Global Antidepressants Drugs Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD9568

December 2024

96

About the Report

Global Antidepressants Drugs Market Overview

- The Global Antidepressants Drugs Market, valued at USD 17 billion, has shown growth driven by the increasing incidence of mental health disorders, with depression affecting over 280 million individuals globally. This trend is primarily driven by the growing awareness of mental health issues, coupled with the expansion of healthcare access globally. Investment in R&D for novel treatment approaches and the availability of diverse medication options also contribute significantly to market growth. The market is buoyed by heightened governmental and NGO support, especially in urban areas where mental health resources are increasingly prioritized.

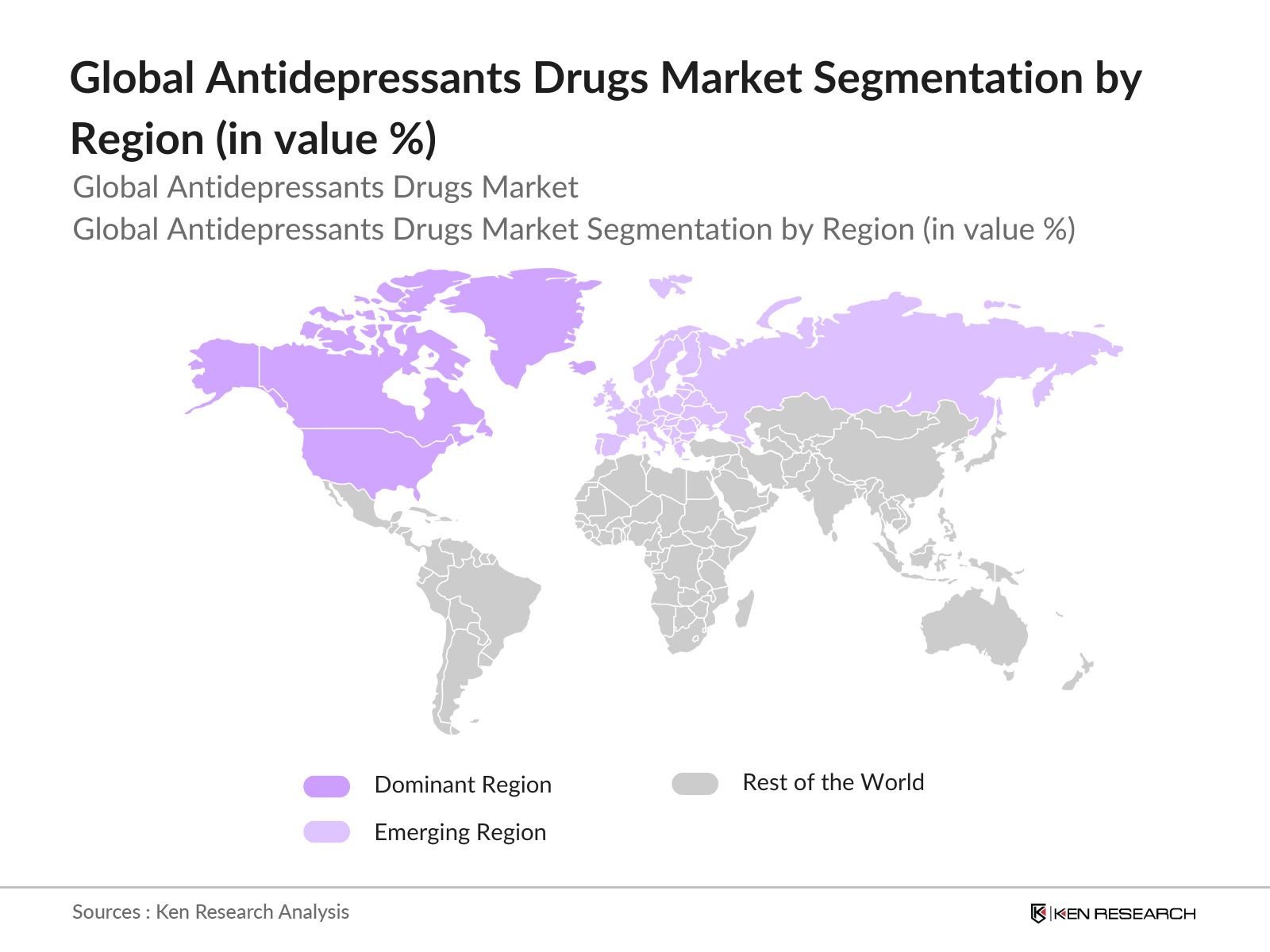

- North America, particularly the United States, remains a dominant market due to extensive healthcare infrastructure, supportive policies, and a high rate of antidepressant prescriptions. Europe follows closely, with Germany and the UK demonstrating strong market influence, attributed to well-established healthcare systems and robust mental health policies. Meanwhile, Japan leads in Asia due to cultural shifts toward mental health openness and strong governmental backing for antidepressant use in clinical treatments.

