Global AI in Drug Discovery Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD9525

November 2024

86

About the Report

Global AI in Drug Discovery Market Overview

- The global AI in drug discovery market is valued at USD 2 billion, based on a five-year historical analysis. This market is driven by several key factors, including the increasing adoption of artificial intelligence to accelerate drug discovery processes, reduce time-to-market for new drugs, and enhance the efficiency of clinical trials. AI enables pharmaceutical companies to analyze massive datasets more efficiently, facilitating faster identification of drug candidates, predictive models for drug interactions, and overall cost savings in drug development.

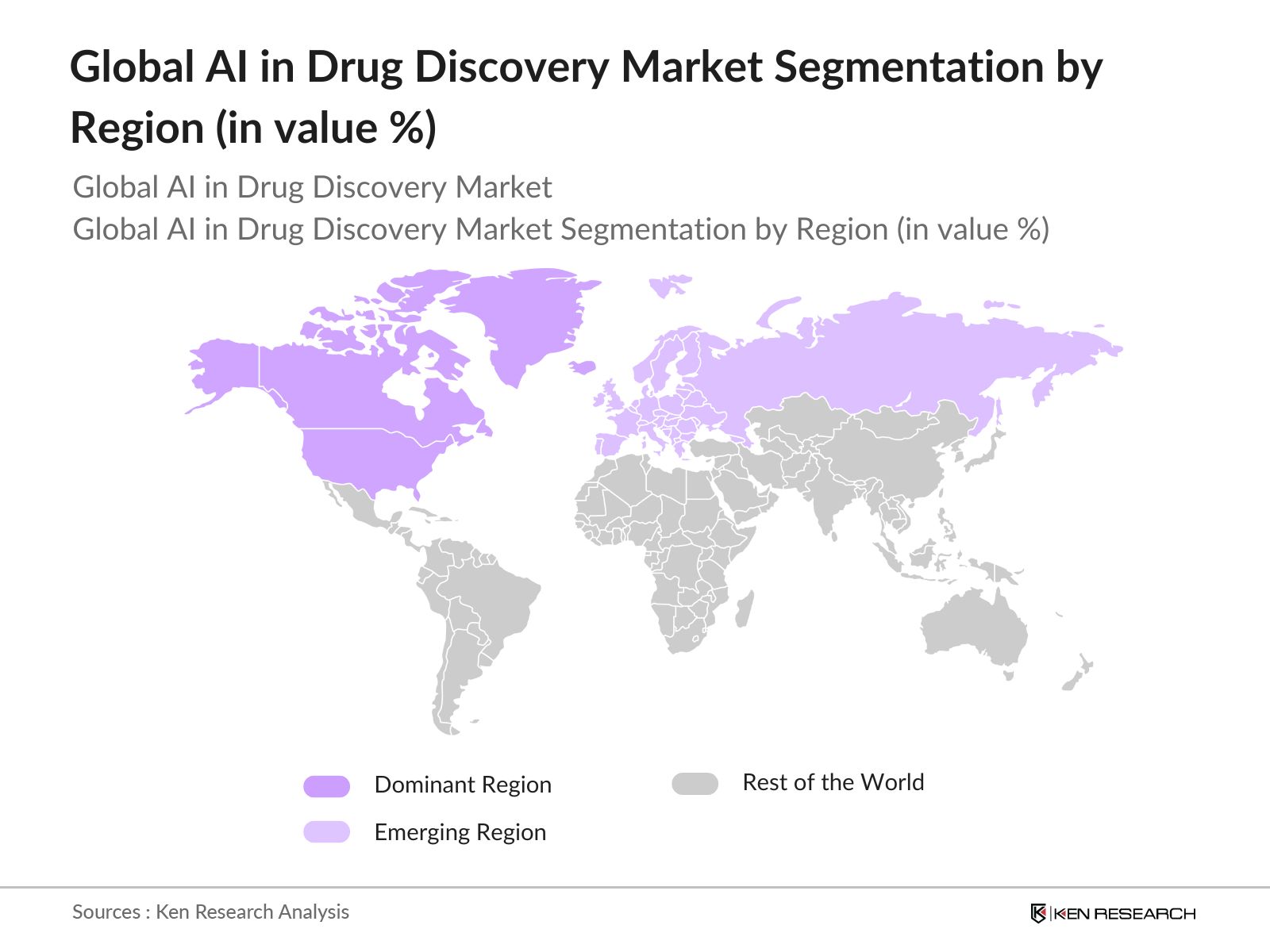

- The market is dominated by major global pharmaceutical hubs such as the United States, the United Kingdom, and China. The dominance of these regions is primarily due to their robust investment in AI technologies, advanced research infrastructure, and significant presence of top pharmaceutical companies collaborating with AI technology providers. Additionally, government initiatives supporting AI innovations in healthcare and strong regulatory frameworks further contribute to the leadership of these regions in the AI-driven drug discovery space.

