Europe Virtual Data Room (VDR) Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD1158

November 2024

94

About the Report

Europe Virtual Data Room Market Overview

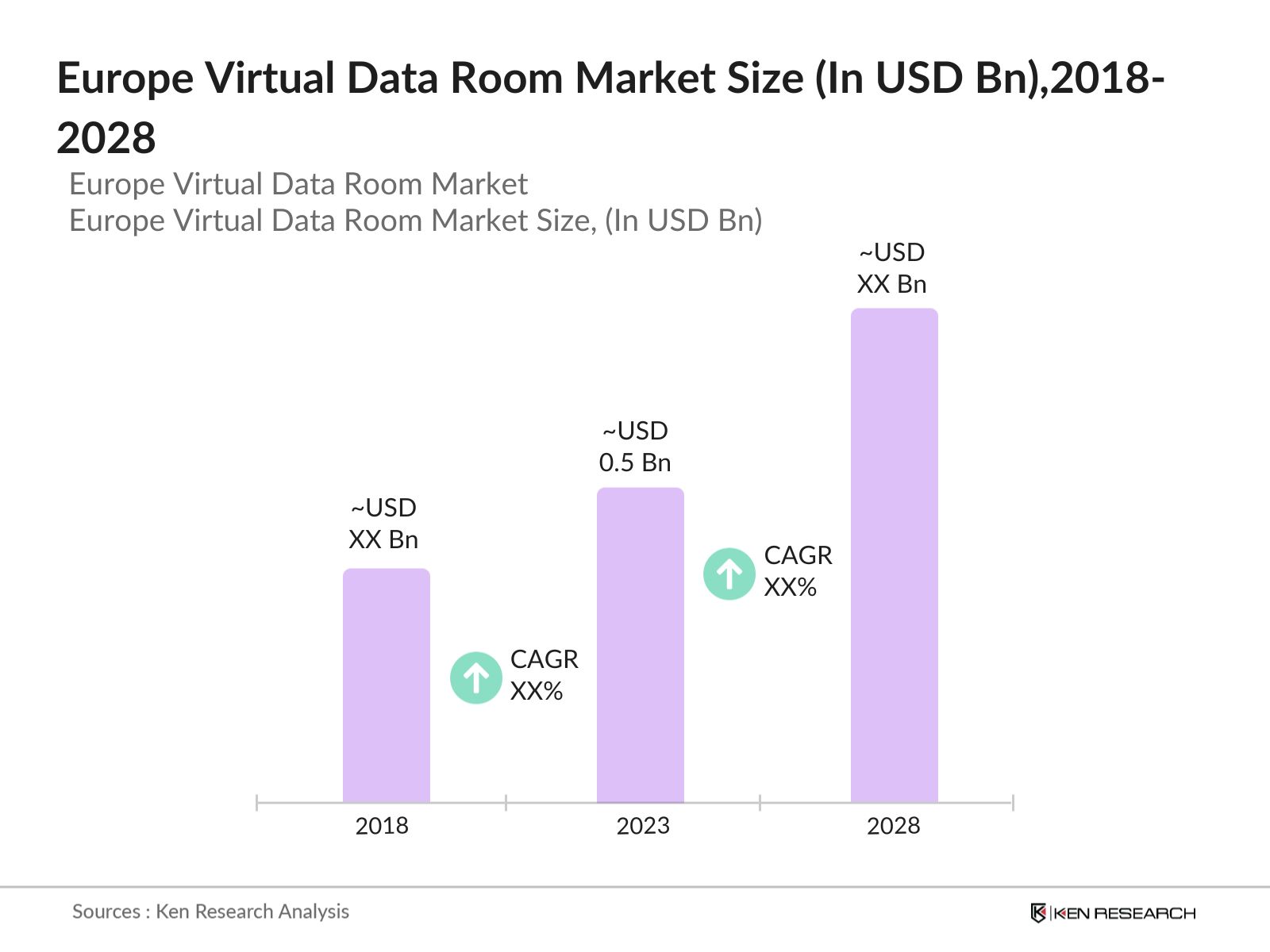

The Europe Virtual Data Room market was valued at USD 0.5 billion in 2023. The rapid growth is driven by the increasing demand for secure data storage and sharing solutions across sectors such as banking, finance, legal, and real estate. The shift toward digital transformation in corporate governance, mergers and acquisitions (M&A), and regulatory compliance management continues to fuel market growth.

