France Green Hydrogen Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD1117

December 2024

87

About the Report

France Green Hydrogen Market Overview

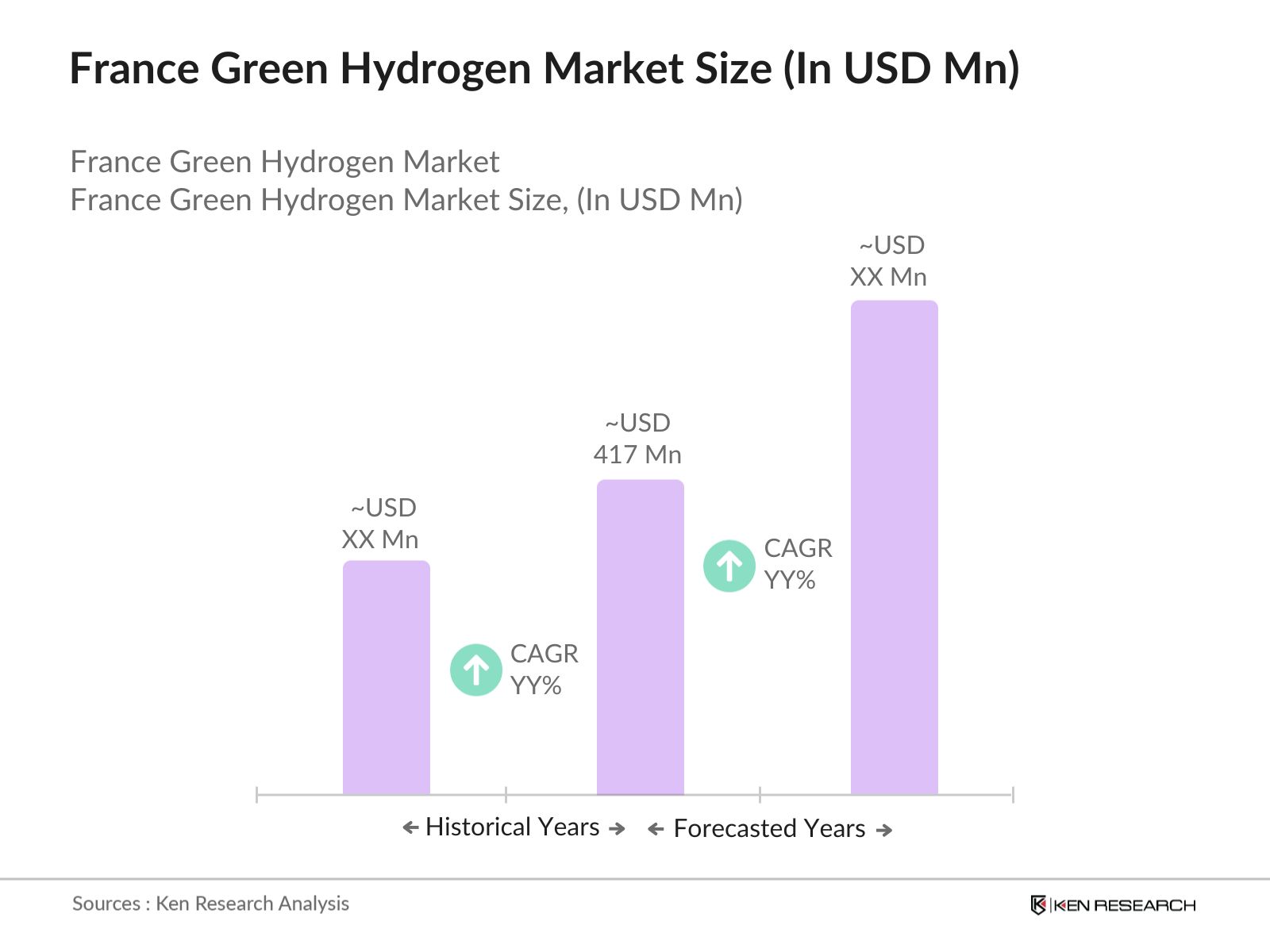

- The France Green Hydrogen market, valued at USD 417 million, is driven by significant investments from both the public and private sectors, aimed at reducing carbon emissions and promoting sustainable energy solutions. The French government has introduced initiatives such as substantial subsidies and strategic partnerships, boosting the infrastructure needed for green hydrogen production, particularly through renewable energy sources.

