Global Aluminium Market outlook to 2030

Region:Global

Author(s):Shubham

Product Code:KROD-091

June 2025

90

About the Report

Global Aluminium Market Overview

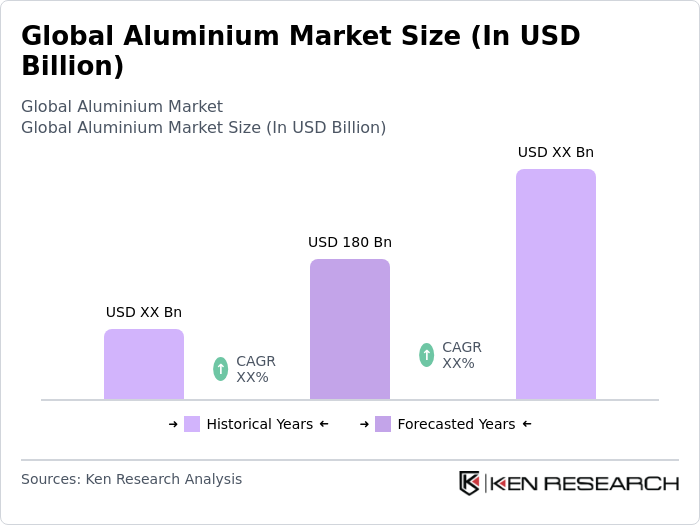

- The Global Aluminium Market was valued at USD 180 billion in 2024. This growth is primarily driven by the increasing demand for lightweight materials in the automotive and aerospace industries, as well as the rising need for energy-efficient solutions in construction and packaging. The market's expansion is also supported by the growing trend towards recycling and sustainability, which enhances the appeal of aluminium as a versatile material.

- Key players in this market include China, the United States, and India. China dominates the market due to its extensive production capabilities and significant investments in aluminium smelting and processing technologies. The United States benefits from a strong automotive sector that increasingly utilizes aluminium for vehicle manufacturing, while India is witnessing rapid urbanization and infrastructure development, driving demand for aluminium products.

- In 2023, the European Union implemented stringent regulations aimed at reducing carbon emissions from aluminium production. The new guidelines require aluminium producers to adopt cleaner technologies and reduce their carbon footprint by 30% by 2030. This regulatory framework is designed to promote sustainable practices within the industry and encourage the use of recycled aluminium, aligning with the EU's broader environmental goals.

Global Aluminium Market Segmentation

By Product: The aluminium market can be segmented based on the aluminium production, which includes primary and secondary aluminium. The primary aluminium segment is currently dominating the market due to the high demand for new aluminium products in various industries, including automotive, aerospace, and construction. However, the secondary aluminium segment is gaining traction as recycling practices improve and the focus on sustainability increases. The trend towards using recycled aluminium is driven by its lower environmental impact and cost-effectiveness, making it an attractive option for manufacturers.

By Application: The aluminium market is also segmented by application, which includes automotive, construction, packaging, and electrical. The automotive segment is leading the market due to the increasing adoption of lightweight materials to enhance fuel efficiency and reduce emissions. The construction sector follows closely, driven by the demand for durable and energy-efficient building materials. The packaging segment is also significant, as aluminium is widely used for its barrier properties and recyclability, making it a preferred choice for food and beverage packaging.

