Global Automotive Bumpers Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD6655

December 2024

99

About the Report

Global Automotive Bumpers Market Overview

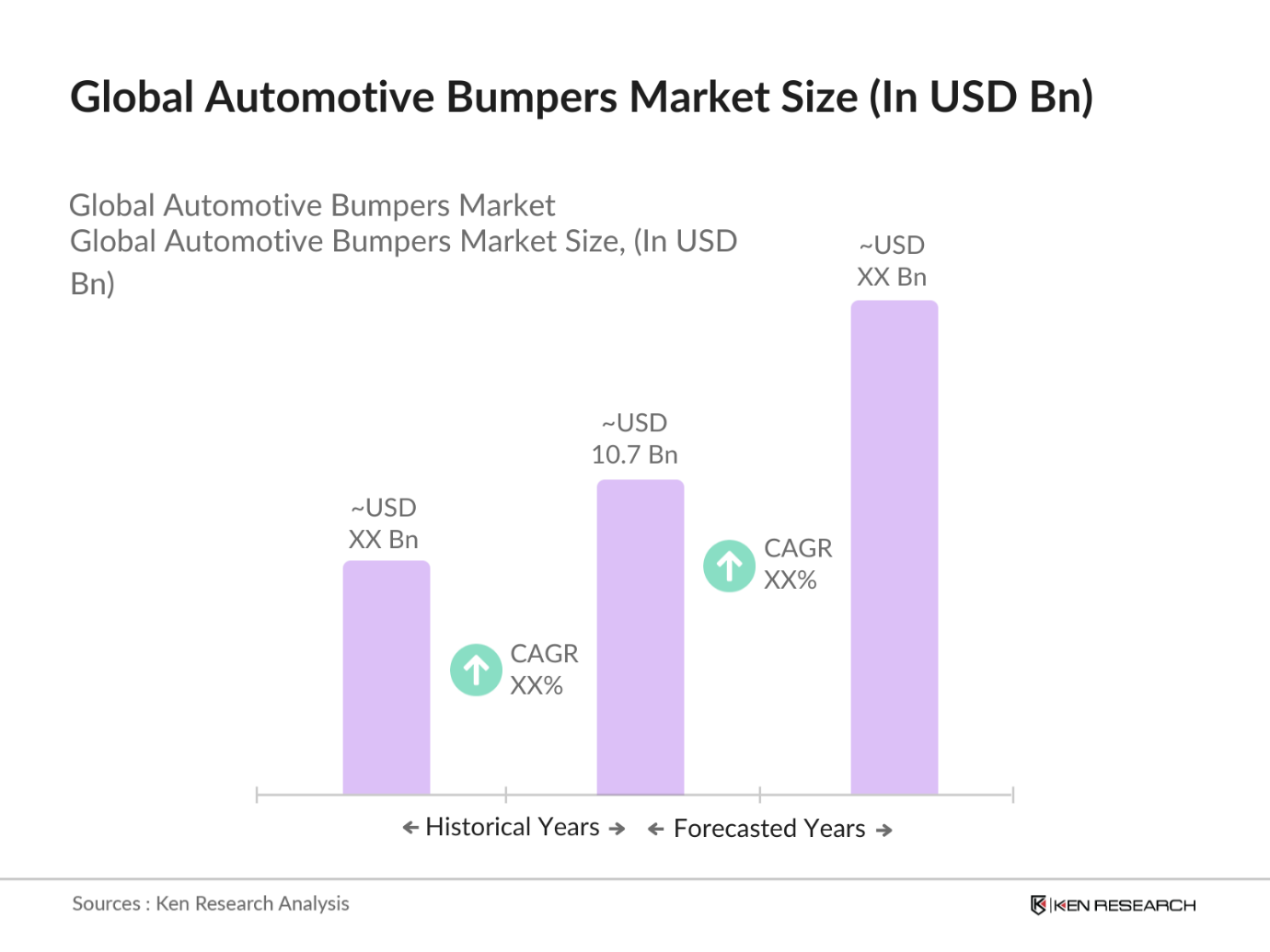

- The Global Automotive Bumpers Market is valued at USD 10.7 billion, driven by increasing vehicle production and advancements in material technology. Automotive bumpers are an essential component in vehicles, providing both safety and aesthetic appeal. Lightweight materials like polypropylene and polycarbonate are becoming increasingly popular as manufacturers aim to improve vehicle fuel efficiency and comply with stringent emission regulations. This growing demand for fuel-efficient vehicles directly contributes to the increasing market size for automotive bumpers.

