Global Aircraft Cockpit Display System Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD5413

November 2024

87

About the Report

Global Aircraft Cockpit Display System Market Overview

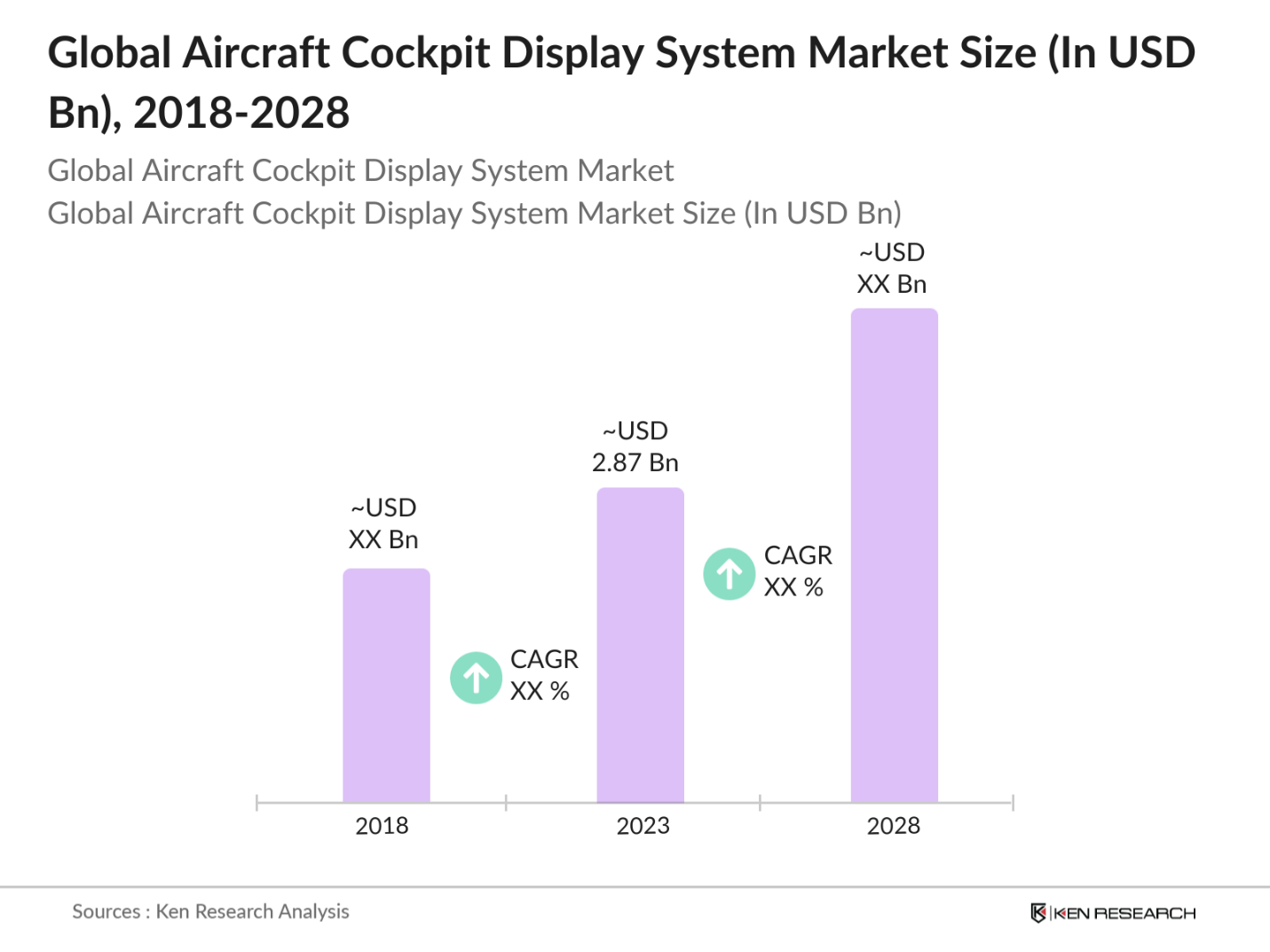

- The Global Aircraft Cockpit Display System Market is valued at USD 2.87 billion, based on a five-year historical analysis. This growth is driven by continuous advancements in avionics technology and the increasing need for real-time data visualization to enhance flight safety and efficiency. As airlines and defense sectors seek to modernize their fleets, cockpit display systems have become essential for situational awareness, system alerts, and navigation, fueling their adoption in both commercial and military aviation sectors.

