Global Advanced Composites Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD9512

November 2024

99

About the Report

Global Advanced Composites Market Overview

- The global advanced composites market, valued at $42.5 billion, is primarily driven by the rising demand for lightweight and high-strength materials across diverse industries, including aerospace, automotive, and renewable energy. These materials offer enhanced durability and performance while meeting strict regulatory standards, especially in sectors prioritizing fuel efficiency and emission reductions. With technological advancements improving production processes, advanced composites are becoming more accessible, further driving their adoption in high-performance applications.

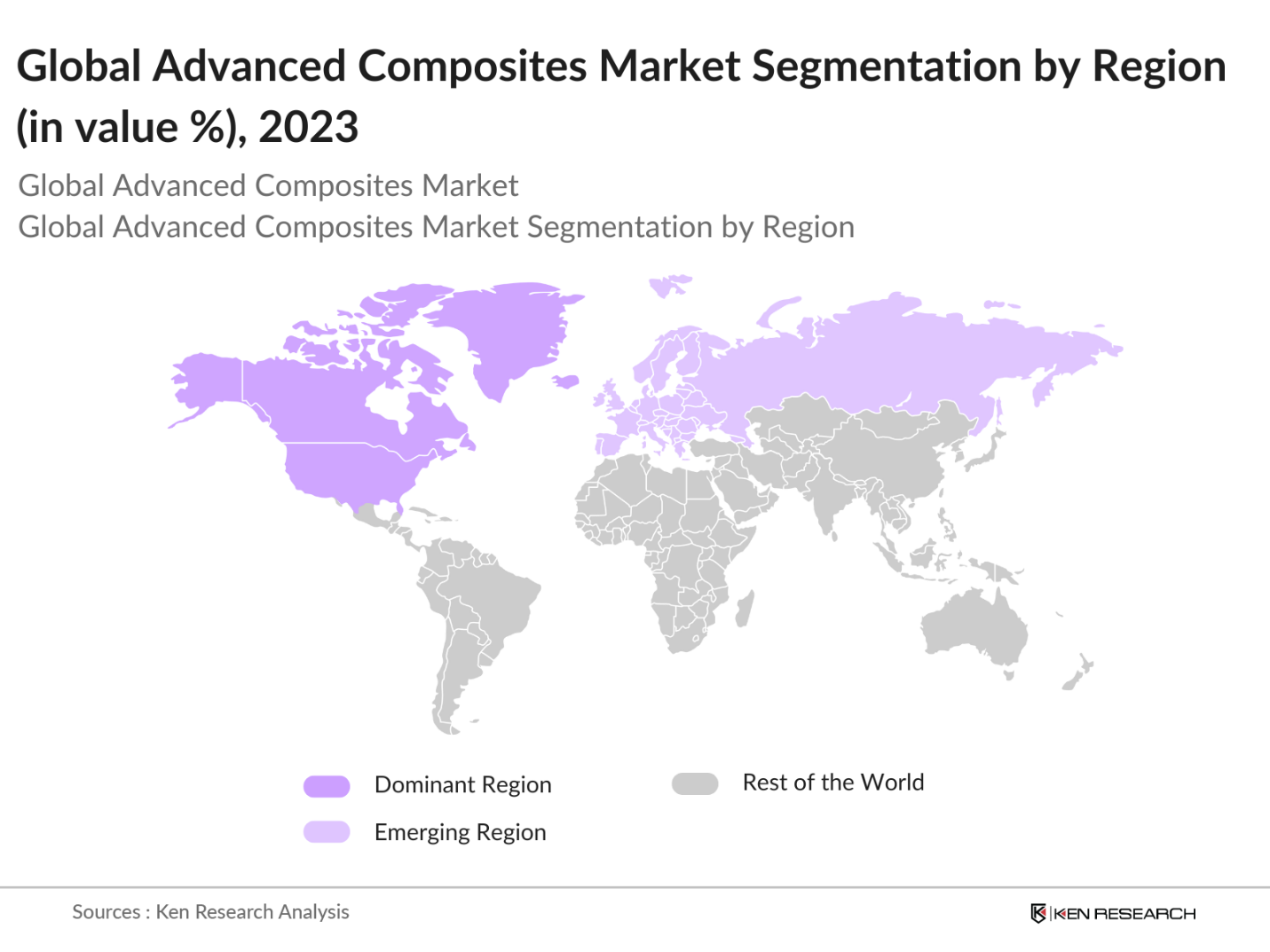

- North America and Europe are the dominant regions in the advanced composites market. North America's leadership is attributed to its robust aerospace and automotive industries, coupled with substantial investments in research and development. Europe's dominance stems from its focus on renewable energy projects, particularly wind energy, which extensively uses advanced composites for turbine blades.

