Global Auto Finance Market Outlook to 2030

Segmented by Type (New Vehicle and Used Vehicle), Source Type (OEMs, Banks, Credit Union, and Financial Institutions), Vehicle Type (Passenger Cars and Commercial Vehicle), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

Region:Asia

Author(s):Akanksha

Product Code:KROD153

March 2023

70

About the Report

The report provides a comprehensive analysis of the potential of the Auto Finance industry Globally. The report covers an overview and genesis of the industry, and market size in terms of credit disbursed.

Its market segmentations include by types of vehicles financed, distribution channel, tenure for new and used vehicles, purpose type, types of commercial and passenger vehicles, Geography; growth enablers and drivers; challenges and bottlenecks; trends driving adoption trends; regulatory framework; end-user analysis, industry analysis, competitive landscape including competition scenario and market shares of major players. The report concludes with future market projections of each market segmentation and analyst recommendations.

Market Overview:

According to Ken Research estimates, the demand for automobiles has increased significantly since the latter part of the year, which has propelled the automotive finance industry and is likely to continue to fuel the market over the projection period. The global auto finance market was valued at USD ~250 billion in 2022 and is projected to grow to USD 400 Billion by 2027, growing at a robust CAGR from 2022 to 2027.

- The Asia-Pacific region is expected to lead the Auto Finance market, followed by North America and Europe. The region is expected to provide several growth opportunities for market vendors during the forecast period.

- Banks have been the dominant players as they have a huge pre-built database that they leverage for their own advantage.

- The market for automotive financing for passenger cars is projected to rise as spending power rises, the number of female drivers increases, customers' lifestyles change, the level of automotive manufacturing grows, and the market for fuel-efficient vehicles increases.

Key Trends by Market Segment:

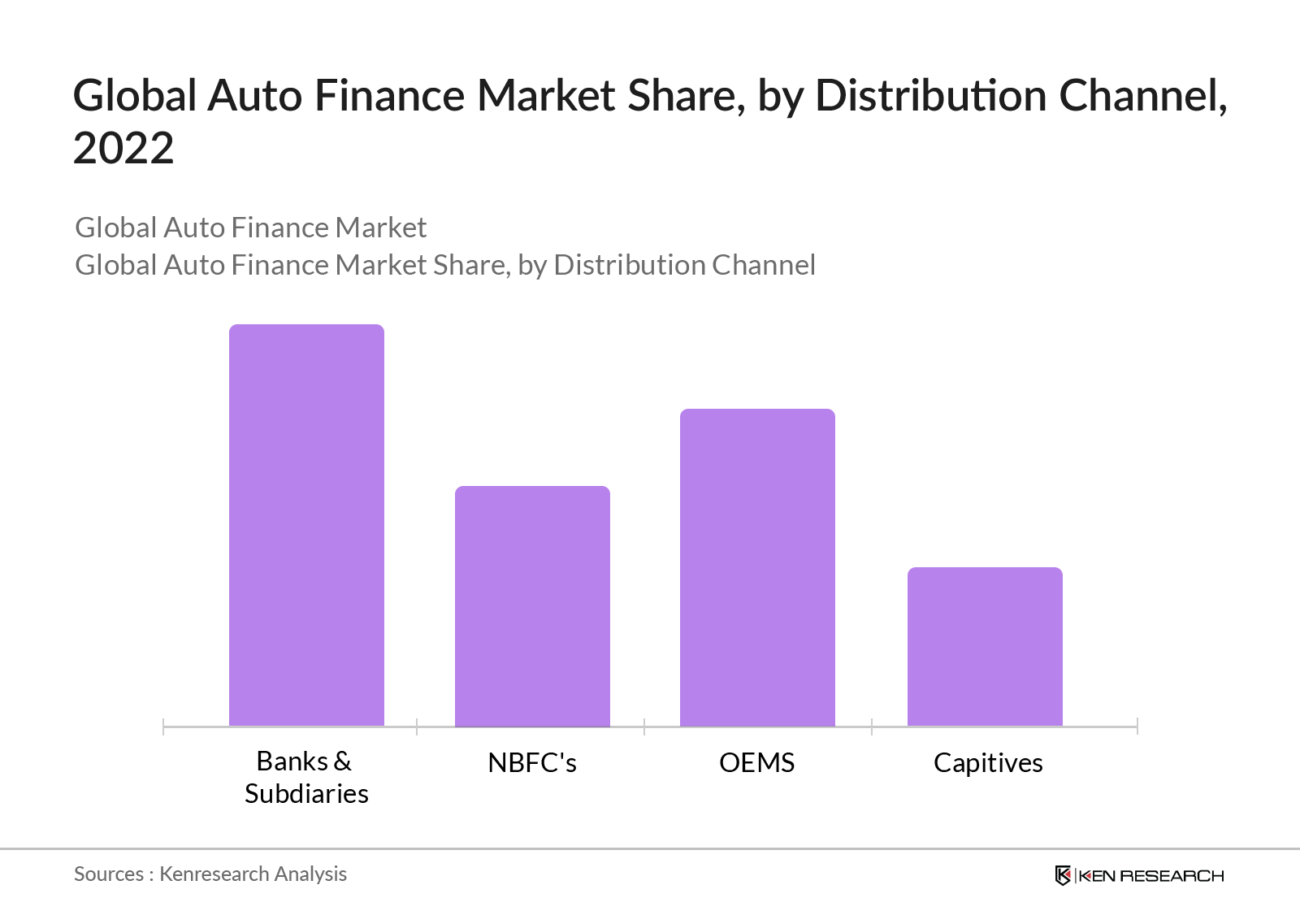

By Distribution Channel: In terms of Distribution Channels, the banks hold the maximum size, increasingly adopting digital automotive finance in order to meet the changing customer needs across the globe. However, the OEM segment is expected to grow at the highest rate during the forecast period as it provides better after-sales services due to the availability of identical automobile parts.