- The European Union, through its Horizon Europe program, allocated 1.2 billion in funding for AI in healthcare in 2024. This funding was directed toward initiatives that integrate AI in drug discovery, with the goal of improving the continents competitiveness in innovative healthcare solutions. A significant portion of these funds was directed toward small and mid-sized pharmaceutical companies.

Global AI in Drug Discovery Market Segmentation

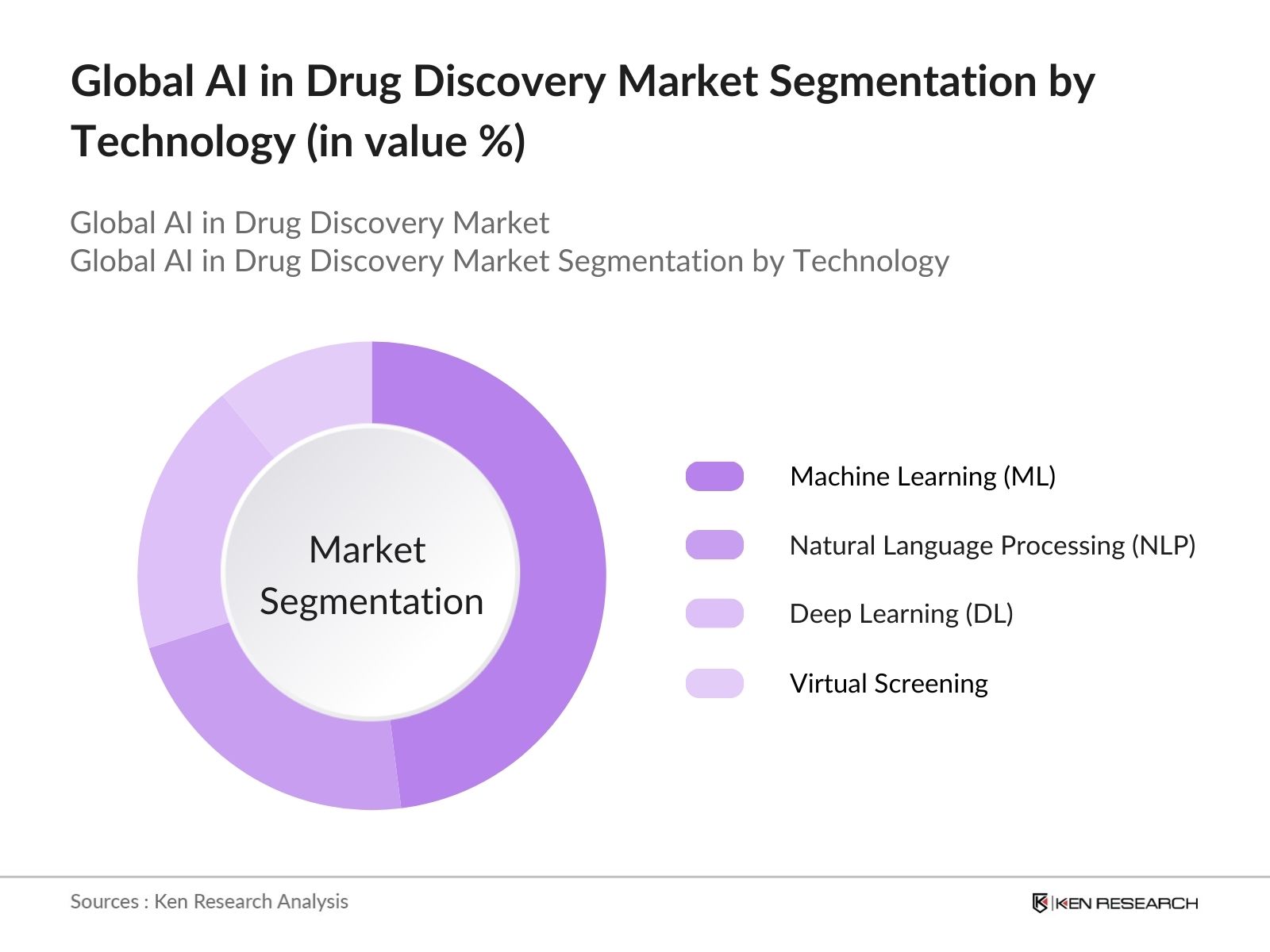

By Technology: The AI in drug discovery market is segmented by technology into Machine Learning (ML), Natural Language Processing (NLP), Deep Learning (DL), and Virtual Screening. Recently, machine learning has dominated the technology segment of the AI drug discovery market due to its ability to analyze large datasets quickly and generate models that can predict drug interactions, toxicity, and efficacy. The automation provided by ML in the drug discovery process significantly reduces both time and cost, making it highly attractive to pharmaceutical companies aiming to speed up their R&D processes.

