Global Animal Health Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD9097

October 2024

95

About the Report

Global Animal Health Market Overview

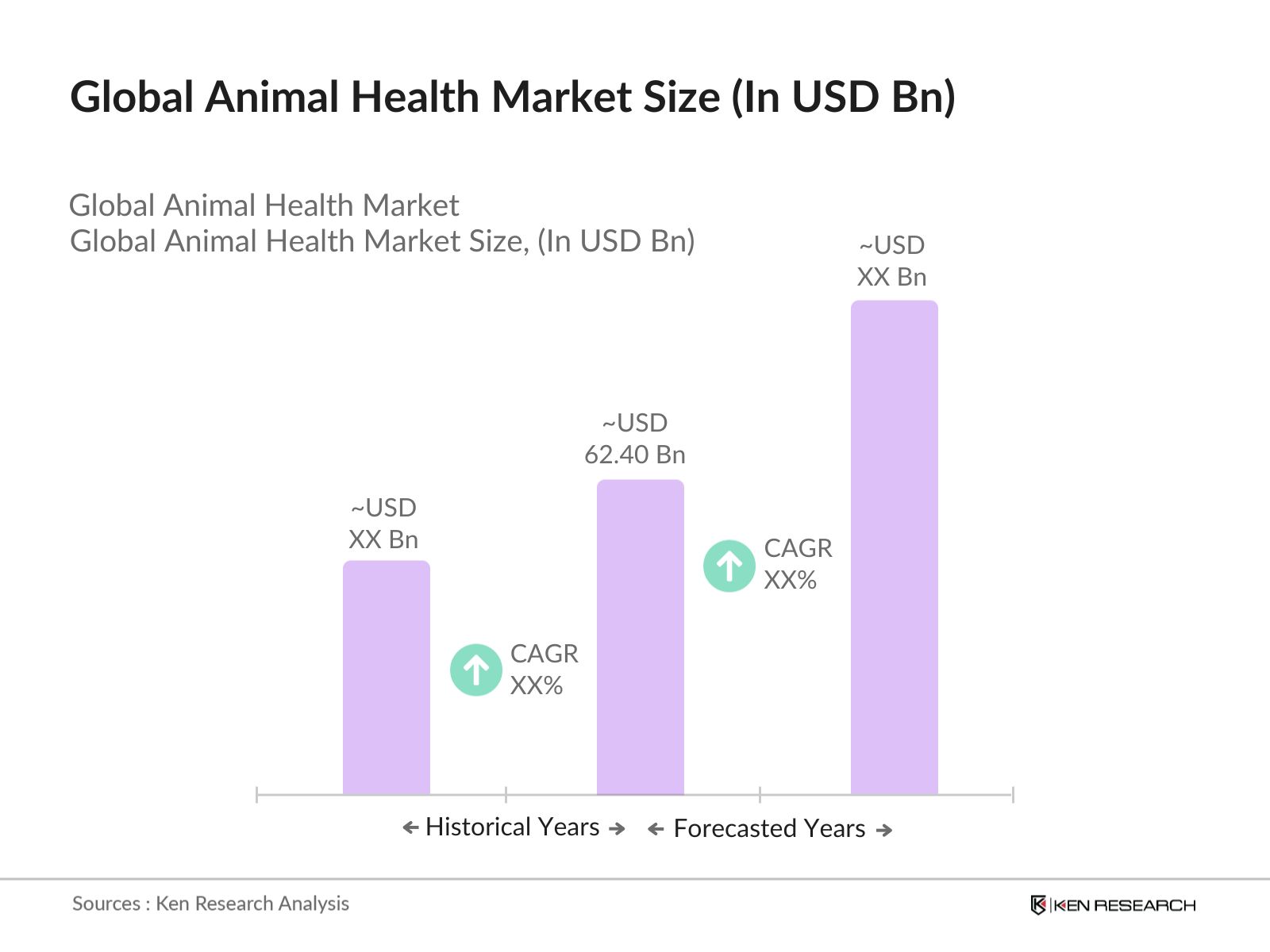

- The global animal health market is valued at USD 62.40 billion, driven by increasing pet ownership, rising demand for livestock products, and advancements in veterinary healthcare. The market's growth is supported by innovations in diagnostic technologies, as well as government initiatives to curb the spread of zoonotic diseases. These factors are enabling the rapid expansion of the veterinary healthcare sector and are fueling demand for pharmaceuticals, vaccines, and preventive care solutions across the globe.

