Europe Unmanned Surface Vehicles Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD10888

November 2024

93

About the Report

Europe Unmanned Surface Vehicles Market Overview

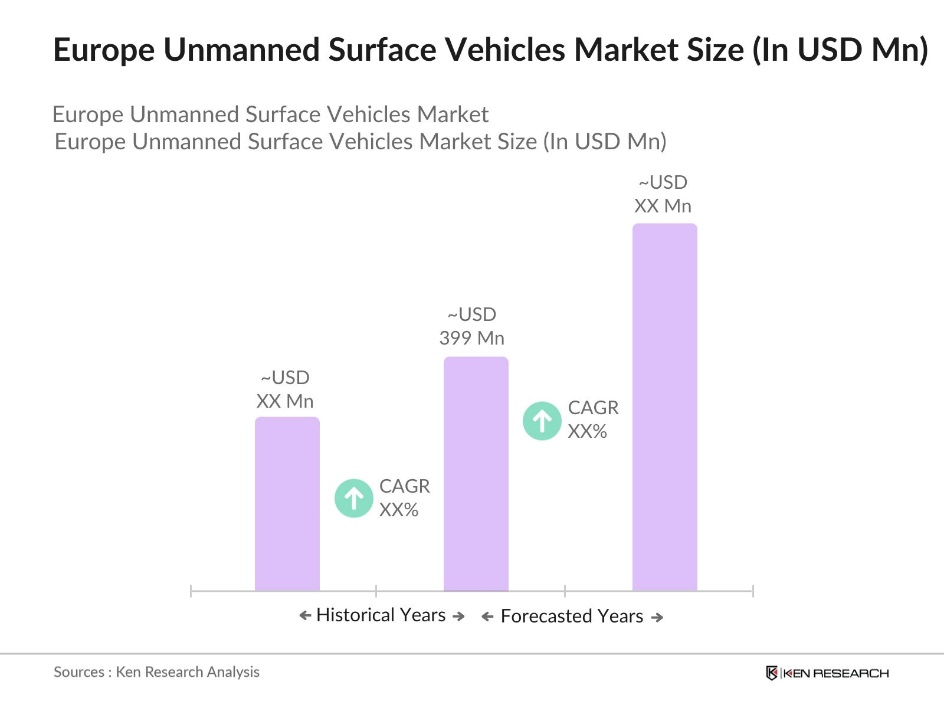

- The Europe Unmanned Surface Vehicles (USV) market is valued at USD 399 million, driven by growing defense spending and the strategic need for maritime surveillance across European coastlines. Demand for USVs is rising as they provide reliable solutions for defense, surveillance, and environmental monitoring, reducing the need for human personnel in high-risk maritime operations.

- The European USV market sees dominance from key countries such as the United Kingdom, Germany, and France. This regional strength is largely due to substantial government funding in maritime defense projects and extensive coastline management needs. The UKs significant naval investments and Germany's high-tech industrial capabilities allow these regions to lead the adoption of USVs for security and scientific exploration.

- The General Data Protection Regulation (GDPR) impacts USV operations by enforcing data privacy laws on real-time data gathering systems. For instance, in 2024, the Dutch Data Protection Authority fined Uber 290 million (approximately USD 316 million) for inadequate data protection practices. This regulation necessitates robust data encryption and compliance measures in USV technology, influencing how real-time data is stored and transmitted.

