Global Athleisure Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4070

December 2024

81

About the Report

Global Athleisure Market Overview

- The Global Athleisure Market has expanded significantly in recent years, driven by shifting consumer lifestyles that prioritize health, wellness, and comfort. This growth is fueled by the rising adoption of fitness-conscious lifestyles and a trend toward casual, versatile clothing that transitions seamlessly between active and everyday settings. The global athleisure market is estimated at USD 394.24 billion, with the demand primarily for high-quality, durable apparel that caters to both fitness and fashion needs, as consumers increasingly view athleisure as a staple wardrobe choice.

- North America dominates the market, largely due to high disposable incomes and the strong presence of established brands like Nike and Lululemon. Consumers in the United States and Canada tend to prioritize comfort and utility in daily wear, making athleisure a popular choice. Europe and Asia-Pacific follow closely, with countries such as Germany and Japan witnessing increased consumer preference for performance-enhancing and eco-friendly apparel. This preference is bolstered by rising health awareness and the influence of social media trends.

- Global standards for textile manufacturing require athleisure brands to adhere to safety, quality, and durability criteria. Regulations enforce guidelines to ensure apparel is safe for skin contact, especially important for activewear that interacts with sweat and friction. Compliance with these standards is essential for brands to access global markets, particularly in regions with stringent quality regulations such as the European Union.

