Europe Vending Machine Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD8654

December 2024

81

About the Report

Europe Vending Machine Market Overview

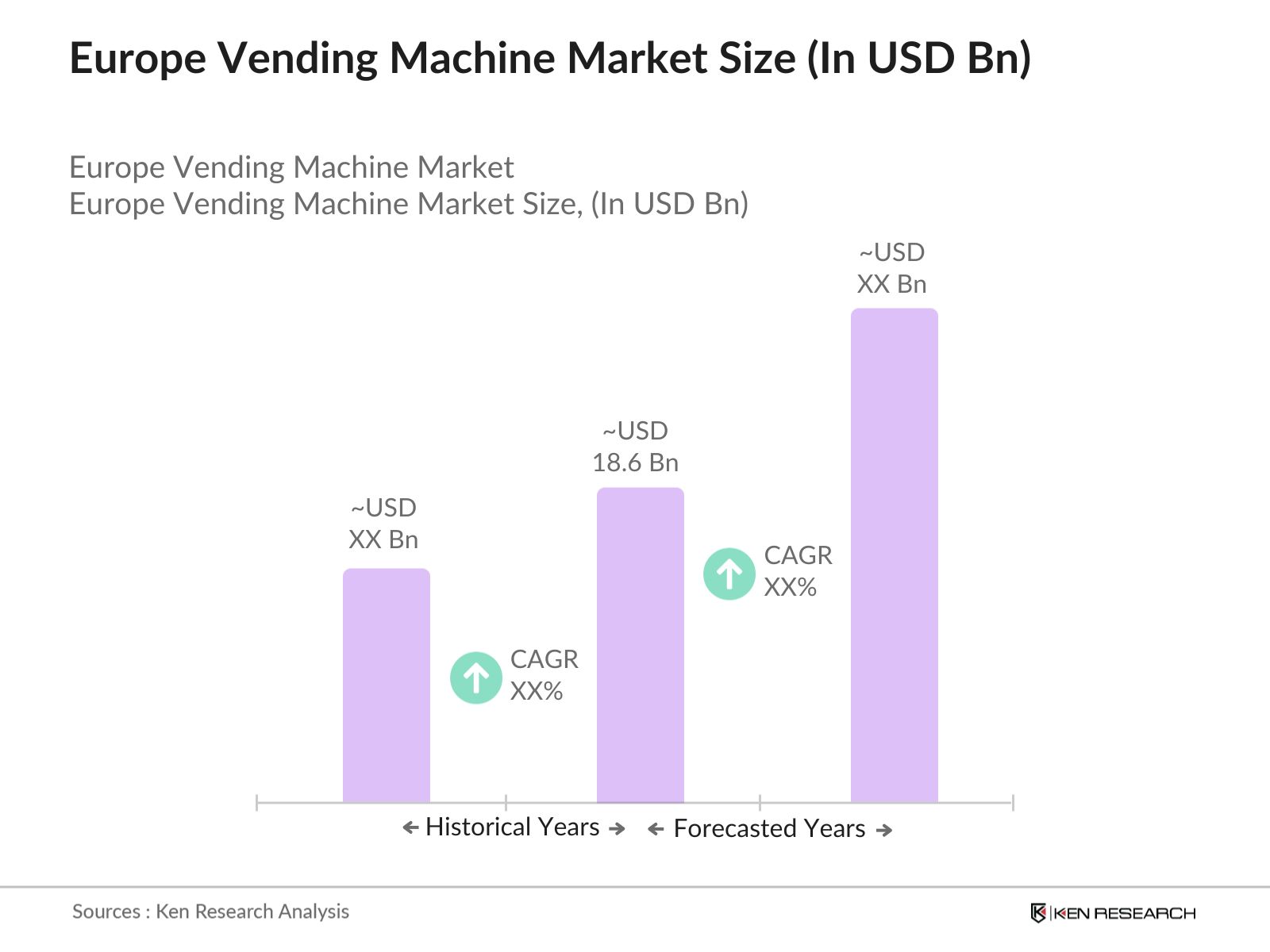

- The Europe vending machine market, valued at USD 18.6 billion based on a five-year historical analysis, is driven by several factors, including the rise of automation in retail and enhanced payment methods such as mobile wallets. The convenience offered by vending machines and the shift towards healthier food options have further fueled growth. Major economies in Europe, with their robust infrastructure and high consumption patterns, play a significant role in driving this demand, while digital payments integration has improved accessibility and functionality for consumers.