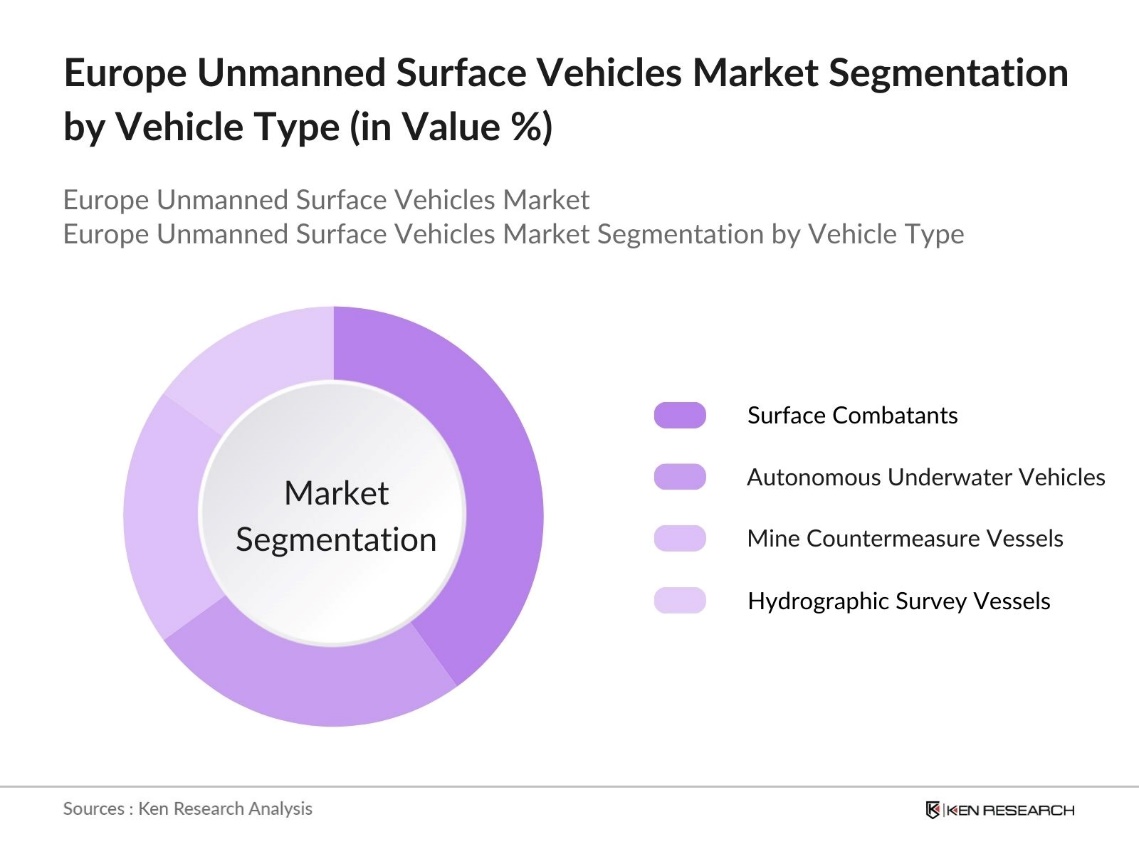

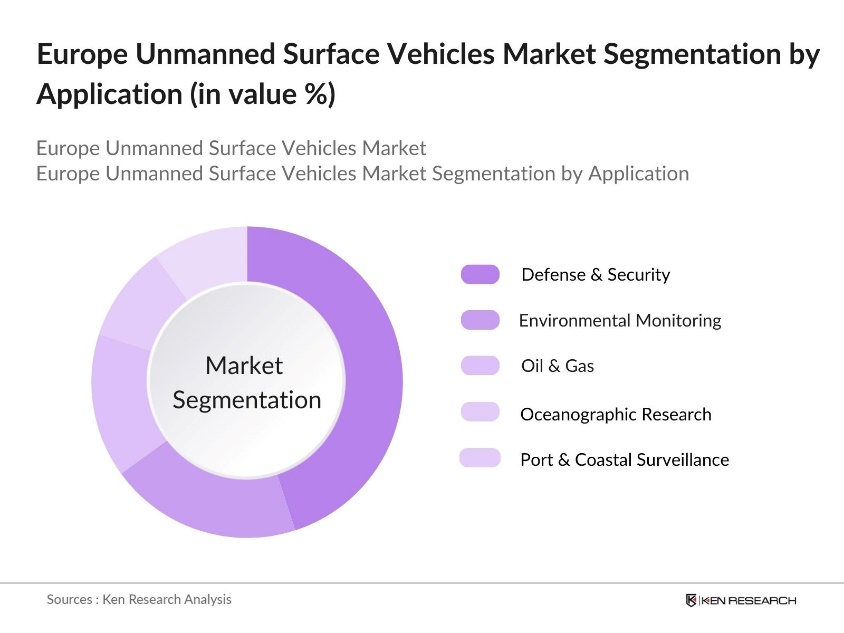

Europe Unmanned Surface Vehicles Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into Surface Combatants, Autonomous Underwater Vehicles (AUVs), Mine Countermeasure Vessels, and Hydrographic Survey Vessels. Among these, surface combatants hold a dominant market share, owing to their primary role in enhancing maritime security and coastal defense. Countries with strong naval forces, particularly the United Kingdom and France, prioritize surface combatants to protect territorial waters and conduct missions with advanced autonomous systems and surveillance capabilities.

