Global Agritech Market Outlook to 2030

Region:Global

Author(s):Geetanshi

Product Code:KROD-001

June 2025

96

About the Report

Global Agritech Market Overview

- The Global Agritech Market was valued at USD 24 billion in 2024, based on a five-year historical analysis. This growth is primarily driven by advancements in technology, increasing demand for food security, and the need for sustainable agricultural practices. The integration of IoT, AI, robotics, and big data analytics in farming operations has significantly enhanced productivity and efficiency, catering to the rising global population and changing dietary preferences.

- Countries such as the United States, China, and India continue to dominate the Agritech market due to their large agricultural sectors and significant investments in technology. The U.S. leads with its innovative agricultural practices and strong research and development initiatives, while China and India benefit from their vast arable land and government support for modernization in agriculture.

- The European Union’s Common Agricultural Policy (CAP) allocates approximately EUR 60 billion annually to support sustainable farming practices. This regulation aims to enhance the competitiveness of the agricultural sector, promote environmental sustainability, and ensure food security across member states, thereby influencing the Agritech market positively.

Global Agritech Market Segmentation

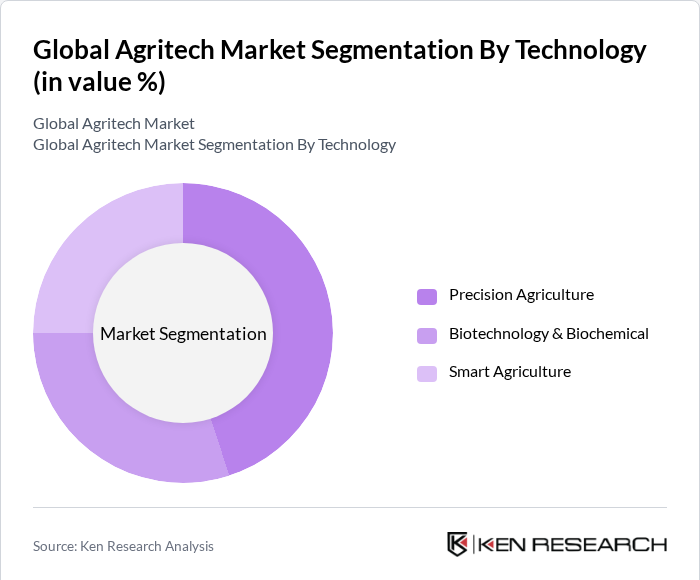

By Technology: The Agritech market is segmented into precision agriculture, biotechnology and biochemical, and smart agriculture technologies. Precision agriculture is the dominant sub-segment, driven by the widespread adoption of IoT devices, AI-based analytics, and data-driven decision-making in agriculture. These solutions enable farmers to optimize resource use, enhance crop yields, and reduce environmental impact, making precision agriculture a primary focus for investment and innovation.

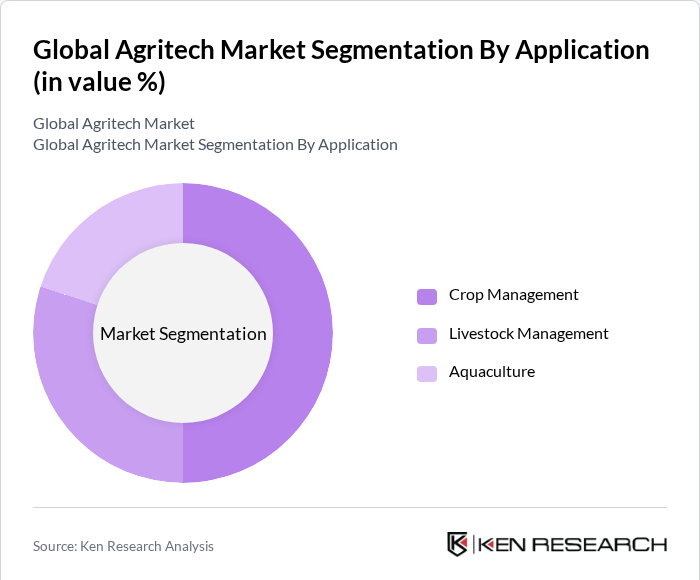

By Application: The Agritech market is categorized into crop management, livestock management, and aquaculture. Crop management is the leading sub-segment, as it encompasses a broad range of technologies aimed at improving crop yield and quality. The focus on food security and sustainability has driven investments in crop management solutions, including advanced monitoring, irrigation management, and nutrient optimization.