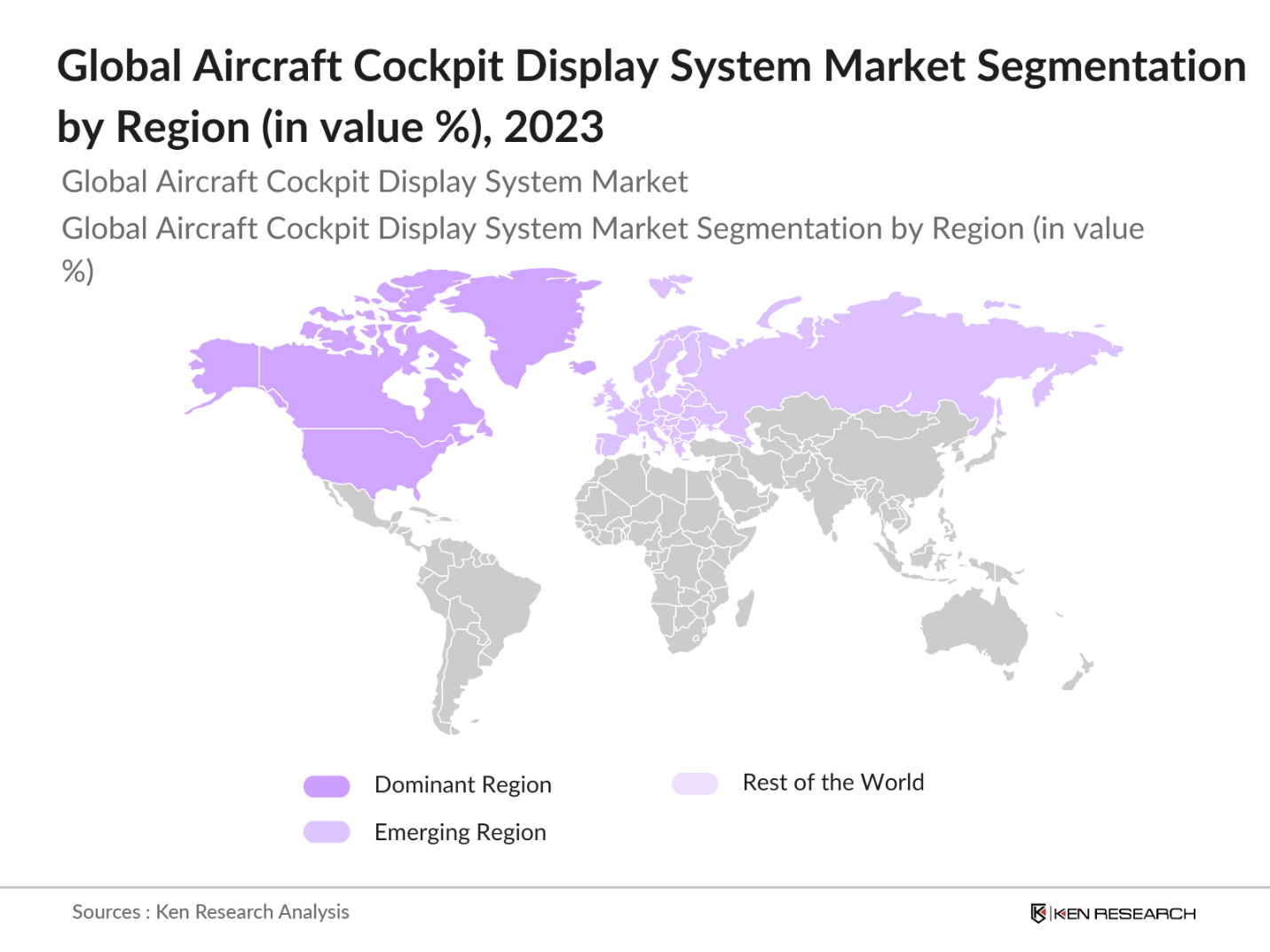

- North America leads the market, primarily due to a well-established aviation industry and strong R&D investments from major players like Honeywell Aerospace and Collins Aerospace. Europe and Asia-Pacific also hold significant shares; Europe benefits from high defense expenditure and the presence of key manufacturers, while Asia-Pacific experiences rapid growth in commercial aviation and increasing investments in aviation technology in countries such as China and India.

- The International Civil Aviation Organization (ICAO) sets global safety standards that influence cockpit display system requirements. For example, ICAO mandates the implementation of Terrain Awareness and Warning Systems (TAWS) in certain aircraft to prevent Controlled Flight into Terrain (CFIT) incidents. Compliance with these standards drives the adoption of advanced cockpit display technologies.

