Region:Global

Author(s):Geetanshi

Product Code:KRAB0163

Pages:87

Published On:August 2025

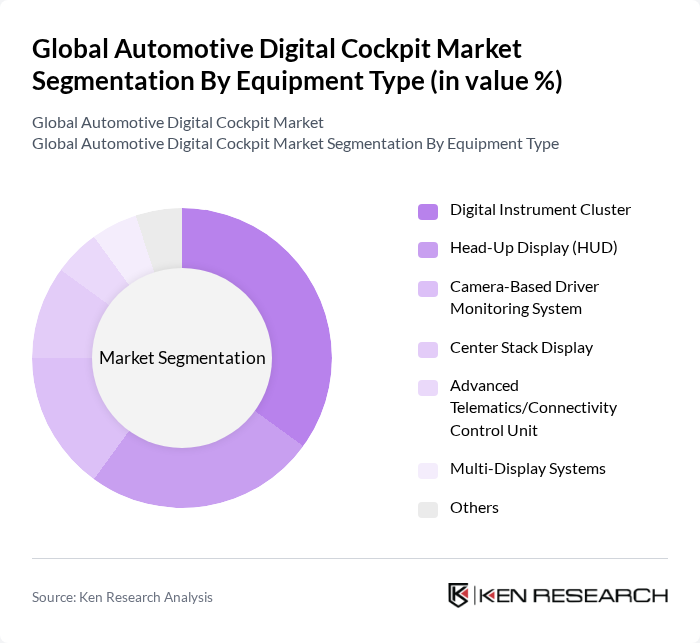

By Equipment Type:The equipment type segmentation includes core components of the digital cockpit: digital instrument clusters, head-up displays (HUD), camera-based driver monitoring systems, center stack displays, advanced telematics/connectivity control units, multi-display systems, and others. The digital instrument cluster remains the leading sub-segment, primarily due to its essential role in delivering real-time information to drivers, supporting safety, and enhancing convenience.

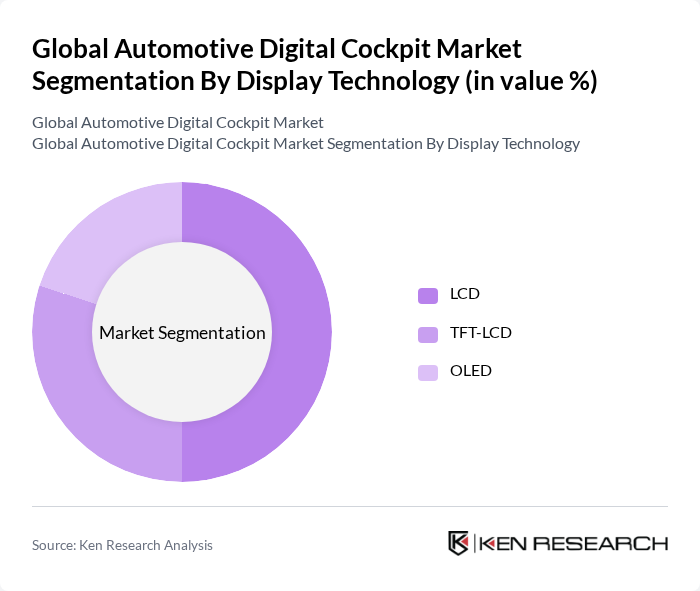

By Display Technology:The display technology segmentation covers LCD, TFT-LCD, and OLED. LCD technology currently dominates due to its cost-effectiveness and broad adoption across vehicle models. OLED is rapidly gaining traction, favored for its superior image quality and design flexibility, especially among premium automotive brands.

The Global Automotive Digital Cockpit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Robert Bosch GmbH, Denso Corporation, Harman International (a Samsung Company), Visteon Corporation, Panasonic Corporation, LG Electronics Inc., Aptiv PLC, NXP Semiconductors N.V., Qualcomm Technologies, Inc., Sony Corporation, Valeo SA, ZF Friedrichshafen AG, Mitsubishi Electric Corporation, Infineon Technologies AG, Hyundai Mobis Co., Ltd., Pioneer Corporation, Garmin Ltd., Faurecia SE (FORVIA Group), Magna International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive digital cockpit landscape is poised for transformative growth, driven by advancements in artificial intelligence and the increasing prevalence of electric vehicles. As automakers prioritize user-centric designs, the integration of personalized experiences will become essential. Additionally, the rise of over-the-air updates will facilitate continuous improvements in vehicle software, enhancing functionality and user satisfaction. These trends indicate a shift towards more adaptive and responsive digital cockpit solutions, aligning with evolving consumer expectations and technological capabilities.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Digital Instrument Cluster Head-Up Display (HUD) Camera-Based Driver Monitoring System Center Stack Display Advanced Telematics/Connectivity Control Unit Multi-Display Systems Others |

| By Display Technology | LCD TFT-LCD OLED |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Medium and Heavy Commercial Vehicles |

| By Propulsion | Internal Combustion Engine (ICE) Battery Electric Vehicle (BEV) Hybrid and Plug-in Hybrid (HEV/PHEV) |

| By Sales Channel | OEM-fitted Aftermarket Retro-fit |

| By Application | Navigation Entertainment Communication Vehicle Diagnostics Others |

| By Geography | North America Europe Asia-Pacific Rest of World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Digital Cockpits | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Digital Solutions | 90 | Fleet Managers, Technology Officers |

| Infotainment System Developers | 60 | Software Engineers, UX Designers |

| Automotive Electronics Suppliers | 50 | Supply Chain Managers, Procurement Specialists |

| Connected Vehicle Technology Experts | 70 | R&D Directors, Innovation Managers |

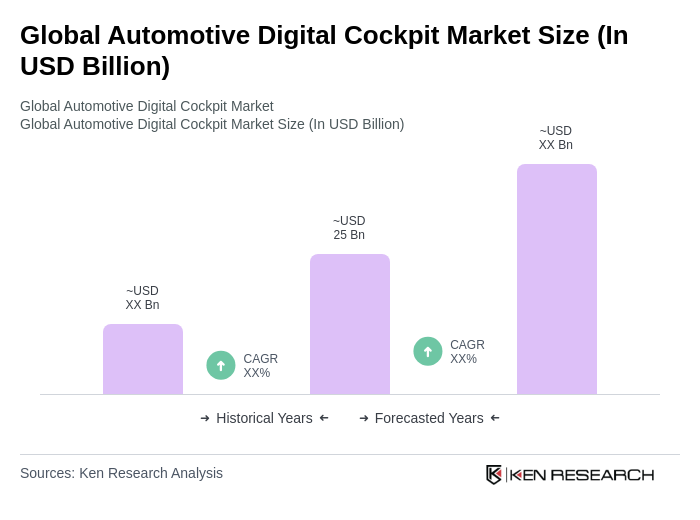

The Global Automotive Digital Cockpit Market is valued at approximately USD 25 billion, driven by the demand for advanced driver assistance systems (ADAS), enhanced connectivity features, and the rise of electric vehicles (EVs) requiring sophisticated digital interfaces.