Global Aramid Fiber Market

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2344

November 2024

94

About the Report

Global Aramid Fiber Market Overview

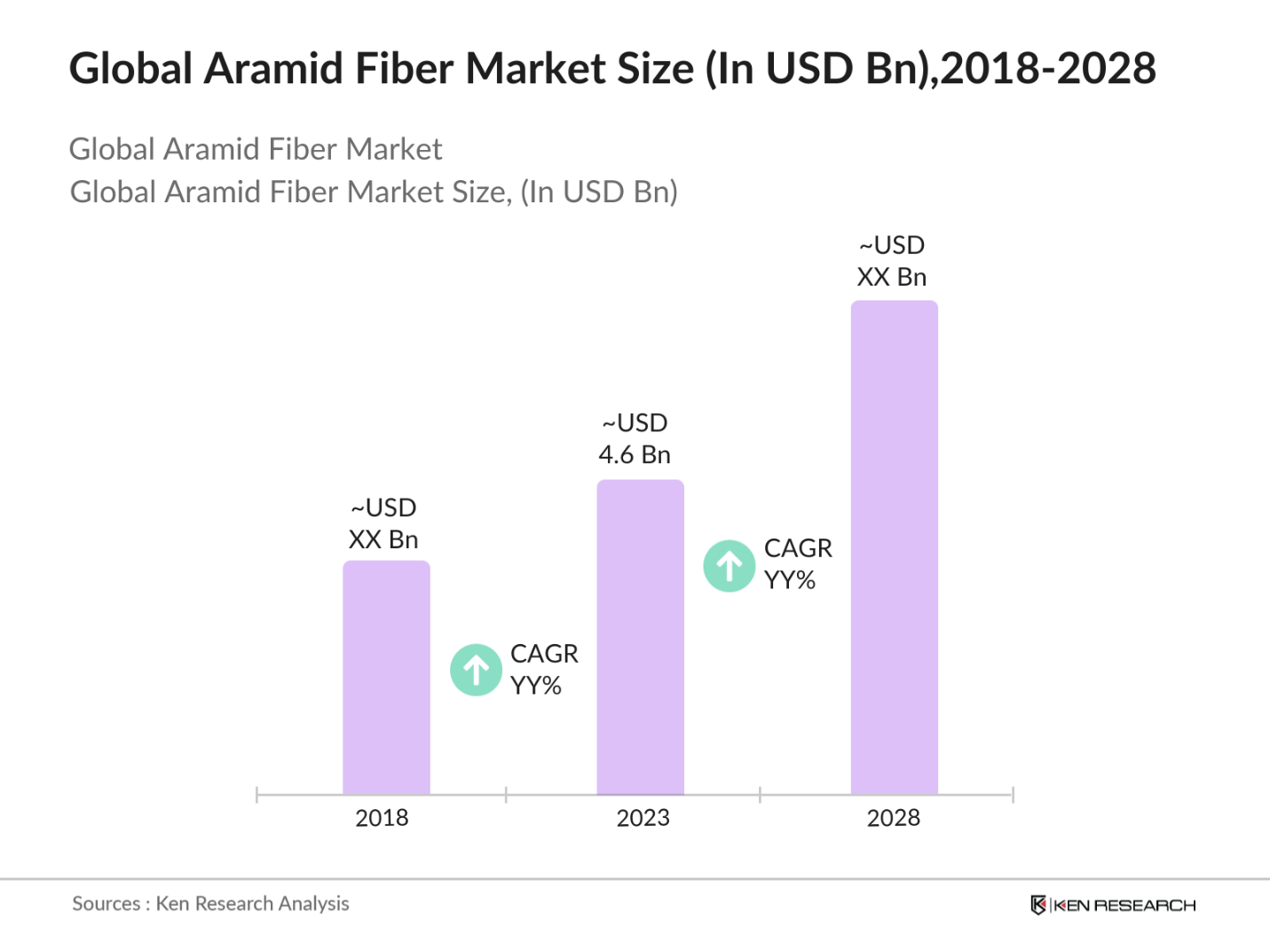

- The global aramid fiber market reached a size of USD 4.6 billion in 2023, driven by the increasing demand for lightweight, high-strength materials across industries. The automotive and aerospace sectors have seen robust growth due to the rising need for fuel-efficient vehicles and aircraft. The materials extensive use in ballistic protection for the military and defense sectors further solidifies its demand. The market's expansion is also attributed to its resistance to heat and chemicals, making it ideal for industrial applications.

