Global Anti-Obesity Medication Market Outlook to 2030

Region:Global

Author(s):Shubham Kashyap

Product Code:KROD4103

December 2024

80

About the Report

Global Anti-Obesity Medication Market Overview

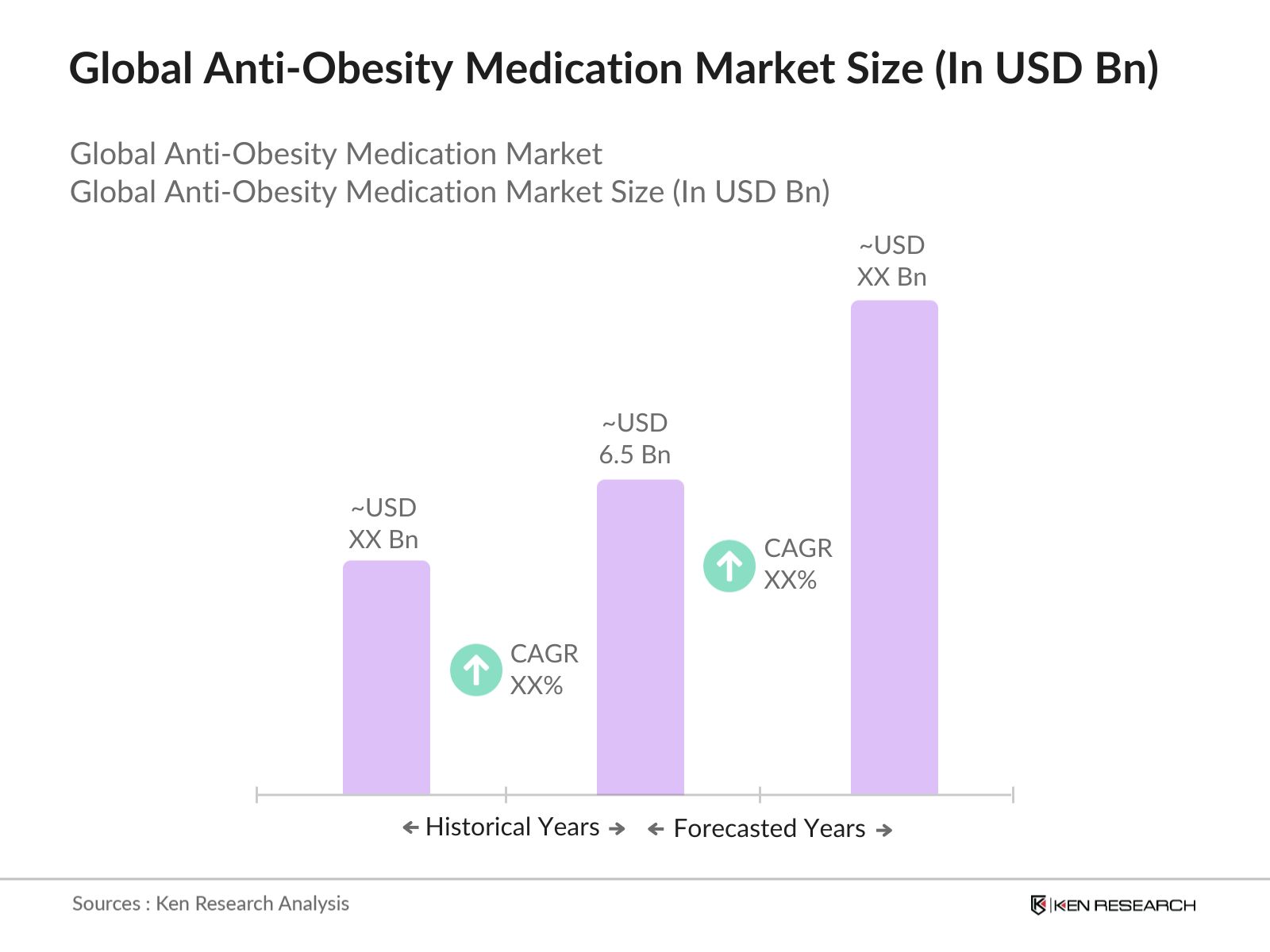

- The global anti-obesity medication market is witnessing remarkable growth, with a projected valuation of USD 6.5 billion, driven by rising awareness about obesity-related health risks and the growing prevalence of obesity worldwide. Over the past five years, an increasing number of individuals affected by obesity has led to heightened demand for effective anti-obesity treatments. The surge in sedentary lifestyles, unhealthy dietary habits, and a lack of physical activity are major contributors to this global health crisis, further propelling the demand for medication solutions.

