Global 300cc Motorcycle Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5509

November 2024

97

About the Report

Global 300cc Motorcycle Market Overview

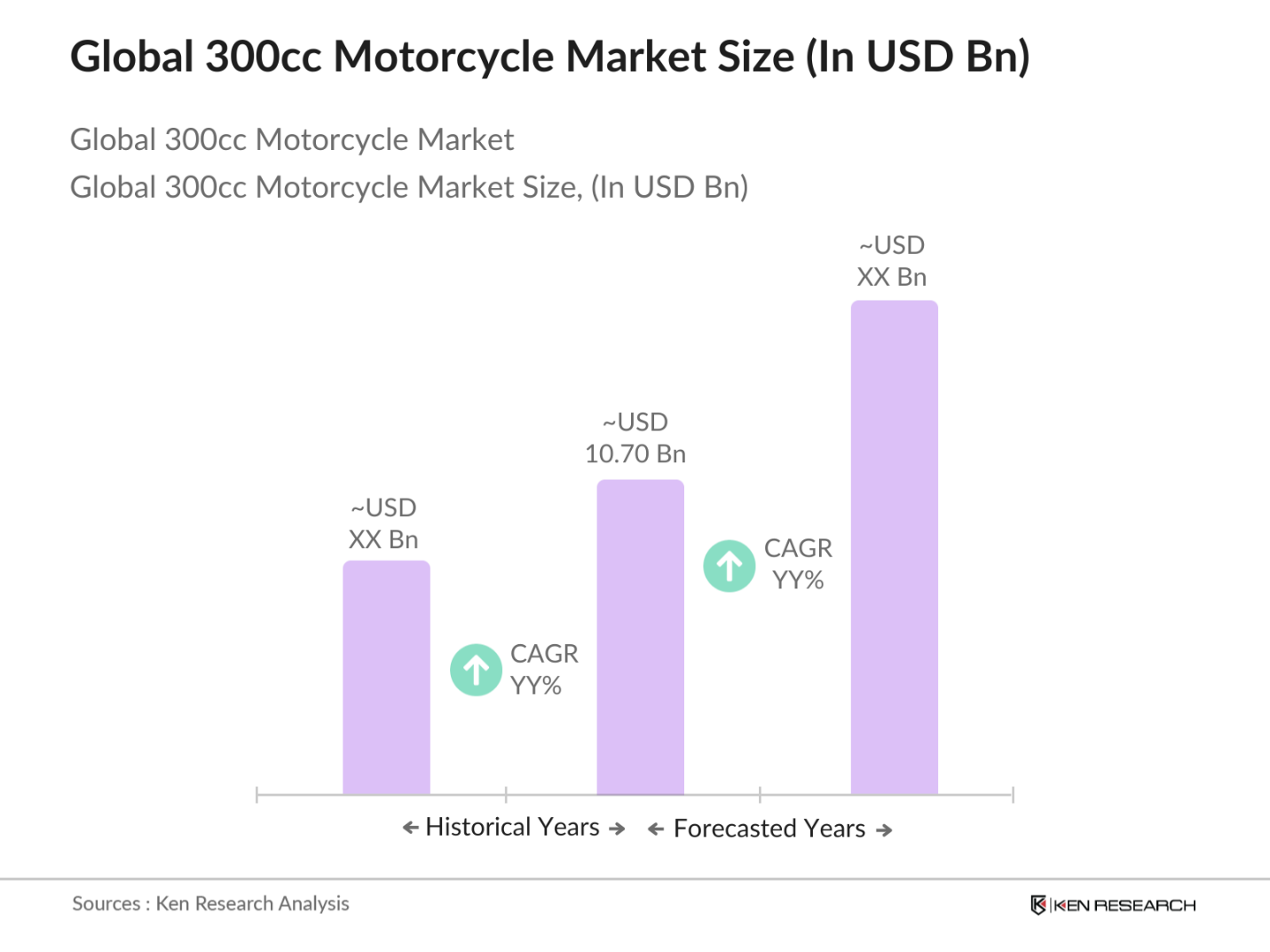

- The global 300cc motorcycle market is valued at USD 10.70 billion, with a strong demand driven by consumer preferences for motorcycles that balance performance and affordability. The increasing adoption of motorcycles in both urban and rural areas, combined with a growing motorcycle touring culture, has driven the demand for this segment. Rising middle-class income levels and favorable government regulations promoting two-wheeled vehicles are additional factors fueling the market.

