Global Antidepressants Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5901

November 2024

97

About the Report

Global Antidepressants Market Overview

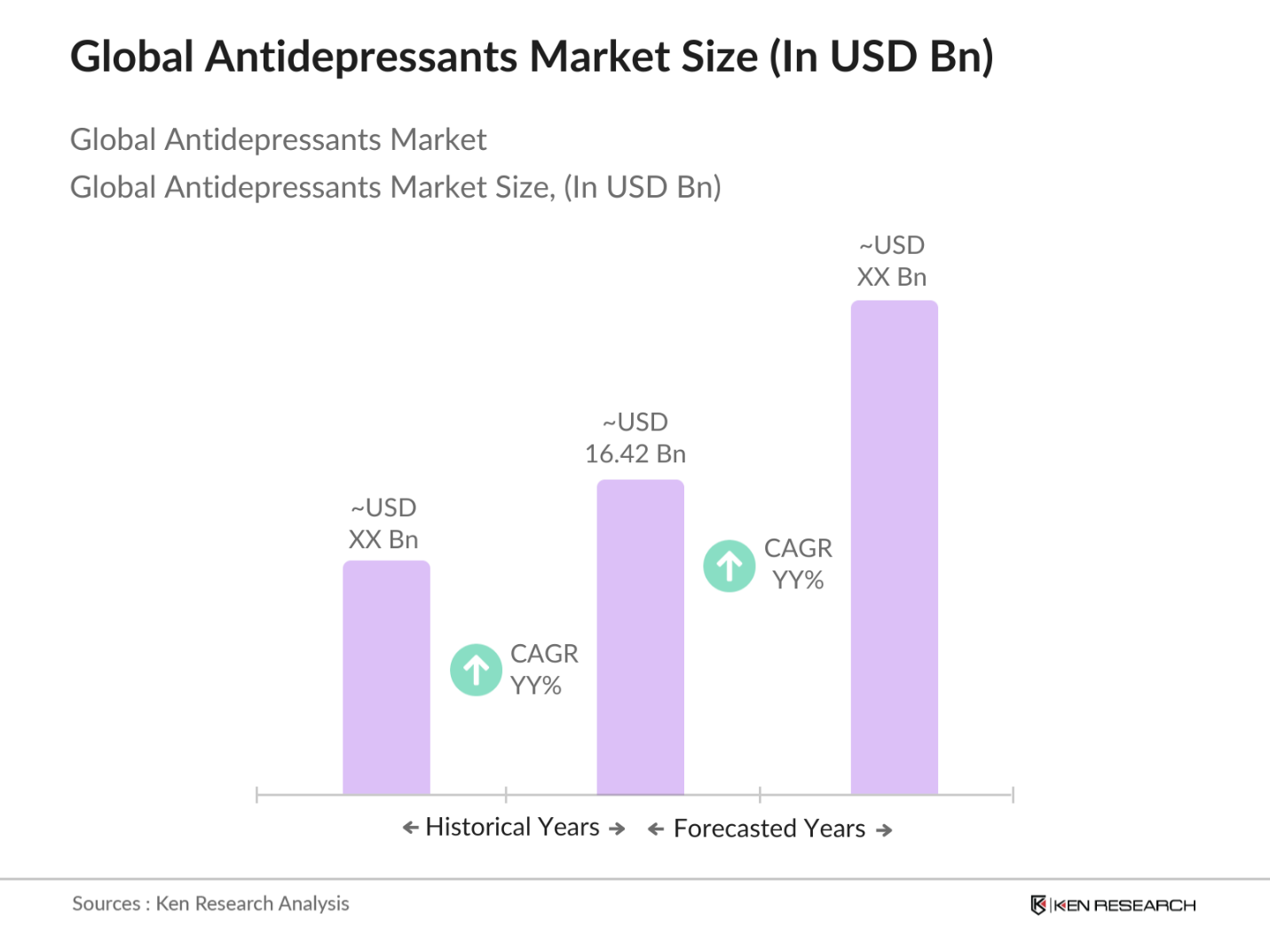

- The global antidepressants market is valued at USD 16.42billion, driven by several key factors including rising incidences of mental health disorders such as depression, anxiety, and bipolar disorder. The surge in diagnosis rates coupled with increased awareness regarding mental health has led to the adoption of antidepressants as a primary treatment. Furthermore, the introduction of novel medications, such as ketamine-based therapies and other fast-acting antidepressants, has contributed significantly to market growth.

