Global Alkyl Polyglucoside Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD9545

December 2024

95

About the Report

Global Alkyl Polyglucoside Market Overview

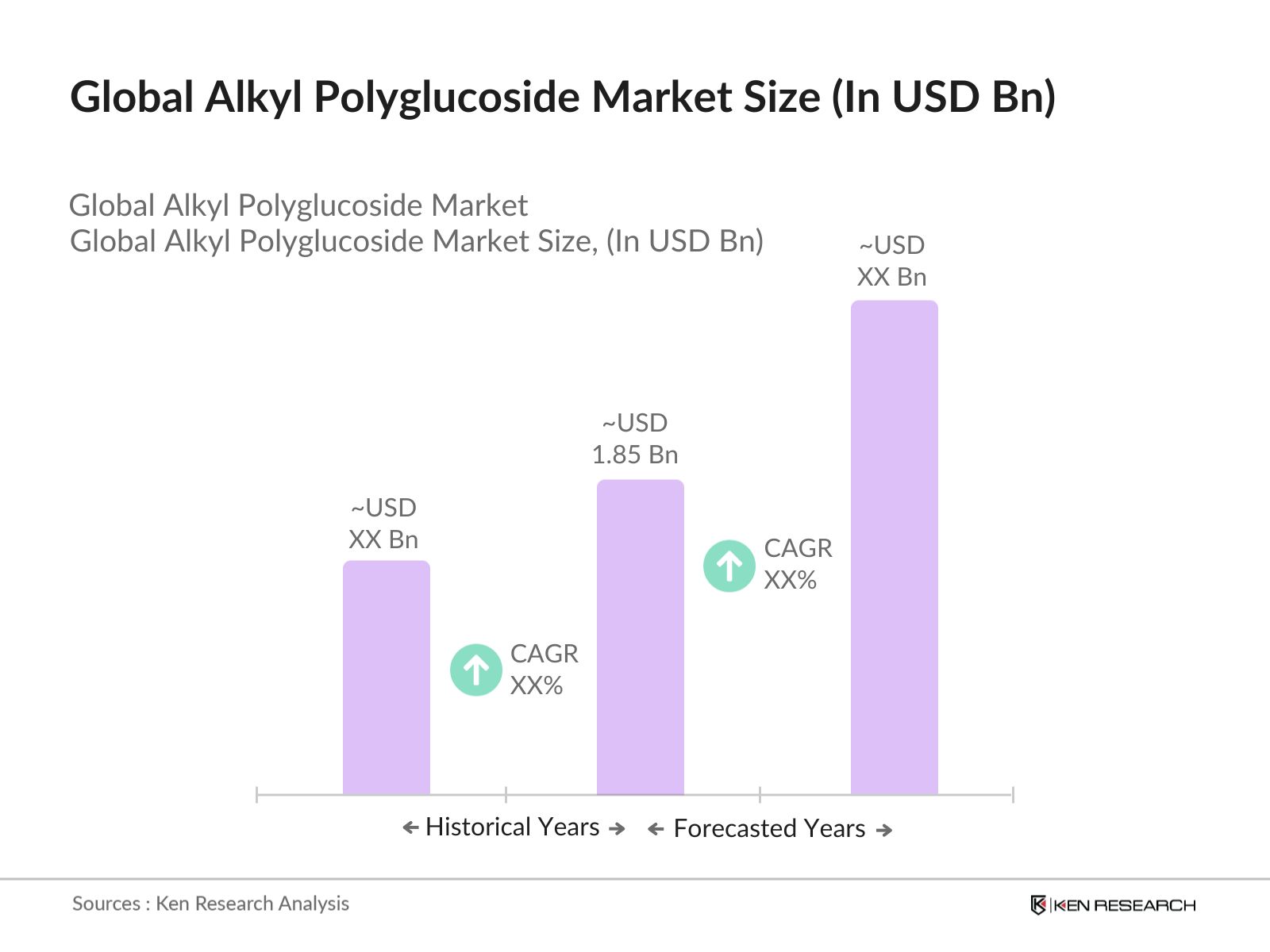

- The global alkyl polyglucoside market was valued at USD 1.85 billion based on a five-year historical analysis. This market is driven by the increasing demand for bio-based surfactants in various applications such as personal care, home care, and industrial sectors. Key drivers include the growing preference for environmentally friendly products, as alkyl polyglucosides are non-toxic, biodegradable, and sourced from renewable resources. This has also been supported by regulatory frameworks encouraging the use of sustainable chemicals in manufacturing processes. The market has witnessed steady growth due to increasing awareness of ecological concerns and the shift towards natural products.