- Thermoplastic composites are gaining popularity due to their recyclability and faster processing times. In 2023, the thermoplastic composites market was valued at $36.5 billion, with applications spanning automotive, aerospace, and consumer goods. Their ability to be reshaped and reprocessed makes them attractive for industries seeking sustainable material solutions.

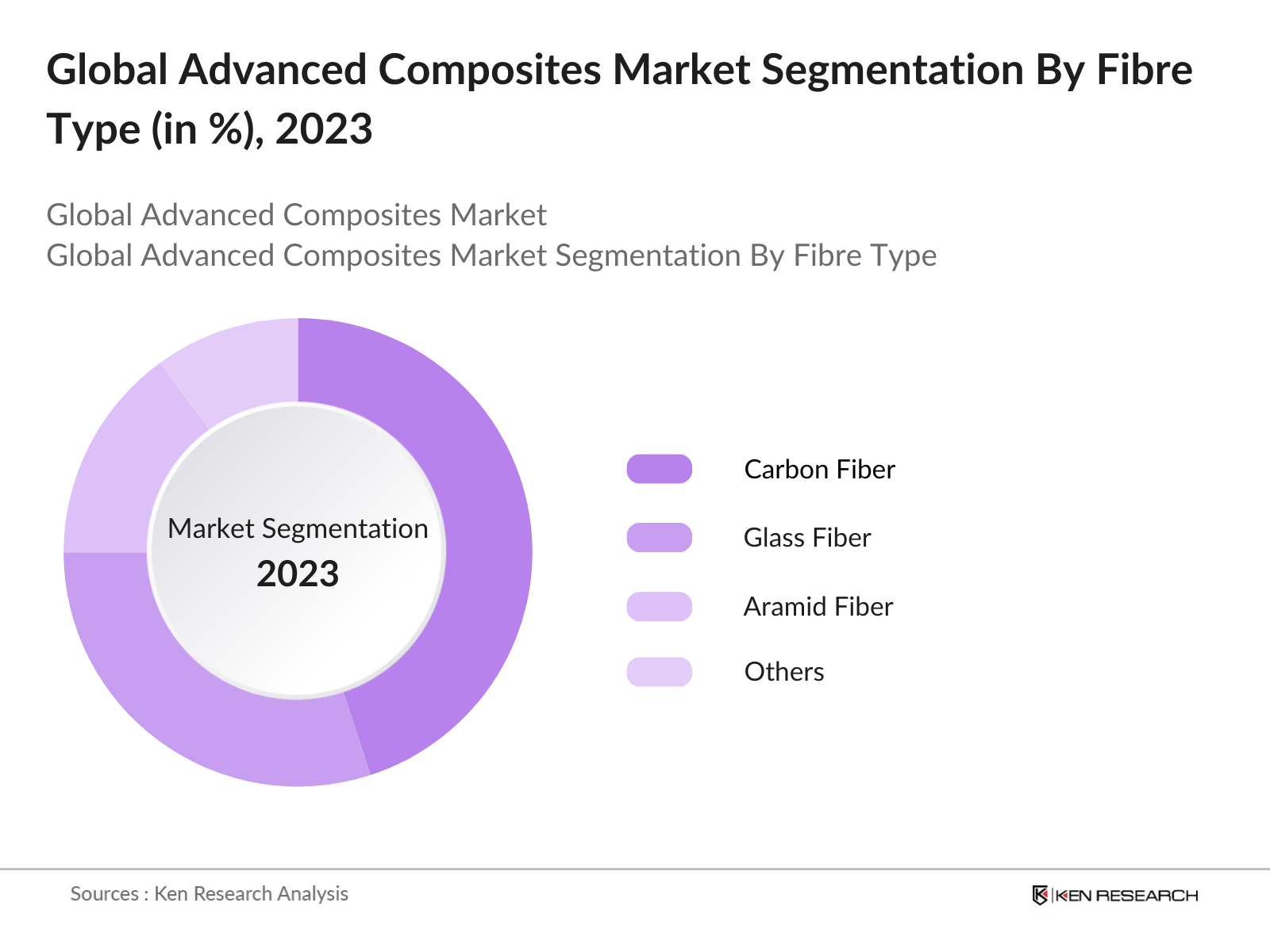

Global Advanced Composites Market Segmentation

By Fiber Type: The advanced composites market is segmented by fiber type into carbon fiber, glass fiber, aramid fiber, and others. Carbon fiber holds a dominant market share due to its superior strength-to-weight ratio and widespread application in aerospace, automotive, and wind energy sectors.

