European Chocolate Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD6903

December 2024

85

About the Report

European Chocolate Market Overview

- The European chocolate market is valued at USD 47.25 billion, supported by growing demand for premium chocolate and heightened consumer interest in health-focused varieties like low-sugar and vegan chocolate. This market's size is driven by established consumer preferences for chocolate across age groups, further bolstered by the availability of diverse chocolate flavors and organic options from both local producers and international brands.

- In terms of regional dominance, Switzerland, Belgium, and Germany lead due to their strong tradition in chocolate making and established export networks. Switzerlands preference for high-quality cocoa products, Belgiums focus on artisanal chocolates, and Germanys large-scale manufacturing capabilities contribute to their strong presence. These countries are well-equipped with skilled craftsmanship and are well-integrated into both domestic and international markets, maintaining their dominance.

- European quality standards regulate chocolate composition, including cocoa content and additive use. The European Union mandates a minimum cocoa content of 35% for dark chocolate, aligning with quality expectations and market competition standards, as recorded in a 2024 EU report. This regulation is critical for maintaining product consistency across European market.

European Chocolate Market Segmentation

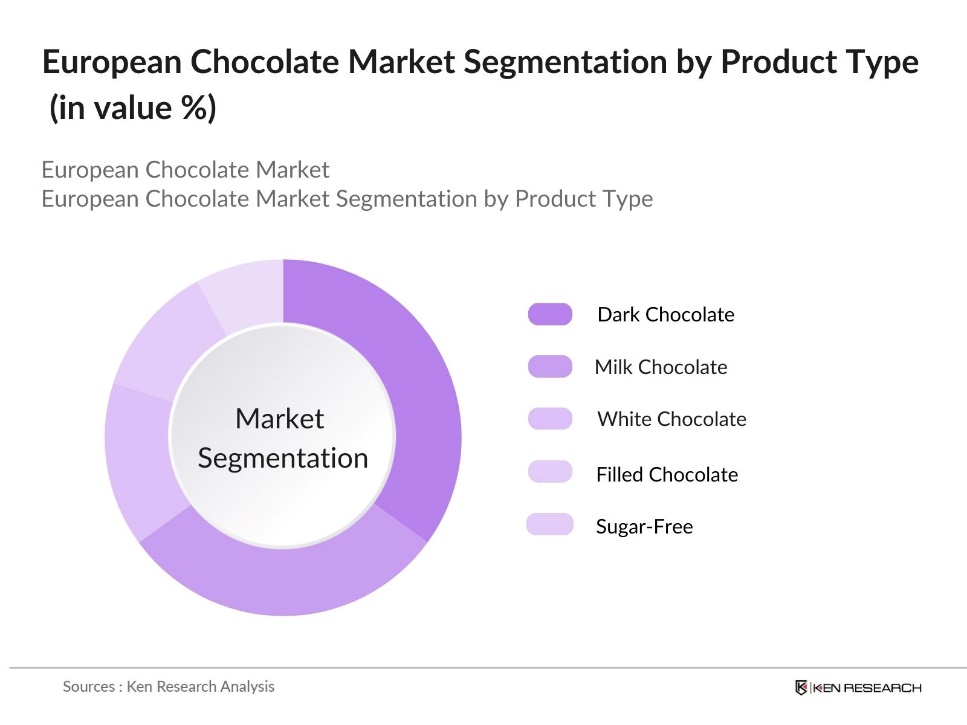

By Product Type: The market is segmented by product type into dark chocolate, milk chocolate, white chocolate, filled chocolate, and sugar-free chocolate. Dark chocolate holds a dominant market share within this segment, driven by the shift toward healthier, lower-sugar options, supported by growing awareness of the antioxidant benefits associated with dark chocolate. Additionally, the unique, intense flavor profile of dark chocolate appeals to a broad consumer base, aiding its popularity.