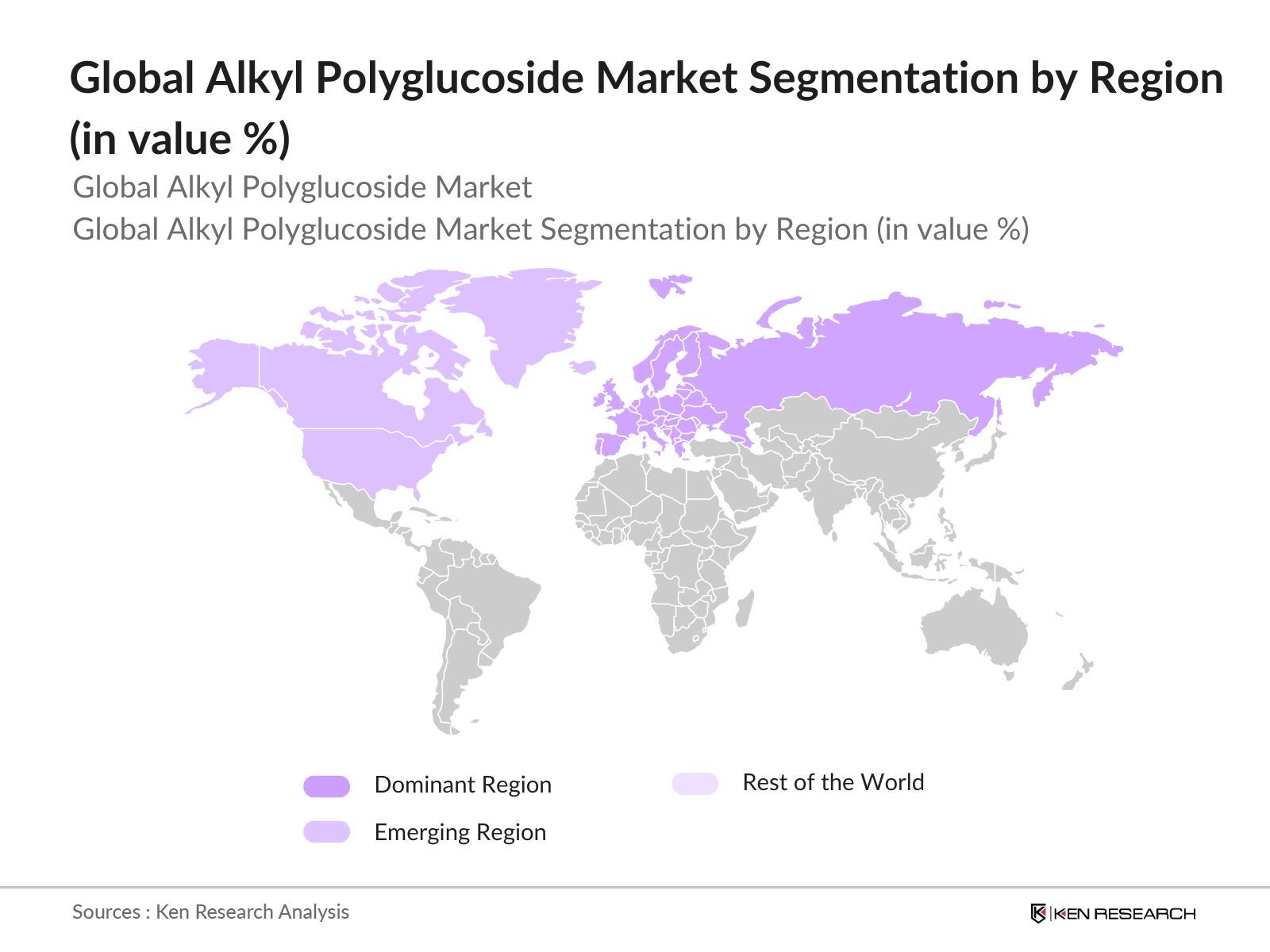

- Regions such as Europe and North America dominate the alkyl polyglucoside market due to their stringent environmental regulations and high consumer awareness of sustainability. Countries like Germany, France, and the United States have seen significant growth due to the high demand for eco-friendly personal care and household cleaning products. Additionally, strong industrial research and development activities and government incentives in these regions support the growth of bio-based products. Asia Pacific is also emerging as a significant market, driven by increasing industrial applications and rising disposable incomes in countries like China and India.