Global Aircraft Cockpit Display System Market Segmentation

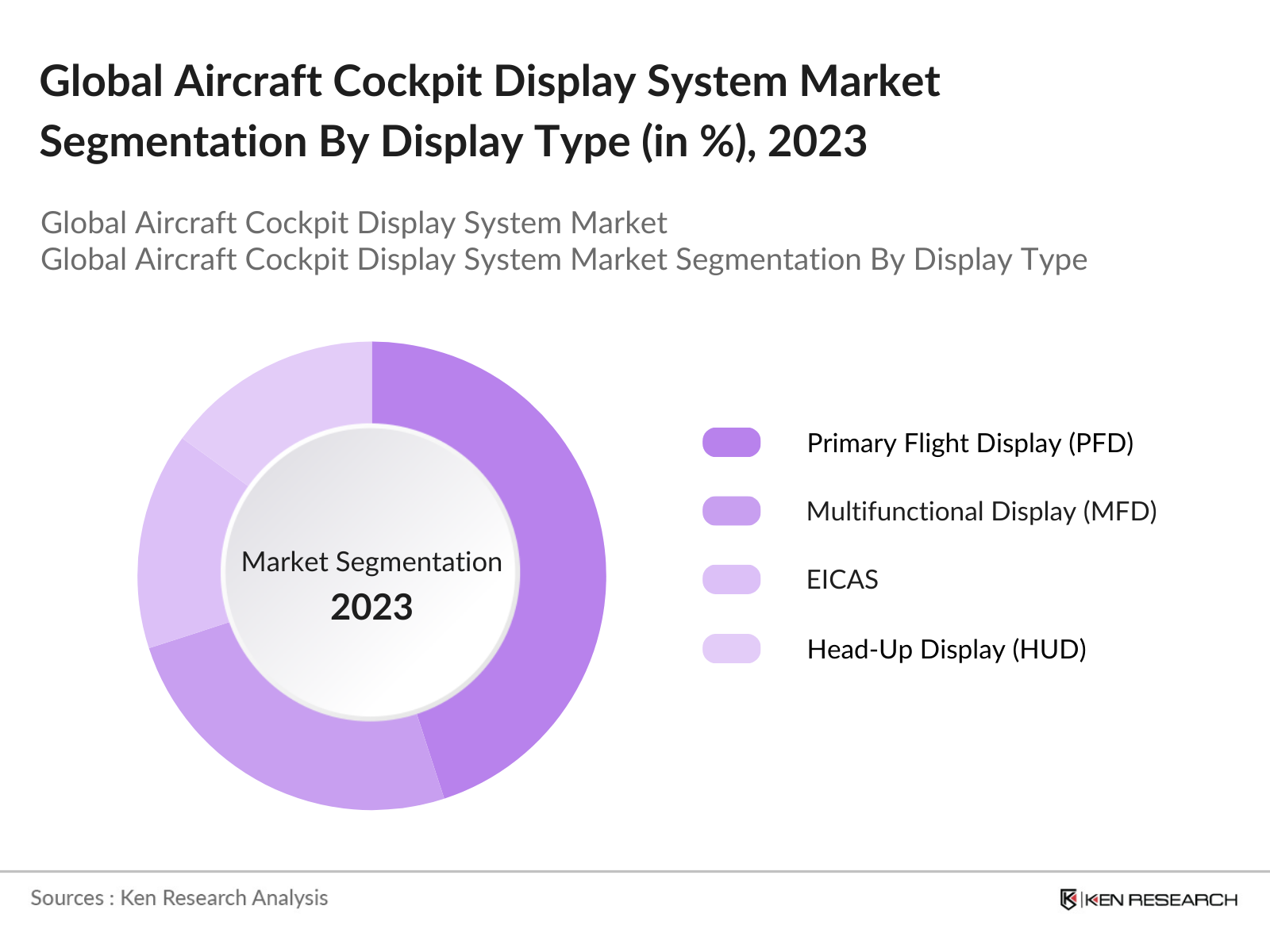

By Display Type: The market is segmented by display type into Primary Flight Display (PFD), Multifunctional Display (MFD), Engine-Indicating and Crew Alerting System (EICAS), Head-Up Display (HUD), and Synthetic Vision Systems (SVS). Among these, Primary Flight Displays dominate due to their essential role in enhancing situational awareness and aiding pilots with critical real-time flight data. These displays have become crucial in both commercial and military aviation, where safety and efficiency are prioritized.

