Global Aluminum Fishing Boats Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD5996

November 2024

92

About the Report

Global Aluminum Fishing Boats Market Overview

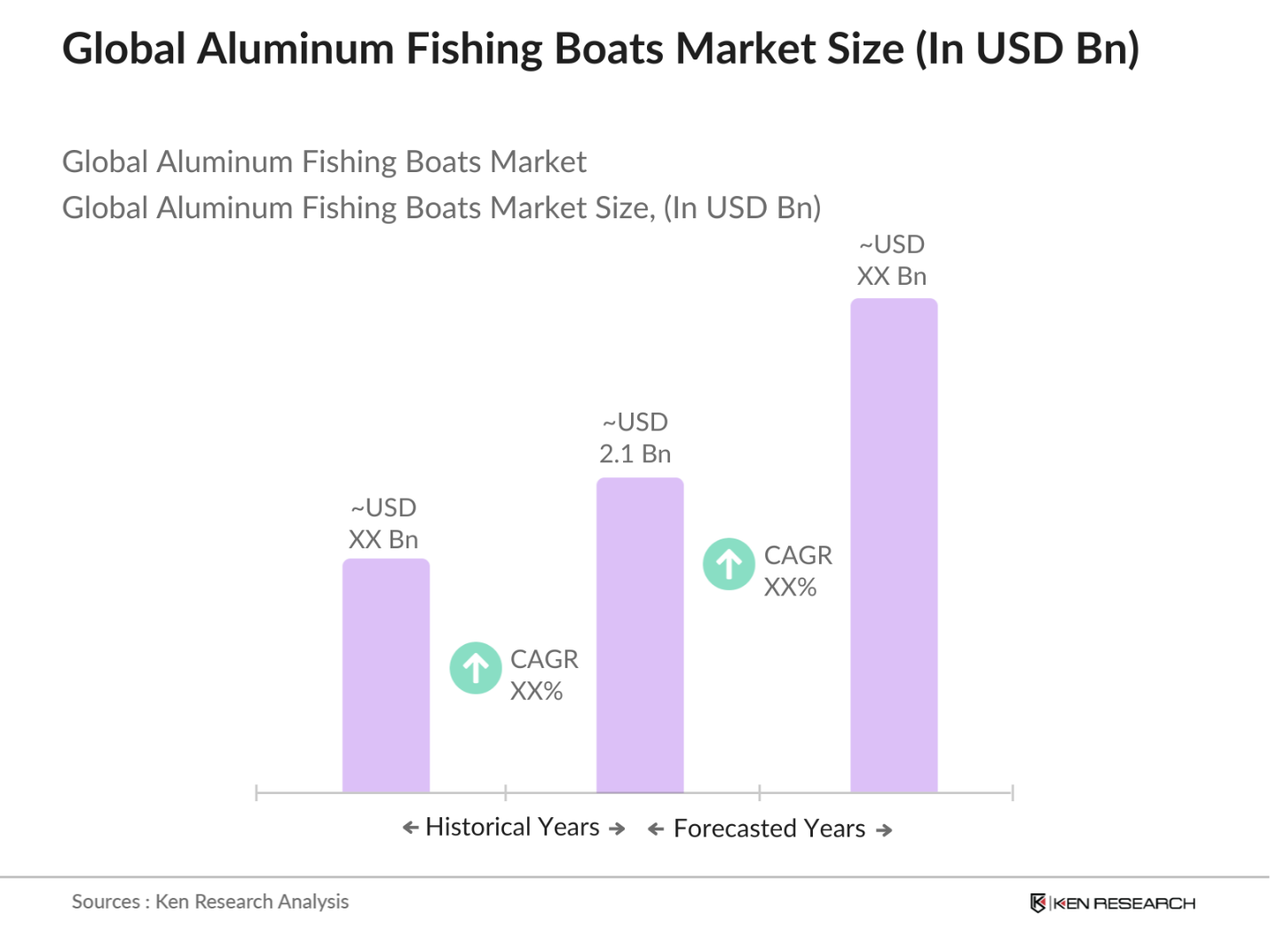

- The global aluminum fishing boats market, driven by rising consumer demand for recreational boating and sport fishing, is valued at approximately USD 2.1 billion, following a strong growth trajectory from previous years. The market is propelled by increased disposable incomes, an expansion of leisure activities, and the lightweight, durable nature of aluminum boats, which offer better fuel efficiency and lower maintenance compared to their fiberglass counterparts. Aluminum boats are increasingly preferred for their resistance to corrosion and ability to navigate shallow waters, making them ideal for both freshwater and saltwater fishing.

