Global Ashwagandha Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD7916

November 2024

89

About the Report

Global Ashwagandha Market Overview

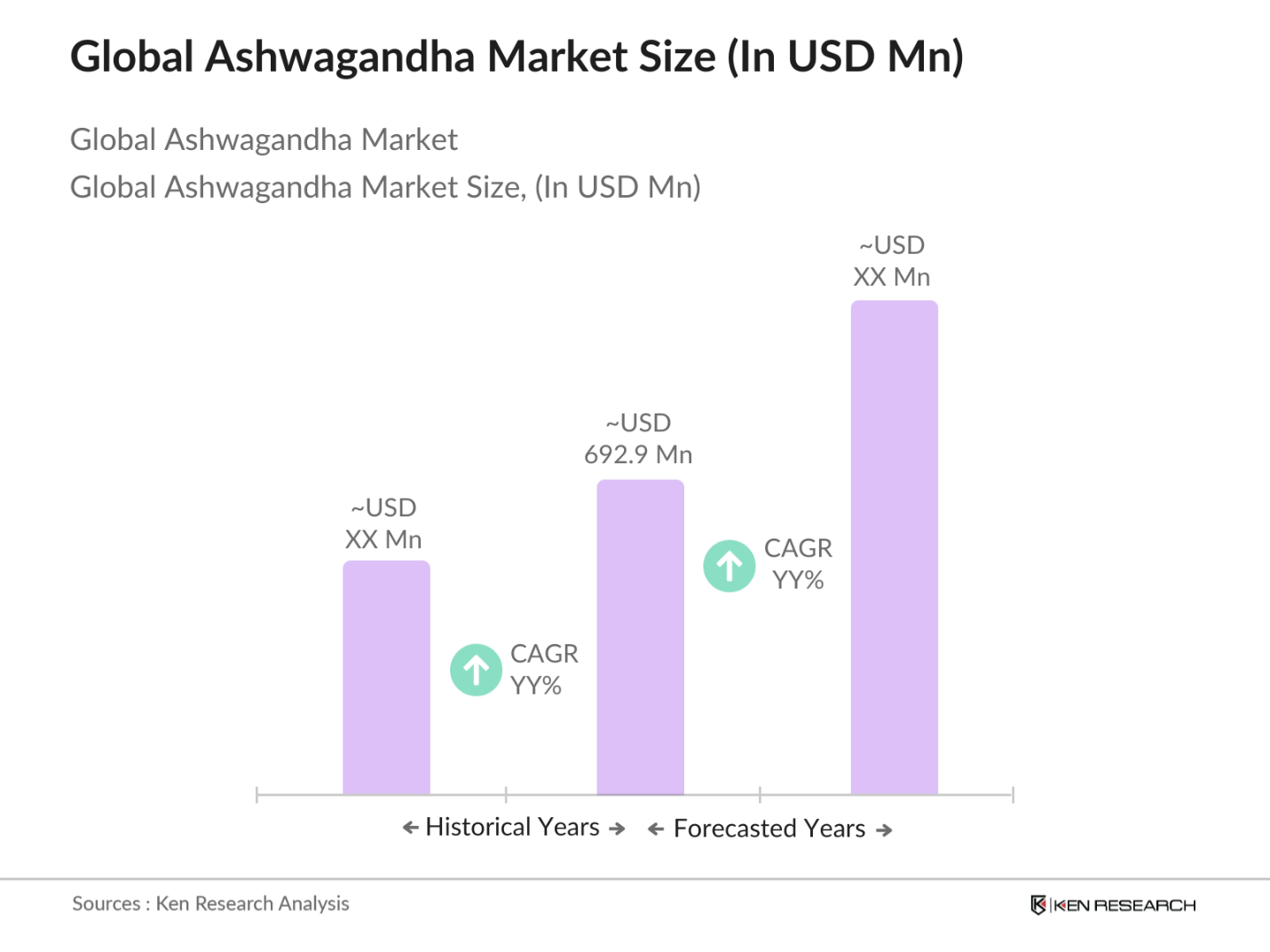

- The global Ashwagandha market is valued at USD 692.9 million, driven by the increasing demand for natural supplements and adaptogens. Consumer awareness regarding the health benefits of Ashwagandha, such as stress reduction and improved cognitive function, has spurred its inclusion in dietary supplements and wellness products. Growth in the market is further propelled by the rise of herbal and ayurvedic remedies, with India being a significant production hub. Global online retail platforms also play a crucial role in expanding market reach.