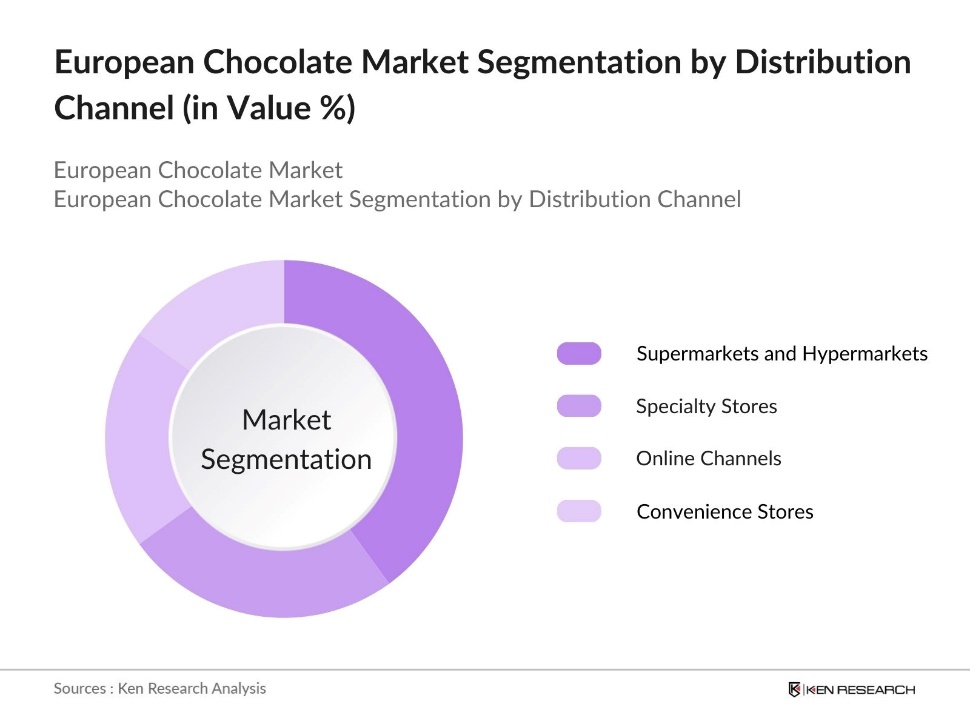

By Distribution Channel: The market is segmented by distribution channels into supermarkets and hypermarkets, specialty stores, online channels, and convenience stores. Supermarkets and hypermarkets hold the largest share in this segment due to their wide reach, consumer accessibility, and the availability of varied chocolate brands and types. This dominance is further reinforced by in-store promotions and seasonal displays, which significantly drive impulse purchases in this category.

European Chocolate Market Competitive Landscape

The European chocolate market is dominated by a select few global and local companies, including Ferrero Group, Lindt & Sprngli AG, and Mondelez International. The competitive landscape underscores the prominence of established players who leverage their robust distribution networks and product innovation to maintain a competitive edge in the market.

European Chocolate Industry Analysis

Growth Drivers

- Consumer Shift to Premium Products (Premiumization): European consumers have increasingly leaned towards premium chocolates, driven by demand for quality and unique flavors. In 2024, European Union statistics indicate that per capita consumption of chocolate reached approximately 5 kg annually, with high-income households spending nearly double on premium chocolates compared to mid-range chocolates. France, Germany, and the Netherlands lead in consumption of premium brands due to a combination of increased purchasing power and quality consciousness, reflecting broader shifts in household expenditure patterns.

- Health-Conscious Consumption Patterns (Low-Sugar, Vegan): The market has adapted to healthier consumption trends, with vegan and low-sugar options expanding. In 2024, over 12% of newly launched chocolate products in Western Europe were vegan-friendly, as recorded by the European Food Information Council, influenced by rising rates of lactose intolerance and dietary preferences. Additionally, low-sugar chocolates constitute a notable portion of the product portfolio in response to health-driven reforms.

- Rising E-commerce Penetration (Digital Channels): The European chocolate market is increasingly driven by e-commerce, broadening access to diverse products and enhancing convenience through digital payments and advanced delivery networks. Supported by the EUs Digital Strategy, which encourages online accessibility, this shift has allowed brands to reach consumers across both urban and rural areas, making online retail a crucial growth channel in the sectors competitive landscape.

