Europe Wearable Tech Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD3495

November 2024

100

About the Report

Europe Wearable Tech Market Overview

The Europe wearable tech market is valued at USD 7.2 billion, based on a comprehensive analysis of market trends, technological advancements, and consumer adoption rates. This market is primarily driven by increasing health consciousness among consumers and the growing integration of IoT with wearable devices. Companies like Apple, Fitbit, and Samsung have introduced new product features such as AI integration and health monitoring systems, which have played a pivotal role in market expansion.

Dominant regions within the European wearable tech market include Germany, the United Kingdom, and France. These countries have tech infrastructure, high disposable incomes, and a consumer base that values innovative and technologically advanced products. The market dominance in these regions is further reinforced by government support for healthcare innovation and IoT integration, as well as a high rate of smartphone penetration, which complements wearable tech adoption.

The EU Medical Device Regulation (MDR), which came into full effect in 2024, has stringent guidelines that medical wearables must comply with to be sold in Europe. These regulations have led to the certification of over 600 wearable devices, according to the European Medicines Agency. MDR compliance ensures that medical wearables meet the highest standards for safety and accuracy, providing consumers and healthcare providers with confidence in their use. This regulatory support is crucial for the continued growth of medical-grade wearables in Europe

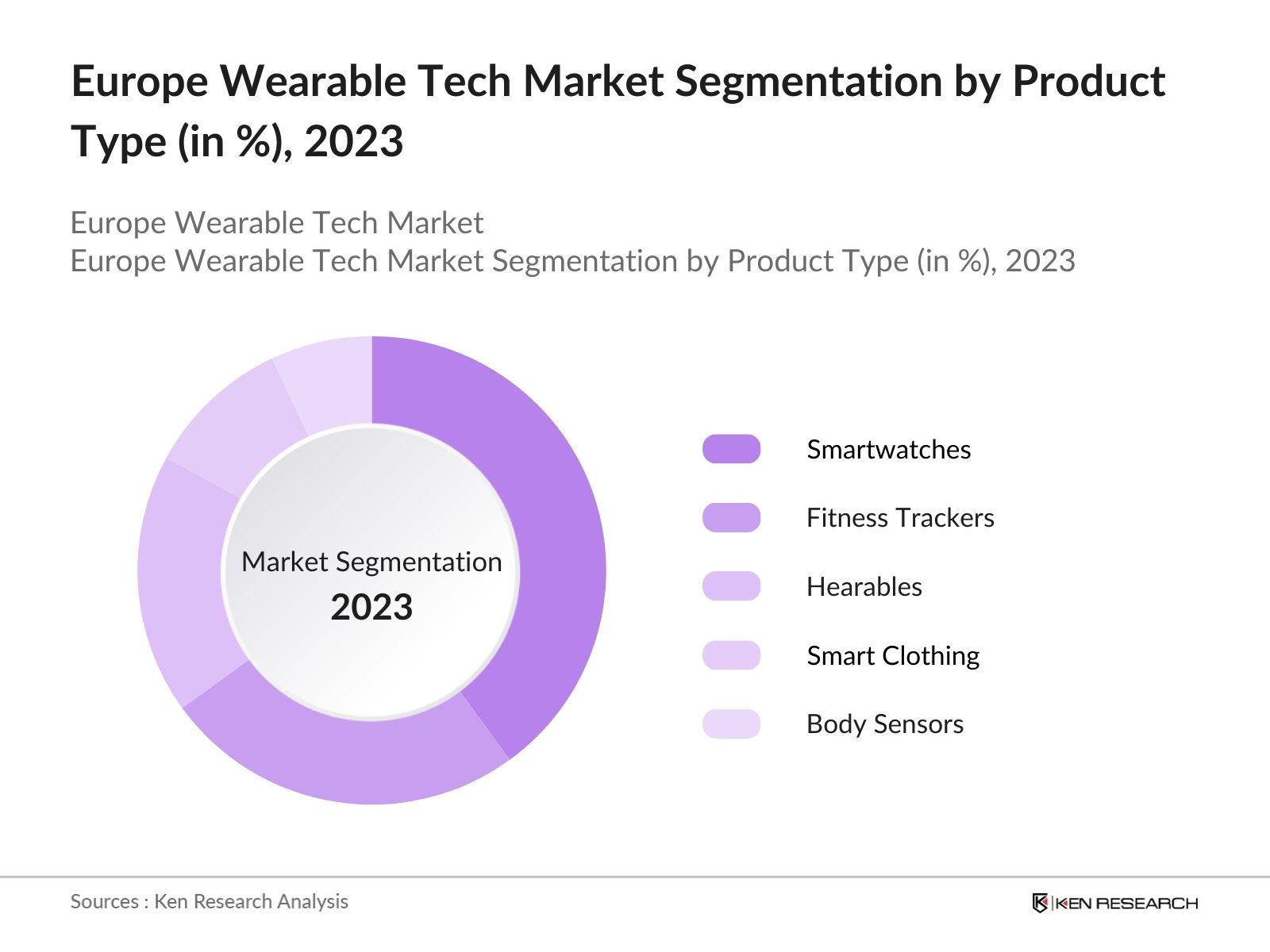

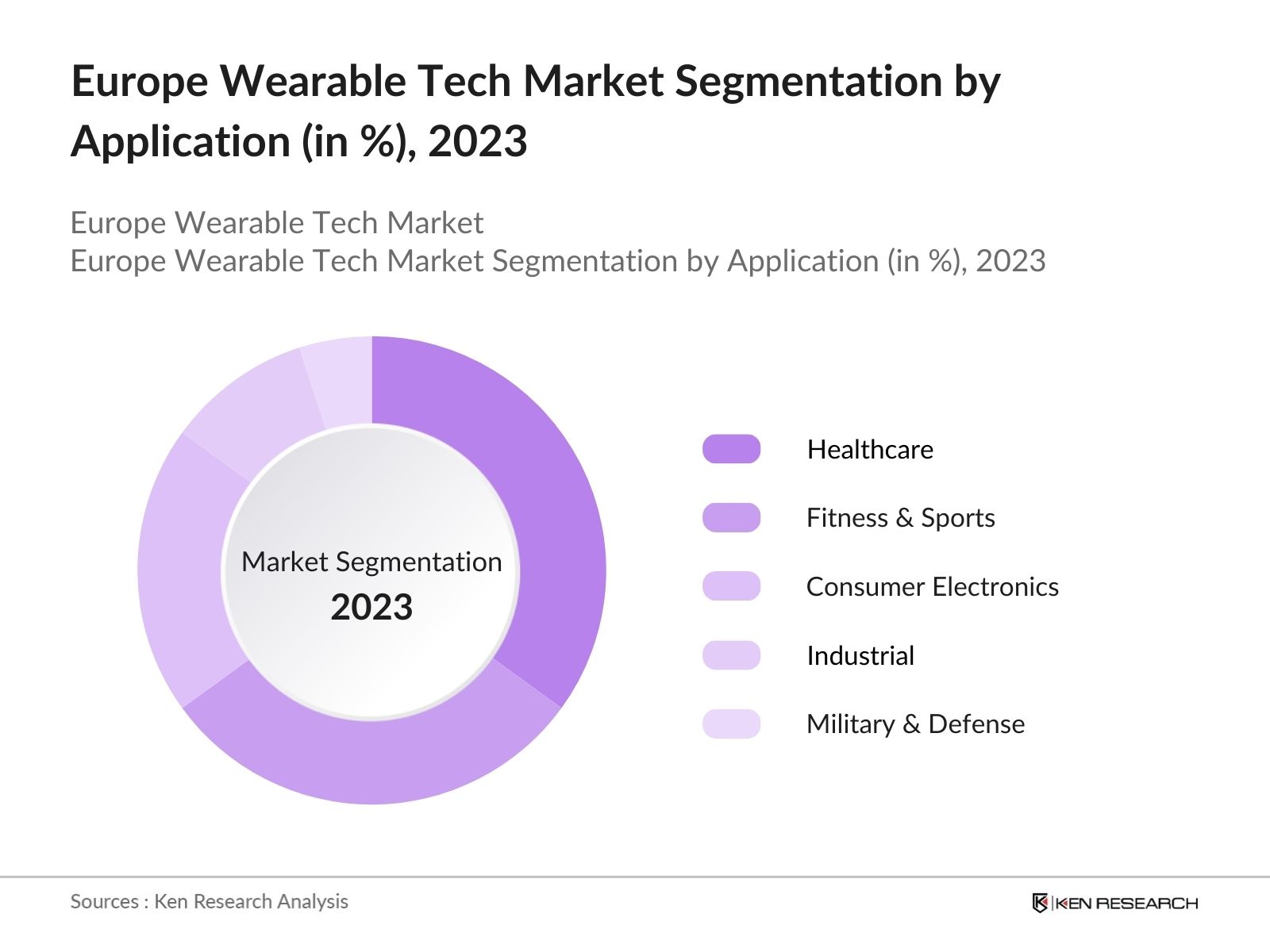

Europe Wearable Tech Market Segmentation

By Product Type: The market is segmented by product type into smartwatches, fitness trackers, hearables, smart clothing, and body sensors. Among these, smartwatches hold the largest market share. The dominance of smartwatches is due to their multifunctionality, offering fitness tracking, communication, and health monitoring features. Leading brands like Apple and Samsung have solidified their market presence by continuously introducing innovative features, such as ECG monitoring and fall detection, making smartwatches an essential gadget for consumers focused on health and convenience.

By Application: The market is segmented by application into healthcare, fitness & sports, consumer electronics, industrial, and military & defense. The healthcare segment dominates due to the increasing use of wearable devices for real-time health monitoring and diagnostics. With the rise in chronic diseases like diabetes and cardiovascular conditions, wearable tech has become indispensable for patient monitoring, providing data on heart rate, oxygen levels, and physical activity. The growth of telemedicine during the pandemic also accelerated healthcare applications of wearable tech, with more hospitals and clinics adopting these technologies to monitor patients remotely.

Europe Wearable Tech Market Competitive Landscape

