Europe Toy Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD7688

December 2024

97

About the Report

Europe Toy Market Overview

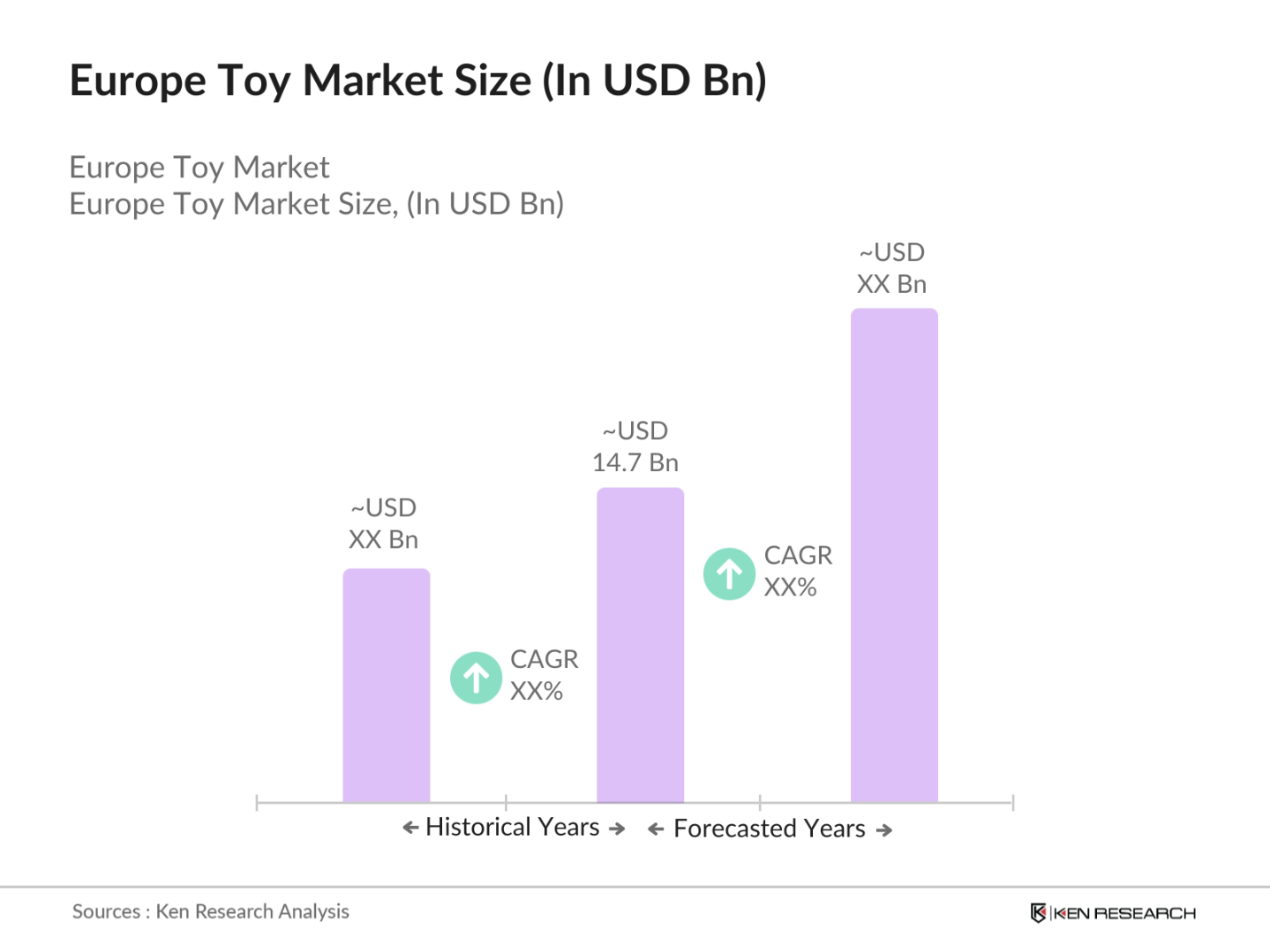

- The Europe toy market, valued at USD 14.7 billion based on a five-year historical analysis, is primarily driven by rising consumer spending on educational and interactive toys. With increasing awareness of child development and educational value, toys like STEM (science, technology, engineering, and mathematics) products are in high demand. This growth is further fueled by e-commerce expansion and the inclusion of digital features in traditional toys, appealing to tech-savvy consumers across all age segments.