Global Athleisure Market Segmentation

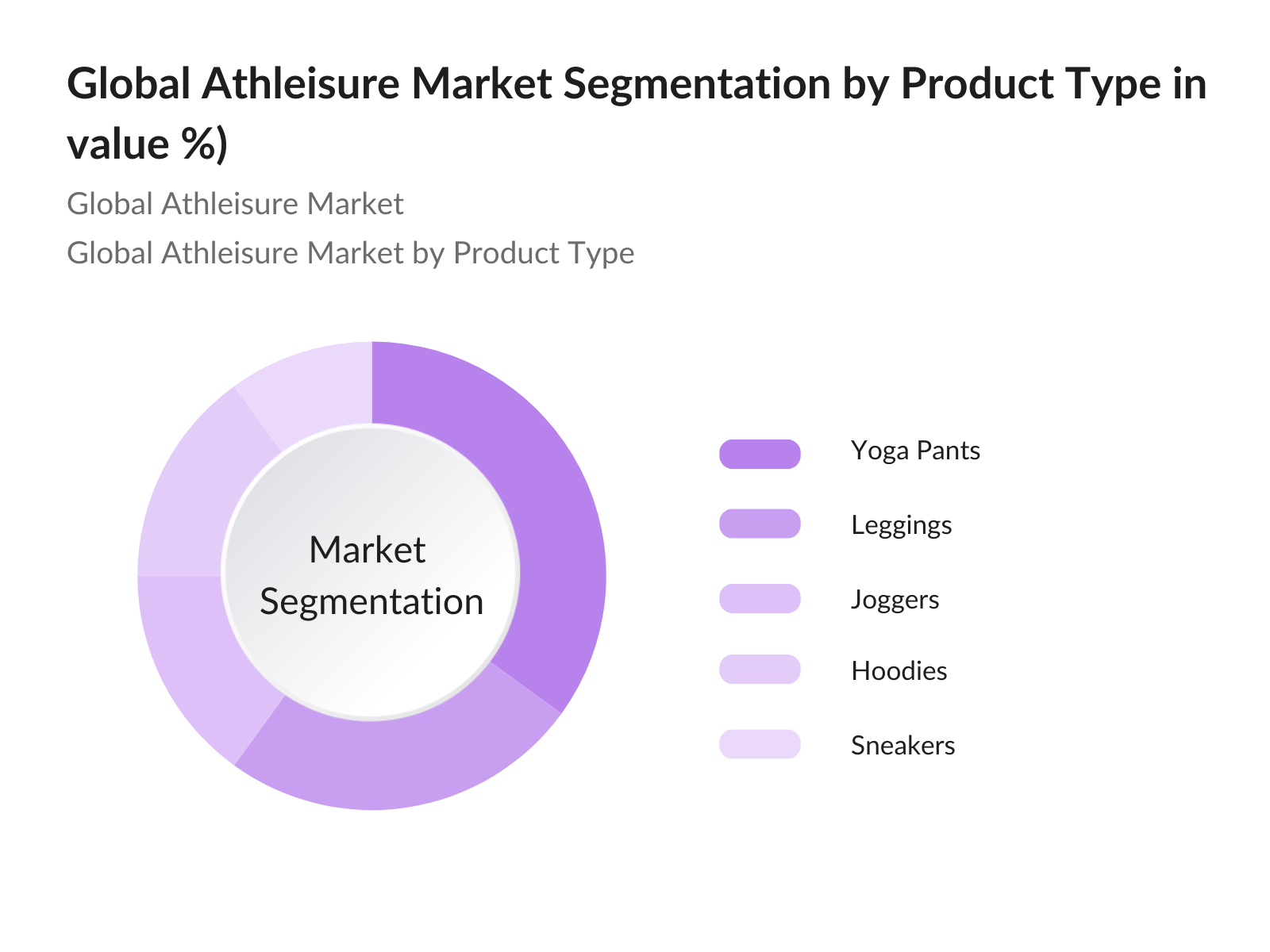

- By Product Type:The Global Athleisure Market is segmented by product type into yoga pants, leggings, joggers, hoodies, and sneakers. Yoga pants hold a dominant position due to their versatility and comfort, appealing to consumers for both athletic activities and casual wear. Yoga pants have become synonymous with the athleisure trend, promoted by various lifestyle and fitness influencers. This dominance is reinforced by consumer preference for stylish yet functional garments, which have become a go-to choice for modern wardrobes.

- By Region: The Global Athleisure Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America dominates due to high consumer spending on fitness and fashion apparel and a culture that embraces casual, active lifestyles. Europe, particularly countries like the United Kingdom and Germany, follows with strong demand for premium and sustainable athleisure options. Asia-Pacific is rapidly emerging as a high-growth market, supported by rising disposable incomes, a shift toward fitness, and the influence of Western fashion trends.

Global Athleisure Market Competitive Landscape

The Global Athleisure Market is competitive, with several major brands leading due to their extensive distribution networks, product innovation, and strong brand presence. Companies such as Nike, Adidas, and Lululemon have established dominance through technological advancements and marketing strategies that resonate with health-conscious consumers. This competitive landscape is marked by an emphasis on sustainability and collaborations with influencers, celebrities, and fitness experts to enhance brand appeal.

|

Company |

Establishment Year |

Headquarters |

Employees |

Revenue |

Product Range |

Distribution Network |

Sustainability Initiatives |

Celebrity Partnerships |

|

Nike Inc. |

1964 |

Beaverton, USA |

- |

- |

- |

- |

- |

- |

|

Adidas AG |

1949 |

Herzogenaurach, Germany |

- |

- |

- |

- |

- |

- |

|

Lululemon Athletica Inc. |

1998 |

Vancouver, Canada |

- |

- |

- |

- |

- |

- |

|

Under Armour, Inc. |

1996 |

Baltimore, USA |

- |

- |

- |

- |

- |

- |

|

Puma SE |

1948 |

Herzogenaurach, Germany |

- |

- |

- |

- |

- |

- |

Global Athleisure Market Analysis

Growth Drivers

- Increased Popularity of Fitness and Active Lifestyles: The rising popularity of fitness and active lifestyles is driving demand for athleisure apparel. Global gym memberships reached 230 million in 2023, with consumers spending significantly on fitness-related products and apparel. Furthermore, the World Health Organization reported that an estimated 1.4 billion adults are physically inactive, spurring campaigns worldwide to promote fitness, which positively impacts athleisure demand as people increasingly seek versatile and functional clothing for exercise and everyday wear.

- Expansion of Online Retail and Direct-to-Consumer Models : The growth of e-commerce and direct-to-consumer (DTC) models has made athleisure more accessible to consumers. E-commerce sales for apparel reached over $800 billion in 2023, a significant portion of which was driven by athleisure brands capitalizing on online retail. The shift to DTC platforms allows brands to better control customer experience, gain insights from direct interactions, and build loyal customer bases, enhancing growth in the athleisure market.