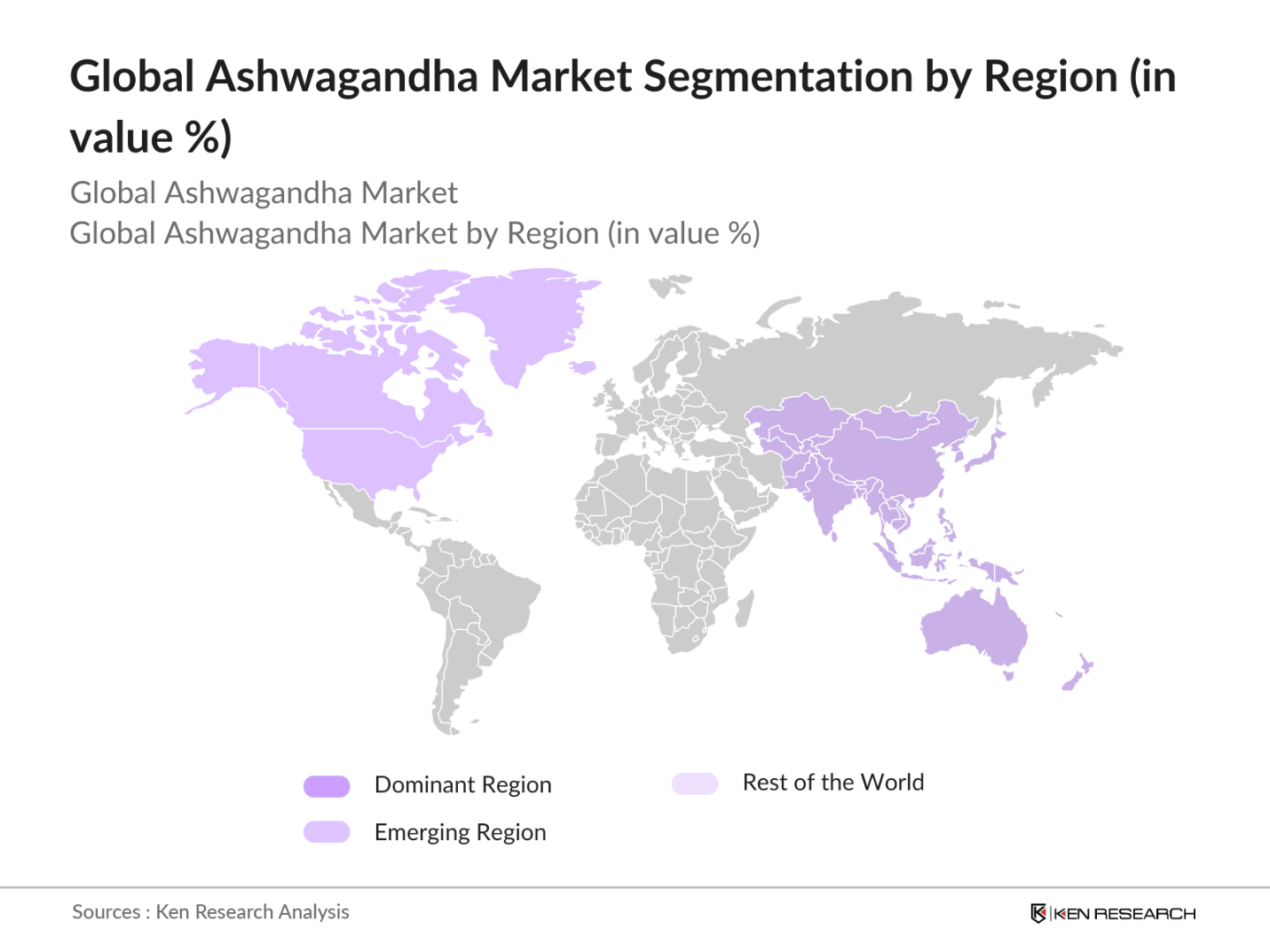

- India and the United States dominate the Ashwagandha market. India leads due to its long-standing tradition of Ayurvedic medicine and its vast supply chain for herbal products. The U.S. market is experiencing growth owing to the rising interest in natural wellness and adaptogens. Both countries benefit from established manufacturing and research infrastructures, as well as consumer demand for alternative healthcare solutions.

