Europe Waste Shredder Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD7322

November 2024

87

About the Report

Europe Waste Shredder Market Overview

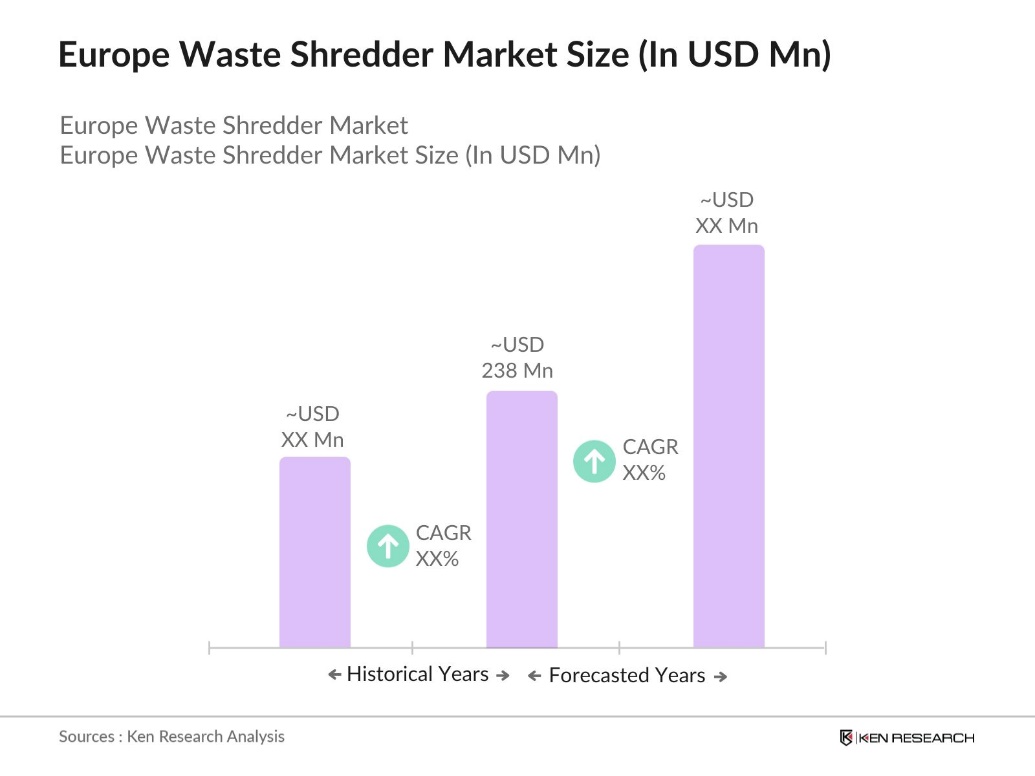

- The Europe waste shredder market, valued at USD 238 million, is driven by stringent environmental regulations and the increasing emphasis on sustainable waste management practices. The adoption of waste shredders facilitates efficient recycling and disposal processes, aligning with the European Union's directives on waste reduction and resource recovery.

- Germany and the United Kingdom are leading markets for waste shredders in Europe. Germany's dominance is attributed to its advanced recycling infrastructure and strong environmental policies, while the UK's focus on reducing landfill usage and promoting recycling initiatives contributes to its significant market presence.

- EPR policies in Europe hold producers accountable for the entire lifecycle of their products, including end-of-life disposal. In 2023, several EU countries implemented EPR schemes for packaging waste, electronics, and batteries, incentivizing manufacturers to design products with recyclability in mind and increasing the demand for efficient waste processing technologies like shredders.