- The global regulatory framework for biodegradable chemicals, including alkyl polyglucosides, is becoming more stringent. over 80 countries have implemented new regulations for biodegradable and bio-based chemicals, emphasizing the need for eco-friendly alternatives. This regulatory push is driving the demand for alkyl polyglucosides, as companies seek to comply with environmental laws and certifications to avoid penalties and improve their sustainability profiles.

Global Alkyl Polyglucoside Market Segmentation

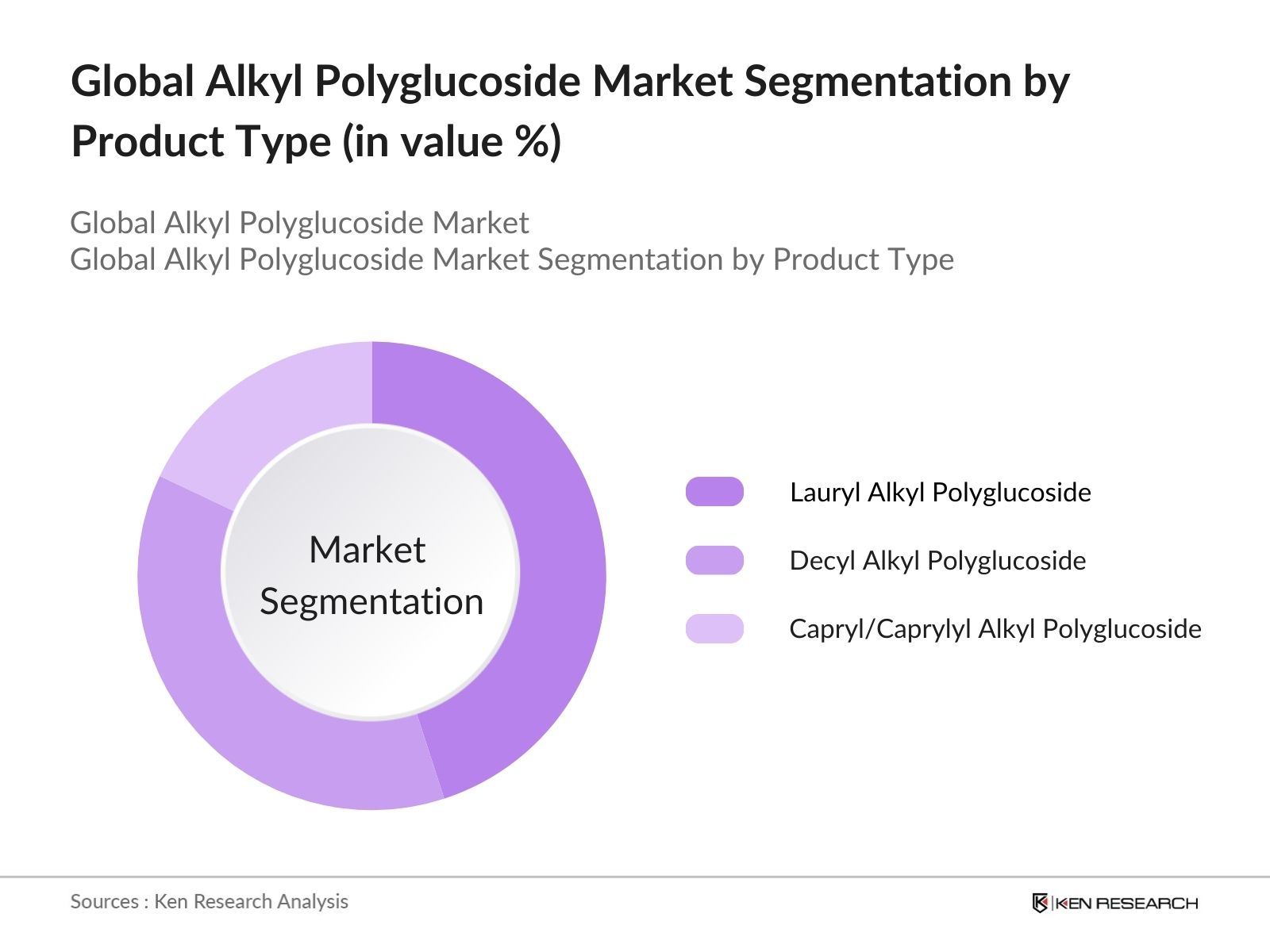

By Product Type: The global alkyl polyglucoside market is segmented by product type into capryl/caprylyl alkyl polyglucoside, lauryl alkyl polyglucoside, and decyl alkyl polyglucoside. Among these, lauryl alkyl polyglucoside holds the dominant market share due to its widespread use in personal care products like shampoos and cleansers. Lauryl alkyl polyglucoside is preferred for its excellent foaming properties and mild nature, making it suitable for formulations targeting sensitive skin and baby care products. Additionally, its ease of formulation and wide availability of raw materials contribute to its leading position in this segment.

By Region: The market is regionally segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe leads the market due to its early adoption of bio-based chemicals and stringent environmental policies. The European Unions REACH regulations have accelerated the shift towards sustainable surfactants, creating robust demand in personal care and home care applications. The presence of large manufacturers and ongoing innovation in the region also contribute to the dominance of Europe in the alkyl polyglucoside market.

By Application: The market is segmented by application into personal care, home care, industrial & institutional cleaners, agriculture, and oil & gas industries. Personal care dominates the market as alkyl polyglucosides are increasingly used in the formulation of eco-friendly products like shampoos, body washes, and facial cleansers. The demand is fueled by the rising consumer preference for biodegradable and mild surfactants that provide gentle cleansing without compromising skin health, particularly in regions like Europe and North America where environmental sustainability is a major concern.

Global Alkyl Polyglucoside Market Competitive Landscape

The global alkyl polyglucoside market is highly competitive, with major players focusing on research and development, product innovations, and partnerships to maintain their market position. The consolidation of key players, especially in Europe and North America, has created a highly concentrated market. Companies are also focusing on expanding their presence in emerging markets in Asia Pacific through collaborations and acquisitions.

