Global Airway Management Devices Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD2160

December 2024

84

About the Report

Global Airway Management Devices Market Overview

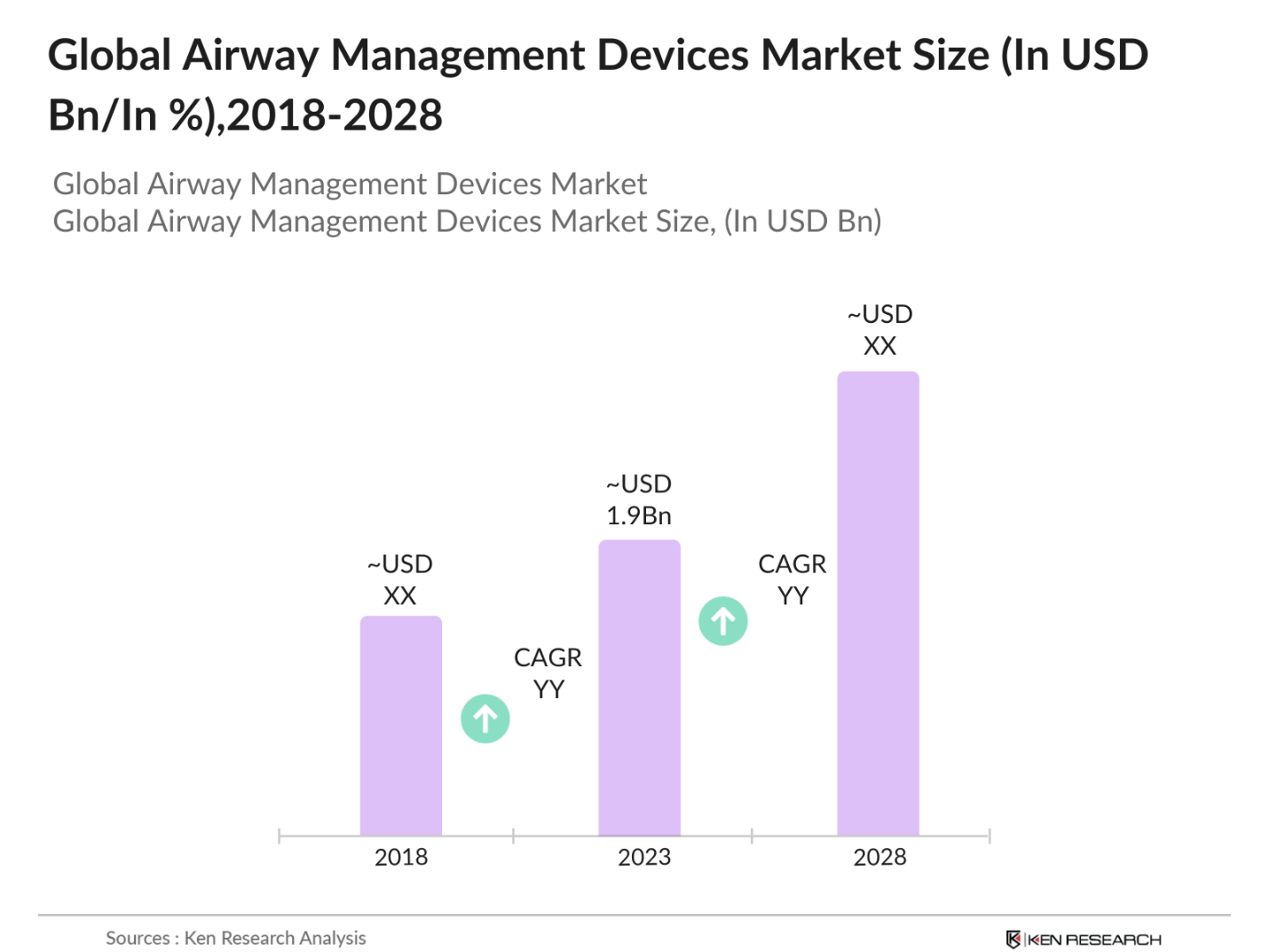

- The Global Airway Management Devices Market was valued at USD 1.9 billion in 2023. The market is driven by the rising prevalence of chronic respiratory diseases such as chronic obstructive pulmonary disease (COPD) and asthma, coupled with an increase in the number of surgical procedures requiring anesthesia.