By Application: The market is further segmented by application into Defense & Security, Environmental Monitoring, Oil & Gas, Oceanographic Research, and Port & Coastal Surveillance. Defense & Security applications dominate this segment, driven by the increasing need for enhanced maritime security, counter-surveillance, and intelligence operations. The adoption of USVs in defense is encouraged by their ability to operate autonomously in high-risk areas, providing strategic advantages in military operations.

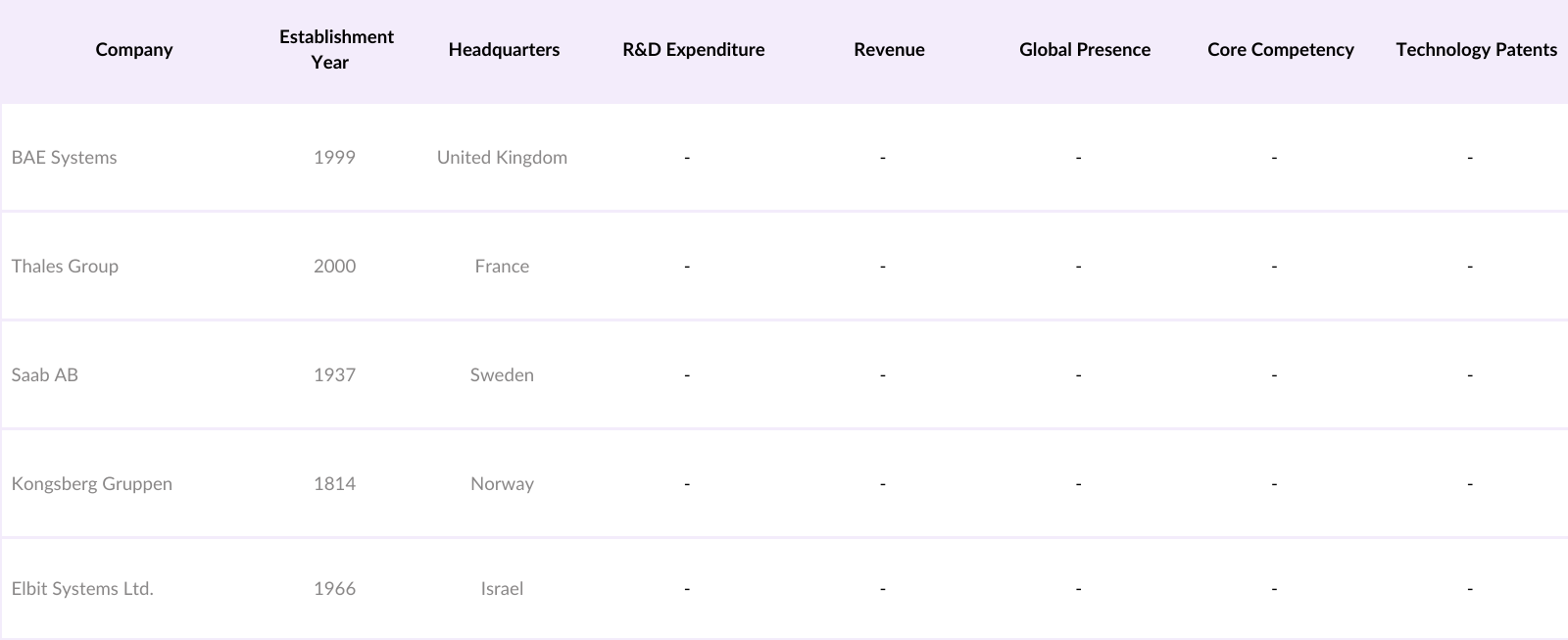

Europe Unmanned Surface Vehicles Market Competitive Landscape

The European USV market is characterized by the presence of established industry players focused on technological innovation and strategic partnerships. Major companies include BAE Systems, Thales Group, Saab AB, Kongsberg Gruppen, and Elbit Systems Ltd., among others. The competitive landscape reflects significant consolidation among a few major players who leverage extensive R&D capabilities to maintain a competitive edge.

Europe Unmanned Surface Vehicles Industry Analysis

Growth Drivers

- Rising Demand for Maritime Security: With Europes focus on strengthening its maritime security, there has been a surge in defense expenditure for monitoring offshore regions. EU member states have significantly increased their defense expenditures, reaching approximately $311.2 billion in 2023. Increased instances of illegal fishing, smuggling, and territorial disputes have necessitated investments in unmanned surface vehicles (USVs) for coastal monitoring and naval defense.

