Global Aluminum Wheels Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD6606

December 2024

97

About the Report

Global Aluminium Wheels Market Overview

- The Global Aluminium Wheels market is valued at USD 18.5 billion, driven by the increasing demand for lightweight and fuel-efficient vehicles. Aluminium wheels have become a key choice for automotive manufacturers as they enhance vehicle performance by reducing overall weight, leading to better fuel economy and lower emissions. Additionally, the rapid growth in electric vehicles (EVs), which require efficient, lightweight materials, has further bolstered the demand for aluminium wheels. The market's growth is also supported by advancements in manufacturing processes such as forging and flow forming.

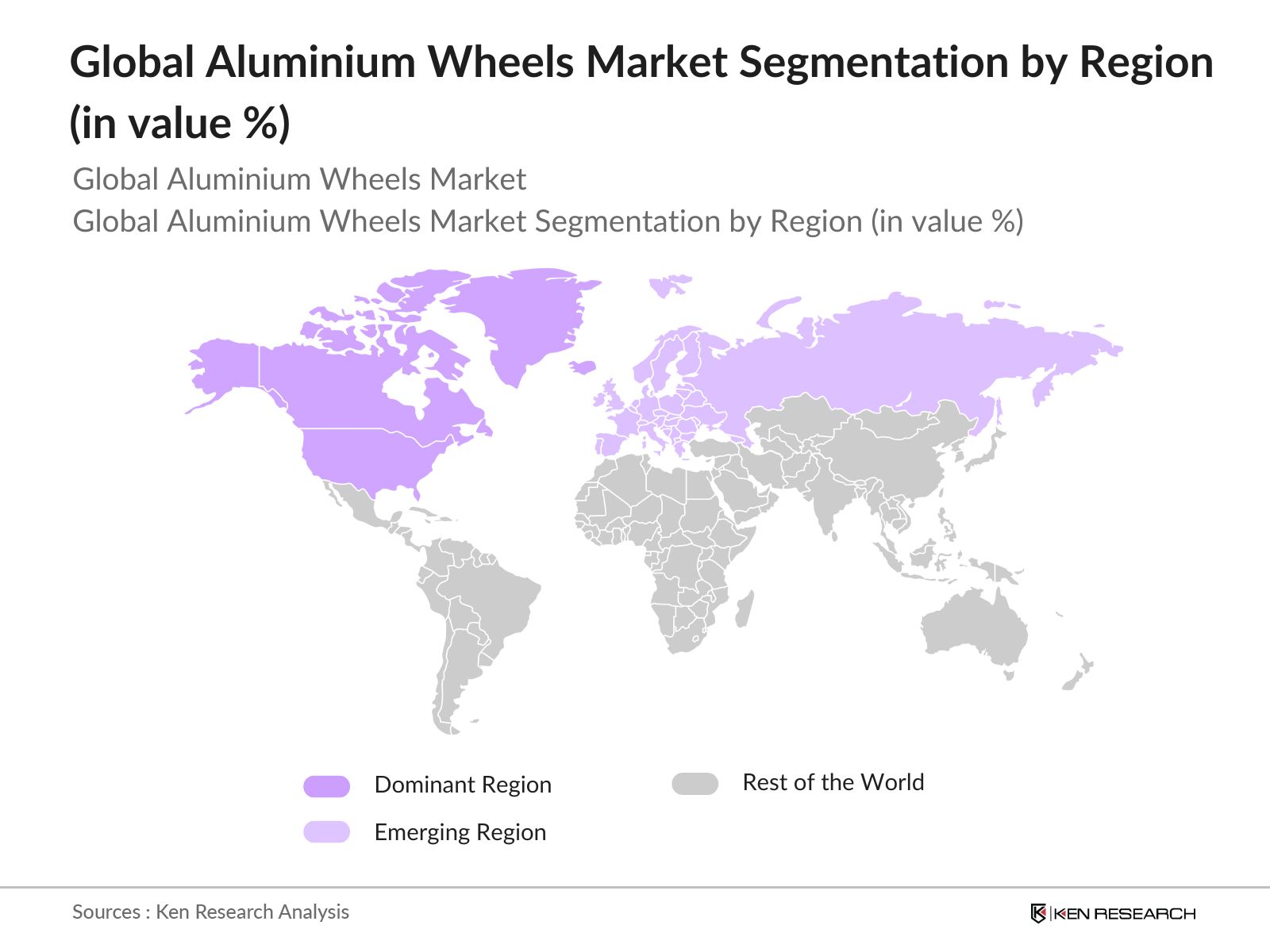

- The market is predominantly led by North America, Europe, and Asia-Pacific, with countries such as the United States, Germany, China, and Japan playing pivotal roles. These regions dominate the market due to their well-established automotive industries, high vehicle production rates, and strong technological capabilities in wheel manufacturing. China, in particular, benefits from its vast aluminium production capacity and government incentives for electric vehicles, while Germany and Japan are home to top automotive brands known for incorporating advanced materials like aluminium in their vehicles.