- The major players in the global airway management devices market include Medtronic, Teleflex Incorporated, Smiths Medical, Ambu A/S, and Vyaire Medical. These companies are at the forefront of developing innovative airway management solutions, particularly in enhancing non-invasive methods and integrating real-time visualization technologies to improve intubation accuracy and patient safety.

- In 2023, Medtronic introduced the Shiley Flexible Tracheostomy Tube, which is designed to improve patient comfort while ensuring secure airway management during surgeries and intensive care. This launch marked a significant enhancement in Medtronics respiratory care portfolio, focusing on solutions that cater to both hospitals and emergency medical services.

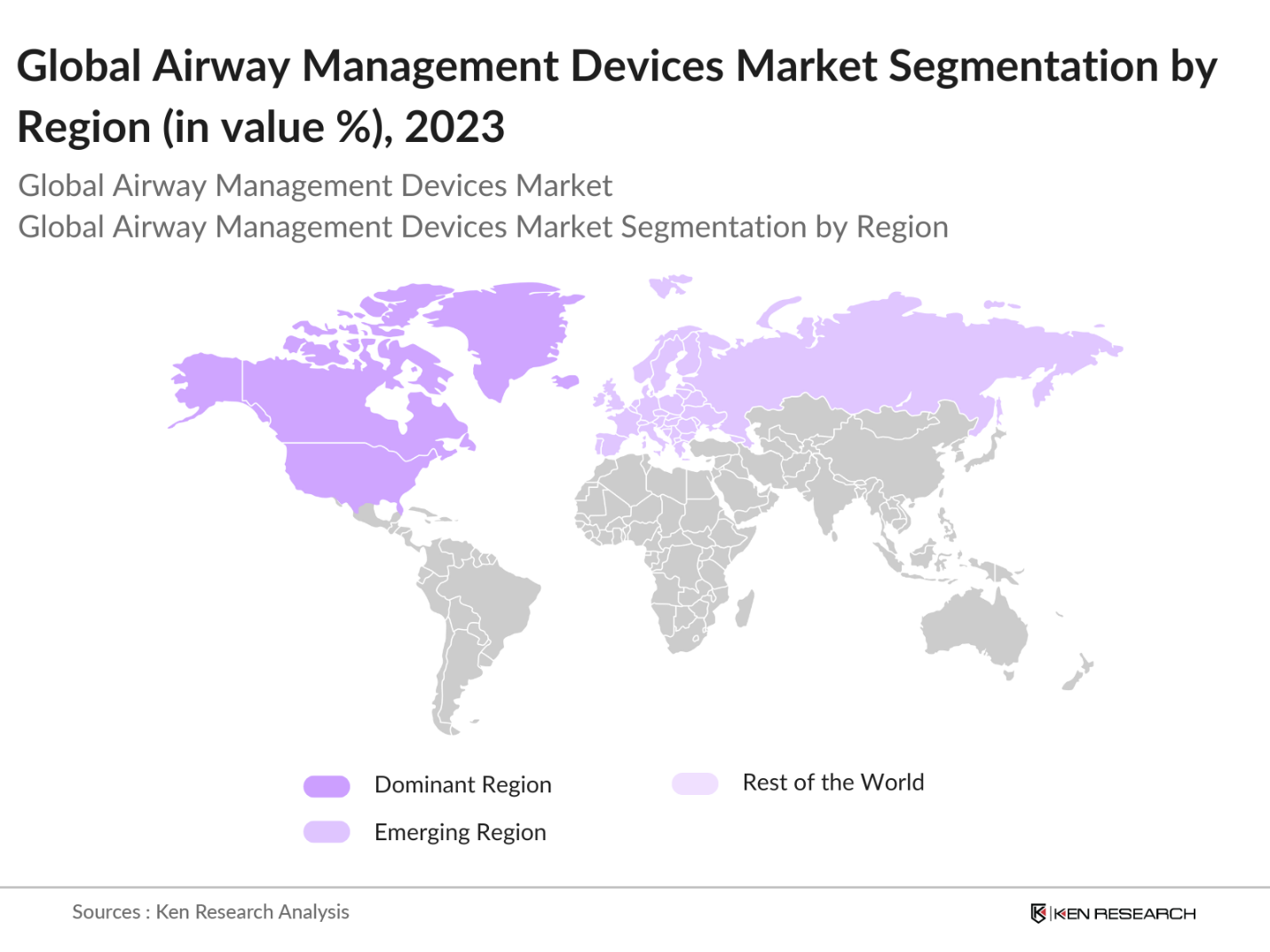

- In 2023, North America dominated the global airway management devices market due to the region's advanced healthcare infrastructure, the high prevalence of respiratory diseases, and substantial investments in healthcare technologies. The increasing number of surgeries performed in North America further solidified the regions leading position in the market.

