Global 3D Cellular Models Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD985

October 2024

84

About the Report

Global 3D Cellular Models Market Overview

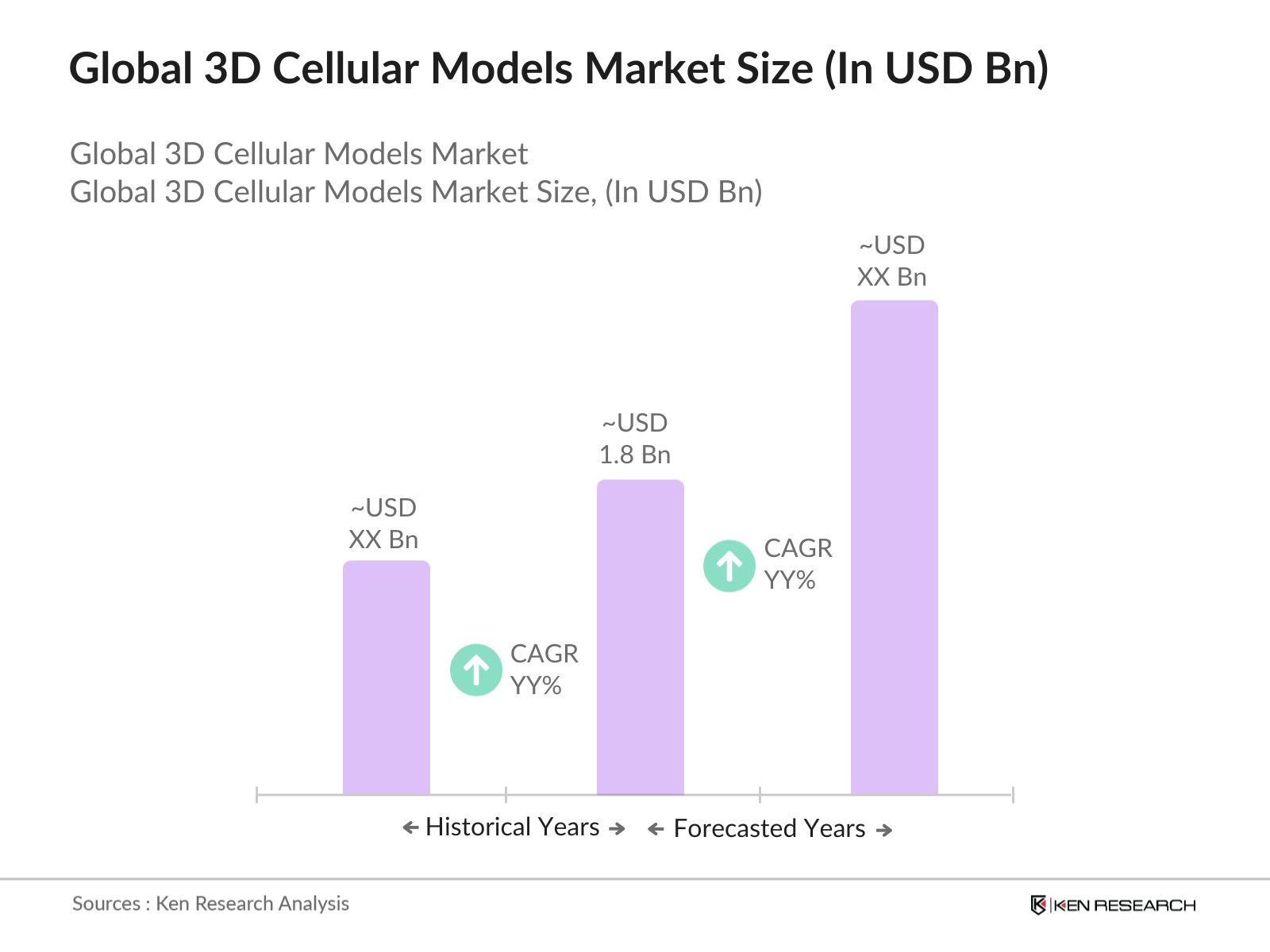

- The Global 3D Cellular Models Market was valued at USD 1.8 billion in 2023. The market growth is primarily driven by the increasing adoption of 3D cellular models in drug discovery and development, owing to their ability to closely mimic the human physiological environment compared to traditional 2D models. This trend is expected to continue as pharmaceutical and biotechnology companies increasingly rely on these models for more accurate predictions of drug efficacy and toxicity.

