Global Antimicrobial Packaging Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD2729

December 2024

100

About the Report

Global Antimicrobial Packaging Market Overview

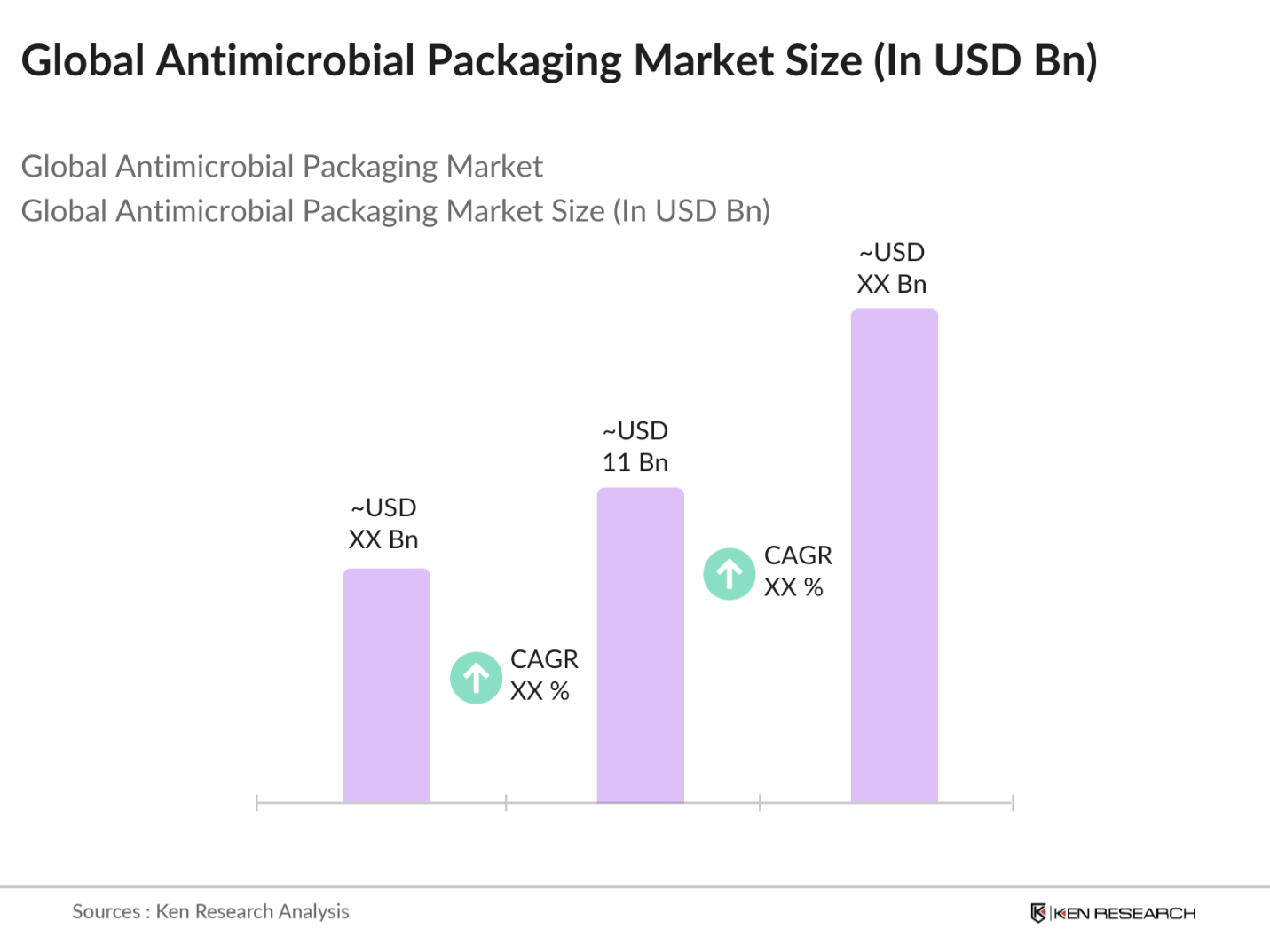

- The global antimicrobial packaging market is valued at USD 11 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for packaged food and beverages, pharmaceutical products, and healthcare supplies. As consumer awareness grows regarding food safety and hygiene, antimicrobial packaging has gained traction due to its ability to inhibit the growth of harmful microorganisms, extending the shelf life of products. With a surge in demand for clean-label products and sustainable packaging solutions, the antimicrobial packaging market is set to experience robust growth in the coming years.