- Stringent compliance requirements from regulatory bodies such as the FDA and EMA heavily influence the antidepressant market. According to the FDA, new antidepressant drugs must undergo extensive clinical trials, encompassing over 1,000 participants and several testing phases, before approval. In 2023, the EMA reported that only 20% of psychiatric drugs submitted met regulatory standards for approval within the year, indicating the high bar for market entry. These standards aim to ensure drug efficacy and patient safety, but they pose challenges for pharmaceutical companies due to the lengthy approval process

Global Antidepressants Drugs Market Segmentation

By Drug Class: The antidepressants drugs market is segmented by drug class into SSRIs, SNRIs, MAOIs, Tricyclic Antidepressants, and Atypical Antidepressants. Recently, SSRIs have gained the largest market share under this segmentation due to their widespread use as a first-line treatment for depression and anxiety disorders. This class is favored for its efficacy, relatively mild side effects, and safety profile, making it a preferred choice among both prescribers and patients.

By Age Group: The market is segmented by age group into Adults, Adolescents, and the Geriatric Population. Among these, the adult demographic holds the largest share, driven by a significant prevalence of mood disorders within this group. Increasing workplace stress and lifestyle changes contribute to higher depression rates in adults, fueling demand for antidepressants.

By Region: Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America commands the largest share, primarily due to advanced healthcare access, supportive insurance policies, and heightened mental health awareness. The Asia-Pacific region, while comparatively smaller, is rapidly growing due to increasing mental health awareness and rising healthcare expenditures.

Global Antidepressants Drugs Market Competitive Landscape

The Global Antidepressants Drugs Market is dominated by leading pharmaceutical companies engaged in extensive R&D and innovation to develop new drugs and improve existing ones. Key players include Pfizer Inc., GlaxoSmithKline plc, Eli Lilly and Company, Johnson & Johnson, and Merck & Co., Inc. This competitive landscape reflects the industry's focus on drug safety, efficacy, and global reach.

Global Antidepressants Drugs Market Analysis

Market Growth Drivers

- Increasing Prevalence of Depression: The prevalence of depression has seen a notable rise globally, particularly in high-income nations, which has escalated demand for antidepressant drugs. According to the World Health Organization (WHO), an estimated 280 million people globally suffer from depression, with mental health-related disorders accounting for nearly 10% of overall disease burdens. In the United States alone, approximately 21 million adults experienced at least one major depressive episode in 2023, intensifying the demand for effective therapeutic options. The socioeconomic cost of untreated depression continues to drive health sector investments and policy initiatives, with governments prioritizing mental health resources to curb its impact.

- Advancements in Drug Delivery: Advancements in drug delivery mechanisms, such as extended-release and transdermal formulations, are driving growth within the antidepressant drug market. Extended-release technologies enable controlled drug release, improving patient adherence by reducing dosage frequency. In 2023, the U.S. Food and Drug Administration (FDA) approved multiple extended-release formulations of selective serotonin reuptake inhibitors (SSRIs), which have shown enhanced efficacy in clinical trials. Studies published by the National Institutes of Health indicate that patient adherence rates have improved by over 15% with extended-release options, promoting stable long-term results in treating chronic depressive disorders.

- Rising Mental Health Awareness Campaigns: Global and national campaigns aiming to reduce the stigma associated with mental health have been significantly increasing awareness and acceptance, particularly for conditions like depression. According to the WHO, investment in mental health has risen by approximately 7 billion USD since 2022, with over 35 countries introducing targeted mental health awareness campaigns. These initiatives have boosted demand for mental health services, including access to antidepressant medication. With nearly 70% of OECD nations integrating mental health into their public health agendas by 2024, greater accessibility to treatment options continues to elevate prescription rates for antidepressant drugs.

