Global Agricultural Equipment Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-012

June 2025

80

About the Report

Global Agricultural Equipment Market Overview

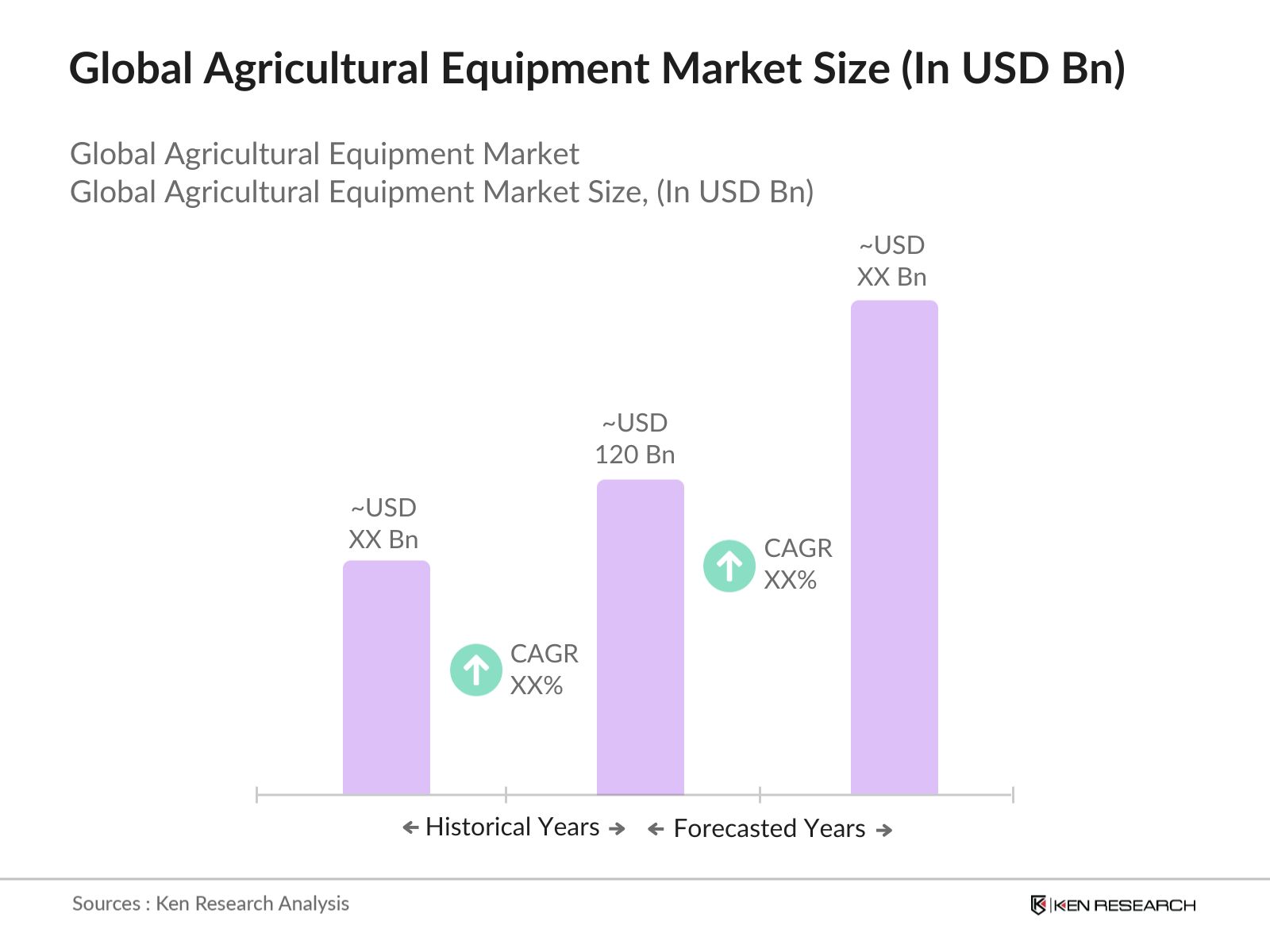

- The Global Agricultural Equipment Market was valued at USD 120 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in technology, increasing demand for food production, and the need for efficient farming practices. The market has seen a surge in the adoption of precision agriculture and automation, which enhances productivity and reduces labor costs.