- Key players in the European toy market include Germany, France, and the United Kingdom. Germanys dominance is attributed to high disposable income, a strong retail infrastructure, and significant cultural emphasis on educational toys. France and the United Kingdom benefit from robust e-commerce networks and consumer preference for eco-friendly toys, aligning with their strong sustainability policies.

- The European Toy Safety Directive sets strict safety standards for toys sold in the EU, aiming to protect children from health and safety risks. The directive covers various factors, including mechanical, electrical, and chemical safety requirements, to ensure that all toys meet stringent safety criteria. Compliance with these standards is mandatory for manufacturers, influencing production processes and costs.

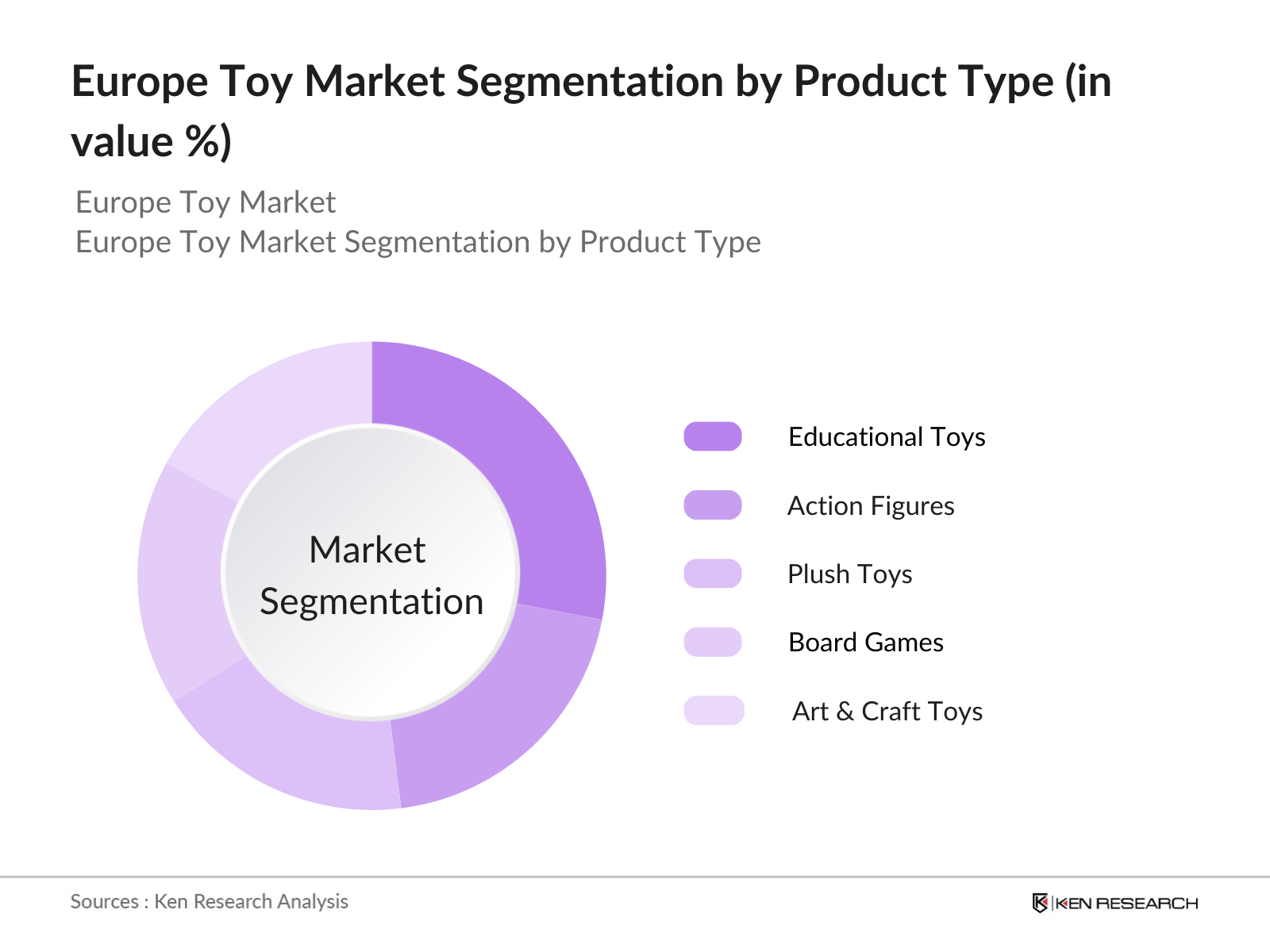

Europe Toy Market Segmentation

By Product Type: The market is segmented by product type into educational toys, action figures, plush toys, board games, and art & craft toys. Educational toys currently dominate the market due to increased focus on STEM-based learning and parental preference for skill-enhancing toys. Brands such as LEGO and VTech have gained consumer trust by aligning their products with developmental needs, solidifying their presence in this segment.