By Type of Financing: The commercial vehicles segment is anticipated to witness significant growth during the forecast period. Since, commercial vehicles are expensive in comparison to other vehicles, numerous banks, and financial institutions have introduced reasonable loan schemes, which include simple terms and conditions. Moreover, the processing time needed to approve commercial vehicle loans is less in comparison to passenger vehicles.

Competitive Landscape

Future Outlook

The Global Auto Finance Market will witness significant growth during the period 2022-2027, owing to increasing investments in autonomous vehicles, growing demand for EVs, and Government investment. Over the forecast period, Asia-Pacific is expected to be the fastest-growing regional market. The increasing number of favourable government initiatives in economies such as India, Japan, and China to promote the automotive industry's growth and maintain consumer interest is expected to create opportunities for the growth of the regional market.

Moreover, advanced technologies like blockchain, AI, digital payment systems, and online mobile banking systems, will be the most prominent technologies used by financial industries, to provide the best auto loan services to clients. Heavy investments in the automobile industry, robust R&D programs, rising penetration of electric cars, and the implementation of autonomous vehicles are just a few of the factors that will drive the Auto Finance industry forward.

Scope of the Report

|

By Vehicle financed |

New cars Used cars Motorcycles |

|

By Distribution channels |

Banks & Subsidiaries NBFC's OEMS Captives |

|

By Type of Financing |

Passenger Vehicles Commercial Vehicles |

|

By purpose type |

Loans Lease |

|

By Tenure of the loans |

1 year 2 years 3 years 4 years 5 year and above |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

Banks and its Subsidiaries

NBFCs

Captive Finance Companies

Government and Institutions

Automobile Companies

Car Dealers

Government and Institutions

Existing Car Finance Companies

OEM Dealerships

New Market Entrants

Investors

Auto mobile Associations

Time Period Captured in the Report

Historical Period: 2017-2022

Base Period: 2022

Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report

Captives

BMW Financial Services

Toyota Financial Services

GM Financial

Honda Financial Services

Subaru Motors Finance

Mercedes-Benz Financial Services (Daimler)

Ford Credit

Volkswagen Credit

Hyundai Motor Finance

Lexus Financial Services

Non-Captives

Ally Financial

Bank of America

Santander

Wells Fargo

Chase

Capital one

FIDITALIA

Table of Contents

1. Executive Summary

2. Global Auto Finance Market Overview

2.1 Taxonomy of Global Auto Finance Market

2.2 Industry Value Chain

2.3 Ecosystem

2.4 Government Regulations/Initiatives for Global Auto Finance Market

2.5 Growth Drivers of Global Auto Finance Market

2.6 Issues and Challenges of Global Auto Finance Market

2.7 Impact of COVID-19 on Global Auto Finance Market

2.8 PESTLE/SWOT Analysis

3. Global Auto Finance Market Size, 2017 – 2022

4. Global Auto Finance Market Segmentation

4.1 By Vehicle Financed, 2017 - 2022

4.2 By Tenure of the loans, 2017 - 2022

4.3 By Regional Split (North America/Europe/Asia-Pacific/Latin America/Middle East & Africa), 2017 - 2022

5. Competitive Landscape

5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

5.2 Strategies Adopted by Leading Players

5.3 Company Profiles – (Top 5 - 7 Major Players)

5.3.1 BMW Financial Services

5.3.2 Toyota Financial Services

5.3.3 GM Financial

5.3.4 Honda Financial Services

5.3.5 Subaru Motors Finance

5.3.6 Mercedes-Benz Financial Services (Daimler)

5.3.7 Ford Credit

6. Global Auto Finance Future Market Size, 2022 – 2027

7. Global Auto Finance Future Market Segmentation

7.1 By Vehicle Financed, 2022 - 2027

7.2 By Tenure of the loans, 2022 - 2027

7.3 By Regional Split (North America/Europe/Asia-Pacific/Latin America/Middle East & Africa), 2022 - 2027

8. Analyst Recommendations

9. Research Methodology

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Exhaustive research is done to identify the list of major players which have a presence in the Auto Finance Market Globally.

Step 2: Market Building:

Exhaustive secondary research done on the Auto Finance Market. Gathered information on the Auto Finance Market from several industry articles, company websites, blogs, and industry reports and also gathered data points from our proprietary database.

Step 3: Validating and Finalizing:

Conducted interviews with the management of the companies (C-level executives, Business Development head, Regional Head, Operations Manager, Area Sales Manager, & others).

Step 4: Research output:

To validate the data points gathered from the interviews, our team then did mystery calling to the companies dealing in the Auto Finance Market Globally. The team also tried to understand their operating and financial indicators including revenue, business models, geographical presence, focus areas, business verticals, and services offered among others.

Frequently Asked Questions

01 How big is global automotive finance market?

The global auto finance market reached USD 250 billion in 2022.

02 What are the driving forces in the global automotive finance market?

Increasing purchasing power of the consumers, adoption of digital echnlogies, government investments, and increase in vehicle pricing are the factors driving the growth of global auto finance market.

03 What is the future of global automotive finance market?

The global automotive market is expected to reach USD 400 billion with a CAGR of 7% during the forecast period 2022-2027.

04 Which are the major auto finance companies in global auto finance market?

Ally Financial, Capital One, Bank of America, Chase Auto finance, Ford Motor Credit Company, and Daimler Financial Services are some of the major companies in global auto finance market.

05 Which is the largest distriution channel global auto finance market?

Banks & and subsidiaries have the highest market share in global auto finance market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.