Global Accelerated Processing Unit Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10635

December 2024

85

About the Report

Global Accelerated Processing Unit Market Overview

- The Global Accelerated Processing Unit (APU) Market, valued at USD 13.8 billion, has experienced steady growth driven by demand for efficient data processing and graphics integration in personal computing and gaming. APUs combine central and graphics processing capabilities, significantly enhancing computing performance while reducing power consumption. This demand has been bolstered by advancements in AI and the need for energy-efficient solutions in consumer and enterprise sectors.

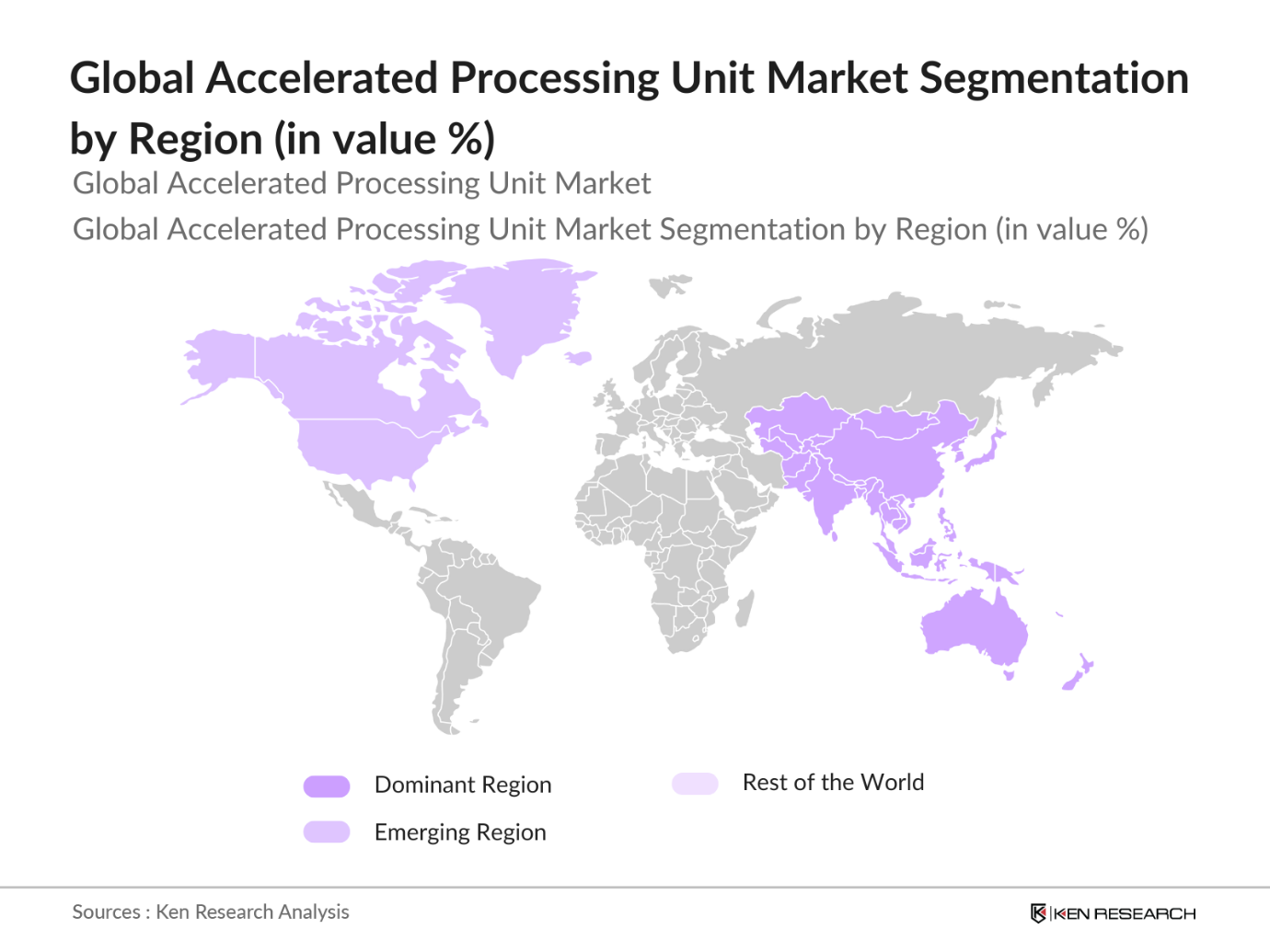

- The market is notably influenced by North America and Asia Pacific, with the U.S., China, and Japan leading due to high investments in semiconductor technologies, established tech infrastructure, and significant consumer bases for gaming and computing devices. These regions also benefit from strong R&D facilities, skilled workforce, and government initiatives supporting the semiconductor industry.

- Governments are providing subsidies and incentives to accelerate semiconductor advancements. In 2024, the IMF noted that global subsidies in this sector surpassed $50 billion, aimed at promoting technological innovations, including APUs. These incentives support the development of more advanced, sustainable APUs, fostering growth in the semiconductor industry.

