Global Artificial Lift Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11344

December 2024

86

About the Report

Global Artificial Lift Market Outlook 2028

Global Artificial Lift Market Overview

- The global artificial lift market is valued at USD 22.7 billion, primarily driven by the increased need for production efficiency in mature oil and gas wells. This demand is further fueled by depleting reserves in conventional oil fields and the rising focus on maximizing output from unconventional resources such as shale and tight oil formations. The steady growth of artificial lift technologies like Electric Submersible Pumps (ESP) and gas lifts is primarily attributed to their cost-effective solutions for enhancing well productivity.

- Countries like the United States and Saudi Arabia dominate the artificial lift market due to their vast onshore and offshore oil fields, advanced technological infrastructure, and significant investments in exploration and production (E&P). The U.S. holds a leading position, largely driven by the growing shale gas exploration, while the Middle Easts dominance stems from its abundant oil reserves and established oilfield service providers, enabling efficient use of artificial lift technologies across both shallow and deep wells.

- Governments are providing financial incentives to oil and gas companies for the adoption of environmentally friendly artificial lift systems. For instance, in 2023, the U.S. government introduced a $10 billion initiative under the Inflation Reduction Act aimed at reducing methane emissions from oil fields, including incentives for upgrading lift systems to reduce environmental impact. Similar programs are underway in Canada and the European Union, offering tax rebates and subsidies for companies that implement green technologies like electric submersible pumps that use cleaner energy sources.