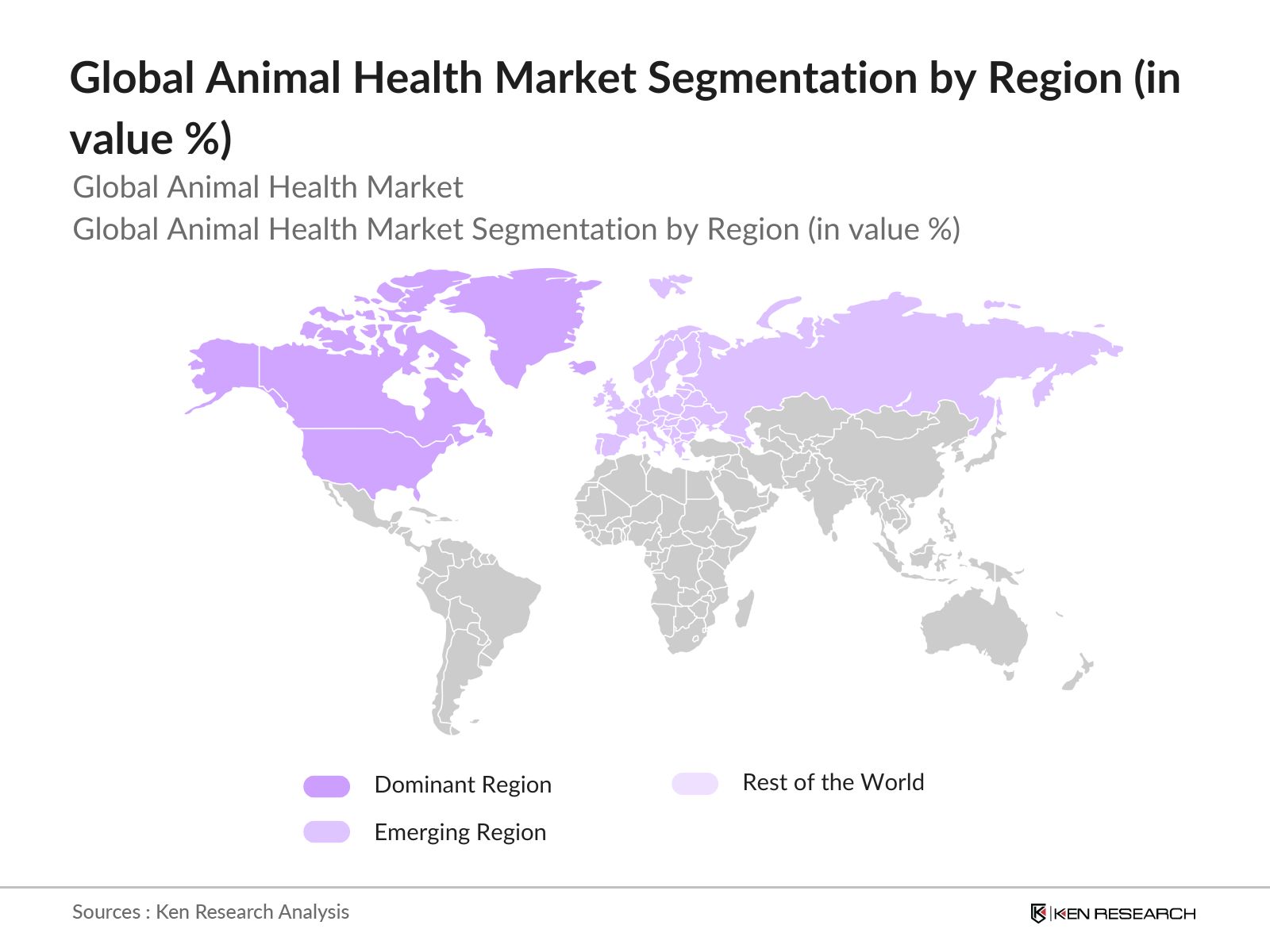

- The market is predominantly dominated by countries with strong agricultural sectors and high pet ownership rates. North America, specifically the United States, leads due to advanced healthcare infrastructure and significant investments in animal health technologies. Europe follows closely, driven by stringent animal welfare regulations, while Asia-Pacific nations like China and India are experiencing rising demand due to growing livestock farming and an increasing middle class that prioritizes pet healthcare.