Global Airway Management Devices Market Segmentation

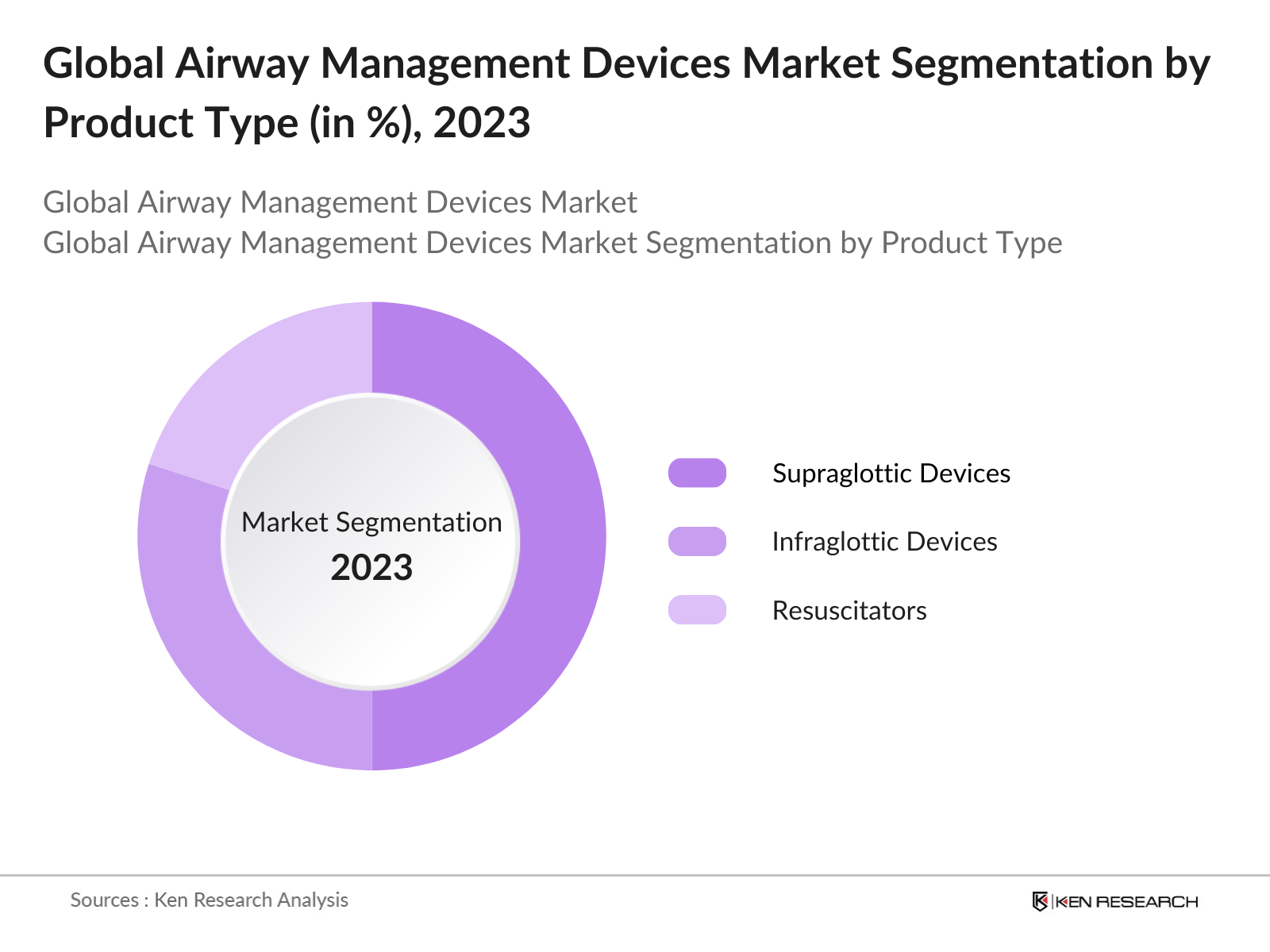

The global airway management devices market is segmented by region, product type, and end user.