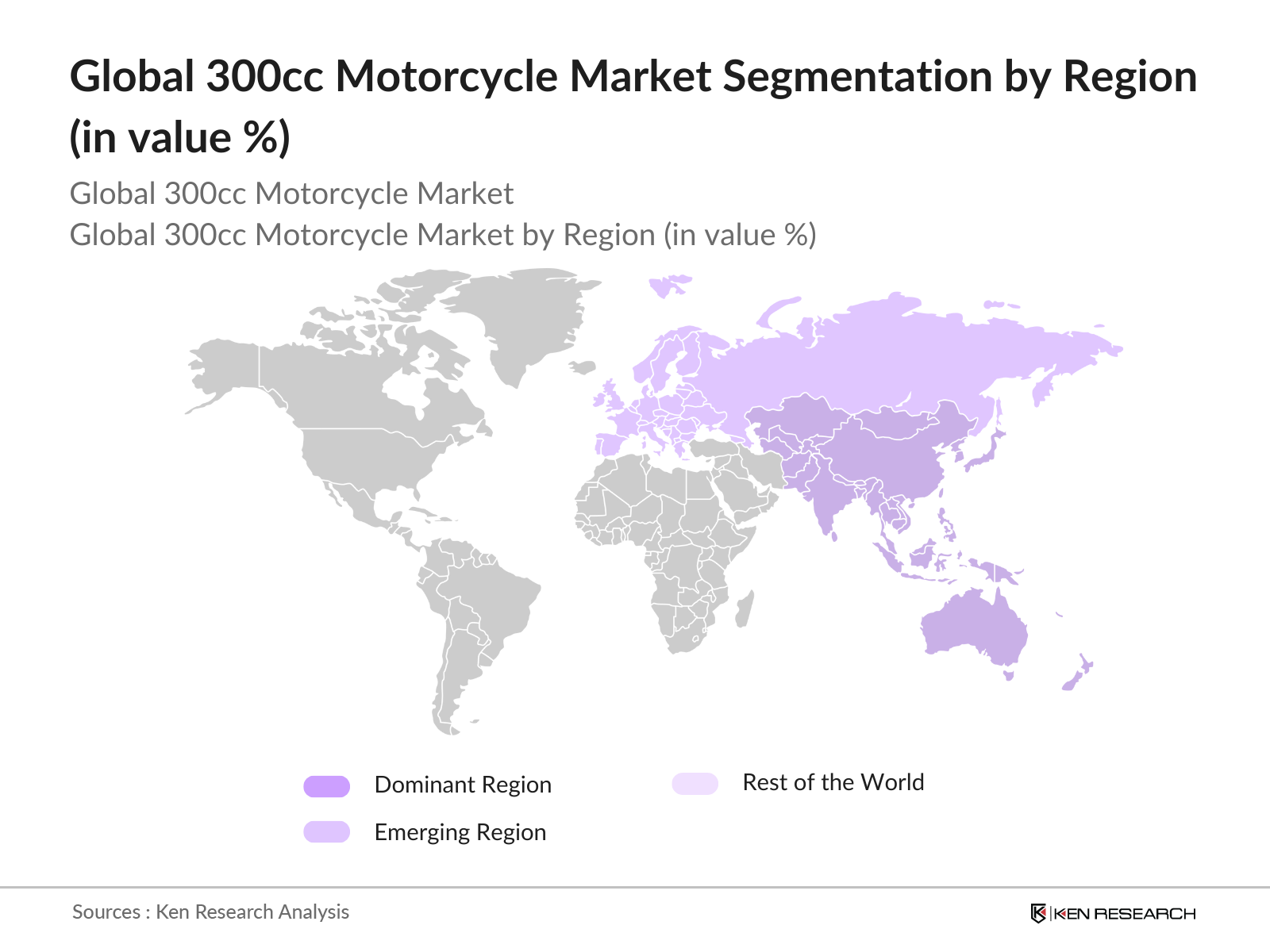

- Asia-Pacific, particularly India and Thailand, dominates the 300cc motorcycle market due to a large population, favorable climatic conditions for motorcycling year-round, and significant urban commuting needs. In India, the increasing number of young riders seeking performance-oriented motorcycles for both commuting and leisure contributes to the segment's dominance. Thailands well-developed motorcycle infrastructure and consumer preference for two-wheelers further strengthen its market leadership.

