Germany Green Hydrogen Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD1187

December 2024

93

About the Report

Germany Green Hydrogen Market Overview

- The Germany Green Hydrogen Market is valued at USD 500 million, driven by a well-established renewable energy sector and a strong commitment to reducing carbon emissions. This growth is bolstered by investment from both the government and private sectors to scale up green hydrogen production, ensuring energy security and addressing industrial demand for low-carbon solutions.

- Key cities leading the green hydrogen initiative in Germany include Hamburg and North Rhine-Westphalia, primarily due to their proximity to industrial zones and advanced renewable energy infrastructure. Hamburg serves as a key hydrogen port, facilitating imports and exports, while North Rhine-Westphalia, a major industrial hub, utilizes green hydrogen to decarbonize steel and chemical manufacturing, demonstrating the region's progressive adoption of hydrogen technology.

- In 2024, Germany expanded its National Hydrogen Strategy, committing 10 billion over the next 5 years for hydrogen R&D, industrial applications, and scaling electrolyzer production to 5 GW capacity. This strategy aims to increase green hydrogen availability by 2030, reducing Germany's reliance on imported natural gas and lowering industrial carbon emissions.

Germany Green Hydrogen Market Segmentation

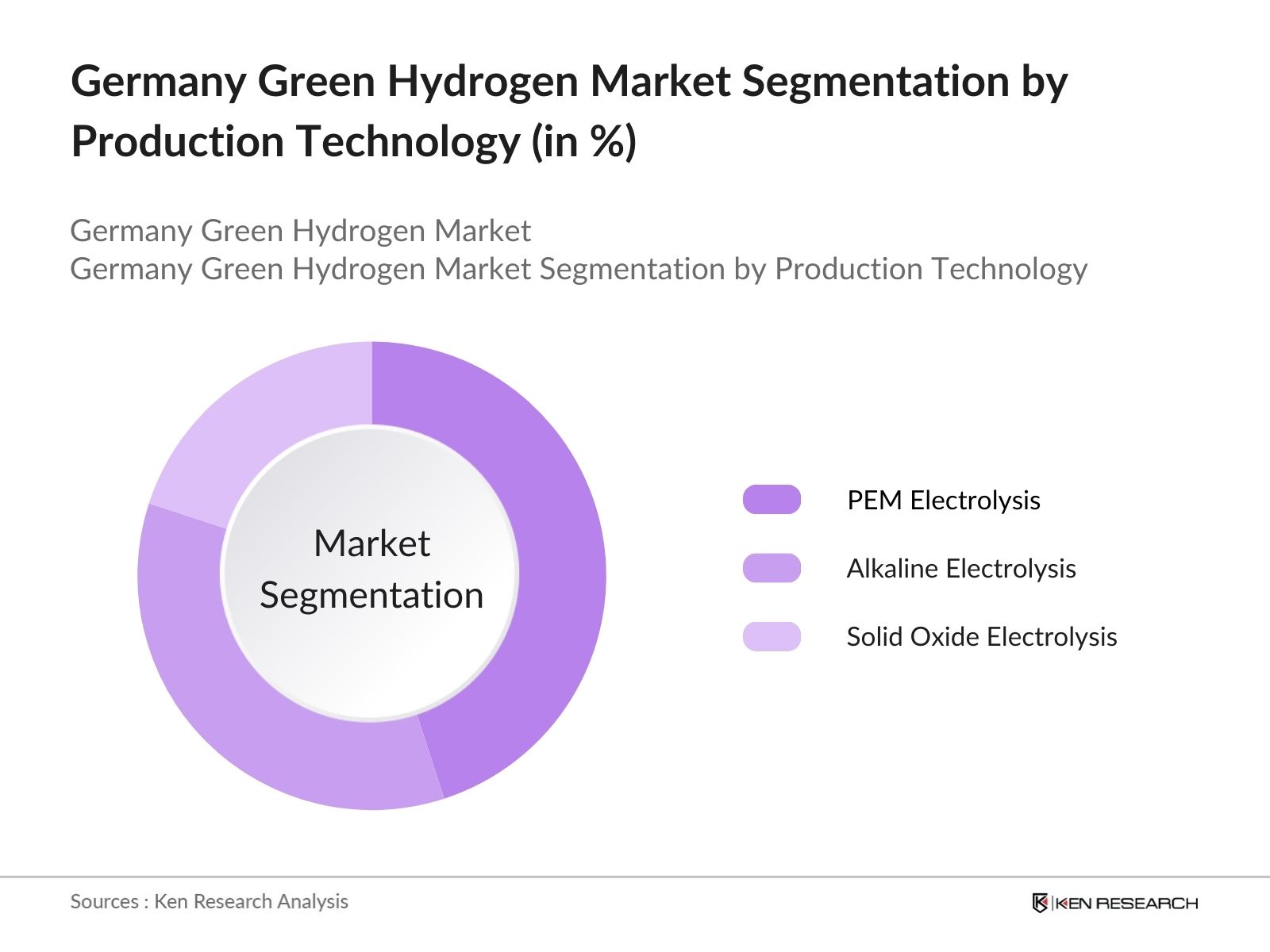

By Production Technology: The market is segmented by production technology, including PEM (Proton Exchange Membrane) Electrolysis, Alkaline Electrolysis, and Solid Oxide Electrolysis. PEM Electrolysis holds a dominant market share due to its efficiency, scalability, and applicability in various sectors, from industry to transport. PEMs flexibility in integrating with renewable energy sources like wind and solar is essential for Germany's sustainable energy goals, which rely on fast-acting, adaptable hydrogen production methods.