- Countries such as China, the United States, and Germany dominate the market due to their high vehicle production rates, technological advancements, and strong automotive industries. China, in particular, benefits from being the largest producer and consumer of vehicles globally, while Germanys established automotive industry and continuous innovations in safety features maintain its prominence. The U.S. market thrives on its focus on advanced safety standards and a large consumer base for both new and used vehicles.

- Governments are enforcing stricter recycling and sustainability initiatives that impact automotive bumper manufacturing. The EUs End-of-Life Vehicle (ELV) Directive mandates that 85% of materials used in vehicles must be recyclable. In 2023, the U.S. implemented new guidelines promoting the use of recycled materials in automotive production. These regulations are encouraging automakers to incorporate sustainable materials, such as bio-based composites and recycled plastics, into their bumper designs. This shift toward a circular economy model is driving innovation in materials and manufacturing processes.

Global Automotive Bumpers Market Segmentation

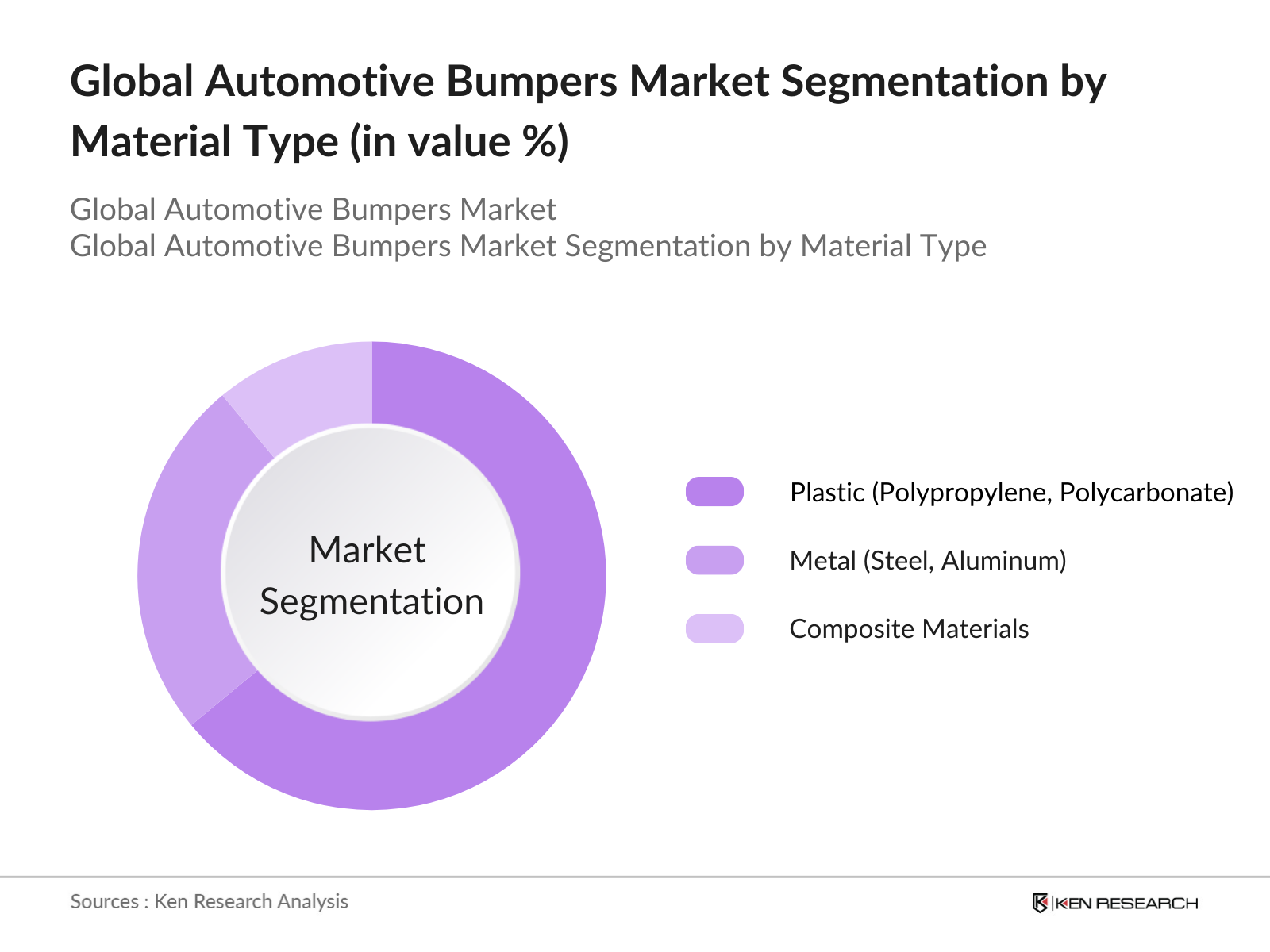

- By Material Type: The Global Automotive Bumpers Market is segmented by material type into plastic (polypropylene, polycarbonate), metal (steel, aluminum), and composite materials (carbon fiber reinforced plastics, glass fiber reinforced plastics). Recently, plastic bumpers, particularly polypropylene, have dominated the market due to their lightweight properties and cost-effectiveness. This material significantly reduces vehicle weight, improving fuel efficiency, which is a critical demand driver in the automotive industry, especially with rising fuel prices and strict emission regulations worldwide. Additionally, plastic bumpers offer flexibility, making them easier to manufacture and repair.

- By Region: The Global Automotive Bumpers Market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific holds the dominant market share due to the booming automotive industries in China, India, and Japan. Chinas position as the worlds largest automotive producer and the rising demand for fuel-efficient and electric vehicles in the region further solidifies its dominance. Additionally, favorable government policies in the region supporting local manufacturing and vehicle safety regulations contribute to its market leadership.

- By Vehicle Type: The Global Automotive Bumpers Market is segmented by vehicle type into passenger vehicles, commercial vehicles, and electric vehicles. Passenger vehicles hold the dominant market share due to their higher production volume globally. The increasing demand for SUVs and crossovers, particularly in North America and Europe, also contributes to the significant share of passenger vehicles. Furthermore, consumer preferences for safety and durability in these vehicles drive the demand for bumpers designed to absorb impacts effectively, making this segment a key contributor to the market.

Global Automotive Bumpers Market Competitive Landscape