- The market is largely dominated by key regions such as North America, Europe, and Asia-Pacific, driven by the presence of a well-developed food and pharmaceutical industry. Countries like the United States, China, and Germany are at the forefront of this market, benefiting from advanced technological infrastructure, regulatory support, and consumer demand for safe and hygienic packaging. Additionally, the strong R&D capabilities and innovations in biodegradable antimicrobial packaging materials have positioned these regions as leaders in the global market.

- The European Food Safety Authority (EFSA) regulates antimicrobial packaging in the EU, ensuring that materials are safe for food contact. Regulation (EC) No 450/2009 governs the use of active and intelligent materials intended for food use, focusing on minimizing risks to consumer health. In 2024, these stringent regulations ensure that antimicrobial packaging does not alter food composition or lead to chemical migration.

Global Antimicrobial Packaging Market Segmentation

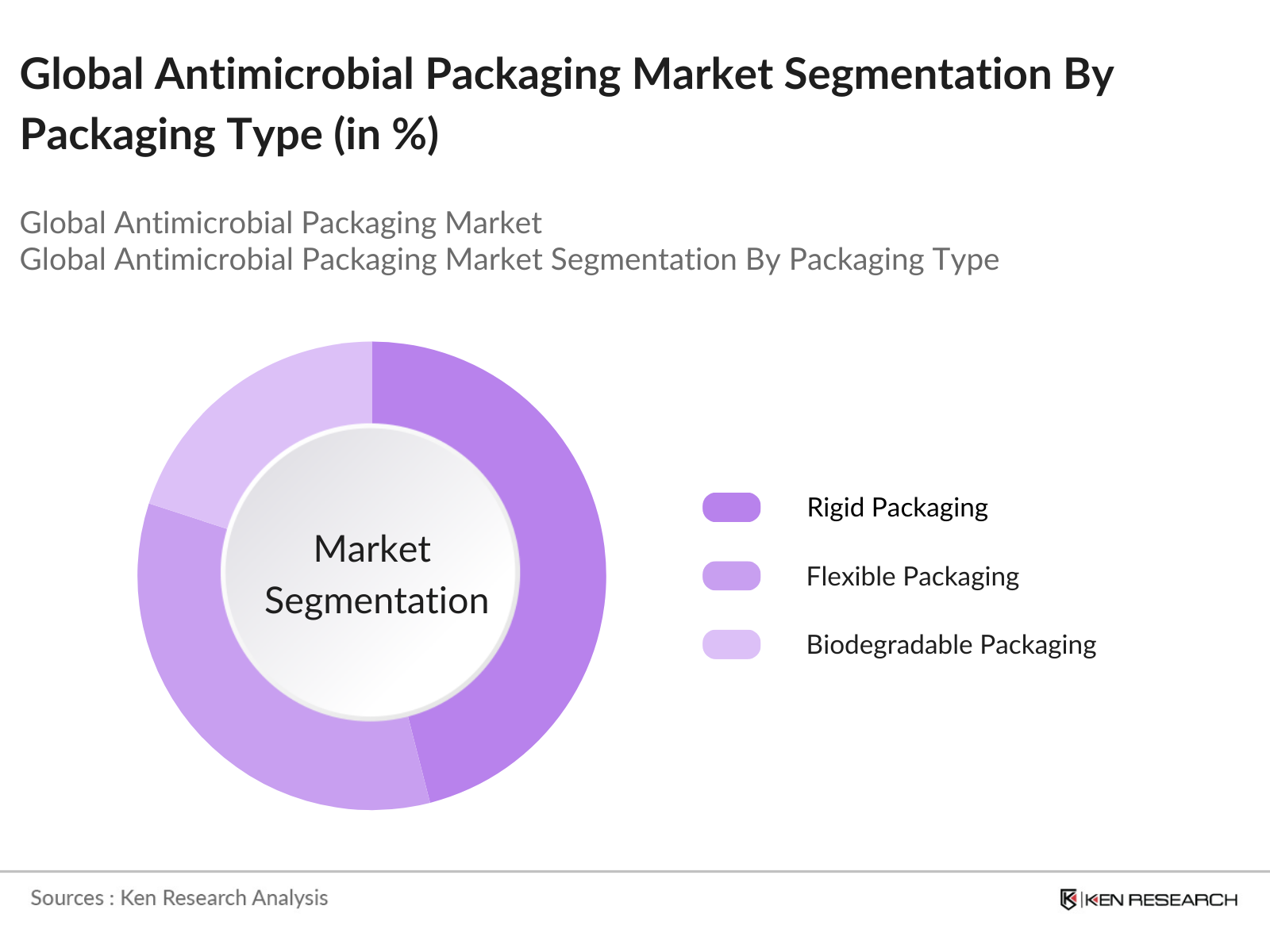

By Packaging Type: The global antimicrobial packaging market is segmented by packaging type into rigid packaging, flexible packaging, and biodegradable packaging. Rigid packaging has a dominant market share due to its widespread use in food and pharmaceutical applications. Rigid containers, bottles, and boxes are known for their ability to provide superior protection against physical and environmental damage, making them ideal for preserving product quality, particularly in the healthcare and food sectors.