Market Challenges

- Regulatory Compliance for New Drug Approval: Strict regulatory standards imposed by agencies such as the FDA and European Medicines Agency (EMA) create challenges for introducing new antidepressant drugs. On average, it takes over a decade and extensive clinical trials to achieve approval, with only 12-15% of drugs successfully navigating the regulatory pipeline. The Center for Drug Evaluation and Research (CDER) reports that regulatory compliance costs have reached over 30 million USD per drug, creating barriers for new market entrants. The regulatory process is designed to ensure patient safety but simultaneously delays access to innovative treatments.

- Side Effects and Stigma: Side effects associated with antidepressants, such as weight gain and sexual dysfunction, often deter patients from initiating or continuing prescriptions, affecting the market demand. A study by the U.S. National Library of Medicine found that approximately 30% of patients discontinue treatment due to adverse effects. Additionally, societal stigma still influences prescription rates, especially in developing countries where mental health literacy is low. The WHO reported that around 40% of individuals experiencing depression in South Asia refrain from seeking medication due to stigma, impacting market penetration in these regions.

Global Antidepressants Drugs Market Future Outlook

Over the coming years, the Global Antidepressants Drugs Market is expected to witness significant growth, propelled by increased healthcare expenditure, ongoing R&D for advanced drug formulations, and enhanced access to mental health treatments. Growing acceptance of mental health challenges and societal openness to treatment options across various regions will likely drive demand further. Emerging markets, particularly in the Asia-Pacific region, show substantial potential for growth due to improving healthcare access and an increasing focus on mental health.

Market Opportunities

- Growth in Digital Therapeutics Integration: The integration of digital therapeutics (DTx) presents substantial growth opportunities for the antidepressant drugs market, as these technologies enable personalized treatment options. By 2023, over 15 million individuals globally utilized mobile applications and online platforms to manage depressive symptoms, with North America leading this trend. The U.S. FDA approved multiple digital health applications for mental health by 2024, increasing accessibility to therapy and monitoring tools that complement pharmacological treatments. This trend supports an ecosystem where antidepressants can be integrated with DTx, potentially enhancing adherence and treatment efficacy.

- Emerging Markets: Emerging markets, particularly in the Asia-Pacific (APAC) region, are experiencing notable growth in antidepressant drug demand. According to the Asia Development Bank (ADB), mental health-related expenditure in APAC countries increased by 20% in 2023, driven by government and private sector initiatives to improve psychiatric care infrastructure. Japan, India, and South Korea have reported over 6 million annual cases of depression, underscoring a large, unmet need for antidepressants.

Scope of the Report

|

By Drug Class |

SSRIs SNRIs MAOIs Tricyclic Atypical |

|

By Age Group |

Adults Adolescents Geriatric Population |

|

By Distribution Channel |

Hospitals Retail Pharmacies Online Pharmacies |

|

By Administration Route |

Oral Injectable Transdermal |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics)

Pharmaceutical Distributors (Regional and International)

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, EMA)

Mental Health Advocacy Organizations

Online Pharmacy Chains

Drug Development and R&D Firms

Insurance Companies

Companies

Players Mentioned in the Report

Pfizer Inc.

GlaxoSmithKline plc

Eli Lilly and Company

Johnson & Johnson

Merck & Co., Inc.

AstraZeneca

Allergan plc

Novartis International AG

Sanofi S.A.