Major players dominating the European VDR market include iDeals Solutions, Intralinks, Merrill Corporation, CapLinked, and Ansarada. These companies offer robust solutions catering to multiple industries with a strong focus on security, ease of use, and collaboration features. Their advanced offerings in terms of AI-powered data analytics and customizable security protocols help enterprises manage sensitive information effectively.

In 2023, iDeals Solutions announced an upgrade to its VDR platform, integrating artificial intelligence (AI)-driven features to enhance document review processes and predictive analytics for deal-making activities. This development highlights the markets push toward automation and data-driven insights, which are expected to reshape M&A transactions, improving efficiency and reducing time to completion.

Germany is the largest market for virtual data rooms in Europe, accounting for nearly one third of the market share in 2023. The countrys highly regulated financial sector, along with strict data protection laws, has necessitated the use of secure digital platforms like VDRs. Additionally, the increasing volume of cross-border M&A activities involving German corporations continues to drive VDR adoption.

Europe Virtual Data Room Market Segmentation

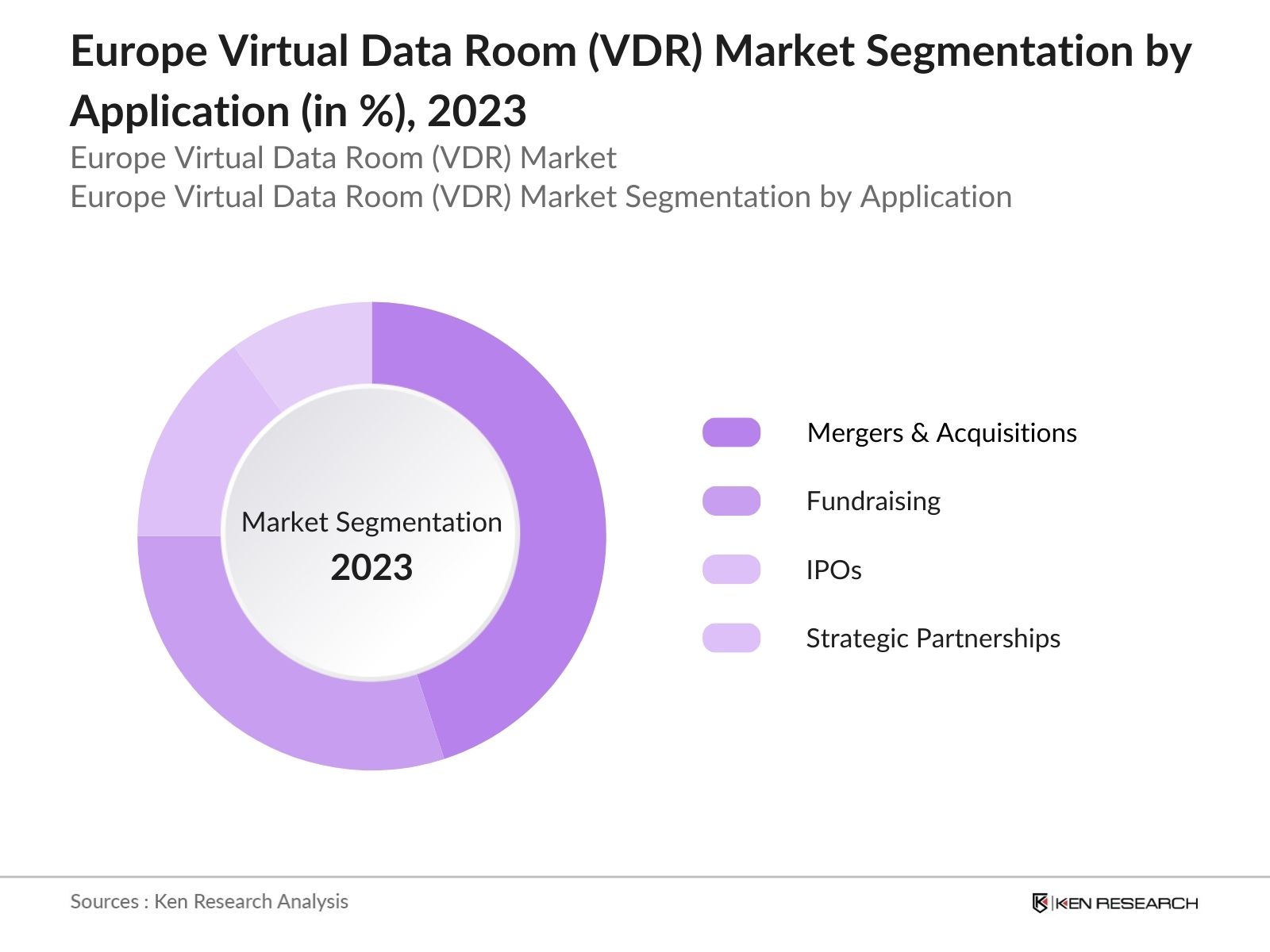

By Application: The market is segmented by application into Mergers & Acquisitions (M&A), Fundraising, IPOs, and Strategic Partnerships. Recently, Mergers & Acquisitions held the dominant market share. This is attributed to the high frequency of M&A transactions across Europe, particularly in the financial and legal sectors. The need for secure data handling and compliance with regulatory frameworks makes VDRs essential in these operations.