- Key Players in the market are Thermo Fisher Scientific, Corning Incorporated, Lonza Group, Merck KGaA, and 3D Biotek. These companies have established a strong presence in the market by offering a wide range of products, including 3D cell culture platforms, reagents, and related services. Their extensive distribution networks and continuous investment in research and development have further solidified their market position.

- In 2023, Thermo Fisher Scientific participated as a founding sponsor of Momentum Labs, a biotech hub in Alachua, Florida. This initiative aims to foster innovation in 3D cellular models and support biotech startups, enhancing Thermo Fisher's role in advancing research and development in the life sciences sector.

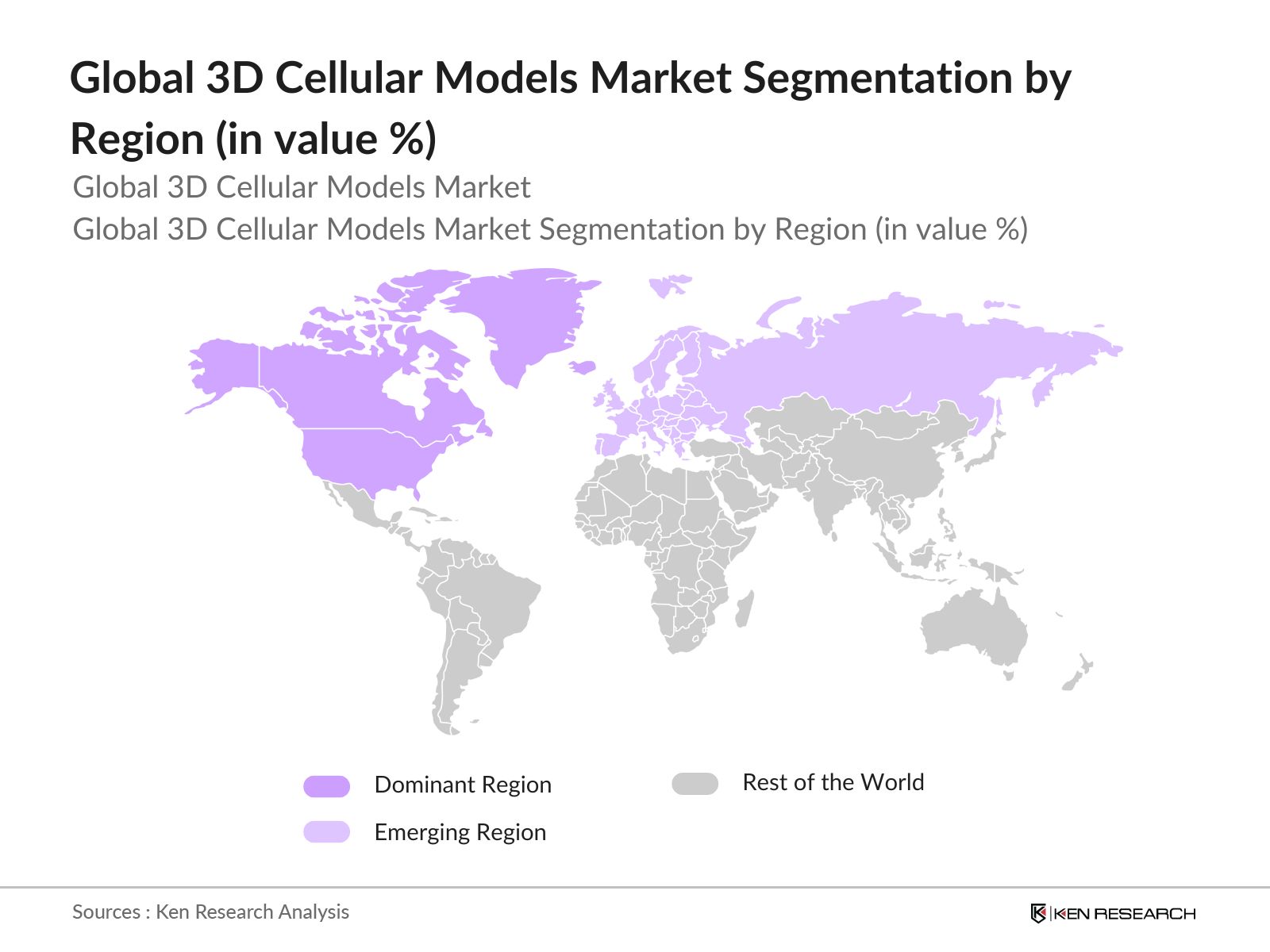

- The United States, dominated the market in 2023, the regions strong focus on personalized medicine and its well-established regulatory framework for drug development have further supported the growth of the market in North America.

Global 3D Cellular Models Market Segmentation

The market is segmented into various factors like product, application and region.