- Key players in the global aramid fiber market include eijin Limited, DuPont de Nemours, Inc., Kolon Industries, Inc., Hyosung Corporation, and Yantai Tayho Advanced Materials Co., Ltd. These companies lead the market due to their advanced product portfolios and strategic collaborations with key industries such as aerospace, defense, and automotive. Additionally, they are focusing on expanding production capacities and entering new markets to stay competitive.

- Teijin has been focusing on sustainability in its operations. At the JEC World 2023 event, the company showcased various sustainable composite products and outlined its strategies for reducing energy consumption and improving manufacturing processes in its carbon fiber production. This includes efforts to recycle carbon fiber products and minimize environmental impact.

- Cities like New York, Frankfurt, and Tokyo dominate the global aramid fiber market due to their strong presence in key industries. New York drives demand for aramid-based protective gear through its defense sector. Frankfurt's automotive industry heavily relies on aramid fibers for vehicle components. Tokyo, known for its industrial innovations, utilizes aramid fibers in various advanced applications.

Global Aramid Fiber Market Segmentation

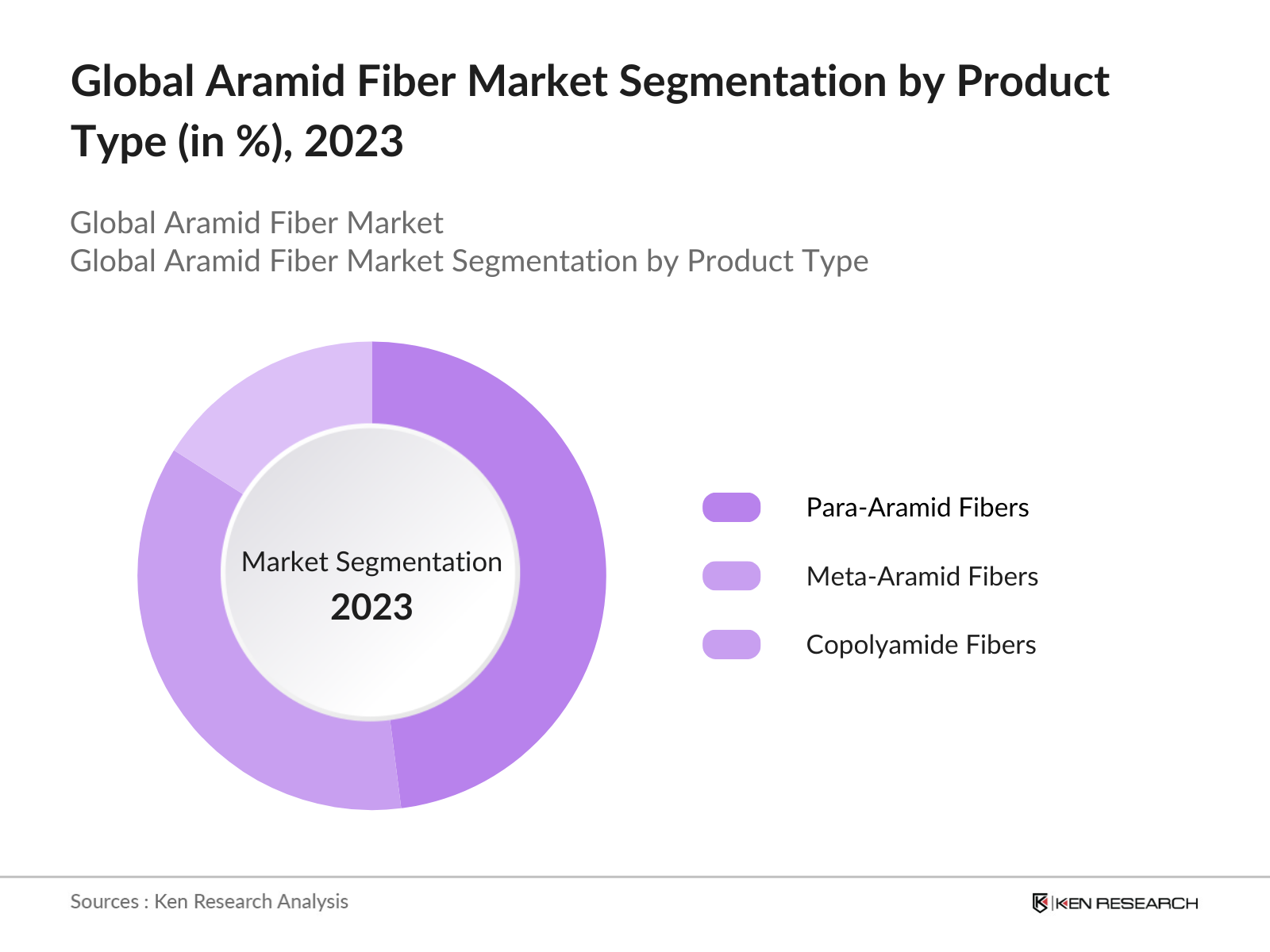

By Product Type: The global aramid fiber market is segmented into para-aramid fibers, meta-aramid fibers, and copolyamide fibers. In 2023, para-aramid fibers dominated the market due to their widespread use in high-strength applications such as bulletproof vests and protective clothing. Their exceptional strength and impact resistance make them crucial for the defense industry. Meta-aramid fibers, valued for their heat resistance, are commonly used in fire-resistant garments, while copolyamide fibers are utilized in lower-strength, specialized applications.