- Several countries have introduced favorable import-export policies to promote the growth of the motorcycle industry. For example, Thailand, a major hub for motorcycle manufacturing, benefits from reduced tariffs under the ASEAN Free Trade Agreement, allowing manufacturers to export motorcycles at lower costs within the region. According to the World Trade Organization, Thailand has seen a rise in motorcycle exports, with over 500,000 units shipped annually to neighboring countries. These reduced tariffs make it more economical to import 300cc motorcycles, promoting cross-border trade and enhancing market growth.

Global 300cc Motorcycle Market Segmentation

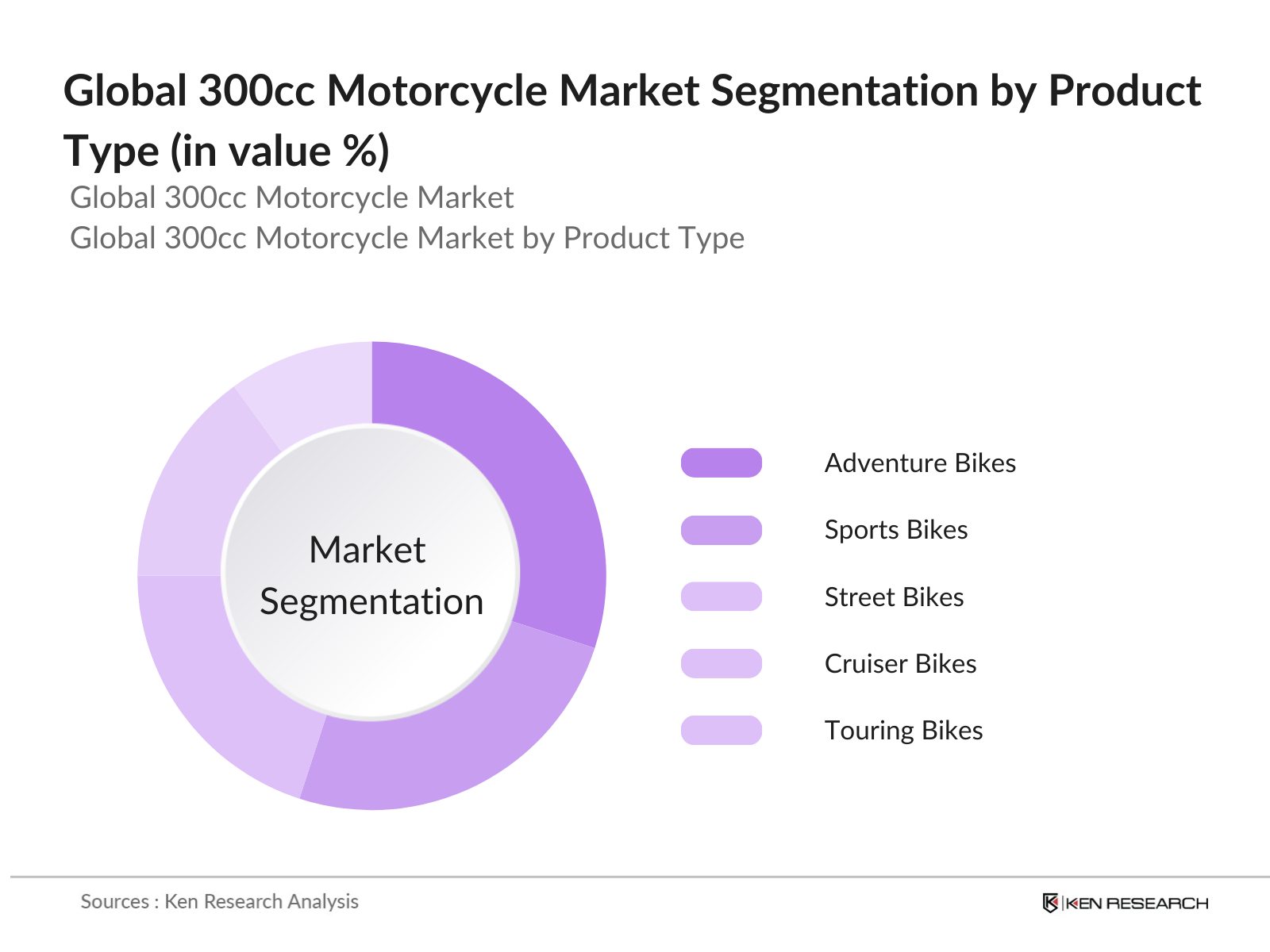

By Product Type: The global 300cc motorcycle market is segmented by product type into street bikes, cruiser bikes, adventure bikes, sports bikes, and touring bikes. Adventure bikes hold a dominant market share within this segment due to their versatility, combining off-road capability with everyday commuting practicality. This sub-segment appeals to both professional riders and hobbyists, driving sales across multiple regions.

By Region: The global 300cc motorcycle market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific dominates the market, driven by large consumer bases in countries like India, Indonesia, and Thailand, where motorcycles are a primary mode of transportation. Urbanization and the popularity of two-wheelers in these regions ensure sustained demand.

Global 300cc Motorcycle Market Competitive Landscape

The global 300cc motorcycle market is consolidated with key players holding significant influence. Companies like Yamaha, Honda, and KTM continue to dominate through extensive product portfolios and strong brand loyalty. These companies also benefit from well-established dealership networks and innovations in motorcycle technology, such as advanced braking systems and fuel efficiency.

|

Company |

Year Established |

Headquarters |

No. of Employees |

Revenue |

Product Range |

Dealership Network |

R&D Investments |

Inception Year |

Market Share |

|

Yamaha Motor Co., Ltd |

1955 |

Japan |

|||||||

|

Honda Motor Co., Ltd |

1948 |

Japan |

|||||||