Global Alkyl Polyglucoside Industry Analysis

Growth Drivers

- Increasing Demand for Bio-Based Surfactants: The demand for alkyl polyglucosides is being driven by the growing global push for bio-based surfactants, supported by rising environmental concerns. A 2024 report by the World Bank indicates that environmental pollution costs the global economy $4.6 trillion annually, highlighting the urgency for sustainable solutions. Alkyl polyglucosides, derived from renewable resources like glucose and fatty alcohols, are playing a crucial role in reducing chemical pollution in surfactant applications. Governments are promoting bio-based chemicals to combat pollution levels, making alkyl polyglucosides integral to addressing this global issue.

- Expanding Applications in Personal Care and Home Care Products: Alkyl polyglucosides are increasingly being used in personal care and home care products due to their mildness, biodegradability, and non-toxic properties. According to a 2024 OECD study, global spending on personal care products reached $1.2 trillion, with a significant portion coming from environmentally conscious consumers. As consumers continue to demand products with fewer chemicals, the use of alkyl polyglucosides is becoming more prevalent in formulations for shampoos, cleansers, and household cleaners.

- Rising Focus on Sustainability and Environmental Protection: The focus on sustainability is no longer a trend but a priority for global industries. The 2024 Environmental Performance Index (EPI) ranks nations like Sweden, Denmark, and Finland as top performers in sustainable policies, which are shaping global regulations. The growing emphasis on sustainable production methods is driving the demand for alkyl polyglucosides, which are biodegradable and derived from renewable resources. This demand is being reinforced by international policies aimed at reducing carbon footprints and encouraging the use of green chemicals.

Market Restraints

- High Production Costs: One of the significant challenges for the alkyl polyglucoside market is the high production costs associated with bio-based surfactants. According to a 2023 report by the UN Environment Program (UNEP), the production of bio-based chemicals, including alkyl polyglucosides, is more expensive due to the cost of renewable raw materials. The global average price for renewable feedstocks, such as sugar and vegetable oils, has risen to $620 per metric ton in 2024, impacting the overall production costs of alkyl polyglucosides. This cost factor can hinder widespread adoption in price-sensitive markets.