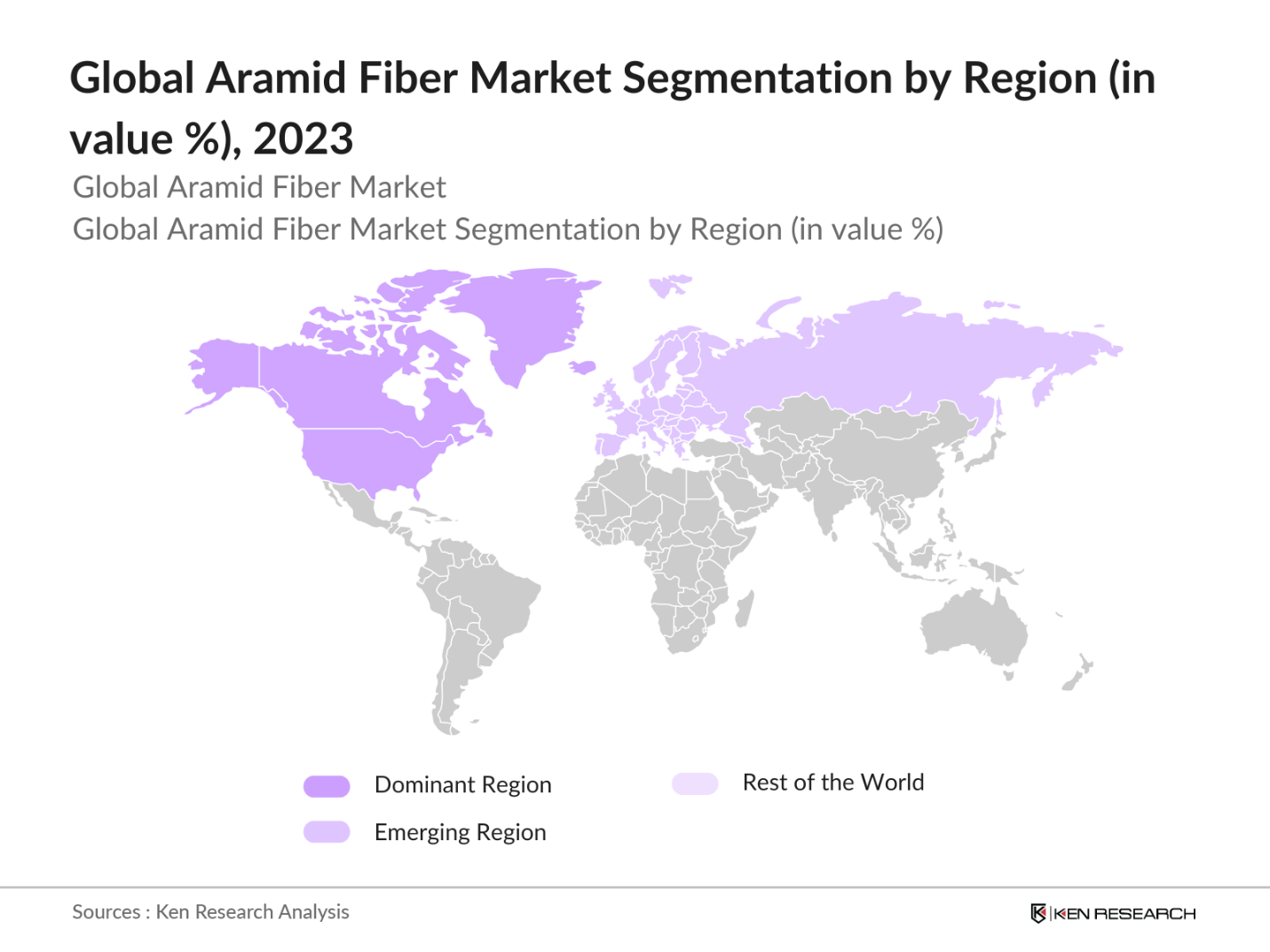

By Region: The global aramid fiber market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and Middle East & Africa (MEA). In 2023, North America held the largest market share due to strong demand from the defense sector and significant investments in the automotive and aerospace industries. Europe saw growth driven by stringent emission regulations, prompting isncreased use of lightweight materials. APAC is also experiencing rapid expansion due to industrial growth and rising defense spending across countries like China and India.

By Application: The aramid fiber market is segmented by application into automotive, aerospace & defense, and electrical insulation. In 2023, the aerospace & defense segment held the largest market share due to increasing demand for lightweight materials in aircraft manufacturing. Aramid fibers are used to reduce weight while maintaining strength, which is crucial for fuel efficiency. Additionally, military applications, such as body armor, rely on aramid fibers for their protective qualities. The automotive sector is also growing, driven by demand for energy-efficient vehicles.

Global Aramid Fiber Market Competitive Landscape

|

Company |

Established Year |

Headquarters |

|

Teijin Limited |

1918 |

Tokyo, Japan |

|

DuPont de Nemours, Inc. |

1802 |

Delaware, USA |

|

Kolon Industries, Inc. |

1954 |

Seoul, South Korea |

|

Hyosung Corporation |

1966 |

Seoul, South Korea |

|

Yantai Tayho Advanced Materials Co. |

1986 |

Yantai, China |