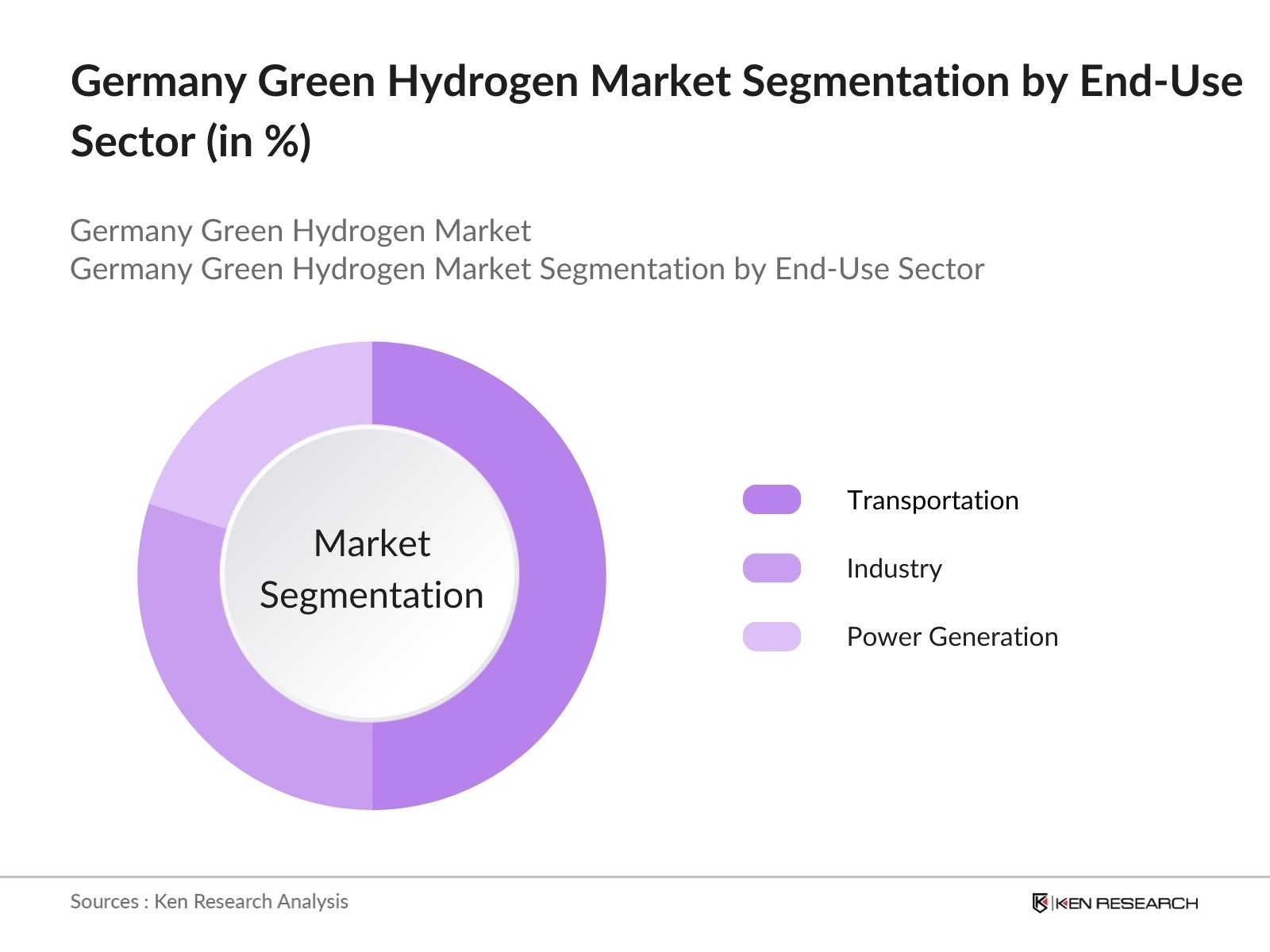

By End-Use Sector: The market is also segmented by end-use sectors, which include transportation, industry, and power generation. The transportation sector holds the largest share due to the growing fleet of hydrogen-powered vehicles and public transport initiatives. Hydrogen fuel cells in buses and heavy-duty trucks, particularly in cities focused on emission reductions, drive this demand, making it a pivotal sector for green hydrogen consumption.

Germany Green Hydrogen Market Competitive Landscape

The market is dominated by several key players with robust technological advancements and large-scale production capabilities. Notable companies include Siemens Energy, Linde Plc, and Thyssenkrupp AG, all of which have significant operations within Germany and collaborations with government bodies to advance hydrogen technology.

Germany Green Hydrogen Market Analysis

Market Growth Drivers

- Government Investment in Hydrogen Infrastructure: In 2024, the German government allocated 7 billion towards scaling up green hydrogen production and distribution infrastructure under the National Hydrogen Strategy. This includes funding for electrolyzer projects with a combined capacity of 2 GW, expected to produce over 30,000 metric tons of green hydrogen annually.

- Industrial Demand for Decarbonization: German industries, especially steel manufacturing, consume amounts of energy and are under pressure to reduce CO emissions. In 2024, the German steel industry announced plans to convert 10 million metric tons of steel production to hydrogen-based methods by 2030, potentially reducing emissions by 25 million metric tons annually.

- Increasing Renewable Energy Capacity: With Germanys renewable energy capacity reaching 65 GW of wind and 55 GW of solar in 2024, surplus energy from these sources is projected to generate 50,000 metric tons of green hydrogen annually. This surplus facilitates cost-effective hydrogen production, enabling industries and transport sectors to access affordable green hydrogen.

Market Challenges

- Water Resource Constraints: Green hydrogen production via electrolysis consumes around 9 liters of water per kilogram. In 2024, with approximately 200 million cubic meters of water required for hydrogen goals, water scarcity, particularly in densely populated or industrial regions, poses a critical resource challenge for scaling up green hydrogen.

- Dependence on Renewable Energy Availability: Germanys reliance on renewable energy sources for green hydrogen production links hydrogen availability to solar and wind output. Seasonal and weather-related variability in renewable energy generation could lead to inconsistent hydrogen production, necessitating storage solutions that add additional costs to green hydrogen projects.

