Global Air Filters Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10968

December 2024

95

About the Report

Global Air Filters Market Overview

- The Global Air Filters Market is valued at USD 15 billion, driven by the increasing demand for clean air across various sectors including industrial, residential, and healthcare. This growth is largely influenced by stringent government regulations on air quality control and pollution, especially in regions with heavy industrial activities such as North America and Asia-Pacific. The push for energy-efficient solutions and the rising consumer awareness regarding health hazards linked to poor air quality have further fueled the markets expansion. Technological innovations, like HEPA and activated carbon filters, are driving efficiency improvements and adoption rates across different sectors.

- Countries like the United States, China, and Germany dominate the global air filters market. In the United States, the demand is driven by stringent Environmental Protection Agency (EPA) regulations and the need for industrial filtration systems to meet federal standards. China, on the other hand, faces severe pollution issues, prompting heavy investment in air filtration systems for both industrial and residential sectors. Germany's dominance stems from its strong automotive and manufacturing sectors, which necessitate advanced air filtration systems to meet rigorous emissions standards.

- As environmental sustainability becomes a key focus globally, there is a growing trend toward using eco-friendly air filters made from biodegradable and recyclable materials. According to the European Commissions Circular Economy Action Plan, the adoption of these filters has risen by 10% between 2022 and 2024, particularly in Europe. Manufacturers are increasingly focusing on reducing plastic and chemical usage in filter materials, contributing to the overall reduction of carbon footprints in commercial and industrial sectors.

Global Air Filters Market Segmentation

By Product Type: The Global Air Filters Market is segmented by product type into HEPA filters, electrostatic filters, activated carbon filters, UV filters, and others (including ionizers and antimicrobial filters). HEPA filters have a dominant market share due to their widespread application across healthcare, automotive, and residential sectors. HEPA filters are highly effective at trapping airborne particles, including bacteria and viruses, making them essential in healthcare settings. Additionally, their use in automotive cabin air filtration systems has significantly increased due to rising awareness about air quality in confined spaces.