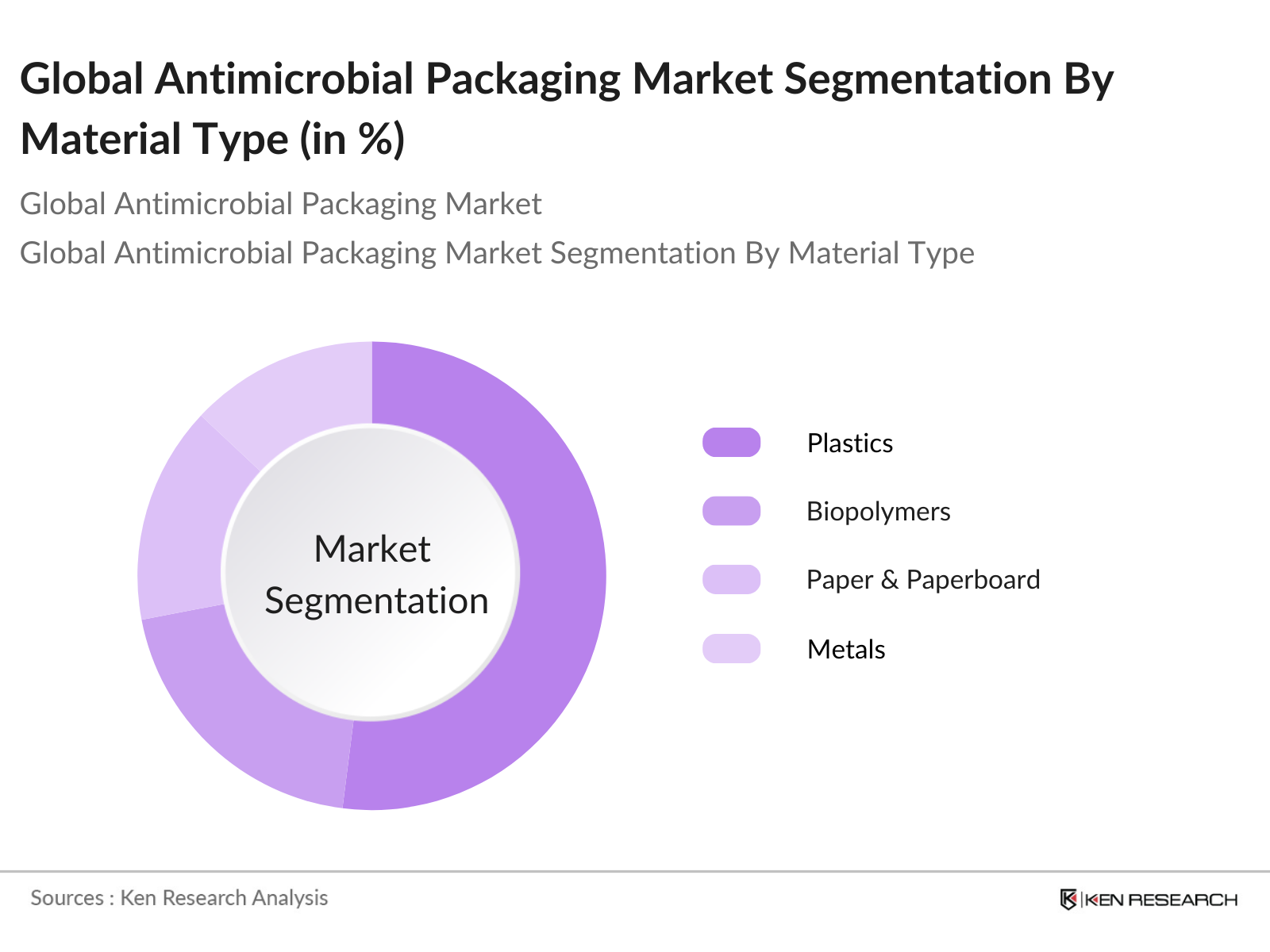

By Material Type: The antimicrobial packaging market is also segmented by material type into plastics, biopolymers, paper & paperboard, and metals. Plastics dominate the market due to their cost-effectiveness, versatility, and ability to integrate antimicrobial agents during the manufacturing process. Plastics offer high barrier protection, and flexibility in design, and are extensively used across industries such as food, healthcare, and personal care products.

Global Antimicrobial Packaging Market Competitive Landscape

The global antimicrobial packaging market is characterized by intense competition among major players, who are continuously investing in research and development to innovate and improve their product offerings. These companies are focused on expanding their market presence through strategic partnerships, mergers, and acquisitions, with a strong emphasis on sustainability and meeting regulatory standards.

Global Antimicrobial Packaging Industry Analysis

Growth Drivers

- Increasing demand for shelf-life extension in food products: The global food waste problem is growing, with nearly 931 million tons of food wasted annually, according to the United Nations Environment Programme. This has increased the demand for packaging solutions that can extend the shelf life of perishable goods. Antimicrobial packaging plays a significant role in preventing microbial contamination, particularly in meat and dairy products.

- Growth in pharmaceutical packaging demand: The pharmaceutical industry has been expanding, with global pharmaceutical spending exceeding USD 1.42 trillion in 2022, according to the World Bank. Antimicrobial packaging is crucial for preserving the integrity of pharmaceuticals, especially in sterile environments. The rise in chronic diseases and aging populations globally further accelerates the demand for safe and effective drug packaging solutions.

- Rising consumer awareness about food safety: Foodborne diseases affect millions of people annually, with an estimated 600 million cases reported globally each year, as per the World Health Organization (WHO). This has driven consumer demand for safer packaging solutions. In 2024, consumers are becoming more aware of the role antimicrobial packaging plays in reducing bacterial growth and contamination risks in food products. Governments are also implementing stricter regulations around food safety, further boosting the demand for antimicrobial packaging in food sectors.

Market Challenges

- High Cost of Antimicrobial Materials: One of the key challenges facing the antimicrobial packaging market is the high cost of incorporating antimicrobial agents into packaging materials. The production and application of these agents require significant investment in R&D, which increases the overall cost of packaging products. This cost barrier can limit the adoption of antimicrobial packaging, particularly among smaller manufacturers and businesses in developing regions.