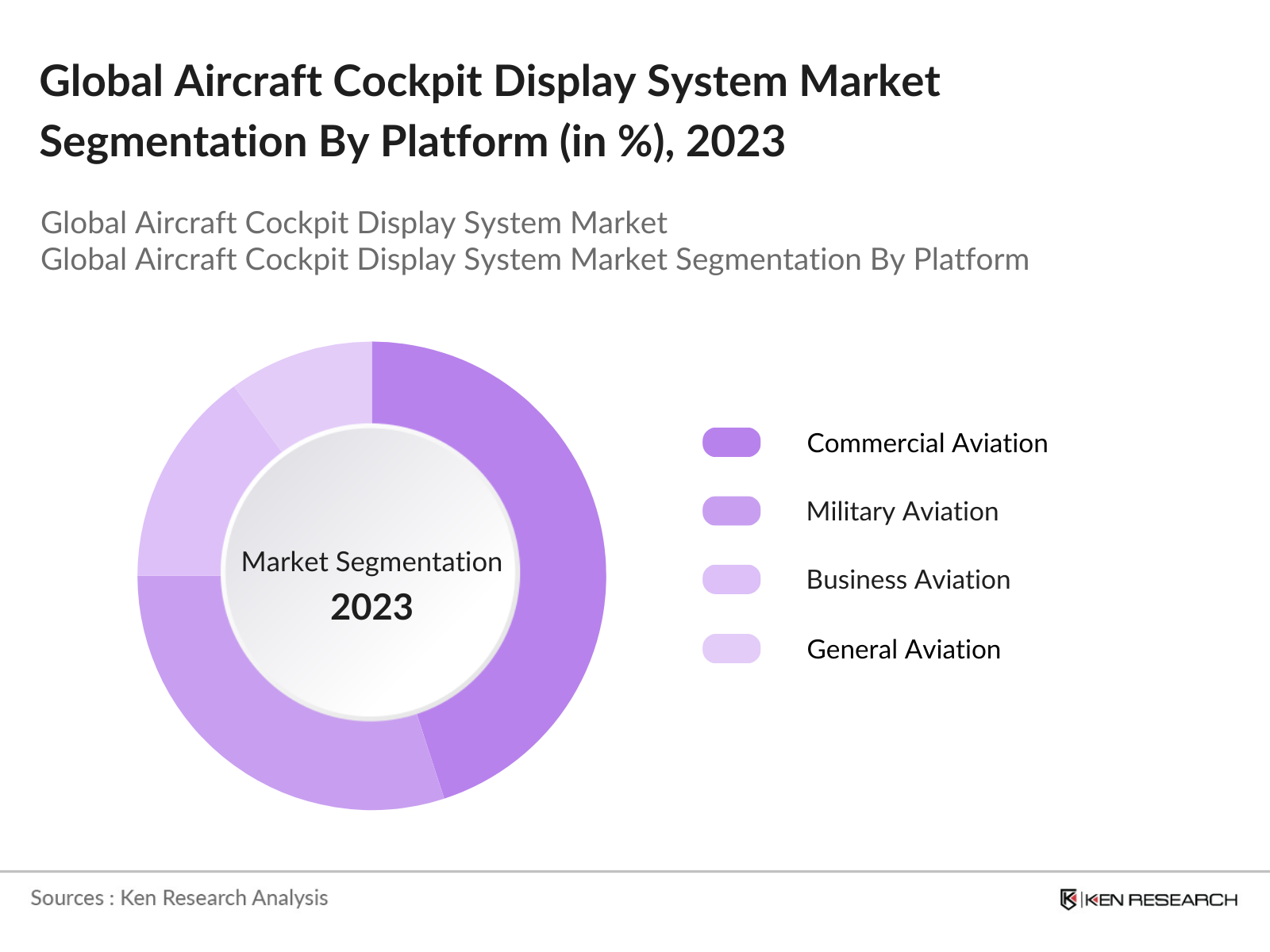

By Platform: The market segmentation by platform includes Commercial Aviation, Military Aviation, Business Aviation, General Aviation, and Helicopters. Commercial Aviation holds the dominant share, driven by the rapid expansion of the global airline industry and an increased focus on passenger safety and efficient flight management systems. Military aviation follows closely due to continuous modernization efforts within defense budgets worldwide.

By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to the presence of major manufacturers and strong R&D capabilities. Europe and Asia-Pacific also play significant roles, with Europe benefitting from strong defense spending and Asia-Pacific witnessing increased investment in commercial aviation to meet rising passenger demand.

Global Aircraft Cockpit Display System Market Competitive Landscape

The Global Aircraft Cockpit Display System Market is led by several key players, including Honeywell Aerospace and Collins Aerospace, which contribute significantly to the market. Their dominance highlights the consolidation of major players, providing a competitive edge through extensive R&D investments, robust distribution networks, and innovative product offerings.

Global Aircraft Cockpit Display System Industry Analysis

Growth Drivers

- Technological Innovations in Avionics: The aviation industry has witnessed significant technological advancements, particularly in avionics systems. The integration of advanced cockpit display systems enhances pilot situational awareness and flight