- Teijin Limited: In 2023, Teijin increased its para-aramid fiber output to meet the growing global demand for advanced protective gear, particularly in Europe and North America. This strategic move aligns with their ongoing investments in research and development to enhance the performance of their fibers, especially for heat-resistant applications.

- Kolon Industries: In 2023, Kolon Industries introduced a new line of bio-based aramid fibers to meet the rising demand for sustainable materials. This product is designed to reduce the environmental impact of aramid fiber production. It specifically targets eco-conscious industries, with a strong focus on the European market.

Global Aramid Fiber Market Analysis

Global Aramid Fiber Market Growth Drivers

- Increased Military and Defense Expenditure: Global defense spending, particularly in the U.S. and China, has driven demand for aramid fiber-based protective gear. In 2023, the U.S. military allocated $16.6 billion for protective equipment, including aramid-based bulletproof vests and helmets, while Chinas defense budget reached $225 billion, boosting demand for ballistic applications. These trends are expected to further enhance the aramid fiber market in the defense sector.

- Stringent Emission Regulations in the Automotive Industry: The European Union's 2023 vehicle emissions standards require automakers to use lightweight materials to cut emissions. Aramid fibers are increasingly adopted for components like tires and transmission belts, which help reduce vehicle weight and improve fuel efficiency. This shift is particularly notable in Germany, where automotive manufacturers are integrating aramid fibers to meet the new regulations.