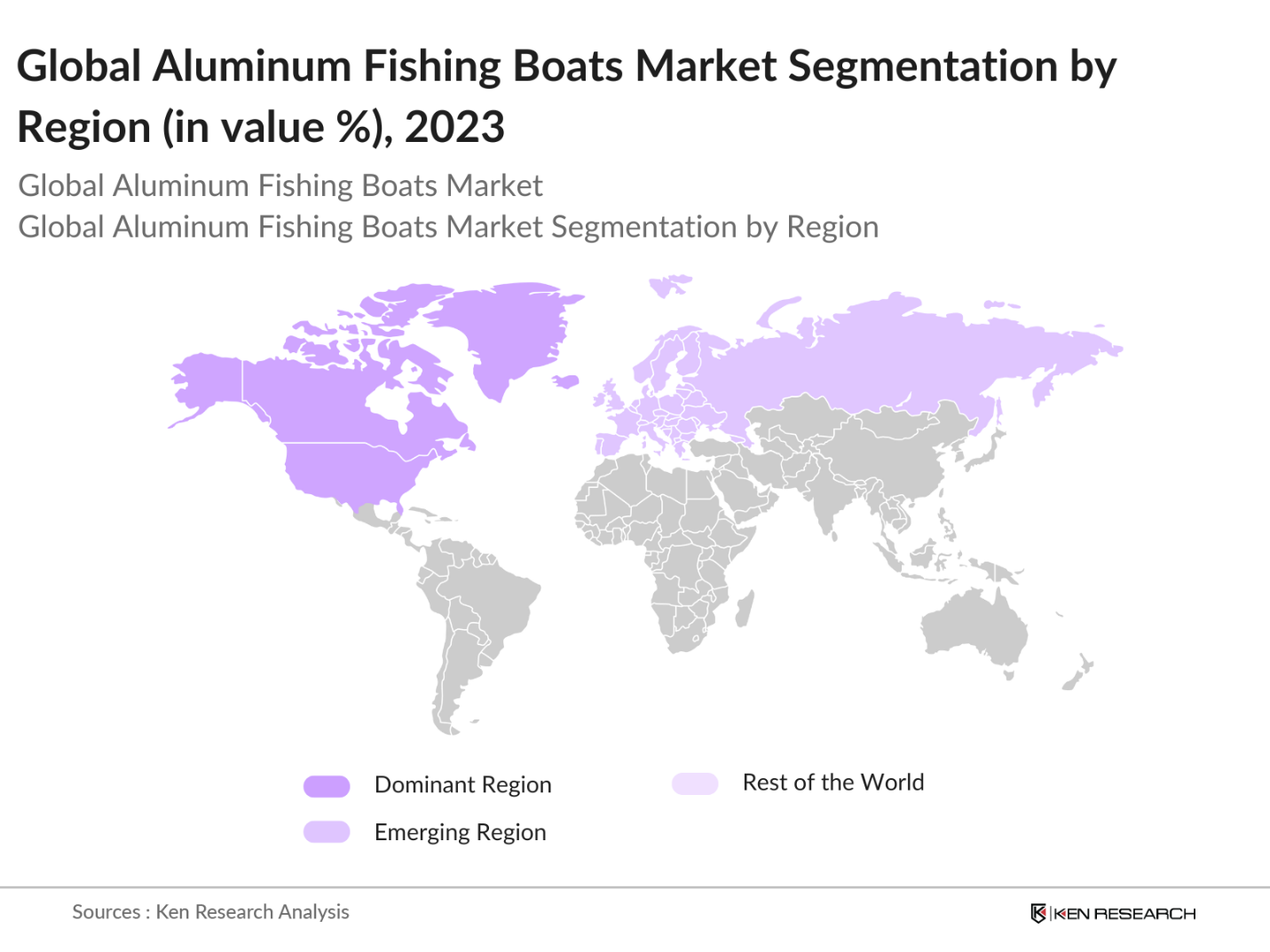

- North America, particularly the United States and Canada, dominates the aluminum fishing boats market due to its well-established recreational fishing industry, high levels of disposable income, and favorable geographical conditions with numerous lakes and rivers. The demand is also fueled by the popularity of fishing as a pastime, supported by strong infrastructure, including fishing tournaments and boat clubs. In Europe, Scandinavian countries lead due to their rich marine resources and fishing culture. The Asia-Pacific region is experiencing rising demand as recreational boating gains traction, especially in Australia and Japan.