- Governments are imposing strict fuel efficiency norms that are driving the adoption of lightweight materials like aluminium in automotive manufacturing. In the United States, the Corporate Average Fuel Economy (CAFE) standards mandate an average fuel economy of 49 miles per gallon for cars and light trucks by 2026. The National Highway Traffic Safety Administration (NHTSA) highlights that reducing vehicle weight through aluminium wheels can contribute to meeting these targets. This regulation creates a strong incentive for automotive OEMs to incorporate more aluminium components into their vehicles.

The Global Aluminium Wheels market is currently valued at USD 18.5 billion, driven by the increasing demand for lightweight and fuel-efficient vehicles.

Global Aluminium Wheels Market Segmentation

- By Product Type: The Global Aluminium Wheels market is segmented by product type into cast aluminium wheels, forged aluminium wheels, and flow-formed aluminium wheels. Cast aluminium wheels currently dominate the market, largely due to their affordability and widespread use in the mass-market passenger vehicle segment. Despite being heavier than forged counterparts, cast wheels offer excellent design flexibility and cost-effectiveness, making them the preferred choice for manufacturers seeking to balance performance with cost.

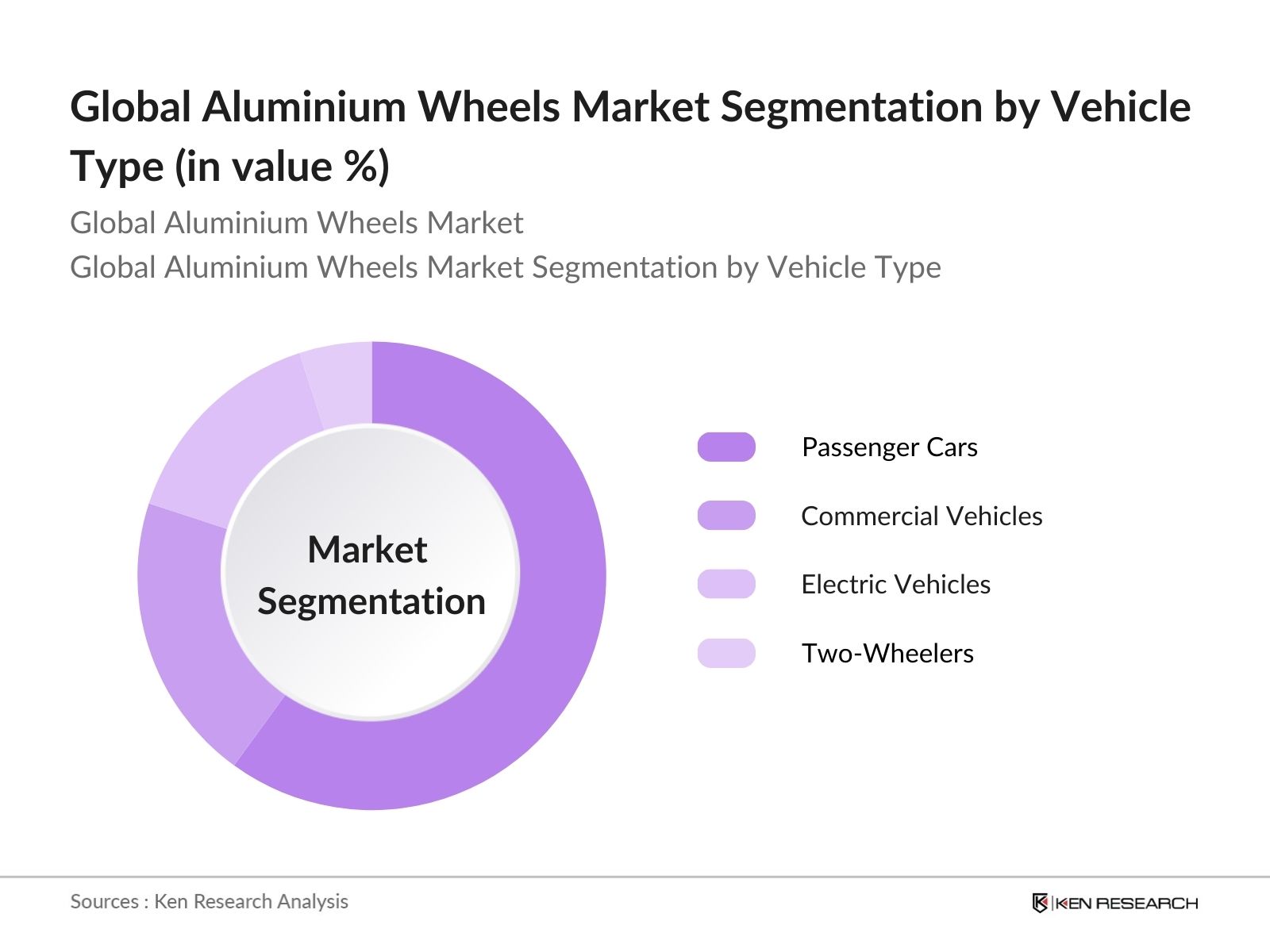

- By Vehicle Type: The market is further segmented by vehicle type into passenger cars, commercial vehicles, electric vehicles (EVs), and two-wheelers. Passenger cars hold the largest market share, driven by the growing consumer preference for high-performance, aesthetically appealing vehicles. Furthermore, the shift towards lightweight vehicles to meet fuel efficiency standards has increased the use of aluminium wheels in passenger cars, particularly in high-end models and luxury segments.

- By Region: Geographically, the aluminium wheels market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America remains the leading region due to the strong presence of major automotive manufacturers and continuous investments in electric vehicle infrastructure. The regions robust economy, technological advancements, and consumer demand for lightweight and fuel-efficient vehicles contribute to its dominant position in the global market.

Global Aluminium Wheels Market Competitive Landscape

The Global Aluminium Wheels market is dominated by a mix of multinational corporations and regional players. The consolidation of major players indicates a highly competitive environment where companies focus on product innovation, capacity expansion, and strategic partnerships to maintain their market positions. Leading manufacturers continue to invest in R&D to improve the strength, design, and performance of aluminium wheels while maintaining sustainability goals.

