Global Automatic Mower Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD8747

December 2024

93

About the Report

Global Automatic Mower Market Overview

- The global automatic mower market, valued at USD 5.2 billion, is influenced by several dynamic factors that support its growing demand. The market's growth is primarily driven by advancements in robotics technology, increased labor costs, and a growing trend toward sustainable landscaping. These factors have contributed to the adoption of automatic mowers, which offer efficient, low-maintenance solutions that align well with both residential and commercial applications. Additionally, the ease of integration with smart home systems further boosts consumer interest in this market.

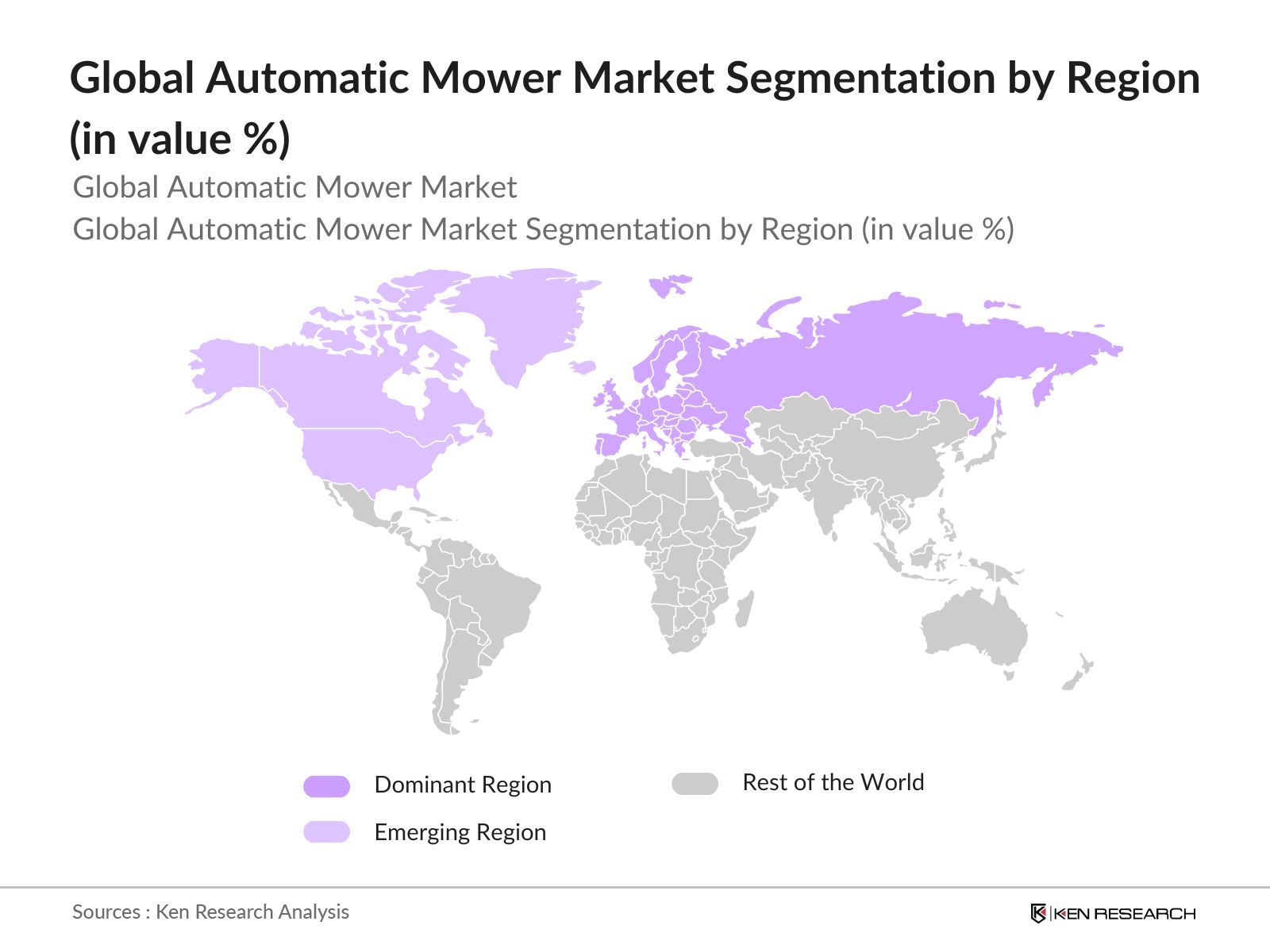

- Regions such as North America and Europe lead the market due to strong technological infrastructure and high consumer adoption of smart devices. The adoption rate in these regions is further propelled by favorable environmental regulations and substantial disposable incomes. In Europe, specifically, the inclination toward sustainability and noise-reduction standards makes automatic mowers a preferred choice in urban areas, thereby establishing these regions as key players in market dominance.