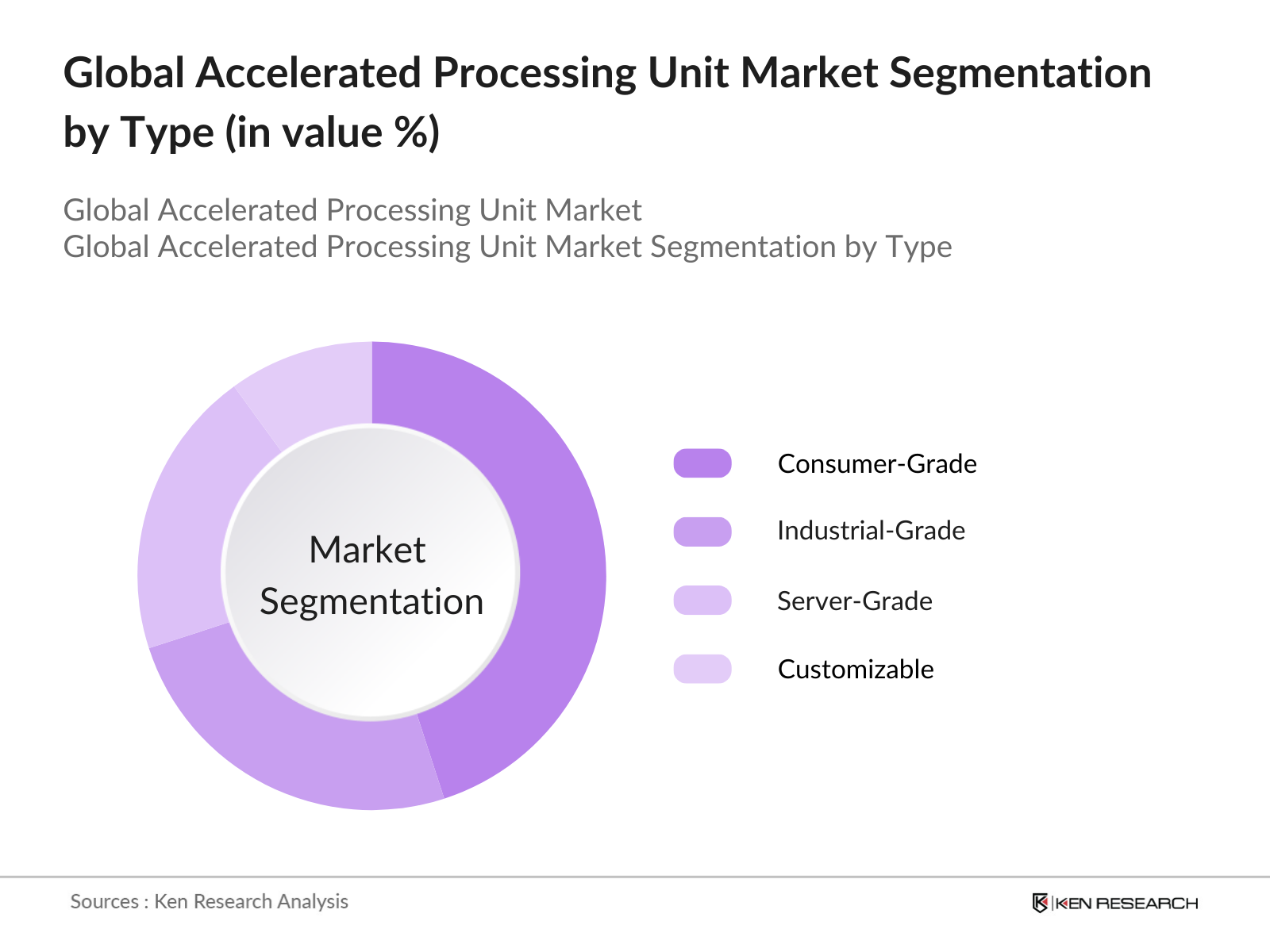

Global Accelerated Processing Unit Market Segmentation

By Type: The APU market is segmented by type into Consumer-Grade, Industrial-Grade, Server-Grade, and Customizable APUs. Consumer-Grade APUs have the highest market share, primarily due to the demand from gaming enthusiasts and personal computer users who value performance and energy efficiency. Brands like AMD and Intel cater to this segment with products that support HD graphics and fast processing speeds.

By Region: The regional segmentation includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific has a dominant share, driven by the tech manufacturing hubs in China and Taiwan, along with the high demand for gaming and consumer electronics in Japan and South Korea. The region’s advantage lies in cost-effective production, advanced R&D facilities, and a strong supply chain network.

By Application: The market is also segmented by application, including Personal Computing, Gaming Consoles, Automotive, Data Centers, and AI & Machine Learning Processing. Gaming Consoles lead the market as they integrate APUs to enhance graphics and computing power for seamless gaming experiences. Major console manufacturers leverage APUs to meet the demand for high-performance gaming systems.

Global Accelerated Processing Unit Market Competitive Landscape

The Global Accelerated Processing Unit (APU) Market is characterized by competition among a few major players who leverage technological innovation, strategic partnerships, and customer-focused offerings.

Global Accelerated Processing Unit Industry Analysis

Growth Drivers