Company | Establishment Year | Headquarters | No. of Manufacturing Plants | Annual Revenue | Production Capacity | Global Presence | Technological Innovations | Strategic Partnerships | Sustainability Initiatives |

Ronal Group | 1969 | Switzerland | - | - | - | - | - | - | - |

Borbet GmbH | 1881 | Germany | - | - | - | - | - | - | - |

Superior Industries International | 1957 | USA | - | - | - | - | - | - | - |

Enkei Corporation | 1950 | Japan | - | - | - | - | - | - | - |

Maxion Wheels | 1908 | Brazil | - | - | - | - | - | - | - |

Global Aluminium Wheels Market Analysis

Global Aluminium Wheels Market Growth Drivers

- Automotive Lightweighting Trend: The global automotive sector's focus on lightweighting is being driven by stricter fuel efficiency norms and the push for sustainability. Aluminium wheels play a key role, being lighter than steel alternatives. According to a study by the International Energy Agency (IEA), reducing vehicle weight by 10% can improve fuel economy by 6-8%. Aluminiums density, which is approximately 2.7 g/cm compared to steels 7.8 g/cm, makes it an ideal material for this trend. This demand is further supported by the IEA's forecast of global vehicle production reaching over 90 million units by 2024.

- Stringent Emission Regulations: Governments worldwide are imposing stricter emission regulations to combat climate change. For instance, the European Unions 2025 CO emission standard mandates fleet-wide average emissions of 95 g/km for cars. Aluminium wheels contribute to lowering vehicle emissions by reducing the overall weight of the vehicle, leading to enhanced fuel efficiency. A reduction in 100 kg of vehicle weight can result in a 5g/km decrease in CO emissions, as stated by the European Commission. These standards drive demand for lightweight materials like aluminium in automotive manufacturing.

- Rise in Vehicle Production: Global vehicle production is experiencing growth across passenger, commercial, and electric vehicle segments. According to the World Bank, the automotive industry saw production of around 85 million vehicles in 2022, with a projected increase in 2023 driven by the growing demand for electric vehicles (EVs). EV production, which reached approximately 10 million units in 2022, relies heavily on lightweight materials like aluminium for enhanced battery efficiency and longer range. This surge in production further accelerates the demand for aluminium wheels.