- Automatic mowers are subject to stringent safety standards to prevent accidents and ensure consumer protection. The European Commission recently updated its General Product Safety Directive in 2023, introducing stricter guidelines on robotic equipment safety, impacting mower design and manufacturing. Compliance with these standards is essential for market access, driving investments in safety technology among manufacturers.

Global Automatic Mower Market Segmentation

- By Product Type: The market is segmented by product type into robotic lawn mowers, walk-behind mowers, and ride-on mowers. Among these, robotic lawn mowers hold a dominant share due to their advanced technology, autonomy, and compatibility with smart systems. As they offer users the ability to schedule and control mowing remotely, robotic mowers align well with the increasing trend toward smart home integration.

- By Power Source: Power sources for automatic mowers include battery-powered, solar-powered, and hybrid models. Battery-powered mowers dominate due to their reliability and efficiency, especially in residential applications. Their high adaptability to different terrains and minimal environmental impact make them favorable in markets focused on sustainability, such as North America and Europe.

- By Region: Regional segmentation of the automatic mower market encompasses North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Europe dominates, particularly in countries like Germany, France, and the United Kingdom, where demand is fueled by a strong focus on sustainability and regulatory standards regarding noise and emissions. Furthermore, the established landscape industry and high urbanization rates contribute to Europe's leading market position.

Global Automatic Mower Market Competitive Landscape

The global automatic mower market is characterized by a few dominant players who set the market's direction through technology, innovation, and strategic expansions. Key players include Husqvarna, Bosch, Honda, and Deere & Company, whose market presence and technology investments define their market positions.

|

Company |

Establishment Year |

Headquarters |

Manufacturing Capacity |

Product Portfolio |

Regional Focus |

R&D Investments |

Revenue (USD bn) |

|

Husqvarna Group |

1689 |

Sweden |

- |

- |

- |

- |

- |

|

Bosch Ltd. |

1886 |

Germany |

- |

- |

- |

- |

- |

|

Honda Motor Co. |

1948 |

Japan |

- |

- |

- |

- |

- |

|

Deere & Company |

1837 |

USA |

- |

- |

- |

- |

- |

|

Robomow (MTD) |

1995 |

Israel |

- |

- |

- |

- |

- |

Global Automatic Mower Market Analysis

Market Growth Drivers

- Rising Labor Costs and Scarcity: The global labor market has seen a steady increase in wages, making automated solutions like robotic mowers a viable alternative in many regions. As per the International Labour Organization, in the U.S., labor costs for landscaping roles increased notably between 2022 and 2024, reaching $20 per hour due to labor scarcity across sectors. Similar trends are observed in Western Europe, with a 5% rise in hourly labor rates in fields requiring physical work like landscaping. The rise in costs highlights a financial incentive for adopting automatic mowers, particularly for commercial properties looking to cut long-term expenses.

- Shift Towards Sustainable Landscaping Solutions: There is a growing demand for sustainable landscaping solutions, driven by environmental concerns. Electric-powered automatic mowers, which are generally zero-emission, align with global green initiatives. As of 2024, the European Environment Agency notes a 4% annual increase in electric mower adoption as industries and municipalities seek to lower carbon footprints. Furthermore, aligning with international commitments like the EUs Green Deal, many regions incentivize using electric-powered tools over fuel-powered alternatives, boosting market adoption.

- Expanding Residential and Commercial Usage: Automatic mowers are being increasingly adopted in both residential and commercial settings, driven by factors such as convenience and cost-effectiveness. The U.S. National Association of Home Builders indicated a 3% year-over-year increase in residential landscaping enhancements between 2022 and 2024. The commercial landscaping industry has also seen adoption, with large-scale properties turning to automation to reduce ongoing maintenance efforts.