- Stringent Regulatory Compliance: Antimicrobial packaging materials must comply with stringent regulatory standards, particularly in the food and healthcare industries. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have established strict guidelines regarding the use of antimicrobial agents in packaging. Navigating these regulations can be challenging for manufacturers, requiring significant resources and time to ensure compliance.

Global Antimicrobial Packaging Market Future Outlook

Over the next five years, the global antimicrobial packaging market is expected to show significant growth, driven by increasing demand for hygienic packaging solutions across industries such as food and beverage, healthcare, and personal care. The integration of new technologies, including nanotechnology and AI, in antimicrobial packaging is anticipated to enhance the effectiveness of these materials, making them more efficient in preventing microbial growth.

Market Opportunities

- Increasing use of natural antimicrobial agents: In 2024, the demand for natural antimicrobial agents in packaging is rising, with natural substances such as chitosan, sourced from crustacean shells, being utilized for their antibacterial properties. The global availability of seafood has led to increased production of chitosan, with over 3 million tons of crustacean waste produced annually. This natural resource is gaining popularity in antimicrobial packaging, offering an eco-friendly alternative to synthetic antimicrobials. Countries with abundant marine resources, such as India and China, are key players in this growing trend.

- Expansion of the pharmaceutical industry: The global pharmaceutical industry has seen remarkable growth, especially with the COVID-19 pandemic highlighting the need for better packaging solutions. In 2022, over 12 billion vaccine doses were administered globally, creating an unprecedented demand for pharmaceutical packaging. Antimicrobial packaging ensures the sterility and safety of drugs, especially for critical care medicines and vaccines. In 2024, pharmaceutical manufacturing hubs in countries like India, which produces 20% of the worlds generic drugs, are driving further adoption of antimicrobial packaging.

Scope of the Report

|

Packaging Type |

Rigid Packaging Flexible Packaging Biodegradable Packaging |

|

Material Type |

Plastics Biopolymers Paper & Paperboard Metal |

|

Active Agent |

Organic Acid-Based Enzyme-Based Antimicrobial Polymer-Based |

|

End-Use Industry |

Food & Beverage Pharmaceuticals Personal Care Products Healthcare |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Antimicrobial Packaging Manufacturers

Food & Beverage Industry Players

Pharmaceutical Companies

Personal Care Product Manufacturers

Government and Regulatory Bodies (e.g., U.S. Food and Drug Administration, European Food Safety Authority)

Investments and Venture Capitalist Firms

Biotechnology Companies

Packaging Material Suppliers

Companies

Players Mentioned in the Report

Amcor plc

BASF SE

Sealed Air Corporation

Dow Inc.

Mondi Group

Sonoco Products Company

Bemis Company, Inc.

PolyOne Corporation

Tetra Pak International S.A.

Dunmore Corporation

Table of Contents

1. Global Antimicrobial Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Antimicrobial Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Antimicrobial Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Increasing demand for shelf-life extension in food products

3.1.2. Growth in pharmaceutical packaging demand

3.1.3. Rising consumer awareness about food safety

3.1.4. Innovations in biodegradable antimicrobial packaging

3.2. Market Challenges

3.2.1. High cost of antimicrobial materials

3.2.2. Regulatory barriers in different regions

3.2.3. Limited consumer adoption in developing markets

3.3. Opportunities

3.3.1. Increasing use of natural antimicrobial agents

3.3.2. Expansion of the pharmaceutical industry

3.3.3. Rising demand for eco-friendly packaging

3.4. Trends

3.4.1. Adoption of nanotechnology in antimicrobial packaging

3.4.2. Use of active and intelligent packaging systems

3.4.3. Focus on sustainability and recycling in antimicrobial packaging

3.5. Regulatory Landscape

3.5.1. U.S. Food and Drug Administration (FDA) standards

3.5.2. European Union regulations (EFSA)

3.5.3. Global Food Safety Initiative (GFSI) compliance

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Raw Material Suppliers, Packaging Manufacturers, End-users)