Global Aluminium Wheels Market Challenges

- High Cost of Raw Materials: The price of aluminium, a critical input for wheel manufacturing, has been subject to volatility. In 2023, the price of aluminium on the London Metal Exchange ranged between $2,200 and $2,700 per ton, influenced by geopolitical factors, energy costs, and supply chain disruptions. Such volatility in raw material costs makes it difficult for manufacturers to maintain consistent profit margins. According to the World Bank, the aluminium market is particularly sensitive to global trade tensions and fluctuations in energy prices, further complicating cost predictability for wheel manufacturers.

- Stringent Quality Requirements: Aluminium wheels must meet stringent safety and quality standards, particularly in regions with high regulatory oversight such as the U.S. and Europe. For instance, the U.S. National Highway Traffic Safety Administration (NHTSA) imposes rigorous impact resistance, fatigue strength, and corrosion resistance tests on automotive wheels. Meeting these standards requires manufacturers to invest in advanced technologies and quality control, increasing production costs. Failure to comply with these stringent requirements can result in recalls and hefty fines, as evidenced by a 2022 case where a manufacturer was fined $10 million for failing to meet safety standards.

Global Aluminium Wheels Market Future Outlook

Over the next five years, the Global Aluminium Wheels market is expected to experience growth, driven by the increasing adoption of electric vehicles, advancements in manufacturing technology, and the automotive industry's focus on reducing vehicle weight. Governments across the globe are imposing stringent fuel efficiency standards, pushing automakers to adopt lightweight materials like aluminium for better fuel economy and lower emissions. Additionally, the surge in electric vehicle sales is anticipated to accelerate the demand for high-performance aluminium wheels that enhance battery efficiency and overall vehicle range.

Global Aluminium Wheels Market Opportunities

- Expansion into Electric Vehicle Market: The growing electric vehicle market presents a major opportunity for aluminium wheel manufacturers. With over 14 million EVs expected to be sold globally in 2024, according to the International Energy Agency, there is increasing demand for lightweight wheels to optimize battery efficiency and vehicle range. Aluminium wheels, being up to 30% lighter than traditional steel options, are ideally suited to meet this demand. This trend provides manufacturers with the opportunity to supply to the rapidly growing EV sector, which is a key pillar in the global transition to green mobility.

- Lightweight Aluminium Alloy Developments: Ongoing research into new aluminium alloys, which offer enhanced strength and durability while being lightweight, is creating additional opportunities for aluminium wheel manufacturers. The development of 7xxx-series aluminium alloys, for instance, offers higher tensile strength while maintaining a low density. The U.S. Department of Energy has noted that these new materials can reduce vehicle weight by up to 40%, leading to improved fuel efficiency and lower emissions. Manufacturers adopting these advanced alloys are well-positioned to capitalize on the automotive sectors increasing demand for lightweight materials.

Scope of the Report

Product Type | Cast Aluminium Wheels Forged Aluminium Wheels Flow-Formed Aluminium Wheels |

Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Two-Wheelers |

Size | Less than 18 Inches 18-22 Inches Above 22 Inches |

Sales Channel | OEM Aftermarket |

Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Electric Vehicle (EV) Manufacturers

Aluminium Suppliers

Banks and Financial Institutions

Wheel Distributors and Retailers

Automotive Aftermarket Providers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Environmental Protection Agencies)

Automotive Associations and Trade Bodies

Companies

Players Mentioned in the Report

Ronal Group

Borbet GmbH

Superior Industries International

Enkei Corporation

Maxion Wheels

Alcoa Wheels

CITIC Dicastal Co., Ltd.

BBS Kraftfahrzeugtechnik AG

Topy Industries Limited

Accuride Corporation

Table of Contents

1. Global Aluminum Wheels Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Aluminum Wheels Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Aluminum Wheels Market Analysis

3.1. Growth Drivers

3.1.1. Automotive Lightweighting Trend

3.1.2. Stringent Emission Regulations

3.1.3. Rise in Vehicle Production (Passenger, Commercial, Electric)

3.1.4. Enhanced Fuel Efficiency

3.2. Market Challenges

3.2.1. High Cost of Raw Materials (Aluminum Price Volatility)

3.2.2. Stringent Quality Requirements

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Expansion into Electric Vehicle Market

