Europe Wine Market Outlook to 2030

Region:Europe

Author(s):Meenakshi

Product Code:KROD10984

November 2024

96

About the Report

Europe Wine Market Overview

- The Europe Wine Market is valued at USD 75.2 billion, driven by consumer interest in quality wine, expanding demand for premium and organic wine, and the established wine culture across the continent. The markets steady growth is fueled by an increase in tourism and wine-related experiences, with emerging channels such as e-commerce further facilitating sales.

- Key regions leading the Europe Wine Market include France, Italy, and Spain, which are recognized globally for their historical vineyards, extensive varietals, and high production standards. These countries dominate due to their established distribution networks, rich heritage in wine production, and a reputation for quality that appeals to global markets.

- In May 2023, Ireland signed the Public Health (Alcohol) (Labelling) Regulations, which mandates comprehensive labeling on alcohol products starting in 2026. This includes requirements for labels to disclose ingredient lists, calorie counts, and health warnings about risks such as liver disease and cancers associated with alcohol consumption. These regulations ensure consumers receive relevant product information, fostering responsible consumption across Europe

Europe Wine Market Segmentation

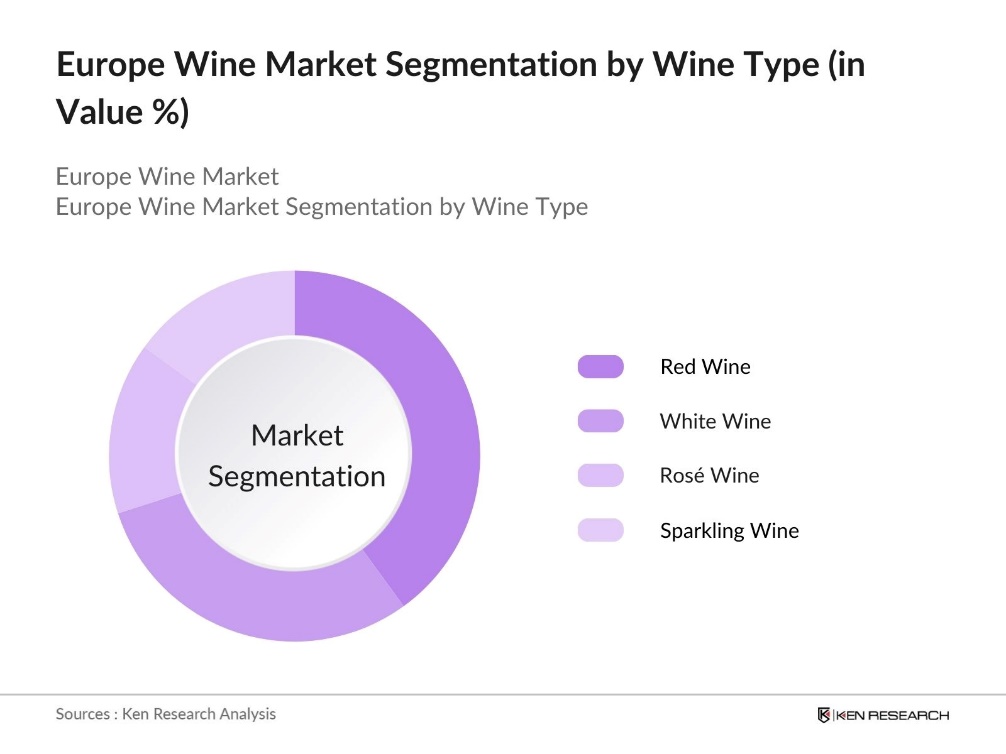

By Wine Type: The market is segmented by wine type into Red Wine, White Wine, Ros Wine, and Sparkling Wine. Red Wine leads this segment, attributable to its established popularity across Europe and increasing demand for premium red wines in both domestic and export markets. The consumer preference for red wine is driven by its strong association with traditional dining experiences and health-oriented consumption trends favoring polyphenol-rich varieties.