Market Challenges

- Fluctuating Cocoa Prices (Raw Material Costs): Fluctuating cocoa prices present a challenge for Europes chocolate manufacturers, as production costs are heavily impacted by variations in raw material pricing. Price changes, often influenced by climatic factors in cocoa-producing regions, create financial pressure on manufacturers who rely on stable input costs. This volatility necessitates careful financial planning to mitigate risks associated with raw material dependencies.

- Sustainability Concerns (Environmental Impact): Sustainability challenges are prominent in Europes chocolate market, especially regarding the environmental impact of cocoa sourcing. Chocolate production has been linked to deforestation and emissions, leading to increased regulatory scrutiny. With the EUs deforestation-free supply chain regulation, European chocolate producers face additional obligations to ensure responsible sourcing, aiming to reduce environmental harm linked to production.

European Chocolate Market Future Outlook

Over the next five years, the European chocolate market is anticipated to experience significant growth, driven by increased consumer interest in health-conscious options, demand for premium products, and digital retail expansion. The market's upward trajectory will likely be influenced by sustainability efforts in the sourcing of cocoa, alongside an increase in vegan and functional chocolates as consumer preferences evolve.

Market Opportunities

- Growing Demand for Functional Chocolates (Nutraceuticals): Functional chocolates, enhanced with nutraceutical ingredients like added vitamins or probiotics, are gaining popularity among health-conscious consumers. This demand allows manufacturers to cater to those seeking nutritional benefits in everyday indulgences, positioning functional chocolates as a favored choice for wellness-oriented individuals. This trend reflects a broader shift toward foods with added health benefits, driving innovation in the chocolate industry.

- Expansion in Emerging Economies (Eastern Europe): Emerging markets in Eastern Europe are experiencing growing demand for chocolate, driven by economic development and urbanization. Countries in this region, including Poland and Hungary, show increasing interest in chocolate products, offering manufacturers opportunities to expand. By tailoring products to local tastes and forming strategic retail partnerships, chocolate brands can establish a stronger presence in these rapidly evolving markets.

Scope of the Report

|

Product Type |

Dark Chocolate Milk Chocolate White Chocolate Filled Chocolate Sugar-Free Chocolate |

|

Application |

Confectionery Bakery Products Beverages Snacks Functional Foods |

|

Distribution Channel |

Supermarkets and Hypermarkets Specialty Stores Online Channels Convenience Stores |

|

Ingredient Type |

Cocoa (Organic, Non-Organic) Sugar (Natural Sweeteners, Artificial Sweeteners) Milk Nuts and Additives |

|

Region |

West East North South |

Products

Key Target Audience

Chocolate Manufacturers

Food and Beverage Industry

Ingredient Suppliers (e.g., Cocoa Producers)

Packaging Industry Players

Government and Regulatory Bodies (e.g., European Commission on Agriculture)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Ferrero Group

Lindt & Sprngli AG

Mondelez International

Ritter Sport

Godiva Chocolatier

Mars, Inc.

Barry Callebaut AG

Nestl S.A.

Thorntons Ltd.