Global Aluminium Market Competitive Landscape

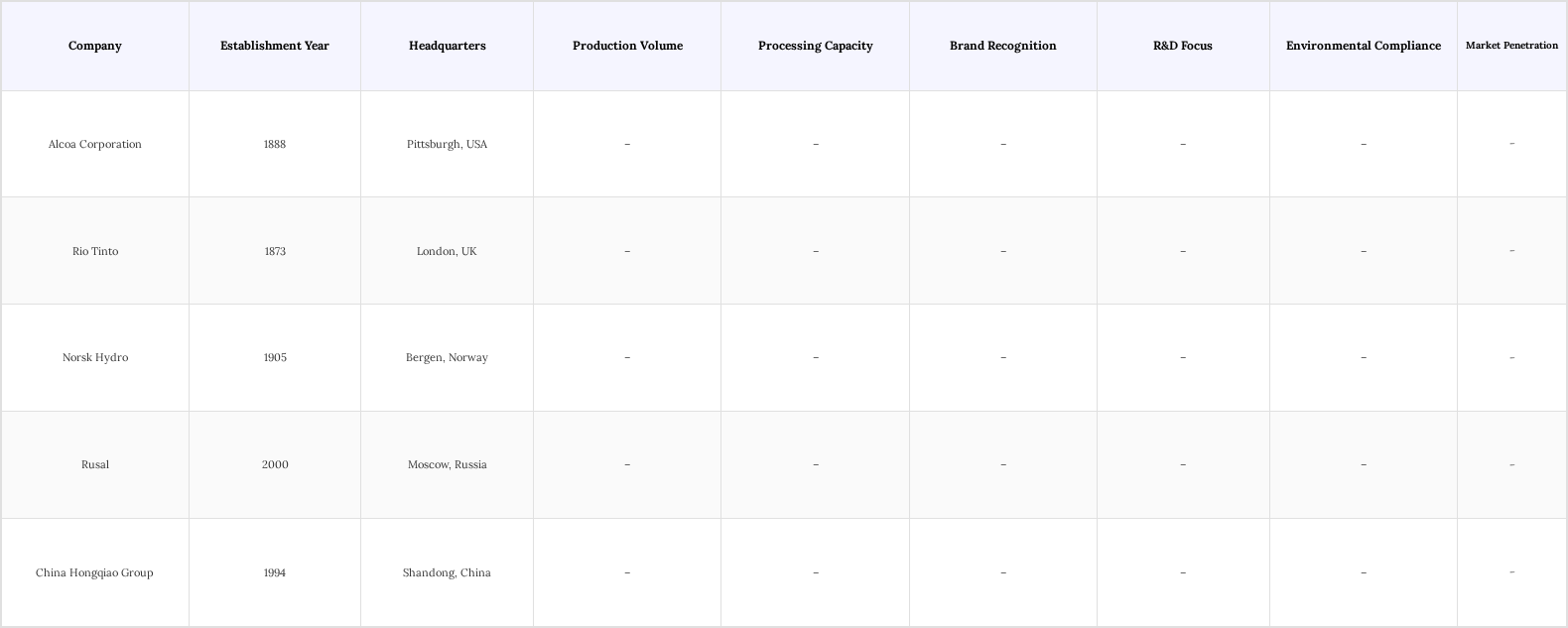

The Global Aluminium Market is characterized by intense competition among key players such as Alcoa Corporation, Rio Tinto, Norsk Hydro, Rusal, and China Hongqiao Group. These companies are engaged in various strategies to enhance their market presence, including mergers and acquisitions, technological advancements, and sustainability initiatives. The market is moderately concentrated, with a few large players dominating production and distribution, while smaller companies focus on niche markets and specialized products.

Global Aluminium Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Industry: The automotive sector is projected to consume approximately 5.5 million tonnes of aluminium in 2024, driven by the need for lightweight materials to enhance fuel efficiency. With global vehicle production expected to reach 92 million units, the demand for aluminium components, such as engine blocks and body panels, is anticipated to rise significantly. This trend is further supported by government regulations promoting lower emissions, which encourage manufacturers to adopt aluminium for its lightweight properties.

- Rising Construction Activities Globally: The construction industry is set to utilize around 12 million tonnes of aluminium in 2024, fueled by urbanization and infrastructure development. Major economies, including the U.S. and China, are investing heavily in residential and commercial projects, with construction spending projected to exceed $1.2 trillion in the U.S. alone. This surge in construction activities is expected to drive the demand for aluminium in windows, doors, and roofing materials, enhancing the overall market growth.

- Growing Focus on Lightweight Materials for Energy Efficiency: The global push for energy efficiency is leading to an increased adoption of lightweight materials, with aluminium being a primary choice. In 2024, the energy savings from using aluminium in various applications are estimated to reach $16 billion, as it reduces energy consumption in transportation and construction. This trend is further supported by advancements in aluminium alloys, which enhance performance while maintaining lower weight, appealing to industries focused on sustainability.

Market Challenges

- Fluctuating Raw Material Prices: The aluminium market faces significant challenges due to the volatility of raw material prices, particularly bauxite and alumina. In 2024, bauxite prices are expected to fluctuate between $42 to $62 per tonne, impacting production costs. This instability can lead to unpredictable pricing for end-users, making it difficult for manufacturers to maintain profit margins and plan for future investments, ultimately hindering market growth.

- Environmental Concerns and Regulations: Increasing environmental regulations are posing challenges for aluminium producers. In 2024, compliance costs related to emissions standards are projected to rise, impacting operational expenses. Stricter regulations on carbon emissions and waste management are forcing companies to invest in cleaner technologies, which can be financially burdensome. This regulatory landscape may limit the ability of smaller players to compete effectively in the market.

Global Aluminium Market Future Outlook

The future of the aluminium market appears promising, driven by technological advancements and a shift towards sustainable practices. Innovations in recycling technologies are expected to enhance the efficiency of aluminium recovery, potentially increasing the recycled aluminium share to 32% by 2025. Additionally, the growing use of aluminium in electric vehicles is anticipated to create new demand avenues, as manufacturers seek lightweight solutions to improve battery efficiency and overall vehicle performance, positioning the market for robust growth.

Market Opportunities

- Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Africa, present significant growth opportunities for aluminium consumption. With urbanization rates projected to exceed 52% in these regions by 2024, the demand for aluminium in construction and transportation is expected to rise sharply, potentially increasing market share by 17% in these areas.