- Key cities and countries leading the Europe vending machine market include Germany, France, and the United Kingdom. Germany's emphasis on smart city initiatives and digital infrastructure creates a conducive environment for advanced vending solutions, while France and the UK benefit from high consumer demand in urban areas with dense populations. The focus in these countries on sustainability and health has also boosted interest in vending machines that dispense fresh and eco-friendly products, strengthening their dominance.

- Energy-efficient vending machines are encouraged across Europe under the EUs Energy Efficiency Directive. These standards are especially pertinent in Germany, where energy-efficient machines have received government incentives. By adopting machines with lower energy consumption, vending operators can reduce operational costs and contribute to the EUs 2024 energy reduction targets, aligning with climate goals and supporting sustainable practices in retail.

Europe Vending Machine Market Segmentation

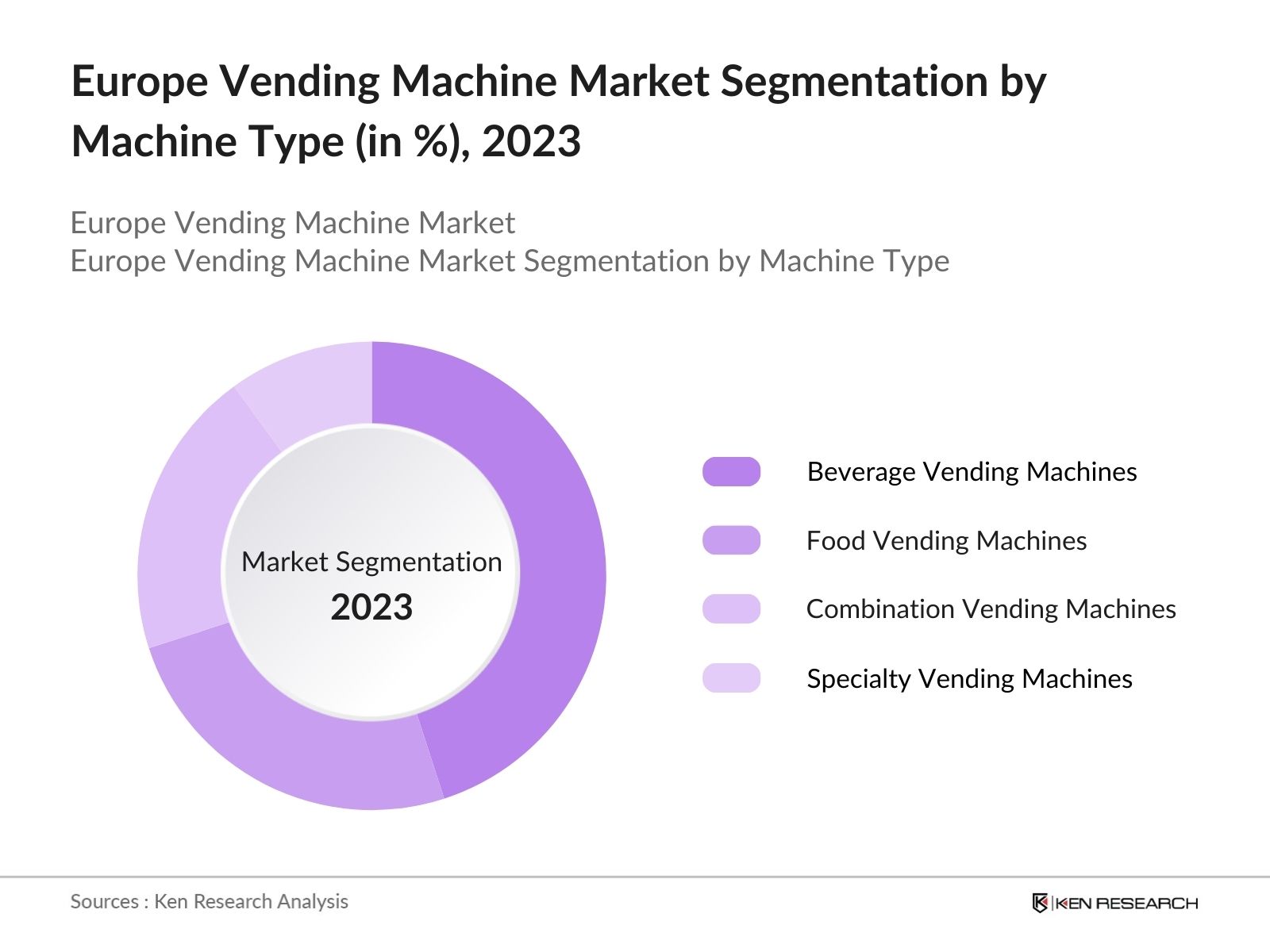

By Machine Type: The market is segmented by machine type into Beverage Vending Machines, Food Vending Machines, Combination Vending Machines, and Specialty Vending Machines. Recently, Beverage Vending Machines hold a dominant market share within this segment due to the increasing demand for on-the-go beverages among busy urban populations. Beverage vending machines are particularly popular in high-traffic locations such as transportation hubs, corporate buildings, and shopping centers, where quick and easy access to drinks is highly valued. This segments dominance is also supported by advancements in machine technology, enabling them to offer various beverages, including hot and cold options, to cater to diverse consumer preferences.

By Payment Mode: The market is segmented by payment mode into Cash-Based, Card-Based, Contactless Payments, and Mobile Wallets. Contactless Payments have emerged as the dominant segment due to the shift towards cashless societies across Europe and the convenience contactless options provide in busy, fast-paced environments. High adoption rates of contactless technology in public transportation and retail settings make contactless vending options more attractive to consumers. Additionally, recent health-conscious trends, especially post-pandemic, have emphasized the preference for contactless interactions, making this payment mode particularly popular.

Europe Vending Machine Market Competitive Landscape

The Europe vending machine market is characterized by the presence of both regional and global players, with major players including Crane Co., Azkoyen Group, Selecta Group, Fuji Electric Co., Ltd., and N&W Global Vending S.p.A. dominating the market. This consolidation highlights the influence these companies have due to their technological innovation, extensive distribution networks, and strategic partnerships across Europe.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

R&D Investments |

Revenue |

Geographic Presence |

Sustainability Initiatives |

