Europe VR Headset Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD9410

December 2024

96

About the Report

Europe VR Headset Market Overview

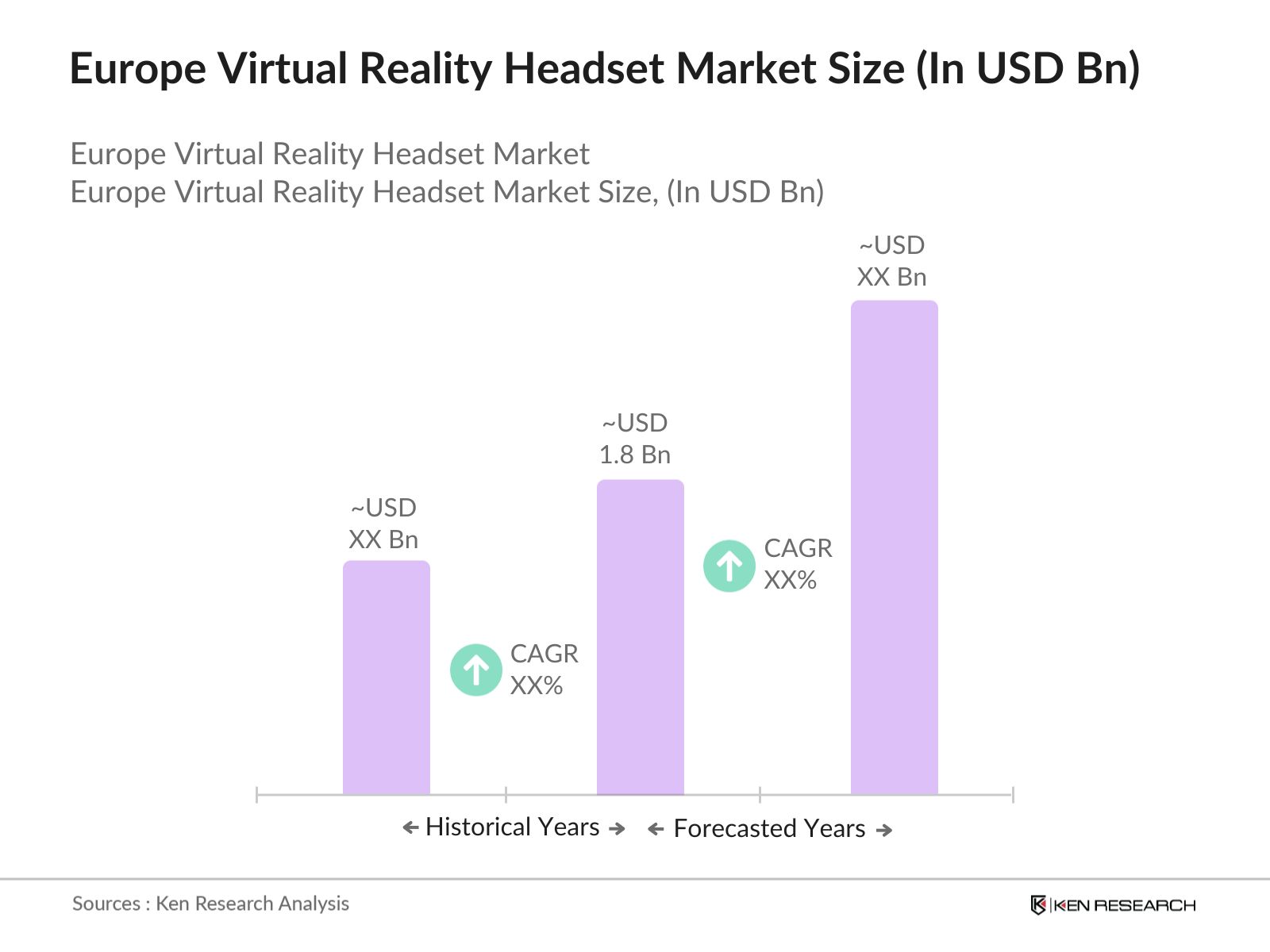

- The Europe VR Headset Market is valued at USD 1.8 billion, based on a five-year historical analysis. The market is driven by advancements in hardware technology, including enhanced display resolutions and reduced latency, making VR headsets more user-friendly and immersive. Additionally, increasing consumer demand for VR experiences in gaming, education, and enterprise applications has contributed significantly to the market growth. The adoption of VR in sectors such as healthcare for training and therapy has also spurred demand, positioning the market for robust development.