3.3.2. Advancements in Manufacturing Technologies (Forging, Casting)

3.3.3. Lightweight Aluminum Alloy Developments

3.4. Trends

3.4.1. Integration of Advanced Manufacturing Techniques (3D Printing, AI)

3.4.2. Increasing Adoption of Custom Wheels

3.4.3. Growing Demand for Aftermarket Wheels

3.5. Government Regulations

3.5.1. Fuel Efficiency Norms

3.5.2. Safety Standards for Aluminum Wheels

3.5.3. Trade Tariffs and Import/Export Policies

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Aluminum Wheels Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Cast Aluminum Wheels

4.1.2. Forged Aluminum Wheels

4.1.3. Flow-Formed Aluminum Wheels

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.2.4. Two-Wheelers

4.3. By Size (In Value %)

4.3.1. Less than 18 Inches

4.3.2. 18-22 Inches

4.3.3. Above 22 Inches

4.4. By Sales Channel (In Value %)

4.4.1. OEM (Original Equipment Manufacturers)

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Aluminum Wheels Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ronal Group

5.1.2. Borbet GmbH

5.1.3. Superior Industries International

5.1.4. Enkei Corporation

5.1.5. Alcoa Wheels

5.1.6. BBS Kraftfahrzeugtechnik AG

5.1.7. Topy Industries Limited

5.1.8. Maxion Wheels

5.1.9. CITIC Dicastal Co., Ltd.

5.1.10. Accuride Corporation

5.1.11. FUTEK ALLOY CO., LTD.

5.1.12. Zhejiang Jinfei Kaida Wheel Co., Ltd.

5.1.13. YHI International Limited

5.1.14. Wanfeng Auto Holdings Group Co., Ltd.

5.1.15. Iochpe-Maxion S.A.

5.2. Cross Comparison Parameters (No. of Manufacturing Plants, Production Capacity, Market Share, Revenue, Geographical Presence, R&D Investments, Strategic Partnerships, Environmental Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Incentives and Subsidies

5.8. Venture Capital & Private Equity Investments

6. Global Aluminum Wheels Market Regulatory Framework

6.1. Environmental Standards for Production

6.2. Compliance Requirements for Safety and Quality

6.3. Certification Processes (ISO, TUV, JWL, VIA)

7. Global Aluminum Wheels Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Aluminum Wheels Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Size (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. Global Aluminum Wheels Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Competitive Positioning

9.3. Product Differentiation Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research focuses on mapping out the entire ecosystem of stakeholders in the Global Aluminium Wheels market. Desk research and secondary databases are utilized to collect industry data. This stage also includes identifying critical variables such as production capacity, raw material availability, and technological advancements that influence market dynamics.

Step 2: Market Analysis and Construction

The second phase involves collecting and analyzing historical data on production volumes, market penetration, and consumer preferences. A bottom-up approach is employed to estimate market size, using metrics such as the number of vehicles produced and the average aluminium wheel utilization per vehicle.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are then validated through interviews with industry experts, including manufacturers and suppliers. These insights are used to refine the understanding of market trends, competitive dynamics, and future growth drivers.

Step 4: Research Synthesis and Final Output

In the final phase, the gathered data is synthesized to form a comprehensive report. This includes cross-referencing insights from industry participants, ensuring that the data on market segments, growth projections, and competitive analysis are accurate and validated.

Frequently Asked Questions

01. How big is the Global Aluminium Wheels Market?

The Global Aluminium Wheels market is valued at USD 18.5 billion, with robust growth driven by the automotive industry's shift towards lightweight and fuel-efficient materials, particularly in electric vehicles.

02. What are the challenges in the Global Aluminium Wheels Market?

Challenges in the Global Aluminium Wheels market include fluctuating aluminium prices, the high cost of advanced manufacturing techniques, and stringent quality standards imposed by automotive manufacturers and regulatory bodies.

03. Who are the major players in the Global Aluminium Wheels Market?

Major players in the Global Aluminium Wheels market include Ronal Group, Borbet GmbH, Superior Industries International, Enkei Corporation, and Maxion Wheels. These companies dominate due to their strong manufacturing capabilities and global presence.

04. What are the growth drivers of the Global Aluminium Wheels Market?

The key growth drivers of the Global Aluminium Wheels market include the increasing production of electric vehicles, advancements in lightweight material technology, and stringent global regulations on fuel efficiency and emissions. These factors are pushing automotive manufacturers to adopt aluminium wheels.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.