Global Artificial Lift Market Segmentation

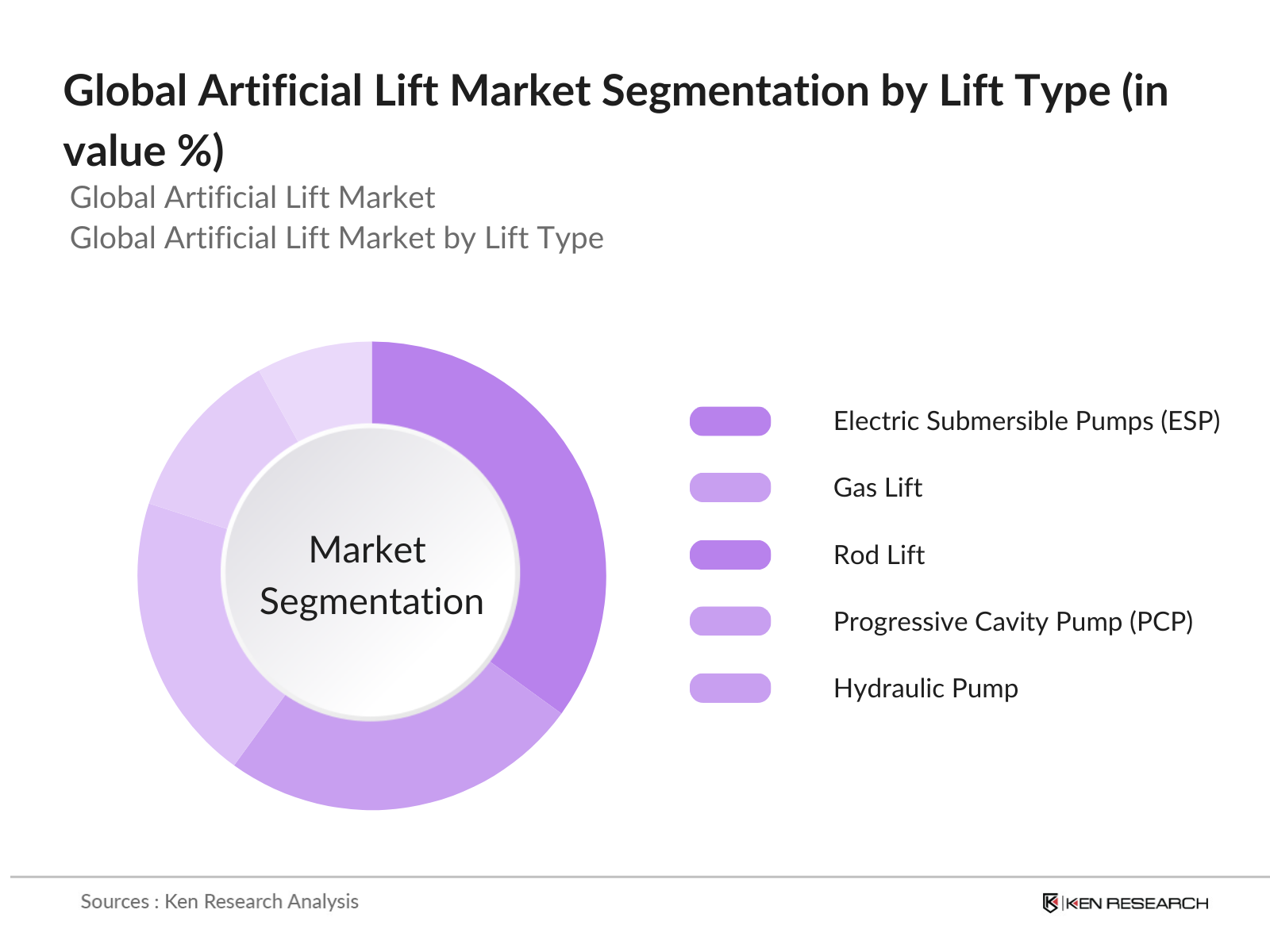

By Lift Type: The global artificial lift market is segmented by lift type into Electric Submersible Pumps (ESP), Gas Lift, Rod Lift, Progressive Cavity Pump (PCP), and Hydraulic Pump. ESP holds a dominant share in 2023, primarily due to its widespread application in high-production oil wells. Its capability to operate in deep wells and its higher efficiency in handling large volumes of fluid make it a preferred choice among operators. This is particularly relevant in regions like North America and the Middle East, where production volumes are significant, driving the demand for ESP.

By Region: The global artificial lift market is segmented regionally into North America, Middle East & Africa, Latin America, Asia Pacific, and Europe. North America leads the market due to the robust growth of the shale gas industry, specifically in the U.S., which heavily relies on artificial lift technologies to maintain production levels. The Middle East & Africa is another key region, with countries like Saudi Arabia and the UAE continuously investing in artificial lift systems to enhance the efficiency of their vast oil reserves.

Global Artificial Lift Market Competitive Landscape

The global artificial lift market is characterized by the presence of several key players that dominate the market through product innovation, strategic partnerships, and geographical expansion. Major players in the market are focusing on offering integrated solutions, combining hardware, software, and services to provide more efficient and cost-effective artificial lift systems. The U.S. companies dominate due to their advanced technological capabilities, while Middle Eastern companies benefit from proximity to abundant oil fields.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Revenue (USD bn) |

R&D Investment |

Technological Patents |

Global Presence |

Product Range |

|

Schlumberger Limited |

1926 |

Houston, U.S. |

- |

- |

- |

- |

- |

- |

|

Halliburton |

1919 |

Houston, U.S. |

- |

- |

- |

- |

- |

- |

|

Baker Hughes |

1907 |

Houston, U.S. |

- |

- |

- |

- |

- |

- |

|

Weatherford International |

1941 |

Houston, U.S. |

- |

- |

- |

- |

- |

- |

|

NOVOMET |

1991 |

Perm, Russia |

- |

- |

- |

- |

- |

- |

Global Artificial Lift Market Analysis

Market Growth Drivers

- Expansion of Unconventional Oil & Gas Production: Unconventional oil and gas production, particularly from shale formations, has surged in regions like the United States, where unconventional oil production accounts for over 8 million barrels per day, according to the U.S. Geological Survey (USGS). Countries such as Argentina and China are also expanding unconventional oil production, which reached over 150,000 barrels per day in 2023. These projects often require artificial lift systems from day one due to lower natural pressure, driving demand for efficient lift systems like electric submersible pumps (ESPs) and rod lifts.

- Rising Investments in Oilfield Services: The global oilfield services sector has seen increased capital investments, particularly in the Middle East and Africa, where Saudi Arabia's ARAMCO invested over $8 billion in new oil field developments in 2023, as per the International Energy Agency (IEA). This growth reflects the need for enhanced recovery methods, including artificial lift technologies, to maximize output from both new and mature fields. Additionally, the growth of offshore projects in Brazil and West Africa, with investments exceeding $6 billion, highlights the rising demand for advanced lifting systems.

- Technological Advancements in Lift Systems: Technological developments in artificial lift systems have led to increased production efficiency, particularly through the integration of automated and real-time monitoring systems. In 2023, the World Bank estimates that global investments in oil and gas digital transformation will exceed $30 billion, driven by the adoption of AI-driven predictive maintenance technologies. These advancements significantly reduce operational downtime and maximize production efficiency, especially in remote and offshore locations where accessibility is limited. The growing reliance on data analytics and automation also enables operators to make faster, data-backed decisions.