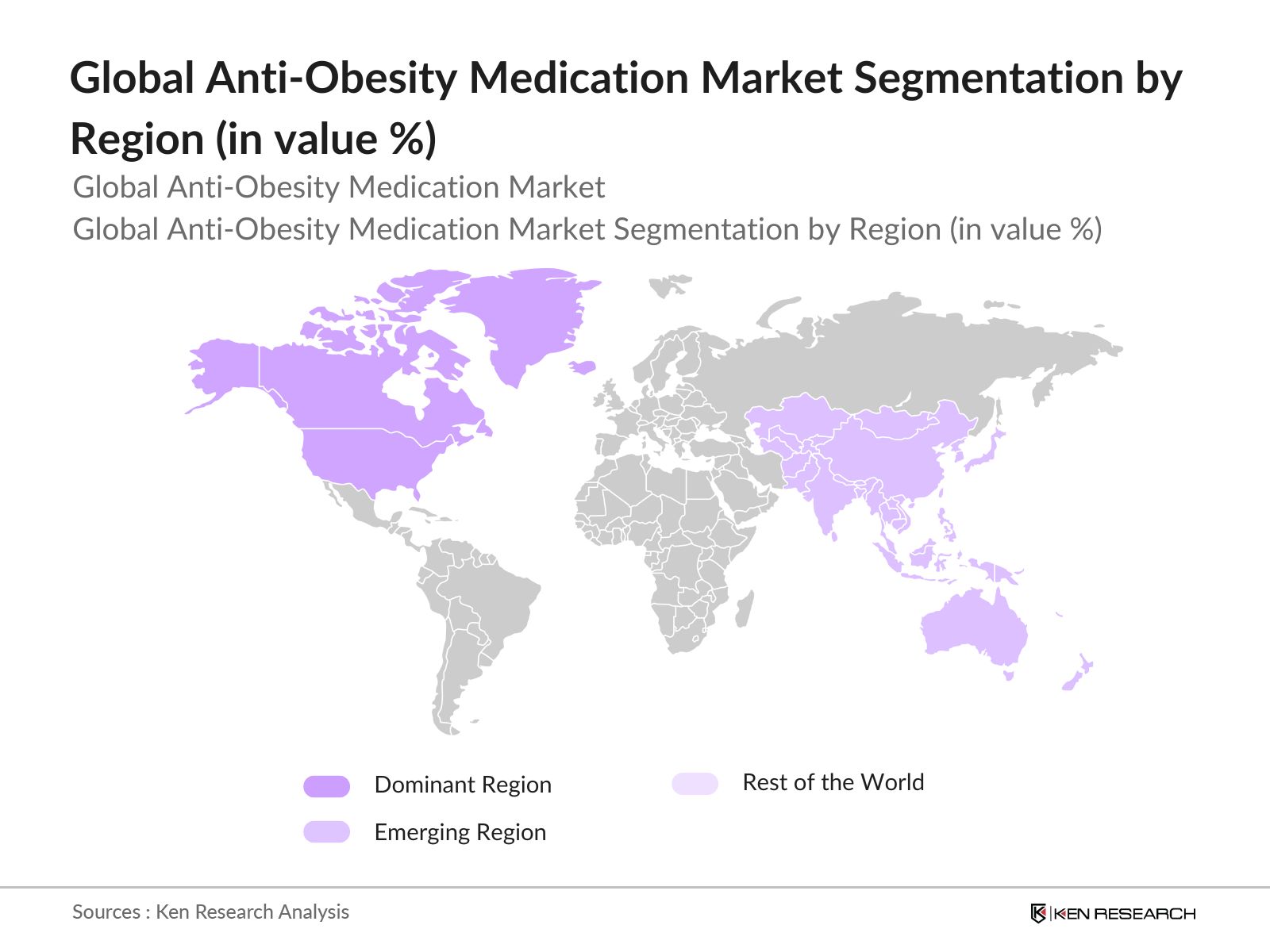

- The United States, the United Kingdom, and Japan are key players in the global anti-obesity medication market. The U.S. dominates the market, backed by high obesity rates and strong healthcare infrastructure, while Japan shows growth potential due to increasing awareness and the adoption of healthier lifestyles. The European market is also experiencing steady growth, with countries such as the United Kingdom implementing government-driven health initiatives to combat obesity.