Payment Integration |

Service Contracts |

|

Crane Co. |

1855 |

Stamford, USA |

|||||||

|

Azkoyen Group |

1945 |

Navarra, Spain |

|||||||

|

Selecta Group |

1957 |

Cham, Switzerland |

|||||||

|

Fuji Electric Co., Ltd. |

1923 |

Tokyo, Japan |

|||||||

|

N&W Global Vending S.p.A. |

1963 |

Valbrembo, Italy |

Europe Vending Machine Industry Analysis

Growth Drivers

- Increasing Automation Demand in Retail: The growing demand for automation across Europes retail sector is significantly impacting the vending machine market, aligning with regional shifts towards streamlined consumer experiences. According to Eurostat, the European retail sectors automation index increased by 15% between 2022 and 2024, with countries like Germany and France reporting substantial growth in automated retail solutions. This surge reflects retail businesses needs to enhance efficiency and reduce labor costs amid rising wage standards across Europe. The European Union has also implemented policies supporting automation in retail, contributing to more than 60,000 vending machines deployed across key regions in 2023 alone.

- Technological Advancements: Technological advancements, especially AI integration, are transforming vending machines into more intuitive, consumer-centric devices in Europe. The European Commissions Digital Decade initiative reports that 18,000 AI-enabled vending machines were operational in the region by 2023. These machines employ machine learning to adjust product recommendations based on customer interactions, optimizing sales and enhancing user experience. This trend is reinforced by the European Unions financial support for AI technologies, with an investment of EUR 1.5 billion in digitalization projects that contribute to the retail and vending machine sector.

- Expanding Cashless Transactions: The widespread adoption of cashless payments across Europe is boosting the vending machine market, as more consumers shift to contactless options. A European Central Bank study shows that non-cash transactions surged to 56 billion in 2023, driven by digital wallet users, particularly in regions like Scandinavia. This development has encouraged vending machine operators to implement cashless payment technologies, catering to the growing preference for digital payments. With nearly 80% of new vending machines supporting contactless options by 2023, the trend aligns with increased EU regulations promoting financial inclusion and digital payments.

Market Challenges

- Stringent Regulatory Compliance: Europes strict regulatory landscape for vending machines mandates operators adhere to health, safety, and environmental standards, adding complexity to market entry. The European Commissions 2023 report on product compliance shows a notable increase in regulations for food and beverage vending machines, particularly in the UK and Germany, where compliance costs averaged EUR 3,500 per machine. These requirements are compounded by labeling and nutritional information standards, particularly impacting operators who serve food and beverage items.

