European Electric Bike Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD10122

December 2024

82

About the Report

European Electric Bike Market Overview

- The Europe Electric Bike Market has been experiencing steady growth, with a market valuation of USD 4.31 billion, as indicated by multiple credible sources. This growth is primarily driven by increasing urbanization and traffic congestion in major cities across Europe. E-bikes offer an efficient, eco-friendly alternative to traditional vehicles, which resonates with consumers looking for sustainable mobility solutions.

- Key cities and countries driving the market include Germany, the Netherlands, and France. These countries dominate due to their strong cycling cultures, well-developed infrastructure for bikes, and government incentives to reduce CO2 emissions. Germany leads the market with widespread adoption, and France has introduced substantial grants to promote electric bike ownership, especially in low-emission zones.

- In 2024, the European Commission is expected to approve an additional EUR 1.2 billion for subsidies targeted toward e-bike buyers. Germany has allocated EUR 250 million toward e-mobility initiatives, which includes funding for electric bikes. Such government backing is expected to result in the sale of an additional 500,000 electric bikes in Germany over the next three years, contributing to the markets expansion.

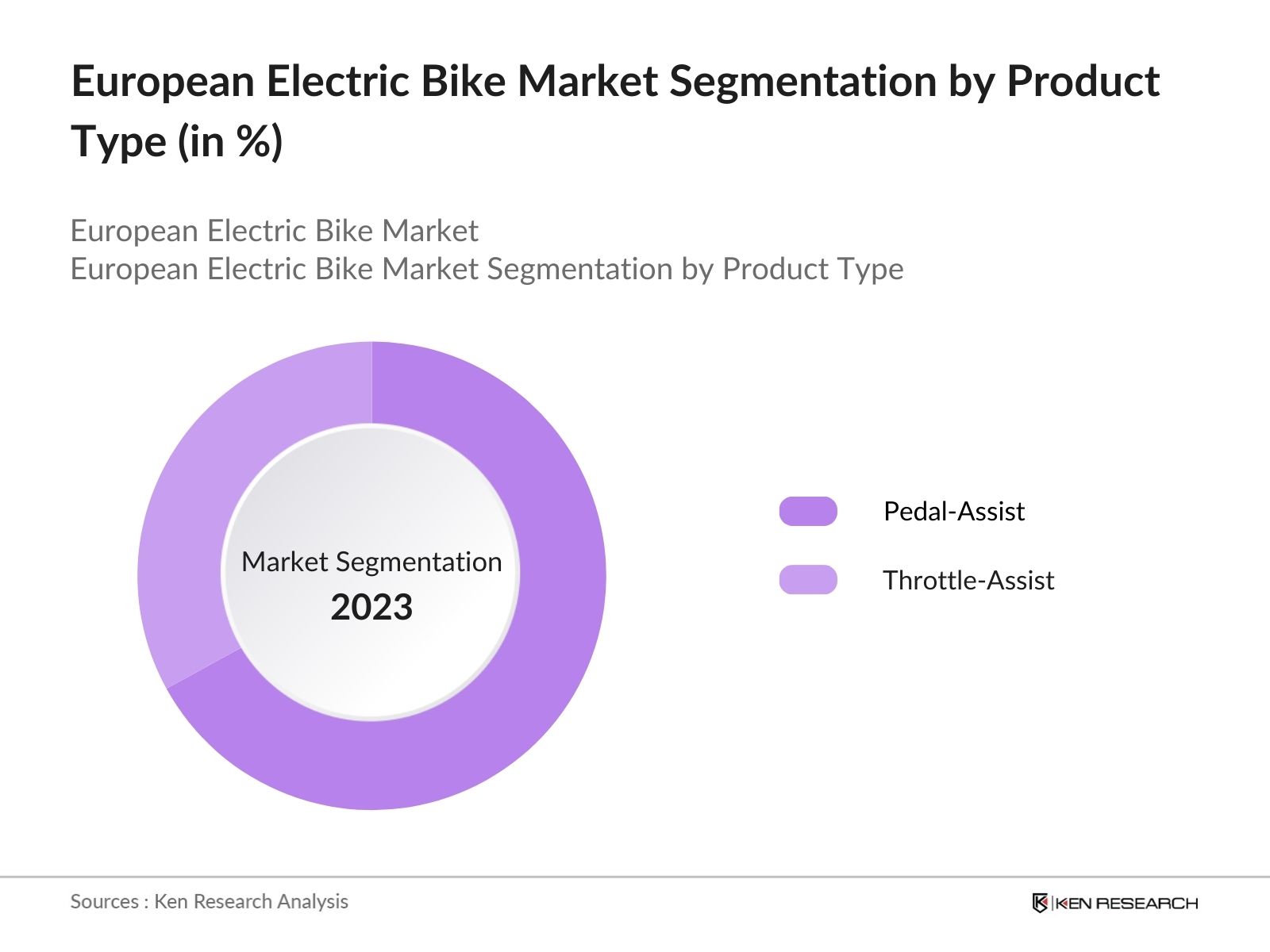

European Electric Bike Market Segmentation

By Product Type: The market is segmented by product type into pedal-assist and throttle-assist e-bikes. Pedal-assist e-bikes currently dominate the market, particularly in urban areas where cycling is already a well-established mode of transportation. The dominance of pedal-assist e-bikes stems from their appeal to health-conscious consumers, as they offer the benefits of cycling while reducing the physical effort needed to pedal.

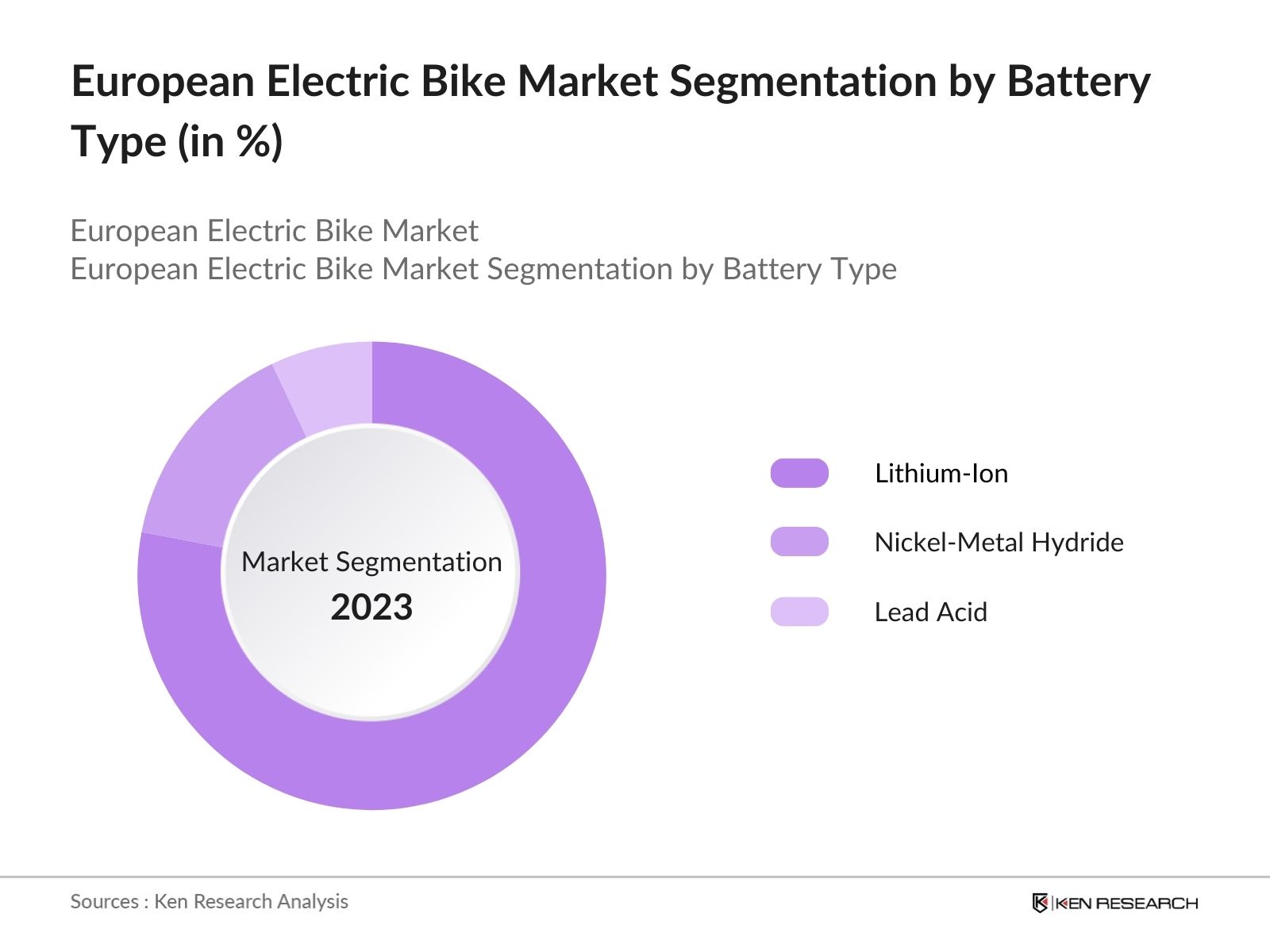

By Battery Type: In the market, segmentation by battery type includes lithium-ion and nickel-metal hydride batteries. Lithium-ion batteries are the clear market leaders due to their high energy density, longer lifespan, and lighter weight compared to other battery types. This dominance is reinforced by advancements in battery technology, making lithium-ion batteries the preferred choice for e-bike manufacturers and users alike, especially in urban commuting settings.