- Prominent regions in France, such as le-de-France, Auvergne-Rhne-Alpes, and Provence-Alpes-Cte d'Azur, lead the market, primarily due to their robust industrial presence and substantial investments in hydrogen infrastructure. These regions are home to major industrial clusters and have been central to the country's renewable energy development, benefiting from both favorable government policies and strategic geographic positioning, which support hydrogen production and distribution efficiently across the nation.

- The 7 billion investment under the France Relance Plan allocated specifically for green hydrogen production includes subsidies for electrolyzer manufacturers and grants for companies aiming to adopt hydrogen. According to government estimates, this initiative will create 50,000 jobs and contribute 10 billion in economic activity by 2030, aiding in the rapid expansion of the hydrogen economy.

France Green Hydrogen Market Segmentation

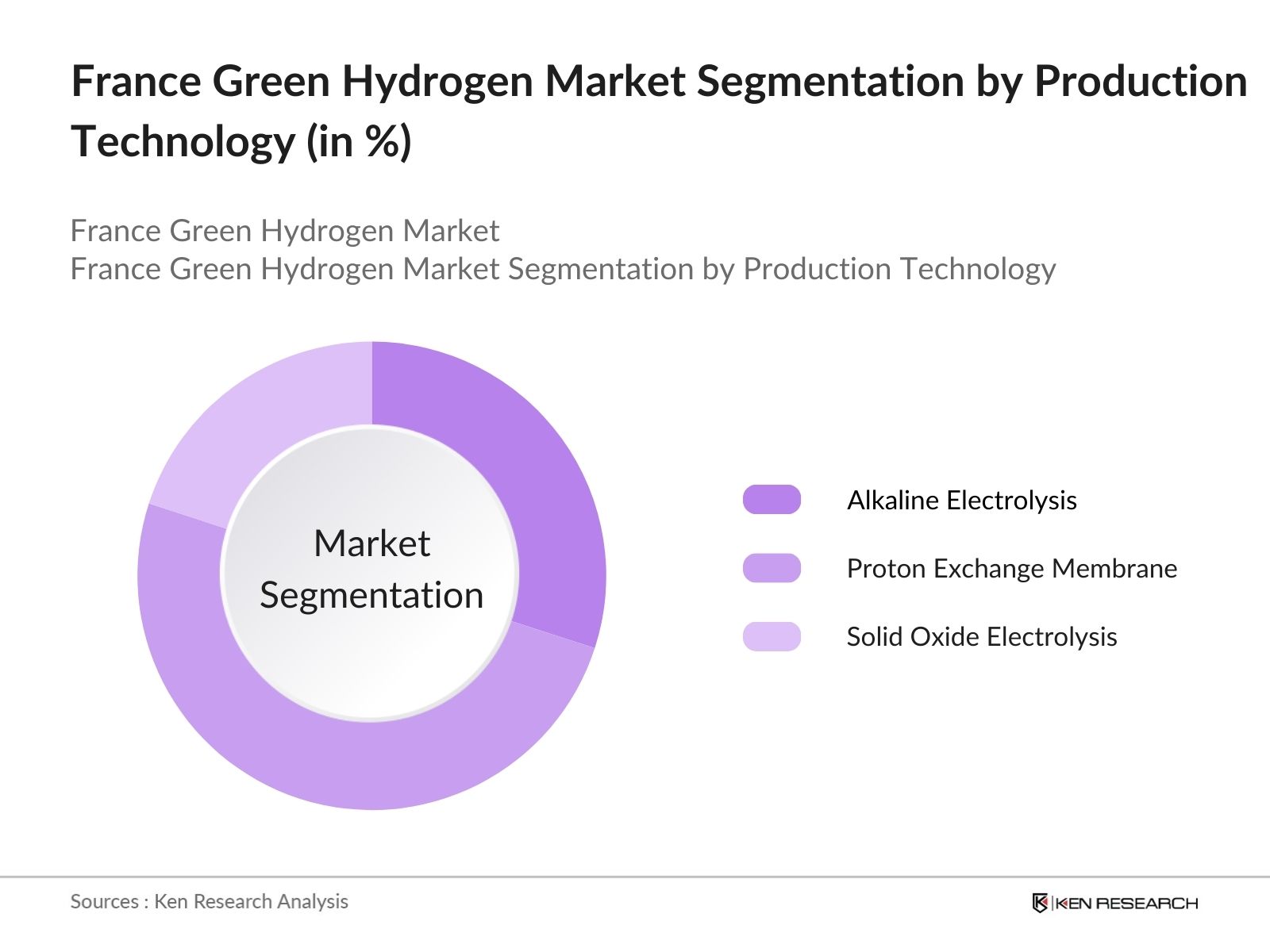

By Production Technology: The market is segmented by production technology into Alkaline Electrolysis, Proton Exchange Membrane (PEM) Electrolysis, and Solid Oxide Electrolysis. Recently, Proton Exchange Membrane Electrolysis has gained a dominant share within this segmentation due to its high efficiency and suitability for a variety of applications, from transportation to industrial use. This technology allows for a more flexible production process, adapting to fluctuations in renewable energy inputs, thus aligning with Frances growing renewable energy goals.