Europe Waste Shredder Market Segmentation

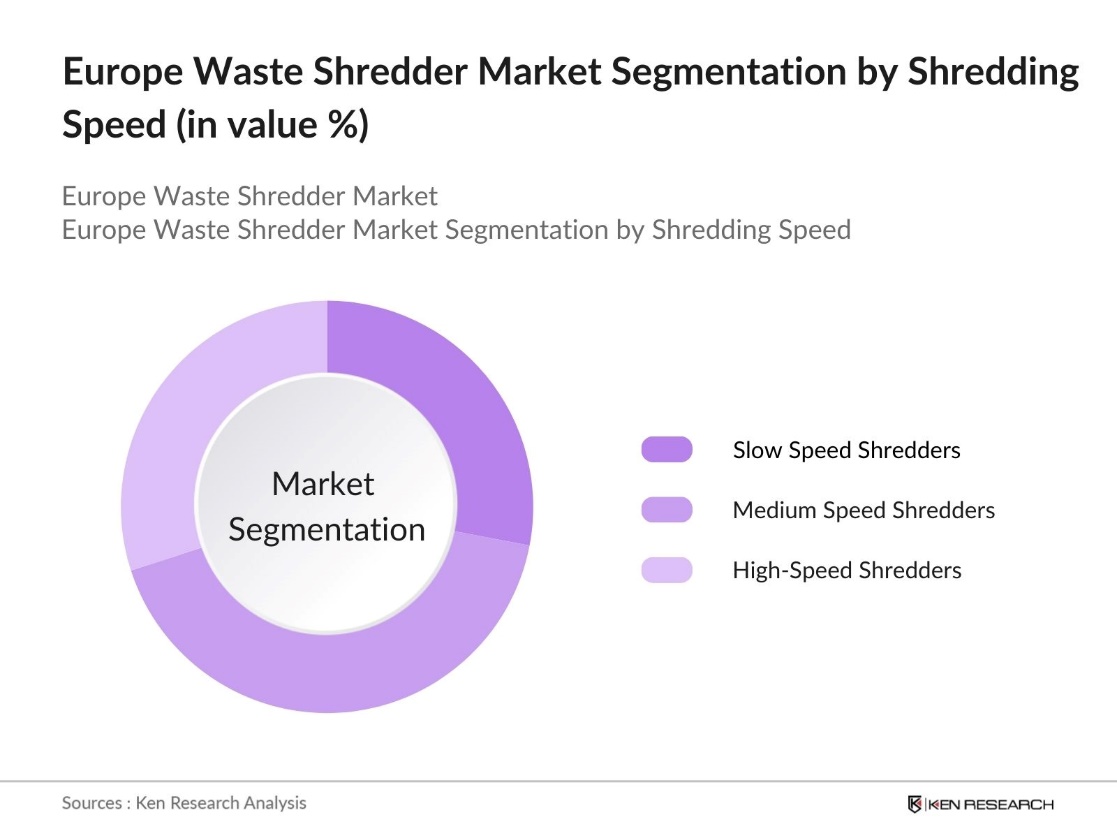

By Shredding Speed: The market is segmented by shredding speed into slow-speed, medium-speed, and high-speed shredders. Medium-speed shredders hold a dominant market share due to their versatility in handling various waste types and their balance between throughput and energy consumption. These shredders are widely adopted in municipal and industrial waste processing facilities for their efficiency and adaptability.