Bristol-Myers Squibb Company

Table of Contents

1. Global Antidepressants Drugs Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Dynamics

1.4 Market Segmentation Overview

2. Global Antidepressants Drugs Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Milestones

3. Global Antidepressants Drugs Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Prevalence of Depression

3.1.2 Advancements in Drug Delivery (e.g., Extended-Release Mechanisms)

3.1.3 Rising Mental Health Awareness Campaigns

3.1.4 Expanding Accessibility of Psychiatric Care

3.2 Market Challenges

3.2.1 Regulatory Compliance for New Drug Approval

3.2.2 Side Effects and Stigma (Impact on Prescription Rates)

3.2.3 High Development Costs for Novel Therapies

3.3 Opportunities

3.3.1 Growth in Digital Therapeutics Integration

3.3.2 Emerging Markets (e.g., APAC Region Demand Growth)

3.3.3 Personalized Medicine and Genetic Profiling

3.4 Trends

3.4.1 Expansion of Telemedicine and E-prescription Models

3.4.2 Collaboration with Digital Health Platforms

3.4.3 Development of Rapid-Acting Antidepressants

3.5 Government Regulation

3.5.1 FDA and EMA Compliance Requirements

3.5.2 Labeling and Prescription Guidelines

3.5.3 Insurance Reimbursement Policies

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

4. Global Antidepressants Drugs Market Segmentation

4.1 By Drug Class (In Value %)

4.1.1 SSRIs (Selective Serotonin Reuptake Inhibitors)

4.1.2 SNRIs (Serotonin-Norepinephrine Reuptake Inhibitors)

4.1.3 MAOIs (Monoamine Oxidase Inhibitors)

4.1.4 Tricyclic Antidepressants

4.1.5 Atypical Antidepressants

4.2 By Age Group (In Value %)

4.2.1 Adults

4.2.2 Adolescents

4.2.3 Geriatric Population

4.3 By Distribution Channel (In Value %)

4.3.1 Hospitals

4.3.2 Retail Pharmacies

4.3.3 Online Pharmacies

4.4 By Administration Route (In Value %)

4.4.1 Oral

4.4.2 Injectable

4.4.3 Transdermal

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Antidepressants Drugs Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Pfizer Inc.

5.1.2 GlaxoSmithKline plc

5.1.3 Eli Lilly and Company

5.1.4 Johnson & Johnson

5.1.5 Merck & Co., Inc.

5.1.6 AstraZeneca

5.1.7 Allergan plc

5.1.8 Novartis International AG

5.1.9 Sanofi S.A.

5.1.10 Bristol-Myers Squibb Company

5.1.11 AbbVie Inc.

5.1.12 Teva Pharmaceuticals Industries Ltd.

5.1.13 Sun Pharmaceutical Industries Ltd.

5.1.14 Lupin Ltd.

5.1.15 H. Lundbeck A/S

5.2 Cross Comparison Parameters (Revenue, Global Reach, R&D Investment, Partnerships, Product Pipeline, Revenue Growth Rate, Market Share by Region, Employee Count)

5.3 Market Share Analysis

5.4 Key Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Landscape

5.7 Venture Capital Funding Trends

5.8 Government Subsidies

5.9 Private Equity Investments

6. Global Antidepressants Drugs Market Regulatory Framework

6.1 Clinical Trial Phases and Requirements

6.2 Drug Labeling Standards

6.3 Adverse Effects Reporting Obligations

6.4 Advertising and Promotional Guidelines

7. Global Antidepressants Drugs Future Market Size (In USD Billion)

7.1 Future Market Size Estimates

7.2 Key Factors Driving Future Growth

8. Global Antidepressants Drugs Future Market Segmentation

8.1 By Drug Class (In Value %)

8.2 By Age Group (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Administration Route (In Value %)

8.5 By Region (In Value %)

9. Global Antidepressants Drugs Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Emerging Market Opportunities

9.4 White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first stage involved mapping major stakeholders in the Global Antidepressants Drugs Market. Extensive desk research and analysis of proprietary databases helped identify critical market drivers, competitive players, and growth factors.

Step 2: Market Analysis and Construction

Historical data for antidepressants drugs was compiled and analyzed to understand market penetration and usage trends by geography, age group, and drug class. Analysis involved revenue generation statistics and examining prescription volumes globally.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses were validated through interviews with industry experts and leading pharmaceutical companies. Insights from these consultations provided operational and financial data to ensure accurate estimations.

Step 4: Research Synthesis and Final Output

Comprehensive insights from leading antidepressant manufacturers, along with quantitative analysis from multiple sources, ensured an accurate depiction of market dynamics. The synthesis stage enabled a full picture of global trends, consumer behavior, and competitive strategies.

Frequently Asked Questions

01. How big is the Global Antidepressants Drugs Market?

The global antidepressants drugs market was valued at USD 17 billion, driven by the increasing incidence of depression and anxiety disorders globally and advances in drug formulations.

02. What are the major challenges in the Global Antidepressants Drugs Market?

Challenges include stringent regulatory approvals, high R&D costs, and societal stigma associated with mental health treatment, which can limit market growth.

03. Who are the major players in the Global Antidepressants Drugs Market?

The market is led by key companies such as Pfizer, GlaxoSmithKline, Eli Lilly, and Johnson & Johnson, recognized for their extensive R&D and established market presence.

04. What are the growth drivers of the Global Antidepressants Drugs Market?

Growth is primarily driven by the rising prevalence of mental health conditions, increasing mental health awareness, and innovation in drug development, especially within SSRIs and SNRIs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.