safety. For instance, the Federal Aviation Administration (FAA) has implemented the NextGen program, aiming to modernize the National Airspace System. This initiative includes the adoption of advanced avionics technologies, such as Automatic Dependent Surveillance-Broadcast (ADS-B), which became mandatory for aircraft operating in certain airspace from January 1, 2020.

- Expansion of Military and Commercial Aviation: The global aviation sector is experiencing growth in both military and commercial segments. According to the International Air Transport Association (IATA), global air passenger numbers are expected to reach 4.0 billion in 2024, recovering to pre-pandemic levels. Additionally, defense budgets have seen increases; for example, the United States Department of Defense's budget for fiscal year 2024 is $842 billion, reflecting a focus on modernizing military capabilities, including aircraft fleets. This expansion necessitates the adoption of advanced cockpit display systems to enhance operational efficiency and safety.

- Regulatory Mandates for Enhanced Safety: Aviation regulatory bodies have implemented stringent safety mandates to improve flight operations. The European Union Aviation Safety Agency (EASA) has introduced regulations requiring the installation of Terrain Awareness and Warning Systems (TAWS) in certain aircraft categories to prevent Controlled Flight into Terrain (CFIT) incidents. Compliance with such regulations drives the demand for advanced cockpit display systems that integrate TAWS functionalities, ensuring adherence to safety standards.