- The adoption of hybrid engines in aluminum fishing boats is becoming a prominent trend, driven by the need for fuel efficiency and reduced emissions. In 2023, hybrid engine sales in the boating sector increased by 40%, reflecting growing consumer interest in sustainable options. The global hybrid marine engine market is expected to reach $2.5 billion by 2025, indicating robust demand for eco-friendly propulsion systems. Furthermore, as regulations around emissions become stricter, boat manufacturers are increasingly investing in hybrid technologies, signaling a shift towards more sustainable boating solutions.

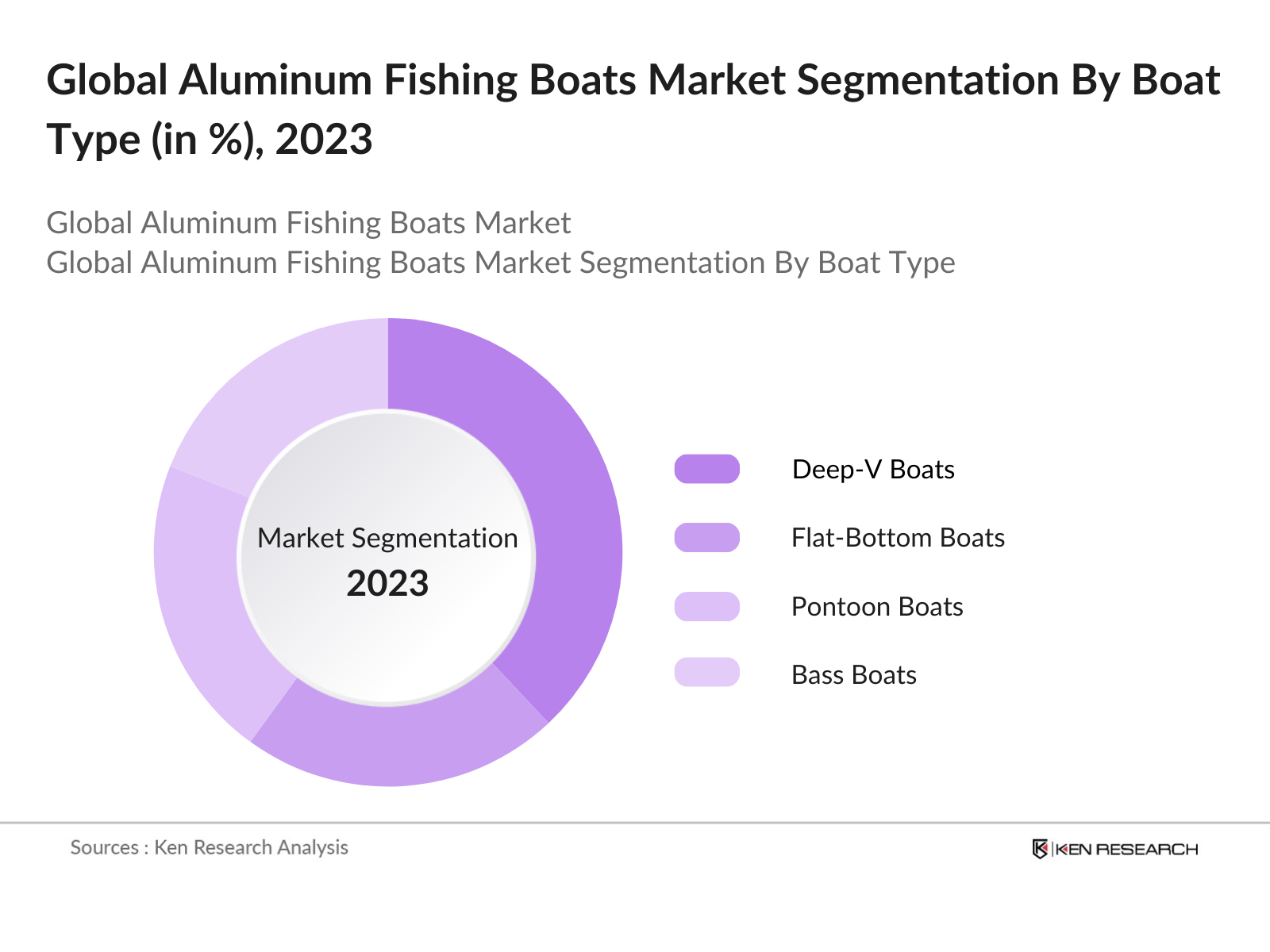

Global Aluminum Fishing Boats Market Segmentation

By Boat Type: The aluminum fishing boats market is segmented by boat type into Deep-V Boats, Flat-Bottom Boats, Pontoon Boats, Bass Boats, and Jon Boats. Recently, Deep-V Boats have held a dominant market share due to their superior stability and ability to handle choppy waters, which makes them popular for both deep-sea fishing and freshwater fishing in large lakes. These boats are preferred for their efficient hull design, which provides a smoother ride even in turbulent water conditions, making them versatile for a wide range of fishing activities.

By Region: The aluminum fishing boats market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

North America leads the global market due to the regions strong recreational fishing industry, expansive freshwater resources, and the presence of a large number of boat manufacturers. The U.S. is a particularly dominant market, with significant consumer demand driven by a well-established infrastructure for boating and fishing activities. Europe, particularly Scandinavia, is witnessing steady growth, fueled by its rich fishing heritage and marine resources.

By Engine Type: The market is further segmented by engine type into Inboard Engines, Outboard Engines, and Electric Engines.

Outboard Engines dominate the market, largely because of their ease of maintenance, versatility, and higher power-to-weight ratios. They allow for more interior space in boats, which is a significant advantage for fishing enthusiasts who need additional room for equipment. Outboard motors are also easily replaceable and ideal for shallow waters, which are prevalent in popular fishing regions.

Global Aluminum Fishing Boats Market Competitive Landscape

The global aluminum fishing boats market is relatively consolidated, with several key players dominating the landscape. This consolidation highlights the influence of established companies with extensive product portfolios and strong distribution networks. The market is dominated by players such as Brunswick Corporation, Lund Boats, and Alumacraft Boat Co., which benefit from strong brand recognition, extensive dealership networks, and a broad range of product offerings tailored to different consumer needs. Innovations in hull design, engine technology, and fishing equipment integration further bolster their competitive advantage.