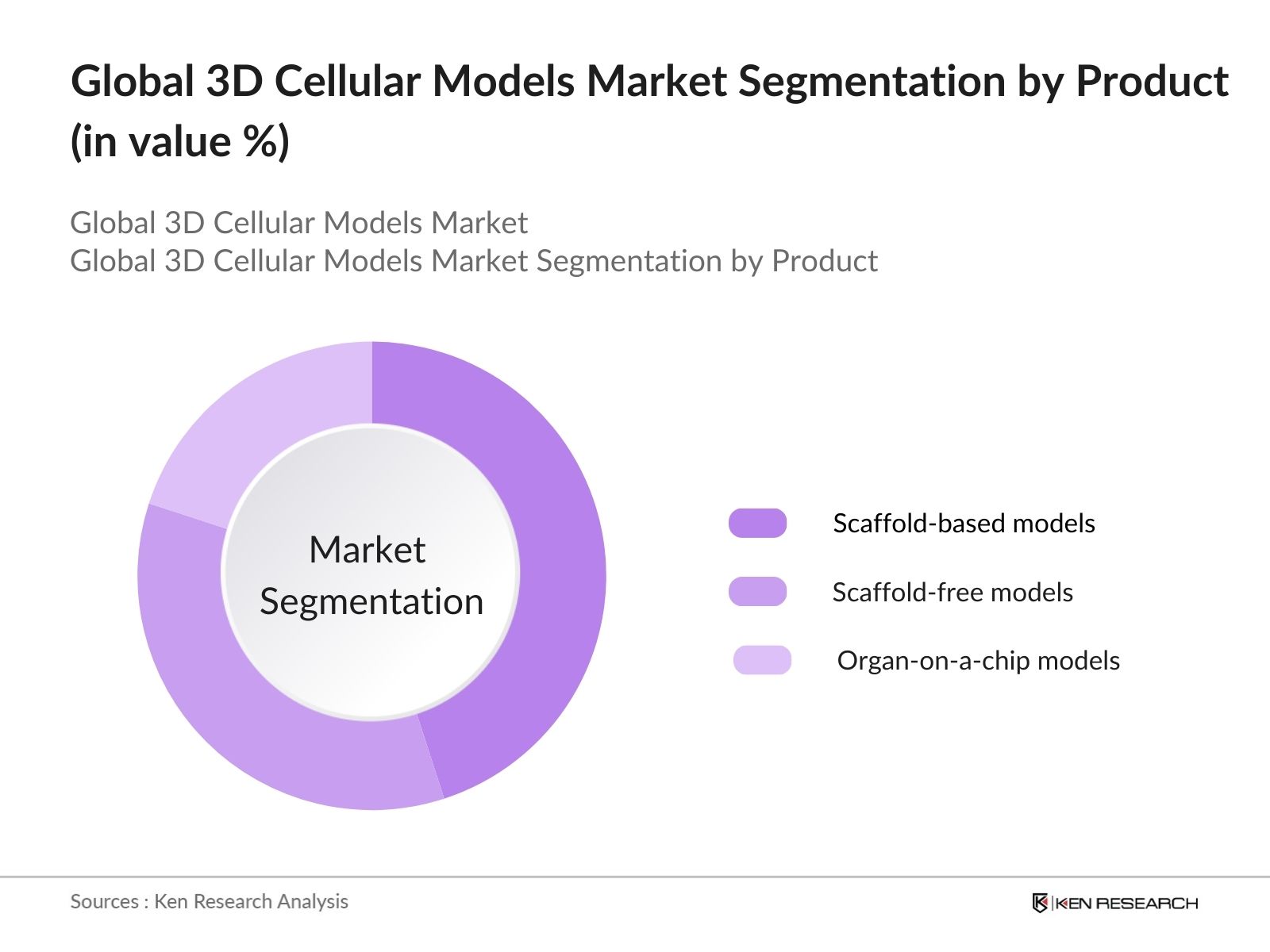

By Product: The market is segmented by product type into scaffold-based models, scaffold-free models, and organ-on-a-chip models. In 2023, scaffold-based models held the largest market share, due to the wide application of scaffold-based models in drug discovery, toxicology testing, and tissue engineering. Scaffold-based models provide a structural framework that closely mimics the extracellular matrix, allowing cells to grow and interact in a more physiologically relevant manner.

By Application: The market is segmented by application into drug discovery and development, toxicology testing, cancer research, and stem cell research. In 2023, drug discovery and development were the dominant application segment, with the increasing need for more accurate preclinical models to predict human responses to new drugs is driving the demand for 3D cellular models in this segment.

By Region: The market is segmented by region into North America, Europe, APAC, MEA, and Latin America. North America was the leading region in 2023, due to the presence of a large number of pharmaceutical and biotechnology companies, advanced healthcare infrastructure, and significant government support for research and development.

Global 3D Cellular Models Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Thermo Fisher Scientific |

1956 |

Waltham, Massachusetts, USA |

|

Corning Incorporated |

1851 |

Corning, New York, USA |

|