By Region: The global airway management devices market is segmented into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. In 2023, North America held the largest market share, supported by its robust healthcare infrastructure, high healthcare expenditure, and the presence of key market players.

By Product Type: The market is segmented into Infraglottic Devices, Supraglottic Devices, and Resuscitators. In 2023, the Supraglottic Devices segment held the highest market share, driven by the growing preference for minimally invasive airway management tools that reduce trauma and are easier to use in both elective and emergency situations.

By End User: The market is segmented into Hospitals, Ambulatory Surgical Centers (ASCs), and Emergency Care Settings. In 2023, Hospitals accounted for the largest market share due to the high volume of surgical procedures and the critical care services provided by hospitals that require advanced airway management systems.

Global Airway Management Devices Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Medtronic |

1949 |

Dublin, Ireland |

|

Teleflex Incorporated |

1943 |

Wayne, Pennsylvania, USA |

|

Smiths Medical |

1940 |

Minneapolis, Minnesota, USA |

|

Ambu A/S |

1937 |

Ballerup, Denmark |

|

Vyaire Medical |

2016 |

Mettawa, Illinois, USA |

- Teleflex Incorporated: In 2023, Teleflex launched a new line of LMA Supreme Airway devices, focusing on improving airway seal and ventilation in both routine and emergency intubations. The device has been adopted by several major hospitals across the U.S., contributing to Teleflexs revenue growth in the airway management sector.

- Smiths Medical: In 2023, Smiths Medical introduced the Portex Soft Seal cuffed endotracheal tubes, which are designed to reduce the risk of tracheal injuries during long-term ventilation. This innovation has been particularly well received in the European market, where safety and patient comfort are high priorities.

Global Airway Management Devices Market Analysis

Global Airway Management Devices Market Growth Drivers:

- Increasing Prevalence of Respiratory Diseases: In 2023, it was reported that 550 million people globally were living with respiratory diseases such as COPD and asthma. This increasing patient pool drives the demand for airway management devices, as these conditions often require advanced airway interventions, especially during hospital admissions and surgeries.

- Rising Number of Surgeries: In 2023, over millions of surgeries were performed globally, many of which required some form of airway management, particularly in procedures involving general anesthesia. This increasing number of surgeries is a key driver of demand for airway devices in hospitals and surgical centers, where maintaining airway patency is critical.

- Advancements in Non-Invasive Airway Management Technologies: In 2023, non-invasive airway management devices, particularly video laryngoscopes, saw a significant rise in adoption due to their ability to reduce complications during intubation. The integration of real-time visualization technology has improved the accuracy of intubation, reducing the risk of complications and improving patient outcomes.

Global Airway Management Devices Market Challenges:

- Limited Access in Emerging Markets: In regions such as Africa and Southeast Asia, access to advanced airway management devices remains limited due to inadequate healthcare infrastructure and training. In 2023, it was estimated that only few of healthcare facilities in these regions were equipped with modern airway management tools.

- Regulatory Hurdles: Stringent regulations, particularly in North America and Europe, require extensive testing and approvals for new airway management devices. In 2023, the U.S. FDA approval process for new devices took an average of 24 months, slowing down the introduction of innovative products to the market.

Global Airway Management Devices Market Government Initiatives:

- U.S. Department of Health and Human Services Emergency Response Program: In 2023, the U.S. Department of Health and Human Services (HHS) launched a program to improve emergency response infrastructure across hospitals. This program is expected to increase the adoption of advanced devices like portable laryngoscopes and tracheostomy kits, providing a much-needed boost to the airway management device market in the U.S.

- India's National Health Mission (NHM) Initiative: In 2023, under India's National Health Mission (NHM), the government allocated 29,085 crore, to upgrade medical infrastructure, including emergency and surgical care units across the country. A significant portion of this funding is directed towards improving the availability of airway management devices in government hospitals and rural healthcare centers, aiming to enhance patient outcomes, especially in remote regions with limited access to critical care equipment.

Global Airway Management Devices Market Future Market Outlook

The Global Airway Management Devices Market is expected to grow substantially through 2028, driven by rising respiratory disease cases, increasing surgical procedures, and technological advancements in airway management devices.

Global Airway Management Devices Market Future Market Trends:

- Integration of Artificial Intelligence (AI) in Airway Management: By 2028, AI-driven airway management systems, particularly in video laryngoscopes, will become more prevalent, offering real-time feedback during intubation and improving procedural outcomes. AI-assisted airway management is expected to enhance patient safety, reduce human error, and become a key feature in next-generation devices.