The Europe wearable tech market is dominated by key players who have established themselves through a combination of innovation, strategic partnerships, and significant investments in R&D. Companies like Apple, Garmin, and Huawei have made substantial advancements in wearable technology, continuously enhancing user experience and expanding their product portfolios. The market is characterized by intense competition, with both established global brands and emerging tech companies vying for market share. The focus is on technological advancements, particularly in health monitoring features and AI integration, which have become key differentiators in the wearable tech space.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Market Presence |

Product Innovation |

R&D Investments |

Partnerships |

Global Reach |

Brand Loyalty |

|---|---|---|---|---|---|---|---|---|---|

|

Apple Inc. |

1976 |

Cupertino, USA |

|||||||

|

Fitbit (Google LLC) |

2007 |

San Francisco, USA |

|||||||

|

Garmin Ltd. |

1989 |

Olathe, USA |

|||||||

|

Huawei Technologies |

1987 |

Shenzhen, China |

|||||||

|

Samsung Electronics |

1938 |

Suwon, South Korea |

Europe Wearable Tech Industry Analysis

Growth Drivers

Increasing Health Awareness: The demand for health and fitness trackers in Europe has surged as health awareness grows, driven by government initiatives to promote healthy lifestyles. The European Health 2020 policy focuses on improving public health through lifestyle interventions, furthering the adoption of wearable tech. In 2024, an estimated 25 million wearable fitness trackers were in active use across Europe, as reported by various government health bodies. The European Commission has also highlighted the growing trend of fitness tech in its health monitoring reports, demonstrating the impact of wearables on individual health management.

