Global Amino Resin Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3305

November 2024

96

About the Report

Global Amino Resin Market Overview

- The global amino resin market is valued at USD 7.17 billion, driven by the demand from industries such as construction, automotive, and wood-based panels. The steady growth is largely attributed to the need for strong adhesive properties in these sectors, with increasing usage in low-emission formaldehyde products becoming a major driver. The shift towards sustainable building materials and the expansion of wood panel industries are also key contributors to this growth.

- Countries like China, the USA, and Germany dominate the amino resin market. China's dominance stems from its vast manufacturing capacity, supported by the construction and furniture industries. In contrast, Germanys leadership is driven by technological advancements in formaldehyde reduction and stringent environmental regulations. The USA maintains a competitive edge due to high demand in the automotive sector and the increasing need for sustainable construction materials.

- Government regulations on formaldehyde emissions are shaping the global amino resin market. In 2023, the U.S. government implemented stricter emission standards for formaldehyde-based products under the Toxic Substances Control Act (TSCA), significantly impacting the resin industry. These regulations have driven demand for low-formaldehyde resins, with North America expected to account for 30% of the global production of low-emission amino resins by the end of 2024. The global regulatory landscape continues to push for lower formaldehyde emissions, affecting production practices worldwide.

Global Amino Resin Market Segmentation

By Type: The global amino resin market is segmented by type into Urea Formaldehyde, Melamine Formaldehyde, and Melamine-Urea Formaldehyde. Urea Formaldehyde holds a dominant market share because of its widespread usage in wood-based panels, particularly for particleboards and plywood. Its adhesive properties, combined with cost-effectiveness, make it an ideal choice for large-scale applications. Additionally, the market's shift towards low-formaldehyde products has further enhanced the demand for Urea Formaldehyde in the construction sector.