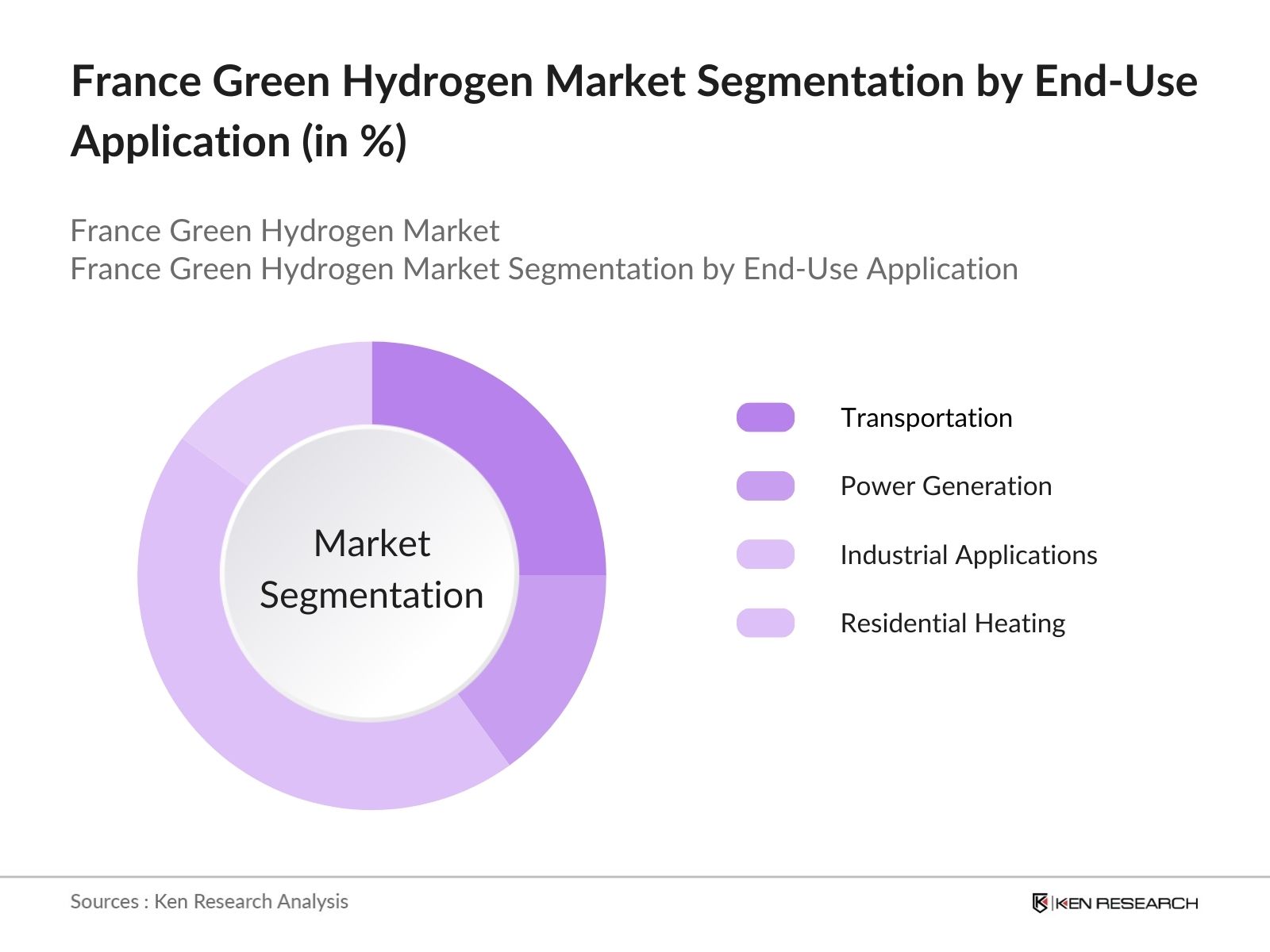

By End-Use Application: The market is further segmented by end-use applications into Transportation, Power Generation, Industrial Applications, and Residential Heating. Currently, Industrial Applications hold a leading position within this category due to the high energy demands of industries such as steel production and chemical manufacturing. These industries are turning to green hydrogen to reduce their carbon footprint and comply with stringent environmental regulations, making this segment the primary consumer of green hydrogen in France.