- Countries like Germany, the United Kingdom, and France dominate the Europe VR Headset Market. Germany leads due to its advanced manufacturing ecosystem and significant investments in VR technology, particularly in the automotive and industrial sectors. The UK excels because of its thriving gaming and entertainment industries, which heavily utilize VR. France is emerging as a key player with government support and innovation hubs fostering VR adoption in media, education, and healthcare.

- Launched as part of the European Commissions Media and Audiovisual Action Plan, this coalition aims to enhance dialogue between the VR/AR industry and policymakers. It focuses on informing policy decisions, encouraging investment, and identifying challenges and opportunities within the sector. The coalition has conducted workshops with over 100 stakeholders to develop a strategy for Web 4.0 and virtual worlds, which was published in July 2023.

Europe VR Headset Market Segmentation

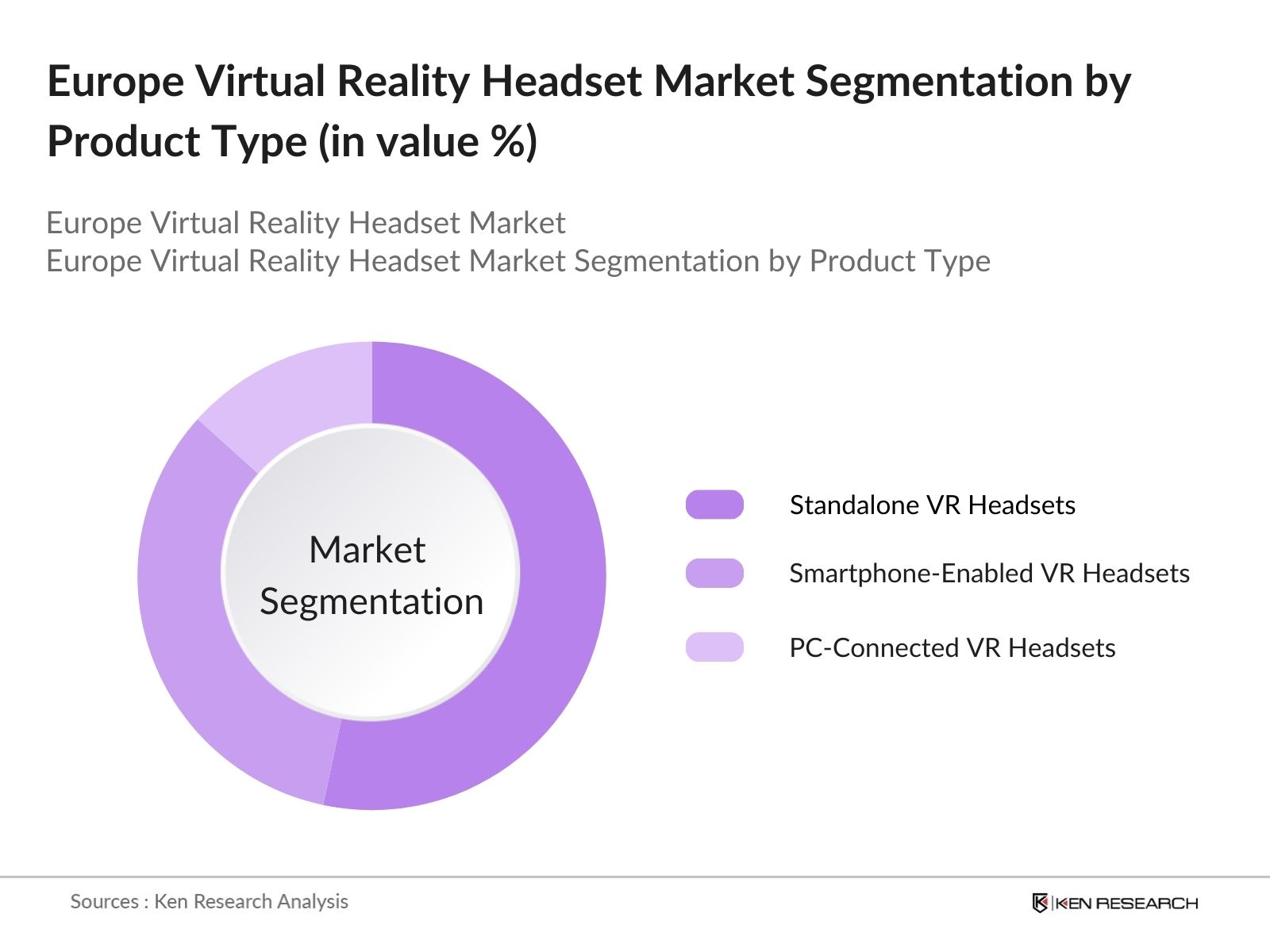

By Product Type: The Europe VR Headset Market is segmented by product type into standalone VR headsets, smartphone-enabled VR headsets, and PC-connected VR headsets. Recently, standalone VR headsets have a dominant market share in Europe under this segmentation. Their portability, ease of use, and all-in-one capabilities have made them popular among both casual and professional users. Advancements in wireless technology and content compatibility have further driven their adoption.