By Region: Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by its high concentration of AI technology companies and pharmaceutical giants actively integrating AI into drug discovery. The region's strong regulatory support and substantial investment in healthcare innovation also contribute to its dominance.

By Application: The market is also segmented by application into Target Identification, Drug Screening, De Novo Drug Design, and Preclinical and Clinical Testing. Target Identification holds the dominant share of the market, largely due to the critical role AI plays in identifying novel drug targets through genome analysis and molecular profiling. AI algorithms help streamline the identification process, leading to more accurate predictions of how drug molecules will interact with specific targets, thereby improving success rates in the early stages of drug development.

Global AI in Drug Discovery Market Competitive Landscape

The global AI in drug discovery market is dominated by both established pharmaceutical companies and innovative AI startups. This consolidation highlights the significance of partnerships between AI specialists and drug manufacturers, with companies investing heavily in AI-driven R&D initiatives. The competitive landscape is characterized by collaborations, strategic alliances, and increasing acquisitions of AI companies by pharmaceutical firms to enhance their drug development pipelines.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

AI Patents |

Therapeutic Areas |

Partnerships |

Drug Candidates |

AI Platform |

|---|---|---|---|---|---|---|---|---|

|

Exscientia |

2012 |

Oxford, UK |

- |

- |

- |

- |

- |

- |

|

BenevolentAI |

2013 |

London, UK |

- |

- |

- |

- |

- |

- |

|

Insilico Medicine |

2014 |

Hong Kong, China |

- |

- |

- |

- |

- |

- |

|

Atomwise |

2012 |

San Francisco, USA |

- |

- |

- |

- |

- |

- |

|

Schrodinger |

1990 |

New York, USA |

- |

- |

- |

- |

- |

- |

Global AI in Drug Discovery Market Analysis

Growth Drivers

- AI Implementation in Drug Discovery: The implementation of AI in drug discovery has been significantly boosted by increasing investments in research and development, especially in the pharmaceutical industry. In 2024, global pharmaceutical companies collectively invested over $100 billion in AI-driven drug discovery projects. These investments aim to speed up the process of identifying viable drug candidates by leveraging AI for protein structure prediction, molecular docking, and drug target discovery. This trend is expected to reduce the time taken for early-stage drug development, thereby providing faster access to treatments.

- Growing Number of AI Startups in Healthcare: The number of startups focused on AI in healthcare, specifically drug discovery, has surged, with over 450 AI-focused biotech startups operating globally by 2024. These startups have garnered funding exceeding $2 billion, with significant contributions from venture capital firms in North America and Europe. Their role in accelerating innovation, providing novel AI algorithms, and collaborating with larger pharmaceutical firms contributes to more efficient discovery pipelines and the identification of new therapeutic compounds.

- Shorter Drug Development Cycles: AI is transforming clinical trials by optimizing patient recruitment, improving trial design, and predicting trial outcomes. In 2024, the average drug development timeline was reduced by nearly 2 years, with AI-based systems significantly reducing the time required to analyze clinical data. The shortened timelines are particularly critical in diseases with urgent medical needs, such as cancer and rare genetic disorders, where AI helps to identify biomarkers and predict patient responses, accelerating the path to regulatory approval.

Market Challenges

- Handling Sensitive Health Data: Handling vast amounts of patient data remains a significant challenge for AI in drug discovery. In 2024, global healthcare systems experienced over 300 data breaches involving sensitive patient information, raising concerns about the security of AI platforms used in drug discovery. Governments are enforcing stricter data privacy regulations like the GDPR and HIPAA, making compliance a costly and complex challenge for companies implementing AI.

- Implementation and Operational Costs: Despite the potential cost savings in drug discovery timelines, implementing AI-driven solutions remains costly. In 2024, the average cost of integrating AI into the drug development process was around $10 million for mid-sized pharmaceutical companies. These costs include AI platform licenses, hiring specialized talent, and ongoing system updates, which may present barriers for smaller biopharma companies that cannot afford such investments.