European Electric Bike Market Competitive Landscape

The market is highly competitive, with several key players driving innovation and market penetration. Companies like Accell Group, Riese & Mller GmbH, and QWIC are investing heavily in R&D, producing bikes that feature advanced technology, including IoT integration and smart features.

|

Company Name |

Year of Establishment |

Headquarters |

Market Segment |

Revenue |

No. of Employees |

Global Presence |

Key Products |

|

Accell Group |

1998 |

Netherlands |

|||||

|

Riese & Mller GmbH |

1993 |

Germany |

|||||

|

QWIC |

2006 |

Netherlands |

|||||

|

Yamaha Motors |

1955 |

Japan |

|||||

|

Kalkhoff Werke GmbH |

1919 |

Germany |

European Electric Bike Market Analysis

Market Growth Drivers

- Increased Government Incentives for Sustainable Transport: In 2024, European governments are expected to allocate more than EUR 5 billion in subsidies and tax incentives to promote electric bikes as part of broader environmental policies. This includes cash rebates for e-bike purchases, as seen in France, where the government offers up to EUR 400 per bike.

- Rising Focus on Reducing Greenhouse Gas Emissions: The European Union (EU) has set a goal to reduce carbon emissions by 55% by 2030, and electric bikes are viewed as a key component in achieving this target. The shift from conventional vehicles to e-bikes, especially in urban areas, will save over 3 million tons of CO2 annually by 2028.

- Increasing Urban Congestion and Demand for Micro-Mobility Solutions: Traffic congestion in European cities, particularly in London, Paris, and Berlin, has caused commute times to increase by 20% since 2019. With approximately 45 million people commuting within urban zones, e-bikes offer a viable alternative.

Market Challenges

- Lack of Charging Infrastructure: Europe currently has over 5,000 electric bike charging stations, which is insufficient to support the expected 30 million e-bikes on the road by 2027. Rural and suburban areas in countries such as Spain and Italy are particularly underserved, leading to range anxiety among potential buyers.

- Battery Supply Chain Disruptions: Europe relies on battery imports from Asia, and recent geopolitical tensions and supply chain disruptions have delayed shipments of lithium-ion batteries. In 2024, battery shortages could affect up to 15% of e-bike production in Europe, causing delays in delivery and increasing prices.

European Electric Bike Market Future Outlook

Over the next five years, the Europe Electric Bike industry is projected to witness growth, driven by several factors. Government initiatives, such as subsidies for purchasing electric vehicles, advancements in battery technology, and the increasing demand for sustainable transportation, are expected to push the market forward.

Future Market Opportunities

- Growth in E-Bike Subscription Services By 2028, subscription-based e-bike services will dominate the European market, offering consumers an affordable and flexible alternative to ownership. These services are projected to add nearly 1 million subscribers by 2027, with large cities like Berlin and Amsterdam being the primary growth hubs.

- Expansion of Solar-Powered Charging Stations As part of the EUs renewable energy targets, solar-powered charging stations for e-bikes will see widespread implementation across Europe by 2027. These stations, supported by EUR 800 million in funding, will reduce dependence on conventional electricity grids and encourage more consumers to switch to e-bikes.

Scope of the Report

|

Product Type |

Pedal Assist Throttle Assist |

|

Battery Type |

Lithium-Ion Nickel-Metal Hydride |

|

Motor Type |

Mid-Drive Motors Hub Motors |

|

Class |

Class I Class II Class III |

|

Application |

Urban Trekking Cargo |

|

Region |

Germany |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (e.g., European Union, national transport ministries)

E-bike Manufacturers

Banks and financial Institutions

Private Equity Firms

Investor and Venture Capitalist Firms

Logistics and Delivery Companies

Companies

Players Mentioned in the Report:

Riese & Mller GmbH

Powabyke UK Ltd

QWIC

Kalkhoff Werke GmbH

Yamaha Motor Co. Ltd

Bosch eBike Systems

Giant Manufacturing Co. Ltd

Trek Bicycle Corporation

VanMoof

Shimano Inc.