- North America and Europe dominate the global antidepressants market due to advanced healthcare systems and well-established pharmaceutical sectors. The United States, in particular, is a major contributor due to its higher prevalence of depression, advanced R&D activities, and robust healthcare infrastructure. In Europe, countries like Germany and the United Kingdom lead the market, driven by high per capita healthcare expenditure and growing mental health awareness programs. These countries possess a strong regulatory framework supporting the approval and distribution of antidepressant drugs, positioning them as market leaders.

- The enforcement of Mental Health Parity Acts across various countries ensures that mental health treatments, including antidepressants, are covered by insurance at the same level as physical health treatments. In 2023, the U.S. government allocated $75 billion to enforcing the Mental Health Parity and Addiction Equity Act, significantly improving access to antidepressants through insurance reimbursements. This regulatory support is a key driver of the antidepressants market, as it reduces financial barriers for patients.

Global Antidepressants Market Segmentation

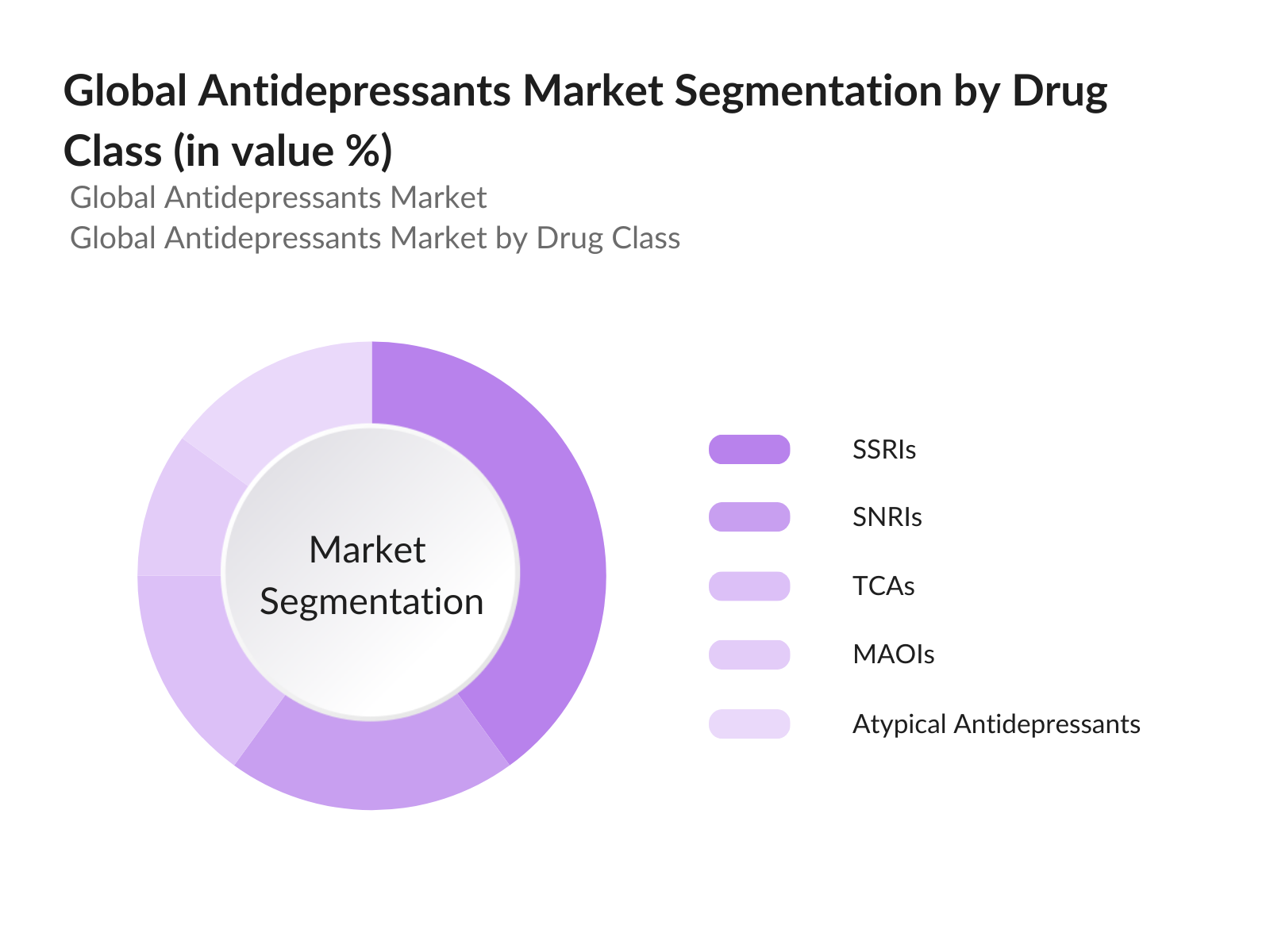

By Drug Class: The antidepressants market is segmented by drug class into Selective Serotonin Reuptake Inhibitors (SSRIs), Serotonin-Norepinephrine Reuptake Inhibitors (SNRIs), Tricyclic Antidepressants (TCAs), Monoamine Oxidase Inhibitors (MAOIs), and Atypical Antidepressants. SSRIs hold the dominant market share, primarily due to their efficacy and fewer side effects compared to other drug classes. SSRIs are often the first-line treatment for depression, anxiety, and other related disorders, making them widely prescribed. Brands like Prozac and Zoloft continue to perform strongly in the market.

By Region: The antidepressants market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America remains the largest regional market, driven by advanced healthcare facilities, widespread awareness regarding mental health, and extensive R&D activities in pharmaceutical sectors. The U.S., being a key market, accounts for the bulk of antidepressant consumption globally.

Global Antidepressants Market Competitive Landscape

The global antidepressants market is highly competitive, with a mixture of established pharmaceutical giants and emerging players. Major companies are engaged in extensive research and development to introduce novel therapies and sustain their market position.

|

Company |

Establishment Year |

Headquarters |

Market Presence |

R&D Expenditure |

Number of Employees |

Revenue |

Key Products |

|

Eli Lilly and Company |

1876 |

Indianapolis, USA |

- |

- |

- |

- |

- |

|

Pfizer Inc. |

1849 |

New York, USA |

- |

- |

- |

- |

- |

|