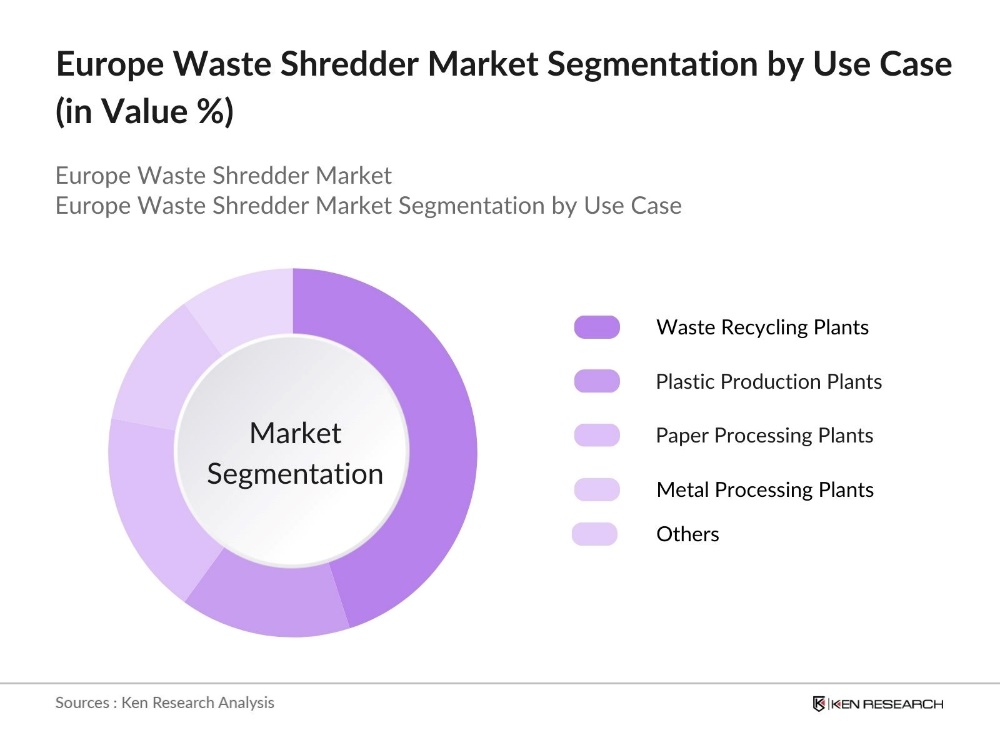

By Use Case: The market is segmented by use case into waste recycling plants, plastic production plants, paper processing plants, metal processing plants, and others. Waste recycling plants constitute the largest segment, driven by the increasing emphasis on recycling and resource recovery across Europe. The integration of waste shredders in these facilities enhances the efficiency of processing recyclable materials, contributing to the segment's prominence.