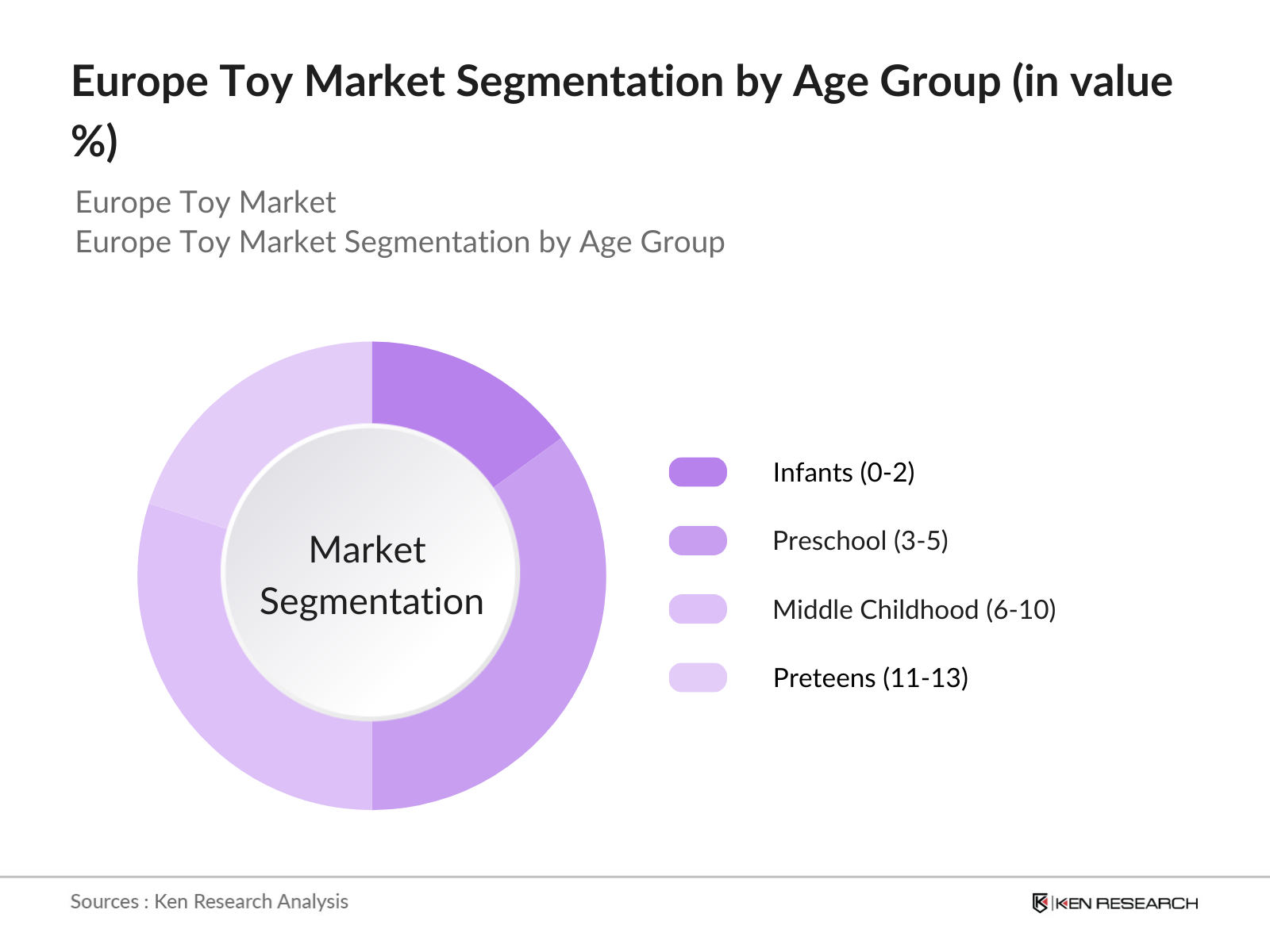

By Age Group: The market is segmented by age group into infants (0-2 years), preschool (3-5 years), middle childhood (6-10 years), and preteens (11-13 years). The preschool segment holds the highest market share, driven by the high demand for educational toys that aid in cognitive development during early years. Toy companies are focusing on products tailored for this age group to align with educational curriculums and cognitive development requirements.

Europe Toy Market Competitive Landscape

The Europe toy market is dominated by a few major players, both global and regional, who leverage brand loyalty and innovation to retain market share. The competitive landscape showcases companies that focus on sustainable and tech-enhanced toys, appealing to eco-conscious and digital-focused consumers.

Europe Toy Market Analysis

Growth Drivers

- Technological Advancements: Technological progress in Europe has transformed the toy industry, with manufacturers integrating innovative features like artificial intelligence, augmented reality, and robotics into traditional toys. For instance, interactive toys using speech recognition and machine learning are popular, fostering an interactive experience that aligns with childrens tech exposure. European manufacturers increasingly focus on aligning toys with digital platforms, creating a seamless interface between traditional play and technology, which enhances engagement and educational potential.

- Educational Demand for Toys: European parents are increasingly prioritizing educational value in toys, propelling the demand for products that foster learning. STEM-based toys, which encourage skills in science, technology, engineering, and mathematics, have gained significant traction across Europe, where educational systems emphasize early cognitive development. Additionally, toys designed to develop social skills, language, and logical thinking have seen a surge, making education-oriented toys a vital driver in the market.

- Increasing Disposable Income: Rising disposable income in Europe has enabled families to allocate more budget towards quality toys, driving up consumer expenditure in this sector. The increased financial capacity allows families to invest in premium, high-quality, and innovative products, which contributes positively to market growth. The growth is particularly evident in Western European countries, where high-income levels translate to increased demand for diverse and sophisticated toy offerings.

Market Challenges

- Regulatory Restrictions: The European toy market faces stringent regulatory frameworks aimed at ensuring child safety, which imposes significant compliance burdens on manufacturers. The Toy Safety Directive mandates rigorous testing and certification procedures for materials and components. These requirements can result in increased operational costs and slower product rollouts, especially for small and medium enterprises with limited resources for compliance.

