Global Antiepileptic Drugs Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD4238

November 2024

95

About the Report

Global Antiepileptic Drugs Market Overview

- The global antiepileptic drugs market is valued at USD 16.50 billion, based on a five-year historical analysis. This market's growth is largely driven by the increasing prevalence of epilepsy worldwide, as well as ongoing advancements in second and third-generation antiepileptic drugs, which offer enhanced efficacy and fewer side effects. The demand for effective epilepsy treatments, along with the expansion of healthcare access in emerging regions, is propelling the market, especially as healthcare systems prioritize neurological health and treatment accessibility.

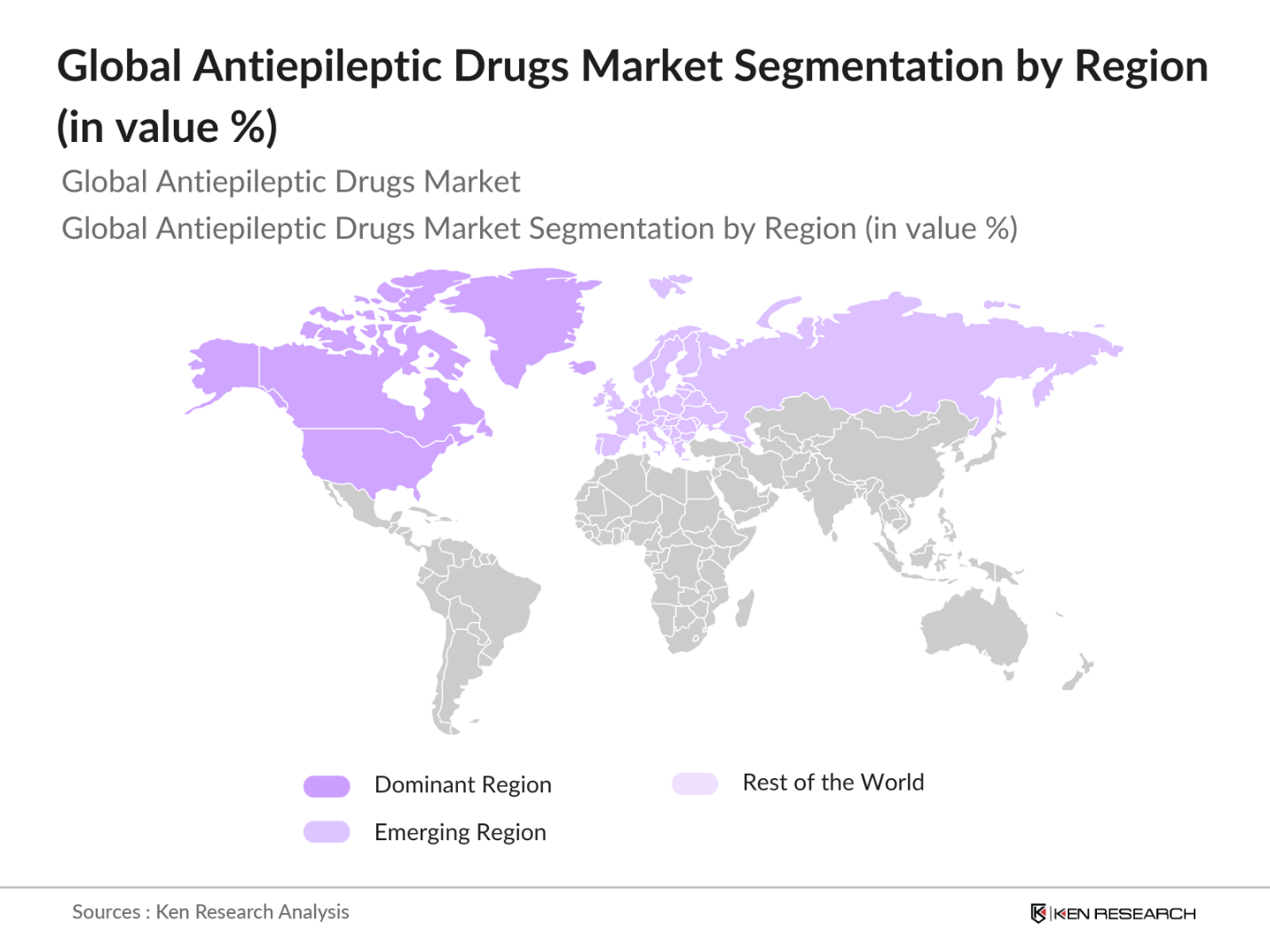

- North America dominates the AED market, primarily due to its advanced healthcare infrastructure, high awareness levels, and significant investments in research and development. The presence of major pharmaceutical companies and favorable reimbursement policies also contribute to the region's leading position. Europe follows, with substantial market share attributed to supportive government initiatives and a well-established healthcare system.