Galler Chocolatier

Table of Contents

1. European Chocolate Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics

1.4 Market Segmentation Overview

2. European Chocolate Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. European Chocolate Market Analysis

3.1 Growth Drivers

3.1.1 Consumer Shift to Premium Products (Premiumization)

3.1.2 Health-Conscious Consumption Patterns (Low-Sugar, Vegan)

3.1.3 Rising E-commerce Penetration (Digital Channels)

3.1.4 Favorable Trade Regulations (Import/Export Incentives)

3.2 Market Challenges

3.2.1 Fluctuating Cocoa Prices (Raw Material Costs)

3.2.2 Sustainability Concerns (Environmental Impact)

3.2.3 Supply Chain Disruptions (Logistics and Storage)

3.3 Opportunities

3.3.1 Growing Demand for Functional Chocolates (Nutraceuticals)

3.3.2 Expansion in Emerging Economies (Eastern Europe)

3.3.3 Innovative Flavor and Ingredient Introductions (Exotic Flavors)

3.4 Trends

3.4.1 Plant-Based Chocolate Alternatives (Vegan Market Growth)

3.4.2 Sustainable Sourcing Initiatives (Fair Trade, Organic Cocoa)

3.4.3 Experiential Marketing in Retail (Pop-Up Stores)

3.5 Regulatory Landscape

3.5.1 EU Health and Nutrition Claims Regulation

3.5.2 Cocoa and Chocolate Products Regulation (Quality Standards)

3.5.3 Sustainability Certification Requirements (Rainforest Alliance, Fairtrade)

3.6 SWOT Analysis

3.7 Supply Chain Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. European Chocolate Market Segmentation

4.1 By Product Type In Value %)

4.1.1 Dark Chocolate

4.1.2 Milk Chocolate

4.1.3 White Chocolate

4.1.4 Filled Chocolate

4.1.5 Sugar-Free Chocolate

4.2 By Application (In Value %)

4.2.1 Confectionery

4.2.2 Bakery Products

4.2.3 Beverages

4.2.4 Snacks

4.2.5 Functional Foods

4.3 By Distribution Channel (In Value %)

4.3.1 Supermarkets and Hypermarkets

4.3.2 Specialty Stores

4.3.3 Online Channels

4.3.4 Convenience Stores

4.4 By Ingredient Type (In Value %)

4.4.1 Cocoa (Organic, Non-Organic)

4.4.2 Sugar (Natural Sweeteners, Artificial Sweeteners)

4.4.3 Milk

4.4.4 Nuts and Additives

4.5 By Region (In Value %)

4.5.1 Western

4.5.2 Eastern

4.5.3 Northern

4.5.4 Southern

5. European Chocolate Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Ferrero Group

5.1.2 Nestl S.A.

5.1.3 Mondelez International, Inc.

5.1.4 Lindt & Sprngli AG

5.1.5 Mars, Inc.

5.1.6 The Hershey Company

5.1.7 Godiva Chocolatier

5.1.8 Barry Calleaut AG

5.1.9 Ritter Sport

5.1.10 Thorntons Ltd.

5.1.11 Neuhaus NV

5.1.12 Galler Chocolatier

5.1.13 Valrhona S.A.

5.1.14 Chocoladefabriken Lindt & Sprngli

5.1.15 Fazer Group

5.2 Cross Comparison Parameters (Production Capacity, Marke Share, Geographic Reach, Innovation Index, CSR Initiatives, Revenue, Key Product Categories, Brand Positioning)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Funding

6. European Chocolate Market Regulatory Framework

6.1 Cocoa Content Standards

6.2 Labeling and Health Claims Regulations

6.3 Import and Export Compliance

7. European Chocolate Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

European Chocolate Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Ingredient Type (In Value %)

8.5 By Region (In Value %)

9. European Chocolate Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping out the major stakeholders within the European chocolate market. Extensive desk research is conducted using a blend of proprietary databases and public sources to gather a complete overview of critical market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and assess historical data relevant to the European chocolate market, including revenue generation by product types and distribution channels. This enables us to produce a reliable analysis that underpins our overall market estimates.

Step 3: Hypothesis Validation and Expert Consultation

We validate our research hypotheses by consulting with industry experts via structured interviews. These insights help refine our estimates, ensuring that the data is both accurate and reflective of market conditions.

Step 4: Research Synthesis and Final Output

The final stage includes synthesizing all collected data and insights from expert consultations, which is further refined through bottom-up analysis. This produces a comprehensive and validated assessment of the European chocolate market.

Frequently Asked Questions

01. How big is the European Chocolate Market?

The European chocolate market is valued at USD 47.25 billion, driven by strong consumer demand for premium and health-focused chocolate products.

02. What are the challenges in the European Chocolate Market?

Challenges in European chocolate market include fluctuating cocoa prices, sustainability concerns, and supply chain disruptions due to logistics and storage issues.

03. Who are the major players in the European Chocolate Market?

Key players in European chocolate market include Ferrero Group, Lindt & Sprngli AG, Mondelez International, Ritter Sport, and Godiva Chocolatier, owing to their extensive distribution networks and strong brand presence.

04. What are the growth drivers of the European Chocolate Market?

Growth drivers in European chocolate market include increasing demand for premium chocolate, a shift toward health-conscious products, and the expansion of online retail channels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.