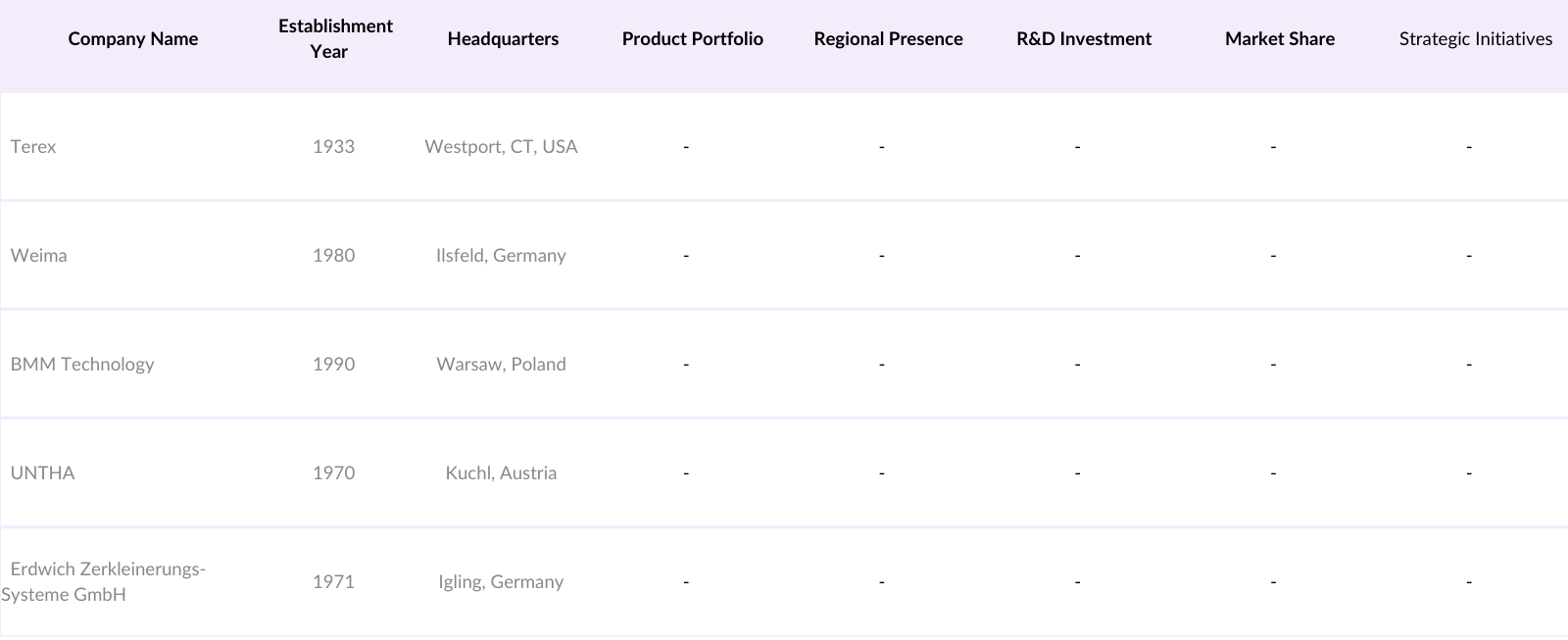

Europe Waste Shredder Market Competitive Landscape

The Europe waste shredder market is characterized by the presence of several key players, each contributing to the market's growth through innovation and strategic initiatives.

Europe Waste Shredder Industry Analysis

Growth Drivers

- Advancements in Recycling Technologies: Innovations in recycling technologies have improved the efficiency of waste processing. For instance, the development of high-torque, low-speed shredders has enabled the processing of diverse waste materials, enhancing the quality of recycled outputs. As of 2022, the EU's average recycling rate for municipal waste was approximately 48.6%, facilitating the processing of complex waste streams.

- Increasing Industrial Waste Generation: In 2022, construction accounted for 38 percent of total waste generation in the European Union., with manufacturing and construction industries being significant contributors. This substantial waste generation underscores the need for efficient waste management solutions, such as shredders, to handle and process industrial waste effectively.

- Rising Adoption of Circular Economy Practices: The European Commissions Circular Economy Action Plan promotes sustainable products and resource efficiency across the EU. This shift is driving demand for waste shredders, essential for recycling and material recovery. With numerous municipalities adopting zero-waste initiatives, theres a growing need for efficient waste processing solutions to support reduced waste generation and improved resource utilization across Europe.

Market Challenges

- High Initial Investment Costs: The acquisition and installation of industrial-grade waste shredders demand substantial capital, presenting financial challenges for small and medium-sized enterprises looking to invest in waste processing equipment. High-capacity shredders require significant upfront costs, which can limit accessibility for smaller organizations seeking sustainable waste management solutions.

- Operational and Maintenance Challenges: Waste shredders require consistent maintenance to maintain optimal performance. Maintenance needs can lead to additional operational expenses and potential downtime, emphasizing the importance of efficient maintenance strategies to manage costs and ensure continuous operation in waste processing facilities.

Europe Waste Shredder Market Future Outlook

Over the next five years, the Europe waste shredder market is expected to experience steady growth, driven by continuous government support, advancements in shredding technology, and increasing demand for efficient waste management solutions. The integration of automation and artificial intelligence in shredding processes is anticipated to enhance operational efficiency and reduce costs. Additionally, the development of mobile shredding units is expected to provide flexible solutions for on-site waste processing, catering to the needs of various industries.

Market Opportunities

- Technological Innovations in Shredding Equipment: Advancements in shredding technology, such as AI integration and automation, have significantly improved operational efficiency. AI-driven shredders can monitor and adjust processes in real-time, enhancing processing precision and speed. These innovations offer substantial opportunities for market growth by meeting the increasing demand for efficient waste management solutions.

- Expansion into Emerging Markets: Rapid industrialization in emerging markets, especially in Eastern Europe, is generating high volumes of industrial waste. This growth in waste production creates a rising demand for effective waste management solutions, including shredders, to efficiently handle and process the increasing waste in these developing regions.

Scope of the Report

|

Shredding Speed |

Slow Speed Shredders |

|

Use Case |

Waste Recycling Plants |

|

Technology |

Single-Shaft Shredders |

|

Waste Type |

Municipal Solid Waste |

|

Country |

Germany |

Products

Key Target Audience

Waste Management Companies

Recycling Facility Operators

Industrial Waste Generators

Equipment Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Terex

Weima

BMM Technology

UNTHA

Erdwich Zerkleinerungs-Systeme GmbH

Zeno-Zerkleinerungsmaschinenbau Norken GmbH

Officina Ballestri Srl

Lessine Tailored Bulk Technology

FAM NV

Akten-Ex GmbH & Co KG

Table of Contents

1. Europe Waste Shredder Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Waste Shredder Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Waste Shredder Market Analysis