Lonza Group |

1897 |

Basel, Switzerland |

|

Merck KGaA |

1668 |

Darmstadt, Germany |

|

3D Biotek |

2008 |

New Jersey, USA |

- Corning Incorporated: Corning Incorporated introduced a new 3D cell culture platform in 2023, which utilizes advanced microfluidic technology to create more physiologically relevant cell models. This innovation has garnered significant attention from the pharmaceutical industry, as it offers a more accurate representation of human tissues, thereby improving the predictability of drug responses.

- 3D Biotek: 3D Biotek is set to launch its fully automatic 3D-CES system in Q3 2024, designed for large-scale expansion of anchorage-dependent cells, achieving up to 500 million cells per run. The launch of the 3D-CES system comes at a time when the demand for advanced in vitro models is increasing, driven by the need for more accurate and predictive tools for drug development and toxicology testing.

Global 3D Cellular Models Market Analysis

Market Growth Drivers

- Increased Adoption of 3D Cellular Models in Drug Discovery: The pharmaceutical industry is increasingly integrating 3D cellular models into their drug discovery and development processes. In 2024, over 350 active drug development programs were reported to incorporate 3D cellular models for preclinical testing. This shift is driven by the need for more accurate in vitro models that can better mimic human physiology compared to traditional 2D cell cultures.