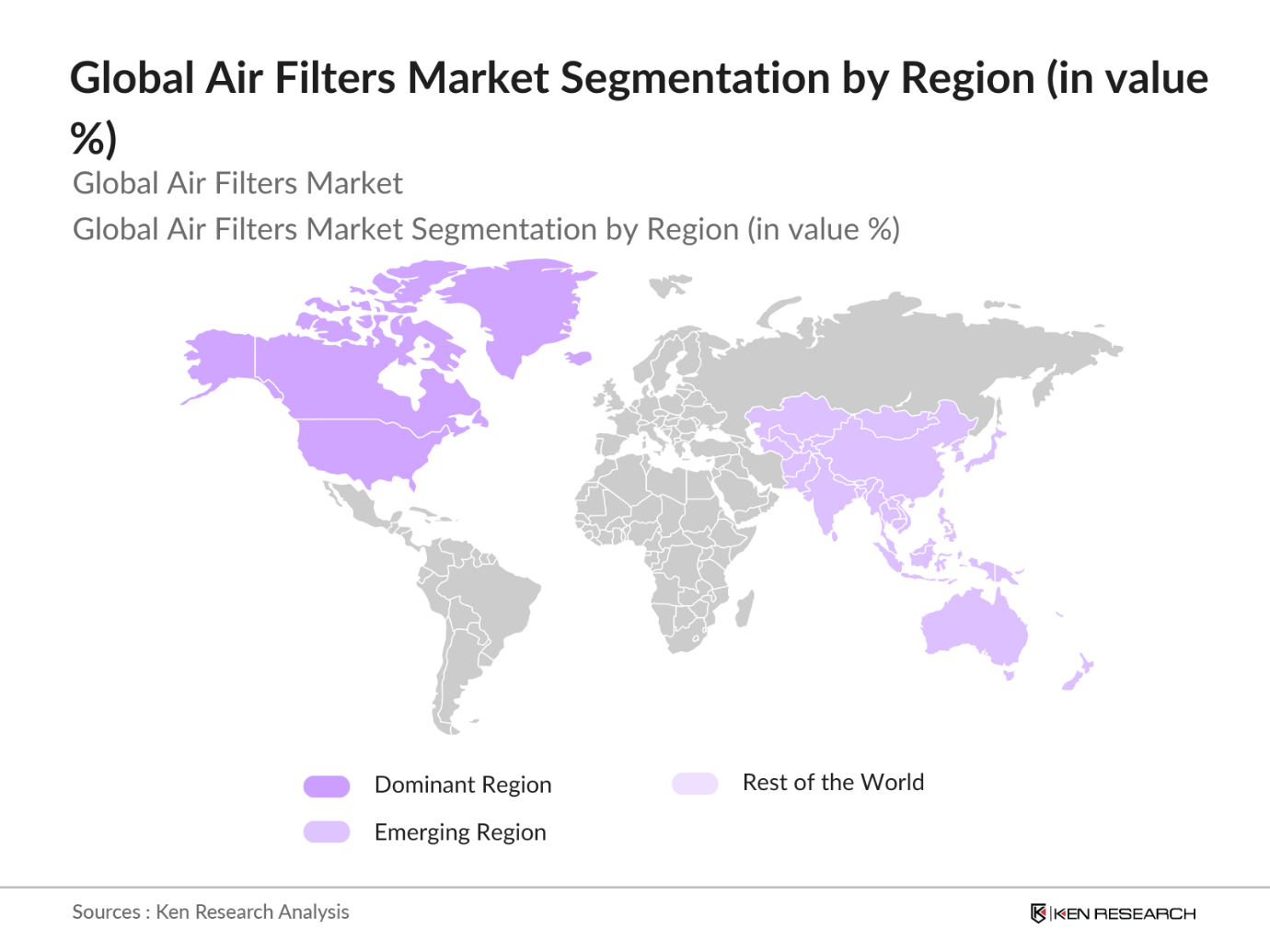

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America has the largest market share, mainly due to strict air quality regulations and the high adoption rate of advanced air filtration systems in the United States. Asia-Pacific is the fastest-growing region, with China and India leading due to increasing industrialization, urbanization, and efforts to tackle air pollution. Europe also holds a significant share, driven by stringent environmental laws and high demand from the automotive and healthcare industries.

By Application: The market is further segmented by application into residential, commercial, industrial, healthcare, and automotive sectors. The industrial segment dominates the market, driven by the high demand for air filtration systems in manufacturing plants, oil & gas refineries, and power generation units. These sectors require continuous air filtration to maintain operational efficiency and comply with regulatory standards. Industrial filtration systems also aid in controlling hazardous emissions and airborne pollutants in facilities, which is critical for environmental compliance and worker safety.

Global Air Filters Market Competitive Landscape

The Global Air Filters Market is dominated by a few major players, including Donaldson Company, Parker Hannifin, and Mann+Hummel. These companies have a strong presence across various sectors and regions, offering a wide range of air filtration products that meet diverse customer needs. Their dominance is also attributed to extensive R&D investments, product innovations, and strategic partnerships aimed at expanding their global reach.

Global Air Filters Industry Analysis

Growth Drivers

- Increasing Environmental Regulations: Global air quality concerns have resulted in stringent environmental regulations worldwide, directly driving the demand for air filters. For instance, according to the World Health Organization (WHO), air pollution is responsible for nearly 7 million deaths annually, prompting nations to enhance regulatory frameworks. The U.S. Environmental Protection Agency (EPA) has set stringent standards for particulate matter (PM2.5), requiring industries to implement more efficient filtration systems. In India, the National Clean Air Program (NCAP) aims to reduce particulate pollution by 20%30% across 122 cities, fostering higher adoption of industrial air filters.

- Rising Demand for Energy Efficiency: Energy efficiency remains critical in reducing operational costs, driving air filter innovations that reduce energy consumption in industrial sectors. According to the International Energy Agency (IEA), energy efficiency improvements in the commercial sector led to savings of 16 million tonnes of oil equivalent (Mtoe) globally in 2022. Energy-efficient air filters, such as those adhering to ASHRAE standards, help minimize energy losses in HVAC systems by reducing pressure drops. For instance, high-efficiency particulate air (HEPA) filters are gaining popularity in Europe and the U.S. for their superior energy performance and compliance with sustainability goals.

- Advancements in Filtration Technologies: Technological advancements in filtration systems, such as nanofiber, HEPA, and activated carbon filters, have significantly enhanced the efficiency and durability of air filters. Nanofiber technology, which allows for the filtration of ultrafine particles as small as 0.3 microns, is increasingly integrated into HVAC systems globally. According to the U.S. National Institute of Occupational Safety and Health (NIOSH), these advancements have boosted filter efficiency by up to 60% compared to traditional filters, especially in industries like healthcare and manufacturing, where air quality is paramount.

Market Restraints

- Availability of Low-Cost Substitutes: The presence of low-cost, less-efficient alternatives such as fiberglass and polyester air filters undermines the adoption of more advanced, high-performance systems. According to the U.S. Department of Energy, the prevalence of these cheaper substitutes reduces the adoption rate of higher-end filtration technologies like HEPA and activated carbon filters, especially in cost-sensitive industries. For example, the average cost of fiberglass filters is 60% less than HEPA filters, making them more accessible to small and medium enterprises (SMEs) despite their lower efficiency.