- Growing Adoption of Disposable Devices: With concerns over cross-contamination and hospital-acquired infections, disposable airway management devices will see increased demand. By 2028, a majority of hospitals are expected to have transitioned to single-use laryngeal masks and endotracheal tubes, ensuring higher hygiene standards.

Scope of the Report

|

By Component Type |

Devices Services |

|

By End User |

Hospitals Ambulatory Surgical Centers Emergency Care Settings |

|

By Product Type |

Infraglottic Devices Supraglottic Devices Resuscitators |

|

By Deployment Mode |

On-Premise |

|

By Region |

North America Europe Asia-Pacific (APAC) Middle East & Africa (MEA) Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies (FDA,EMA)

Hospitals and Emergency Care Industry

Medical Device Companies

Healthcare Companies

Healthcare R&D Companies

Capital Investor & Firm

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Medtronic

Teleflex Incorporated

Smiths Medical

Ambu A/S

Vyaire Medical

Cook Medical

KARL STORZ

Intersurgical Ltd.

Fisher & Paykel Healthcare

Flexicare Medical Ltd.

Table of Contents

1. Global Airway Management Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Airway Management Devices Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Airway Management Devices Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Respiratory Diseases

3.1.2. Rising Number of Surgeries

3.1.3. Advancements in Non-Invasive Airway Management Technologies

3.2. Restraints

3.2.1. Limited Access in Emerging Markets

3.2.2. Regulatory Hurdles

3.2.3. High Cost of Advanced Devices

3.3. Opportunities

3.3.1. Technological Advancements in AI and Machine Learning

3.3.2. Expansion into Emerging Markets

3.3.3. Increasing Demand for Disposable Airway Management Devices

3.4. Trends

3.4.1. Integration of AI in Airway Management

3.4.2. Growing Adoption of Disposable Devices

3.4.3. Enhanced Real-Time Visualization Technologies

3.5. Government Regulation

3.5.1. U.S. Department of Health and Human Services Initiatives

3.5.2. European Union MDR Compliance

3.5.3. Indias National Health Mission (NHM) Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. Global Airway Management Devices Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Infraglottic Devices

4.1.2. Supraglottic Devices

4.1.3. Resuscitators

4.2. By End User (in Value %)

4.2.1. Hospitals

4.2.2. Ambulatory Surgical Centers (ASCs)

4.2.3. Emergency Care Settings

4.3. By Deployment Mode (in Value %)

4.3.1. On-Premise

4.3.2. Cloud-Based

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific (APAC)

4.4.4. Latin America

4.4.5. Middle East & Africa (MEA)

5. Global Airway Management Devices Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Medtronic

5.1.2. Teleflex Incorporated

5.1.3. Smiths Medical

5.1.4. Ambu A/S

5.1.5. Vyaire Medical

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Airway Management Devices Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Airway Management Devices Market Regulatory Framework

7.1. U.S. FDA Regulations and Compliance

7.2. European Union MDR Compliance

7.3. Certification Processes and Requirements

8. Global Airway Management Devices Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Airway Management Devices Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End User (in Value %)

9.3. By Deployment Mode (in Value %)

9.4. By Region (in Value %)

10. Global Airway Management Devices Market Analysts' Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the Market to collate Market-level information.

Step: 2 Market Building

Collating statistics on the Global Airway Management Devices Market over the years, and analyzing the penetration of Marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building Market hypotheses and conducting CATIs with Market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple Airway Management Devices companies to understand the nature of service segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these Airway Management Devices companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01 How big is the Global Airway Management Devices Market?

The global airway management devices market was valued at USD 1.9 billion in 2023, driven by the increasing prevalence of respiratory diseases and rising surgical procedures requiring advanced airway management solutions.

02 What are the major growth drivers of the Global Airway Management Devices Market?

The major growth drivers include the rising number of respiratory disease cases, the increasing volume of surgeries requiring anesthesia, and advancements in non-invasive airway management technologies, such as video laryngoscopes.

03 Who are the major players in the Global Airway Management Devices Market?

Key players include Medtronic, Teleflex Incorporated, Smiths Medical, Ambu A/S, and Vyaire Medical. These companies lead the market through innovative product development and a strong global distribution network.

04 What challenges does the Global Airway Management Devices Market face?

Challenges include the high cost of advanced devices, a shortage of skilled healthcare professionals in emerging markets, and stringent regulatory barriers, particularly in North America and Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.