- Technological advancements in drug delivery systems and the development of personalized medications are also contributing to the market's growth. The introduction of new classes of anti-obesity drugs, such as GLP-1 receptor agonists and dual-targeting therapies, is expected to revolutionize the treatment landscape. With ongoing clinical trials and innovations, major players in the pharmaceutical industry are investing in research and development to introduce more effective and long-lasting solutions to address the obesity epidemic.

Global Anti-Obesity Medication Market Segmentation

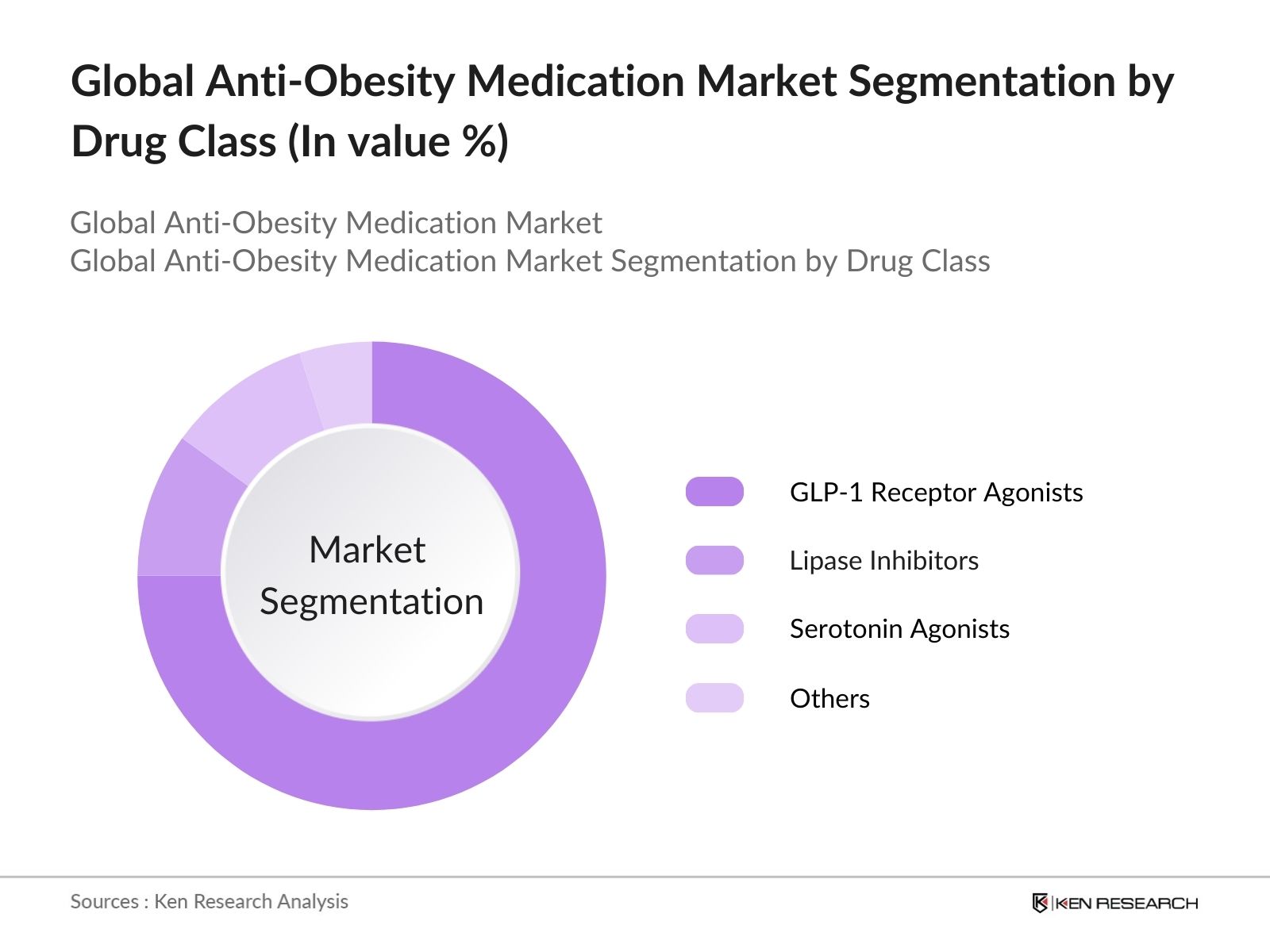

- By Drug Class: The market is segmented into GLP-1 receptor agonists, lipase inhibitors, serotonin agonists, and others. The GLP-1 receptor agonists dominate the market, accounting for the majority of the total market share. This class of drugs has gained popularity due to its dual action of reducing appetite and increasing insulin sensitivity, making it a preferred choice for individuals with obesity and comorbidities such as type 2 diabetes. Lipase inhibitors, which block the absorption of fats from food, are also experiencing demand, particularly in developed markets. Serotonin agonists, designed to control appetite through the brains neurotransmitter pathways, continue to gain traction in specific patient populations.