Global Agritech Market Competitive Landscape

The Global Agritech Market is characterized by a competitive landscape with key players such as Bayer AG, Corteva Agriscience, and Trimble Inc. These companies are at the forefront of innovation, focusing on developing advanced agricultural technologies and solutions. The market is marked by a mix of established firms and emerging startups, all striving to enhance agricultural productivity and sustainability through technological advancements.

Global Agritech Market Analysis

Growth Drivers

- Increasing Demand for Food Security: The global population is projected to reach 9.7 billion by 2050, requiring a 70% increase in food production to meet demand. In 2024, the global food retail market is estimated to handle over $12.5 trillion in revenue, reflecting growing consumer access and spending. Rising incomes and shifting dietary preferences, especially in developing regions, are driving demand for nutritious and convenient food options. Additionally, global food imports are expected to reach a record $1.8 trillion, underscoring the need for innovative agritech solutions to enhance productivity, sustainability, and food security worldwide.

- Technological Advancements in Farming Practices: Adoption rates of precision agriculture technologies are rising steadily, with yield monitor usage increasing from 40% to 46% among farmers between recent years. These technologies enable variable rate application of inputs, reducing waste by up to 30% and optimizing crop yields by treating different soil zones uniquely. Additionally, the integration of IoT sensors and AI-driven analytics allows real-time monitoring of soil and crop health, improving decision-making and resource efficiency.

- Rising Investment in Sustainable Agriculture: In India, annual financial flows toward sustainable agriculture averaged around USD 301 billion) during FY 2020-21 and FY 2021-22, with private financing accounting for 67% of this total and increasing by 11.4% over this period. Domestic sources overwhelmingly dominate these investments, representing 99.5% of the total, while government budgets allocated roughly USD 98 billion annually to agriculture, with about USD 86 billion directed specifically toward sustainable agriculture activities. Additionally, sustainable agriculture investments through Farmland REITs have increased by 15% in the past year, reflecting growing interest from both public and private sectors.

Market Challenges

- High Initial Investment Costs: The adoption of advanced agritech solutions often requires significant upfront capital, which can be a barrier for many farmers, especially in developing regions. The high cost of implementing precision agriculture technologies makes it challenging for small-scale farmers to invest. This financial hurdle limits the widespread adoption of innovative practices that have the potential to enhance productivity and sustainability.

- Regulatory Compliance and Standards: Navigating the complex landscape of agricultural regulations poses significant challenges for agritech companies. Compliance with regulations related to safety, environmental impact, and product efficacy can lead to substantial operational costs. These stringent requirements often slow down innovation and delay market entry, particularly for startups and smaller enterprises.

Global Agritech Market Future Outlook

The future of the agritech market appears promising, driven by ongoing technological advancements and increasing global food demands. As farmers adopt precision agriculture and smart farming technologies, the market is expected to witness significant transformations. Additionally, the focus on sustainability and climate-resilient practices will likely shape future innovations. Collaborative efforts between governments, private sectors, and research institutions will be crucial in addressing challenges and unlocking new growth avenues in the agritech landscape.

Market Opportunities

- Expansion of E-commerce in Agriculture: The global e-commerce market for agricultural products is rapidly growing, with crop produce accounting for over 47% of online sales as of 2023. Business-to-business (B2B) platforms dominate, capturing more than half of the market share by enabling bulk orders and customized pricing. Increasing internet and mobile penetration, especially in rural areas, is allowing farmers to access wider markets and streamline supply chains.

- Adoption of IoT and AI in Farming: In 2024, over 60% of large-scale farms worldwide have integrated IoT sensors for real-time monitoring of soil moisture, temperature, and crop health, enabling precise irrigation and fertilization. Precision farming techniques powered by AI analytics have improved resource efficiency by reducing water and fertilizer use by up to 25%, while increasing crop yields by approximately 15%. Additionally, the number of connected agricultural devices is expected to exceed 75 million globally by 2025, reflecting rapid adoption of smart farming technologies that enhance productivity and sustainability.

Scope of the Report

| By Technology |

Precision Agriculture Biotechnology Biochemical Smart Agriculture Technologies |

| By Application |

Crop Management Livestock Management Aquaculture |

| By Region |

North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Farm Size |

Small-scale Farms Medium-scale Farms Large-scale Farms |

| By Crop Type |

Cereals and Grains Fruits and Vegetables Oilseeds and Pulses Others |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Food and Agriculture Organization, U.S. Department of Agriculture)

Manufacturers and Producers

Distributors and Retailers

Agricultural Cooperatives

Technology Providers

Industry Associations

Financial Institutions

Companies

Players Mentioned in the Report:

Bayer AG

Corteva Agriscience

Trimble Inc.