- Advancements in Autonomous Technology: The EUs investment of USD 95 billion (95.5 billion) in technology innovation under the Horizon Europe program has fostered advancements in AI-driven autonomous systems, including those for USVs. Autonomous USVs are increasingly sought for their precision and reduced operational costs in extensive maritime operations. Enhanced autonomous navigation and obstacle detection technology are now critical components in European defense systems.

- Increasing Investments in Defense Infrastructure: European nations are prioritizing defense infrastructure with a strategic focus on unmanned surface vehicles (USVs) to address new security challenges. Key countries like Germany and France are integrating USVs into their fleets to enhance patrolling, intelligence, and reconnaissance capabilities. This aligns with NATOs modernization goals, emphasizing USVs as essential tools in bolstering maritime security and enabling rapid response to threats across European waters.

Market Challenges

- Regulatory Hurdles in Maritime Zones: European maritime zones operate under strict environmental and operational regulations that can hinder USV deployment. Each EU country maintains its standards for vessel operations in Exclusive Economic Zones (EEZs), complicating cross-border interoperability. These varied frameworks pose challenges to autonomous vessel operations, creating obstacles for seamless USV deployment across shared waters and requiring careful navigation of regulatory compliance.

- Limited Interoperability with Traditional Systems: Integrating USVs with existing naval and commercial vessels presents challenges due to technical compatibility issues. Many traditional fleets lack the advanced communication infrastructure needed for effective collaboration with autonomous systems, creating operational delays in mixed fleet environments. This limited interoperability restricts the full potential of USVs within Europes broader maritime framework, highlighting the need for further technological upgrades.

Europe Unmanned Surface Vehicles Market Future Outlook

Over the next five years, the European USV market is expected to continue evolving due to advancements in autonomous technology, the integration of artificial intelligence, and the strategic focus on enhancing maritime security. Government support in the form of defense budgets and technological investments further bolsters the outlook, creating opportunities for sustainable growth within the industry.

Market Opportunities

- Adoption in Civil Applications: The use of USVs in civil sectors, including marine research, environmental monitoring, and disaster response, is expanding steadily. Applications in these areas provide opportunities for USV manufacturers to diversify beyond defense, meeting growing demands in scientific and ecological fields. As USVs become more integrated into civil use, they enable efficient, automated data collection and response capabilities that support a wide range of non-military operations.

- Rising Demand for Environmental Monitoring: Europe's commitment to environmental sustainability is driving increased adoption of USVs for monitoring ecosystems, pollution, and climate effects. Initiatives like the EUs Green Deal underscore the need for real-time data collection across marine environments, with USVs playing a key role in minimizing the environmental footprint of monitoring activities. This shift supports sustainability goals by promoting emission-free operations in sensitive marine ecosystems.

Scope of the Report

|

Vehicle Type |

Surface Combatants Autonomous Underwater Vehicles (AUVs) Mine Countermeasure Vessels Hydrographic Survey Vessels |

|

Technology |

Fully Autonomous Semi-Autonomous Remote-Controlled |

|

Application |

Defense & Security Environmental Monitoring Oil & Gas Oceanographic Research Port & Coastal Surveillance |

|

Payload Type |

Sonar Systems Cameras & Sensors Radars Laser Scanners |

|

Region |

West North South East |

Products

Key Target Audience

Underwater Archaeology and Exploration Firms

Marine Engineering and Maintenance Firms

Maritime Data Analytics Firms

Offshore Energy Sector

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., European Defence Agency, Ministry of Defence - UK)

Companies

Players Mentioned in the Report

BAE Systems

Thales Group

Saab AB

Kongsberg Gruppen

Elbit Systems Ltd.