- Rising Demand for High-Performance Computing: The demand for high-performance computing has surged due to the increasing needs in industries such as healthcare, finance, and defense, which rely on data-intensive operations. According to the World Bank, global IT spending for processing-intensive tasks is estimated at $4.5 trillion as of 2024, with many companies prioritizing high-performance infrastructure to support complex applications. This shift has led to increased adoption of APUs, which integrate CPU and GPU capabilities to handle large volumes of data, enhancing processing speed and computational power across sectors.

- Expanding Applications in AI and Machine Learning: Applications of APUs in artificial intelligence (AI) and machine learning (ML) are growing as they offer the required computational strength. In 2024, global AI investments reached $230 billion, with countries like the U.S. and China leading in APU adoption to support the processing needs of AI systems, per IMF data. This expansion is evident in healthcare and retail sectors, where APUs facilitate AI-driven predictive analytics, enhancing efficiency.

- Shift to Energy-Efficient Processing Units: With a global push towards sustainability, energy-efficient APUs are gaining traction. The World Bank reported that in 2024, global electricity demand from data centers reached 400 TWh, necessitating energy-efficient processors to reduce power consumption. APUs offer significant energy savings in high-processing environments, contributing to a 15-20% reduction in power use in comparison to traditional CPUs in extensive operational deployments.

Market Restraints

- Limited Market Awareness (Awareness and Education): Despite technological advancements, there remains limited awareness about APUs in many sectors. The World Bank data indicates that in 2024, only about 40% of businesses in emerging markets are familiar with advanced processing units, impeding widespread adoption. This lack of awareness often leads to slower uptake of APU solutions in sectors where they could offer significant benefits.