- Competition from Conventional Surfactants: Despite the growing demand for sustainable alternatives, alkyl polyglucosides face stiff competition from conventional surfactants, which are cheaper and more widely available. In 2024, conventional surfactants accounted for 84% of the total surfactant market, according to the International Council of Chemical Associations (ICCA). This dominance poses a significant challenge for the growth of alkyl polyglucosides, especially in regions where cost is a determining factor for manufacturers and consumers.

Global Alkyl Polyglucoside Market Future Outlook

Over the next five years, the global alkyl polyglucoside market is expected to exhibit significant growth, driven by the increasing adoption of bio-based surfactants across various industries, particularly in personal and home care. The demand for sustainable and biodegradable products is expected to rise, supported by stringent environmental regulations and heightened consumer awareness regarding eco-friendly alternatives. The expansion of product applications in emerging markets like Asia Pacific will also contribute to market growth, along with advancements in production technologies that aim to reduce costs and improve efficiency.

Market Opportunities

- Growth in Emerging Markets (Market Entry Barriers, Regulatory Requirements): Emerging markets present significant growth opportunities for alkyl polyglucosides, as governments in these regions are increasingly implementing regulations for eco-friendly chemicals. In 2024, Brazil, India, and China collectively allocated over $28 billion for green infrastructure and sustainable development projects. This regulatory shift in emerging markets reduces entry barriers for bio-based surfactants. However, companies looking to enter these markets must navigate complex regulatory frameworks related to green chemicals and bio-based product certifications.

- Expansion in Industrial and Agricultural Applications: Alkyl polyglucosides are finding new applications in industrial and agricultural sectors due to their low toxicity and environmental benefits. The global agricultural market was valued at $12.8 trillion in 2024, as per FAO statistics. With increasing concerns over the environmental impact of chemical pesticides and fertilizers, alkyl polyglucosides are being explored as eco-friendly alternatives for crop protection, emulsification, and wetting agents. Industrial applications are also expanding as manufacturers seek sustainable solutions to meet regulatory requirements and consumer expectations.

Scope of the Report

|

By Product Type |

Capryl/Caprylyl Alkyl Polyglucoside |

|

By Application |

Personal Care |

|

By Function |

Surfactants |

|

By Source |

Corn-Based Alkyl Polyglucosides |

|

By Region |

North America |

Products

Key Target Audience

Personal Care Manufacturers

Household Cleaning Product Manufacturers

Agriculture Industry Participants

Industrial and Institutional Cleaners

Oil & Gas Industry Players

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, EU REACH)

Sustainability-Oriented Companies

Companies

Players Mentioned in the Report:

BASF SE

Croda International PLC

Dow Chemical Company

Huntsman Corporation

Galaxy Surfactants Ltd.

Clariant AG

Airedale Chemical Company

SEPPIC S.A.

Shanghai Fine Chemical Co., Ltd.

LG Household & Health Care

Table of Contents

1. Global Alkyl Polyglucoside Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Alkyl Polyglucoside Market Size (in USD Million)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Alkyl Polyglucoside Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Bio-Based Surfactants

3.1.2. Expanding Applications in Personal Care and Home Care Products

3.1.3. Rising Focus on Sustainability and Environmental Protection

3.1.4. Government Initiatives to Promote Green Chemicals

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Competition from Conventional Surfactants

3.2.3. Limited Awareness Among End-Users

3.3. Opportunities

3.3.1. Growth in Emerging Markets (Market Entry Barriers, Regulatory Requirements)

3.3.2. Expansion in Industrial and Agricultural Applications

3.3.3. Advancements in Production Technology (Process Optimization, Cost-Reduction Methods)

3.4. Trends

3.4.1. Preference for Natural Ingredients in Personal Care Products

3.4.2. Innovation in Formulation and Product Diversification (Specific to Alkyl Polyglucoside)

3.4.3. Shift Towards Sustainable Packaging (Impact on Demand and Supply Chain)

3.5. Government Regulations

3.5.1. Regulatory Framework for Biodegradable Chemicals

3.5.2. Environmental Certifications (Ecolabel, USDA BioPreferred)

3.5.3. International Trade Policies and Tariffs (Impact on Exports and Imports)

3.6. SWOT Analysis

3.7. Value Chain Analysis (Raw Material Sourcing, Production, Distribution)

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Global Alkyl Polyglucoside Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Capryl/Caprylyl Alkyl Polyglucoside