- Regulatory Push for Alternatives to Animal Testing: In 2024, regulatory bodies such as the FDA and the European Medicines Agency (EMA) have intensified their push for alternatives to animal testing, mandating the use of more ethical and accurate testing methods in drug development. The FDAs commitment of USD 200 million towards research and development of 3D cellular models underscores the shift towards these models as a standard in preclinical testing.

- Expansion of Contract Research Organizations (CROs): In 2024, there were over 200 CROs worldwide offering 3D cellular model-based services, with the top 10 companies generating combined revenues exceeding USD 4 billion. These organizations are providing pharmaceutical and biotechnology companies with access to advanced 3D cellular models without the need for significant internal investment, thereby accelerating the adoption of these technologies.

Market Challenges

- Lack of Standardization in 3D Cell Culture Techniques: In 2024, variability in research outcomes due to non-standardized methods was reported in over 40% of studies involving 3D cellular models. This inconsistency can hinder the reproducibility of results, which is critical for regulatory approval and widespread adoption. The industrys efforts to develop and implement standardized protocols are ongoing, but this remains a significant hurdle.

- Technical Complexity and Long Learning Curve: The technical complexity associated with 3D cellular models and the steep learning curve for researchers and technicians present a challenge to the market. In 2024, over 30% of laboratories reported difficulties in transitioning from 2D to 3D cell cultures, citing challenges such as cell viability, nutrient diffusion, and scalability.

Government Initiatives

- European Union's Horizon Europe Program: The European Unions Horizon Europe program, with a budget of EUR 95.5 billion for 2021-2027, has allocated significant funding toward the development of 3D cellular models and other advanced in vitro technologies. In 2024, over EUR 200 million was directed specifically towards projects focused on reducing animal testing through the use of 3D cellular models.

- U.S. Government's Investment in Advanced In Vitro Models: In 2024, the U.S. government supported to the "Innovative In Vitro Models Initiative," aimed at advancing the development and commercialization of 3D cellular models and other in vitro technologies. This funding is expected to support collaborations between academic institutions, biotech companies, and regulatory bodies, fostering innovation and accelerating the adoption of 3D cellular models in drug development.

Global 3D Cellular Models Market Future Outlook

The future trends in the global 3D cellular models industry include increased adoption of 3D cellular models in precision medicine, expansion of organ-on-a-chip technologies, growing demand for ethical testing alternatives, and the integration of artificial intelligence with 3D cellular models to enhance drug discovery processes.

Future Market Trends

- Increased Adoption of 3D Cellular Models in Precision Medicine: Over the next five years, the adoption of 3D cellular models in precision medicine is expected to grow significantly, driven by the need for more accurate and patient-specific drug testing. By 2028, it is estimated that more drug development programs worldwide will incorporate 3D cellular models.

- Expansion of Organ-on-a-Chip Technologies: The market for organ-on-a-chip technologies, a subset of 3D cellular models, is projected to experience substantial growth by 2028. These technologies, which replicate the functions of human organs on microchips, are expected to become a standard tool in drug development and toxicology testing.

Scope of the Report

|

By Product |

Scaffold-Based Models Scaffold-Free Models Organ-on-a-Chip Models |

|

By Application |

Drug Discovery & Development Toxicology Testing Cancer Research Stem Cell Research |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical Companies

Biotechnology Companies

Hospitals & Diagnostic Laboratories

Venture Capitalists & Investors

Government & Public Health Agencies

Drug Development Companies

Toxicology Testing Companies

Personalized Medicine Developers

Tissue Engineering Companies

Companies

Players Mentioned in the Report:

Thermo Fisher Scientific

Corning Incorporated

Lonza Group

Merck KGaA

3D Biotek

TissUse GmbH

InSphero AG

Hurel Corporation

MIMETAS BV

Emulate, Inc.

SynVivo

Kirkstall Ltd

Synthecon, Inc.

Global Cell Solutions, Inc.