Germany Green Hydrogen Market Future Outlook

The Germany Green Hydrogen Industry is anticipated to see expansion, driven by ambitious decarbonization targets, increased adoption in transportation and industrial sectors, and substantial government subsidies.

Future Market Opportunities

- Rise in Green Hydrogen Export Potential: By 2029, Germany is expected to produce surplus green hydrogen with production reaching 1 million metric tons annually, creating opportunities to export hydrogen to neighboring EU countries. This export potential is anticipated to generate 1 billion in additional revenue annually, positioning Germany as a major hydrogen hub within Europe.

- Increased Adoption in Energy Storage: Over the next five years, Germany is expected to deploy over 10 large-scale hydrogen storage facilities with a combined capacity of 200,000 metric tons to support renewable energy integration. This infrastructure will stabilize hydrogen supply during peak and off-peak periods, enhancing the reliability of green hydrogen for industrial users.

Scope of the Report

|

Production Technology |

PEM Electrolysis |

|

End-Use Sector |

Transportation (Fuel Cell Vehicles, Hydrogen Rail) |

|

Storage Type |

Compressed Gas Storage |

|

Application Mode |

Onsite Production |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Renewable Energy Project Developers

Transportation Sector Investors

Industrial Manufacturers (Steel, Chemical Industries)

Hydrogen Fuel Cell Technology Providers

Public Transport Authorities

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Federal Ministry for Economic Affairs and Energy, German Environment Agency)

Utilities and Grid Operators

Companies

Players Mentioned in the Report:

Siemens Energy

Linde Plc

Thyssenkrupp AG

Air Liquide

ITM Power

McPhy Energy

Nel ASA

Plug Power Inc.

ENGIE

rsted A/S

Table of Contents

1. Germany Green Hydrogen Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Hydrogen Demand by Sector, Renewable Energy Integration)

1.4. Green Hydrogen Production Pathways (Electrolysis Methods, Source Dependency)

2. Germany Green Hydrogen Market Size (In USD Mn)

2.1. Historical Market Size (Capacity, Production, Consumption)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Policy Initiatives, Infrastructure Projects)

3. Germany Green Hydrogen Market Analysis

3.1. Growth Drivers

3.1.1. National Hydrogen Strategy

3.1.2. Decarbonization Targets in Industrial and Mobility Sectors

3.1.3. EU Energy Transition Funding (National and Cross-border Projects)

3.1.4. Advances in Electrolyzer Technology and Efficiency

3.2. Market Challenges

3.2.1. High Production Costs Relative to Grey Hydrogen

3.2.2. Limited Infrastructure for Hydrogen Distribution

3.2.3. Regulatory and Policy Ambiguities in Hydrogen Usage

3.3. Opportunities

3.3.1. Export Potential within the EU Hydrogen Backbone

3.3.2. Hydrogen Blending in Natural Gas Networks

3.3.3. Cross-Sector Collaboration (Industry, Energy, Transport)

3.4. Trends

3.4.1. Investment in Renewable Hydrogen Projects

3.4.2. Expansion of Green Hydrogen Mobility Initiatives

3.5. Regulatory Framework

3.5.1. National Hydrogen Strategy Mandates

3.5.2. EU Renewable Energy Directive (RED II Compliance)

3.5.3. Standards for Green Hydrogen Certification

3.6. Stakeholder Ecosystem (Public, Private, and Joint Ventures)

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape and Industry Ecosystem (Key Players, Strategic Alliances)