- Governments worldwide are prioritizing the prevention and control of zoonotic diseases through comprehensive programs. In 2024, the US government allocated $1.2 billion to the Centers for Disease Control and Prevention (CDC) for zoonotic disease research and prevention initiatives. Similar efforts are underway in Europe and Asia, where governments are implementing robust animal disease surveillance systems. These programs aim to control outbreaks of zoonotic diseases such as avian influenza and rabies, with a focus on vaccination, disease monitoring, and early intervention strategies.

Global Animal Health Market Segmentation

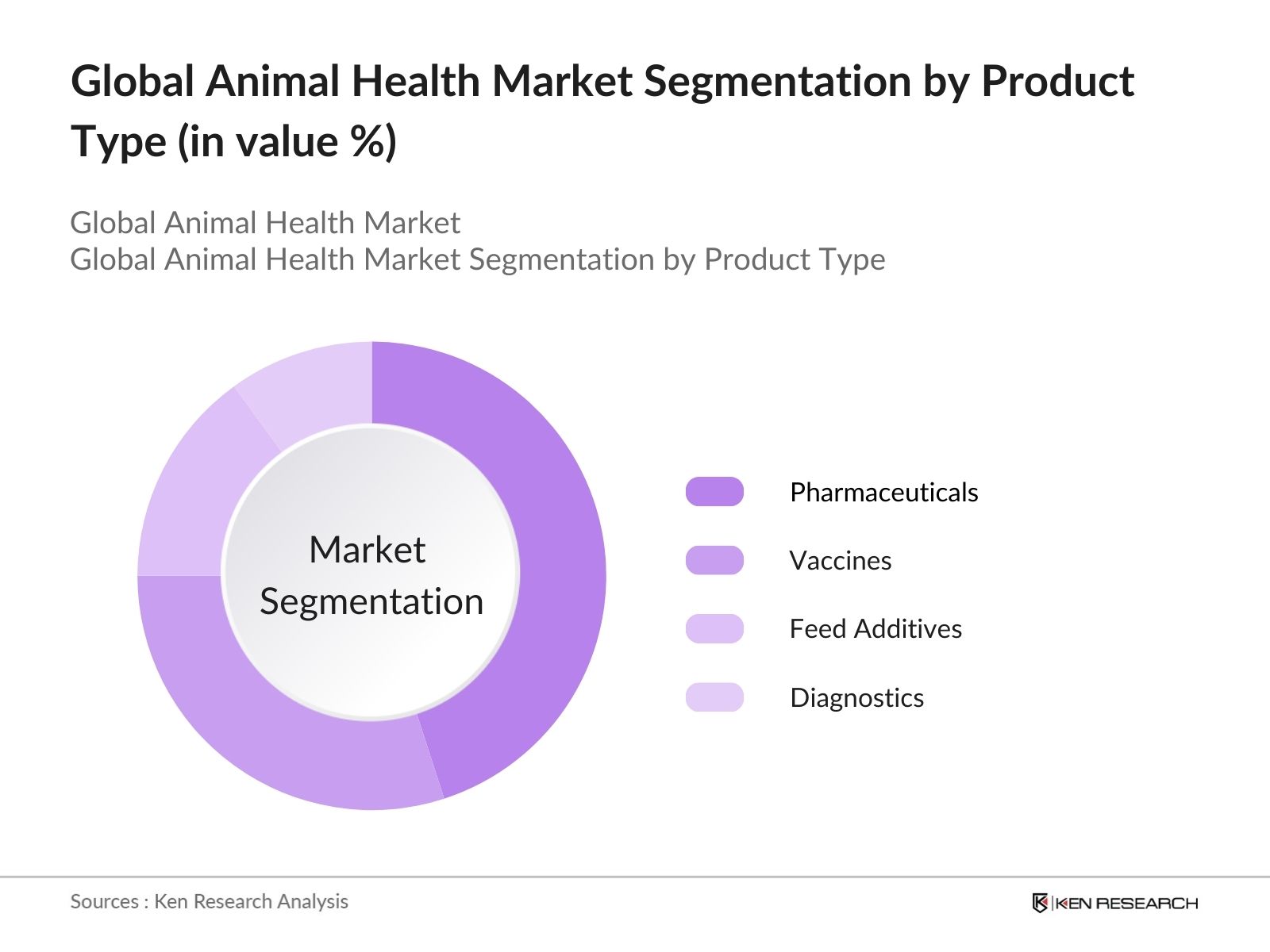

- By Product Type: The global animal health market is segmented by product type into Pharmaceuticals, Vaccines, Feed Additives, Diagnostics, and Others (Medical Devices, Therapeutics). Pharmaceuticals maintain the largest market share due to the high demand for treatments addressing common animal diseases and the growing number of pet and livestock populations worldwide.