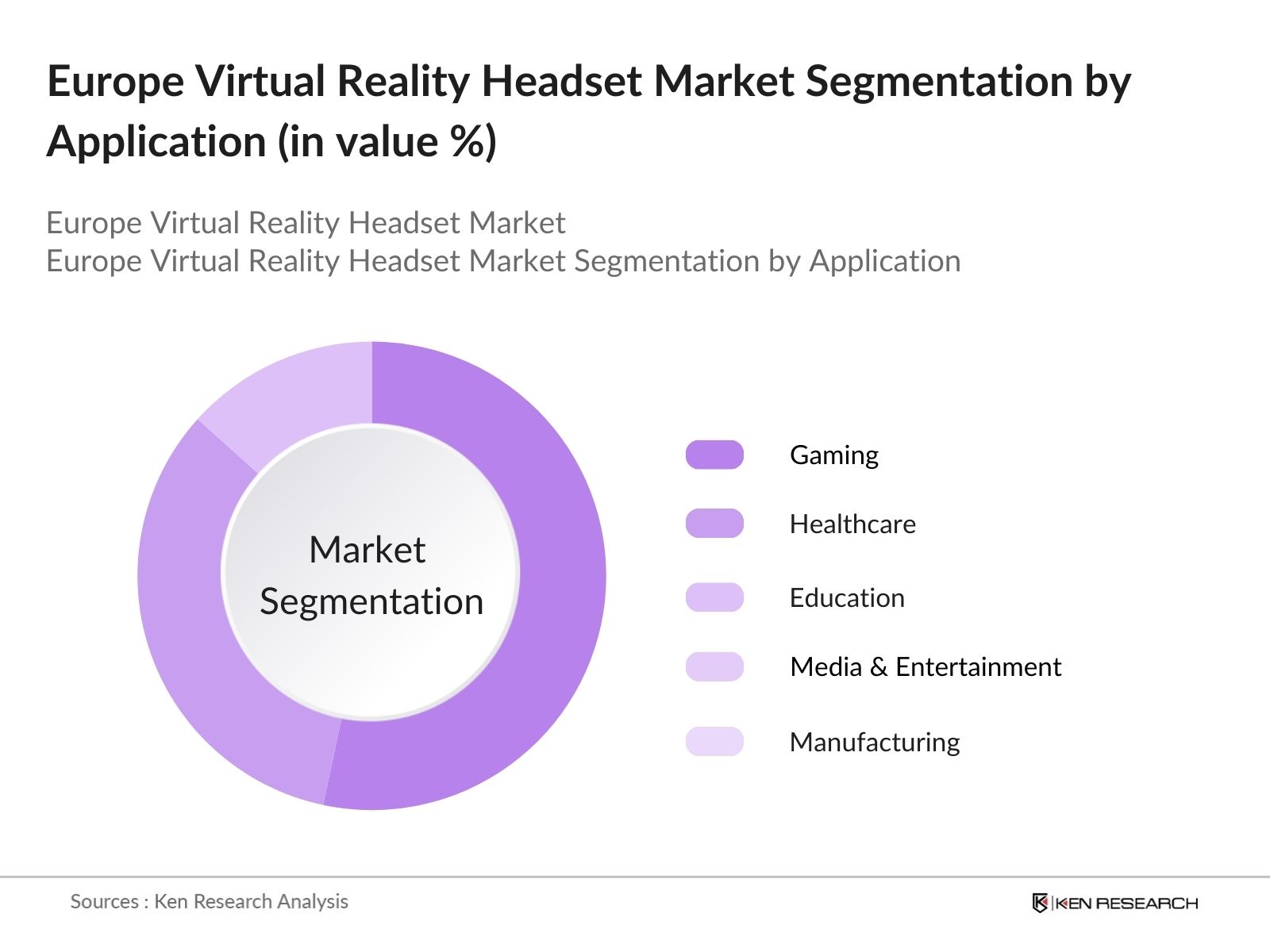

By Application: The Europe VR Headset Market is segmented by application into gaming, healthcare, education, media & entertainment, and manufacturing. Gaming is the leading application segment due to its wide consumer base, strong gaming culture, and significant investments by gaming companies in VR content development. The immersive experiences provided by VR headsets make them ideal for gamers seeking high-quality entertainment.