Global Aluminum Fishing Boats Industry Analysis

Growth Drivers

- Increased Leisure Activities: The growing trend of leisure activities is significantly influencing the aluminum fishing boats market. In 2022, global participation in recreational boating was estimated at around 135 million people, highlighting a robust interest in water-based activities. The demand for leisure activities has risen as disposable income levels have increased. For instance, in 2023, the global GDP growth rate was projected at 3.2%, driving more consumers to spend on leisure. This uptick is supported by the increasing number of boat registrations, with 1.15 million recreational boats registered in the U.S. alone, indicating a strong market for aluminum fishing boats.

- Rising Popularity of Recreational Fishing: The popularity of recreational fishing continues to surge, significantly bolstering the aluminum fishing boats market. In the United States, approximately 49 million individuals engaged in recreational fishing in 2021, with participation projected to remain stable or grow, contributing to a substantial consumer base for fishing boats. The sector is supported by an estimated $50 billion annual economic impact from recreational fishing in the U.S., indicating a vibrant market environment. Furthermore, the growing interest in sustainable fishing practices has led to a higher demand for specialized fishing vessels that meet ecological standards.

- Growing Demand for Lightweight Boats: Lightweight boats, especially aluminum fishing boats, are increasingly favored for their enhanced performance and fuel efficiency. In 2022, the average fuel efficiency of aluminum boats was reported at approximately 20% higher than that of traditional fiberglass boats, making them more appealing to environmentally conscious consumers. Moreover, the global lightweight materials market is expected to reach $300 billion by 2025, indicating a broader trend towards lightweight structures in various industries, including boating. The trend is supported by the rising demand for performance-oriented vessels, where reduced weight translates to better handling and fuel savings.

Market Challenges

- High Maintenance Costs: Despite their advantages, aluminum fishing boats face challenges related to maintenance costs. In 2023, the average annual maintenance cost for recreational boats was estimated to be around $3,000, impacting consumer spending. Additionally, the rising cost of materials and labor has contributed to increased maintenance expenses, with aluminum prices experiencing a notable increase of about 30% from 2021 to 2023 due to supply chain disruptions. This financial burden may deter potential buyers, particularly in emerging markets where consumer spending is more sensitive to price fluctuations.