Market Challenges

- High Installation and Maintenance Costs: Implementing advanced cockpit display systems involves substantial financial investment. The cost of installing a modern avionics suite in a commercial aircraft can range from $500,000 to $1 million, depending on the system's complexity. Additionally, maintenance expenses are significant; the FAA estimates that avionics maintenance accounts for approximately 20% of an aircraft's total maintenance costs. These high costs can be a barrier for airlines, especially those operating on tight budgets.

- System Integration Complexities: Integrating new cockpit display systems with existing avionics can be complex and time-consuming. The FAA's Advisory Circular AC 20-165B outlines the challenges associated with integrating ADS-B systems, emphasizing the need for thorough testing and validation to ensure compatibility and functionality. Such complexities can lead to extended aircraft downtime and increased labor costs during the integration process.

Global Aircraft Cockpit Display System Market Future Outlook

Over the coming years, the Global Aircraft Cockpit Display System Market is expected to experience substantial growth, fueled by advancements in display technology, increasing focus on safety and situational awareness, and rising demand for connected avionics systems. The expansion of military and commercial aviation sectors, coupled with ongoing efforts for fleet modernization and adoption of augmented reality displays, will further drive market growth.

Market Opportunities

- Next-Generation Cockpit Display Technologies: The development of next-generation cockpit display technologies presents significant opportunities. The National Aeronautics and Space Administration (NASA) is researching advanced display systems, such as synthetic vision systems (SVS), which provide pilots with 3D representations of terrain and obstacles. These innovations aim to enhance situational awareness and flight safety, offering potential for integration into commercial and military aircraft.

- Growth in Emerging Markets: Emerging markets are experiencing rapid growth in air travel demand. The International Air Transport Association (IATA) forecasts that India will become the third-largest aviation market by 2024, with an estimated 442 million passengers. This surge necessitates the expansion of airline fleets and the adoption of advanced avionics, including modern cockpit display systems, to meet operational and safety standards.

Scope of the Report

|

Display Type |

Primary Flight Display (PFD) Multifunctional Display (MFD) Engine-Indicating and Crew Alerting System (EICAS) Head-Up Display (HUD) Synthetic Vision Systems (SVS) |

|

Platform |

Commercial Aviation Military Aviation Business Aviation General Aviation Helicopters |

|

Technology |

Light-Emitting Diode (LED) Organic Light-Emitting Diode (OLED) Active-Matrix Liquid Crystal Display (AMLCD) |

|

Component |

Hardware Software Services |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Aircraft Manufacturers

Aerospace Component Suppliers

Avionics Systems Integrators

Government and Regulatory Bodies (FAA, EASA, ICAO)

Military and Defense Agencies

Commercial Airlines

Investment and Venture Capitalist Firms

R&D Organizations in Aviation

Companies

Players Mentioned in the Report

Honeywell Aerospace

Collins Aerospace

Thales Group

Elbit Systems

Garmin Ltd.