Market Challenges

- High Initial Installation Costs: The upfront cost of deploying artificial lift systems is substantial, especially for offshore projects where installation costs are higher due to increased logistical challenges. A report from the U.S. Department of Energy (DOE) indicates that installing an electric submersible pump in deepwater environments can cost between $800,000 to $2 million per well, depending on the complexity of the reservoir. This significant expenditure can be a barrier for small and medium-sized operators, particularly in low-margin markets, where capital availability is more constrained.

- Environmental and Regulatory Constraints: The oil and gas industry faces increasing pressure to comply with stringent environmental regulations. The International Energy Agency (IEA) reported that 2023 saw the implementation of over 200 new regulatory standards for emissions management in the oil sector, including methane capture requirements for wells using artificial lift. These regulations, especially in regions such as the European Union and North America, have imposed additional compliance costs on operators, reducing the profitability of using certain lift systems that are less environmentally friendly.

Global Artificial Lift Market Future Outlook

Market Opportunities:

- Shift Towards Hybrid Lift Systems: Hybrid lift systems, which combine multiple types of lift technologies, are gaining traction as oil wells mature. In 2023, the U.S. Energy Information Administration (EIA) reported that hybrid systems combining gas lift and ESPs were being increasingly deployed in deepwater projects, as they can adapt to varying production rates and well conditions. These systems offer greater operational flexibility, which is crucial for complex reservoirs with fluctuating pressure. The trend toward hybridization is expected to grow as operators seek more versatile and cost-effective solutions to maximize production from challenging wells, particularly in regions like Brazil and West Africa.

- Increasing Collaboration with Independent Operators: Collaboration between large oilfield service providers and independent operators has been growing, especially in regions like North America. In 2023, many artificial lift contracts in the U.S. shale sector were awarded to independent operators, according to the U.S. Department of Energy (DOE). These collaborations enable smaller operators to access advanced lift technologies without large upfront investments, leveraging the expertise and infrastructure of larger service providers. This trend is expected to continue as the industry shifts towards greater efficiency and cost-sharing mechanisms, particularly in low-margin regions such as the Permian Basin and the Eagle Ford Shale.

Scope of the Report

|

By Lift Type |

Electric Submersible Pump (ESP) Gas Lift, Rod Lift Progressive Cavity Pump (PCP) Hydraulic Pump |

|

By Application |

Onshore Offshore |

|

By Well Type |

Horizontal Wells Vertical Wells |

|

By Component |

Pumping Units Motors Control Systems Sensors Surface Equipment |

|

By Region |

North America Middle East & Africa Latin America Asia Pacific, Europe |

Products

Key Target Audience

Oilfield Service Providers

Oil & Gas Exploration and Production (E&P) Companies

Artificial Lift Equipment Manufacturers

Drilling Contractors

Oilfield Automation Companies

Government and Regulatory Bodies (e.g., U.S. Department of Energy, Saudi Ministry of Energy)

Investments and Venture Capitalist Firms

Offshore and Onshore Operators

Companies

Players Mention in the Report

Schlumberger Limited

Halliburton

Baker Hughes

Weatherford International

NOVOMET

Borets International

ChampionX

Dover Corporation

Tenaris

John Crane

National Oilwell Varco

Occidental Petroleum

Saudi Aramco

General Electric

Siemens Energy

Table of Contents

1. Global Artificial Lift Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview

1.5. Key Market Metrics (Production Efficiency, Well Optimization, Operational Costs)

2. Global Artificial Lift Market Size (In USD Bn)

2.1. Historical Market Size (Production Output, Revenue)

2.2. Year-On-Year Growth Analysis (Well Productivity Increase, Operational Expenditure)

2.3. Key Market Developments and Milestones (Innovations, Major Installations, Technology Adoptions)

3. Global Artificial Lift Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Well Depth and Depletion Rates

3.1.2. Expansion of Unconventional Oil & Gas Production

3.1.3. Rising Investments in Oilfield Services

3.1.4. Technological Advancements in Lift Systems

3.2. Market Challenges

3.2.1. High Initial Installation Costs

3.2.2. Environmental and Regulatory Constraints

3.2.3. Equipment Maintenance and Downtime Issues

3.2.4. Market Volatility in Oil Prices

3.3. Opportunities

3.3.1. Increased Focus on Offshore Production

3.3.2. Integration of Automation and Digitalization in Lift Systems

3.3.3. Expansion in Middle East & Latin American Markets

3.3.4. Growth in Enhanced Oil Recovery (EOR) Applications

3.4. Trends

3.4.1. Adoption of Real-Time Monitoring Systems

3.4.2. Shift Towards Hybrid Lift Systems

3.4.3. Increasing Collaboration with Independent Operators

3.4.4. Sustainable and Energy-Efficient Lift Systems

3.5. Regulatory Landscape

3.5.1. Environmental Regulations for Oilfield Operations

3.5.2. Well Integrity and Safety Standards

3.5.3. Government Incentives for Unconventional Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (OEMs, Oilfield Service Providers, Operators, Government Bodies)