- By Route of Administration: The market is categorized into oral, injectable, and others. Oral medications hold the largest market share, due to their ease of use and wide availability. Injectable therapies, such as GLP-1 receptor agonists, are also growing rapidly, particularly among patients seeking more effective weight loss outcomes. With technological advancements in drug delivery systems, injectables are expected to see robust growth, especially as patient awareness and preference for effective solutions increase.

- By Region: The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North American anti-obesity medication market dominates due to high obesity rates, advanced healthcare infrastructure, and substantial investments in research and development. The presence of key pharmaceutical players and strong public health initiatives in the U.S. and Canada contribute to the regions market leadership. The U.S., in particular, has the largest market share in this segment, driven by government-backed healthcare programs and insurance coverage for obesity treatments.

Global Anti-Obesity Medication Market Competitive Landscape

The global anti-obesity medication market is dominated by a few major players who are investing heavily in research and development to introduce more effective treatments. Companies such as Novo Nordisk and Eli Lilly are focusing on advanced drug classes like GLP-1 receptor agonists, which have demonstrated efficacy in weight management. This market concentration is driven by the high cost of R&D, regulatory barriers, and the need for substantial marketing resources to promote anti-obesity drugs.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Market Presence |

R&D Investment |

Global Reach |

Product Portfolio |

Certifications |

Recent Drug Approvals |

|

Novo Nordisk |

1923 |

Bagsvrd, Denmark |

|||||||

|

Eli Lilly |

1876 |

Indianapolis, USA |

|||||||

|

Pfizer Inc. |

1849 |

New York, USA |

|||||||

|

Johnson & Johnson |

1886 |

New Brunswick, USA |

|||||||

|

Roche |

1896 |

Basel, Switzerland |

Global Anti-Obesity Medication Market Analysis

Growth Drivers

- Rising Prevalence of Obesity: The global obesity epidemic is a driver of the anti-obesity medication market, as reported by the World Health Organization (WHO). In 2023, over 2 billion adults globally were classified as overweight, with over 650 million considered obese. This rapid increase in obesity rates is largely attributed to lifestyle changes, urbanization, and the availability of high calorie processed foods. Furthermore, health conditions linked to obesity, such as cardiovascular diseases and diabetes, are rising, creating a substantial demand for effective treatment options. The economic impact of obesity-related illnesses globally reached $2 trillion annually by 2023.

- Technological Advancements in Drug Development: Technological breakthroughs in anti-obesity treatments, including the development of GLP-1 receptor agonists, have impacted the market. Medications such as semaglutide have shown remarkable efficacy in managing obesity by suppressing appetite. In 2023, dual-target therapies addressing both glucose and weight regulation were introduced, enhancing patient outcomes. These treatments, which focus on innovative mechanisms to control weight, have led to an increase in demand for advanced therapies globally. By 2023, over 108525 prescriptions for these medications were filled in the United States alone, reflecting growing market potential.

- Increasing Healthcare Expenditure: Healthcare spending on obesity treatment is rising globally as governments and private sectors allocate resources to address the public health crisis. In 2021, global healthcare expenditure surpassed USD 9.1 trillion, with an increasing share directed toward managing obesity-related conditions. In countries like the United States, government programs such as Medicare and Medicaid have expanded coverage for anti-obesity treatments, increasing patient access. Furthermore, private healthcare investments in this sector increased, with venture capital investments in weight management technologies exceeding USD 2.5 billion in 2023.

Market Challenges

- High Cost of Anti-Obesity Medications: Anti-obesity medications remain costly, creating access barriers, especially in developing regions. The high prices limit the affordability of effective treatment for a portion of the global population, particularly in low-income countries where healthcare expenditure is lower. As a result, the penetration of these therapies in regions like Sub-Saharan Africa and Southeast Asia remains minimal, affecting the global markets growth potential. Additionally, the lack of insurance coverage in some countries further compounds affordability issues, limiting access to life-changing treatments for obesity.