|

KTM AG |

1934 |

Austria |

|||||||

|

Bajaj Auto Ltd. |

1945 |

India |

|||||||

|

Royal Enfield |

1955 |

India |

Global 300cc Motorcycle Market Analysis

Market Growth Drivers

- Rising Middle-Class Income: The rising income levels of the middle class, particularly in emerging markets like India and Southeast Asia, have led to a surge in the demand for affordable and mid-range motorcycles, such as those in the 300cc segment. In India, the middle-class population is projected to grow significantly, with household incomes between $10,000 to $50,000 annually increasing, according to the World Bank. This rise in disposable income has allowed consumers to invest in motorcycles for personal transportation and leisure. Additionally, motorcycle sales in emerging markets have grown by over 20 million units annually, bolstering the 300cc market.

- Expansion of Motorcycle Touring Culture: Motorcycle touring has gained popularity globally, especially in Europe, North America, and Southeast Asia, where the culture of long-distance bike touring is expanding. The 300cc motorcycle segment has benefited from this, with affordable adventure bikes catering to both novice and experienced riders. In regions like Europe, the tourism industry supports motorcycle touring, contributing around $2 trillion to global tourism revenue, as reported by the United Nations World Tourism Organization (UNWTO). This cultural shift is pushing manufacturers to release more 300cc adventure models, adding to the markets growth.

- Government Regulations Promoting Two-Wheelers: Governments in countries like India, Thailand, and Brazil are implementing policies to promote two-wheeler ownership as part of their efforts to reduce traffic congestion and lower carbon emissions. For instance, Indias government has introduced subsidies and tax benefits for two-wheeler purchases under its National Electric Mobility Mission Plan, aiming to encourage more people to adopt fuel-efficient motorcycles. These policies have led to a noticeable rise in two-wheeler registrations, with government data reflecting significant growth in demand for affordable and fuel-efficient motorcycles like those in the 300cc segment.