By Region: The advanced composites market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America leads the market, driven by its advanced aerospace and automotive industries, along with significant investments in research and development.

By Resin Type: The market is categorized by resin type into thermosetting and thermoplastic resins. Thermosetting resins dominate the market, primarily because of their high-temperature resistance and structural integrity, making them suitable for aerospace and automotive applications.

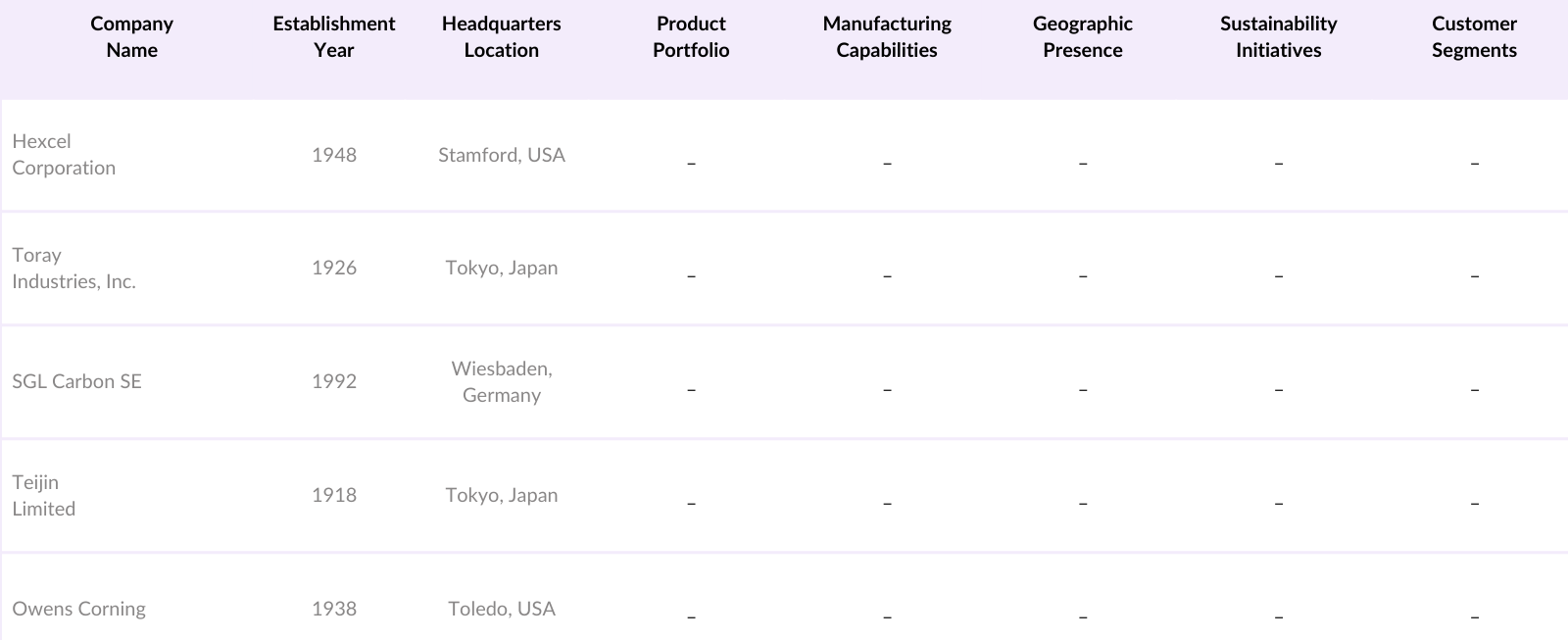

Global Advanced Composites Market Competitive Landscape

The global advanced composites market is characterized by the presence of several key players who contribute to its growth and development. The table below provides an overview of five major companies in the market:

Global Advanced Composites Industry Analysis

Growth Drivers

- Demand in Aerospace and Defense: The aerospace and defense sectors are significant consumers of advanced composites due to their need for lightweight, high-strength materials. In 2023, the global military expenditure reached $2.24 trillion, reflecting a continuous investment in defense capabilities. The United States, for instance, allocated $801 billion to its defense budget in 2023, emphasizing the procurement of advanced materials for aircraft and defense systems. This substantial spending underscores the critical role of advanced composites in modern military applications.

- Adoption in Automotive Sector: The automotive industry is increasingly integrating advanced composites to enhance fuel efficiency and reduce emissions. In 2023, global vehicle production was approximately 85 million units, with manufacturers focusing on lightweight materials to meet stringent emission standards. For example, the European Union has set a target of 95 grams of CO per kilometer for new cars, prompting automakers to adopt composites to achieve these goals.

- Expansion in Wind Energy Applications: The wind energy sector relies on advanced composites for manufacturing durable and efficient turbine blades. In 2023, global wind power capacity reached 837 gigawatts, with significant installations in countries like China and the United States. The U.S. Department of Energy reported that wind energy accounted for 8.4% of the nation's electricity generation in 2023, highlighting the growing importance of composites in renewable energy infrastructure.

Market Challenges

- High Production Costs: The production of advanced composites involves significant costs due to expensive raw materials and complex manufacturing processes. For example, carbon fiber composites can cost between $10 to $20 per pound, compared to steel at approximately $0.50 per pound. This cost disparity poses a challenge for widespread adoption, particularly in cost-sensitive industries.

- Recycling Limitations: Recycling advanced composites remains a challenge due to the difficulty in separating fibers from resin matrices. As a result, a significant portion of composite waste ends up in landfills. In 2023, it was estimated that over 50,000 tons of composite waste were generated globally, with limited recycling solutions available. This environmental concern necessitates the development of more efficient recycling technologies.

Global Advanced Composites Market Future Outlook

Over the next five years, the global advanced composites market is expected to experience significant growth. This expansion is driven by the increasing adoption of lightweight materials in aerospace and automotive industries, advancements in manufacturing technologies, and the rising demand for renewable energy solutions. The development of sustainable and recyclable composite materials is also anticipated to open new avenues for market growth.

Opportunities

- Growth in Emerging Markets: Emerging economies are investing in infrastructure and industrial development, creating opportunities for advanced composites. In 2023, India's infrastructure spending was projected to reach $1.4 trillion, with significant allocations for transportation and energy sectors. Similarly, Southeast Asian countries are investing in aerospace and automotive industries, driving demand for composite materials.

- Applications in Healthcare and Electronics: Advanced composites are finding new applications in healthcare and electronics due to their biocompatibility and electrical conductivity. In 2023, the global medical devices market was valued at $603 billion, with composites being used in prosthetics, implants, and diagnostic equipment. Additionally, the electronics industry is incorporating composites in components like circuit boards and casings to enhance performance and durability.

Scope of the Report

|

Fiber Type |

Carbon Fiber Glass Fiber Aramid Fiber Others |

|

Resin Type |

Thermosetting Thermoplastic |

|

Manufacturing Process |

Automated Tape Laying (ATL) Hand Layup/Spray Layup Filament Winding Pultrusion Resin Transfer Molding (RTM) Compression Molding Injection Molding, Others |

|

End-User |

Aerospace and Defense Automotive Energy and Power Sports Equipment Industrial Applications |

|

Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Aerospace and Defense Manufacturing Industries

Automotive OEMs and Supplier Companies

Wind Energy Equipment Manufacturing Companies

Sports Equipment Manufacturing Companies

Industrial Equipment Manufacturing Companies

Construction Material Supplier Companies

Government and Regulatory Bodies (e.g., U.S. Department of Defense, European Aviation Safety Agency)

Investment and Venture Capital Firms

Companies

Players Mentioned in the Report

Hexcel Corporation

Toray Industries, Inc.