- Rising Demand for Casual and Comfortable Apparel in Daily Wear : The demand for versatile, comfortable clothing has accelerated, with athleisure becoming a staple in everyday fashion. In 2023, casual and activewear represented a major portion of clothing sales across North America and Europe, with consumers favoring flexible and multifunctional apparel. The trend reflects a lifestyle shift towards a blend of fitness and leisure in daily wear, increasing athleisure's integration into professional and social settings.

Market Challenges

- Intense Competition and Brand Proliferation: The athleisure market is highly competitive, with a proliferation of brands entering the space. Established brands, niche players, and fast-fashion retailers all vie for market share, leading to saturated competition in key markets like the U.S. and Europe. This crowded landscape forces brands to differentiate themselves through innovation, quality, and brand loyalty strategies, which can create challenges for both new entrants and established players.

- Environmental Concerns Due to Synthetic Fabrics: Environmental concerns associated with synthetic fabrics, like polyester and nylon, pose challenges for athleisure brands. These fabrics, commonly used for their durability and moisture-wicking properties, contribute to microplastic pollution, with an estimated 700,000 microplastic fibers released per washing cycle. The demand for more sustainable production methods and materials is driving brands to explore alternatives, but eco-friendly options often incur higher production costs, impacting profitability.

Global Athleisure Future Market Outlook

Over the next five years, the Global Athleisure Market is anticipated to expand due to increasing consumer preference for versatile, comfort-oriented fashion. Technological innovations in fabrics, growth in e-commerce, and a focus on sustainable and eco-friendly apparel will drive market growth. Additionally, the athleisure trend is expected to gain traction in emerging economies as fitness awareness rises and brands target these regions with accessible, trend-driven products.

Market Opportunities:

- Growth of Wearable Tech-Integrated Apparel : Wearable technology integration is on the rise in the athleisure market, with apparel embedded with fitness trackers, heart rate monitors, and moisture sensors. The global wearables market is projected to add millions of units annually, reflecting consumer interest in combining functionality with fashion. Athleisure brands are leveraging this trend by creating tech-enabled clothing that supports active lifestyles, attracting consumers who prioritize health and convenience.

- Shift Toward Gender-Neutral Collections: The shift towards gender-neutral fashion is influencing athleisure collections, with brands introducing unisex designs to appeal to a broader demographic. This trend aligns with the movement toward inclusivity in fashion, catering to consumers who value versatility and breaking away from traditional gender norms. Brands report increasing demand for gender-neutral apparel, leading to expanded collections that offer comfort, style, and inclusivity across all genders.

Scope of the Report

|

By Product Type |

Yoga Pants Leggings |

|

By End-User |

Women Men Unisex |

|

By Distribution Channel |

Online Retail Specialty Stores Department Stores Hypermarkets/Supermarkets |

|

By Fabric Type |

Synthetic (Polyester, Nylon) Natural (Cotton, Wool) Recycled Materials |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Athletic Apparel Retailers

Sports and Fitness Enthusiasts

Fashion Retail Chains

Specialty Sports Stores

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Federal Trade Commission)

Textile and Fabric Manufacturers

E-commerce Platforms and Marketplaces

Companies

Players Mentioned in the Report

Nike Inc.

Adidas AG

Lululemon Athletica Inc.

Under Armour, Inc.

Puma SE

Columbia Sportswear Company

ASICS Corporation

VF Corporation

Reebok International Limited

The North Face

Fabletics

Gymshark

Patagonia

New Balance

Hanesbrands Inc.

Table of Contents

1. Global Athleisure Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Athleisure Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Athleisure Market Analysis