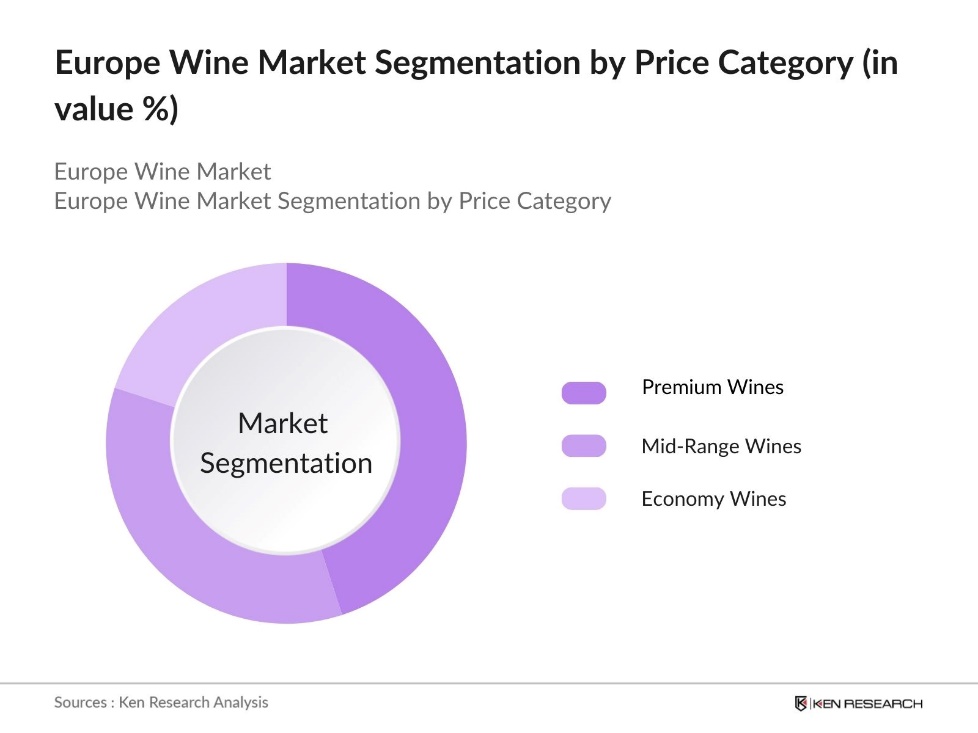

By Price Category: The market is segmented by price category into Premium Wines, Mid-Range Wines, and Economy Wines. Premium Wines hold a significant share due to the increasing consumer willingness to spend on high-quality wines, particularly among millennial and Gen Z consumers who favor luxury products and unique, artisanal wines. The focus on authenticity and origin contributes to the strength of this category in Europe, reinforcing the reputation of well-known regions.

Europe Wine Market Competitive Landscape

The Europe Wine Market is characterized by a blend of multinational corporations and established family-owned wineries. Notable players include European heritage brands and conglomerates, creating a competitive environment where heritage, brand loyalty, and authenticity are significant differentiators. The competitive landscape is defined by the presence of well-established European players and increasing international interest, highlighting a robust export environment where authenticity and premium quality dominate.

Europe Wine Industry Analysis

Growth Drivers

- Rise in Organic Wine Demand: The demand for organic wine in Europe has significantly risen, supported by the European Unions ongoing commitment to sustainable agriculture. In 2023, Spain dedicated 166,286 hectares to organic grape cultivation, marking an increase of 10.9% from the previous year. This area now accounts for 18% of the country's total vineyard area, solidifying Spain's position as a leader in organic agriculture within Europe. This rise in organic production aligns with consumer demand for eco-friendly products, which has created robust sales channels for organic wines within and outside Europe.

- Increasing Consumption Among Younger Demographics: Young European consumers are showing a shift in alcohol preferences, with wine becoming increasingly popular. Among the EU population, about 8.4% reported consuming alcohol daily, while 28.8% drank weekly. This demographic shift has encouraged wineries to introduce new wine varieties and fostered innovations, like single-serve wine bottles. The steady rise in wine consumption among younger demographics boosts market demand, presenting a transformative impact on European wine retail channels.

- Expansion of Wine Tourism: Europes wine tourism is growing, particularly in iconic regions like Tuscany, Bordeaux, and the Douro Valley. This expansion stimulates local economies and supports small wineries, especially in countries like Spain and Italy, where rural development initiatives encourage enhanced tourism facilities. These efforts boost the appeal of European wines, solidifying Europes reputation as a top destination for wine enthusiasts worldwide.