- Rising Raw Material Costs: Escalating prices for essential raw materials such as plastic, rubber, and metals have impacted production costs within the toy industry. The market is particularly vulnerable to fluctuations in oil prices, as many plastic materials are petroleum-based. This cost pressure limits pricing flexibility and can affect the profitability of toy manufacturers across Europe, particularly those relying heavily on raw materials sourced from outside the EU.

Europe Toy Market Future Outlook

In the coming years, the Europe toy market is poised for growth driven by advancements in digital technology, consumer demand for educational toys, and a shift towards eco-friendly options. Expansions in digital gaming, augmented reality in toys, and an increase in STEM-oriented products are anticipated to enhance the market landscape. Additionally, government support for sustainable manufacturing practices is likely to encourage toy companies to adopt environmentally-friendly materials, further driving market innovation.

Opportunities

- Emerging Demand for Licensed Products: Demand for licensed toys featuring popular movie and TV characters remains strong in Europe, creating opportunities for companies to leverage popular media franchises. Collaborations with entertainment studios enable toy companies to produce products that resonate with children and parents alike, offering a competitive advantage. This segments appeal also extends to collectibles, making it a lucrative area for growth.

- Expansion in E-commerce Channels: The increasing reliance on e-commerce for shopping has expanded access to toys, especially in underserved regions. Online platforms allow manufacturers to reach a broader customer base, while also facilitating personalized marketing and consumer engagement. The shift toward digital sales channels provides toy companies with opportunities to boost sales and engage consumers more directly.

Scope of the Report

|

Product Type |

Educational Toys |

|

Age Group |

Infants (0-2 Years) |

|

Distribution Channel |

Specialty Stores |

|

Material Type |

Plastic |

|

Country |

Germany |

Products

Key Target Audience

Toy Manufacturers

Retail Chains and Supermarkets

E-commerce Platforms

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, national consumer safety agencies)

Parents and Caregivers Associations

Educational Institutions

Digital Gaming and AR Developers

Companies

Major Players

LEGO Group

Mattel Inc.

Hasbro Inc.

Ravensburger AG

VTech Holdings Ltd.

Spin Master Ltd.

Playmobil (Geobra Brandsttter GmbH & Co. KG)

Bandai Namco Holdings Inc.

Smoby Toys SAS

Clementoni S.p.A.

TOMY Company Ltd.

Jakks Pacific Inc.

Moose Toys Pty Ltd

MGA Entertainment Inc.

Simba Dickie Group

Table of Contents

1. Europe Toy Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Europe Toy Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Toy Market Analysis

3.1. Growth Drivers (Technological Advancements, Consumer Trends, Regulatory Influence)

3.1.1. Rise of Sustainable Toys

3.1.2. Digital and Smart Toys Adoption

3.1.3. Increased Licensing Agreements

3.2. Market Challenges (Supply Chain, Safety Regulations, Market Competition)

3.2.1. High Production Costs

3.2.2. Stringent Safety Regulations

3.2.3. Supply Chain Disruptions

3.3. Opportunities (Emerging Markets, Customization Trends, Edutainment Toys)

3.3.1. Expansion into New Demographics

3.3.2. Growth in Online Sales Channels

3.3.3. Innovative Toy Lines for Educational Purposes

3.4. Trends (Interactive Play, Eco-Friendly Manufacturing, Cross-Brand Collaborations)

3.4.1. Integration of AR/VR in Toys

3.4.2. Eco-Conscious Manufacturing

3.4.3. Collaborative Branding with Media Franchises

3.5. Regulatory Environment (Safety Standards, Import Regulations, Environmental Compliance)

3.5.1. European Toy Safety Directive

3.5.2. REACH Compliance

3.5.3. CE Marking Standards

3.5.4. Circular Economy Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis (Supplier Power, Buyer Power, Competition Level)