The Global Automotive Bumpers Market is consolidated, with a few major players dominating the market. Companies like Magna International, Plastic Omnium, and Faurecia lead the market due to their extensive product portfolios, innovative designs, and partnerships with top automotive manufacturers. These companies are consistently investing in research and development (R&D) to produce lightweight and energy-absorbing bumpers that meet the stringent safety standards globally. The competitive landscape highlights the importance of innovation and strong relationships with automotive OEMs.

Global Automotive Bumpers Industry Analysis

Growth Drivers

- Increasing Vehicle Production (Passenger Vehicles, Commercial Vehicles): The automotive industry has witnessed a steady rise in vehicle production due to growing demand, particularly in emerging markets. For instance, China alone produced over 27 million vehicles in 2022, maintaining its status as the world's largest automobile producer. Similarly, the U.S. saw production exceed 10 million units, with a notable recovery in commercial vehicle output. The rise in demand for passenger and commercial vehicles in markets such as India, with over 4.5 million vehicles produced in 2022, is fueling the growth of automotive bumpers. This increase in production is directly impacting the demand for bumpers.

- Demand for Lightweight Materials (Polypropylene, Polycarbonate, Polyurethane): The push for fuel efficiency and compliance with environmental standards has driven automakers to adopt lightweight materials for bumper manufacturing. For instance, the average vehicle weight reduction targets in the European Union are aligned with emissions reduction efforts. Lightweight materials like polypropylene and polyurethane are now commonly used in bumper production, contributing to fuel savings. The demand for these materials is backed by the 20-30 kg weight reduction observed per vehicle using these materials, helping automakers meet strict emission targets set by regulators in the EU and U.S.

- Stringent Safety Regulations (Crash Test Standards, ISO Safety Norms): Automotive bumpers are a critical component for ensuring vehicle safety compliance. With the tightening of global crash test standards, such as Euro NCAP and U.S. NHTSA regulations, the bumper design has evolved to absorb greater impact. In 2023, Europe set new standards requiring vehicles to withstand higher frontal collision forces, increasing the demand for enhanced bumper technology. The ISO safety norms for materials used in bumper manufacturing have also become more stringent, further boosting the demand for advanced materials and technologies in bumper production.

Market Restraints

- Fluctuating Raw Material Prices (Plastic Resins, Aluminum, Steel): The automotive bumper market faces significant challenges due to volatile raw material prices. For instance, the price of plastic resins, essential for producing lightweight bumpers, rose by 18% from 2022 to 2023, impacting production costs. Aluminum and steel, which are also used in bumper manufacturing, have seen fluctuations due to global supply chain disruptions and geopolitical tensions. Aluminum prices rose to $2,500 per ton in 2023, while steel prices also saw a 15% increase. These price variations pose challenges for manufacturers trying to maintain cost-effective production.