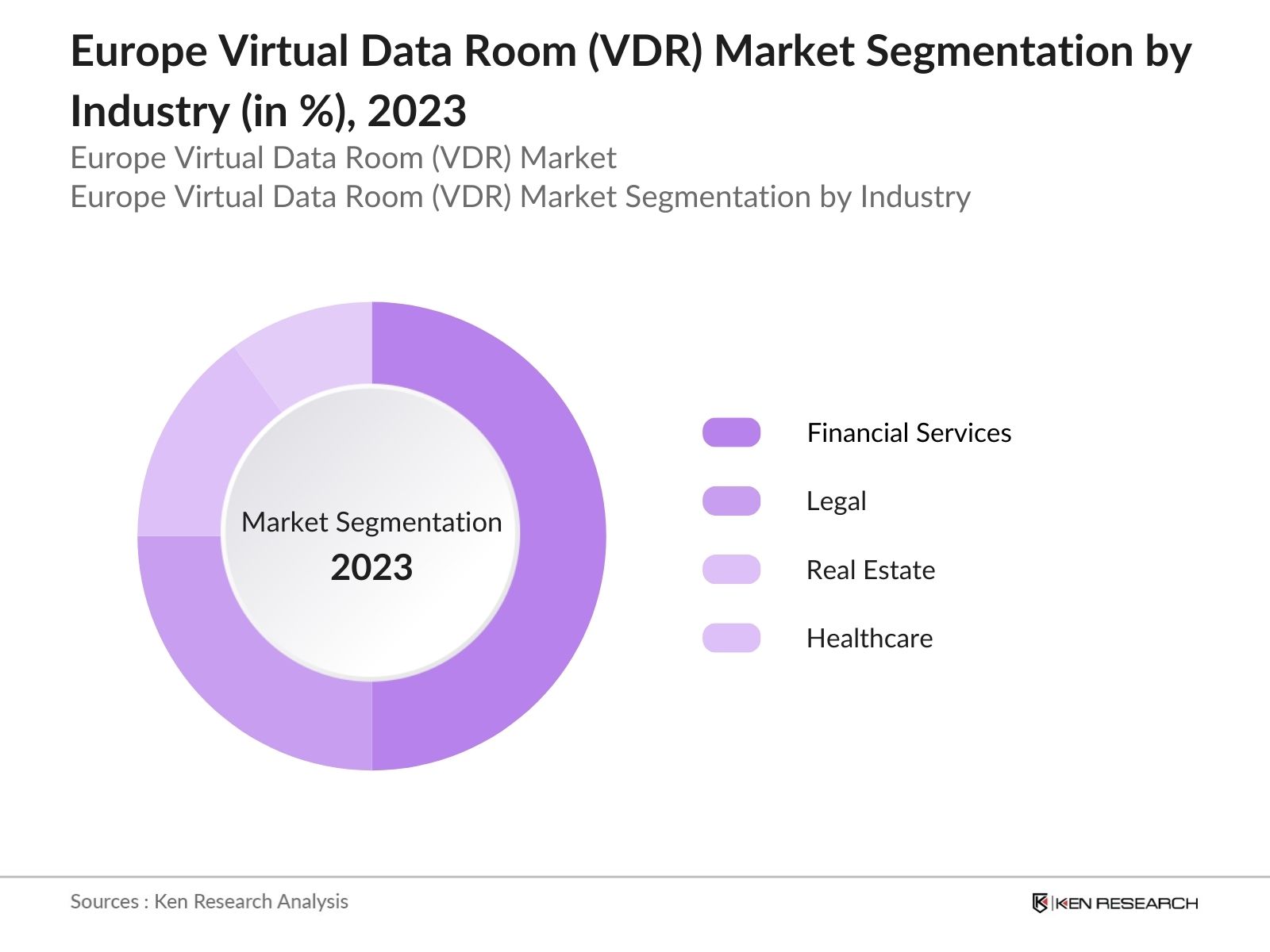

By Industry: The market is further segmented by industry into Financial Services, Legal, Real Estate, and Healthcare. Financial Services dominated the market share, driven by the sectors need for secure, streamlined document exchange during IPOs, due diligence processes, and regulatory compliance. The growing number of fintech startups and private equity investments further fuel the demand for VDR solutions in this industry.

By Region: The market in Europe is divided into Germany, France, United Kingdom, Sweden, Italy and Rest of Europe. Germany holds the dominant market share in the Europe Virtual Data Room market. This is driven by its robust regulatory environment, stringent data protection laws, and high adoption of VDR solutions in the financial, legal, and M&A sectors.

Europe Virtual Data Room (VDR) Market Competitive Landscape

|

Company Name |

Year of Establishment |

Headquarters |

|---|---|---|

|

iDeals Solutions |

2008 |

London, UK |

|

Intralinks |

1996 |

New York, USA |

|

Merrill Corp |

1968 |

St. Paul, USA |

|

CapLinked |

2010 |

California, USA |

|

Ansarada |

2005 |

Sydney, Australia |

- Intralinks Introduces AI-Powered Data Analytics: In 2023, Intralinks integrated artificial intelligence (AI) into its VDR platform to enhance data analytics and predictive insights during M&A transactions. This development is projected to improve deal closure times by 30% in 2024, making it a valuable tool for financial institutions and legal firms.

- Merrill Corporation Partners with Major European Bank: Merrill, which rebranded to Datasite in 2020, has established itself as a significant player in the VDR sector, particularly in Europe. The company offers a suite of tools designed to facilitate mergers and acquisitions, due diligence processes, and secure document sharing. Their solutions include Datasite Diligence, Datasite Outreach, and Datasite One, among others, which cater primarily to large enterprises and sectors such as finance, law, and private equity.