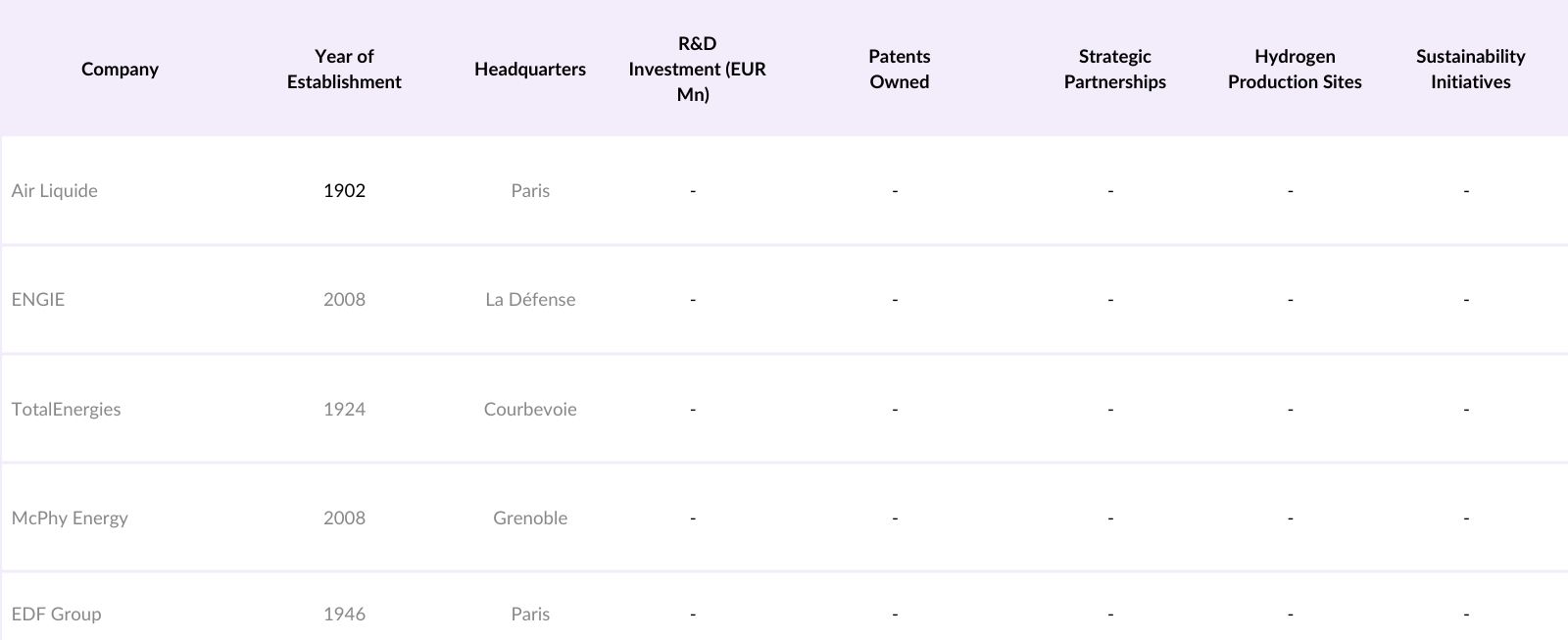

France Green Hydrogen Market Competitive Landscape

The market is dominated by a mix of domestic and international players, including Air Liquide, ENGIE, TotalEnergies, McPhy Energy, and EDF Group. These companies lead the market with significant investments in green hydrogen infrastructure and technological advancements, supporting the French governments ambitious hydrogen strategy and positioning themselves as key players in the European green energy transition.

France Green Hydrogen Market Analysis

Market Growth Drivers

- Increasing Investment in Electrolyzer Capacity: By 2024, Frances electrolyzer capacity is set to expand, with government-backed funding reaching 7 billion to ramp up the production of green hydrogen. According to the French Ministry for the Ecological Transition, this investment is part of a larger 30 billion allocation aimed at enhancing sustainable energy infrastructure across the nation.

- Industrial Sector Demand for Decarbonization: Heavy industries in France, including steel manufacturing and chemical production, are anticipated to become major consumers of green hydrogen as they strive to reduce carbon emissions by 2025. The French industrial sector, currently emitting over 100 million metric tons of CO annually, will adopt green hydrogen to substitute fossil fuels in production processes, potentially cutting emissions by at least 5 million metric tons by 2028.

- Expansion of Hydrogen-Powered Transportation: Frances national target to deploy 5,000 hydrogen fuel cell buses and trucks by 2030 is beginning to accelerate as vehicle manufacturers receive substantial subsidies and tax breaks. The French government has allocated 1.9 billion for transportation decarbonization, intending to lower CO emissions from heavy transport by over 20,000 metric tons annually by 2025.

Market Challenges

- Energy-Intensive Production Requirements: Producing green hydrogen is highly energy-intensive, requiring around 55 kWh to produce one kilogram, which raises concerns regarding energy source sustainability. With renewable sources like wind and solar expected to generate only 120 terawatt-hours by 2024, the strain on resources could slow production growth if renewable capacity isnt expanded accordingly.

- Limited Market Awareness and Acceptance: Despite government support, the adoption rate of green hydrogen across different sectors is hindered by limited awareness and technical expertise. According to a 2024 survey by the Ministry of Ecological Transition, fewer than 20% of industrial leaders in small and medium-sized enterprises have adequate knowledge or infrastructure to adopt hydrogen-based energy solutions, requiring an investment in education and training programs.