- High Cost of Advanced Materials (Carbon Fiber Reinforced Plastics, Aluminum): While carbon fiber-reinforced plastics (CFRP) and advanced aluminum alloys are favored for their lightweight and strength properties, their high cost is a significant barrier to widespread adoption. CFRP prices remain high at around $40 per kilogram, making it a costly option for mass-market vehicles. Similarly, advanced aluminum used in bumper production is priced at $2,500 per ton as of 2023, which increases the production costs for manufacturers. These elevated material costs make it challenging for automakers to adopt such materials on a larger scale, especially for budget vehicles.

Global Automotive Bumpers Market Future Outlook

Over the next five years, the Global Automotive Bumpers Market is expected to show steady growth, driven by increasing vehicle production, advancements in material technology, and rising consumer demand for lightweight and fuel-efficient vehicles. Stringent government regulations regarding vehicle safety and emissions are expected to drive the adoption of advanced bumper materials and designs. Additionally, the growing demand for electric vehicles and the increasing focus on sustainability will also contribute to the evolution of the market.

Market Opportunities

- Adoption of Advanced Manufacturing Technologies (3D Printing, Automation, AI): The adoption of advanced manufacturing technologies, such as 3D printing, automation, and artificial intelligence (AI), is revolutionizing the automotive bumper market. In 2023, automakers like BMW and Ford increased their use of 3D printing for prototype development and limited production, resulting in cost savings and faster product cycles. Automation in production processes has reduced labor costs and improved precision in manufacturing. AI integration is enhancing the design of bumpers, particularly in incorporating sensors and cameras for safety features. These technologies offer significant opportunities for growth and innovation in bumper production.

- Growth in Electric Vehicles (EV Bumpers, Lightweight Bumpers): The electric vehicle (EV) market is expanding rapidly, driving demand for lightweight bumpers that improve energy efficiency. In 2022, global EV sales surpassed 10 million units, with China accounting for over 6 million of those sales. EV manufacturers are increasingly adopting lightweight bumpers made of plastic composites to reduce vehicle weight and enhance battery efficiency. This trend is expected to continue, particularly in regions like Europe and North America, where governments are incentivizing the adoption of electric vehicles through subsidies and infrastructure development.

Scope of the Report

|

By Material Type |

Plastic (Polypropylene, Polycarbonate) |

|

Metal (Steel, Aluminum) |

|

|

Composite Materials (Carbon Fiber Reinforced Plastics) |

|

|

By Vehicle Type |

Passenger Vehicles |

|

Commercial Vehicles |

|

|

Electric Vehicles |

|

|

By Sales Channel |

OEM (Original Equipment Manufacturer) |

|

Aftermarket |

|

|

By End-use |

On-road Vehicles |

|

Off-road Vehicles |

|

|

By Region |

North America |

|

Europe |

|

|

Asia-Pacific |

|

|

Latin America |

|

|

Middle East & Africa |

Products

Key Target Audience

Automotive Manufacturers (OEMs)

Bumper Material Suppliers

Automotive Safety Organizations (Euro NCAP, NHTSA)

Automotive Aftermarket Suppliers

Research and Development Firms

Government and Regulatory Bodies (EU Emission Regulations, U.S. CAF Standards)

Investors and Venture Capitalist Firms

Environmental Agencies (End-of-Life Vehicle Directives, Circular Economy Initiatives)

Companies

Players Mentioned in the Report:

Magna International Inc.

Plastic Omnium

Faurecia

Flex-N-Gate Corporation

Hyundai Mobis

SMP Deutschland GmbH

KIRCHHOFF Automotive

Toyoda Gosei Co. Ltd.

Benteler Automotive

Seoyon E-Hwa

SRG Global Inc.

Rehau Group

ABC Group Inc.

Zhejiang Yuanchi Group Co., Ltd.

Jiangnan Mould & Plastic Technology Co., Ltd.

Table of Contents

1. Global Automotive Bumpers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Automotive Bumpers Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Automotive Bumpers Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Vehicle Production (Passenger Vehicles, Commercial Vehicles)

3.1.2. Demand for Lightweight Materials (Polypropylene, Polycarbonate, Polyurethane)

3.1.3. Stringent Safety Regulations (Crash Test Standards, ISO Safety Norms)

3.1.4. Rising Automotive Aftermarket (Repair, Replacement, Accessories)

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices (Plastic Resins, Aluminum, Steel)