Europe VR Headset Market Competitive Landscape

The Europe VR Headset Market is dominated by several major players, ranging from established global corporations to innovative startups. Key players such as Meta Platforms (Oculus) and HTC Corporation continue to lead due to their robust R&D capabilities and diverse product portfolios. European companies and partnerships are also gaining traction, contributing to a competitive ecosystem.

Europe VR Headset Market Analysis

Growth Drivers

- Technological Advancements: The market is experiencing significant traction due to advancements in AR/VR hardware manufacturing processes, with global production units of AR/VR headsets surpassing 25 million devices in 2024. These advancements enhance performance metrics such as latency reduction and field-of-view improvement, making AR/VR devices more viable for broader applications.

- Increasing Adoption in Gaming and Entertainment: The gaming and entertainment industries accounted for over 85 million active AR/VR users globally in 2024. This adoption is fueled by immersive gaming experiences and partnerships between AR/VR developers and leading entertainment companies, enabling the development of tailored content and systems optimized for next-generation gaming consoles and online platforms.

- Expansion into Healthcare and Education Sectors: The healthcare sector integrated AR/VR solutions in over 10,000 hospitals globally by 2024, focusing on patient therapy and remote surgical assistance. Similarly, the education industry has implemented AR/VR systems across 45,000 learning institutions to enhance remote learning environments and interactive STEM programs.

Market Challenges

- High Initial Costs: The average cost of AR/VR hardware systems remains between $800 and $2,000 per unit in 2024, limiting accessibility among consumers and small enterprises. Despite efforts to lower production costs, affordability remains a critical barrier in emerging markets.

- Technical Limitations and User Experience Issues: Issues such as motion sickness and low-quality content continue to hinder user adoption rates. Studies show that over 30% of surveyed users in 2024 reported discomfort during prolonged usage, underscoring the need for further technical refinement.

Europe VR Headset Market Future Outlook

Over the next five years, the Europe VR Headset Market is expected to witness significant growth driven by increasing demand for immersive experiences, technological advancements, and wider applications in industries like healthcare, education, and manufacturing. The development of 5G networks and more affordable devices are anticipated to enhance VR adoption across diverse user segments.

Market Opportunities

- Integration with Augmented Reality (AR) Technologies: AR adoption in industrial applications reached over 300,000 deployments in 2024. Integrating AR/VR platforms within manufacturing, retail, and logistics processes creates opportunities to enhance operational efficiencies and reduce downtime.

- Growth in Enterprise Applications: Over 15,000 companies globally adopted AR/VR technologies in 2024 for applications such as virtual collaboration, product prototyping, and workforce training. Demand is driven by increased reliance on hybrid work environments and remote operational models.

Scope of the Report

|

End-Device |

Low-End Devices |

|

Product Type |

Standalone VR Headsets |

|

Application |

Gaming |

|

Technology |

Non-Immersive |

|

Country |

United Kingdom |

Products

Key Target Audience

VR Device Manufacturers

Content Developers and Creators

Gaming Studios and Publishers

Healthcare Providers and Trainers

Education Institutes and E-learning Platforms

Government and Regulatory Bodies (EU Digital Innovation Hubs, European Health Agency)

Investors and Venture Capitalist Firms

Industrial Automation Companies

Companies

Players Mentioned in the Report:

Meta Platforms, Inc. (Oculus)

HTC Corporation

Sony Group Corporation

Samsung Electronics Co., Ltd.

Microsoft Corporation

Lenovo Group Limited

Google LLC

Valve Corporation

Pimax Technology Co., Ltd.

HP Inc.