Market Challenges:

- High Costs of Premium Models: The high price of premium 300cc motorcycles remains a challenge, particularly in developing markets. In countries like Brazil, the average cost of a premium 300cc bike can be as high as $6,000, compared to lower-capacity bikes, which cost around $1,500. This substantial cost disparity limits the accessibility of premium models to a broader audience, according to data from Brazil's Institute of Applied Economic Research. While financing options exist, many lower-middle-income buyers opt for more affordable models or second-hand bikes, thus curbing market penetration.

- Competition from Electric Two-Wheelers: Electric two-wheelers are rapidly gaining traction as governments push for electric mobility to curb pollution and reliance on fossil fuels. Countries like China and India are leading the shift, with electric two-wheeler sales surpassing 5 million units annually in China alone, according to Chinas National Bureau of Statistics. As a result, traditional 300cc motorcycles face increasing competition from electric counterparts, which offer lower operational costs and are supported by government subsidies. This has made it harder for gasoline-powered motorcycles to compete, particularly in regions with stringent emission regulations.

Global 300cc Motorcycle Market Future Outlook

Over the next five years, the global 300cc motorcycle market is expected to show moderate but steady growth driven by increasing urbanization, demand for affordable transportation, and rising middle-class incomes. Technological advancements, such as better fuel efficiency and enhanced safety features, will further drive adoption, while regions like Asia-Pacific will continue to lead due to their large, growing population and reliance on motorcycles for daily commuting.

Market Opportunities:

- Emerging Markets Expansion: Emerging markets such as Southeast Asia, Africa, and Latin America offer immense growth opportunities for the 300cc motorcycle market. In Africa, motorcycle sales have increased dramatically in the past decade, with Nigeria and Kenya becoming key markets. According to the African Development Bank, the motorcycle industry in Africa supports over 1.5 million jobs and is crucial to both urban and rural transportation. These regions present untapped potential, especially as income levels rise, and infrastructure development improves access to rural areas, enabling more motorcycle purchases.

- Technological Advancements in Motorcycle Design: Technological innovations are driving the growth of the 300cc motorcycle segment, particularly with the integration of advanced features such as ride-by-wire, anti-lock braking systems (ABS), and traction control, which were previously available only in higher-end models. Manufacturers are introducing these technologies in mid-range motorcycles to enhance safety and performance, making them more appealing to consumers. In the U.S., safety regulations mandating the inclusion of ABS in new motorcycles have increased demand for 300cc bikes with advanced features, according to the National Highway Traffic Safety Administration.

Scope of the Report

|

By Product Type |

Street Bikes Cruiser Bikes Adventure Bikes Sports Bikes Touring Bikes |

|

By Application |

Commuting Leisure Touring |

|

By Technology |

Carbureted Fuel Injection ABS Traction Control |

|

By Engine Type |

Single-Cylinder Engines Twin-Cylinder Engines Hybrid Powertrains |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Motorcycle Manufacturers

Dealerships and Distributors

Government and Regulatory Bodies (Ministry of Transport, Emission Regulatory Agencies)

Investment and Venture Capital Firms

Motorcycle Component Suppliers

Aftermarket Service Providers

Ride-Sharing Companies

Insurance Providers

Companies

Players Mention in the Report

Yamaha Motor Co., Ltd.

Honda Motor Co., Ltd.

KTM AG

Bajaj Auto Ltd.

Royal Enfield (Eicher Motors Ltd.)

Suzuki Motor Corporation

Harley-Davidson, Inc.

BMW Motorrad

TVS Motor Company

Hero MotoCorp Ltd.

Kawasaki Heavy Industries

Piaggio & C. SpA

Ducati Motor Holding S.p.A.