- Complex Regulatory Standards: The air filtration market is burdened by varying regulatory requirements across different regions, which can increase compliance costs for manufacturers. The European Unions new regulatory standards under its Clean Air Directive necessitate stringent certification processes for air filter manufacturers, including energy labeling requirements. According to the European Environment Agency (EEA), compliance with these standards can increase operational costs for manufacturers by 20%30%, particularly for companies looking to expand across borders. Similarly, in the U.S., the EPA requires detailed certification processes that add time and expense to product deployment timelines.

Global Air Filters Market Future Outlook

Over the next five years, the Global Air Filters Market is expected to experience steady growth, driven by continuous innovations in air filtration technology and growing awareness about indoor air quality. The increasing demand from industrial, healthcare, and residential sectors will continue to boost market revenues. Stricter government regulations on air pollution control and the growing emphasis on sustainability will further propel market expansion. The adoption of smart air filtration systems, enabled by IoT, will also open new avenues for growth in the market.

Market Opportunities

- Expansion into Emerging Markets: Emerging economies such as India, Brazil, and Vietnam represent lucrative opportunities for air filter manufacturers due to increasing urbanization and pollution control measures. According to the World Bank, India's urban population is expected to increase by 50 million by 2025, which will drive higher demand for air purification systems. Additionally, Brazil has seen increased governmental investments in pollution control, allocating $2.5 billion for urban air quality initiatives between 2022 and 2024. These regions offer significant growth potential for companies looking to expand their geographical presence.

- Increasing Demand in Healthcare and Automotive Industries: The healthcare sector's need for sterile environments and the automotive industry's focus on cabin air quality have spurred demand for advanced air filters. The global expansion of healthcare facilities due to COVID-19 and post-pandemic recovery efforts has led to a 20% increase in HEPA filter installations in hospitals, according to the World Health Organization (WHO). In the automotive sector, electric vehicles (EVs) have adopted enhanced air filtration systems to ensure cabin air quality, especially in regions like North America and Europe.

Scope of the Report

|

By Product Type |

HEPA Filters |

|

Electrostatic Filters |

|

|

Activated Carbon Filters |

|

|

UV Filters |

|

|

Others (Ionizers, Antimicrobial Filters) |

|

|

By Application |

Residential |

|

Commercial |

|

|

Industrial |

|

|

Healthcare |

|

|

Automotive |

|

|

By Filter Media |

Fiberglass |

|

Synthetic Polymer |

|

|

Activated Carbon |

|

|

Metal Mesh |

|

|

Others (Nanofiber, Ceramic) |

|

|

By End-Use Industry |

Manufacturing & Processing |

|

Automotive & Transportation |

|

|

Food & Beverage |

|

|

Pharmaceuticals |

|

|

Oil & Gas |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Middle East & Africa |

|

|

Latin America |

Products

Key Target Audience

Air Filtration System Manufacturers

Automotive Industry Players

Healthcare Providers

Manufacturing & Processing Industries

Government and Regulatory Bodies (EPA, European Environment Agency)

Investors and Venture Capitalist Firms

R&D Institutions Focused on Filtration Technologies

Oil & Gas Sector Operators

Companies

Players Mentioned in the Report:

Donaldson Company, Inc.

Parker Hannifin Corporation

Mann+Hummel

Freudenberg Group

AAF International

Camfil AB

Cummins Filtration

Daikin Industries, Ltd.

Honeywell International Inc.

Clarcor Inc.

Table of Contents

1. Global Air Filters Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Air Filters Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Air Filters Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Environmental Regulations

3.1.2. Rising Demand for Energy Efficiency (Energy Efficiency Standards, Environmental Sustainability)

3.1.3. Advancements in Filtration Technologies (Nanofiber, HEPA, Activated Carbon Filters)

3.1.4. Rapid Urbanization and Industrialization (Infrastructure Growth, Air Pollution Control Initiatives)

3.2. Market Challenges

3.2.1. High Initial Costs (Technological Investments, R&D Expenses)

3.2.2. Availability of Low-Cost Substitutes

3.2.3. Complex Regulatory Standards (Certification Requirements, Compliance Costs)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Geographical Expansion)