- The FDA and EU regulatory frameworks for herbal supplements significantly impact the Ashwagandha market. According to the European Commission, herbal products sold in the EU in 2023 were required to comply with stringent safety and quality standards. Similarly, in the US, the FDAs oversight on herbal supplements demands compliance with Good Manufacturing Practices (GMP). These regulations ensure that Ashwagandha products meet safety standards, influencing market entry strategies for manufacturers aiming to sell in these regions.

Global Ashwagandha Market Segmentation

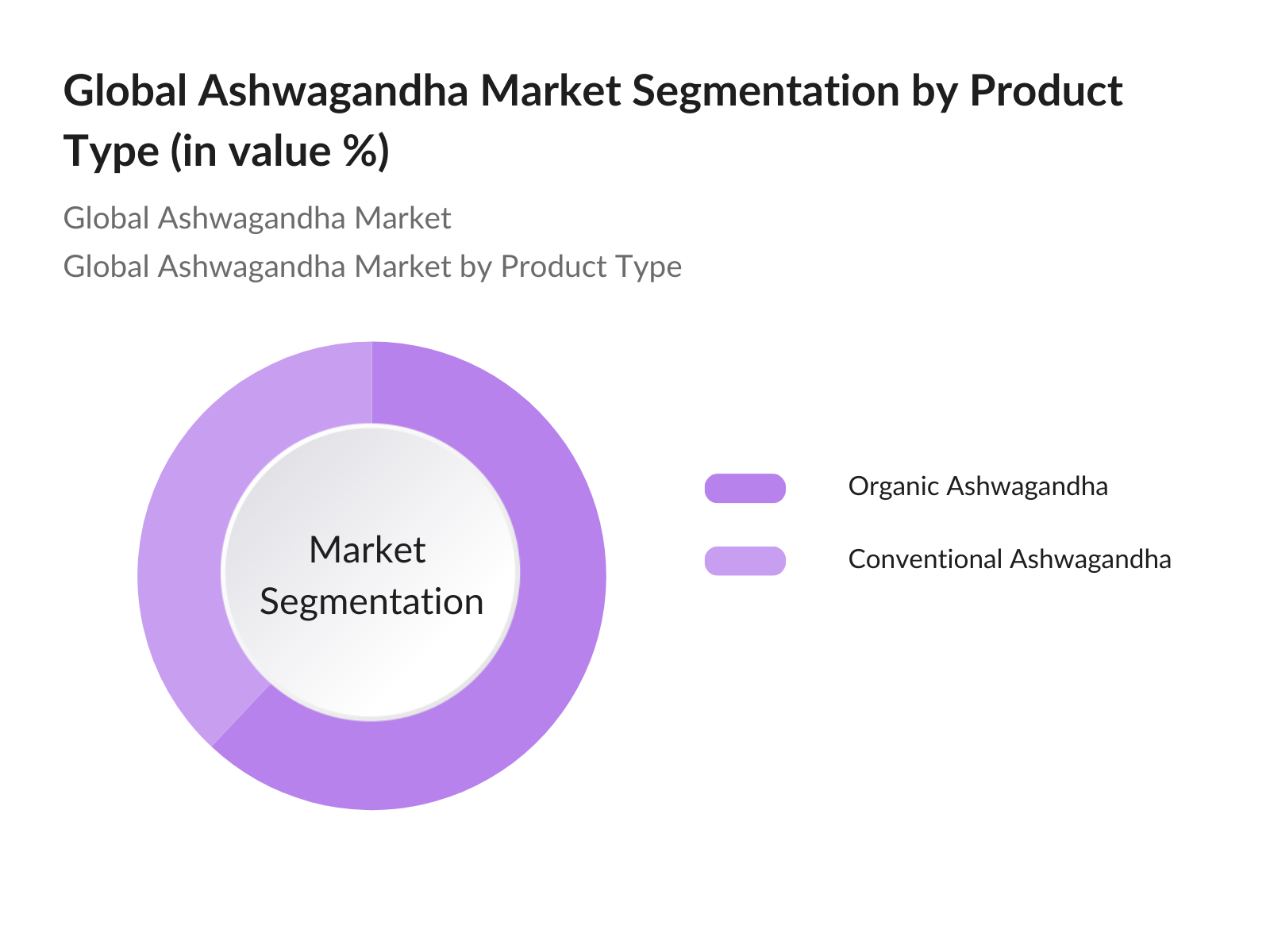

By Product Type: The Ashwagandha market is segmented by product type into organic Ashwagandha and conventional Ashwagandha. Organic Ashwagandha holds a dominant market share due to consumer preferences for organic and non-GMO products. The increasing demand for certified organic supplements, especially in North America and Europe, has driven this segments growth. Furthermore, the higher price premium associated with organic products also adds to its market dominance.

By Region: The Ashwagandha market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific, led by India, is the leading region in the Ashwagandha market due to the large-scale cultivation and processing of Ashwagandha roots in India. Additionally, the region benefits from government initiatives supporting traditional herbal medicine production and export. The high availability of raw materials in this region also lowers production costs, allowing it to maintain a competitive edge in global markets.

Global Ashwagandha Market Competitive Landscape

The Ashwagandha market is dominated by both global supplement brands and domestic producers specializing in herbal products. Major players in the market include Natreon Inc. and Ixoreal Biomed, who are known for their proprietary formulations like KSM-66. Several companies are leveraging Ashwagandhas growing popularity by introducing innovative product lines, such as Ashwagandha-based powders, gummies, and tinctures. These companies emphasize quality control and certifications, including GMP and organic certifications, to differentiate themselves in a competitive marketplace.

|

Company |

Establishment Year |

Headquarters |

Product Line Diversity |

Certifications |

Global Reach |

R&D Investment |

Market Share |