Rising Penetration of IoT: The adoption of IoT technology is increasingly penetrating the European wearable tech market, with over 1 billion IoT connections forecasted for the continent by the end of 2024. The integration of IoT into wearables allows for real-time data tracking and monitoring, enhancing the functionality of fitness and medical wearables. The European Union's Digital Strategy aims to strengthen IoT infrastructure, fueling the growth of wearables in sectors like healthcare, fitness, and personal safety. In fact, IoT-integrated wearables now account for 70% of all wearables used in healthcare monitoring.

Advancements in Battery Life and Connectivity: Europe is seeing substantial advancements in wearable technology, particularly in battery efficiency and connectivity. With the widespread adoption of 5G technology in 2024, the latency for connected wearable devices has reduced, improving user experience. Furthermore, battery technology has advanced with the development of solid-state batteries, which now offer wearables up to 7 days of continuous operation without recharging. The European Battery Alliance has reported major strides in battery innovation, which directly impacts the performance of wearable devices in both the consumer and medical sectors.

Market Challenges

High Device Costs: While wearable technology continues to grow in Europe, high device costs remain a significant barrier to widespread adoption, especially in price-sensitive markets like Eastern Europe. Government surveys in 2024 indicate that less than 20% of households in lower-income countries such as Bulgaria and Romania can afford high-end wearables, compared to 60% in wealthier countries like Germany and France. This disparity in affordability creates an uneven distribution of wearable tech adoption across the continent, limiting the overall market penetration of these devices.

Privacy and Data Security Concerns: The introduction of stringent data compliance regulations, such as the General Data Protection Regulation (GDPR), has raised concerns about the security of data collected by wearable devices. In 2024, the European Data Protection Board flagged several instances where wearable tech companies were fined for non-compliance, amounting to penalties of over 20 million euros. These security breaches, along with concerns about data privacy, hinder consumer confidence, affecting the market growth for wearables in Europe, particularly in healthcare applications where sensitive data is involved.

Europe Wearable Tech Market Future Outlook

Over the next five years, the Europe wearable tech market is expected to experience robust growth, driven by continuous advancements in AI, increasing demand for health monitoring devices, and the rising trend of fitness tracking. The market is also expected to benefit from growing consumer demand for connected devices and the increasing adoption of 5G technology, which will enhance the functionality of wearables. As Europe continues to prioritize healthcare innovation and consumer health awareness rises, wearable tech is poised to become an essential part of daily life for millions of consumers.

Europe Wearable Tech Market Future Market Opportunities

Integration of AI in Wearables: The integration of artificial intelligence (AI) into wearables offers immense opportunities for growth, particularly in healthcare and fitness. AI-enabled wearables can now track health metrics in real time and provide actionable health recommendations. By 2024, approximately 15 million wearable devices in Europe incorporated AI-driven features, according to health ministry statistics. This integration has improved the accuracy of health monitoring, significantly enhancing user engagement. AI-based algorithms in these wearables are particularly useful in detecting irregular heart rhythms or sleep apnea, showcasing their critical role in preventive healthcare.

Expansion into Corporate Wellness Programs: Wearable tech is expanding into corporate wellness programs as companies seek to enhance employee well-being and productivity. In 2024, over 25% of large corporations in Europe have adopted health monitoring wearables as part of their corporate wellness initiatives, with more than 3 million employees benefiting from these programs. European government reports highlight that wearables in corporate environments have contributed to a 12% reduction in absenteeism and a 15% improvement in overall employee health, further driving their adoption in the business sector.

Scope of the Report

|

Segment |

Sub-Segment |

|---|---|

|

Device Type |

Smartwatches |

|

Fitness Trackers |

|

|

Hearables |

|

|

Smart Clothing |

|

|

Medical Wearables |

|

|

Application |

Healthcare & Medical |

|

Fitness & Sports |

|

|

Consumer Electronics |

|

|

Industrial |

|

|

Technology |

AI-Enabled |

|

IoT-Integrated |

|

|

Wireless Connectivity (5G, Bluetooth) |

|

|

AR Wearables |

|

|

End-Use |

Healthcare Institutions |

|

Individuals/Consumers |

|

|

Corporations/Enterprise |

|

|

Region |

West |

|

East |

|

|

North |

|

|

South |

List of Major Players

-

Apple Inc.

