Region:Global

Author(s):Geetanshi

Product Code:KRAA0028

Pages:93

Published On:August 2025

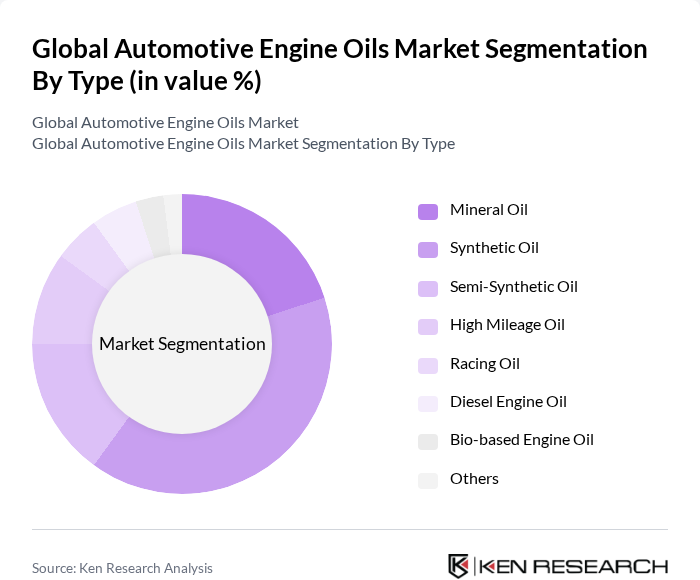

By Type:The automotive engine oils market is segmented into various types, including Mineral Oil, Synthetic Oil, Semi-Synthetic Oil, High Mileage Oil, Racing Oil, Diesel Engine Oil, Bio-based Engine Oil, and Others. Among these, Synthetic Oil is gaining significant traction due to its superior performance characteristics, including better thermal stability and engine protection. The increasing demand for high-performance vehicles and the growing trend of longer oil change intervals are driving the preference for synthetic oils over traditional mineral oils .

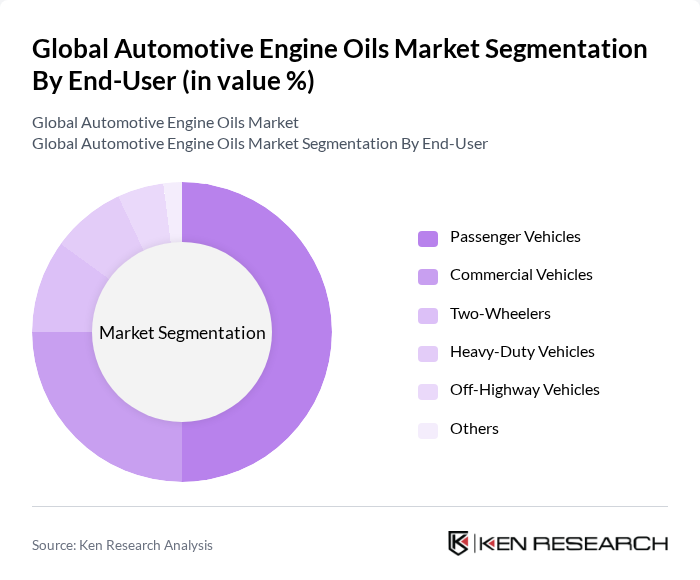

By End-User:The market is segmented by end-user into Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Vehicles, Off-Highway Vehicles, and Others. The Passenger Vehicles segment holds the largest share, driven by the increasing number of personal vehicles and the growing trend of regular maintenance among consumers. Additionally, the rise in disposable income and urbanization in emerging markets is further propelling the demand for engine oils in passenger vehicles .

The Global Automotive Engine Oils Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil, Shell, BP, Chevron, TotalEnergies, Castrol, Valvoline, FUCHS Petrolub, Liqui Moly, Amsoil, Motul, Gulf Oil, Pennzoil, Red Line Oil, Royal Purple, PETRONAS, Idemitsu Kosan, LUKOIL, Eni, Repsol contribute to innovation, geographic expansion, and service delivery in this space.

The automotive engine oils market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As electric vehicles gain traction, the demand for specialized lubricants will increase, necessitating innovation in oil formulations. Additionally, the focus on sustainability will push manufacturers to develop eco-friendly products. The integration of smart technology in engine oils will also enhance performance monitoring, creating new opportunities for growth. Overall, the market is expected to adapt dynamically to these trends, ensuring resilience and expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral Oil Synthetic Oil Semi-Synthetic Oil High Mileage Oil Racing Oil Diesel Engine Oil Bio-based Engine Oil Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles Off-Highway Vehicles Others |

| By Application | Engine Lubrication Transmission Systems Gear Oils Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (OEMs & Workshops) Others |

| By Packaging Type | Bottles Drums Bulk Pouches Others |

| By Brand | OEM Brands Aftermarket Brands Private Labels Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Engine Oil Users | 120 | Car Owners, Automotive Enthusiasts |

| Commercial Vehicle Fleet Managers | 60 | Fleet Managers, Maintenance Supervisors |

| Automotive Repair Shops | 50 | Service Managers, Technicians |

| Lubricant Distributors | 40 | Sales Representatives, Product Managers |

| Automotive Engineers and R&D Professionals | 40 | Automotive Engineers, R&D Managers |

The Global Automotive Engine Oils Market is valued at approximately USD 41 billion, driven by factors such as increasing vehicle production, consumer awareness regarding maintenance, and advancements in oil formulations that enhance engine performance and longevity.