- Rising Demand for Lightweight Aircraft Components: The aerospace sector is focused on fuel-efficient aircraft due to high fuel costs. Manufacturers are increasingly using aramid fibers to reduce aircraft weight and improve fuel efficiency. Boeing and Airbus have both enhanced their use of aramid composites to meet these demands, and this trend is likely to continue as aviation regulations favor lightweight materials.

Global Aramid Fiber Market Challenges

- High Production Costs: Aramid fiber production is costly due to expensive and scarce raw materials, such as isophthaloyl chloride and diamines. Supply chain disruptions exacerbate these costs, posing challenges for smaller manufacturers. The high production costs lead to higher final product prices, limiting adoption in cost-sensitive industries like construction and consumer goods.

- Environmental Concerns Related to Aramid Fiber Disposal: Aramid fibers are durable but non-biodegradable, leading to disposal challenges. In 2023, EU regulations pushed for eco-friendly recycling methods. The aerospace and defense sectors face scrutiny over managing aramid waste from outdated equipment. This raises environmental concerns as industries seek solutions to minimize pollution from aramid fiber disposal.

Global Aramid Fiber Market Government Initiatives

- U.S. Defense Department Funding for Advanced Protective Gear: In 2023, the U.S. Department of Defense announced an increase in funding for the development of advanced protective gear, including body armor and helmets, which are made from aramid fibers. The total budget allocation for military personnel protection reached $2.5 billion, with a focus on enhancing the durability and weight reduction of combat gear. This initiative is expected to significantly drive the demand for aramid fibers in the U.S. market over the next five years.

- Indias Focus on Domestic Defense Manufacturing: In 2023, the Indian government launched the Atmanirbhar Bharat initiative, promoting domestic production of defense equipment, including body armor and helmets made from aramid fibers. Indias defense budget saw a substantial increase to $76.7 billion, with a focus on indigenizing the production of military gear to reduce import dependency. This initiative is expected to stimulate demand for aramid fibers in India, as local manufacturers increase production capacities to meet government requirements.

Global Aramid Fiber Market Outlook

The global aramid fiber market is poised for significant growth by 2028, driven by the increasing demand for lightweight, durable materials across various industries. As regulations tighten and sustainability becomes a key focus, industries such as automotive, renewable energy, and telecommunications are shifting towards more advanced materials like aramid fibers to meet their evolving needs.

Future Trends:

- Increased Demand for Lightweight Electric Vehicle Components: By 2028, the demand for lightweight materials in electric vehicles (EVs) is expected to drive the aramid fiber market. Aramid fibers will be increasingly used in tire reinforcements, motor housings, and battery casings to enhance energy efficiency and reduce weight. This trend will be particularly prominent in North America and Europe, where regulations continue to push for greener transportation solutions.

- Expansion in the Renewable Energy Sector: By 2028, the demand for aramid fibers in wind turbine blades will increase as the renewable energy sector grows. Aramid fibers will be crucial for creating lightweight, durable blades, contributing to better energy efficiency. Major investments in wind energy by leading countries will drive this trend, supporting advancements in green technology.

Scope of the Report

|

By Product Type |

Para-Aramid Fibers Meta-Aramid Fibers Copolyamide Fibers |

|

By Application |

Aerospace & Defense Automotive Electrical Insulation |

|

By Region |

North America Europe APAC Latin America MEA |

|

By End-Use Industry |

Aerospace & Defense Automotive Oil & Gas Electrical & Electronics |

Products

Key Target Audience:

Automotive manufacturers

Aerospace and defense contractors

Protective equipment manufacturers

Electrical insulation companies

Construction material companies

Industrial machinery manufacturers

Textile manufacturers

Investments and venture capitalist firms

Government and regulatory bodies (DoD)

Military and defense organizations

Companies

Players Mentioned in the Report:

Teijin Limited

DuPont de Nemours, Inc.

Kolon Industries, Inc.

Hyosung Corporation

Yantai Tayho Advanced Materials Co., Ltd.

Kermel

China National Bluestar (Group) Co., Ltd.

Toray Chemical Korea Inc.

SRO Group (China) Ltd.