Market Challenges

- Stringent Alcohol Regulations: European wine producers operate within a highly regulated environment, facing strict rules on production, labeling, and advertising. Recent EU updates, including mandatory labeling requirements, have added compliance costs for producers. Additionally, high alcohol taxes in several countries impact pricing strategies, posing challenges for smaller vineyards and affecting their competitiveness within the broader European market.

- Fluctuations in Grape Production: European grape production faces increased vulnerability due to climate change, with unpredictable weather impacting both yield and quality. These fluctuations create supply instability, driving up production costs and affecting market availability for wineries. As weather-related risks continue to rise, wine producers face ongoing challenges in maintaining consistent product quality and volume across harvests.

Europe Wine Market Future Outlook

The Europe Wine Market is anticipated to sustain steady growth, propelled by evolving consumer preferences toward premium and organic wines, advancements in digital retail channels, and continued demand from the tourism sector. The emphasis on sustainable practices and the rise of digital wine clubs are expected to shape the markets dynamics, facilitating greater customer reach and loyalty.

Market Opportunities

- Emerging Markets and Export Opportunities; Europe's wine export market is growing, with increased demand in Asia, particularly for premium and luxury wines. Trade agreements with countries like Japan and South Korea open accessible export channels, benefiting European producers by reducing tariffs. This expanding international interest boosts the market potential for European wines, especially those from renowned wine regions in France and Italy.

- Product Innovation in Packaging and Labeling: European wineries are enhancing packaging with eco-friendly materials and smart labeling technologies. Many wineries have adopted lightweight and recyclable glass bottles and integrated QR code labels, offering consumers insights into wine origins. This sustainable and informative packaging approach aligns with environmental goals, appealing to eco-conscious consumers and creating new market advantages for European wine producers.

Scope of the Report

|

By Type |

Red Wine White Wine Ros Wine Sparkling Wine |

|

By Price Category |

Premium Wines Mid-Range Wines Economy Wines |

|

By Distribution Channel |

Supermarkets Specialty Stores Online Retailers, On-trade |

|

By Wine Varietal |

Chardonnay Merlot Cabernet Sauvignon Pinot Noir |

|

By Country |

France Italy Spain Germany Portugal |

Products

Key Target Audience

Wine and Beverage Packaging Companies

Digital and E-commerce Platforms

Food and Beverage Importers

Investors and venture capital Firms

Government and Regulatory Bodies (e.g., European Commission, National Wine Associations)

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Pernod Ricard

Diageo

Constellation Brands

Treasury Wine Estates

Mot Hennessy

Accolade Wines

Castel Group

Gruppo Italiano Vini

Antinori

Baron Philippe de Rothschild

Table of Contents

1. Europe Wine Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics (Supply Chains, Consumption Trends)

1.4 Market Segmentation Overview

2. Europe Wine Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Volume vs. Value Analysis

2.3 Key Market Developments and Milestones

3. Europe Wine Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Organic Wine Demand

3.1.2 Increasing Consumption Among Younger Demographics

3.1.3 Expansion of Wine Tourism

3.2 Market Challenges

3.2.1 Stringent Alcohol Regulations

3.2.2 Fluctuations in Grape Production

3.2.3 Environmental Sustainability Pressures

3.3 Opportunities

3.3.1 Emerging Markets and Export Opportunities

3.3.2 Product Innovation in Packaging and Labeling

3.3.3 Growth of E-commerce Channels

3.4 Trends

3.4.1 Shift Toward Premiumization and Luxury Wine

3.4.2 Adoption of Digital Marketing and DTC Models

3.4.3 Increased Preference for Low and Non-Alcoholic Wines

3.5 Government Regulations

3.5.1 EU Wine Quality Standards and PDO/PGI Classifications

3.5.2 Taxation Policies on Alcoholic Beverages

3.5.3 Labeling and Health Warnings Requirements

3.6 SWOT Analysis

3.7 Value Chain Analysis (Grape Cultivation, Processing, Distribution)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Wine Market Segmentation

