Region:Europe

Author(s):Geetanshi

Product Code:KRAA0245

Pages:97

Published On:August 2025

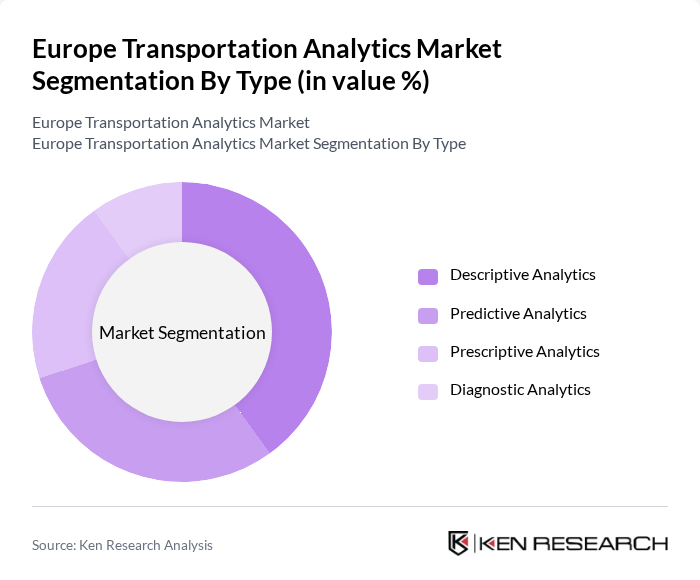

By Type:The market is segmented into four types of analytics: Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Diagnostic Analytics. Descriptive Analytics remains the leading sub-segment, providing essential insights into historical data and enabling organizations to understand past performance and trends. Predictive Analytics follows, driven by the increasing need for forecasting and proactive decision-making in transportation operations. The demand for Prescriptive and Diagnostic Analytics is also rising as organizations seek to optimize operations and enhance efficiency through advanced analytics solutions .

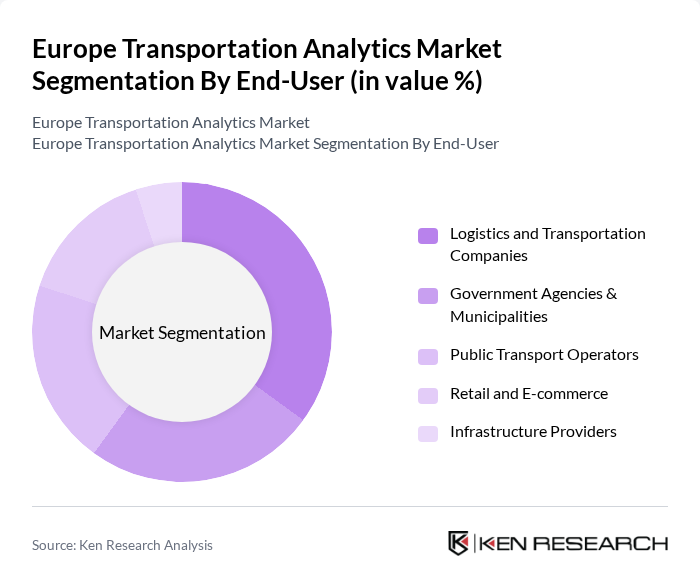

By End-User:The end-user segmentation includes Logistics and Transportation Companies, Government Agencies & Municipalities, Public Transport Operators, Retail and E-commerce, and Infrastructure Providers. Logistics and Transportation Companies dominate this segment, driven by the need for efficient supply chain management and real-time tracking of goods. Government Agencies are significant users, leveraging analytics for urban planning, traffic management, and regulatory compliance. The expanding e-commerce sector is increasing the demand for analytics in Retail, while Public Transport Operators and Infrastructure Providers are adopting analytics to enhance service delivery, optimize routes, and improve operational efficiency .

The Europe Transportation Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Siemens AG, TomTom N.V., Indra Sistemas S.A., Kapsch TrafficCom AG, INRIX, Inc., Cubic Corporation, HERE Technologies, Trimble Inc., Alteryx, Inc., Cellint Traffic Solutions Ltd., SAP SE, Hexagon AB, Bentley Systems, Incorporated, Oracle Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe transportation analytics market appears promising, driven by technological advancements and increasing investments in smart transportation solutions. As companies prioritize operational efficiency and customer experience, the integration of AI and IoT technologies will become more prevalent. Additionally, the focus on sustainability will push firms to adopt data-driven strategies that minimize environmental impact. Overall, the market is expected to evolve rapidly, with innovative solutions reshaping the transportation landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics |

| By End-User | Logistics and Transportation Companies Government Agencies & Municipalities Public Transport Operators Retail and E-commerce Infrastructure Providers |

| By Region | Western Europe (Germany, UK, France, Benelux) Eastern Europe (Poland, Russia, Others) Northern Europe (Nordics, Baltics) Southern Europe (Italy, Spain, Portugal, Others) |

| By Application | Traffic & Incident Management Traffic Planning & Maintenance Logistics Management Fleet Management Route Optimization Toll & Revenue Management |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Data Source | GPS Data Sensor Data (IoT, Cameras, Inductive Loops) Historical Data Transactional Data |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services Managed Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Analytics | 100 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Analytics | 60 | Railway Operations Managers, Data Analysts |

| Air Cargo Analytics | 50 | Airline Logistics Coordinators, Supply Chain Analysts |

| Maritime Transportation Analytics | 40 | Port Authority Managers, Shipping Analysts |

| Smart Transportation Solutions | 60 | Technology Providers, Urban Mobility Planners |

The Europe Transportation Analytics Market is valued at approximately USD 5.6 billion, reflecting a significant growth driven by the demand for data-driven decision-making, operational efficiency, and advanced technologies like IoT and AI.