Table of Contents

1. Europe VR Headset Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe VR Headset Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe VR Headset Market Analysis

3.1 Growth Drivers

3.1.1 Technological Advancements

3.1.2 Increasing Adoption in Gaming and Entertainment

3.1.3 Expansion into Healthcare and Education Sectors

3.1.4 Rising Consumer Demand for Immersive Experiences

3.2 Market Challenges

3.2.1 High Initial Costs

3.2.2 Technical Limitations and User Experience Issues

3.2.3 Content Availability and Development Constraints

3.3 Opportunities

3.3.1 Integration with Augmented Reality (AR) Technologies

3.3.2 Growth in Enterprise Applications

3.3.3 Expansion into Emerging European Markets

3.4 Trends

3.4.1 Development of Standalone VR Headsets

3.4.2 Enhanced Wireless Connectivity

3.4.3 Collaboration with Content Creators and Developers

3.5 Government Regulations

3.5.1 EU Data Protection and Privacy Laws

3.5.2 Health and Safety Standards

3.5.3 Import and Export Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe VR Headset Market Segmentation

4.1 By End-Device (in Value %)

4.1.1 Low-End Devices

4.1.2 Mid-Range Devices

4.1.3 High-End Devices

4.2 By Product Type (in Value %)

4.2.1 Standalone VR Headsets

4.2.2 Smartphone-Enabled VR Headsets

4.2.3 PC-Connected VR Headsets

4.3 By Application (in Value %)

4.3.1 Gaming

4.3.2 Healthcare

4.3.3 Media & Entertainment

4.3.4 Manufacturing

4.3.5 Education

4.3.6 Retail

4.3.7 Telecommunications

4.3.8 Others

4.4 By Technology (in Value %)

4.4.1 Non-Immersive

4.4.2 Semi-Immersive

4.4.3 Fully Immersive

4.5 By Country (in Value %)

4.5.1 United Kingdom

4.5.2 Germany

4.5.3 France

4.5.4 Italy

4.5.5 Spain

4.5.6 Netherlands

4.5.7 Rest of Europe

5. Europe VR Headset Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Meta Platforms, Inc. (Oculus)

5.1.2 Sony Group Corporation

5.1.3 HTC Corporation

5.1.4 Samsung Electronics Co., Ltd.

5.1.5 Microsoft Corporation

5.1.6 Lenovo Group Limited

5.1.7 Google LLC

5.1.8 Valve Corporation

5.1.9 Pimax Technology (Shanghai) Co., Ltd.

5.1.10 HP Inc.

5.1.11 Xiaomi Corporation

5.1.12 Panasonic Corporation

5.1.13 Magic Leap, Inc.

5.1.14 Vuzix Corporation

5.1.15 StarVR Corporation

5.2 Cross Comparison Parameters

5.2.1 Headquarters

5.2.2 Inception Year

5.2.3 Revenue

5.2.4 Market Share

5.2.5 Product Portfolio

5.2.6 R&D Investment

5.2.7 Regional Presence

5.2.8 Strategic Initiatives

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Europe VR Headset Market Regulatory Framework

6.1 EU Regulations on VR Devices

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe VR Headset Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe VR Headset Future Market Segmentation

8.1 By End-Device (in Value %)

8.2 By Product Type (in Value %)

8.3 By Application (in Value %)

8.4 By Technology (in Value %)

8.5 By Country (in Value %)

9. Europe VR Headset Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the VR headset market ecosystem, identifying stakeholders, and defining key influencing variables. Desk research is conducted using proprietary databases and secondary sources to gather foundational data.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to evaluate product trends, sales channels, and industry penetration. Detailed assessments are conducted to ensure accuracy in revenue and segment estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through in-depth interviews with VR manufacturers, distributors, and industry experts. These consultations provide critical insights into product innovation, competitive dynamics, and market trends.

Step 4: Research Synthesis and Final Output

The final phase consolidates primary and secondary research findings, ensuring a validated and comprehensive report. Insights from leading players in the VR headset industry are integrated to provide a holistic view.

Frequently Asked Questions

01. How big is the Europe VR Headset Market?

The Europe VR Headset Market is valued at USD 1.8 billion, driven by rapid adoption across gaming, healthcare, and education sectors. Technological advancements and immersive experiences have further propelled its growth.

02. What are the challenges in the Europe VR Headset Market?

The primary challenges in the Europe VR Headset Market include high costs, limited content availability, and technical barriers such as latency and motion sickness. Addressing these issues is crucial for mass adoption.

03. Who are the major players in the Europe VR Headset Market?

Key players in the Europe VR Headset Market include Meta Platforms (Oculus), HTC Corporation, Sony Group Corporation, Lenovo Group Limited, and Microsoft Corporation. These companies dominate due to their innovative products and established distribution networks.

04. What are the growth drivers of the Europe VR Headset Market?

Growth of Europe VR Headset Market is fueled by advancements in hardware, increasing demand in gaming, healthcare applications, and the development of affordable VR solutions compatible with various content platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.