4.1.2. Lauryl Alkyl Polyglucoside

4.1.3. Decyl Alkyl Polyglucoside

4.2. By Application (In Value %)

4.2.1. Personal Care (Shampoos, Cleansers, etc.)

4.2.2. Home Care (Laundry Detergents, Dishwashing Liquids, etc.)

4.2.3. Industrial & Institutional Cleaners

4.2.4. Agriculture

4.2.5. Oil & Gas Industry

4.3. By Function (In Value %)

4.3.1. Surfactants

4.3.2. Emulsifiers

4.3.3. Dispersing Agents

4.3.4. Wetting Agents

4.4. By Source (In Value %)

4.4.1. Corn-Based Alkyl Polyglucosides

4.4.2. Wheat-Based Alkyl Polyglucosides

4.4.3. Coconut-Based Alkyl Polyglucosides

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Alkyl Polyglucoside Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. BASF SE

5.1.2. Croda International PLC

5.1.3. Dow Chemical Company

5.1.4. Huntsman Corporation

5.1.5. Galaxy Surfactants Ltd.

5.1.6. Clariant AG

5.1.7. Airedale Chemical Company

5.1.8. SEPPIC S.A.

5.1.9. Shanghai Fine Chemical Co., Ltd.

5.1.10. LG Household & Health Care

5.1.11. Ecover Belgium NV

5.1.12. Yangzhou Chenhua New Material Co., Ltd.

5.1.13. IRO Group Inc.

5.1.14. Fenchem Biotek Ltd.

5.1.15. AkzoNobel N.V.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Market Share, Revenue, Regional Presence, R&D Investment, Strategic Initiatives, Product Portfolio)

5.3. Market Share Analysis

5.4. Strategic Initiatives (New Product Launches, Collaborations, Joint Ventures)

5.5. Mergers and Acquisitions

5.6. Investment Analysis (Private Equity, Venture Capital, Government Grants)

6. Global Alkyl Polyglucoside Market Regulatory Framework

6.1. International Environmental Standards

6.2. Compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals)

6.3. Labeling and Certification Requirements (EU Ecolabel, North American Organic Standards)

7. Global Alkyl Polyglucoside Future Market Size (in USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Global Alkyl Polyglucoside Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Function (In Value %)

8.4. By Source (In Value %)

8.5. By Region (In Value %)

9. Global Alkyl Polyglucoside Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Strategies and Recommendations

9.4. White Space Opportunity Identification

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves identifying the core variables that influence the global alkyl polyglucoside market. This is achieved through a combination of desk research, industry reports, and proprietary databases to map out all stakeholders and potential market drivers, with a particular focus on personal care, industrial, and home care sectors.

Step 2: Market Analysis and Construction

This stage involves gathering historical data on production volumes, pricing, and market share to assess the current landscape. Key performance indicators such as revenue generation and end-user adoption rates are analyzed to establish a foundation for market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Our market assumptions are validated through in-depth interviews with industry leaders and experts. These consultations provide insights into the operational and financial aspects of the industry, contributing to the refinement of market projections.

Step 4: Research Synthesis and Final Output

The final stage entails synthesizing research findings from both primary and secondary sources to develop accurate market forecasts. The final output includes a comprehensive market analysis, segmentation, and future outlook validated through cross-checking with industry players.

Frequently Asked Questions

1. How big is the Global Alkyl Polyglucoside Market?

The global alkyl polyglucoside market was valued at USD 1.85 billion based on a five-year historical analysis, driven by the demand for bio-based surfactants in personal care and household cleaning products.

2. What are the challenges in the Global Alkyl Polyglucoside Market?

The major challenges include high production costs, competition from synthetic surfactants, and limited awareness among consumers in emerging markets.

3. Who are the major players in the Global Alkyl Polyglucoside Market?

Key players in the market include BASF SE, Croda International PLC, Dow Chemical Company, Galaxy Surfactants Ltd., and Huntsman Corporation, all of which have strong research and development capabilities.

4. What are the growth drivers of the Global Alkyl Polyglucoside Market?

The market is propelled by factors such as the increasing preference for eco-friendly products, government regulations promoting green chemicals, and advancements in production technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.