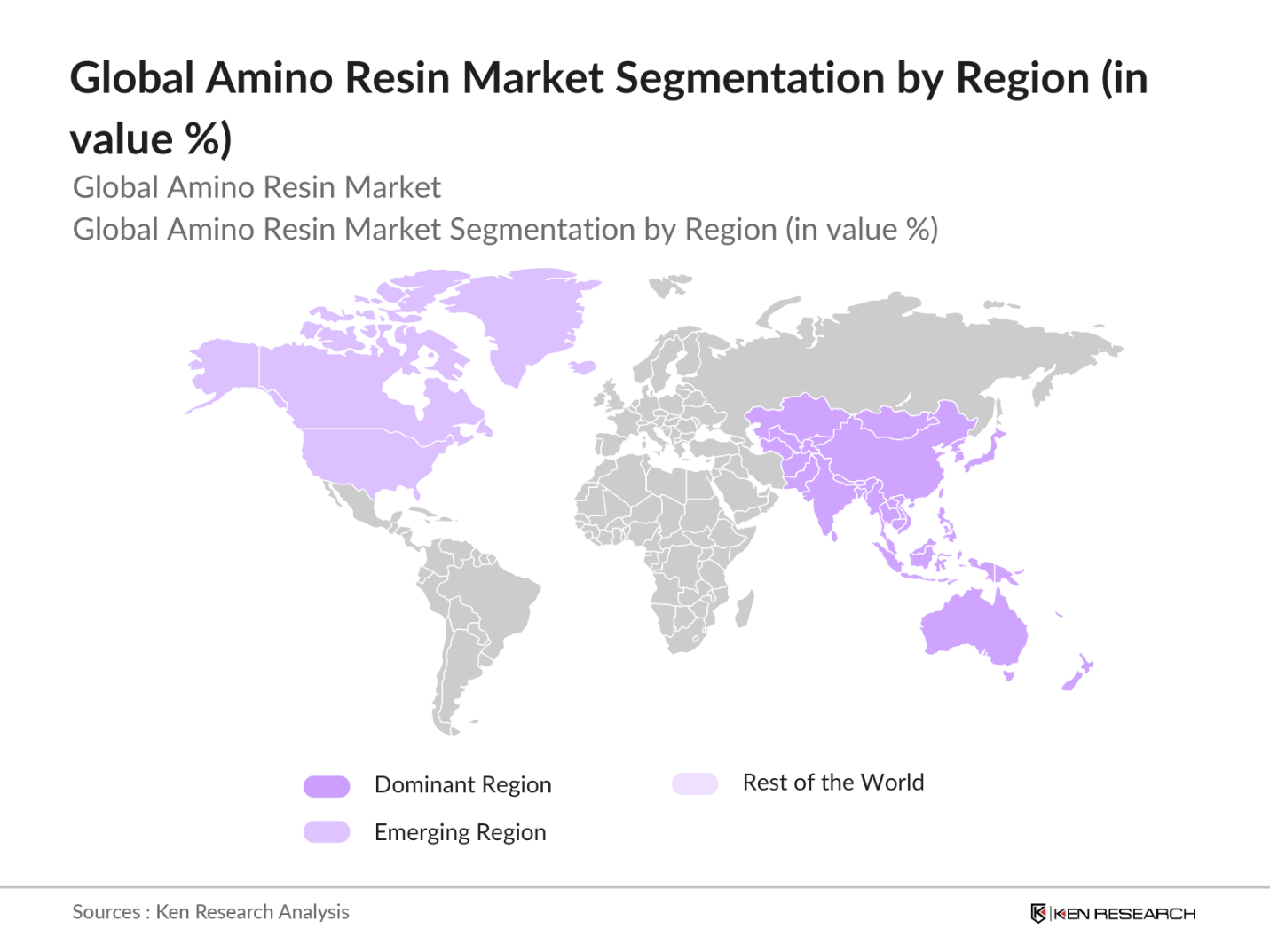

By Region: The global amino resin market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific holds the largest market share, led by China and India due to their booming construction and automotive industries. China, in particular, dominates with extensive production capacity and demand for sustainable construction materials. Europe follows closely with Germany spearheading the regions technological advancements in resin formulation and formaldehyde emission reduction.

Global Amino Resin Market Competitive Landscape

The global amino resin market is dominated by several key players who hold significant market shares due to their advanced production capabilities, research & development investments, and extensive distribution networks. Companies like BASF SE and Hexion Inc. are prominent in the space, leveraging technological advancements and strong ties to end-user industries such as construction and automotive. The market is also characterized by intense competition, with players focusing on innovations like low-emission formaldehyde products to comply with environmental regulations.

|

Company |

Year Established |

Headquarters |

Revenue (USD Bn) |

Production Capacity |

Market Share (%) |

Product Portfolio |

R&D Expenditure |

Regional Presence |

Technological Advancements |

|

BASF SE |

1865 |

Germany |

87.6 |

||||||

|

Hexion Inc. |

1899 |

USA |

8.5 |

||||||

|

Georgia-Pacific Chemicals |

1927 |

USA |

25.4 |

||||||

|

The Dow Chemical Company |

1897 |

USA |

57.0 |

||||||

|

Mitsui Chemicals, Inc. |

1912 |

Japan |

35.7 |

Global Amino Resin Market Analysis

Market Growth Drivers

- Increasing Demand in Construction Materials: The global construction sector has been witnessing significant growth, driven by rapid urbanization and infrastructural development. Amino resins are increasingly used in adhesives, coatings, and insulation materials within construction. The global construction industry has reached a value of over USD 15 trillion in 2023, according to the World Bank. The rise in infrastructure projects, especially in developing regions, continues to drive the need for durable and versatile materials like amino resins in both commercial and residential construction applications.

- Advancements in Resin Technologies: The advancements in resin technologies, particularly in reducing formaldehyde emissions, have been a major driver in the amino resin market. New technologies have made it possible to lower formaldehyde content without compromising performance, aligning with increasing environmental standards. As of 2024, over 1.5 million tons of resins are expected to be produced with reduced formaldehyde content in Europe alone. This shift is driven by research advancements and the rising adoption of sustainable alternatives in the resin industry, which is shaping future product developments.