- The U.S. Food and Drug Administration (FDA) plays a pivotal role in the antiepileptic drugs market by evaluating and approving new medications. In 2022, the FDA approved several novel antiepileptic drugs, including cenobamate (XCOPRI), which has shown efficacy in treating partial-onset seizures in adults. The FDA also provides guidelines on the development and labeling of these drugs to ensure their safety and effectiveness.

Global Antiepileptic Drugs Market Segmentation

By Drug Generation: The AED market is segmented into first, second, and third-generation drugs. Second-generation AEDs hold a dominant market share due to their enhanced efficacy and reduced side effects compared to first-generation drugs. These medications, including lamotrigine and levetiracetam, offer broader therapeutic options and improved patient compliance, leading to their widespread adoption.

By Distribution Channel: Distribution channels for AEDs include hospital pharmacies, retail pharmacies, online pharmacies, and drug stores. Hospital pharmacies dominate the market, accounting for the largest share, due to the critical nature of epilepsy treatment and the need for specialized medical supervision. Patients often rely on hospital pharmacies for access to a comprehensive range of AEDs and expert guidance.

By Region: Geographically, the AED market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by a high prevalence of epilepsy, advanced healthcare infrastructure, and significant R&D investments. Europe holds a substantial share due to supportive healthcare policies and awareness programs. The Asia-Pacific region is experiencing rapid growth, attributed to increasing healthcare access and rising awareness about epilepsy.

Global Antiepileptic Drugs Market Competitive Landscape

The global AED market is characterized by the presence of several key players who contribute significantly to market dynamics. These companies focus on continuous research and development, strategic collaborations, and expanding their product portfolios to maintain a competitive edge.

Global Antiepileptic Drugs Industry Analysis

Growth Drivers

- Increasing Prevalence of Epilepsy: Epilepsy affects approximately 50 million people worldwide, making it one of the most common neurological disorders. Each year, an estimated 5 million people are diagnosed with epilepsy globally. In high-income countries, the annual incidence rate is around 49 per 100,000 people, while in low- and middle-income countries, it can be as high as 139 per 100,000. This significant prevalence underscores the growing demand for effective antiepileptic drugs.

- Advancements in Drug Development: Recent years have seen notable advancements in antiepileptic drug development. For instance, in January 2022, Sun Pharmaceutical Industries Ltd. launched a range of Brivaracetam dosage forms for epilepsy treatment in India. Similarly, in June 2021, Glenmark Pharma introduced Rufinamide tablets in the U.S. market. These developments highlight the pharmaceutical industry's commitment to enhancing treatment options for epilepsy patients.

- Rising Geriatric Population: The global population aged 65 and above is projected to reach 1.5 billion by 2050, up from 703 million in 2019. As the elderly are more susceptible to neurological disorders, including epilepsy, this demographic shift is expected to increase the demand for antiepileptic drugs. Age-related factors such as stroke, neurodegenerative diseases, and other comorbidities contribute to the higher incidence of epilepsy in older adults.

Market Challenges

- Patent Expirations of Key Drugs: The expiration of patents for major antiepileptic drugs leads to the introduction of generic versions, resulting in increased market competition and reduced revenues for original manufacturers. For instance, Pfizer's Lyrica (pregabalin) lost its patent protection in 2019, leading to a significant decline in its market share as generic versions became available.

- Side Effects Associated with Antiepileptic Drugs: Antiepileptic drugs can cause side effects such as dizziness, fatigue, weight gain, and cognitive impairment, which may lead to non-compliance among patients. A study published in the Journal of Neurology in 2020 reported that approximately 30% of patients discontinued their medication due to adverse effects, highlighting the need for better-tolerated therapies.

Global Antiepileptic Drugs Market Future Outlook

Over the next five years, the global antiepileptic drugs market is expected to experience significant growth, driven by continuous advancements in drug development, increasing prevalence of epilepsy, and expanding healthcare access in emerging markets. The development of novel therapeutics with improved efficacy and safety profiles, along with personalized medicine approaches, is anticipated to create new opportunities for market expansion.

Market Opportunities

- Emerging Markets Expansion: Emerging economies, particularly in Asia and Africa, present significant growth opportunities for the antiepileptic drugs market. These regions have high epilepsy prevalence rates and improving healthcare infrastructures. For example, in India, the prevalence of epilepsy is estimated at 5.9 per 1,000 individuals, indicating a substantial patient population in need of treatment.

- Development of Novel Therapeutics: Ongoing research into the pathophysiology of epilepsy is paving the way for the development of novel therapeutics. Advancements in gene therapy, neurostimulation devices, and precision medicine offer promising avenues for more effective and personalized treatments. For instance, the FDA approved the use of cannabidiol (Epidiolex) for certain types of epilepsy, marking a significant step forward in treatment options.