GlaxoSmithKline (GSK) Plc |

2000 |

London, UK |

- |

- |

- |

- |

- |

|

Johnson & Johnson |

1886 |

New Brunswick, USA |

- |

- |

- |

- |

- |

|

Lundbeck |

1915 |

Copenhagen, Denmark |

- |

- |

- |

- |

- |

Global Antidepressants Market Analysis

Market Growth Drivers

- Increase in Mental Health Awareness: The growing awareness of mental health conditions, particularly depression, is driving demand for antidepressants. In 2023, over 970 million individuals globally were estimated to suffer from mental disorders, with depression accounting for approximately 264 million cases, according to the World Health Organization (WHO). Government initiatives such as the European Mental Health Action Plan have focused on promoting early diagnosis and intervention. These efforts have significantly boosted the consumption of antidepressants, as reflected in the rising number of prescriptions for such medications. This growing awareness continues to support the expansion of the market.

- Rising Incidences of Chronic Diseases and Stress Disorders: As of 2024, an estimated 1.4 billion individuals suffer from chronic diseases globally, with heart disease, diabetes, and cancer leading in prevalence, according to data from the World Bank. These chronic conditions frequently contribute to the onset of depression, as many individuals with chronic illnesses also experience mental health disorders. This link between chronic diseases and depression is a key factor driving the antidepressants market, as healthcare providers are increasingly recommending medications to manage the mental health symptoms associated with long-term illness and stress.

- Advancements in Pharmaceutical R&D: Pharmaceutical R&D has witnessed significant growth in mental health medication development. In 2023, global spending on R&D for depression-related treatments reached $35 billion, with new formulations, such as rapid-acting antidepressants and personalized treatments, entering clinical trials. The U.S. Food and Drug Administration (FDA) approved three new depression medications in 2023 alone, reflecting the rapid pace of development. This momentum in R&D continues to contribute to the market expansion.

Market Challenges:

- Adverse Drug Reactions and Dependency: Antidepressants are associated with significant side effects, including an increased risk of dependency. A report by the National Institutes of Health (NIH) in 2023 highlighted that many patients experienced severe side effects from common antidepressants, with dependency issues being a recurring concern. Additionally, the FDA issued 12 black box warnings on antidepressants in 2023, raising concerns about their long-term safety. These factors present a considerable challenge for the market as regulatory bodies continue to tighten control on antidepressant prescriptions.