SGL Carbon SE

Teijin Limited

Owens Corning

Mitsubishi Chemical Holdings Corporation

Cytec Solvay Group

Tencate Advanced Composites

Nippon Carbon Co., Ltd.

Huntsman Corporation

Table of Contents

1. Global Advanced Composites Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Advanced Composites Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Advanced Composites Market Analysis

3.1 Growth Drivers

3.1.1 Demand in Aerospace and Defense

3.1.2 Adoption in Automotive Sector

3.1.3 Expansion in Wind Energy Applications

3.1.4 Technological Innovations in Manufacturing

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Recycling Limitations

3.2.3 Raw Material Supply Chain Issues

3.3 Opportunities

3.3.1 Growth in Emerging Markets

3.3.2 Applications in Healthcare and Electronics

3.3.3 Development of Sustainable Materials

3.4 Trends

3.4.1 Nanotechnology Integration

3.4.2 Increase in Thermoplastic Composites

3.4.3 Automation in Composite Manufacturing

3.5 Government Regulations

3.5.1 Environmental Compliance Standards

3.5.2 Trade and Tariff Policies

3.5.3 Certification and Safety Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Global Advanced Composites Market Segmentation

4.1 By Fiber Type (In Value %)

4.1.1 Carbon Fiber

4.1.2 Glass Fiber

4.1.3 Aramid Fiber

4.1.4 Others

4.2 By Resin Type (In Value %)

4.2.1 Thermosetting

4.2.2 Thermoplastic

4.3 By Manufacturing Process (In Value %)

4.3.1 Automated Tape Laying (ATL)

4.3.2 Hand Layup/Spray Layup

4.3.3 Filament Winding

4.3.4 Pultrusion

4.3.5 Resin Transfer Molding (RTM)

4.3.6 Compression Molding

4.3.7 Injection Molding

4.3.8 Others

4.4 By End-User (In Value %)

4.4.1 Aerospace and Defense

4.4.2 Automotive

4.4.3 Energy and Power

4.4.4 Sports Equipment

4.4.5 Industrial Applications

5. Global Advanced Composites Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Hexcel Corporation

5.1.2 Toray Industries, Inc.

5.1.3 SGL Carbon SE

5.1.4 Teijin Limited

5.1.5 Owens Corning

5.1.6 Mitsubishi Chemical Holdings Corporation

5.1.7 Cytec Solvay Group

5.1.8 Tencate Advanced Composites

5.1.9 Nippon Carbon Co., Ltd.

5.1.10 Huntsman Corporation

5.1.11 DuPont de Nemours, Inc.

5.1.12 Zoltek Corporation

5.1.13 Hexion Inc.

5.1.14 BASF SE

5.1.15 3B-the Fibreglass Company

5.2 Cross Comparison Parameters (Revenue, Product Portfolio, Manufacturing Capabilities, Geographic Presence, Sustainability Initiatives, Customer Segments, Innovation Investments, Quality Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Investments

5.8 Government Subsidies and Grants

6. Global Advanced Composites Market Regulatory Framework

6.1 Environmental Standards and Compliance

6.2 Industry-Specific Safety Requirements

6.3 Certification and Testing Standards

6.4 Trade Regulations and Tariffs

7. Global Advanced Composites Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors for Future Growth

8. Global Advanced Composites Future Market Segmentation

8.1 By Fiber Type (In Value %)

8.2 By Resin Type (In Value %)

8.3 By Manufacturing Process (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Advanced Composites Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Targeted Marketing Initiatives

9.4 White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global advanced composites market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global advanced composites market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple composite material manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the global advanced composites market.

Frequently Asked Questions

01. How big is the global advanced composites market?

The global advanced composites market was valued at $42.5 billion, driven by increasing demand across aerospace, automotive, and renewable energy sectors.

02. What are the challenges in the global advanced composites market?

Challenges include high production costs, limited recycling options, and supply chain constraints for raw materials, which can impact market growth and profitability.

03. Who are the major players in the global advanced composites market?

Key players include Hexcel Corporation, Toray Industries, Inc., SGL Carbon SE, Teijin Limited, and Owens Corning, dominating due to their extensive product portfolios and global presence.

04. What are the growth drivers of the global advanced composites market?

The market is propelled by the adoption of lightweight materials in aerospace and automotive industries, technological advancements in manufacturing, and the expansion of renewable energy projects.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.