Sustainability Initiatives |

|

Natreon Inc. |

1998 |

U.S. |

Herbal Extracts |

- |

- |

- |

- |

- |

|

Ixoreal Biomed Inc. |

2009 |

India |

KSM-66 Ashwagandha |

- |

- |

- |

- |

- |

|

Himalaya Drug Company |

1930 |

India |

Ayurvedic Supplements |

- |

- |

- |

- |

- |

|

Dabur India Ltd. |

1884 |

India |

Ayurvedic Products |

- |

- |

- |

- |

- |

|

Organic India Pvt Ltd. |

1997 |

India |

Organic Wellness Products |

- |

- |

- |

- |

- |

Global Ashwagandha Market Analysis

Market Growth Drivers

- Rising Consumer Focus on Natural Supplements: The growing demand for natural and plant-based supplements is driving the Ashwagandha market. In 2022, global demand for herbal supplements reached over 110,000 metric tons, with a notable portion focused on adaptogens like Ashwagandha. Ashwagandhas popularity is spurred by consumer interest in holistic health solutions. In the US, the National Institutes of Health (NIH) reported that 41 million adults were using herbal supplements by 2023. The global trend aligns with rising awareness of chronic disease management through natural alternatives, supported by government health campaigns.

- Increased Awareness of Health Benefits (Health-Conscious Consumer Segment): Health-conscious consumers are seeking Ashwagandha for its benefits in stress reduction, immune support, and energy enhancement. According to the WHOs 2023 Global Health Data report, 55 million adults globally are shifting towards herbal solutions for managing lifestyle-related stress. This awareness is particularly strong in countries like India and the USA, where a large portion of the urban population reports using herbal supplements for stress and immunity improvement. The market is driven by this rising demand among health-conscious consumers looking for safe, natural alternatives.

- Government Promotion of Ayurveda: Government initiatives promoting Ayurvedic medicine are propelling Ashwagandha demand globally. India's AYUSH Ministry allocated $250 million to promote Ayurveda-based products, including Ashwagandha, in 2023. Additionally, the Indian governments export promotion efforts resulted in a 15% increase in Ashwagandha-related product exports, targeting regions such as Europe and Southeast Asia. Government endorsements and certifications further bolster the credibility of Ayurvedic products, enhancing consumer trust.