3.8. Porters Five Forces (Suppliers, Buyers, Substitutes, New Entrants, Rivalry)

3.9. Competition Ecosystem

4. Global Antimicrobial Packaging Market Segmentation

4.1. By Packaging Type (In Value %)

4.1.1. Rigid Packaging

4.1.2. Flexible Packaging

4.1.3. Biodegradable Packaging

4.2. By Material Type (In Value %)

4.2.1. Plastics

4.2.2. Biopolymers

4.2.3. Paper & Paperboard

4.2.4. Metal

4.3. By Active Agent (In Value %)

4.3.1. Organic Acid-Based

4.3.2. Enzyme-Based

4.3.3. Antimicrobial Polymer-Based

4.4. By End-Use Industry (In Value %)

4.4.1. Food & Beverage

4.4.2. Pharmaceuticals

4.4.3. Personal Care Products

4.4.4. Healthcare

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Antimicrobial Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Amcor plc

5.1.2. Mondi Group

5.1.3. BASF SE

5.1.4. Sealed Air Corporation

5.1.5. Dow Inc.

5.1.6. Tetra Pak International S.A.

5.1.7. PolyOne Corporation

5.1.8. Sonoco Products Company

5.1.9. Bemis Company, Inc.

5.1.10. Dunmore Corporation

5.1.11. BioCote Ltd

5.1.12. Takex Labo Co., Ltd.

5.1.13. Microban International, Ltd.

5.1.14. Linpac Packaging Ltd.

5.1.15. Plasmatreat GmbH

5.2. Cross Comparison Parameters

5.2.1. Manufacturing Capacities

5.2.2. Global Presence

5.2.3. Revenue

5.2.4. Product Portfolio

5.2.5. Strategic Partnerships

5.2.6. R&D Investment

5.2.7. Innovation Capabilities

5.2.8. Sustainability Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Antimicrobial Packaging Market Regulatory Framework

6.1. Food Contact Materials Standards

6.2. Antimicrobial Additives Compliance

6.3. Packaging Waste and Recycling Legislation

6.4. Certification and Labeling Requirements

7. Global Antimicrobial Packaging Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Antimicrobial Packaging Market Future Segmentation

8.1. By Packaging Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By Active Agent (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Global Antimicrobial Packaging Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping the global antimicrobial packaging market, focusing on key stakeholders across industries such as food, pharmaceuticals, and healthcare. This phase involves comprehensive desk research, analyzing secondary and proprietary databases to gather market data.

Step 2: Market Analysis and Construction

In this phase, we collect historical data to construct a detailed market analysis. This involves analyzing packaging material trends, antimicrobial agents, and the use of these materials across various end-use industries.

Step 3: Hypothesis Validation and Expert Consultation

To validate the findings, we conduct interviews with industry experts from antimicrobial packaging manufacturers, healthcare providers, and regulatory bodies. These insights are used to refine the market data and ensure accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data into a comprehensive market report, providing detailed insights into market trends, competitive dynamics, and growth opportunities in the antimicrobial packaging market.

Frequently Asked Questions

1. How big is the global antimicrobial packaging market?

The global antimicrobial packaging market is valued at USD 11 billion, driven by increasing demand from the food, pharmaceutical, and healthcare sectors. The rising need for extended product shelf life and safety in packaging is contributing to its growth.

2. What are the key challenges in the global antimicrobial packaging market?

Challenges include the global antimicrobial packaging market high cost of antimicrobial materials, strict regulatory frameworks, and limited consumer awareness in developing regions. Additionally, some antimicrobial agents face issues with food safety compliance in certain countries.

3. Who are the major players in the global antimicrobial packaging market?

Key players in the global antimicrobial packaging market include Amcor plc, BASF SE, Dow Inc., Sealed Air Corporation, and Mondi Group. These companies dominate the market through innovation, sustainability initiatives, and a strong global presence.

4. What are the growth drivers of the global antimicrobial packaging market?

The global antimicrobial packaging market is propelled by rising consumer health concerns, demand for longer shelf life in packaged food, and the need for effective packaging solutions in the pharmaceutical sector. The adoption of nanotechnology in packaging also plays a significant role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.