation

3.1.2. Increasing Demand for Herbal and Functional Teas

3.1.3. Rise in Health-Conscious Consumers

3.1.4. Expansion of Specialty Tea Cafes

3.2. Market Challenges

3.2.1. Fluctuations in Tea Leaf Prices

3.2.2. Supply Chain Disruptions

3.2.3. Market Saturation in Traditional Tea Varieties

3.2.4. Shifting Consumer Preferences

3.3. Opportunities

3.3.1. Growth in Tea-Infused Beverages (Kombucha, Ready-to-Drink Teas)

3.3.2. Rising Demand for Sustainable and Ethical Sourcing

3.3.3. Increasing Popularity of Premium and Artisanal Teas

3.3.4. Expansion into New Markets (Non-Traditional Tea-Drinking Regions)

3.4. Trends

3.4.1. Increasing Demand for Wellness and Detox Teas

3.4.2. Growth of Direct-to-Consumer Tea Brands

3.4.3. Rise in Eco-Friendly Tea Packaging Solutions

3.4.4. Popularity of Tea Subscription Services

3.5. Government Regulation

3.5.1. EU Regulations on Organic Tea Production

3.5.2. Restrictions on Tea Imports and Exports

3.5.3. Sustainability Requirements for Packaging

3.5.4. Certifications and Standards for Fair Trade and Organic Teas

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Europe Tea Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Green Tea

4.1.2. Black Tea

4.1.3. Herbal/Floral Teas

4.1.4. Fruit-Infused Teas

4.1.5. Other Specialty Teas

4.2. By Format (In Value %)

4.2.1. Loose Leaf Tea

4.2.2. Tea Bags

4.2.3. Ready-to-Drink (RTD) Teas

4.2.4. Tea Capsules

4.2.5. Instant Tea

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Specialty Tea Stores

4.3.3. Online Retail

4.3.4. Cafes and Tea Houses

4.3.5. Direct Sales

4.4. By End User (In Value %)

4.4.1. Retail Consumers

4.4.2. Foodservice & Hospitality

4.4.3. Corporate Offices

4.4.4. Institutions (Healthcare, Education)

4.4.5. Specialty Stores

4.5. By Region (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Northern Europe

4.5.4. Southern Europe

4.5.5. Central Europe

5. Europe Tea Market Competitive Analysis

5.1 Detailed Profiles of Major Companies (15 Competitors)

5.1.1. Unilever

5.1.2. Tata Consumer Products

5.1.3. Twinings

5.1.4. Harney & Sons

5.1.5. Teekanne GmbH

5.1.6. Dilmah Ceylon Tea Company

5.1.7. R. Twining & Co. Ltd

5.1.8. Celestial Seasonings

5.1.9. Bigelow Tea

5.1.10. The Republic of Tea

5.1.11. Mighty Leaf Tea

5.1.12. Yogi Tea

5.1.13. Pukka Herbs

5.1.14. Kusmi Tea

5.1.15. Clipper Teas

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Product Portfolio, Market Presence, Inception Year, Revenue, Sustainability Initiatives, Innovation & R&D Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions (Recent Strategic Deals)

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Tea Market Regulatory Framework

6.1. Organic Certification Standards

6.2. Sustainability Compliance Regulations

6.3. Fair Trade Certification Processes

6.4. Import-Export Trade Regulations

7. Europe Tea Future Market Size (In USD Bn)

7.1. Future Market Size Projections (In USD Bn)

7.2. Key Factors Driving Future Market Growth

8. Europe Tea Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Format (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Europe Tea Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Europe Tea Market ecosystem, identifying stakeholders across the supply chain. Extensive desk research using secondary data and proprietary databases is conducted to identify key variables such as production trends, consumer preferences, and regulatory influences.

Step 2: Market Analysis and Construction

Historical data is compiled to assess tea market growth, including consumption patterns by region and product category. Revenue generation is cross-checked with market penetration rates, while service quality metrics from key players are evaluated for accuracy.

Step 3: Hypothesis Validation and Expert Consultation

CATI interviews are conducted with tea manufacturers and distributors to validate market hypotheses. These consultations provide valuable insights into consumer behavior, supply chain dynamics, and product development strategies, ensuring a robust and accurate market analysis.

Step 4: Research Synthesis and Final Output

Direct engagement with leading tea companies is conducted to gather data on product segments, sales performance, and consumer preferences. This information is synthesized into a final report, ensuring comprehensive and validated insights into the Europe tea market.

Frequently Asked Questions

1. How big is the Europe Tea Market?

The Europe tea market is valued at USD 13.4 billion, driven by growing consumer demand for organic, herbal, and specialty teas across major markets like the UK, Germany, and France.

2. What are the challenges in the Europe Tea Market?

Challenges in the Europe tea market include fluctuating raw material costs, rising competition from coffee and alternative beverages, and regulatory barriers regarding organic certifications and sustainability standards.

3. Who are the major players in the Europe Tea Market?

Key players in the Europe tea market include Unilever, Tata Consumer Products, Twinings, Harney & Sons, and Teekanne GmbH, all of which maintain strong market positions through their diversified product portfolios and sustainability initiatives.

4. What are the growth drivers of the Europe Tea Market?

The Europe tea market is propelled by increased consumer interest in health and wellness, leading to the rising popularity of herbal and functional teas, alongside growing demand for ethically sourced and organic products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.