Global AI in Drug Discovery Market Future Outlook

Over the next five years, the global AI in drug discovery market is expected to witness significant growth driven by the increasing integration of AI technologies in pharmaceutical research, heightened investment in AI-driven drug pipelines, and the adoption of AI across both early-stage drug discovery and clinical trials. Additionally, advancements in AI algorithms, coupled with the expanding application of AI in predicting drug efficacy and toxicity, will likely lead to the development of more targeted therapies.

Market Opportunities

- Collaboration Between Pharma and AI Companies: The collaboration between AI tech companies and pharmaceutical giants has emerged as a major opportunity for accelerating drug discovery. In 2024, there were over 100 joint ventures formed between pharmaceutical firms and AI companies, with deals totaling over $5 billion. These collaborations leverage the pharmaceutical companies' drug development expertise with the technological prowess of AI companies, leading to more efficient pipelines and a higher probability of discovering breakthrough drugs.

- Increasing Use of AI for Rare Diseases Drug Discovery: AI has been particularly impactful in the discovery of treatments for rare diseases, which often have limited research and fewer therapeutic options. In 2024, AI-driven platforms identified 200 new drug candidates targeting rare diseases that had previously been under-researched. This represents a critical opportunity to fill therapeutic gaps and meet the needs of patients who suffer from conditions that currently lack effective treatments.

Scope of the Report

|

By Technology |

Machine Learning (ML) |

|

By Application |

Target Identification |

|

By Drug Type |

Small Molecule Drugs |

|

By End-User |

Pharmaceutical Companies |

|

By Region |

North America |

Products

Key Target Audience

Pharmaceutical Companies

Biotechnology Companies

Contract Research Organizations (CROs)

AI Technology Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, EMA, PMDA)

Healthcare Providers and Hospitals

Academic and Research Institutions

Companies

Players Mentioned in the Report:

Exscientia

BenevolentAI

Insilico Medicine

Atomwise

Schrodinger

Cyclica

Healx

Recursion Pharmaceuticals

Deep Genomics

Valo Health

Table of Contents

1. Global AI in Drug Discovery Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Market Segmentation Overview

2. Global AI in Drug Discovery Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global AI in Drug Discovery Market Analysis

3.1. Growth Drivers

3.1.1. Increasing R&D Investments (AI Implementation in Drug Discovery)

3.1.2. Growing Number of AI Startups in Healthcare (Startups Contribution)

3.1.3. Shorter Drug Development Cycles (Efficiency in Clinical Trials)

3.1.4. Rising Demand for Precision Medicine (AI in Personalized Therapies)

3.2. Market Challenges

3.2.1. Data Privacy and Security (Handling Sensitive Health Data)

3.2.2. High Costs of AI Solutions (Implementation and Operational Costs)

3.2.3. Regulatory Compliance (FDA and EMA AI Drug Discovery Guidelines)

3.2.4. Lack of Skilled Workforce (Shortage of AI Specialists in Drug Development)

3.3. Opportunities

3.3.1. Collaboration Between Pharma and AI Companies (Partnerships and Joint Ventures)

3.3.2. Increasing Use of AI for Rare Diseases Drug Discovery (Filling Therapeutic Gaps)

3.3.3. Expansion into Emerging Markets (Untapped Potential in APAC and Africa)

3.3.4. AI-Driven Predictive Analytics (Use of AI in Predictive Clinical Outcomes)

3.4. Trends

3.4.1. Use of AI in Biomarker Discovery (Accelerating Disease Diagnosis)

3.4.2. Increased Application of NLP in Drug Discovery (Text Mining for Data Extraction)

3.4.3. Integration of AI with High-Throughput Screening (Automation in Drug Screening)

3.4.4. Rise in AI-Backed Drug Repurposing Initiatives (Rediscovering Drugs with AI)

3.5. Government Regulation

3.5.1. AI Regulatory Frameworks for Drug Development (FDA, EMA Standards)

3.5.2. Government AI Innovation Initiatives in Healthcare (Global AI Policies in Drug R&D)

3.5.3. Public-Private Partnerships in AI (AI in National Health Programs)

3.5.4. AI Ethics and Drug Discovery (Ethical Use of AI in Healthcare)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (AI Software Providers, Pharma Companies, Research Institutions)