Europe Virtual Data Room (VDR) Market Industry Analysis

Growth Drivers

- Increase in Cross-Border M&A Activity: In 2023, Europe experienced a rise in cross-border mergers and acquisitions (M&A), with major deals being transacted across major sectors such as finance, energy, and healthcare. This surge has driven the demand for Virtual Data Room (VDR) solutions, which facilitate secure data exchange and compliance with international regulatory requirements. With the European Central Bank predicting an increase in cross-border deals in 2024.

- Rising Focus on Data Protection Compliance: European countries such as Germany and France have stringent data protection regulations, which impact sectors like finance, healthcare, and legal services. Companies in these sectors spent over EUR 5 billion on data security solutions, including VDRs, to comply with GDPR and other national data protection laws. This emphasis on data protection compliance continues to drive market growth as companies look for secure.

- Adoption of VDRs in the Real Estate Sector: Real estate transactions in Europe surpassed EUR 140 billion in 2023, and a large portion of these deals utilized VDRs to manage sensitive documents during transactions. The trend of digitization in real estate is expected to continue in 2024, with more companies opting for secure, digital solutions like VDRs to streamline property sales, leasing, and investment deals.

Challenges

- Cybersecurity Concerns: Despite the robust security features offered by VDRs, businesses remain concerned about potential cybersecurity threats, especially in high-profile transactions such as M&As and IPOs. In 2023, Europe reported many cyberattacks on financial institutions involved in cross-border transactions, raising concerns about the safety of sensitive data. This has led companies to delay the adoption of VDRs until more robust security assurances are provided by providers.

- Limited Awareness Among SMEs: The market is still under-penetrated among small and medium-sized enterprises (SMEs) in Europe, particularly in Eastern Europe. Very limited SMEs in the region used VDRs, mainly due to a lack of awareness about the benefits of secure document management. This gap in awareness limits the overall market growth, especially in regions where SMEs dominate the economy.

Government Initiatives

- European Data Protection Regulation Compliance Support: The GDPR, enacted on May 25, 2018, establishes strict guidelines for data protection and privacy, requiring organizations to implement robust security measures and ensuring individuals have control over their personal data. This initiative is expected to drive significant adoption of VDRs across sectors like healthcare, banking, and legal services.

- National Data Sovereignty Programs: On February 7 2024, Germany launched a national data sovereignty initiative, requiring companies to store and process data within the country. This initiative is likely to increase the demand for localized VDR solutions that comply with Germany's stringent data localization laws. Local VDR providers are expected to benefit the most from this regulation, creating new opportunities in the market.

Europe Virtual Data Room (VDR) Market Future Outlook

The Europe Virtual Data Room market is projected to grow exponentially by 2028, driven by advancements in cloud computing, data encryption technologies, and increasing compliance requirements under the General Data Protection Regulation (GDPR). Additionally, the rise of hybrid working models and the growing importance of cybersecurity in data sharing.

Future Trends

- Integration of Blockchain for Enhanced Security: Over the next five years, the Europe market is expected to see significant adoption of blockchain technology, particularly in sectors requiring immutable audit trails such as finance and healthcare. By 2028, more companies in Europe are projected to use blockchain-enabled VDRs to ensure the integrity and security of sensitive data.

- Increased Focus on Data Localization Compliance: As countries like Germany and France continue to implement stricter data localization laws, VDR providers will need to offer localized data storage solutions to comply with these regulations. Localized VDR services are expected cover a major part of the total VDR market in Europe, driven by increasing regulatory requirements.