- Key players in this market include the United States, Germany, and Japan. The dominance of these countries can be attributed to their strong agricultural sectors, technological innovations, and significant investments in research and development. The presence of major manufacturers and a robust supply chain further solidify their positions in the global market.

- In 2024, the U.S. government implemented new regulations aimed at promoting sustainable agricultural practices. This includes incentives for farmers to adopt eco-friendly equipment and technologies, with a budget allocation to support research and development in sustainable farming methods. The initiative is designed to reduce the environmental impact of agriculture while enhancing productivity.

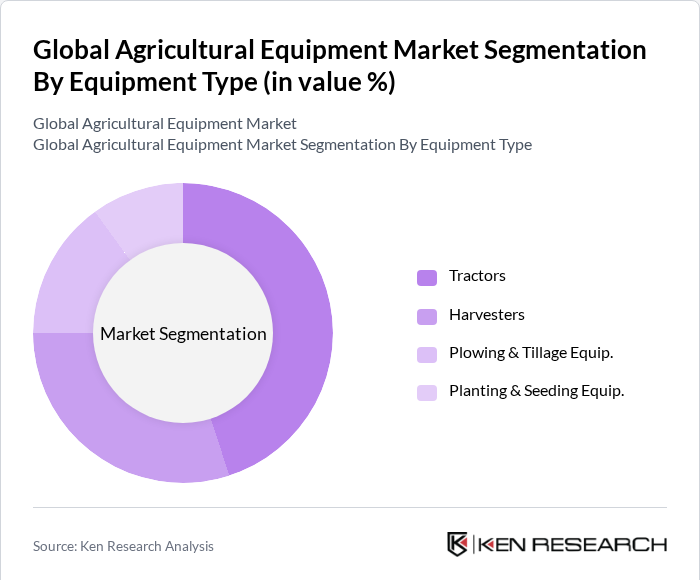

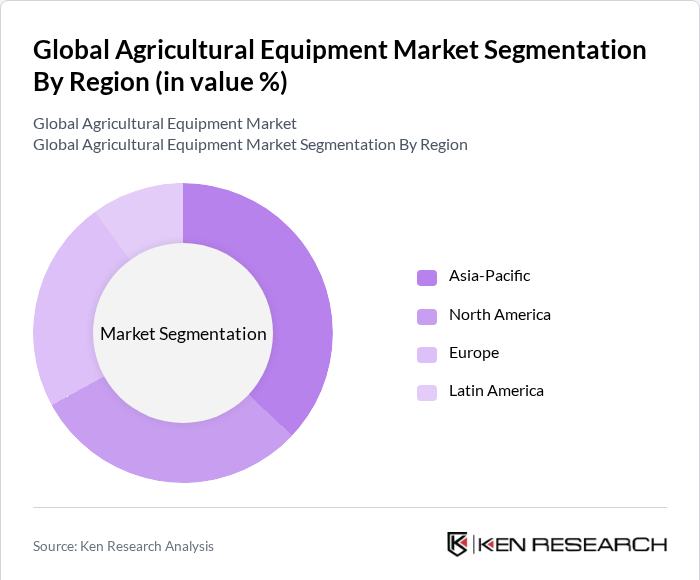

Global Agricultural Equipment Market Segmentation

By Equipment Type: The agricultural equipment market is segmented into tractors, harvesters, plowing and tillage equipment, and planting & seeding equipment. Among these, tractors dominate the market due to their versatility and essential role in various farming operations. The increasing mechanization of agriculture, particularly in developing countries, has led to a higher demand for tractors. Farmers are increasingly investing in modern tractors equipped with advanced technology to enhance efficiency and productivity, which further drives the growth of this segment.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, and Latin America. Asia-Pacific currently holds the largest share of the market, driven by rapid mechanization, government subsidies, and increasing adoption of advanced machinery, especially in China and India. North America and Europe also maintain significant shares due to high adoption of advanced technologies and strong manufacturer presence. Latin America is experiencing growth due to expanding agricultural activities and modernization efforts.

Global Agricultural Equipment Market Competitive Landscape

The Global Agricultural Equipment Market is characterized by intense competition among key players such as John Deere, AGCO Corporation, and CNH Industrial. These companies are known for their innovative products and extensive distribution networks, which enhance their market presence. The competitive dynamics are influenced by technological advancements, customer preferences, and regulatory changes, leading to a rapidly evolving landscape.