- Social Stigma and Patient Compliance: Social stigma around obesity continues to affect patient compliance with treatment protocols. Many patients undergoing treatment for obesity discontinue medications due to the stigma associated with obesity treatment and fear of social judgment. Furthermore, patient adherence to treatment plans is often affected by psychological factors, reducing the effectiveness of long-term weight management strategies. This low compliance has a direct impact on the markets potential, particularly in regions where societal pressures around body image are high, affecting the overall success of obesity treatment programs.

Global Anti-Obesity Medication Market Future Outlook

The global anti-obesity medication market is expected to see growth through 2028, driven by the rising prevalence of obesity and advancements in therapeutic options. Companies will continue to focus on developing more efficient and accessible treatments to meet the growing demand for weight loss solutions.

Future Market Opportunities

- Personalized Medicine and Genetic Targeting: The increasing adoption of personalized medicine in the treatment of obesity is creating new market opportunities. As of 2023, genetic profiling technologies allowed healthcare providers to tailor obesity treatments based on individual genetic predispositions. Advances in pharmacogenomics have enabled the identification of specific genes responsible for metabolism, providing opportunities to develop targeted therapies that enhance efficacy and reduce side effects. The global personalized medicine market is expanding, with a growing focus on genetic therapies for weight management.

- Expansion in Emerging Markets: Emerging markets in Latin America and Southeast Asia present substantial growth opportunities for anti-obesity medications. In 2023, Brazil reported over 20 million obese individuals, driving demand for weight management solutions. Similarly, countries such as Thailand and Malaysia witnessed rising obesity rates due to increasing urbanization. Government initiatives to address public health concerns, combined with rising healthcare expenditure in these regions, are expected to foster market growth. In 2023, healthcare expenditure in Latin America exceeded USD 500 billion, with portions allocated to managing non-communicable diseases like obesity.

Scope of the Report

|

Drug Class |

GLP-1 Receptor Agonists Lipase Inhibitors Serotonin Agonists Others |

|

Route of Administration |

Oral Medications Injectable Therapies Others |

|

Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

End-User |

Hospitals Clinics Homecare |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (U.S. FDA, EMA, and Japan's Ministry of Health)

Pharmaceutical Manufacturers

Healthcare Providers (Hospitals, Clinics)

Insurance Providers

Drug Distribution Networks

Healthcare Policy Makers

Public Health Agencies (WHO, and CDC)

Banks and Financial Institutions

Companies

Major Players Mentioned in the Report

Novo Nordisk

Eli Lilly

Pfizer Inc.

Johnson & Johnson

Roche

GlaxoSmithKline

AstraZeneca

Merck & Co.

Sanofi

Boehringer Ingelheim

Bristol-Myers Squibb

Allergan

Takeda Pharmaceuticals

VIVUS, Inc.

Amgen Inc.

Table of Contents

1. Global Anti-Obesity Medication Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Factors driving growth: rising obesity prevalence, drug development trends, and healthcare spending)