3.9. Competition Landscape Overview

4. Europe Toy Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Action Figures

4.1.2. Dolls & Plush Toys

4.1.3. Construction Sets

4.1.4. Educational Toys

4.1.5. Outdoor & Sports Toys

4.2. By Age Group (In Value %)

4.2.1. 0-3 Years

4.2.2. 4-7 Years

4.2.3. 8-12 Years

4.2.4. 13+ Years

4.3. By Material (In Value %)

4.3.1. Plastic

4.3.2. Wood

4.3.3. Metal

4.3.4. Biodegradable Materials

4.4. By Distribution Channel (In Value %)

4.4.1. Specialty Stores

4.4.2. Supermarkets & Hypermarkets

4.4.3. Online Retail

4.4.4. Department Stores

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. UK

4.5.4. Italy

4.5.5. Spain

5. Europe Toy Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. LEGO Group

5.1.2. Hasbro, Inc.

5.1.3. Mattel, Inc.

5.1.4. Ravensburger AG

5.1.5. Playmobil

5.1.6. Spin Master Corp.

5.1.7. Simba Dickie Group

5.1.8. VTech Holdings Ltd.

5.1.9. Bandai Namco Holdings Inc.

5.1.10. TOMY Company, Ltd.

5.1.11. Clementoni S.p.A

5.1.12. Goliath Games

5.1.13. Giochi Preziosi

5.1.14. Moose Toys

5.1.15. Schleich GmbH

5.2. Cross Comparison Parameters (Revenue, Market Share, Regional Presence, Product Innovation, Brand Value, Sustainability Initiatives, Distribution Network, Strategic Partnerships)

5.3. Market Share Analysis (Competitor Market Share, Regional Dominance)

5.4. Strategic Initiatives (Mergers, Product Launches, Partnerships)

5.5. Investment Analysis (Venture Funding, R&D Investments)

5.6. Government and Private Investments

5.7. Joint Ventures and Collaborations

5.8. Marketing and Advertising Strategies

6. Europe Toy Market Regulatory Framework

6.1. Compliance Standards

6.2. Safety Certifications

6.3. Industry Regulations and Norms

6.4. Environmental and Sustainability Policies

7. Europe Toy Market Future Segmentation (In Value %)

7.1. By Product Type

7.2. By Age Group

7.3. By Material

7.4. By Distribution Channel

7.5. By Country

8. Europe Toy Market Analysts' Recommendations

8.1. Strategic Market Positioning

8.2. Customer Cohort Targeting

8.3. Untapped Market Opportunities

8.4. Marketing Optimization

8.5. White Space Identification

9. Europe Toy Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves constructing a detailed map of all significant stakeholders in the Europe Toy Market, supported by extensive desk research and proprietary database access to define critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on product penetration, retail versus online sales ratios, and revenue generation from various sub-segments to accurately assess market potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through industry expert interviews conducted with key players. These consultations provide real-time insights into market trends and confirm data reliability.

Step 4: Research Synthesis and Final Output

The final phase includes data synthesis, involving direct engagements with manufacturers to verify insights on product segments, sales performance, and consumer preferences, ensuring comprehensive and validated analysis.

Frequently Asked Questions

01 How big is the Europe Toy Market?

The Europe Toy Market is valued at USD 14.7 billion, driven by a rising consumer interest in educational and interactive toys.

02 What are the primary challenges in the Europe Toy Market?

Key challenges in the Europe Toy Market include regulatory restrictions on materials, increasing raw material costs, and competition from digital entertainment options.

03 Who are the major players in the Europe Toy Market?

Major players in the Europe Toy Market include LEGO, Mattel, Hasbro, Ravensburger, and VTech, with these companies benefiting from strong brand loyalty and diverse product ranges.

04 What are the growth drivers of the Europe Toy Market?

Growth drivers in the Europe Toy Market include technological advancements, demand for STEM and educational toys, and a shift towards sustainable materials due to environmental awareness.

05 Which age group segment is most dominant in the Europe Toy Market?

The preschool age group dominates the Europe Toy Market due to the demand for educational toys that promote cognitive development, aligning with parental preferences for early childhood learning.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.