Market Challenges:

- Standardization and Quality Control Issues: Quality control is a significant challenge in the Ashwagandha market due to varying production standards. According to the WHO, many herbal product manufacturers struggle to meet Good Manufacturing Practices (GMP), which impacts the consistency of Ashwagandhas therapeutic properties. This inconsistency in standardization poses a challenge for expanding into stricter markets such as the European Union, where herbal supplements must pass stringent quality tests before entering the market. Establishing globally recognized certifications and stringent quality control measures remains critical for ensuring product reliability and market expansion.

- Price Volatility of Raw Materials: The Ashwagandha market is susceptible to price volatility due to fluctuations in raw material availability. Data from the Indian Ministry of Agriculture shows a 15% price increase in Ashwagandha roots between 2022 and 2023, influenced by poor harvests and rising labor costs in key growing regions. Such volatility complicates pricing strategies for manufacturers and exporters, impacting profit margins. Ensuring sustainable farming practices and better yield management could mitigate future price fluctuations.

Global Ashwagandha Market Future Outlook

The Ashwagandha market is expected to witness significant growth in the coming years due to increasing consumer demand for plant-based adaptogens and wellness products. The growing awareness regarding Ashwagandhas benefits for mental health and immunity, particularly in developed markets, is expected to drive future demand. Additionally, the expansion of e-commerce platforms and advancements in herbal supplement formulations will open new opportunities for market players.

Market Opportunities:

- Rising Demand for Adaptogens: Adaptogens, including Ashwagandha, are experiencing rising demand in the health and wellness sector. According to the National Center for Complementary and Integrative Health (NCCIH), adaptogen usage grew by 17% in the US from 2022 to 2023, as consumers sought remedies for stress and mental well-being. Globally, Ashwagandha is being integrated into a growing number of adaptogenic products, including beverages and supplements, creating new growth opportunities in the wellness industry.

- Expanding Online Retail Channels (E-Commerce Growth): The expansion of online retail channels offers a significant opportunity for Ashwagandha manufacturers. The World Bank reported that global e-commerce sales reached $6 trillion in 2023, with a noticeable uptick in herbal supplement purchases. Ashwagandha-based supplements are particularly popular on platforms like Amazon and Alibaba, where they are marketed directly to health-conscious consumers. This growing e-commerce presence allows manufacturers to reach a wider audience, driving sales and increasing product visibility.

Scope of the Report

|

By Product Type |

Organic Ashwagandha Conventional Ashwagandha |

|

By Application |

Dietary Supplements Functional Food and Beverages Cosmetics and Personal Care Pharmaceuticals |

|

By Distribution Channel |

Offline (Retail, Pharmacy) Online |

|

By End-User |

Individual Consumers Commercial Buyers (Pharmaceutical Companies, FMCG) |

|

By Region |

North America Europe Asia Pacific Latin America Middle East and Africa |

Products

Key Target Audience

Dietary Supplement Manufacturers

Functional Food & Beverage Companies

Pharmaceuticals Companies

Personal Care & Cosmetics Manufacturers

Government & Regulatory Bodies (FDA, WHO)

Organic Certification Bodies (USDA Organic, EU Organic)

Investment & Venture Capitalist Firms

Health & Wellness Retailers

Companies

Major Players

Natreon Inc.

Ixoreal Biomed Inc.

Himalaya Drug Company

Organic India Pvt Ltd.

Dabur India Ltd.

Nature's Way Products, LLC

Herbalife International

Gaia Herbs

Jarrow Formulas

Pukka Herbs

Banyan Botanicals

NOW Foods

Swanson Health Products

Life Extension

NutraScience Labs

Table of Contents

1. Global Ashwagandha Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Ashwagandha Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Ashwagandha Market Analysis