Table of Contents

1. Europe Electric Bike Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Electric Bike Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Electric Bike Market Analysis

3.1 Growth Drivers

3.1.1 Urban Traffic Congestion

3.1.2 Expansion in the Tourism Sector

3.1.3 Increasing Social Trends & Lifestyle Changes

3.1.4 Government Subsidies and Incentives

3.2 Market Challenges

3.2.1 High Maintenance and Service Costs

3.2.2 Perception Barriers and Social Resistance

3.2.3 Regulatory Restrictions in Certain Regions

3.3 Opportunities

3.3.1 Rising Health Consciousness

3.3.2 Growth in Emerging Markets

3.3.3 Evolving Battery and Motor Technologies

3.4 Trends

3.4.1 Adoption of Pedal Assist and Throttle Modes

3.4.2 Integration of IoT and Smart Features

3.4.3 Growth in E-Cargo and Rental Services

3.5 Government Regulations

3.5.1 Incentives for E-Bike Purchases

3.5.2 Emission Reduction Policies

3.5.3 Type Approval for Low-Power Vehicles

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Electric Bike Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Pedal Assist

4.1.2 Throttle Assist

4.2 By Battery Type (In Value %)

4.2.1 Lithium-Ion

4.2.2 Nickel-Metal Hydride

4.2.3 Lead Acid

4.3 By Motor Type (In Value %)

4.3.1 Mid-Drive Motors

4.3.2 Hub Motors

4.4 By Class (In Value %)

4.4.1 Class I

4.4.2 Class II

4.4.3 Class III

4.5 By Application (In Value %)

4.5.1 Urban

4.5.2 Trekking

4.5.3 Cargo

4.6 By Region (%)

4.5.1 Germany

4.5.2 France

4.5.3 UK

4.5.4 Sweden

4.5.5 Italy

4.5.6 Rest of Europe

5. Europe Electric Bike Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Accell Group

5.1.2 Riese & Mller GmbH

5.1.3 Powabyke UK Ltd

5.1.4 QWIC

5.1.5 Kalkhoff Werke GmbH

5.1.6 Yamaha Motor Co. Ltd

5.1.7 Giant Manufacturing Co. Ltd

5.1.8 Trek Bicycle Corporation

5.1.9 VanMoof

5.1.10 Bosch eBike Systems

5.1.11 Shimano Inc.

5.1.12 Specialized Bicycle Components

5.1.13 Orbea

5.1.14 Cannondale

5.1.15 Derby Cycle

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants

5.8 Venture Capital Funding

6. Europe Electric Bike Market Regulatory Framework

6.1 European Emission Standards

6.2 Certification and Compliance Requirements

7. Europe Electric Bike Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Electric Bike Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Battery Type (In Value %)

8.3 By Motor Type (In Value %)

8.4 By Class (In Value %)

8.5 By Application (In Value %)

8.6 By Region (In Value %)

9. Europe Electric Bike Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began with the identification of critical variables influencing the Europe E-bike market. This included assessing market drivers such as urban congestion and government policies promoting sustainable transport. Extensive desk research and secondary data sources were used to map the ecosystem and define these key variables.

Step 2: Market Analysis and Construction

Historical data from reliable sources was compiled and analyzed, focusing on market penetration, product types, and revenue generation. The analysis included evaluating the ratio of e-bike adoption in different European countries and the impact of policies on market expansion.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts, including e-bike manufacturers and battery suppliers, were consulted through structured interviews. These consultations provided insights into market trends and validated the initial market hypotheses.

Step 4: Research Synthesis and Final Output

The final phase involved compiling the data into a comprehensive report, incorporating input from various stakeholders. The synthesis included verifying key metrics such as market size and revenue forecasts to ensure the accuracy of the findings.

Frequently Asked Questions

01. How big is the Europe Electric Bike Market?

The Europe Electric Bike Market was valued at USD 4.31 billion, with steady growth driven by urbanization, increasing consumer preference for eco-friendly transportation, and government incentives.

02. What are the challenges in the Europe Electric Bike Market?

Key challenges in the Europe Electric Bike Market include the high maintenance and service costs of e-bikes, especially related to electrical components, as well as social resistance from traditional cyclists in certain regions.

03. Who are the major players in the Europe Electric Bike Market?

Key players in the Europe Electric Bike Market include Accell Group, Riese & Mller GmbH, Powabyke UK Ltd, QWIC, and Kalkhoff Werke GmbH. These companies dominate the market through innovation, extensive distribution, and strategic partnerships.

04. What are the growth drivers of the Europe Electric Bike Market?

The Europe Electric Bike Market is primarily driven by urban traffic congestion, increasing health consciousness, government subsidies for electric vehicles, and advancements in e-bike battery and motor technologies.

05. What is the future outlook of the Europe Electric Bike Market?

The Europe Electric Bike Market is expected to witness substantial growth over the next five years due to advancements in smart bike technologies, rising eco-consciousness, and expansions in urban cycling infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.