Scope of the Report

|

Drug Generation |

First Generation |

|

Distribution Channel |

Hospital Pharmacies |

|

Seizure Type |

Focal Seizures |

|

Route of Administration |

Oral |

|

Region |

North America |

Products

Key Target Audience

Pharmaceutical Manufacturers

Healthcare Providers

Neurologists and Epileptologists

Research and Development Organizations

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration, European Medicines Agency)

Insurance Companies and Payers

Patient Advocacy Groups

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report

Pfizer Inc.

UCB S.A.

GlaxoSmithKline plc

Sanofi S.A.

Novartis AG

Johnson & Johnson

Eisai Co., Ltd.

Abbott Laboratories

Sunovion Pharmaceuticals Inc.

Bausch Health Companies Inc.

Table of Contents

1. Global Antiepileptic Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Antiepileptic Drugs Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Antiepileptic Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Epilepsy

3.1.2. Advancements in Drug Development

3.1.3. Government Initiatives and Funding

3.1.4. Rising Geriatric Population

3.2. Market Challenges

3.2.1. Patent Expirations of Key Drugs

3.2.2. Side Effects Associated with Antiepileptic Drugs

3.2.3. High Treatment Costs

3.3. Opportunities

3.3.1. Emerging Markets Expansion

3.3.2. Development of Novel Therapeutics

3.3.3. Integration of Personalized Medicine

3.4. Trends

3.4.1. Adoption of Second and Third-Generation Drugs

3.4.2. Increasing Use of Combination Therapies

3.4.3. Growth of Online Pharmacies

3.5. Regulatory Landscape

3.5.1. FDA Approvals and Guidelines

3.5.2. EMA Regulations

3.5.3. Regional Regulatory Frameworks

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Antiepileptic Drugs Market Segmentation

4.1. By Drug Generation (In Value %)

4.1.1. First Generation

4.1.2. Second Generation

4.1.3. Third Generation

4.2. By Distribution Channel (In Value %)

4.2.1. Hospital Pharmacies

4.2.2. Retail Pharmacies

4.2.3. Online Pharmacies

4.2.4. Drug Stores

4.3. By Seizure Type (In Value %)

4.3.1. Focal Seizures

4.3.2. Generalized Seizures

4.3.3. Non-Epileptic Seizures

4.3.4. Others

4.4. By Route of Administration (In Value %)

4.4.1. Oral

4.4.2. Intravenous

4.4.3. Others

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Antiepileptic Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Pfizer Inc.

5.1.2. UCB S.A.

5.1.3. GlaxoSmithKline plc

5.1.4. Sanofi S.A.

5.1.5. Novartis AG

5.1.6. Johnson & Johnson

5.1.7. Eisai Co., Ltd.

5.1.8. Abbott Laboratories

5.1.9. Sunovion Pharmaceuticals Inc.

5.1.10. Bausch Health Companies Inc.

5.1.11. H. Lundbeck A/S

5.1.12. Teva Pharmaceutical Industries Ltd.

5.1.13. Zogenix, Inc.

5.1.14. SK Biopharmaceuticals Co., Ltd.

5.1.15. Marinus Pharmaceuticals, Inc.

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, R&D Investment, Market Share, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Global Antiepileptic Drugs Market Regulatory Framework

6.1. Drug Approval Processes

6.2. Compliance Requirements

6.3. Intellectual Property Rights

6.4. Pricing and Reimbursement Policies

7. Global Antiepileptic Drugs Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Antiepileptic Drugs Future Market Segmentation

8.1. By Drug Generation (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Seizure Type (In Value %)

8.4. By Route of Administration (In Value %)

8.5. By Region (In Value %)

9. Global Antiepileptic Drugs Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the global antiepileptic drugs market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the global antiepileptic drugs market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple pharmaceutical companies and healthcare providers to acquire detailed insights into drug segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the global antiepileptic drugs market.

Frequently Asked Questions

01. How big is the Global Antiepileptic Drugs Market?

The global antiepileptic drugs market is valued at USD 16.50 billion, based on a five-year historical analysis. This market's growth is largely driven by the increasing prevalence of epilepsy worldwide, as well as ongoing advancements in second and third-generation antiepileptic drugs, which offer enhanced efficacy and fewer side effects.

02. What are the primary challenges in the Global Antiepileptic Drugs Market?

Key challenges in this market include patent expirations for major drugs, side effects associated with antiepileptic medications, and high treatment costs, which can limit patient adherence.

03. Who are the major players in the Global Antiepileptic Drugs Market?

Top players in the market include Pfizer Inc., UCB S.A., GlaxoSmithKline plc, Sanofi S.A., and Novartis AG, all of whom lead through extensive R&D investment, broad drug portfolios, and global distribution networks.

04. What factors are driving growth in the Global Antiepileptic Drugs Market?

The market growth is propelled by increased awareness of epilepsy, government funding, advancements in therapeutic options, and the adoption of personalized medicine approaches, improving patient outcomes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.