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Artificial Lift Market Segmentation

4.1. By Lift Type (In Value %)

4.1.1. Electric Submersible Pump (ESP)

4.1.2. Gas Lift

4.1.3. Rod Lift

4.1.4. Progressive Cavity Pump (PCP)

4.1.5. Hydraulic Pump

4.2. By Application (In Value %)

4.2.1. Onshore

4.2.2. Offshore

4.3. By Well Type (In Value %)

4.3.1. Horizontal Wells

4.3.2. Vertical Wells

4.4. By Component (In Value %)

4.4.1. Pumping Units

4.4.2. Motors

4.4.3. Control Systems

4.4.4. Sensors

4.4.5. Surface Equipment

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Middle East & Africa

4.5.3. Latin America

4.5.4. Asia Pacific

4.5.5. Europe

5. Global Artificial Lift Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Schlumberger Limited

5.1.2. Halliburton

5.1.3. Baker Hughes

5.1.4. Weatherford International

5.1.5. National Oilwell Varco

5.1.6. Borets International

5.1.7. NOVOMET

5.1.8. ChampionX

5.1.9. Apergy Corporation

5.1.10. Tenaris

5.1.11. Dover Corporation

5.1.12. John Crane

5.1.13. Occidental Petroleum

5.1.14. Saudi Aramco

5.1.15. General Electric

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Range, R&D Expenditure, Patents Held)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.4.1. Mergers and Acquisitions

5.4.2. Strategic Partnerships

5.4.3. Joint Ventures

5.4.4. Technological Collaborations

5.5. Investment Analysis

5.5.1. Venture Capital Funding

5.5.2. Private Equity Investments

5.5.3. Government Grants

6. Global Artificial Lift Market Regulatory Framework

6.1. Environmental Standards and Emission Norms

6.2. Compliance Requirements for Oilfield Operations

6.3. Certification Processes and Industry Regulations

7. Global Artificial Lift Market Future Size (In USD Bn)

7.1. Future Market Size Projections (Production Growth, Market Expansion)

7.2. Key Factors Driving Future Market Growth (New Technologies, Market Expansion in Emerging Economies)

8. Global Artificial Lift Market Future Segmentation

8.1. By Lift Type (In Value %)

8.2. By Application (In Value %)

8.3. By Well Type (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

9. Global Artificial Lift Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives and Market Penetration Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins by identifying the crucial variables influencing the artificial lift market. This involves in-depth desk research, drawing data from government publications, proprietary databases, and industry reports to map the entire ecosystem.

Step 2: Market Analysis and Construction

The second step involves gathering and analyzing historical data on artificial lift systems across various regions and applications. The collected data is utilized to estimate market penetration and production efficiency, which serve as the basis for revenue generation analysis.

Step 3: Hypothesis Validation and Expert Consultation

A hypothesis on market trends and growth drivers is developed and validated through direct consultations with industry experts. This is achieved using computer-assisted interviews and surveys to ensure the accuracy and reliability of the projected market data.

Step 4: Research Synthesis and Final Output

Finally, a comprehensive report is produced, synthesizing all data from previous steps. This includes validation from key artificial lift manufacturers and stakeholders to present a well-rounded, accurate, and actionable market analysis.

Frequently Asked Questions

01. How big is the global artificial lift market?

The global artificial lift market is valued at USD 22.7 billion, driven by increasing demand for enhanced oil recovery and production efficiency solutions in mature oil fields.

02. What are the challenges in the global artificial lift market?

Key challenges include high initial installation costs, maintenance requirements, and the volatility of oil prices, which can affect investment in new projects.

03. Who are the major players in the global artificial lift market?

Major players in the market include Schlumberger, Halliburton, Baker Hughes, Weatherford International, and NOVOMET, all known for their technological expertise and global presence.

04. What are the growth drivers of the global artificial lift market?

The market is driven by the depletion of conventional oil fields, the need for higher production efficiency, and advancements in technology that enable cost-effective artificial lift solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.