- Regulatory Restrictions: Regulatory challenges also pose significant hurdles for the aluminum fishing boats market. Stringent environmental regulations, such as the U.S. Clean Water Act, impose compliance costs that can reach $10,000 annually for boat manufacturers, complicating production processes. In 2022, the introduction of new emissions standards by the European Union aimed to reduce carbon footprints in the maritime sector further strained manufacturers, as they must adapt to evolving regulations while maintaining profitability. Compliance with these regulations can limit the production capabilities and increase costs for aluminum boat manufacturers.

Global Aluminum Fishing Boats Market Future Outlook

Over the next five years, the global aluminum fishing boats market is expected to experience significant growth, driven by increased consumer interest in outdoor recreational activities, rising disposable incomes, and advancements in boat electrification technology. The transition toward eco-friendly, sustainable boating solutions is projected to accelerate, with electric engines and hybrid technologies becoming more prevalent. North America and Europe will continue to dominate, but emerging markets in Asia-Pacific are expected to show substantial growth, spurred by increasing consumer interest in recreational fishing.

Opportunities

- Expansion of Eco-friendly Boats: The increasing consumer demand for eco-friendly solutions offers substantial growth opportunities for the aluminum fishing boats market. As of 2023, sales of electric and hybrid boats have seen a rise, with over 15,000 units sold in the U.S. alone, indicating a significant shift towards sustainable boating options. Moreover, the global market for eco-friendly boats is anticipated to continue expanding as consumers become more environmentally conscious. The market value for electric and hybrid marine engines reached $3.5 billion in 2022, suggesting a fertile ground for manufacturers to innovate and diversify their offerings.

- Technological Innovations in Navigation Systems: Technological advancements in navigation systems are transforming the aluminum fishing boats market. The integration of smart technology has enhanced safety and user experience, with the global marine navigation market projected to reach $10 billion by 2025. Innovations such as GPS tracking and sonar fish finders are becoming standard features in modern fishing boats, appealing to tech-savvy consumers. In 2023, approximately 60% of new boats sold were equipped with some form of advanced navigation technology, indicating a shift towards smarter, more efficient fishing vessels.

Scope of the Report

|

By Boat Type |

Deep-V Boats Flat-Bottom Boats Pontoon Boats Bass Boats Jon Boats |

|

By Engine Type |

Inboard Engines Outboard Engines Electric Engines |

|

By Application |

Recreational Fishing Commercial Fishing Marine Patrolling Water Sports |

|

By Length |

<20 Feet 20–30 Feet >30 Feet |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Aluminum Fishing Boat Manufacturing Companies

Marine Equipment Industries

Recreational Fishing Companies

Distributor and Dealershiip Industries

Government and Regulatory Bodies (e.g., U.S. Coast Guard, Transport Canada)

Investments and Venture Capitalist Firms

Boat Rental Companies

Environmental and Sustainability Companies

Companies

Players Mentioned in the Report

Brunswick Corporation

Yamaha Motor Co., Ltd.

Lund Boats

Smoker Craft Inc.

Alumacraft Boat Co.

Tracker Marine Group

Legend Boats

Xpress Boats

G3 Boats

Crestliner Inc.

Table of Contents

1. Global Aluminum Fishing Boats Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Industry Value Chain

2. Global Aluminum Fishing Boats Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Aluminum Fishing Boats Market Dynamics