- Market Saturation of Common Drug Classes (e.g., SSRIs): Selective Serotonin Reuptake Inhibitors (SSRIs) have reached a point of market saturation, representing a dominant portion of global antidepressant prescriptions. In 2023, approximately 180 million SSRI prescriptions were issued worldwide, making up a significant part of the total antidepressant market. This saturation limits potential growth for SSRI-based treatments, as the markets dependency on these drugs poses challenges for the introduction of newer, more innovative drug classes. Furthermore, diminishing efficacy in some cases has increased the pressure on pharmaceutical companies to develop alternatives, but these innovations face regulatory hurdles.

Global Antidepressants Market Future Outlook

Over the next five years, the global antidepressants market is expected to witness significant growth, propelled by increasing mental health awareness, the rise of digital health solutions, and the introduction of novel therapies. Government initiatives focused on mental health reform and financial support for R&D activities will further strengthen market expansion. With ongoing advancements in treatment options, including non-traditional antidepressants and neurostimulation techniques, the market is set to benefit from growing patient acceptance of emerging therapies.

Market Opportunities:

- Introduction of Digital Health Solutions in Mental Health Management: Digital health solutions, such as mobile apps and wearable devices, are playing an increasingly prominent role in managing mental health conditions. As of 2024, there are over 20,000 mental health apps available globally, many of which track mood and manage medication regimens, according to WHO. These tools help monitor patient progress, ensure adherence to antidepressant medications, and reduce the frequency of clinical visits, thereby complementing pharmaceutical treatments.

- Collaboration Between Pharma Companies and Mental Health Organizations: Pharmaceutical companies are increasingly partnering with mental health organizations to raise awareness and improve access to treatments. In 2023, Pfizer partnered with the National Alliance on Mental Illness (NAMI) to launch a global campaign aimed at reducing stigma around depression. Similar collaborations in the European Union have led to the development of community-based mental health programs, which have shown a 20% increase in antidepressant use in participating regions. These partnerships are instrumental in expanding market reach.

Scope of the Report

|

By Drug Class |

SSRIs SNRIs TCAs MAOIs Atypical Antidepressants |

|

By Indication |

Major Depressive Disorder Bipolar Disorder Anxiety Disorders OCD, Others |

|

By Distribution Channel |

Hospital Pharmacies Retail Pharmacies Online Pharmacies |

|

By Age Group |

Pediatric Adults Geriatric |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Pharmaceutical Companies

Healthcare Providers (Hospitals, Clinics)

Government and Regulatory Bodies (FDA, EMA)

Mental Health Organizations

Telemedicine Providers

Investment and Venture Capitalist Firms

Online Pharmacy Chains

R&D Institutions (Specialized in Drug Development)

Companies

Players Mention in the Report

Eli Lilly and Company

Pfizer Inc.

GlaxoSmithKline Plc

Johnson & Johnson

Lundbeck

AstraZeneca

Merck & Co. Inc.

Teva Pharmaceuticals

Allergan

Sanofi

Bristol-Myers Squibb

Takeda Pharmaceuticals

Mylan N.V.

Sun Pharmaceuticals

Cipla Ltd.

Table of Contents

01. USA Volumetric Display Market Overview

1.1. Definition and Scope (Volumetric Imaging, 3D Displays, Real-Time Projections)

1.2. Market Taxonomy (Hardware, Software, Services)

1.3. Market Growth Rate (CAGR, Revenue Growth, Market Expansion)

1.4. Market Segmentation Overview (By Product Type, By Display Technology, By Application, By End-User, By Region)

02. USA Volumetric Display Market Size (In USD Mn)

2.1. Historical Market Size (Retrospective Growth, Technological Milestones)

2.2. Year-On-Year Growth Analysis (Market Performance, Economic Impact)

2.3. Key Market Developments and Milestones (Product Launches, Patent Approvals, M&A Activity)

03. USA Volumetric Display Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand in Medical Imaging

3.1.2. Advancements in AR/VR Technologies

3.1.3. Defense and Security Applications

3.1.4. Growing Entertainment Sector (Movies, Gaming)

3.2. Restraints

3.2.1. High Initial Costs of Deployment

3.2.2. Limited Awareness Among End Users

3.2.3. Technical Challenges (Processing Power, Data Load)

3.3. Opportunities

3.3.1. Expansion in Healthcare Applications (Surgery Planning, Medical Visualization)

3.3.2. Partnerships with Content Creators (Gaming, Media)

3.3.3. Adoption in Automotive Design

3.4. Trends

3.4.1. Increasing Use of Holographic Technology

3.4.2. Integration with AI for Enhanced Display

3.4.3. Rising Demand for Personalization in Display Devices

3.5. Government Regulations and Standards

3.5.1. FCC Guidelines for Display Devices

3.5.2. Patent Laws and Intellectual Property

3.5.3. Regulations for Use in Medical and Defense Applications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Software Providers, System Integrators)