1.4 Market Segmentation Overview

2. Global Anti-Obesity Medication Market Size (In USD Bn)

2.1 Historical Market Size (In-depth analysis of market trends)

2.2 Year-on-Year Growth Analysis (Key factors impacting growth)

2.3 Key Market Developments and Milestones (Clinical trials, regulatory approvals, major drug launches)

3. Global Anti-Obesity Medication Market Analysis

3.1 Growth Drivers

3.1.1 Rising Prevalence of Obesity (WHO data, increasing obesity rates globally)

3.1.2 Technological Advancements (Introduction of GLP-1 receptor agonists, dual-target therapies)

3.1.3 Increasing Healthcare Expenditure (Growing investments in obesity treatment by governments and private sector)

3.2 Market Challenges

3.2.1 High Cost of Anti-Obesity Medications (Access issues in developing regions)

3.2.2 Social Stigma and Patient Compliance (Impact on medication adherence)

3.2.3 Regulatory and Approval Barriers (Strict regulations for drug approval, market access issues)

3.3 Opportunities

3.3.1 Personalized Medicine and Genetic Targeting (Emerging trends in tailored treatments)

3.3.2 Expansion in Emerging Markets (Growth potential in Latin America and Southeast Asia)

3.3.3 Increasing Focus on Preventive Healthcare (Role of public health programs and campaigns)

3.4 Trends

3.4.1 Development of Combination Therapies (Enhanced efficacy for weight management)

3.4.2 Growth in Injectable Anti-Obesity Medications (Increasing demand for long-acting injectables)

3.4.3 Adoption of Digital Therapeutics (Integration with digital health solutions)

3.5 Government Regulation

3.5.1 FDA Guidelines (United States regulatory framework)

3.5.2 EMA Approvals (European Medicines Agency approval trends)

3.5.3 Reimbursement Policies (Insurance coverage for anti-obesity treatments)

3.6 SWOT Analysis

3.7 Stake Ecosystem (Key stakeholders and their role in market growth)

3.8 Porters Five Forces (Competitive dynamics and supplier bargaining power)

3.9 Competition Ecosystem

4. Global Anti-Obesity Medication Market Segmentation

4.1 By Drug Class (In Value %)

4.1.1 GLP-1 Receptor Agonists

4.1.2 Lipase Inhibitors

4.1.3 Serotonin Agonists

4.1.4 Others

4.2 By Route of Administration (In Value %)

4.2.1 Oral Medications

4.2.2 Injectable Therapies

4.2.3 Others

4.3 By Distribution Channel (In Value %)

4.3.1 Hospital Pharmacies

4.3.2 Retail Pharmacies

4.3.3 Online Pharmacies

4.4 By End-User (In Value %)

4.4.1 Hospitals

4.4.2 Clinics

4.4.3 Homecare

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Anti-Obesity Medication Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Novo Nordisk

5.1.2 Eli Lilly

5.1.3 Pfizer Inc.

5.1.4 Johnson & Johnson

5.1.5 Roche

5.1.6 GlaxoSmithKline

5.1.7 AstraZeneca

5.1.8 Merck & Co.

5.1.9 Sanofi

5.1.10 Boehringer Ingelheim

5.1.11 Bristol-Myers Squibb

5.1.12 Amgen Inc.

5.1.13 Allergan

5.1.14 Takeda Pharmaceuticals

5.1.15 VIVUS, Inc.

5.2 Cross-Comparison Parameters (Market-specific):

Inception Year

Headquarters

Revenue

Market Share

R&D Investment

Global Reach

Product Portfolio

Certification/Regulation Compliance

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Private Equity Investments

6. Global Anti-Obesity Medication Market Regulatory Framework

6.1 FDA, EMA, and Other Regional Standards

6.2 Compliance and Safety Requirements

6.3 Reimbursement and Coverage Policies

7. Global Anti-Obesity Medication Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Technological advancements, growing patient awareness)

8. Global Anti-Obesity Medication Future Market Segmentation

8.1 By Drug Class (In Value %)

8.2 By Route of Administration (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Anti-Obesity Medication Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables influencing the global anti-obesity medication market, including consumer preferences, regulatory policies, and competitive dynamics. This is achieved through extensive desk research, utilizing secondary sources such as proprietary databases and industry reports.

Step 2: Market Analysis and Construction

In this step, historical data on the anti-obesity medication market is gathered and analyzed. Factors such as market penetration, treatment success rates, and revenue generation are examined to ensure a robust understanding of market trends. A combination of primary and secondary data sources is used to verify the accuracy of these estimates.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted to validate market hypotheses through interviews. This process ensures that insights are based on practical, real-world experiences from leading pharmaceutical companies. Experts provide valuable feedback on drug performance, patient compliance, and future market trends.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all the research into a cohesive report, focusing on critical insights related to drug classes, market challenges, and future opportunities. This ensures a comprehensive analysis that reflects the most up-to-date data and trends in the global anti-obesity medication market.

Frequently Asked Questions

01. How big is the Global Anti-Obesity Medication Market?

The global anti-obesity medication market is valued at USD 6.5 billion and is driven by rising obesity rates and the development of advanced drug therapies aimed at long-term weight management.

02. What are the challenges in the Global Anti-Obesity Medication Market?

Key challenges in the global anti-obesity medication market include the high cost of anti-obesity medications, social stigma associated with weight-loss drugs, and regulatory barriers in gaining market approvals for new treatments.

03. Who are the major players in the Global Anti-Obesity Medication Market?

Major players in the global anti-obesity medication market include Novo Nordisk, Eli Lilly, Pfizer Inc., Johnson & Johnson, and Roche, all of which dominate the market due to their extensive R&D efforts and comprehensive product portfolios.

04. What are the growth drivers of the Global Anti-Obesity Medication Market?

The global anti-obesity medication market growth is driven by the increasing prevalence of obesity globally, advancements in drug classes such as GLP-1 receptor agonists, and the growing focus on preventing obesity-related diseases.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.