- Security Concerns: Vending machines in Europe face security challenges, both in terms of data protection and physical vandalism. A 2023 study by the European Network Information Security Agency noted a 20% rise in data security breaches in retail IoT devices, including vending machines. Additionally, physical vandalism incidents cost operators over EUR 15 million in damages in 2023. This has necessitated higher investment in security features like tamper-resistant design and advanced software encryption, but the costs remain a financial challenge for smaller operators.

Europe Vending Machine Market Future Outlook

The Europe vending machine market is projected to experience steady growth, supported by rapid advancements in digital payment systems, the integration of IoT in vending technologies, and a growing preference for convenience-oriented retail solutions. As smart city initiatives across European countries gain momentum, vending machine applications are expected to diversify, catering to a wide array of consumer needs. Increased collaboration between vending machine operators and food and beverage companies is anticipated to offer consumers more options and contribute to further market expansion.

Future Market Opportunities

- Integration with Smart City Initiatives: Smart city initiatives across Europe present significant growth opportunities for the vending machine market. As part of the EUs Horizon 2020 program, more than EUR 300 million was allocated to smart city projects in 2023, supporting infrastructure that includes automated retail solutions. Cities like Amsterdam and Barcelona are now integrating vending machines with public Wi-Fi and energy-efficient systems, making them integral to urban automation projects. This has led to a 12% rise in vending machine installations in smart cities across Europe in the past year.

- Expansion in Underdeveloped Regions: The expansion of vending machines into underdeveloped regions within Europe offers untapped potential, as urbanization and retail infrastructure in these areas grow. Data from the European Regional Development Fund in 2023 indicates that EUR 400 million was invested in rural development, with a focus on infrastructure for essential services. This includes a rising number of vending machine installations to support consumer convenience, especially in emerging markets in Eastern Europe. This regional expansion aligns with EU goals to improve rural infrastructure and increase accessibility to automated services.

Scope of the Report

|

By Machine Type |

Beverage Vending Machines |

|

By Payment Mode |

Cash-based |

|

By Location |

Transportation Hubs |

|

By Product |

Snacks |

|

By Country |

Germany |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, Local Health Authorities)

Vending Machine Manufacturers

Retail Chains and Supermarket Operators

Technology Providers and Payment Solution Firms

Smart City Developers and Planners

Corporate Offices and Facilities Managers

Educational and Healthcare Institutions

Companies

Major Players

Crane Co.

Azkoyen Group

Selecta Group

Fuji Electric Co., Ltd.

N&W Global Vending S.p.A.

Bianchi Vending Group

Westomatic Vending Services Ltd.

Royal Vendors Inc.

Sanden Corporation

Seaga Manufacturing Inc.

Jofemar Corporation

Rhea Vendors Group

FAS International S.p.A.