- Technical Limitations in Complex Processing (Processing Constraints): While APUs provide integrated processing capabilities, certain high-end applications face processing constraints. According to World Bank findings, industries requiring extreme computational power, such as high-end scientific research, still face a 25% lag in processing speed with current APUs compared to standalone GPUs, impacting the broader utility of APUs in advanced research applications.

Global Accelerated Processing Unit Market Future Outlook

The Accelerated Processing Unit (APU) Market is projected to grow further as demand for integrated processing units rises across industries. With technology continuously evolving, APUs will find increased adoption in next-gen applications, such as autonomous driving and advanced AI computations. Major investments in semiconductor manufacturing and infrastructure, coupled with the shift towards greener technologies, will foster market expansion, especially in the Asia Pacific and North American regions.

Market Opportunities

- Advancements in Integrated Graphics Processing: Advances in integrated graphics processing are enhancing APUs’ performance-to-cost ratio, making them viable for broader market applications. In 2024, graphics demand in consumer electronics rose by 30%, aligning with the availability of efficient APUs. The World Bank reports an expansion in the graphics processing sector, valued at approximately $280 billion, with APUs offering affordable solutions for integrated graphics needs in consumer and industrial electronics.

- Market Expansion in Emerging Economies: Emerging markets in Asia and Latin America are experiencing a rise in APU adoption, driven by increased investment in IT infrastructure. In 2024, IT spending in these regions reached nearly $500 billion, with notable uptake in processing technologies, particularly in India and Brazil, where APUs are being incorporated into public and private sector applications.

Scope of the Report

|

By Type |

Consumer-Grade Industrial-Grade Server-Grade Customizable |

|

By Application |

Personal Computing Gaming Consoles Automotive Data Centers AI & ML Processing |

|

By Technology |

GPU Integration CPU Integration FPGA-Enhanced Hybrid Integration |

|

By Core Count |

Dual-Core Quad-Core Octa-Core Multi-Core |

|

By End-User |

Consumer Electronics IT & Telecom Automotive Defense & Aerospace Healthcare |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Semiconductor Manufacturers

Gaming Console Manufacturers

Automotive and Mobility Companies

Data Center Providers

Consumer Electronics Firms

Government and Regulatory Bodies (e.g., U.S. Federal Trade Commission, European Commission)

AI and Machine Learning Solution Providers

Companies

Players Mentioned in the Report:

AMD (Advanced Micro Devices)

Intel Corporation

Nvidia Corporation

Qualcomm Technologies, Inc.

MediaTek Inc.

Samsung Electronics

Arm Holdings

Broadcom Inc.

Apple Inc.

Texas Instruments Incorporated

Table of Contents

1. Global Accelerated Processing Unit (APU) Market Overview

Definition and Scope

Market Taxonomy

Market Dynamics Overview

Market Segmentation Summary

2. Global Accelerated Processing Unit (APU) Market Size (in USD Mn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

3. Global Accelerated Processing Unit (APU) Market Analysis

Growth Drivers

Rising Demand for High-Performance Computing

Expanding Applications in AI and Machine Learning (Market Adoption Rate)

Shift to Energy-Efficient Processing Units (Power Consumption Efficiency)

Influence of 5G and IoT Integration

Market Challenges

High R&D Costs

Limited Market Awareness (Awareness and Education)

Technical Limitations in Complex Processing (Processing Constraints)

Opportunities

Advancements in Integrated Graphics Processing (Performance-to-Cost Ratio)

Market Expansion in Emerging Economies (APU Adoption in Asia and Latin America)

Increasing Demand for Customizable APU Solutions

Trends

Rising Hybrid Cloud Deployments

Growing Integration with Quantum Computing

Innovations in Multi-Functional APU Architectures

Government Regulations

Emission Standards for Processing Units

Energy-Efficiency Certifications

Subsidies and Incentives for Semiconductor Advancements

4. Global Accelerated Processing Unit (APU) Market Segmentation

By Type (in Value %)