3.1 Growth Drivers

3.1.1 Stringent Environmental Regulations

3.1.2 Advancements in Recycling Technologies

3.1.3 Increasing Industrial Waste Generation

3.1.4 Rising Adoption of Circular Economy Practices

3.2 Market Challenges

3.2.1 High Initial Investment Costs

3.2.2 Operational and Maintenance Challenges

3.2.3 Variability in Waste Composition

3.3 Opportunities

3.3.1 Technological Innovations in Shredding Equipment

3.3.2 Expansion into Emerging Markets

3.3.3 Integration with Smart Waste Management Systems

3.4 Trends

3.4.1 Adoption of Energy-Efficient Shredders

3.4.2 Development of Mobile Shredding Units

3.4.3 Increased Use of Automation and AI in Shredding Processes

3.5 Government Regulations

3.5.1 EU Waste Framework Directive

3.5.2 Extended Producer Responsibility (EPR) Policies

3.5.3 National Waste Management Plans

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe Waste Shredder Market Segmentation

4.1 By Shredding Speed (In Value %)

4.1.1 Slow Speed Shredders

4.1.2 Medium Speed Shredders

4.1.3 High-Speed Shredders

4.2 By Use Case (In Value %)

4.2.1 Waste Recycling Plants

4.2.2 Plastic Production Plants

4.2.3 Paper Processing Plants

4.2.4 Metal Processing Plants

4.2.5 Others

4.3 By Technology (In Value %)

4.3.1 Single-Shaft Shredders

4.3.2 Double-Shaft Shredders

4.3.3 Four-Shaft Shredders

4.4 By Waste Type (In Value %)

4.4.1 Municipal Solid Waste

4.4.2 Industrial Waste

4.4.3 Electronic Waste

4.4.4 Construction and Demolition Waste

4.4.5 Others

4.5 By Country (In Value %)

4.5.1 Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Italy

4.5.5 Spain

4.5.6 Rest of Europe

5. Europe Waste Shredder Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Terex

5.1.2 Weima

5.1.3 BMM Technology

5.1.4 UNTHA

5.1.5 Erdwich Zerkleinerungs-Systeme GmbH

5.1.6 Zeno-Zerkleinerungsmaschinenbau Norken GmbH

5.1.7 Officina Ballestri Srl

5.1.8 Lessine Tailored Bulk Technology

5.1.9 FAM NV

5.1.10 Akten-Ex GmbH & Co KG

5.1.11 ITS Srl

5.1.12 Arjes-Recycling International

5.1.13 Shanghai Xiazhou Heavy Industry Machinery Co., Ltd.

5.1.14 Vipeak Heavy Industry Machinery Company

5.1.15 SHRED-TECH

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Regional Presence, R&D Investment, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Europe Waste Shredder Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Waste Shredder Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Waste Shredder Future Market Segmentation

8.1 By Shredding Speed (In Value %)

8.2 By Use Case (In Value %)

8.3 By Technology (In Value %)

8.4 By Waste Type (In Value %)

8.5 By Country (In Value %)

9. Europe Waste Shredder Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe waste shredder market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe waste shredder market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple waste shredder manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe waste shredder market.

Frequently Asked Questions

01 How big is the Europe waste shredder market?

The Europe waste shredder market is valued at USD 238 million, driven by stringent environmental regulations and the increasing emphasis on sustainable waste management practices.

02 What are the challenges in the Europe waste shredder market?

Challenges in Europe waste shredder market include high initial investment costs, operational and maintenance challenges, and variability in waste composition, which can affect the efficiency and effectiveness of shredding processes.

03 Who are the major players in the Europe waste shredder market?

Key players in the Europe waste shredder market include Terex, Weima, BMM Technology, UNTHA, and Erdwich Zerkleinerungs-Systeme GmbH. These companies dominate due to their extensive product portfolios, strong regional presence, and continuous innovation.

04 What are the growth drivers of the Europe waste shredder market?

The Europe waste shredder market is propelled by factors such as stringent environmental regulations, advancements in recycling technologies, and the rising emphasis on sustainable waste management practices. Additionally, the push towards a circular economy in Europe encourages the adoption of waste shredders to aid in resource recovery and waste reduction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.