3.1 Growth Drivers (Health and Wellness Trends, E-commerce Growth, Demand for Comfortable Apparel)

3.1.1 Increased Popularity of Fitness and Active Lifestyles

3.1.2 Expansion of Online Retail and Direct-to-Consumer Models

3.1.3 Rising Demand for Casual and Comfortable Apparel in Daily Wear

3.1.4 Influence of Social Media and Celebrity Endorsements

3.2 Market Challenges (Saturated Market, Sustainability Issues, Supply Chain Complexity)

3.2.1 Intense Competition and Brand Proliferation

3.2.2 Environmental Concerns Due to Synthetic Fabrics

3.2.3 Complex Supply Chain Logistics and Sourcing Constraints

3.3 Opportunities (Sustainable Material Innovation, Personalization, Emerging Markets)

3.3.1 R&D in Sustainable and Recycled Fabrics

3.3.2 Customizable Apparel and Personalization Trends

3.3.3 Rising Popularity in Emerging Economies

3.4 Trends (Tech-Enhanced Apparel, Gender-Neutral Designs, Focus on Eco-Friendly Production)

3.4.1 Growth of Wearable Tech-Integrated Apparel

3.4.2 Shift Toward Gender-Neutral Collections

3.4.3 Increased Focus on Environmentally Friendly and Ethical Production

3.5 Government Regulations (Textile Standards, Labor Laws, Trade Regulations)

3.5.1 Textile Manufacturing Standards for Quality and Safety

3.5.2 Labor Compliance Requirements

3.5.3 Trade Regulations Impacting International Sourcing and Import Tariffs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Global Athleisure Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Yoga Pants

4.1.2 Leggings

4.1.3 Joggers

4.1.4 Hoodies

4.1.5 Sneakers

4.2 By End-User (In Value %)

4.2.1 Women

4.2.2 Men

4.2.3 Unisex

4.3 By Distribution Channel (In Value %)

4.3.1 Online Retail

4.3.2 Specialty Stores

4.3.3 Department Stores

4.3.4 Hypermarkets/Supermarkets

4.4 By Fabric Type (In Value %)

4.4.1 Synthetic (Polyester, Nylon)

4.4.2 Natural (Cotton, Wool)

4.4.3 Recycled Materials

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Athleisure Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nike Inc.

5.1.2 Adidas AG

5.1.3 Lululemon Athletica Inc.

5.1.4 Under Armour, Inc.

5.1.5 Puma SE

5.1.6 Columbia Sportswear Company

5.1.7 ASICS Corporation

5.1.8 VF Corporation

5.1.9 Reebok International Limited

5.1.10 The North Face

5.1.11 Fabletics

5.1.12 Gymshark

5.1.13 Patagonia

5.1.14 New Balance

5.1.15 Hanesbrands Inc.

5.2 Cross Comparison Parameters (Headquarters, Inception Year, Revenue, Product Range, Distribution Channels, Sustainability Initiatives, Technology Integration, Brand Value)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Private Equity Investments

5.6.3 Celebrity Endorsements and Brand Partnerships

6. Global Athleisure Market Regulatory Framework

6.1 Standards for Fabric and Product Safety

6.2 Compliance with Environmental Regulations

6.3 Labor Laws and Ethical Production Requirements

7. Global Athleisure Market Future Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Athleisure Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Fabric Type (In Value %)

8.5 By Region (In Value %)

9. Global Athleisure Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research methodology began with defining the primary variables impacting the athleisure market, such as consumer trends, technological advancements in fabric, and distribution channel preferences. Comprehensive desk research and proprietary data sources were used to understand these dynamics and set the foundation for further analysis.

Step 2: Market Analysis and Construction

The next phase involved collecting and analyzing historical data on product demand, distribution channels, and end-user behavior in the athleisure market. Data on product types and consumer spending habits were examined to ensure accurate and reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth, trends, and competitive positioning were validated through in-depth interviews with industry experts, brand managers, and distribution partners. Their insights provided strategic perspectives and operational insights into the athleisure industry, which were crucial for accurate data alignment.

Step 4: Research Synthesis and Final Output

Data was synthesized to create a comprehensive view of the athleisure market, incorporating both quantitative and qualitative insights. This process ensured an in-depth understanding of the markets structure and growth potential, validated by expert insights and current market dynamics.

Frequently Asked Questions

01. How big is the Global Athleisure Market?

The global athleisure market is valued at approximately USD 394.24 billion, driven by rising consumer interest in fitness-oriented lifestyles and the demand for comfortable, versatile apparel suitable for daily wear.

02.What are the challenges in the Global Athleisure Market?

Challenges include market saturation, sustainability concerns regarding synthetic materials, and complex global supply chains that affect product availability and environmental impact.

03.Who are the major players in the Global Athleisure Market?

Key players include Nike, Adidas, Lululemon, Under Armour, and Puma. These companies lead due to their extensive brand recognition, innovative product lines, and strategic collaborations.

04.What are the growth drivers of the Global Athleisure Market?

Growth drivers include increased health consciousness, expansion of online retail channels, demand for sustainable and high-quality materials, and the influence of social media and celebrity endorsements.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.