GE Aviation

Northrop Grumman

Dynon Avionics

BAE Systems

Saab AB

Table of Contents

1. Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Market Analysis

3.1 Growth Drivers

3.1.1 Technological Innovations in Avionics

3.1.2 Expansion of Military and Commercial Aviation

3.1.3 Regulatory Mandates for Enhanced Safety

3.1.4 Rising Demand for Real-Time Flight Data

3.2 Market Challenges

3.2.1 High Installation and Maintenance Costs

3.2.2 System Integration Complexities

3.2.3 Limited Skilled Workforce in Developing Regions

3.3 Opportunities

3.3.1 Next-Generation Cockpit Display Technologies

3.3.2 Growth in Emerging Markets

3.3.3 Retrofit Demand for Aging Aircraft

3.4 Trends

3.4.1 Adoption of Multi-Function Displays

3.4.2 Use of Augmented Reality for Enhanced Visualization

3.4.3 Shift to Lightweight and Durable Display Materials

3.5 Government Regulations

3.5.1 ICAO Safety Standards

3.5.2 FAA and EASA Certification Requirements

3.5.3 National Defense and Security Initiatives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Market Segmentation

4.1 By Display Type (In Value %)

4.1.1 Primary Flight Display (PFD)

4.1.2 Multifunctional Display (MFD)

4.1.3 Engine-Indicating and Crew Alerting System (EICAS)

4.1.4 Head-Up Display (HUD)

4.1.5 Synthetic Vision Systems (SVS)

4.2 By Platform (In Value %)

4.2.1 Commercial Aviation

4.2.2 Military Aviation

4.2.3 Business Aviation

4.2.4 General Aviation

4.2.5 Helicopters

4.3 By Technology (In Value %)

4.3.1 Liquid Crystal Display (LCD)

4.3.2 Light-Emitting Diode (LED)

4.3.3 Organic Light-Emitting Diode (OLED)

4.3.4 Active Matrix Liquid Crystal Display (AMLCD)

4.4 By Component (In Value %)

4.4.1 Hardware

4.4.2 Software

4.4.3 Services

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Honeywell Aerospace

5.1.2 Thales Group

5.1.3 GE Aviation

5.1.4 Collins Aerospace

5.1.5 Elbit Systems

5.1.6 Transdigm Group

5.1.7 Northrop Grumman

5.1.8 Aspen Avionics

5.1.9 Garmin Ltd.

5.1.10 L3Harris Technologies

5.1.11 Dynon Avionics

5.1.12 BAE Systems

5.1.13 Saab AB

5.1.14 Universal Avionics Systems Corporation

5.1.15 Avidyne Corporation

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Regulatory Framework

6.1 Aviation Safety Standards

6.2 Compliance and Certification Processes

6.3 Environmental Regulations

6.4 Cybersecurity and Data Privacy Standards

7. Future Market Size (In USD Million)

7.1 Market Size Projections

7.2 Key Drivers of Future Growth

8. Future Market Segmentation

8.1 By Display Type (In Value %)

8.2 By Platform (In Value %)

8.3 By Technology (In Value %)

8.4 By Component (In Value %)

8.5 By Region (In Value %)

9. Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the main stakeholders and variables affecting the Global Aircraft Cockpit Display System Market. This includes a comprehensive analysis of industry sources, utilizing both primary and secondary research data to identify market drivers, challenges, and emerging opportunities.

Step 2: Market Analysis and Construction

Next, we analyze historical data and assess current market trends to estimate market sizes and growth rates. This step includes a bottom-up approach to evaluate revenue streams across various platforms, segments, and regions, ensuring accuracy in our market projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate the gathered data, we conduct interviews with industry experts and stakeholders through computer-assisted telephone interviews (CATI). Insights from these consultations help refine market assumptions and provide additional perspectives on technological advancements.

Step 4: Research Synthesis and Final Output

In the final stage, data from primary and secondary sources are synthesized to produce a comprehensive market analysis. This report integrates insights from key players and market influencers to offer a holistic overview of current and future trends in the Aircraft Cockpit Display System Market.

Frequently Asked Questions

01. How big is the Global Aircraft Cockpit Display System Market?

The Global Aircraft Cockpit Display System Market is valued at USD 2.87 billion, based on a five-year historical analysis. This growth is driven by continuous advancements in avionics technology and the increasing need for real-time data visualization to enhance flight safety and efficiency.

02. What are the challenges in the Global Aircraft Cockpit Display System Market?

Challenges include high costs of installation and maintenance, system integration complexities, and cybersecurity concerns, especially in connected aircraft systems.

03. Who are the major players in the Global Aircraft Cockpit Display System Market?

Key players include Honeywell Aerospace, Collins Aerospace, Thales Group, Elbit Systems, and Garmin Ltd., recognized for their innovative avionics solutions.

04. What are the growth drivers of the Global Aircraft Cockpit Display System Market?

The market is driven by advancements in display technology, increasing safety regulations, and growing demand for multifunctional and augmented reality displays in commercial and military aviation.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.