Owens Corning

Table of Contents

01. Global Aramid Fiber Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Aramid Fiber Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Aramid Fiber Market Analysis

3.1. Growth Drivers

3.1.1. Increased Military and Defense Expenditure

3.1.2. Stringent Emission Regulations in the Automotive Industry

3.1.3. Rising Demand for Lightweight Aircraft Components

3.2. Challenges

3.2.1. High Production Costs

3.2.2. Environmental Concerns Related to Aramid Fiber Disposal

3.2.3. Dependence on Fluctuating Raw Material Supply

3.3. Opportunities

3.3.1. Expanding Use in Telecommunications and 5G Infrastructure

3.3.2. Increasing Use in Renewable Energy Projects

3.4. Trends

3.4.1. Growth in Fire-Resistant Clothing for Industrial Workers

3.4.2. Expansion in Electric Vehicle Applications

3.4.3. Sustainability Initiatives in Aramid Fiber Manufacturing

3.5. Government Initiatives

3.5.1. U.S. Defense Department Funding for Advanced Protective Gear

3.5.2. European Union Emission Regulation Enforcement

3.5.3. India's "Atmanirbhar Bharat" Initiative for Domestic Defense Production

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

04. Global Aramid Fiber Market Segmentation, 2023

4.1. By Region (in Value %)

4.1.1. North America

4.1.2. Europe

4.1.3. Asia-Pacific (APAC)

4.1.4. Latin America

4.1.5. Middle East & Africa (MEA)

4.2. By Product Type (in Value %)

4.2.1. Para-Aramid Fibers

4.2.2. Meta-Aramid Fibers

4.2.3. Copolyamide Fibers

4.3. By Application (in Value %)

4.3.1. Aerospace & Defense

4.3.2. Automotive

4.3.3. Electrical Insulation

4.4. By End-Use Industry (in Value %)

4.4.1. Aerospace & Defense

4.4.2. Automotive

4.4.3. Oil & Gas

4.4.4. Electrical & Electronics

4.5. By Fiber Form (in Value %)

4.5.1. Continuous Fibers

4.5.2. Staple Fibers

4.5.3. Pulp

4.6. By Function (in Value %)

4.6.1. Protection

4.6.2. Reinforcement

4.6.3. Friction Management

05. Global Aramid Fiber Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Teijin Limited

5.1.2. DuPont de Nemours, Inc.

5.1.3. Kolon Industries, Inc.

5.1.4. Hyosung Corporation

5.1.5. Yantai Tayho Advanced Materials Co., Ltd.

5.1.6. Kermel

5.1.7. China National Bluestar (Group) Co., Ltd.

5.1.8. Toray Chemical Korea Inc.

5.1.9. Owens Corning

5.1.10. Honeywell International Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

06. Global Aramid Fiber Market Competitive Landscape Analysis

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. Global Aramid Fiber Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

08. Global Aramid Fiber Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

09. Global Aramid Fiber Market Future Market Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Product Type (in Value %)

9.3. By Application (in Value %)

9.4. By End-Use Industry (in Value %)

10. Global Aramid Fiber Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the Global Aramid Fiber Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Aramid Fiber Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Aramid Fiber and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Aramid Fiber.

Frequently Asked Questions

01. How big is the global aramid fiber market?

The global aramid fiber market was valued at USD 4.6 billion in 2023, driven by the demand for lightweight, high-strength materials in sectors like defense, automotive, and aerospace. Increased adoption in ballistic protection and fuel-efficient vehicles are key factors contributing to its growth.

02. What are the challenges in the global aramid fiber market?

Challenges in the global aramid fiber market include high production costs, limited raw material supply, and environmental concerns related to fiber disposal. The dependence on specific chemicals and price volatility in supply chains also pose threats to market stability.

03. Who are the major players in the global aramid fiber market?

Key players in the global aramid fiber market include Teijin Limited, DuPont de Nemours, Inc., Kolon Industries, Inc., Hyosung Corporation, and Yantai Tayho Advanced Materials Co., Ltd. These companies lead the market with their advanced product portfolios and strong partnerships across multiple industries.

04. What are the growth drivers of the global aramid fiber market?

The global aramid fiber market is driven by the rising demand for protective gear in the defense sector, stringent emissions regulations in the automotive industry, and the push for lightweight materials in aerospace to improve fuel efficiency. The material's high strength-to-weight ratio makes it critical across these sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.