3.1 Growth Drivers

3.1.1 Rising Consumer Focus on Natural Supplements

3.1.2 Increased Awareness of Health Benefits (Health-Conscious Consumer Segment)

3.1.3 Expanding Herbal Product Demand

3.1.4 Government Promotion of Ayurveda

3.2 Market Challenges

3.2.1 Supply Chain Constraints

3.2.2 Standardization and Quality Control Issues

3.2.3 Price Volatility of Raw Materials

3.3 Opportunities

3.3.1 Rising Demand for Adaptogens

3.3.2 Expanding Online Retail Channels (E-Commerce Growth)

3.3.3 Potential in Functional Food and Beverage Industry

3.4 Trends

3.4.1 Growing Demand for Organic Ashwagandha

3.4.2 Innovations in Supplement Formats (Capsules, Powders, Gummies)

3.4.3 Integration with Mental Health and Wellness Products

3.5 Regulatory Framework

3.5.1 FDA & EU Regulations on Herbal Supplements

3.5.2 Certification Processes (Organic Certifications, GMP)

3.5.3 Regional Government Initiatives in India and Southeast Asia

3.6 SWOT Analysis

3.7 Porters Five Forces

3.8 Competition Ecosystem

4. Global Ashwagandha Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Organic Ashwagandha

4.1.2 Conventional Ashwagandha

4.2 By Application (In Value %)

4.2.1 Dietary Supplements

4.2.2 Functional Food and Beverages

4.2.3 Pharmaceuticals

4.2.4 Cosmetics and Personal Care Products

4.3 By Distribution Channel (In Value %)

4.3.1 Offline (Retail, Pharmacy)

4.3.2 Online

4.4 By End-User (In Value %)

4.4.1 Individual Consumers

4.4.2 Commercial Buyers (Pharmaceutical Companies, FMCG)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East and Africa

5. Global Ashwagandha Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1 Natreon Inc.

5.1.2 Ixoreal Biomed Inc. (KSM-66)

5.1.3 Himalaya Drug Company

5.1.4 Organic India Pvt Ltd.

5.1.5 Dabur India Ltd.

5.1.6 Nature's Way Products, LLC

5.1.7 Herbalife International

5.1.8 Gaia Herbs

5.1.9 Jarrow Formulas

5.1.10 Pukka Herbs

5.1.11 Banyan Botanicals

5.1.12 NOW Foods

5.1.13 Swanson Health Products

5.1.14 Life Extension

5.1.15 NutraScience Labs

5.2 Cross Comparison Parameters (Product Portfolio, Global Reach, Revenue, Market Share, R&D Initiatives, Product Innovation, Certifications, Sustainability Practices)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Funding

6. Global Ashwagandha Market Regulatory Framework

6.1 International Standards for Herbal Supplements

6.2 Organic Certifications and Labeling Guidelines

6.3 Import/Export Regulations

7. Global Ashwagandha Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Ashwagandha Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By End-User (In Value %)

8.5 By Region (In Value %)

9. Global Ashwagandha Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial stage, we identified the critical variables influencing the Ashwagandha market. Through desk research, we analyzed market stakeholders, such as manufacturers, suppliers, and retailers, to form an ecosystem map. This allowed us to gain insights into the factors driving the demand for Ashwagandha-based products.

Step 2: Market Analysis and Construction

We gathered and analyzed historical data on the global Ashwagandha market, assessing key metrics such as market growth rates, consumer preferences, and distribution channels. Our analysis included identifying the main end-use segments, including dietary supplements and pharmaceuticals, contributing to overall revenue.

Step 3: Hypothesis Validation and Expert Consultation

Through a combination of interviews with industry experts and CATIs, we validated our hypotheses concerning market trends and growth drivers. Expert consultation provided critical insights on regional market trends and regulatory frameworks, particularly in Asia and North America.

Step 4: Research Synthesis and Final Output

Finally, we synthesized all collected data into a comprehensive report, providing validated market figures and insights. The research process involved engaging with manufacturers and distributors to ensure accuracy in our final projections and market segmentation analysis.

Frequently Asked Questions

01. How big is the global Ashwagandha market?

The global Ashwagandha market is valued at USD 692.9 million, driven by rising consumer awareness of its adaptogenic benefits and increased demand in dietary supplements.

02. What are the challenges in the global Ashwagandha market?

Key challenges include supply chain disruptions, particularly in raw material sourcing, and quality control issues. The lack of standardized certification across markets also creates challenges for global distribution.

03. Who are the major players in the Ashwagandha market?

Major players in the market include Natreon Inc., Ixoreal Biomed Inc., Himalaya Drug Company, Organic India Pvt Ltd., and Dabur India Ltd. These companies dominate due to their strong supply chains and established brand presence.

04. What are the growth drivers of the global Ashwagandha market?

The market is driven by increasing consumer interest in plant-based adaptogens, rising demand for stress-relief products, and expanding applications in the food, beverage, and cosmetics industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.