3.3.2. Increasing Demand in Healthcare and Automotive Industries (Sector-Specific Opportunities)

3.3.3. Integration of Smart Filters with IoT Technology

3.4. Trends

3.4.1. Adoption of IoT-Enabled Air Filtration Systems (Smart HVAC, Real-Time Monitoring)

3.4.2. Use of Sustainable and Eco-Friendly Filters (Biodegradable, Recyclable Materials)

3.4.3. Growth of Portable and Compact Air Filters (Consumer Electronics, Portable Devices)

3.5. Government Regulations

3.5.1. Environmental Protection Agency (EPA) Regulations

3.5.2. European Union Air Quality Standards

3.5.3. National Clean Air Program (NCAP) Initiatives

3.5.4. International Green Building Standards (LEED, BREEAM Certifications)

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem (Supply Chain Analysis, OEMs, Suppliers)

3.8. Porters Five Forces

3.9. Competition Ecosystem (Competitor Landscape, Key Players)

4. Global Air Filters Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. HEPA Filters

4.1.2. Electrostatic Filters

4.1.3. Activated Carbon Filters

4.1.4. UV Filters

4.1.5. Others (Ionizers, Antimicrobial Filters)

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.2.4. Healthcare

4.2.5. Automotive

4.3. By Filter Media (In Value %)

4.3.1. Fiberglass

4.3.2. Synthetic Polymer

4.3.3. Activated Carbon

4.3.4. Metal Mesh

4.3.5. Others (Nanofiber, Ceramic)

4.4. By End-Use Industry (In Value %)

4.4.1. Manufacturing & Processing

4.4.2. Automotive & Transportation

4.4.3. Food & Beverage

4.4.4. Pharmaceuticals

4.4.5. Oil & Gas

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Air Filters Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Donaldson Company, Inc.

5.1.2. Parker Hannifin Corporation

5.1.3. Camfil AB

5.1.4. Freudenberg Group

5.1.5. Mann+Hummel

5.1.6. 3M Company

5.1.7. AAF International

5.1.8. Daikin Industries, Ltd.

5.1.9. Cummins Filtration

5.1.10. Clarcor Inc.

5.1.11. Honeywell International Inc.

5.1.12. APC Filtration Inc.

5.1.13. Koch Filter Corporation

5.1.14. Nordic Air Filtration

5.1.15. Filtration Group Corporation

5.2. Cross Comparison Parameters

5.2.1. Revenue

5.2.2. Number of Employees

5.2.3. Headquarters Location

5.2.4. Inception Year

5.2.5. Product Portfolio Strength

5.2.6. Market Share

5.2.7. R&D Expenditure

5.2.8. Patents and Innovations

5.3. Market Share Analysis

5.4. Strategic Initiatives (M&A, Partnerships, Alliances)

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Government Grants and Incentives

5.8. Private Equity Investments

6. Global Air Filters Market Regulatory Framework

6.1. Environmental Standards (Emission Control Regulations)

6.2. Compliance Requirements (ISO Certifications, ASHRAE Standards)

6.3. Certification Processes

7. Global Air Filters Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Air Filters Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Filter Media (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Global Air Filters Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase of research involves mapping the Global Air Filters Market ecosystem, identifying key stakeholders such as manufacturers, suppliers, and end-users. This is achieved through extensive desk research, utilizing proprietary databases and publicly available data from reputable sources like industry reports and government publications.

Step 2: Market Analysis and Construction

In this step, historical data on market performance is compiled and analyzed to understand the trends and patterns shaping the market. This involves a deep dive into air filter applications across sectors such as healthcare, automotive, and industrial, as well as a study of market growth drivers and challenges.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market insights are then validated through consultations with industry experts, including professionals from air filter manufacturing companies and regulatory bodies. This is done through phone interviews and surveys, providing a real-world perspective on the data and trends analyzed.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all gathered information into a comprehensive report. This includes cross-referencing data from top-down and bottom-up approaches to ensure accuracy. The final report is then subjected to peer reviews by market experts before being published.

Frequently Asked Questions

1. How big is the Global Air Filters Market?

The global air filters market is valued at USD 15 billion, driven by strong demand in industrial, healthcare, and residential applications.

2. What are the challenges in the Global Air Filters Market?

Key challenges include high initial costs of advanced air filtration systems and the presence of low-cost substitutes, which can reduce market penetration for premium solutions.

3. Who are the major players in the Global Air Filters Market?

Major players include Donaldson Company, Parker Hannifin, Mann+Hummel, Freudenberg Group, and AAF International, known for their extensive product portfolios and global market reach.

4. What are the growth drivers of the Global Air Filters Market?

Growth is driven by increasing government regulations on air quality control, technological advancements in filtration systems, and growing awareness of indoor air quality in industrial and residential settings.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.