Scope of the Report

|

By Application |

Mergers & Acquisitions (M&A) Fundraising IPOs Strategic Partnerships |

|

By Industry |

Financial Services Legal Real Estate Healthcare |

|

By Region |

Germany France United Kingdom Sweden Italy Rest of Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors and VC Firms

Banks and Financial Institutions

IT departments in multinational corporations

Corporate governance teams

European Data Protection Board (EDPB)

National Data Protection Authorities (DPAs)

M&A advisory firms

Corporate legal departments

Public sector enterprises

Compliance officers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

iDeals Solutions

Intralinks

Merrill Corporation

CapLinked

Ansarada

SmartRoom

SecureDocs

EthosData

Brainloop

ShareVault

Firmex

HighQ

Datasite

Box

ShareFile

Table of Contents

1. Europe Virtual Data Room Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Virtual Data Room Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Virtual Data Room Market Analysis

3.1. Growth Drivers

3.1.1. Cross-border M&A Activity

3.1.2. Data Protection Regulations

3.1.3. Corporate Governance Compliance

3.1.4. Real Estate Digitization

3.2. Restraints

3.2.1. Complex Regulatory Environment

3.2.2. High Integration and Customization Costs

3.2.3. Cybersecurity Concerns

3.2.4. Limited Awareness Among SMEs

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Expansion into New Sectors

3.3.3. Government Support for Digital Infrastructure

3.3.4. Increased Focus on Data Localization

3.4. Trends

3.4.1. Blockchain Integration

3.4.2. AI and Automation in VDRs

3.4.3. Rising Demand in Cross-Border Transactions

3.4.4. Hybrid Cloud Adoption

3.5. Government Regulations

3.5.1. GDPR Compliance

3.5.2. Data Sovereignty Laws

3.5.3. Digital Europe Programme

3.5.4. National Cybersecurity Strategies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Landscape

4. Europe Virtual Data Room Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Mergers & Acquisitions

4.1.2. Fundraising

4.1.3. IPOs

4.1.4. Strategic Partnerships

4.2. By Industry (in Value %)

4.2.1. Financial Services

4.2.2. Legal

4.2.3. Real Estate

4.2.4. Healthcare

4.3. By Region (in Value %)

4.3.1. Western Europe

4.3.2. Northern Europe

4.3.3. Southern Europe

4.3.4. Eastern Europe

5. Europe Virtual Data Room Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. iDeals Solutions

5.1.2. Intralinks

5.1.3. Merrill Corporation

5.1.4. CapLinked

5.1.5. Ansarada

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Europe Virtual Data Room Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Europe Virtual Data Room Market Regulatory Framework

7.1. GDPR and Compliance Requirements

7.2. Data Localization Laws

7.3. Certification Processes

8. Europe Virtual Data Room Future Market Size (in USD Mn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Europe Virtual Data Room Future Market Segmentation, 2028

9.1. By Application (in Value %)

9.2. By Industry (in Value %)

9.3. By Region (in Value %)

10. Europe Virtual Data Room Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Europe Virtual Data Rooms (VDR) industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different Virtual Data Rooms (VDR) companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple virtual data room companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Virtual Data Rooms (VDR) companies.

Frequently Asked Questions

01 How big is Europe Virtual Data Room Market?

The Europe Virtual Data Room market, valued at USD 850 million in 2023, is driven by the increasing need for secure data sharing solutions in M&A, financial transactions, and legal processes across highly regulated sectors.

02 What are the challenges in Europe Virtual Data Room Market?

Challenges in the Europe Virtual Data Room market include a complex regulatory environment across different European countries, high costs of integration and customization, cybersecurity concerns, and limited awareness among small and medium-sized enterprises about the benefits of VDRs.

03 Who are the major players in the Europe Virtual Data Room Market?

Key players in the Europe Virtual Data Room market include iDeals Solutions, Intralinks, Merrill Corporation, CapLinked, and Ansarada. These companies lead the market with advanced security features and comprehensive solutions catering to industries like finance, healthcare, and legal.

04 What are the growth drivers of Europe Virtual Data Room Market?

Growth drivers in the Europe Virtual Data Room Market include the rise in cross-border M&A activity, stringent data protection regulations, increasing adoption of digital tools for corporate governance, and growing use of VDRs in the real estate sector for secure document handling during large transactions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.