Consumer-Grade APUs

Industrial-Grade APUs

Server-Grade APUs

Customizable APUs

By Application (in Value %)

Personal Computing

Gaming Consoles

Automotive (ADAS, Infotainment Systems)

Data Centers and Cloud Servers

AI and Machine Learning Processing

By Technology (in Value %)

GPU Integration

CPU Integration

FPGA-Enhanced APUs

Hybrid Integration (APU + ASIC)

By Core Count (in Value %)

Dual-Core APUs

Quad-Core APUs

Octa-Core APUs

Multi-Core (Beyond Octa)

By End-User Industry (in Value %)

Consumer Electronics

IT & Telecommunication

Automotive

Defense & Aerospace

Healthcare

5. Global Accelerated Processing Unit (APU) Market Competitive Analysis

Detailed Profiles of Major Companies

AMD (Advanced Micro Devices)

Intel Corporation

Nvidia Corporation

Qualcomm Technologies, Inc.

Arm Holdings

Apple Inc.

Samsung Electronics

Broadcom Inc.

MediaTek Inc.

Texas Instruments Incorporated

Marvell Technology Group Ltd.

Fujitsu Limited

Toshiba Corporation

VIA Technologies, Inc.

Huawei Technologies Co., Ltd.

Cross Comparison Parameters

Innovation Index (Patent Count)

Revenue and Market Share

Global Reach and Regional Presence

Employee Strength

Research and Development Spending

Partnership Ecosystem

Production Capacity (APU Units)

Customization Capability (Industry-Specific APUs)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Government Grants and Incentives

6. Global Accelerated Processing Unit (APU) Market Regulatory Framework

Standards for APU Integration and Interoperability

Safety and Quality Certifications

Environmental Regulations for Semiconductor Manufacturing

Compliance and Certification Processes

Export and Trade Regulations for APUs

7. Global Accelerated Processing Unit (APU) Future Market Size (in USD Mn)

Projected Market Growth

Key Drivers Influencing Future Market Demand

9. Global Accelerated Processing Unit (APU) Future Market Segmentation

By Type (in Value %)

By Application (in Value %)

By Technology (in Value %)

By Core Count (in Value %)

By Region (in Value %)

10. Global Accelerated Processing Unit (APU) Market Analysts Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis (Tech-Oriented vs. Consumer-Centric)

Market Entry Strategies

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping the APU market's ecosystem, identifying key stakeholders, and gathering foundational industry data. This step includes data from secondary sources such as reputable industry reports, financial databases, and technology publications to outline market variables.

Step 2: Market Analysis and Construction

Historical data and trends in the APU market are analyzed, including market penetration rates, average consumer spending, and growth rates across different regions. Market dynamics are examined to determine segment performance and demand patterns.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and drivers are developed and validated through expert interviews and consultations with industry stakeholders. Insights from these interviews are crucial to refining our market forecasts and verifying the data accuracy.

Step 4: Research Synthesis and Final Output

In this stage, the data is cross-referenced with direct feedback from key players in the APU industry to ensure accuracy and reliability. This process also involves checking data consistency and completing a validated and comprehensive report output.

Frequently Asked Questions

1. How big is the Global Accelerated Processing Unit (APU) Market?

The APU market is valued at USD 13.8 billion, driven by its use in personal computing and gaming applications, alongside growing integration in AI.

2. What are the challenges in the APU Market?

Challenges include high R&D expenses, increasing competition from traditional processors, and limitations in handling complex computing tasks that require specialized processing capabilities.

3. Who are the major players in the APU Market?

The major players include AMD, Intel, Nvidia, Qualcomm, and MediaTek, recognized for their innovation and strategic partnerships in the semiconductor industry.

4. What are the growth drivers of the APU Market?

Key drivers include the demand for energy-efficient processing, increased applications in AI and machine learning, and rising adoption of high-performance gaming consoles and personal computers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.