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem (Market Dynamics, Disruptors, New Entrants)

04. USA Volumetric Display Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Static Volumetric Displays

4.1.2. Swept-Volume Displays

4.1.3. Multi-Planar Volumetric Displays

4.2. By Display Technology (In Value %)

4.2.1. Digital Light Processing (DLP)

4.2.2. Liquid Crystal Display (LCD)

4.2.3. Light Emitting Diode (LED)

4.3. By Application (In Value %)

4.3.1. Medical Imaging

4.3.2. AR/VR

4.3.3. Advertising and Marketing

4.3.4. Engineering and Design

4.4. By End-User (In Value %)

4.4.1. Healthcare

4.4.2. Automotive

4.4.3. Aerospace & Defense

4.4.4. Entertainment and Media

4.4.5. Education

4.5. By Region (In Value %)

4.5.1. North-East

4.5.2. Midwest

4.5.3. West Coast

4.5.4. Southern States

05. USA Volumetric Display Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LightSpace Technologies

5.1.2. HoloTech Switzerland

5.1.3. Voxon Photonics

5.1.4. RealView Imaging

5.1.5. Leia Inc.

5.1.6. 3DIcon Corporation

5.1.7. Holoxica Ltd

5.1.8. The Coretec Group Inc.

5.1.9. Alioscopy

5.1.10. Seekway Technology Ltd.

5.1.11. Zebra Imaging

5.1.12. Voxeon LLC

5.1.13. Unity Technologies

5.1.14. Fovi 3D

5.1.15. Light Field Lab, Inc.

5.2. Cross Comparison Parameters (Revenue, No. of Employees, Key Patents, Product Portfolio, R&D Investments)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment and Funding Analysis

5.7. Venture Capital Funding

5.8. Government Funding and Grants

5.9. Private Equity Investments

06. USA Volumetric Display Market Regulatory Framework

6.1. Compliance with FCC and FDA Standards

6.2. Certification for Medical Applications

6.3. Guidelines for Defense and Security Applications

07. USA Volumetric Display Market Future Size (In USD Mn)

7.1. Future Market Size Projections (Technological Progress, Adoption Rates)

7.2. Key Factors Driving Future Market Growth (AI Integration, User Demand, Lower Costs)

08. USA Volumetric Display Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Display Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

09. USA Volumetric Display Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Distribution Strategies

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first stage involved a comprehensive mapping of the global antidepressants market, covering all major stakeholders, including pharmaceutical manufacturers, healthcare providers, and government bodies. Desk research was conducted to identify key market variables, including drug adoption rates, regulatory landscape, and R&D investment.

Step 2: Market Analysis and Construction

Historical data from proprietary databases and public sources was compiled and analyzed to determine key market trends and growth drivers. This stage also involved assessing market penetration and drug availability across various regions to evaluate revenue potential.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated through interviews with pharmaceutical professionals and mental health experts. These consultations provided real-time insights into current challenges and opportunities in the antidepressants market, offering a comprehensive view of market dynamics.

Step 4: Research Synthesis and Final Output

The final step integrated insights from stakeholders, pharmaceutical companies, and market data to produce a robust analysis of the global antidepressants market. This final output provided a validated and accurate depiction of market size, key trends, and future projections.

Frequently Asked Questions

1. How big is the global antidepressants market?

The global antidepressants market is valued at USD 16.42billion, driven by the rising prevalence of mental health disorders and increased awareness regarding depression treatments. The market is expected to see steady growth due to advancements in drug delivery and the availability of fast-acting antidepressants.

2. What are the challenges in the global antidepressants market?

The key challenges include regulatory scrutiny, side effects associated with long-term antidepressant use, and the growing availability of cheaper generic drugs. Furthermore, there is concern regarding patient dependency on these medications, which limits long-term market expansion.

3. Who are the major players in the global antidepressants market?

Key players include Eli Lilly and Company, Pfizer Inc., GlaxoSmithKline Plc, Johnson & Johnson, and Lundbeck. These companies dominate the market due to their extensive R&D efforts, strong global distribution networks, and comprehensive product portfolios.

4. What are the growth drivers of the global antidepressants market?

The market is driven by increasing diagnosis rates of mental health disorders, advancements in pharmaceutical R&D, and the introduction of innovative therapies. Additionally, government initiatives aimed at promoting mental health awareness and reform have supported market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.