France Green Hydrogen Market Future Outlook

Over the next five years, the France Green Hydrogen industry is expected to expand considerably, driven by progressive policies, advancements in electrolysis technology, and rising demand across industrial and transportation sectors.

Future Market Opportunities

- Expansion of Electrolyzer Capacity: By 2028, France is expected to enhance its electrolyzer capacity to produce up to 1 million tons of green hydrogen annually. This expansion will likely be supported by an additional 5 billion in government and private sector funding, positioning France as one of Europes leading producers and suppliers of green hydrogen for industrial use and export.

- Development of Hydrogen-Powered Heavy Transport Solutions: France is projected to have over 15,000 hydrogen-powered buses and trucks in operation by 2030, driven by increased funding and collaborations with automotive companies. This shift is expected to decrease annual CO emissions from transport by at least 100,000 metric tons, with a further 3 billion earmarked to expand hydrogen refueling infrastructure nationwide.

Scope of the Report

|

Production Technology |

Alkaline Electrolysis |

|

End-Use Application |

Transportation |

|

Distribution Channel |

Pipeline |

|

Region |

North East West South |

|

System Component |

Electrolyzers |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Ecological Transition, ADEME - French Environment & Energy Management Agency)

Green Energy Startups

Industrial Manufacturers and Heavy Industry Firms

Automotive Companies and EV Manufacturers

Renewable Energy Companies

Hydrogen Infrastructure Developers

Electrolyzer and Fuel Cell Manufacturers

Companies

Players Mentioned in the Report:

Air Liquide

ENGIE

TotalEnergies

McPhy Energy

EDF Group

Siemens Energy

HDF Energy

Hydrogen Refueling Solutions (HRS)

Areva H2Gen

Symbio

Table of Contents

1. France Green Hydrogen Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Industry Lifecycle Analysis

1.4. Market Segmentation Overview

1.5. Value Chain Analysis

2. France Green Hydrogen Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Key Market Milestones and Developments

2.3. Year-On-Year Market Growth Rate Analysis

2.4. Market Maturity Level

3. France Green Hydrogen Market Dynamics

3.1. Growth Drivers

3.1.1. Government Policy Support and Subsidies

3.1.2. Technological Advancements in Electrolyzers

3.1.3. Rising Demand in Industrial Applications (e.g., Chemical, Steel)

3.1.4. Corporate Commitments to Decarbonization

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Limited Infrastructure for Hydrogen Distribution