Rafael Advanced Defense Systems

Atlas Elektronik

Rolls-Royce Holdings

ECA Group

Liquid Robotics

Table of Contents

1. Europe Unmanned Surface Vehicles Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Unmanned Surface Vehicles Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Unmanned Surface Vehicles Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Maritime Security

3.1.2 Advancements in Autonomous Technology

3.1.3 Increasing Investments in Defense Infrastructure

3.1.4 Expansion of Offshore Energy Projects

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Regulatory Hurdles in Maritime Zones

3.2.3 Limited Interoperability with Traditional Systems

3.3 Opportunities

3.3.1 Integration with Artificial Intelligence (AI)

3.3.2 Adoption in Civil Applications

3.3.3 Rising Demand for Environmental Monitoring

3.4 Trends

3.4.1 Miniaturization of Sensor Technology

3.4.2 Increased Focus on Sustainability

3.4.3 Real-Time Data Analytics Integration

3.5 Government Regulations

3.5.1 Environmental Compliance Standards

3.5.2 National Defense Procurement Policies

3.5.3 EU Data Privacy Laws Impacting USV Systems

3.5.4 Cross-Border Maritime Collaboration Agreements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Overview

4. Europe Unmanned Surface Vehicles Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Surface Combatants

4.1.2 Autonomous Underwater Vehicles (AUVs)

4.1.3 Mine Countermeasure Vessels

4.1.4 Hydrographic Survey Vessels

4.2 By Technology (In Value %)

4.2.1 Fully Autonomous

4.2.2 Semi-Autonomous

4.2.3 Remote-Controlled

4.3 By Application (In Value %)

4.3.1 Defense & Security

4.3.2 Environmental Monitoring

4.3.3 Oil & Gas

4.3.4 Oceanographic Research

4.3.5 Port & Coastal Surveillance

4.4 By Payload Type (In Value %)

4.4.1 Sonar Systems

4.4.2 Cameras & Sensors

4.4.3 Radars

4.4.4 Laser Scanners

4.5 By Region (In Value %)

4.5.1 West

4.5.2 North

4.5.3 South

4.5.4 East

5. Europe Unmanned Surface Vehicles Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Textron Inc.

5.1.2 Rafael Advanced Defense Systems

5.1.3 Saab AB

5.1.4 Elbit Systems Ltd.

5.1.5 Thales Group

5.1.6 BAE Systems

5.1.7 Atlas Elektronik

5.1.8 Rolls-Royce Holdings

5.1.9 ECA Group

5.1.10 Liquid Robotics

5.1.11 Ocean Infinity

5.1.12 ASV Global

5.1.13 L3Harris Technologies

5.1.14 Sea Machines Robotics

5.1.15 Kongsberg Gruppen

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Technology Differentiators, Global Presence, Innovation Index, Strategic Collaborations, Core Competencies)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Unmanned Surface Vehicles Market Regulatory Framework

6.1 Defense Procurement Standards

6.2 Maritime Zoning Laws

6.3 Environmental Safety Protocols

6.4 Compliance with Data Privacy Regulations

7. Europe Unmanned Surface Vehicles Future Market Size (In USD Mn)

7.1 Market Size Projections

7.2 Key Growth Drivers

8. Europe Unmanned Surface Vehicles Future Market Segmentation

8.1 By Vehicle Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Payload Type (In Value %)

8.5 By Region (In Value %)

9. Europe Unmanned Surface Vehicles Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process began with an in-depth analysis of key variables influencing the European Unmanned Surface Vehicles market. This included gathering data on technology advancements, regulatory influences, and application-specific requirements to define the primary market drivers and constraints.

Step 2: Market Analysis and Construction

We utilized historical data to analyze growth patterns and the impact of defense budgets on the adoption rate of USVs. The data encompassed various segments such as technology type and application, enabling a comprehensive understanding of market structure and value.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through direct interviews and surveys with industry experts, including naval engineers and defense procurement officers. These consultations offered insights into operational challenges and opportunities within the USV landscape.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing findings from primary and secondary research to ensure accurate representation of the USV market. We cross-verified statistics and qualitative insights to create a robust, validated market report.

Frequently Asked Questions

01 How big is the Europe Unmanned Surface Vehicles Market?

The Europe Unmanned Surface Vehicles market is valued at USD 399 million, with steady growth driven by military and offshore energy applications.

02 What challenges exist in the Europe Unmanned Surface Vehicles Market?

Key challenges in Europe Unmanned Surface Vehicles market include high initial investment costs, regulatory restrictions in maritime zones, and interoperability issues with traditional systems.

03 Who are the major players in the Europe Unmanned Surface Vehicles Market?

Major players in Europe Unmanned Surface Vehicles market include BAE Systems, Thales Group, Saab AB, Kongsberg Gruppen, and Elbit Systems Ltd., each leveraging R&D and strategic partnerships.

04 What are the growth drivers for the Europe Unmanned Surface Vehicles Market?

The Europe Unmanned Surface Vehicles market is propelled by increased focus on maritime security, advancements in autonomous technology, and government investment in defense infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.