Global Agricultural Equipment Market Industry Analysis

Growth Drivers

- Increasing Food Production Demand: The global population is projected to reach approximately 9.7 billion by 2050, necessitating a 70% increase in food production. This surge in demand drives farmers to adopt advanced agricultural equipment to enhance productivity. In 2024, the agricultural sector is expected to contribute around $3.2 trillion to the global economy, highlighting the critical need for efficient farming solutions to meet food security challenges.

- Technological Advancements: Innovations in agricultural technology are transforming the farming landscape, with precision farming, automation, and IoT integration leading the way. In 2024, investments in agri-tech are expected to surpass $11 billion, fueling the development and adoption of advanced tools that improve crop yields and optimize resource management. The incorporation of IoT devices in farming equipment enables real-time monitoring of soil conditions, weather, and crop health, allowing farmers to make data-driven decisions

- Government Initiatives: Many governments are implementing policies to promote mechanization in agriculture, providing subsidies and financial incentives. The USDA announced over $2.14 billion in payments to agricultural producers in 2024, primarily through conservation and safety-net programs such as the Conservation Reserve Program and Agriculture Risk Coverage. Such initiatives aim to reduce labor costs and improve efficiency, encouraging farmers to invest in modern equipment, thereby driving market growth in the agricultural sector.

Market Challenges

- High Initial Investment Costs: The adoption of advanced agricultural equipment often requires significant upfront capital, which can be a major barrier for small-scale and resource-constrained farmers. The high cost of machinery makes it difficult for many to upgrade their equipment or adopt modern technologies, limiting productivity and operational efficiency in the sector.

- Fluctuating Raw Material Prices: The agricultural equipment industry is heavily dependent on raw materials such as steel and aluminum, which are subject to price volatility. This unpredictability in material costs can lead to increased production expenses, resulting in higher equipment prices. Consequently, manufacturers face challenges in maintaining competitive pricing while preserving profitability.

Global Agricultural Equipment Market Future Outlook

The future of the agricultural equipment market appears promising, driven by ongoing technological advancements and increasing adoption of sustainable practices. As farmers seek to optimize yields and reduce environmental impact, the demand for precision agriculture and automation technologies is expected to rise significantly. Additionally, the expansion of e-commerce platforms will facilitate easier access to agricultural equipment, enhancing market penetration and growth opportunities for manufacturers in the coming years.

Market Opportunities

- Precision Agriculture Adoption: The adoption of precision agriculture technologies is steadily increasing, with sales and support for yield monitors and data analysis tools rising from 40% to 46%. This growing use of advanced equipment enables farmers to optimize resource utilization and improve crop yields. Precision agriculture practices contribute to significant environmental benefits.

- Sustainable Farming Practices: Growing awareness of environmental sustainability is prompting farmers to adopt eco-friendly practices. In 2024, investments in sustainable agricultural technologies are expected to exceed $6.1 billion. This shift creates opportunities for manufacturers to develop equipment that aligns with sustainable practices, such as electric machinery and bio-based materials, catering to the evolving market demands.

Scope of the Report

| By Equipment Type |

Tractors Harvesters Plowing and Tillage Equipment Planting & Seeding Equipment |

| By Region |

North America Europe Asia-Pacific Latin America |

| By Application |

Crop Production Livestock Farming Agricultural Services |

| By Technology |

Conventional Technology Precision Agriculture Technology Automation and Robotics |

| By End-User |

Farmers Agricultural Cooperatives Government Agencies |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food and Agriculture Organization, U.S. Department of Agriculture)

Manufacturers and Producers

Distributors and Retailers

Farm Equipment Dealers

Technology Providers

Industry Associations (e.g., Association of Equipment Manufacturers)

Financial Institutions

Companies

Players Mentioned in the Report:

John Deere

AGCO Corporation

CNH Industrial

Mahindra & Mahindra

Kubota Corporation

Trimble Ag Technology

CLAAS Group

Yanmar Agricultural Equipment

AG Leader Technology

Valtra

Table of Contents

1. Global Agricultural Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Agricultural Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Agricultural Equipment Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for food production due to population growth