Market Challenges

- High Initial Cost and Maintenance Concerns: High upfront costs and ongoing maintenance requirements remain major barriers for many potential users. Data from the U.S. Bureau of Labor Statistics indicate that consumers spend an average of $500 annually on manual landscaping tools, while the initial investment in robotic mowers is higher. Despite potential long-term savings, these costs deter lower-budget residential and small commercial users from adopting the technology.

- Limited Adaptability to Complex Terrains: Automatic mowers face challenges operating on complex terrains, which limits their utility in hilly or uneven landscapes. A survey by Japans Ministry of Land, Infrastructure, Transport and Tourism in 2024 found that only 60% of rural landscaping equipment meets the technical requirements for efficient slope navigation. This limitation in adaptability restricts broader adoption of automatic mowers in regions with challenging geographical landscapes

Global Automatic Mower Market Future Outlook

The global automatic mower market is positioned for steady growth, supported by continuous advancements in autonomous technology and an increasing emphasis on eco-friendly, low-emission landscaping solutions. With the ongoing integration of AI and IoT, automatic mowers are anticipated to become more intelligent and energy-efficient, making them an attractive solution for both residential and commercial applications. Rising labor costs in developed economies further highlight the demand for such innovative solutions, solidifying the markets trajectory.

Market Opportunities

- Integration of AI for Enhanced Efficiency: Integrating AI can improve automatic mower efficiency by enabling autonomous decision-making based on real-time data. For example, Japan's Ministry of Economy, Trade and Industry has noted that AI integration in landscaping technology increased by 8% between 2022 and 2024, improving productivity. With AI advancements, these mowers can now optimize mowing patterns, reduce power consumption, and autonomously navigate complex landscapes, enhancing the market appeal for large-scale commercial applications.

- Expansion into Emerging Markets: Emerging markets like Southeast Asia and Latin America are beginning to see increased demand for automation in landscaping. According to the World Bank, these regions have seen a 6% year-over-year increase in household income between 2022 and 2024, allowing more residential consumers to invest in automated solutions. This growth in disposable income makes robotic mowers more accessible, presenting a market expansion opportunity for manufacturers targeting price-sensitive markets

Scope of the Report

|

Product Type |

Robotic Lawn Mowers Walk-Behind Ride-On |

|

Power Source |

Battery-Powered Solar-Powered Hybrid |

|

Technology |

Self-Learning Algorithms GPS App-Control |

|

End-User |

Residential Commercial Landscaping Sports |

|

Distribution Channel |

Online Offline Retail Specialty Stores |

Products

Key Target Audience

Residential Landscaping Companies

Commercial Landscaping Service Providers

Urban Development Agencies (Local Government Entities)

Environmental Regulatory Bodies (Environmental Protection Agency, European Environmental Agency)

Smart Home Product Integrators

Banks and Financial Institutions

Automated Equipment Retailers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Department of Energy, National Institute of Standards and Technology)

Companies

Players Mentioned in the Report

Husqvarna Group

Bosch Ltd.

Honda Motor Co.

Deere & Company

Robomow (MTD Products)

Worx (Positec Tool Corporation)

STIGA S.p.A.