- Environmental Regulatory Compliance: Stringent global environmental regulations have significantly impacted the amino resin market. Regulatory bodies, such as the U.S. Environmental Protection Agency (EPA), have imposed stricter formaldehyde emission standards for resin products used in manufacturing. In 2024, the EPAs national formaldehyde standard for composite wood products has resulted in a surge in demand for low-emission amino resins. The European Unions REACH regulations have also pushed manufacturers to adopt more eco-friendly solutions, leading to a substantial reduction in formaldehyde emissions globally.

Market Challenges

- Volatility in Raw Material Prices (Urea, Melamine): Amino resin production is heavily dependent on raw materials like urea and melamine, both of which have experienced price fluctuations due to global supply chain disruptions. These price fluctuations have directly impacted production costs for amino resins, putting pressure on manufacturers to stabilize supply. This volatility continues to be a significant challenge for the amino resin market, as the availability and pricing of these critical raw materials remain uncertain amidst geopolitical and economic uncertainties. Managing this volatility will be crucial for manufacturers to maintain cost-effective production processes and market stability.

- Stringent Environmental Regulations: The introduction of stringent environmental regulations globally has increased the operational burden on manufacturers of amino resins. The European Unions REACH regulation and the U.S. EPAs formaldehyde emission limits have made it necessary for manufacturers to invest in new technologies to meet these stringent requirements. Compliance costs have risen significantly, with estimates suggesting that resin producers in Europe are spending over USD 3 billion annually on environmental compliance in 2024. This financial strain, coupled with the threat of non-compliance penalties, remains a significant market challenge.

Global Amino Resin Market Future Outlook

Over the next five years, the global amino resin market is expected to grow steadily, driven by increasing demand for low-emission products, advancements in resin technology, and rising consumer demand for sustainable building materials. Government regulations aimed at reducing formaldehyde emissions and promoting green building practices will play a crucial role in shaping the market's future. Expansion into untapped markets such as Latin America and Africa presents significant growth opportunities, especially for companies investing in research & development.

Market Opportunities:

- Adoption of Low-Formaldehyde Resins: One of the key trends in the amino resin market is the growing adoption of low-formaldehyde resins, driven by stringent emission standards across the globe. This trend is expected to dominate the market as countries impose stricter controls on formaldehyde emissions. Manufacturers that focus on low-emission products are likely to gain a competitive advantage in environmentally conscious markets, where regulatory compliance and sustainability play a pivotal role in product selection and industry adoption.

- Rising Usage in Sustainable Building Materials: Sustainability is a dominant theme in the building materials industry, and amino resins are increasingly being used in the production of environmentally friendly construction materials. The demand for adhesives and coatings that meet environmental standards is rising, with amino resins, particularly low-formaldehyde variants, being adopted to meet this demand. This trend is especially prevalent in regions like North America and Europe, where regulations and consumer preferences are pushing for sustainable construction solutions. Manufacturers focusing on sustainable resin options are poised to benefit from this growing demand.

Scope of the Report

|

By Type |

Urea Formaldehyde Melamine Formaldehyde Melamine-Urea Formaldehyde |

|

By Application |

Wood-based Panels Automotive Construction |

|

By End-Use Industry |

Building & Construction Automotive & Transportation Consumer Goods Electronics |

|

By Resin Form |

Liquid Amino Resins Powder Amino Resins |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Amino Resin Manufacturers

Construction Companies

Automotive Manufacturers

Wood-Based Panel Producers

Textile Manufacturers

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (EPA, European Chemicals Agency)

Adhesive and Coating Manufacturers

Table of Contents

1. Global Amino Resin Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (In production capacity and consumption trends)