3.1.2. Advancements in agricultural technology enhancing efficiency

3.1.3. Government initiatives promoting mechanization in agriculture

3.2. Market Challenges

3.2.1. High initial investment costs for advanced equipment

3.2.2. Fluctuating raw material prices affecting production

3.2.3. Lack of skilled labor for operating advanced machinery

3.3. Opportunities

3.3.1. Rising adoption of precision agriculture techniques

3.3.2. Expansion of e-commerce platforms for agricultural equipment

3.3.3. Growing interest in sustainable farming practices

3.4. Trends

3.4.1. Increasing integration of IoT in agricultural equipment

3.4.2. Shift towards electric and hybrid machinery

3.4.3. Enhanced focus on data analytics for farm management

3.5. Government Regulation

3.5.1. Compliance with environmental protection standards

3.5.2. Regulations on emissions and fuel efficiency for machinery

3.5.3. Safety standards for agricultural equipment operation

3.5.4. Subsidies and incentives for adopting modern equipment

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Agricultural Equipment Market Segmentation

4.1. By Equipment Type

4.1.1. Tractors

4.1.2. Harvesters

4.1.3. Plowing and Tillage Equipment

4.1.4. Planting & Seeding Equipment

4.2. By Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia-Pacific

4.2.4. Latin America

4.3. By Application

4.3.1. Crop Production

4.3.2. Livestock Farming

4.3.3. Agricultural Services

4.4. By Technology

4.4.1. Conventional Technology

4.4.2. Precision Agriculture Technology

4.4.3. Automation and Robotics

4.5. By End-User

4.5.1. Farmers

4.5.2. Agricultural Cooperatives

4.5.3. Government Agencies

5. Global Agricultural Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. John Deere

5.1.2. AGCO Corporation

5.1.3. CNH Industrial

5.1.4. Mahindra & Mahindra

5.1.5. Kubota Corporation

5.1.6. Trimble Ag Technology

5.1.7. CLAAS Group

5.1.8. Yanmar Agricultural Equipment

5.1.9. AG Leader Technology

5.1.10. Valtra

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Portfolio Diversity

5.2.3. Geographic Presence

5.2.4. R&D Investment

5.2.5. Customer Satisfaction Ratings

5.2.6. Supply Chain Efficiency

5.2.7. Pricing Strategies

5.2.8. Brand Reputation

6. Global Agricultural Equipment Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Agricultural Equipment Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Agricultural Equipment Market Future Market Segmentation

8.1. By Equipment Type

8.1.1. Tractors

8.1.2. Harvesters

8.1.3. Plowing and Tillage Equipment

8.1.4. Planting & Seeding Equipment

8.2. By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia-Pacific

8.2.4. Latin America

8.3. By Application

8.3.1. Crop Production

8.3.2. Livestock Farming

8.3.3. Agricultural Services

8.4. By Technology

8.4.1. Conventional Technology

8.4.2. Precision Agriculture Technology

8.4.3. Automation and Robotics

8.5. By End-User

8.5.1. Farmers

8.5.2. Agricultural Cooperatives

8.5.3. Government Agencies

9. Global Agricultural Equipment Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders and variables that impact the Global Agricultural Equipment Market. This is achieved through extensive desk research, leveraging secondary data sources and proprietary databases to gather relevant industry insights. The goal is to pinpoint and define the essential factors that drive market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Global Agricultural Equipment Market is compiled and analyzed. This includes evaluating market penetration rates, the balance between equipment manufacturers and service providers, and the resulting revenue streams. Additionally, service quality metrics will be assessed to ensure the accuracy and reliability of the revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors within the agricultural equipment landscape. These consultations will yield critical operational and financial insights, which are essential for refining the market data and ensuring its relevance to current industry conditions.

Step 4: Research Synthesis and Final Output

The final phase focuses on engaging with multiple manufacturers to gather in-depth insights into product categories, sales trends, and consumer preferences. This direct interaction will help verify and enhance the data collected through previous methodologies, ensuring a thorough and validated analysis of the Global Agricultural Equipment Market.

Frequently Asked Questions

01. How big is the Global Agricultural Equipment Market?

The Global Agricultural Equipment Market is valued at USD 120 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Agricultural Equipment Market?

Key challenges in the Global Agricultural Equipment Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Agricultural Equipment Market?

Major players in the Global Agricultural Equipment Market include John Deere, AGCO Corporation, CNH Industrial, Mahindra & Mahindra, Kubota Corporation, among others.

04. What are the growth drivers for the Global Agricultural Equipment Market?

The primary growth drivers for the Global Agricultural Equipment Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.