4. Germany Green Hydrogen Market Segmentation

4.1. By Production Technology (In Value %)

4.1.1. PEM Electrolysis

4.1.2. Alkaline Electrolysis

4.1.3. Solid Oxide Electrolysis

4.2. By End-Use Sector (In Value %)

4.2.1. Transportation (Fuel Cell Vehicles, Hydrogen Rail)

4.2.2. Industry (Steel, Chemicals)

4.2.3. Power Generation and Storage

4.3. By Storage Type (In Value %)

4.3.1. Compressed Gas Storage

4.3.2. Liquid Hydrogen

4.3.3. Ammonia Storage

4.4. By Application Mode (In Value %)

4.4.1. Onsite Production

4.4.2. Offsite Distribution

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Germany Green Hydrogen Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens Energy

5.1.2. Thyssenkrupp AG

5.1.3. Linde Plc

5.1.4. Air Liquide

5.1.5. ITM Power

5.1.6. Nel ASA

5.1.7. ENGIE

5.1.8. rsted A/S

5.1.9. Enapter AG

5.1.10. Green Hydrogen Systems

5.1.11. Plug Power Inc.

5.1.12. Ballard Power Systems

5.1.13. Proton Motor Fuel Cell GmbH

5.1.14. McPhy Energy

5.1.15. Hydrogenics Corporation

5.2. Cross Comparison Parameters (Annual Revenue, R&D Investments, Market Position, Electrolyzer Capacity, Hydrogen Output, Partnerships, Employee Count, Headquarters Location)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Venture Capital and Private Equity Trends

6. Germany Green Hydrogen Market Regulatory Framework

6.1. National Standards and Certifications

6.2. Compliance with EU Regulations

6.3. Licensing and Permitting Processes

7. Germany Green Hydrogen Market Future Segmentation

7.1. By Production Technology (In Value %)

7.2. By End-Use Sector (In Value %)

7.3. By Storage Type (In Value %)

7.4. By Application Mode (In Value %)

7.5. By Region (In Value %)

8. Germany Green Hydrogen Market Future Outlook

8.1. Future Market Size Projections (In USD Mn)

8.2. Key Factors Influencing Future Growth

8.3. Emerging Opportunities for Market Expansion

9. Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Go-to-Market Strategies for Emerging Players

9.3. White Space Opportunity Analysis

9.4. Regional Expansion Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves a thorough analysis of stakeholders within the Germany Green Hydrogen Market, leveraging both secondary research and proprietary data to understand key variables that drive market dynamics, such as production capacity, technological advancements, and policy initiatives.

Step 2: Market Analysis and Construction

This phase aggregates and evaluates historical data, particularly focusing on Germany's hydrogen production trends, sector adoption rates, and geographical factors influencing distribution. The goal is to provide a clear picture of market penetration and regional growth.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed based on initial findings and validated through direct interviews with industry professionals, including green hydrogen producers, technology providers, and regulatory experts, ensuring comprehensive insights from the field.

Step 4: Research Synthesis and Final Output

Engagements with major hydrogen production companies supplement data accuracy, allowing for validation of statistics obtained through secondary sources, resulting in a well-rounded, precise report on the Germany Green Hydrogen Market.

Frequently Asked Questions

01. How big is the Germany Green Hydrogen Market?

The Germany Green Hydrogen Market is valued at UDS 500 million, driven by the expansion of renewable energy resources and targeted government incentives supporting sustainable energy transition initiatives.

02. What are the challenges in the Germany Green Hydrogen Market?

Key challenges in the Germany Green Hydrogen Market include high production costs relative to traditional hydrogen, limited infrastructure for distribution, and the need for regulatory clarity on hydrogen applications in different sectors.

03. Who are the major players in the Germany Green Hydrogen Market?

Key companies in the Germany Green Hydrogen Market include Siemens Energy, Linde Plc, Thyssenkrupp AG, Air Liquide, and ITM Power, all of which have significant hydrogen production projects and strategic partnerships in Germany.

04. What are the growth drivers of the Germany Green Hydrogen Market?

The Germany Green Hydrogen Market growth is supported by Germanys National Hydrogen Strategy, which aims to reduce carbon emissions in industries such as steel and transport, combined with substantial EU funding and renewable resource availability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.