Advanced Biomatrix

Table of Contents

1. Global 3D Cellular Models Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global 3D Cellular Models Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global 3D Cellular Models Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption in Drug Discovery

3.1.2. Rising Investments in Biotechnology R&D

3.1.3. Regulatory Push for Alternatives to Animal Testing

3.1.4. Expansion of Contract Research Organizations (CROs)

3.2. Restraints

3.2.1. High Cost of 3D Cellular Models Development

3.2.2. Lack of Standardization in 3D Cell Culture Techniques

3.2.3. Technical Complexity and Long Learning Curve

3.2.4. Ethical Concerns and Regulatory Scrutiny

3.3. Opportunities

3.3.1. Technological Advancements in 3D Bioprinting

3.3.2. Expansion into Personalized Medicine

3.3.3. Integration with AI for Enhanced Drug Discovery

3.3.4. Increased Funding from Government Initiatives

3.4. Trends

3.4.1. Growing Demand for Ethical Testing Alternatives

3.4.2. Expansion of Organ-on-a-Chip Technologies

3.4.3. Integration of Artificial Intelligence in 3D Models

3.4.4. Adoption in Precision Medicine

3.5. Government Regulation

3.5.1. U.S. Innovative In Vitro Models Initiative

3.5.2. European Union's Horizon Europe Program

3.5.3. China's National Health Innovation Program

3.5.4. Japan's Regenerative Medicine Promotion Program

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global 3D Cellular Models Market Segmentation, 2023

4.1. By Product Type (in Value %

4.1.1. Scaffold-Based Models

4.1.2. Scaffold-Free Models

4.1.3. Organ-on-a-Chip Models

4.2. By Application (in Value %)

4.2.1. Drug Discovery & Development

4.2.2. Toxicology Testing

4.2.3. Cancer Research

4.2.4. Stem Cell Research

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. APAC

4.3.4. MEA

4.3.5. Latin America

5. Global 3D Cellular Models Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Thermo Fisher Scientific

5.1.2. Corning Incorporated

5.1.3. Lonza Group

5.1.4. Merck KGaA

5.1.5. 3D Biotek

5.1.6. TissUse GmbH

5.1.7. InSphero AG

5.1.8. Hurel Corporation

5.1.9. MIMETAS BV

5.1.10. Emulate, Inc.

5.1.11. SynVivo

5.1.12. Kirkstall Ltd

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global 3D Cellular Models Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global 3D Cellular Models Market Regulatory Framework

7.1. Ethical Standards and Compliance

7.2. Certification and Approval Processes

7.3. Regional Regulatory Differences

8. Global 3D Cellular Models Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global 3D Cellular Models Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Region (in Value %)

10. Global 3D Cellular Models Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for the Global 3D Cellular Models industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple biotechnology companies and understand the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through the bottom to top approaches from such biotechnology companies.

Frequently Asked Questions

01 How big is the Global 3D Cellular Models market?

The Global 3D Cellular Models Market was valued at USD 1.8 billion in 2023. The market growth is primarily driven by the increasing adoption of 3D cellular models in drug discovery and development, owing to their ability to closely mimic the human physiological environment compared to traditional 2D models.

02 What are the challenges in the Global 3D Cellular Models market?

Challenges in the Global 3D Cellular Models market include such as the high cost of developing and maintaining 3D cellular models, lack of standardization in 3D cell culture techniques, technical complexity and long learning curve, and ethical concerns related to the use of human-derived cells.

03 Who are the major players in the Global 3D Cellular Models market?

Key players in the Global 3D Cellular Models market include Thermo Fisher Scientific, Corning Incorporated, Lonza Group, Merck KGaA, and 3D Biotek. These companies are leaders in the development and distribution of 3D cell culture technologies and related products.

04 What are the main growth drivers of the Global 3D Cellular Models market?

The growth of the Global 3D Cellular Models market includes the increasing adoption of 3D cellular models in drug discovery, rising investments in biotechnology and pharmaceutical R&D, regulatory push for alternatives to animal testing, and the expansion of contract research organizations (CROs) specializing in 3D cell culture technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.