4.1 By Type (In Value %)

4.1.1 Red Wine

4.1.2 White Wine

4.1.3 Ros Wine

4.1.4 Sparkling Wine

4.2 By Price Category (In Value %)

4.2.1 Premium Wines

4.2.2 Mid-Range Wines

4.2.3 Economy Wines

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets and Hypermarkets

4.3.2 Specialty Stores

4.3.3 Online Retailers

4.3.4 On-trade (Hotels, Bars, Restaurants)

4.4 By Wine Varietal (In Value %)

4.4.1 Chardonnay

4.4.2 Merlot

4.4.3 Cabernet Sauvignon

4.4.4 Pinot Noir

4.5 By Country (In Value %)

4.5.1 France

4.5.2 Italy

4.5.3 Spain

4.5.4 Germany

4.5.5 Portugal

5. Europe Wine Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Pernod Ricard

5.1.2 Diageo

5.1.3 Constellation Brands

5.1.4 Treasury Wine Estates

5.1.5 The Wine Group

5.1.6 E. & J. Gallo Winery

5.1.7 Castel Group

5.1.8 Accolade Wines

5.1.9 Vina Concha y Toro

5.1.10 Baron Philippe de Rothschild

5.1.11 Davide Campari-Milano N.V.

5.1.12 Caviro

5.1.13 Gruppo Italiano Vini

5.1.14 Antinori

5.1.15 Mot Hennessy

5.2 Cross Comparison Parameters (Product Portfolio Diversity, Regional Market Presence, Sustainability Practices, Annual Production Volume, Distribution Network Strength, Wine Awards and Recognition, Customer Loyalty Programs, Revenue)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Sustainability Programs, Innovation in Packaging)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Venture Capital Interest)

5.7 Private Equity Investments

5.8 Government Grants and Subsidies for Wine Production

6. Europe Wine Market Regulatory Framework

6.1 European Alcohol Policy Framework

6.2 Compliance and Certification (Organic, Biodynamic)

6.3 Trade Agreements and Export Tariffs

6.4 Environmental Regulations in Wine Production

7. Europe Wine Future Market Size (In USD Mn)

7.1 Future Market Projections

7.2 Key Factors Driving Future Market Trends

8. Europe Wine Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Price Category (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Wine Varietal (In Value %)

8.5 By Country (In Value %)

9. Europe Wine Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Behavior and Cohort Analysis

9.3 Marketing and Positioning Recommendations

9.4 White Space and New Market Entry Strategy

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase includes mapping the Europe Wine Market landscape, identifying stakeholders such as wineries, distributors, retailers, and regulatory bodies. Key variables, such as wine types, price categories, and consumption trends, are defined through secondary research.

Step 2: Market Analysis and Construction

Historical data is compiled to assess wine production, imports, exports, and pricing trends. This involves analyzing consumption patterns, production methods, and distribution frameworks across major European wine-producing countries.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market dynamics are validated through expert interviews with industry veterans, vineyard owners, and distribution partners. These insights are cross-referenced with primary data, providing an accurate picture of current trends.

Step 4: Research Synthesis and Final Output

The final step synthesizes insights from wine producers, regional stakeholders, and e-commerce entities to ensure a comprehensive view of the market, verified through both top-down and bottom-up methodologies.

Frequently Asked Questions

01. How big is the Europe Wine Market?

The Europe Wine Market is valued at USD 75.2 billion, supported by an increase in premium wine consumption, growing wine tourism, and widespread adoption of digital wine retail channels.

02. What are the challenges in the Europe Wine Market?

Challenges in Europe Wine Market include stringent regulations, competition from non-European wines, and environmental concerns over sustainable production practices, impacting production and market access.

03. Who are the major players in the Europe Wine Market?

Key players in Europe Wine Market include Pernod Ricard, Diageo, Treasury Wine Estates, Constellation Brands, and Mot Hennessy, who dominate through extensive brand portfolios, innovation, and established distribution networks.

04. What are the growth drivers of the Europe Wine Market?

The Europe Wine Market growth drivers include a rising preference for premium and organic wines, increasing wine tourism, and technological advancements in wine distribution and marketing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.