CFMoto

Benelli QJ

Table of Contents

01. Global 300cc Motorcycle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global 300cc Motorcycle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global 300cc Motorcycle Market Analysis

3.1. Growth Drivers

3.1.1. Rising Middle-Class Income

3.1.2. Increasing Adoption for Daily Commuting

3.1.3. Expansion of Motorcycle Touring Culture

3.1.4. Government Regulations Promoting Two-Wheelers

3.2. Market Challenges

3.2.1. High Costs of Premium Models

3.2.2. Competition from Electric Two-Wheelers

3.2.3. Fluctuating Fuel Prices

3.3. Opportunities

3.3.1. Emerging Markets Expansion

3.3.2. Technological Advancements in Motorcycle Design

3.3.3. Availability of Financing Options

3.4. Trends

3.4.1. Integration of Advanced Features (ABS, Ride-by-Wire)

3.4.2. Growth in Customization Market

3.4.3. Popularity of Adventure Bikes in the 300cc Segment

3.5. Government Regulations

3.5.1. Emission Standards and Compliance

3.5.2. Import-Export Tariffs on Motorcycles

3.5.3. Safety Regulations (ABS, Traction Control Requirements)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Global 300cc Motorcycle Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Street Bikes

4.1.2. Cruiser Bikes

4.1.3. Adventure Bikes

4.1.4. Sports Bikes

4.1.5. Touring Bikes

4.2. By Application (In Value %)

4.2.1. Commuting

4.2.2. Leisure

4.2.3. Touring

4.3. By Technology (In Value %)

4.3.1. Carbureted

4.3.2. Fuel Injection

4.3.3. ABS (Anti-lock Braking System)

4.3.4. Traction Control

4.4. By Engine Type (In Value %)

4.4.1. Single-Cylinder Engines

4.4.2. Twin-Cylinder Engines

4.4.3. Hybrid Powertrains

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global 300cc Motorcycle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Yamaha Motor Co., Ltd.

5.1.2. Honda Motor Co., Ltd.

5.1.3. Kawasaki Heavy Industries

5.1.4. Suzuki Motor Corporation

5.1.5. BMW Motorrad

5.1.6. KTM AG

5.1.7. Bajaj Auto Ltd.

5.1.8. Royal Enfield (Eicher Motors Ltd.)

5.1.9. TVS Motor Company

5.1.10. Hero MotoCorp Ltd.

5.1.11. Harley-Davidson, Inc.

5.1.12. Ducati Motor Holding S.p.A.

5.1.13. Piaggio & C. SpA

5.1.14. CFMoto

5.1.15. Benelli QJ

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Inception Year, Product Range, R&D Investments, Dealership Network, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global 300cc Motorcycle Market Regulatory Framework

6.1. Emission Standards (Euro 5, BS-VI)

6.2. Safety Regulations (Mandatory ABS, Traction Control)

6.3. Import/Export Laws

07. Global 300cc Motorcycle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global 300cc Motorcycle Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Engine Type (In Value %)

8.5. By Region (In Value %)

09. Global 300cc Motorcycle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, key variables affecting the global 300cc motorcycle market were identified, such as consumer demand, regional preferences, and technological advancements. This involved extensive desk research using proprietary databases to establish a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

Here, historical data was compiled and analyzed to assess market penetration, revenue generation, and overall market size. This stage involved the assessment of demand across different regions, coupled with a review of key market segments and consumer behavior.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated through expert consultations. Key stakeholders from motorcycle manufacturing companies and distributors were interviewed, providing insights into consumer trends, technological changes, and future growth opportunities.

Step 4: Research Synthesis and Final Output

Data was synthesized and verified through direct engagement with industry experts and primary research. This allowed for an accurate and comprehensive analysis of the global 300cc motorcycle market, ensuring the reliability of the final output.

Frequently Asked Questions

01. How big is the Global 300cc Motorcycle Market?

The global 300cc motorcycle market is valued at USD 10.70 billion, driven by demand for affordable and high-performance motorcycles, particularly in regions like Asia-Pacific.

02. What are the challenges in the Global 300cc Motorcycle Market?

Challenges include competition from electric vehicles, fluctuating fuel prices, and stringent emission regulations that may affect the cost of production and motorcycle affordability.

03. Who are the major players in the Global 300cc Motorcycle Market?

Key players include Yamaha Motor Co., Ltd., Honda Motor Co., Ltd., KTM AG, Bajaj Auto Ltd., and Royal Enfield, among others. These companies dominate due to their extensive product ranges, strong brand loyalty, and innovation in technology.

04. What drives the Global 300cc Motorcycle Market?

The market is driven by rising urbanization, increasing disposable incomes, and consumer preferences for motorcycles that offer a balance between performance and fuel efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.