Venditalia

Evoca Group

Table of Contents

1. Europe Vending Machine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Penetration Rate

1.4 Key Market Developments

2. Europe Vending Machine Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Milestones and Achievements

3. Europe Vending Machine Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Automation Demand in Retail

3.1.2 Technological Advancements (e.g., AI-enabled Vending Solutions)

3.1.3 Expanding Cashless Transactions

3.1.4 Changing Consumer Preferences (Healthier Options)

3.2 Market Challenges

3.2.1 High Initial Investment

3.2.2 Maintenance and Service Requirements

3.2.3 Stringent Regulatory Compliance

3.2.4 Security Concerns (Data and Physical Vandalism)

3.3 Opportunities

3.3.1 Integration with Smart City Initiatives

3.3.2 Expansion in Underdeveloped Regions

3.3.3 Customized Product Offerings

3.3.4 Partnerships with E-commerce for Delivery Points

3.4 Trends

3.4.1 Shift Toward Contactless Payment

3.4.2 Sustainability in Vending Machine Materials

3.4.3 Increased Adoption of IoT

3.4.4 Integration with Customer Loyalty Programs

3.5 Regulatory Framework

3.5.1 Health and Safety Regulations

3.5.2 Energy Efficiency Standards

3.5.3 Consumer Protection Guidelines

3.5.4 Data Protection Policies (GDPR Compliance)

3.6 Market Structure Analysis

3.7 Stakeholder Ecosystem (e.g., Manufacturers, Retailers, Service Providers)

3.8 Porters Five Forces

3.9 Competitive Ecosystem

4. Europe Vending Machine Market Segmentation

4.1 By Machine Type (In Value %)

4.1.1 Beverage Vending Machines

4.1.2 Food Vending Machines

4.1.3 Combination Vending Machines

4.1.4 Specialty Vending Machines (e.g., Health Products)

4.2 By Payment Mode (In Value %)

4.2.1 Cash-based

4.2.2 Card-based

4.2.3 Contactless Payments

4.2.4 Mobile Wallets

4.3 By Location (In Value %)

4.3.1 Transportation Hubs

4.3.2 Educational Institutions

4.3.3 Corporate Offices

4.3.4 Hospitals and Health Centers

4.4 By Product (In Value %)

4.4.1 Snacks

4.4.2 Beverages

4.4.3 Health and Wellness Products

4.4.4 Fresh Food Items

4.5 By Country (In Value %)

4.5.1 Germany

4.5.2 United Kingdom

4.5.3 France

4.5.4 Italy

4.5.5 Spain

5. Europe Vending Machine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Crane Co.

5.1.2 Azkoyen Group

5.1.3 Selecta Group

5.1.4 Royal Vendors Inc.

5.1.5 Sanden Corporation

5.1.6 Seaga Manufacturing Inc.

5.1.7 Fuji Electric Co., Ltd.

5.1.8 Jofemar Corporation

5.1.9 N&W Global Vending S.p.A.

5.1.10 Bianchi Vending Group

5.1.11 Westomatic Vending Services Ltd.

5.1.12 Rhea Vendors Group

5.1.13 FAS International S.p.A.

5.1.14 Venditalia

5.1.15 Evoca Group

5.2 Cross Comparison Parameters (Revenue, Number of Machines, Production Capacity, Sustainability Initiatives, Geographic Presence, Payment Integration, Service Contracts, R&D Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Technological Collaborations

6. Europe Vending Machine Market Regulatory Framework

6.1 Compliance and Certification Requirements

6.2 Environmental Regulations and Standards

6.3 Energy Efficiency Directives

6.4 Consumer Safety Regulations

7. Europe Vending Machine Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Drivers Impacting Future Market Growth

8. Europe Vending Machine Future Market Segmentation

8.1 By Machine Type

8.2 By Payment Mode

8.3 By Location

8.4 By Product

8.5 By Country

9. Europe Vending Machine Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Competitive Positioning Strategies

9.3 Key Marketing Initiatives

9.4 Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase involved constructing a market ecosystem map, identifying primary stakeholders such as manufacturers, operators, and technology providers in the Europe vending machine market. This step utilized in-depth desk research and proprietary data sources to define variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data for the Europe vending machine market was analyzed to gauge market penetration, sales distribution, and service quality metrics. This provided a foundation for reliable revenue estimates and performance assessments within each segment.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and potential growth areas were validated through interviews with industry experts using computer-assisted telephone interviews (CATIs). These discussions provided operational insights directly from industry leaders, refining our data.

Step 4: Research Synthesis and Final Output

The last phase involved engaging with multiple European vending machine companies for in-depth insights into product segments, technological advancements, and consumer trends. This primary research ensured a robust and verified analysis, complementing the bottom-up approach for accurate market assessment.

Frequently Asked Questions

01. How big is the Europe Vending Machine Market?

The Europe vending machine market is valued at USD 18.6 billion, driven by technological advancements, automation trends, and evolving consumer preferences toward convenient retail options.

02. What challenges does the Europe Vending Machine Market face?

Challenges in the Europe vending machine market include high initial investment, ongoing maintenance requirements, and stringent regulatory compliance, especially regarding payment security and energy efficiency standards.

03. Who are the major players in the Europe Vending Machine Market?

Key players in the Europe vending machine market include Crane Co., Azkoyen Group, Selecta Group, Fuji Electric Co., Ltd., and N&W Global Vending S.p.A., with each excelling in technological integration and regional expansion.

04. What drives growth in the Europe Vending Machine Market?

Growth in the Europe vending machine market is propelled by rising demand for automated retail options, consumer trends toward cashless payments, and the inclusion of healthier product offerings in vending machines.

05. Which regions lead the Europe Vending Machine Market?

Germany, France, and the United Kingdom lead due to advanced digital infrastructure, high population density in urban areas, and supportive regulations for cashless payments and eco-friendly products in the Europe vending machine market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.