-

Fitbit (Google LLC)

-

Garmin Ltd.

-

Huawei Technologies Co. Ltd.

-

Samsung Electronics Co. Ltd.

-

Xiaomi Corporation

-

Sony Corporation

-

LG Electronics

-

Withings SA

-

Polar Electro Oy

-

Fossil Group, Inc.

-

Casio Computer Co. Ltd.

-

Suunto Oy

-

TomTom NV

-

Zepp Health Corporation

Products

Key Target Audience

Wearable Technology Manufacturers

Healthcare Providers

Fitness and Wellness Centers

Government and Regulatory Bodies (e.g., European Medicines Agency, GDPR Supervisory Bodies)

Consumer Electronics Distributors

Banks and Financial Institutes

Military and Defense Contractors

Investment and Venture Capitalist Firms

Smart Home Technology Developers

Table of Contents

1. Europe Wearable Tech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Annual Growth Rate in Wearable Device Adoption)

1.4. Market Segmentation Overview (Wearable Device Types, End-Use Sectors)

2. Europe Wearable Tech Market Size (In USD Bn)

2.1. Historical Market Size (Growth in Wearable Shipments)

2.2. Year-On-Year Growth Analysis (Wearables by Region)

2.3. Key Market Developments and Milestones (New Product Launches, R&D Investments)

3. Europe Wearable Tech Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness (Health and Fitness Tracker Demand)

3.1.2. Rising Penetration of IoT (IoT-Integrated Wearable Devices)

3.1.3. Advancements in Battery Life and Connectivity (Battery Efficiency, 5G Adoption)

3.1.4. Regulatory Support for Medical Wearables (Medical Certification for Wearables)

3.2. Market Challenges

3.2.1. High Device Costs (Price Sensitivity in European Markets)

3.2.2. Privacy and Data Security Concerns (Data Compliance Regulations)

3.2.3. Limited Battery Life in Advanced Devices

3.3. Opportunities

3.3.1. Integration of AI in Wearables (AI-enabled Health Tracking and Recommendations)

3.3.2. Growing Demand for Smart Clothing (Adoption in Sports & Healthcare)

3.3.3. Expansion into Corporate Wellness Programs (Corporate Adoption of Health Devices)

3.4. Trends

3.4.1. Miniaturization of Devices (Microchip and Nanotech Integration)

3.4.2. Hybrid Devices (Combination of Fitness, Medical, and Communication Functions)

3.4.3. Fashion and Wearable Tech Collaborations (Luxury Brands in Wearables)

3.5. Government Regulation

3.5.1. EU Medical Device Regulation (MDR Compliance for Wearables)

3.5.2. GDPR Impact on Wearable Data Collection (Data Protection Laws)

3.5.3. Subsidies for Health Monitoring Devices (Government Support for Medical Wearables)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Partnerships Among Tech, Fashion, and Healthcare Providers)

