Region:Global

Author(s):Geetanshi

Product Code:KRAA0081

Pages:90

Published On:August 2025

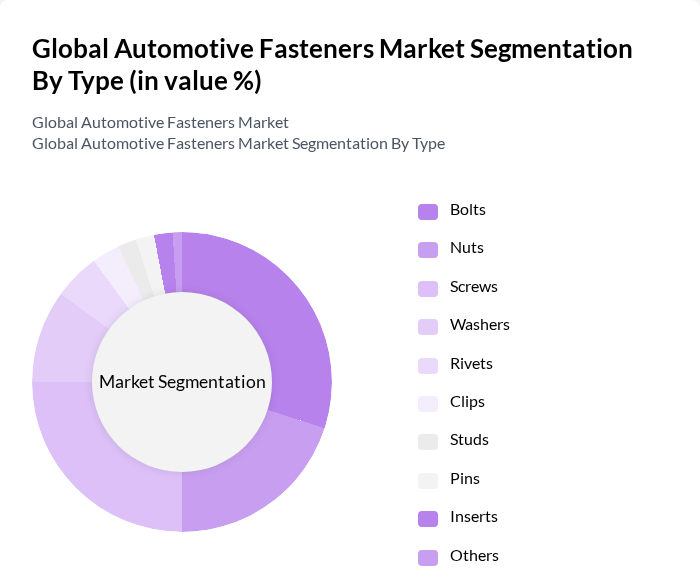

By Type:The automotive fasteners market is segmented into various types, including bolts, nuts, screws, washers, rivets, clips, studs, pins, inserts, and others. Among these, bolts and screws are the most widely used due to their essential roles in securing components in vehicles. The demand for high-strength bolts has surged, driven by the need for enhanced safety and durability in automotive applications. Additionally, the trend towards lightweight vehicles has increased the use of specialized fasteners that can withstand higher loads while minimizing weight. The adoption of plastic and composite fasteners is also rising due to their cost and weight advantages, especially in electric and energy-efficient vehicles .

By End-User:The automotive fasteners market is segmented by end-user into passenger vehicles, commercial vehicles, two-wheelers, heavy-duty vehicles, electric vehicles, and others. Passenger vehicles dominate the market due to the high volume of production and the increasing consumer preference for personal mobility. The rise in electric vehicle production is also contributing to the demand for specialized fasteners that cater to the unique requirements of electric drivetrains and battery systems. Additionally, commercial vehicles and heavy-duty vehicles represent significant segments due to ongoing infrastructure development and logistics growth in emerging markets .

The Global Automotive Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illinois Tool Works Inc., Stanley Black & Decker, Inc., Würth Group, ARaymond Network (ARaymond), Norma Group SE, Bulten AB, KAMAX Holding GmbH & Co. KG, LISI Automotive (LISI Group), Bossard Holding AG (Bossard Group), Sundram Fasteners Limited, PennEngineering, SFS Group AG, Nifco Inc., Fontana Gruppo, and Trifast plc (TR Fastenings) contribute to innovation, geographic expansion, and service delivery in this space .

The automotive fasteners market is poised for significant transformation as manufacturers increasingly prioritize sustainability and innovation. The shift towards electric vehicles (EVs) is expected to drive demand for specialized fasteners that cater to new designs and materials. Additionally, advancements in smart fastening technologies will enhance operational efficiency. As the industry adapts to these trends, collaboration between manufacturers and technology providers will be crucial in developing solutions that meet evolving market needs and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Bolts Nuts Screws Washers Rivets Clips Studs Pins Inserts Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles Electric Vehicles Others |

| By Material | Steel Aluminum Plastic/Polymer Titanium Copper Others |

| By Coating Type | Zinc Coated Phosphate Coated Chrome Plated Nickel Coated Others |

| By Application | Engine Components Body and Chassis Interior Components Electrical & Electronics Systems Battery Assemblies Others |

| By Distribution Channel | OEMs (Original Equipment Manufacturers) Aftermarket Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Fasteners | 100 | Product Managers, Design Engineers |

| Commercial Vehicle Fasteners | 80 | Procurement Officers, Supply Chain Managers |

| Electric Vehicle Fasteners | 60 | R&D Engineers, Sustainability Officers |

| Aftermarket Fasteners | 50 | Retail Managers, Automotive Service Technicians |

| Specialty Fasteners for Racing | 40 | Race Team Engineers, Performance Parts Buyers |

The Global Automotive Fasteners Market is valued at approximately USD 23 billion, driven by the increasing demand for lightweight materials, the expansion of electric vehicle production, and advancements in fastener technology and manufacturing processes.