- By Region: The global animal health market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. North America dominates the market, primarily due to advanced healthcare infrastructure and high pet ownership rates.

- By Distribution Channel The market is segmented by distribution channel into Veterinary Pharmacies, Wholesalers and Distributors, and E-Commerce. Veterinary pharmacies hold the largest share, as they are the preferred option for purchasing animal healthcare products.

Global Animal Health Market Competitive Landscape

The global animal health market is characterized by intense competition among several leading players, each contributing significantly to advancements in veterinary pharmaceuticals, diagnostics, and vaccines. Companies are focusing on expanding their product portfolios through mergers, acquisitions, and R&D investments to gain a competitive edge in this fast-growing industry. The top competitors are also forming strategic alliances with local players to enhance their global reach and penetrate emerging markets more effectively.

|

Company Name |

Year Established |

Headquarters |

Product Portfolio |

R&D Expenditure |

Global Market Presence |

Strategic Partnerships |

Sustainability Initiatives |

Recent Mergers & Acquisitions |

Innovation Index |

|

Zoetis Inc. |

1952 |

Parsippany, NJ, USA |

|||||||

|

Boehringer Ingelheim |

1885 |

Ingelheim, Germany |

|||||||

|

Merck Animal Health |

1891 |

Kenilworth, NJ, USA |

|||||||

|

Elanco Animal Health |

1954 |

Greenfield, IN, USA |

|||||||

|

Bayer Animal Health |

1863 |

Leverkusen, Germany |

Global Animal Health Industry Analysis

Growth Drivers

- Rising Pet Ownership and Expenditure: In 2024, the global pet population is estimated to reach over 470 million dogs and 370 million cats, contributing to the increasing demand for animal health services and products. In the United States alone, spending on pets is expected to exceed $140 billion in 2024, reflecting the growing trend of pet humanization, where owners prioritize health care for their pets. Countries like China and India are witnessing a rapid rise in pet ownership, driving demand for veterinary services and pharmaceuticals. This rise in pet care expenditure underscores the expanding animal healthcare market.

- Increasing Incidence of Zoonotic Diseases: Zoonotic diseases, which account for more than 60% of known infectious diseases, are on the rise due to urbanization, deforestation, and close interaction between humans and animals. In 2023, the World Health Organization (WHO) reported over 200,000 new zoonotic disease cases globally. Government initiatives in Europe, North America, and Asia are aimed at controlling zoonotic outbreaks, further increasing the need for preventive animal healthcare. Vaccination programs and disease surveillance systems have seen more than $10 billion in funding by 2024, supporting the development of effective veterinary healthcare solutions.

- Advancements in Veterinary Healthcare Technologies: Veterinary healthcare technologies have significantly advanced in 2024, particularly with innovations in diagnostic tools such as PCR testing and animal genomics. The development of veterinary telemedicine platforms has seen increased adoption in the US, with more than 35% of veterinary consultations being conducted online in 2024. These advancements are particularly crucial in regions where access to veterinary care is limited, driving demand for digital health solutions. Investment in animal biotechnology, especially in North America and Europe, is projected to rise to $15 billion in 2024, bolstering the overall growth of the animal healthcare sector.

Market Restraints

- Regulatory Hurdles (Regulatory Policies): Strict regulatory frameworks across regions slow down the approval of veterinary drugs and products. In 2024, it takes an average of 3-5 years for new veterinary drugs to receive regulatory approval in regions like the European Union and North America. Compliance costs for pharmaceutical companies developing animal healthcare products have risen by over 20%, due to stringent testing requirements and new guidelines on antimicrobial resistance (AMR). This regulatory complexity, combined with varying standards across countries, creates significant challenges for manufacturers aiming to introduce new products into the global market.