- Innovations in Recycling Technologies: The development of advanced recycling technologies is set to revolutionize the aluminium industry. By 2024, innovations could increase recycling rates to 78%, significantly reducing the need for primary aluminium production. This shift not only supports sustainability goals but also lowers production costs, creating a competitive advantage for companies that invest in these technologies.

Scope of the Report

| By Source |

Bauxite Alumina Recycled Aluminium |

| By Application |

Automotive Construction Packaging Electrical |

| By Product Type |

Primary Aluminium Secondary Aluminium |

| By End-User Industry |

Aerospace Transportation Consumer Goods |

| By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., International Aluminium Institute, U.S. Department of Energy)

Aluminium Manufacturers and Producers

Aluminium Fabricators and Processors

Mining Companies and Raw Material Suppliers

Logistics and Transportation Companies

Industry Associations (e.g., Aluminium Association, European Aluminium)

Financial Institutions and Investment Banks

Companies

Players Mentioned in the Report:

Alcoa Corporation

Rio Tinto

Norsk Hydro

Rusal

China Hongqiao Group

AluGlobal Industries

Apex Aluminium Solutions

EcoAluminium Innovations

Zenith Aluminium Group

TerraMetals Aluminium Co.

Table of Contents

1. Global Aluminium Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Aluminium Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Aluminium Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand from Automotive Industry

3.1.2. Rising Construction Activities Globally

3.1.3. Growing Focus on Lightweight Materials for Energy Efficiency

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Environmental Concerns and Regulations

3.2.3. Competition from Alternative Materials

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Innovations in Recycling Technologies

3.3.3. Development of New Aluminium Alloys

3.4. Trends

3.4.1. Shift Towards Sustainable Aluminium Production

3.4.2. Increasing Use of Aluminium in Electric Vehicles

3.4.3. Growth of Smart Packaging Solutions

3.5. Government Regulation

3.5.1. Emission Standards for Aluminium Production

3.5.2. Trade Policies Affecting Aluminium Imports and Exports

3.5.3. Incentives for Recycling and Sustainable Practices

3.5.4. Safety Regulations in Manufacturing Processes

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Aluminium Market Segmentation

4.1. By Source

4.1.1. Bauxite

4.1.2. Alumina

4.1.3. Recycled Aluminium

4.2. By Application

4.2.1. Automotive

4.2.2. Construction

4.2.3. Packaging

4.2.4. Electrical

4.3. By Product Type

4.3.1. Primary Aluminium

4.3.2. Secondary Aluminium

4.4. By End-User Industry

4.4.1. Aerospace

4.4.2. Transportation

4.4.3. Consumer Goods

4.5. By Region

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Aluminium Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Alcoa Corporation

5.1.2. Rio Tinto

5.1.3. Norsk Hydro

5.1.4. Rusal

5.1.5. China Hongqiao Group

5.1.6. AluGlobal Industries

5.1.7. Apex Aluminium Solutions

5.1.8. EcoAluminium Innovations

5.1.9. Zenith Aluminium Group

5.1.10. TerraMetals Aluminium Co.

5.2. Cross Comparison Parameters

5.2.1. Market Share Analysis

5.2.2. Revenue Growth Rate

5.2.3. Product Portfolio Diversity

5.2.4. Geographic Presence

5.2.5. Innovation and R&D Investment

5.2.6. Customer Base Size

5.2.7. Sustainability Initiatives

5.2.8. Strategic Partnerships and Alliances

6. Global Aluminium Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Aluminium Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Aluminium Market Future Market Segmentation

8.1. By Source

8.1.1. Bauxite

8.1.2. Alumina

8.1.3. Recycled Aluminium

8.2. By Application

8.2.1. Automotive

8.2.2. Construction

8.2.3. Packaging

8.2.4. Electrical

8.3. By Product Type

8.3.1. Primary Aluminium

8.3.2. Secondary Aluminium

8.4. By End-User Industry

8.4.1. Aerospace

8.4.2. Transportation

8.4.3. Consumer Goods

8.5. By Region

8.5.1. North America

8.5.2. Europe

8.5.3. Asia-Pacific

8.5.4. Latin America

8.5.5. Middle East & Africa

9. Global Aluminium Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Aluminium Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Aluminium Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Aluminium Market.

Frequently Asked Questions

01. How big is the Global Aluminium Market?

The Global Aluminium Market is valued at USD 180 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Aluminium Market?

Key challenges in the Global Aluminium Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Aluminium Market?

Major players in the Global Aluminium Market include Alcoa Corporation, Rio Tinto, Norsk Hydro, Rusal, China Hongqiao Group, among others.

04. What are the growth drivers for the Global Aluminium Market?

The primary growth drivers for the Global Aluminium Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.