3.1. Growth Drivers (Hull Material, Fuel Efficiency, Boat Design)

3.1.1. Increased Leisure Activities

3.1.2. Rising Popularity of Recreational Fishing

3.1.3. Growing Demand for Lightweight Boats

3.2. Market Challenges (Operational Costs, Competition from Fiberglass Boats)

3.2.1. High Maintenance Costs

3.2.2. Regulatory Restrictions

3.2.3. Limited Infrastructure in Emerging Markets

3.3. Opportunities (Boat Electrification, Customizable Features)

3.3.1. Expansion of Eco-friendly Boats

3.3.2. Technological Innovations in Navigation Systems

3.3.3. Emerging Markets for Sport Fishing

3.4. Market Trends (Fishing Equipment Integration, Sustainable Materials)

3.4.1. Adoption of Hybrid Engines

3.4.2. Rise in Use of Smart Technologies in Boats

3.4.3. Demand for Multi-functional Fishing Boats

3.5. Regulatory Impact (Emissions Standards, Safety Regulations)

3.5.1. Environmental Protection Standards

3.5.2. Marine Safety Regulations

3.5.3. Regional Emission Guidelines

4. Global Aluminum Fishing Boats Market Segmentation

4.1. By Boat Type (In Value %)

4.1.1. Deep-V Boats

4.1.2. Flat-Bottom Boats

4.1.3. Pontoon Boats

4.1.4. Bass Boats

4.1.5. Jon Boats

4.2. By Engine Type (In Value %)

4.2.1. Inboard Engines

4.2.2. Outboard Engines

4.2.3. Electric Engines

4.3. By Application (In Value %)

4.3.1. Recreational Fishing

4.3.2. Commercial Fishing

4.3.3. Marine Patrolling

4.3.4. Water Sports

4.4. By Length (In Value %)

4.4.1. <20 Feet

4.4.2. 2030 Feet

4.4.3. >30 Feet

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Aluminum Fishing Boats Market Competitive Analysis

5.1. Detailed Profiles of Major Companies (Inception Year, Headquarters, Revenue, Employee Size, Market Share)

5.1.1. Brunswick Corporation

5.1.2. Yamaha Motor Co., Ltd.

5.1.3. Lund Boats

5.1.4. Smoker Craft Inc.

5.1.5. Alumacraft Boat Co.

5.1.6. Tracker Marine Group

5.1.7. Legend Boats

5.1.8. Xpress Boats

5.1.9. G3 Boats

5.1.10. Crestliner Inc.

5.1.11. War Eagle Boats

5.1.12. Lowe Boats

5.1.13. Princecraft Boats

5.1.14. Polar Kraft Boats

5.1.15. Ranger Boats

5.2. Cross Comparison Parameters (Boat Type Offering, Engine Type, Customization Options, Dealer Network, Technology Integration, Sustainability Initiatives, Pricing, Customer Service Ratings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

5.8. Joint Ventures and Partnerships

6. Global Aluminum Fishing Boats Market Regulatory Framework

6.1. Environmental Protection and Emission Regulations

6.2. Marine Safety Standards

6.3. Boat Licensing and Certification

6.4. Import/Export Restrictions and Tariffs

7. Global Aluminum Fishing Boats Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Aluminum Fishing Boats Future Market Segmentation

8.1. By Boat Type (In Value %)

8.2. By Engine Type (In Value %)

8.3. By Application (In Value %)

8.4. By Length (In Value %)

8.5. By Region (In Value %)

9. Global Aluminum Fishing Boats Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase of this research involved identifying major stakeholders within the aluminum fishing boats market. Through desk research and secondary data collection, we mapped the industry's ecosystem to identify key variables, including consumer preferences, boat type demand, and technological advancements.

Step 2: Market Analysis and Construction

We analyzed historical data to understand market penetration, sales trends, and revenue streams. Market size was calculated through the collection of data from boat manufacturers, suppliers, and distributors, ensuring the inclusion of different market segments.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses regarding market growth, consumer behavior, and technology integration were validated through expert consultations and interviews with industry leaders from top aluminum boat manufacturing firms. Insights from these discussions informed our final market estimates.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing data gathered from primary and secondary sources to produce an accurate, comprehensive analysis. The report incorporates feedback from boat manufacturers and market experts to ensure that findings reflect current market conditions.

Frequently Asked Questions

01. How big is the global aluminum fishing boats market?

The global aluminum fishing boats market is valued at approximately USD 2.1 billion in 2023, driven by rising demand for recreational fishing and advancements in boat technology.

02. What are the challenges in the aluminum fishing boats market?

Challenges include high maintenance costs for aluminum boats, regulatory hurdles regarding emissions, and competition from fiberglass boats, which are often preferred for their design flexibility.

03. Who are the major players in the global aluminum fishing boats market?

Major players in the market include Brunswick Corporation, Yamaha Motor Co., Ltd., Lund Boats, Alumacraft Boat Co., and Smoker Craft Inc. These companies dominate due to their extensive product portfolios, strong brand recognition, and innovation in boat design.

04. What are the growth drivers of the aluminum fishing boats market?

The market is driven by the increasing popularity of recreational fishing, rising disposable incomes, and a growing preference for lightweight, fuel-efficient aluminum boats, particularly in North America and Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.