- Limited Access to Veterinary Services in Rural Areas: In 2024, over 65% of livestock in low- and middle-income countries reside in rural areas, yet access to veterinary services remains sparse. For example, only 15% of rural regions in sub-Saharan Africa have adequate access to professional veterinary care, according to the World Bank. This lack of infrastructure results in inadequate disease management and reduced productivity among livestock populations, which depend on basic veterinary interventions. Moreover, transportation costs and a shortage of trained veterinarians in these areas exacerbate the issue, posing a major challenge to improving animal health in developing regions.

Global Animal Health Market Future Outlook

Over the next five years, the global animal health market is expected to witness significant growth, driven by increasing awareness of zoonotic diseases, rising pet ownership, and advancements in animal healthcare technologies. The demand for preventive veterinary care is projected to rise as pet owners prioritize the health of companion animals, while livestock farmers seek to ensure the well-being of their animals to meet growing demand for animal-based products. Additionally, technological innovations in diagnostics and telemedicine will play a pivotal role in reshaping the veterinary care landscape, further bolstering market growth.

Market Opportunities

- Expansion of Animal Vaccination Programs: In 2024, governments worldwide are increasing funding for animal vaccination programs, aiming to prevent the spread of zoonotic diseases and improve livestock productivity. The African Union's Pan-African Veterinary Vaccine Centre (AU-PANVAC) has launched an initiative to distribute 500 million doses of livestock vaccines across 30 countries by the end of 2025. In Europe, similar programs targeting rabies and foot-and-mouth disease in livestock are receiving substantial investments from government bodies, which are expected to improve animal health and boost demand for veterinary services.

- Increasing Demand for Companion Animal Healthcare: he global demand for companion animal healthcare, including pet diagnostics and supplements, is set to rise sharply in 2024. Over 220 million pets are reported in Europe alone, where the annual expenditure on pet supplements has exceeded $4 billion. In the US, diagnostic testing for pets is growing rapidly, with over 25 million diagnostic tests conducted annually. These trends reflect a shift toward preventive care and wellness, with owners increasingly seeking comprehensive healthcare solutions, thereby creating lucrative opportunities in the companion animal healthcare market.

Scope of the Report

Scope Table for Global Animal Health Market

|

Product Type |

Pharmaceuticals, Vaccines, Feed Additives, Diagnostics, Others |

|

Animal Type |

Companion Animals, Livestock Animals |

|

End User |

Veterinary Hospitals and Clinics, Retail Pharmacies, Online Pharmacies |

|

Distribution Channel |

Veterinary Pharmacies, Wholesalers and Distributors, E-Commerce |

|

Region |

North America, Europe, Asia-Pacific, Latin America, Middle East and Africa |

Products

Key Target Audience

Veterinary Hospitals and Clinics

Livestock Farmers and Agribusiness Owners

Pet Owners and Companion Animal Care Providers

Veterinary Pharmaceutical Manufacturers

Government and Regulatory Bodies (FDA, USDA, EMA)

Animal Welfare Organizations

Investors and Venture Capitalist Firms

Veterinary Diagnostic Laboratories

Companies

Players Mentioned in the Report:

Zoetis Inc.

Boehringer Ingelheim

Merck Animal Health

Elanco Animal Health

Bayer Animal Health

Ceva Sant Animale

Virbac

Vetoquinol

Dechra Pharmaceuticals

IDEXX Laboratories

Heska Corporation

Phibro Animal Health

Neogen Corporation

Covetrus

PetIQ, Inc.

Table of Contents

1. Global Animal Health Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Animal Health Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Animal Health Market Analysis

3.1. Growth Drivers

3.1.1. Rising Pet Ownership and Expenditure

3.1.2. Increasing Incidence of Zoonotic Diseases

3.1.3. Advancements in Veterinary Healthcare Technologies

3.1.4. Growing Demand for Livestock Products

3.2. Market Challenges

3.2.1. High Costs of Animal Healthcare

3.2.2. Regulatory Hurdles (Regulatory Policies)

3.2.3. Limited Access to Veterinary Services in Rural Areas

3.3. Opportunities

3.3.1. Expansion of Animal Vaccination Programs

3.3.2. Increasing Demand for Companion Animal Healthcare (Pet Diagnostics, Pet Supplements)

3.3.3. Emerging Markets in Asia Pacific

3.4. Trends

3.4.1. Rising Adoption of Telemedicine in Veterinary Care

3.4.2. Growth of Preventive Healthcare Solutions (Preventive Veterinary Medicine)

3.4.3. Development of Advanced Animal Pharmaceuticals (Innovations in Animal Biologics)

3.5. Government Regulation

3.5.1. Veterinary Drug Approvals (Regulation of Animal Drugs)

3.5.2. Animal Health and Welfare Standards (Global Animal Health Standards)

3.5.3. Zoonotic Disease Prevention and Control Programs (Animal Disease Management)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Veterinary Practitioners, Pet Owners, Livestock Farmers, Regulators)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Animal Health Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Pharmaceuticals