3.8. Porters Five Forces (Buyer Power, Supplier Dependence, Threat of Substitutes)

3.9. Competition Ecosystem

4. Europe Wearable Tech Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Smartwatches

4.1.2. Fitness Trackers

4.1.3. Hearables (Wireless Earbuds with Smart Features)

4.1.4. Smart Clothing

4.1.5. Medical Wearables

4.2. By Application (In Value %)

4.2.1. Healthcare & Medical (Remote Patient Monitoring)

4.2.2. Fitness & Sports (Wearables for Performance Monitoring)

4.2.3. Consumer Electronics (Wearable Communications Devices)

4.2.4. Industrial (Wearables for Worker Safety)

4.3. By Technology (In Value %)

4.3.1. AI-Enabled Wearables

4.3.2. IoT-Integrated Devices

4.3.3. Wireless Connectivity (5G, Bluetooth)

4.3.4. Augmented Reality Wearables

4.4. By End-Use (In Value %)

4.4.1. Healthcare Institutions

4.4.2. Individuals/Consumers

4.4.3. Corporations/Enterprise

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

5. Europe Wearable Tech Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Samsung Electronics Co., Ltd.

5.1.3. Fitbit, Inc.

5.1.4. Garmin Ltd.

5.1.5. Xiaomi Corporation

5.1.6. Huawei Technologies Co., Ltd.

5.1.7. Fossil Group, Inc.

5.1.8. Alphabet Inc. (Google Fit)

5.1.9. Polar Electro Oy

5.1.10. Withings

5.1.11. Medtronic PLC

5.1.12. Sony Corporation

5.1.13. LG Electronics Inc.

5.1.14. Zepp Health Corp.

5.1.15. Whoop, Inc.

5.2 Cross Comparison Parameters (Revenue, R&D Investment, Product Portfolio, Market Share, Innovation Index, Patent Filing, ESG Initiatives, Distribution Network)

5.3. Market Share Analysis (Global and Regional)

5.4. Strategic Initiatives (Product Launches, Expansion Strategies)

5.5. Mergers And Acquisitions

5.6. Investment Analysis (Venture Capital, Government Investment)

5.7. Government Grants for Wearable Tech

5.8. Private Equity Investments

6. Europe Wearable Tech Market Regulatory Framework

6.1. Health Device Certifications

6.2. Environmental and Safety Standards (Material Use, End-of-Life Recycling)

6.3. Data Compliance Regulations (GDPR, Data Encryption Standards)

7. Europe Wearable Tech Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (5G, AI, IoT Integration)

8. Europe Wearable Tech Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-Use (In Value %)

8.5. By Region (In Value %)

9. Europe Wearable Tech Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Available Market, Serviceable Market, and Obtainable Market)

9.2. Marketing Initiatives for Device Adoption

9.3. White Space Opportunity Analysis (Underserved Market Segments)

9.4. Customer Cohort Analysis (Behavioral Segmentation for Wearable Users)

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the ecosystem of the Europe wearable tech market, identifying the key stakeholders, including manufacturers, tech innovators, healthcare providers, and government regulators. Extensive desk research and proprietary databases are used to gather relevant industry-level information and identify critical market variables.

Step 2: Market Analysis and Construction

Historical market data, including penetration rates and revenue generation across key regions, are compiled and analyzed. This phase also includes a thorough evaluation of the service and product quality to ensure the reliability of the market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through interviews with industry experts, including executives from leading wearable tech companies and healthcare providers. This provides insights into market trends, product performance, and operational challenges, refining the accuracy of the market data.

Step 4: Research Synthesis and Final Output

In the final stage, primary data is synthesized with expert consultation and secondary research, ensuring the final report provides an accurate and comprehensive analysis of the Europe wearable tech market. This is validated with bottom-up and top-down approaches to ensure consistency and precision in the findings.

Frequently Asked Questions

How big is the Europe Wearable Tech Market?

The Europe wearable tech market is valued at USD 7.2 billion, driven by growing consumer interest in health and fitness technologies, IoT integration, and increasing healthcare applications.

What are the challenges in the Europe Wearable Tech Market?

Challenges in the Europe wearable tech market include privacy concerns related to data security, high production costs, and battery limitations, which affect product performance and consumer satisfaction.

Who are the major players in the Europe Wearable Tech Market?

Key players in the Europe wearable tech market include Apple Inc., Fitbit (Google LLC), Garmin Ltd., Huawei Technologies, and Samsung Electronics, all known for their extensive R&D investments and innovation in wearable technology.

What are the growth drivers of the Europe Wearable Tech Market?

Growth drivers in the Europe wearable tech market include rising health awareness, technological advancements in AI and IoT, and the expanding use of wearable devices in healthcare monitoring and fitness tracking.

Which regions dominate the Europe Wearable Tech Market?

Germany, the United Kingdom, and France dominate the Europe wearable tech market, owing to their advanced technological infrastructure, high consumer purchasing power, and strong government support for healthcare and technology integration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.