3.8. Porters Five Forces (Market Power Dynamics Between Pharma and AI Providers)

3.9. Competitive Ecosystem (AI-Driven Drug Discovery Landscape)

4. Global AI in Drug Discovery Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Machine Learning (ML)

4.1.2. Natural Language Processing (NLP)

4.1.3. Deep Learning (DL)

4.1.4. Virtual Screening

4.2. By Application (In Value %)

4.2.1. Target Identification

4.2.2. Drug Screening

4.2.3. De Novo Drug Design

4.2.4. Preclinical and Clinical Testing

4.3. By Drug Type (In Value %)

4.3.1. Small Molecule Drugs

4.3.2. Biologics

4.3.3. Gene Therapies

4.3.4. RNA-based Drugs

4.4. By End-User (In Value %)

4.4.1. Pharmaceutical Companies

4.4.2. Biotechnology Companies

4.4.3. Contract Research Organizations (CROs)

4.4.4. Academic & Research Institutes

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global AI in Drug Discovery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Exscientia

5.1.2. BenevolentAI

5.1.3. Insilico Medicine

5.1.4. Atomwise

5.1.5. Schrodinger

5.1.6. Iktos

5.1.7. Deep Genomics

5.1.8. Recursion Pharmaceuticals

5.1.9. Valo Health

5.1.10. XtalPi

5.1.11. BioSymetrics

5.1.12. Healx

5.1.13. Cyclica

5.1.14. Owkin

5.1.15. Verge Genomics

5.2 Cross Comparison Parameters (Funding Received, AI Expertise, Drug Discovery Platforms, Therapeutic Focus, Patents Held, Key Partnerships, Clinical Trials Contribution, AI-Driven Drug Approvals)

5.3 Market Share Analysis (By Company, By Application, By Region)

5.4 Strategic Initiatives (R&D Investments, AI-Healthcare Collaborations)

5.5 Mergers and Acquisitions (AI-Focused Pharma M&A)

5.6 Investment Analysis (AI-Specific Drug Discovery Investments)

5.7 Venture Capital Funding (Top AI Healthcare Investors)

5.8 Government Grants (AI Research Funding in Drug Development)

5.9 Private Equity Investments (PE Investments in AI Drug Discovery Companies)

6. Global AI in Drug Discovery Market Regulatory Framework

6.1. AI and Drug Discovery Regulatory Compliance (FDA, EMA, PMDA Standards)

6.2. Certification Processes for AI-Driven Solutions in Drug Development

7. Global AI in Drug Discovery Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global AI in Drug Discovery Future Market Segmentation

8.1. By Technology (In Value %)

8.2. By Application (In Value %)

8.3. By Drug Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global AI in Drug Discovery Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Product Positioning

9.3. White Space Opportunity Analysis

9.4. Growth Opportunity Mapping

Research Methodology

Step 1: Identification of Key Variables

The first step involved creating an in-depth ecosystem map of the global AI in drug discovery market. Through extensive desk research using proprietary databases and industry-level sources, key variables like R&D investment, AI application areas, and major collaborations between pharma and AI companies were identified.

Step 2: Market Analysis and Construction

This step entailed gathering historical data related to AI implementation in drug discovery and evaluating the growth trajectory across key segments, including technology and application types. The analysis also covered AIs role in drug pipeline acceleration and clinical trials optimization.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses were validated through consultations with AI and pharmaceutical industry experts. CATIs were conducted with key stakeholders to collect insights on AI integration in drug discovery, partnerships, and R&D trends.

Step 4: Research Synthesis and Final Output

We synthesized the findings from expert consultations and quantitative data collection to generate a comprehensive analysis of the market. The final report is a validated overview of the global AI in drug discovery market, including projections and future trends.

Frequently Asked Questions

01. How big is the Global AI in Drug Discovery Market?

The global AI in drug discovery market is valued at USD 2 billion, driven by the rising adoption of AI technologies across the pharmaceutical industry to accelerate drug development and clinical trials.

02. What are the challenges in the Global AI in Drug Discovery Market?

Challenges include high implementation costs, regulatory hurdles, and the need for a skilled workforce proficient in both AI and drug discovery, limiting the full-scale adoption of AI across pharmaceutical R&D.

03. Who are the major players in the Global AI in Drug Discovery Market?

Key players include Exscientia, BenevolentAI, Insilico Medicine, Atomwise, and Schrodinger, all of which have established strong partnerships with pharmaceutical companies and made significant advancements in AI-driven drug discovery platforms.

04. What are the growth drivers of the Global AI in Drug Discovery Market?

Growth drivers include increasing R&D investments, the rising need for precision medicine, the application of AI in target identification and drug screening, and collaborations between AI companies and pharmaceutical firms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.