AL-KO Kober Group

Cub Cadet

Mamibot

Table of Contents

1. Global Automatic Mower Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Industry Landscape Overview

2. Global Automatic Mower Market Size

2.1 Historical Market Size (Revenue in USD Billion)

2.2 Key Market Milestones

2.3 Market Growth Rate Analysis

2.4 Market Investment Trends

3. Global Automatic Mower Market Analysis

3.1 Growth Drivers

3.1.1 Rising Labor Costs and Scarcity

3.1.2 Technological Advancements in Sensor Technology

3.1.3 Shift Towards Sustainable Landscaping Solutions

3.1.4 Expanding Residential and Commercial Usage

3.2 Market Challenges

3.2.1 High Initial Cost and Maintenance Concerns

3.2.2 Limited Adaptability to Complex Terrains

3.2.3 Dependency on Weather Conditions

3.3 Opportunities

3.3.1 Integration of AI for Enhanced Efficiency

3.3.2 Expansion into Emerging Markets

3.3.3 Partnerships with Smart Home Technology Providers

3.4 Trends

3.4.1 Adoption of Solar-Powered Models

3.4.2 Integration with IoT Ecosystems

3.4.3 Growing Popularity of Fleet Management Solutions

3.5 Regulatory Environment

3.5.1 Safety Standards and Compliance

3.5.2 Environmental Regulations

3.5.3 Noise Emission Standards

3.6 Competitive Landscape Analysis

3.7 Porters Five Forces Model

3.8 SWOT Analysis

3.9 Stakeholder Ecosystem

4. Global Automatic Mower Market Segmentation (In Value %)

4.1 By Product Type

4.1.1 Robotic Lawn Mowers

4.1.2 Walk-Behind Lawn Mowers

4.1.3 Ride-On Mowers

4.2 By Power Source

4.2.1 Battery-Powered

4.2.2 Solar-Powered

4.2.3 Hybrid Models

4.3 By Technology

4.3.1 Self-Learning Algorithms

4.3.2 GPS-Enabled Models

4.3.3 Smart App-Controlled Systems

4.4 By End-User

4.4.1 Residential

4.4.2 Commercial Landscaping

4.4.3 Sports & Recreational Facilities

4.5 By Distribution Channel

4.5.1 Online

4.5.2 Offline Retail

4.5.3 Specialty Stores

5. Global Automatic Mower Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Husqvarna Group

5.1.2 Bosch Ltd.

5.1.3 Honda Motor Co.

5.1.4 Deere & Company

5.1.5 Robert Bosch GmbH

5.1.6 Robomow (MTD Products)

5.1.7 Worx (Positec Tool Corporation)

5.1.8 STIGA S.p.A

5.1.9 AL-KO Kober Group

5.1.10 Cub Cadet

5.1.11 Mamibot

5.1.12 Redback

5.1.13 Hangzhou Favor Robot Tech

5.1.14 FutureGen Robotics

5.1.15 Kobi Company

5.2 Cross Comparison Parameters (Market Presence, Manufacturing Capacity, Product Portfolio, Regional Focus, R&D Investments, Revenue, Strategic Alliances, Customer Base)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Landscape

5.7 Venture Capital Trends

5.8 Government Incentives and Support

5.9 Technological Collaboration

6. Global Automatic Mower Market Regulatory Framework

6.1 Compliance Standards

6.2 Environmental Standards for Product Design

6.3 Product Safety Certifications

7. Global Automatic Mower Market Future Segmentation

7.1 By Product Type

7.2 By Power Source

7.3 By Technology

7.4 By End-User

7.5 By Distribution Channel

8. Market Analysts Recommendations

8.1 Emerging Demand Trends

8.2 TAM/SAM/SOM Analysis

8.3 Customer Preference Shifts

8.4 Product Positioning Insights

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The process begins with a comprehensive ecosystem analysis, identifying major stakeholders in the automatic mower market. Extensive desk research is utilized to compile relevant information from both secondary and proprietary sources, establishing critical variables affecting market trends.

Step 2: Market Analysis and Construction

This phase involves gathering and assessing historical data for the automatic mower market. It covers analysis metrics such as product performance, distribution channels, and end-user engagement to ensure accurate insights and trends.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are then validated through expert consultations, using Computer-Assisted Telephone Interviews (CATI) with professionals from leading companies in the industry. These discussions provide critical insights into operational efficiencies and future growth perspectives.

Step 4: Research Synthesis and Final Output

The final stage incorporates data synthesis from interviews with top automatic mower manufacturers. This step verifies findings and finalizes an in-depth market analysis, creating a robust and accurate market overview.

Frequently Asked Questions

01. How big is the Global Automatic Mower Market?

The global automatic mower market was valued at USD 5.2 billion, driven by technological innovations, increased adoption of smart devices, and a shift toward low-maintenance landscaping solutions.

02. What are the challenges in the Global Automatic Mower Market?

Challenges in the market include high initial costs, limited adaptability on complex terrains, and dependency on favorable weather conditions, which restricts market expansion in some regions.

03. Who are the major players in the Global Automatic Mower Market?

Key players include Husqvarna Group, Bosch, Honda, Deere & Company, and Robomow (MTD Products), recognized for their technological advancements, extensive portfolios, and strategic partnerships.

04. What are the growth drivers of the Global Automatic Mower Market?

The market's growth is fueled by rising labor costs, technological integration with smart homes, and a focus on sustainable landscaping practices, encouraging the adoption of autonomous mowers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.