3.2.3. Regulatory Compliance and Safety Standards

3.2.4. Dependency on Renewable Energy Availability

3.3. Opportunities

3.3.1. Expansion into Emerging End-Use Sectors

3.3.2. Technological Partnerships and Collaborations

3.3.3. Export Potential to EU Markets

3.3.4. Public-Private Investment Opportunities

3.4. Trends

3.4.1. Increasing Electrolyzer Capacity Investments

3.4.2. Integration of Hydrogen in Transportation Sector

3.4.3. Cross-Border Collaborations in the EU

3.4.4. Enhanced Focus on Hydrogen Storage Solutions

3.5. Regulatory Environment

3.5.1. EU Green Deal and National Regulations

3.5.2. Emission Reduction Targets and Standards

3.5.3. Hydrogen Strategy in the Energy Transition Law

3.5.4. Incentives for Renewable Energy Integration

3.6. Competitive Ecosystem

3.7. Porters Five Forces Analysis

3.8. Industry Stakeholders Ecosystem Analysis

3.9. SWOT Analysis

4. France Green Hydrogen Market Segmentation

4.1. By Production Technology (In Value %)

4.1.1. Alkaline Electrolysis

4.1.2. Proton Exchange Membrane (PEM) Electrolysis

4.1.3. Solid Oxide Electrolysis

4.2. By End-Use Application (In Value %)

4.2.1. Transportation

4.2.2. Power Generation

4.2.3. Industrial Applications

4.2.4. Residential Heating

4.3. By Distribution Channel (In Value %)

4.3.1. Pipeline

4.3.2. Liquid Hydrogen Carriers

4.3.3. Compression and Storage Tanks

4.4. By Region (In Value %)

4.4.1. North

4.4.2. East

4.4.3. West

4.4.4. South

4.5. By System Component (In Value %)

4.5.1. Electrolyzers

4.5.2. Fuel Cells

4.5.3. Storage Systems

5. France Green Hydrogen Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Air Liquide

5.1.2. ENGIE

5.1.3. TotalEnergies

5.1.4. Linde Group

5.1.5. McPhy Energy

5.1.6. EDF Group

5.1.7. Siemens Energy

5.1.8. HDF Energy

5.1.9. Hydrogen Refueling Solutions (HRS)

5.1.10. Areva H2Gen

5.1.11. Symbio

5.1.12. ITM Power

5.1.13. Enapter

5.1.14. Plug Power

5.1.15. Ballard Power Systems

5.2. Cross Comparison Parameters (R&D Investment, Market Presence, Revenue, Product Portfolio, Number of Hydrogen Projects, Technology Patents, Partnerships, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Merger & Acquisition Analysis

5.6. Venture Capital and Investment Funding

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. France Green Hydrogen Market Regulatory Framework

6.1. National Energy Strategy for Hydrogen

6.2. EU Funding Programs (e.g., Horizon Europe)

6.3. Certification and Quality Standards

6.4. Safety and Operational Guidelines

7. France Green Hydrogen Future Market Size (In USD Mn)

7.1. Forecasted Market Size Projections

7.2. Growth Factors Influencing Future Demand

8. France Green Hydrogen Market Future Segmentation

8.1. By Production Technology (In Value %)

8.2. By End-Use Application (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Region (In Value %)

8.5. By System Component (In Value %)

9. France Green Hydrogen Market Analysts Recommendations

9.1. Total Addressable Market (TAM) Analysis

9.2. Serviceable Obtainable Market (SOM) Analysis

9.3. Strategic Partnership Opportunities

9.4. White Space and Emerging Market Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map of the France Green Hydrogen market, covering key stakeholders such as government agencies, hydrogen producers, and infrastructure developers. Comprehensive desk research leverages credible databases and industry reports to outline critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase includes collecting and analyzing historical market data, including production volumes, consumption rates, and technological adoption trends. Additional focus is placed on regulatory impacts and government incentives driving growth in the green hydrogen market.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through structured interviews with industry experts, such as hydrogen technology specialists and regulatory advisors. These insights reinforce data accuracy and provide a deeper understanding of market trends and challenges.

Step 4: Research Synthesis and Final Output

The final phase synthesizes insights from direct consultations with hydrogen manufacturers, which complements data obtained through secondary research. This bottom-up approach ensures a validated, comprehensive analysis of the France Green Hydrogen market, covering all relevant segments.

Frequently Asked Questions

01. How big is the France Green Hydrogen Market?

The France Green Hydrogen market is valued at USD 417 million, reflecting investments aimed at reducing carbon emissions and promoting renewable energy sources as part of France's national energy strategy.

02. What are the challenges in the France Green Hydrogen Market?

Challenges in this France Green Hydrogen market include high production costs, limited distribution infrastructure, and the dependency on renewable energy availability. Regulatory compliance and safety standards also add complexity to market expansion efforts.

03. Who are the major players in the France Green Hydrogen Market?

Major players in the France Green Hydrogen market include Air Liquide, ENGIE, TotalEnergies, McPhy Energy, and EDF Group, with strong national and regional footprints that support Frances hydrogen energy goals.

04. What are the growth drivers of the France Green Hydrogen Market?

Growth drivers in the France Green Hydrogen market include government subsidies, strategic public-private partnerships, and technological advancements in electrolysis, which make green hydrogen production more efficient and scalable.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.