4.1.2. Vaccines

4.1.3. Feed Additives

4.1.4. Diagnostics

4.1.5. Others (Medical Devices, Therapeutics)

4.2. By Animal Type (In Value %)

4.2.1. Companion Animals

4.2.2. Livestock Animals

4.3. By End User (In Value %)

4.3.1. Veterinary Hospitals and Clinics

4.3.2. Retail Pharmacies

4.3.3. Online Pharmacies

4.4. By Distribution Channel (In Value %)

4.4.1. Veterinary Pharmacies

4.4.2. Wholesalers and Distributors

4.4.3. E-Commerce

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East and Africa

5. Global Animal Health Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Zoetis Inc.

5.1.2. Boehringer Ingelheim

5.1.3. Merck Animal Health

5.1.4. Elanco Animal Health

5.1.5. Bayer Animal Health

5.1.6. Ceva Sant Animale

5.1.7. Virbac

5.1.8. Vetoquinol

5.1.9. Dechra Pharmaceuticals

5.1.10. IDEXX Laboratories

5.1.11. Heska Corporation

5.1.12. Phibro Animal Health

5.1.13. Neogen Corporation

5.1.14. Covetrus

5.1.15. PetIQ, Inc.

5.2. Cross Comparison Parameters (Headquarters, Number of Employees, Market Presence, Product Portfolio, Innovation Index, R&D Investment, Strategic Partnerships, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Animal Health Market Regulatory Framework

6.1. Animal Drug Regulatory Authorities

6.2. Compliance and Certification Requirements (GMP, ISO)

6.3. Animal Health Product Registration Processes

7. Global Animal Health Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Animal Health Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By End User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Animal Health Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped the ecosystem of the global animal health market by identifying major stakeholders, including veterinary pharmaceutical companies, pet care providers, and livestock farmers. This step involved extensive desk research using both secondary data and proprietary industry databases to gather crucial market information. The goal was to define the critical variables influencing the dynamics of the animal health market.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data, including market penetration of veterinary pharmaceuticals, diagnostics, and vaccines. This phase also included an assessment of service availability across various geographies and sectors. Data was cross-verified to ensure accurate revenue estimates and service-level insights, particularly regarding preventive animal healthcare and livestock productivity.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses and validated them through consultations with industry experts via computer-assisted interviews (CATIs). Experts from key companies in the veterinary healthcare field provided valuable insights on market trends, operational challenges, and opportunities, which were critical to refining the market analysis.

Step 4: Research Synthesis and Final Output

In the final phase, we engaged with major players in the global animal health market, including veterinary pharmaceutical manufacturers and livestock farmers, to obtain granular insights on sales performance, product development, and regional demand patterns. This bottom-up approach helped to ensure the accuracy of our findings and provided a comprehensive view of the global animal health market.

Frequently Asked Questions

01. How big is the Global Animal Health Market?

The global animal health market is valued at USD 62.40 billion, driven by increasing pet ownership, the rise in livestock farming, and growing demand for animal-based products. The market has experienced rapid growth due to advancements in veterinary diagnostics and pharmaceuticals.

02. What are the challenges in the Global Animal Health Market?

The animal health market faces several challenges, including high costs associated with veterinary care, stringent regulatory policies, and limited access to healthcare services in rural areas. These factors hinder the growth potential, especially in emerging markets.

03. Who are the major players in the Global Animal Health Market?

Key players in the global animal health market include Zoetis Inc., Boehringer Ingelheim, Merck Animal Health, Elanco Animal Health, and Bayer Animal Health. These companies dominate due to their extensive R&D investments, strong global presence, and diverse product portfolios.

04. What are the growth drivers of the Global Animal Health Market?

The market is driven by rising pet ownership, increased demand for livestock products, and advancements in veterinary healthcare technologies. Additionally, government initiatives to control zoonotic diseases and improve animal health standards further propel market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.