1.4 Market Segmentation Overview

2. Global Amino Resin Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones (Regulatory changes, new innovations)

3. Global Amino Resin Market Analysis

3.1 Growth Drivers

3.1.1 Increasing demand in construction materials

3.1.2 Advancements in resin technologies

3.1.3 Environmental regulatory compliance

3.1.4 Rising automotive industry demands

3.2 Market Challenges

3.2.1 Volatility in raw material prices (Urea, Melamine)

3.2.2 Stringent environmental regulations

3.2.3 Shifting consumer preference towards eco-friendly alternatives

3.3 Opportunities

3.3.1 Growth in the wood-based panel industry

3.3.2 Expansion into untapped regions (Africa, Latin America)

3.3.3 Technological advancements in formaldehyde reduction

3.4 Trends

3.4.1 Adoption of low-formaldehyde resins

3.4.2 Rising usage in sustainable building materials

3.4.3 Increased research into bio-based amino resins

3.5 Government Regulations

3.5.1 Formaldehyde Emission Standards

3.5.2 Incentives for eco-friendly resins

3.5.3 Industry-specific emission reduction policies

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

Global Amino Resin Market Segmentation

4.1 By Type (In Value %)

4.1.1 Urea Formaldehyde

4.1.2 Melamine Formaldehyde

4.1.3 Melamine-Urea Formaldehyde

4.2 By Application (In Value %)

4.2.1 Wood-based Panels

4.2.2 Automotive

4.2.3 Construction

4.2.4 Textile

4.3 By End-Use Industry (In Value %)

4.3.1 Building & Construction

4.3.2 Automotive & Transportation

4.3.3 Consumer Goods

4.3.4 Electronics

4.4 By Resin Form (In Value %)

4.4.1 Liquid Amino Resins

4.4.2 Powder Amino Resins

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Amino Resin Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BASF SE

5.1.2 Hexion Inc.

5.1.3 Georgia-Pacific Chemicals

5.1.4 The Dow Chemical Company

5.1.5 Mitsui Chemicals, Inc.

5.1.6 Allnex Group

5.1.7 Kronospan Holdings Ltd.

5.1.8 Arclin Inc.

5.1.9 Chemiplastica

5.1.10 Prefere Resins Holding GmbH

5.1.11 Momentive Specialty Chemicals

5.1.12 INEOS Melamines

5.1.13 Ercros S.A.

5.1.14 Metadynea

5.1.15 Dynea Oy

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Product Portfolio, Market Presence, Innovation)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. Global Amino Resin Market Regulatory Framework

6.1 Emission Standards

6.2 Industry Certifications and Compliance

6.3 International Trade Regulations

7. Global Amino Resin Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Amino Resin Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Resin Form (In Value %)

8.5 By Region (In Value %)

9. Global Amino Resin Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Market Expansion Strategies

9.4 Innovation and R&D Focus

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the global amino resin market. This step is based on extensive desk research, utilizing secondary and proprietary databases to gather comprehensive market information. Key variables like production capacity and market penetration will be identified.

Step 2: Market Analysis and Construction

In this phase, historical data will be compiled and analyzed, assessing the ratio of product demand to supply across different regions. Further analysis of resin formulation advancements and their commercial impact will be undertaken.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through interviews with industry experts, including manufacturers, distributors, and key stakeholders. These consultations will provide operational insights to refine market forecasts and corroborate data from proprietary databases.

Step 4: Research Synthesis and Final Output

The final phase will involve engaging with major amino resin manufacturers to acquire detailed insights into production trends, product developments, and distribution channels. These interactions will ensure a comprehensive and validated market analysis.

Frequently Asked Questions

01. How big is the global amino resin market?

The global amino resin market is valued at USD 7.17 billion, driven by increased demand across construction, automotive, and wood-based panel industries.

02. What are the challenges in the global amino resin market?

Challenges include volatility in raw material prices, stringent environmental regulations on formaldehyde emissions, and competition from eco-friendly resin alternatives.

03. Who are the major players in the global amino resin market?

Key players in the market include BASF SE, Hexion Inc., Georgia-Pacific Chemicals, The Dow Chemical Company, and Mitsui Chemicals, Inc.

04. What are the growth drivers of the global amino resin market?

The market is propelled by demand in the construction and automotive industries, advancements in low-emission resin technology, and increasing adoption of sustainable building materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.