3.2.2. High Cost of Advanced Materials (Carbon Fiber Reinforced Plastics, Aluminum)

3.2.3. Environmental Regulations (Waste Management, Recycling Policies)

3.3. Opportunities

3.3.1. Adoption of Advanced Manufacturing Technologies (3D Printing, Automation, AI)

3.3.2. Growth in Electric Vehicles (EV Bumpers, Lightweight Bumpers)

3.3.3. Expansion in Emerging Markets (China, India, Brazil)

3.4. Trends

3.4.1. Smart Bumpers with Sensors and Cameras (ADAS Integration, Collision Avoidance)

3.4.2. Use of Sustainable Materials (Recyclable Plastics, Bio-based Composites)

3.4.3. Modular Bumper Systems (Interchangeable Components, Customization Options)

3.5. Government Regulations

3.5.1. Emission Reduction Standards (EU Emission Regulations, U.S. CAF Standards)

3.5.2. Vehicle Safety Standards (Euro NCAP, NHTSA)

3.5.3. Recycling and Sustainability Initiatives (End-of-Life Vehicle Directives, Circular Economy)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Automotive OEMs, Tier-1 Suppliers, Material Providers)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Automotive Bumpers Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Plastic (Polypropylene, Polycarbonate)

4.1.2. Metal (Steel, Aluminum)

4.1.3. Composite Materials (Carbon Fiber Reinforced Plastics, Glass Fiber Reinforced Plastics)

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Electric Vehicles

4.3. By Sales Channel (In Value %)

4.3.1. OEM (Original Equipment Manufacturer)

4.3.2. Aftermarket

4.4. By End-use (In Value %)

4.4.1. On-road Vehicles

4.4.2. Off-road Vehicles

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Automotive Bumpers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Magna International Inc.

5.1.2. Plastic Omnium

5.1.3. Faurecia

5.1.4. Toyoda Gosei Co. Ltd.

5.1.5. Flex-N-Gate Corporation

5.1.6. SMP Deutschland GmbH

5.1.7. Benteler Automotive

5.1.8. KIRCHHOFF Automotive

5.1.9. Seoyon E-Hwa

5.1.10. Hyundai Mobis

5.1.11. Zhejiang Yuanchi Group Co., Ltd.

5.1.12. Jiangnan Mould & Plastic Technology Co., Ltd.

5.1.13. SRG Global Inc.

5.1.14. Rehau Group

5.1.15. ABC Group Inc.

5.2. Cross Comparison Parameters (Revenue, Headquarters, Number of Employees, Product Portfolio, Technological Capabilities, Manufacturing Presence, R&D Investments, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Automotive Bumpers Market Regulatory Framework

6.1. Emission Standards Compliance

6.2. Vehicle Safety Regulations

6.3. Material Recycling Regulations

6.4. Trade Tariffs and Import/Export Policies

7. Global Automotive Bumpers Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Automotive Bumpers Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Sales Channel (In Value %)

8.4. By End-use (In Value %)

8.5. By Region (In Value %)

9. Global Automotive Bumpers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase of research involved constructing a comprehensive map of key stakeholders in the Global Automotive Bumpers Market. This step focused on gathering data from secondary sources, including industry reports, government publications, and proprietary databases, to identify the critical variables influencing the market.

Step 2: Market Analysis and Construction

Historical data related to automotive bumper production, material consumption, and industry revenue was collected. The analysis also considered market penetration rates of different vehicle types and the use of advanced manufacturing technologies to estimate market growth and trends.

Step 3: Hypothesis Validation and Expert Consultation

The gathered data was then validated through in-depth consultations with industry experts, including manufacturers and material suppliers. Their insights provided valuable operational and financial data, refining the market analysis.

Step 4: Research Synthesis and Final Output

The final phase involved engaging with automotive OEMs and material suppliers to cross-verify market trends, product innovations, and sales data. This step ensured a comprehensive and validated analysis of the Global Automotive Bumpers Market.

Frequently Asked Questions

01. How big is the Global Automotive Bumpers Market?

The Global Automotive Bumpers Market is valued at USD 10.7 billion, driven by increasing vehicle production and advancements in material technology, particularly in regions like Asia-Pacific and Europe.

02. What are the challenges in the Global Automotive Bumpers Market?

Key challenges include fluctuating raw material prices, stringent safety and environmental regulations, and high production costs of advanced materials like carbon fiber-reinforced plastics.

03. Who are the major players in the Global Automotive Bumpers Market?

Major players include Magna International, Plastic Omnium, Faurecia, Hyundai Mobis, and Flex-N-Gate Corporation, who lead the market due to their extensive global presence and innovative product portfolios.

04. What are the growth drivers in the Global Automotive Bumpers Market?

Growth is driven by increasing vehicle production, rising demand for fuel-efficient and electric vehicles, and advancements in material technologies, such as lightweight and recyclable materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.