AG Leader Technology

Deere & Company

AgriTech Innovations

CropSense Solutions

TerraGrow Technologies

EcoFarming Systems

HarvestIQ Analytics

Table of Contents

1. Global Agritech Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Agritech Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Agritech Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Food Security

3.1.2. Technological Advancements in Farming Practices

3.1.3. Rising Investment in Sustainable Agriculture

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Regulatory Compliance and Standards

3.2.3. Limited Access to Technology in Developing Regions

3.3. Opportunities

3.3.1. Expansion of E-commerce in Agriculture

3.3.2. Adoption of IoT and AI in Farming

3.3.3. Growing Interest in Organic Farming Solutions

3.4. Trends

3.4.1. Shift Towards Precision Agriculture

3.4.2. Increasing Use of Drones and Robotics

3.4.3. Focus on Climate-Resilient Crop Varieties

3.5. Government Regulation

3.5.1. Overview of Agricultural Policies

3.5.2. Impact of Subsidies on Agritech Adoption

3.5.3. Environmental Regulations Affecting Agritech

3.5.4. International Trade Agreements and Their Implications

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Agritech Market Segmentation

4.1. By Technology

4.1.1. Precision Agriculture

4.1.2. Biotechnology

4.1.3. Biochemical

4.1.4. Smart Agriculture Technologies

4.2. By Application

4.2.1. Crop Management

4.2.2. Livestock Management

4.2.3. Aquaculture

4.3. By Region

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East and Africa

4.4. By Farm Size

4.4.1. Small-scale Farms

4.4.2. Medium-scale Farms

4.4.3. Large-scale Farms

4.5. By Crop Type

4.5.1. Cereals and Grains

4.5.2. Fruits and Vegetables

4.5.3. Oilseeds and Pulses

4.5.4. Others

5. Global Agritech Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bayer AG

5.1.2. Corteva Agriscience

5.1.3. Trimble Inc.

5.1.4. AG Leader Technology

5.1.5. Deere & Company

5.1.6. AgriTech Innovations

5.1.7. CropSense Solutions

5.1.8. TerraGrow Technologies

5.1.9. EcoFarming Systems

5.1.10. HarvestIQ Analytics

5.2. Cross Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Revenue Growth Rate

5.2.3. Product Innovation Index

5.2.4. Customer Satisfaction Ratings

5.2.5. Geographic Reach

5.2.6. R&D Investment Levels

5.2.7. Supply Chain Efficiency

5.2.8. Brand Recognition and Reputation

6. Global Agritech Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Agritech Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Agritech Market Future Market Segmentation

8.1. By Technology

8.1.1. Precision Agriculture

8.1.2. Biotechnology

8.1.3. Biochemical

8.1.4. Smart Agriculture Technologies

8.2. By Application

8.2.1. Crop Management

8.2.2. Livestock Management

8.2.3. Aquaculture

8.3. By Region

8.3.1. North America

8.3.2. Europe

8.3.3. Asia-Pacific

8.3.4. Latin America

8.3.5. Middle East and Africa

8.4. By Farm Size

8.4.1. Small-scale Farms

8.4.2. Medium-scale Farms

8.4.3. Large-scale Farms

8.5. By Crop Type

8.5.1. Cereals and Grains

8.5.2. Fruits and Vegetables

8.5.3. Oilseeds and Pulses

8.5.4. Others

9. Global Agritech Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the ecosystem of the Global Agritech Market, identifying key stakeholders such as farmers, technology providers, and regulatory bodies. This step relies on extensive desk research, utilizing secondary data sources and proprietary databases to gather relevant industry information. The primary goal is to pinpoint and define the critical variables that drive market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Global Agritech Market will be compiled and analyzed. This includes evaluating market penetration rates, the balance between technology providers and end-users, and revenue generation patterns. Additionally, an assessment of service quality metrics will be conducted to ensure the reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts from various sectors within the agritech landscape. These consultations will yield operational and financial insights that are crucial for refining the market data. Engaging with practitioners will help corroborate the findings and enhance the overall understanding of market trends.

Step 4: Research Synthesis and Final Output

The final phase will involve direct engagement with key manufacturers and stakeholders to gather in-depth insights into product segments, sales performance, and consumer preferences. This interaction will serve to validate and enrich the data obtained from previous steps, ensuring a comprehensive and accurate analysis of the Global Agritech Market.

Frequently Asked Questions

01. How big is the Global Agritech Market?

The Global Agritech Market is valued at USD 24 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Agritech Market?

Key challenges in the Global Agritech Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Agritech Market?

Major players in the Global Agritech Market include Bayer AG, Corteva Agriscience, Trimble Inc., AG Leader Technology, Deere & Company, among others.

04. What are the growth drivers for the Global Agritech Market?

The primary growth drivers for the Global Agritech Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.